Copy Coupon Code to Get

Up to 25% Off 🎉

Forex Funds Flow

Forex, Metals, Crypto, Indices, Commodities

HK

2025

CEO: Yahya Abdul

Metatrader 5

Crypto

Wire Transfer/ Bank Transfer

Crypto

Mastercard

Credit/Debit Card

PayPal

Visa

Daman Markets

Is Forex Funds Flow Worth It in 2025?

Is Forex Funds Flow Worth It in 2025?

11/1/2025

Introduction

This blog will provide an in-depth look at Forex Funds Flow (FFF) - a style of proprietary trading (prop-firm) platform that provides funded accounts to traders successfully passing evaluation challenges. We will take you through how the firm operates, assess their models and rules, compare the challenges, review the payout and scaling policies, share user feedback and we will provide an overall assessment for 2025.

About Forex Funds Flow (FFF)

Forex Funds Flow (FFF) is a proprietary trading firm that offers funded capital to traders through the 1-Step Challenge, the 2-Step Evaluation, and the Instant Funding program with account sizes as much as $100,000. FFF is registered in Hong Kong as Fx Funds Flow Ltd, 2025-00415. FFF is also clear in that it is only an evaluation service and does not offer brokerage accounts or live trading accounts—positioning itself within the modern space of being an evaluation-based prop firm for skilled traders.

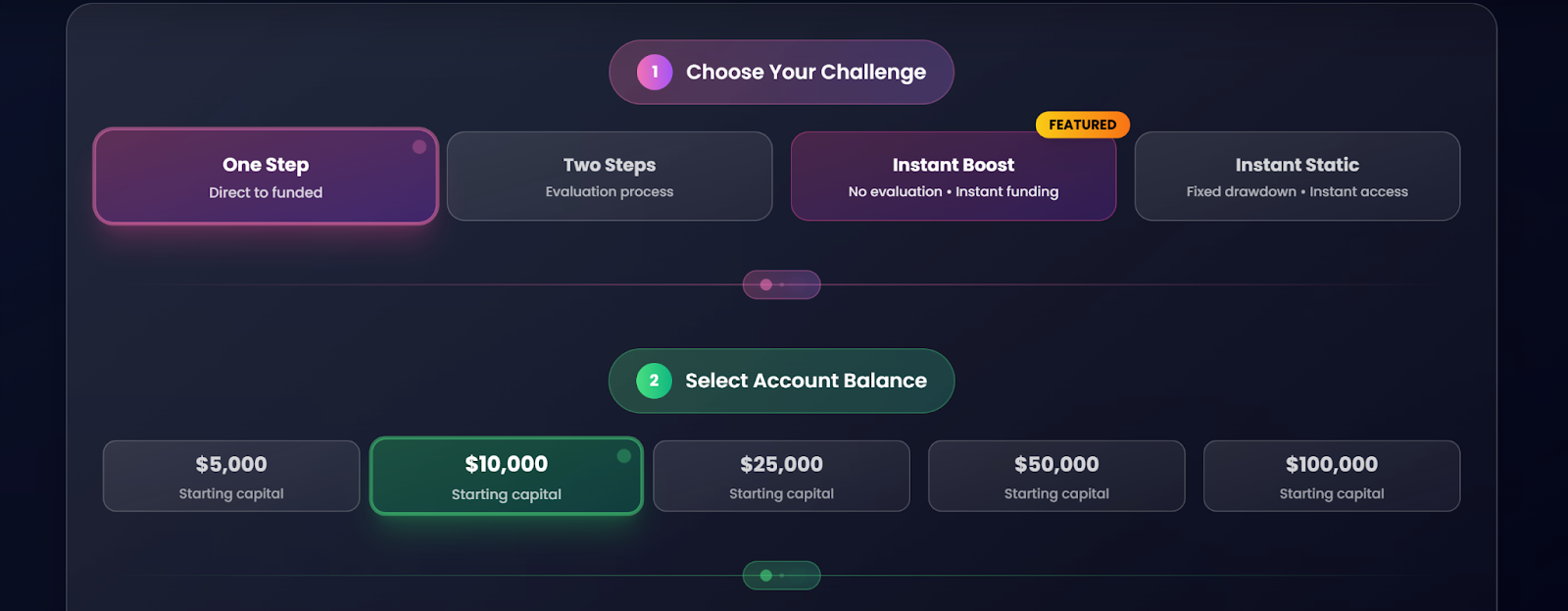

Forex Funds Flow - Models and Challenges

In this section, we will outline how FFF evaluation (challenges) models are structured and what could be pitfalls/challenges for traders.

Introduction

As a trader to become funded with Forex Funds Flow, you will first need to pass either the challenge program (i.e., 1-Step, 2-Step, Instant). These programs require traders to realize targets, drawdown rules, trading conditions - the challenge simply being to prove to FFF that you can trade profitably and consistently in an environment of constraints.

2-Step Challenge

With the 2-Step model, there are two assessments, usually a lower-target first assessment, then the higher-target second assessment, meaning that you can check not just your trading ability but, more importantly, your discipline to trade realistically.

Details

Profit target, drawdown rules and trading conditions: According to TheTrustedProp, FFF hosts “higher drawdown limits and quick payouts”. Unfortunately, the exact public breakdown for each assessment (target %, daily loss, max drawdown) is ambiguously presented in the sourcing I found. You'll have to refer to FFF's official documentation.

Account Size and Challenges Fees: According to FFF, account sizes are up to $100,000 for funded accounts. The challenge fee details regarding the 2-Step model are not meaningfully described in the sourcing.

Trading Strategies Allowed In The Challenge: The general prop-firm model allows "forex, crypto and indices", according to TheTrustedProp. The FFF website explains that they are "evaluation only" (the challenge will be nothing otherwise). But the exact strategies that are allowed and not allowed (e.g., scalping, hedging, news trading) are not meaningfully discussed in the sourcing.

Profit Split & Payout Frequency: FFF offers up to 90% profit share (variable for challenge type) and payout periods every 2 weeks for 2-Step & 1-Step; every 3 days for Instant.

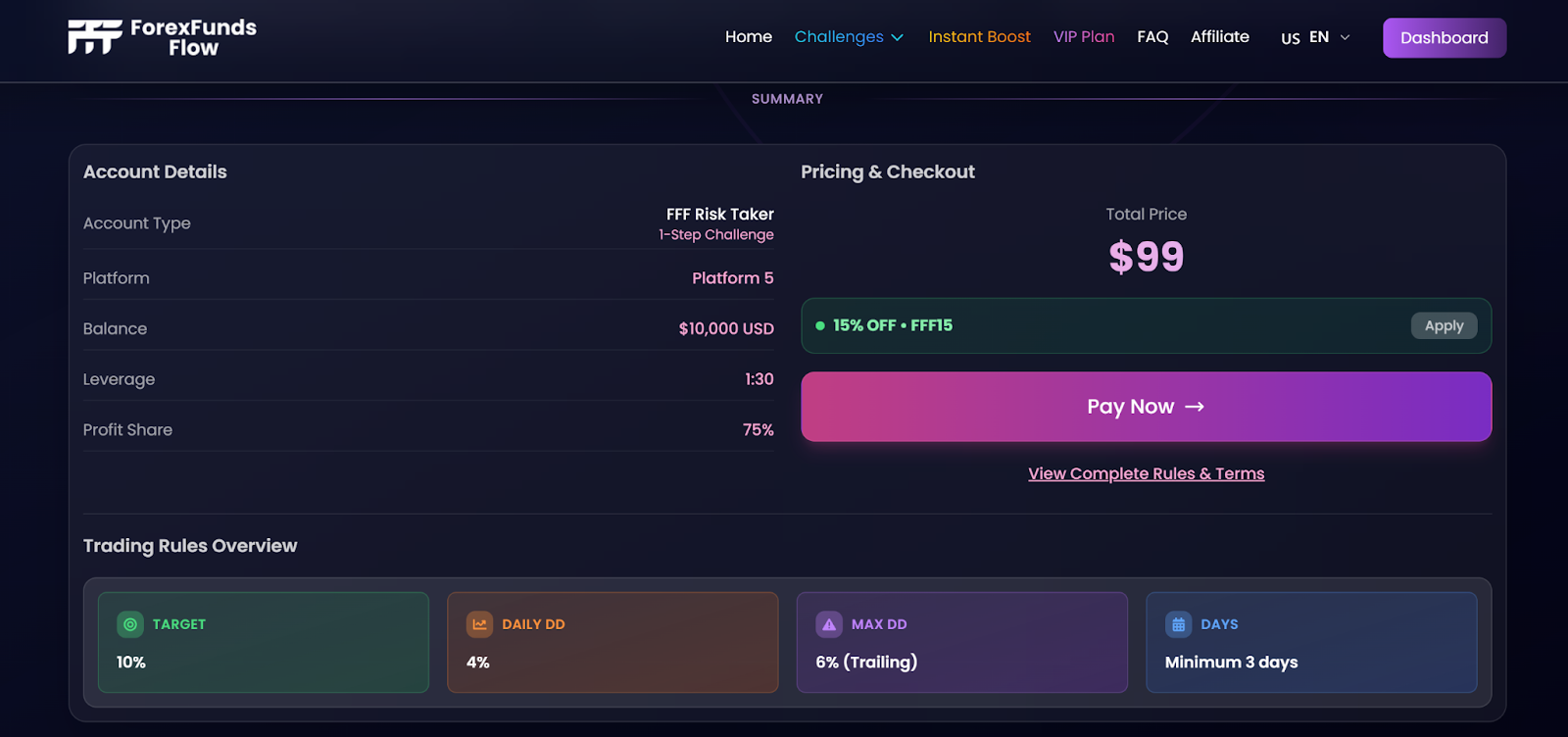

1-Step Challenge

For traders seeking a faster route to funding, the 1-Step model entails only one evaluation phase prior to the funded account (assuming success). The rules are generally tighter (higher target) but simpler.

Details

Profits target, drawdown rules, and trading conditions: Same caveat, FFF does not outline specifics regarding each issue publicly in the sources.

Account Size and Challenges Fees: Probably a similar account size as above; fees not publicly specified.

Trading Strategies Allowed In The Challenge: same as above.

Profit Split & Payout Frequency: Up to 90% profit split, and biweekly payout.

Instant Funding Challenge

The instant model gives traders faster access to funded accounts (or at least you will soon) - fewer evaluation phases; quicker payouts; but generally tighter risk controls/conditions.

Details

Profits target, drawdown rules, and trading conditions: TheTrustedProp states that FFF offers "instant funding accounts with limits on trading," and "higher drawdown limits."

Account Size and Challenges Fees: Not publicly specified.

Trading Strategies Allowed In The Challenge: Likely the same general asset classes, but specifics are not often clearly available.

Profit Split & Payout Frequency: Every 3 days payout cycle.

A Comprehensive Comparison of Different Challenge Types

| Criteria | 2-Step Evaluation | 1-Step Challenge | Instant Funding / Instant Pro |

| Profit Target | Phase 1: ~6% • Phase 2: ~3% | Around 8% for 1-Phase challenge | About 5% profit to qualify for a reward (varies by plan) |

| Daily Loss Limit | ~3% – 7% of account balance | Not always clearly listed | “No daily drawdown” in some Instant Pro plans |

| Max Loss Limit (Max Drawdown) | ~6% – 14% total drawdown | “Static drawdown” model for 1-Phase | Relaxed or “no time limit” rules in some plans |

| Min Trading Days | Very low / None | Not clearly specified | Zero – very low (some plans) |

| News Trading Allowed | Allowed for most accounts | Likely allowed | Allowed – high flexibility |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 (crypto-focused) |

| Profit Split | 40% - 100% depending on plan | Up to 100% | Up to 100% (varies by plan) |

| Payout Frequency | Rapid / On-demand | On-demand | Instant or very fast payouts |

| Best For | Traders who prefer a structured 2-phase evaluation | Traders seeking a single-phase quick challenge | Traders wanting instant capital access without evaluation |

We Analyze Forex Funds Flow Challenge Accounts

Forex Funds Flow (FFF) is an alluring prop trading opportunity to consider with profit splits of up to 90%, several different types of challenge options, which include instant funding, and even offering funded accounts of up to $100,000. While decisive flexibility is enticing, the absence of any transparency in specifics such as profit targets, daily/weekly drawdown limits, and all fees is concerning. Traders should be cautious and review all terms of the phase evaluation before joining. For experienced prop traders, FFF may be suitable, but for beginners, advise caution and verifying all terms.

Forex Funds Flow Rules to Know

Following your funding (or if you passed the challenge), you must comply with the rules to maintain qualification for payouts and scaling hiccups. Rules will protect the firm's capital, but also you as a trader.

Key rules to watch out for include

- Consistency in trading (some companies require consistent activity rather than large spikes).

- Inactivity rules (if you don’t trade for X days, you may lose access).

- Maximum drawdown rules (if your equity drops below a limit, you may lose the account).

- Restrictions on strategies (some companies limit news trading, high-frequency scalping, and hedging).

- Leverage limits and how much risk you can take per trade.

For FFF specifically, I am not including the exact funded account rules, as they were not fully conveyed in my sources, but you should request a “once funded” terms of service document from FFF directly.

Trading Consistency Rules

- Make sure you know how FFF defines “active trading” ( e.g., a trade at least every X days).

- Usually, consistency means you cannot hit the goal in one trade and then stop trading, many companies require a minimum number of trading days or trades.

- Always check for rules that prevent you from taking one big winning trade and then making small trades just to avoid hitting the drawdown limit.

Rules of Inactivity

Several prop firms deactivate or close accounts that have not experienced trading activity for a particular time frame (e.g., no activity in the past 30 days). Check if FFF has a similar rule (the sources do not clearly indicate one). If such rules exist, be sure to trade consistently instead of stopping after one big win or at least find out the minimum trading activity required to stay compliant.

Forex Funds Flow: Trading Conditions and Platform Access (2025 Guide)

Understanding what platform you will be trading on and what conditions (leverage, access to assets, spreads, execution) will be is very important. Here is what I have discovered regarding FFF.

Detail

- According to FFF, they offer evaluated trading in a “simulated trading environment” (not live with a funding broker).

- Access/platform specifics: TheTrustedProp mentions that FFF "offers access to trading forex, crypto and indices”

- Leverage: Because no specific values have been specified, traders must contact FFF directly.

- Access: Since it's for evaluation simulation, the performance conditions (slippage, spreads) are not likely to be the same as what would occur in the live market.

- Risk management: A prop rule for drawdown and daily loss applies (although no fully transparent numbers are provided).

Our Verdict on Platform Access

It is both refreshing and limiting for FFF to explicitly note that they are "evaluation only," which means you are trading in a simulated environment (for evaluation) versus trading live funds. This is often a normal occurrence for many prop firms, but, also ensures you understand how the funded accounts will transition into a "live" stage. The opportunity to trade across a range of asset classes is a plus. The lack of transparency around leverage/spreads is a negative - ask upfront for this information.

Instruments You Can Use to Trade and Track Forex Funds Flow

A significant consideration is what instruments (forex pairs, cryptos, indices, commodities, stocks) can be traded during the funded account and under FFF's challenge. The more flexible you can be with your instrument, the more options you have for strategy.

Details

- According to TheTrustedProp: FFF is only targeting “forex, crypto and indices traders" at this time.

- The website indicates that they are connecting “skilled traders … with funding”; they don't provide a list of every available instrument.

Our Verdict on Instruments

The availability of at least 3 major asset classes (forex, crypto/indices) isn't too bad from our standpoint. But for a trader working with a cross-asset strategy (ie, stocks or commodities), you need to confirm with them that you'd be able to trade those. Simply put, the more instruments you have access to, the more flexible your strategy will be across time and market conditions. As always, check back on what restrictions are excluded (i.e., news trading or high-leverage asset classes) if this applies.

Forex Funds Flow Payment Structure and Bonus System (Explained Simply)

At the end of the day, the main goal is to get paid. Here is a brief overview of how Forex Funds Flow prices its payment/reward system.

Details

- According to TheTrustedProp, they have a profit split of 90%+.

- Payment Frequency: Payments are processed bi-weekly for both 1-Step and 2-Step; payments are made every 3 days for the Instant Boost option.

Payment Eligibility: When will you be able to request a payment?

Based on the information available, you will be able to request payment after you have an active funded account and have made a profit, as long as you are abiding by Forex Funds Flow rules (drawdown limits, consistency, etc.). However, we do not have the very minimum amount, or exact waiting period, for payout minimums confirmed - you would need to attempt with Forex Funds Flow.

Forex Funds Flow Payout Requirements: Payout Depending on Account Type

There have not been adequate public details to help determine payout requirements by account size/type, aside from the slight changes based on challenge type. You would need to check directly with Forex Funds Flow.

How Fast Are Forex Funds Flow Payments Processed?

Payment frequency (every 3 days/bi-weekly) offers some insight into payment processing, however, actual processing time (i.e., 3-5 business days) has not been published publicly. It would be wise to check with Forex Funds Flow support when confirming your pay period and then ask further on receipt timelines and possible challenges with withdrawal methods.

Scaling Plan for Forex Fund Flow

According to TheTrustedProp: FFF states account sizes are “up to $100k” initially and “up to $2M via scaling” for successful traders.

A scaling plan means that once you have a funded account and achieve certain performance criteria, they may allow you to increase to a larger account size. However, the specific thresholds to scale (monthly profit, drawdown record, trading days, etc.) are not outlined publicly. You need to ask FFF: “What are the criteria to scale?”

How to Succeed in Passing Forex Funds Flow: Pro Tips from Real Traders

Here are the best practices in general to attempt a prop-firm challenge like FFF’s – along with recommendations based on what we know about FFF.

- Know your rules thoroughly: target, maximum drawdown, daily loss limit, and minimum number of trading days. Without specifics, you might inadvertently breach them.

- Risk management is critical: many firms will cancel accounts based on max drawdown or daily loss limit breaches.

- Be consistent: space out trading over days rather than hoping for one big trade.

- Avoid strategies against the rules: look closely at FFF’s T&C on news trading, leverage, hedging, exotic assets, etc.

- Trade by your personal expertise: even though you have funds supplied by a firm, recognize it as your own, and avoid making foolish positions.

- Take good records/screenshots: especially in the challenge phase, some firms are only want proof or trade records in case of a disagreement/argument.

- Pay attention to the simulation-to-live transition: Because FFF is basing the whole evaluation phase on a simulated environment, you will want to be mindful of how that differs from live funded account conditions.

- Be mindful of any conditions for leaving or withdrawing: after the funded period, be aware of when/how you can withdraw and the minimum amount to withdraw and when.

Final Thoughts: You Got This

Passing a prop-firm challenge is a test of trading skill, discipline, and strategy, not just luck. If you take their challenge seriously and follow the rules of the challenge, as well as your trading plan, you are really improving your chances of passing the challenge. FFF even has some of the most competitive conditions in the industry, with up to a 90% profit split, and different challenges to fit your risk profile.

Real User Feedback & Trust Insights on Forex Funds Flow

What We Are Hearing From The Forex Funds Flow Community

- On Trustpilot, FFF has reviews saying it is "a modern proprietary trading firm … granting access to trade capital through … 1 Step Challenge, 2 Step Evaluation, and Instant Funding" etc.

- TheTrustProp’s write-up acknowledges FFF, however, they comment that while it is "one of the best prop firms with hassle-free challenges, competitive fees, and transparent rules, it does still have unanswered details."

- More broadly, the prop-firm space has many warnings from traders and analysts stating that evaluation fees and hidden rules will trip up a trader who did not see them coming.

Should You Choose Forex Funds Flow?

FFF meets a lot of criteria you might have for a potential, viable option: they seem to have multiple challenge paths in play, they seem to have a high profit split claim, and they seem to market nicely that they are evaluation only. The cons: they don't make all the rules' details available (account-size, fees fee, account-size target numbers, etc), they would also need you to read their fine print describing the transition from simulation to your live funded account, and any of the broader prop-firm space brings risk around lack of clarity.

Final Verdict & Real Insights on Forex Funds Flows

Forex Funds Flow does seem to be a legitimate option for prop-firm funding that is fairly well positioned for 2025 - especially for traders who have already developed discipline and strategy in their trading. There is a good upside via profit split, multiple paths to funding and it is more of a modern structure.

BUT it's not perfect: as with many prop firms, it's not 100% transparent on some terms of service; there are inherent risks with prop-firm funding methods (you pay fees for challenges, you have rules to follow, you are probably trading simulated first). So, if you are serious, prepared and realistic, it is something to consider. If you're new, be careful, read the terms, compare with others, etc.

Bonus Tip

Prop firms are frequently offering promotions (reduced challenge fees, cash back, holiday specials. For FFF: you should monitor their official channels (website, Twitter/X, Facebook) for announcements. For example, FFF's Twitter profile states: "Welcome to a new standard in the world of prop firms with Forex Funds Flow multiple account types and diverse trading."

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict