Copy Coupon Code to Get

20% Off 🎉

My Funded Futures

Forex, Futures, Stocks, Crypto

US

2023

CEO: Matthew Leech

50% OFF on Pro + 20% OFF on Rapid + Upto 1200 Trust Points

Coupon Code:

Tradovate

Ninjatrader

QuantTower

Trading View

Rise

Credit/Debit Card

Visa

Crypto

Tradovate

Rithmic

My Funded Futures Flex Challenge Explained (2026 Guide)

My Funded Futures Flex Challenge Explained (2026 Guide)

2/14/2026

Introduction

The My Funded Futures Flex Plan is a unique trading program designed specifically for traders who wish to trade futures without risking their money. This plan stands out because it aims to be laid-back and economical so that anyone can give it a try to become a professional trader. If you are fond of trading without stressful daily regulations, then the My Funded Futures Flex Plan might be the perfect fit for you. The My Funded Futures Flex Challenge might be suitable for beginner traders who require a simple route and also for seasoned traders who want to minimize their trading expenses. This futures prop firm offers a transparent and trader focused funding path to reach the sim-to-live trading account.

To know about other challenge types of MFFU, you can read our detailed ‘My Funded Futures Review 2026’ available on The Trusted Prop site.

What Is the My Funded Futures Flex Challenge?

My Funded Futures Flex Plan is basically a one step evaluation where you prove your trading skills in a demo account and get a funded account. The Flex Plan disrupts the traditional prop firm model by removing multi-step evaluations and strong activation fees, offering a streamlined path to professional capital. It is a fast and simple program that runs on a simulated funded model, so you go from a test level to a funded stage where you trade with simulated capital and earn real payouts.

My Funded Futures Flex Plan is a low-cost futures trading evaluation with no activation fees and no daily loss limits. Traders need to deliver a 6% of profit target while using the end-of-day (EOD) drawdown requirements. The idea is to offer a clear and flexible route to professional funding.

How the Flex Challenge Works (Step-by-Step)

Step 1 - Select Account Size

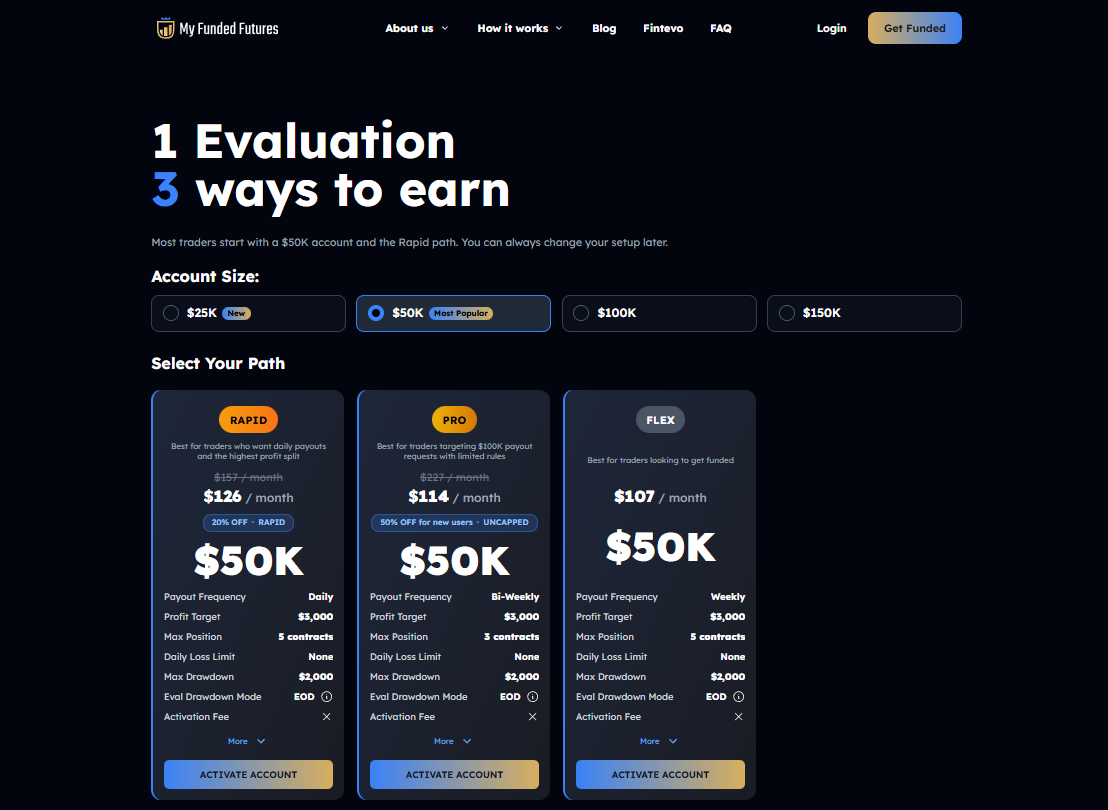

You start by selecting your account size. There are two account size options available - $25K and $50K Flex Plan, but most trader prefer the My Funded Futures $50K Flex Plan.

Step 2 - Reach the Target Profit

You have to meet a 6% profit target while adhering to the drawdown limits, trading restrictions and consistency rule. For the $25K account the profit target is $1,500 and for the $50k Flex account, it is $3,000. There are no time limit - so you trade as slow as you want without any time pressure. But you need to achieve minimum 2 trading days that ends with profit.

Step 3 – Stay within Drawdown Limits

You have to ensure that your account balance never drops below the maximum drawdown level. The Flex plan utilizes an end-of-day drawdown of 4%, which is much simpler than trailing drawdown that changes with your account balance profits. For the $25K account the drawdown limit is is $1,000 and for the $50k Flex account, it is $2,000.

Step 4 - Become Funded & Withdraw

After you have reached the target and traded for at least 2 days, you go to the simulated funded stage. Then, you uses the Flex plan payout procedures to get your money.

MFFU Flex Challenge Rules Explained (2026 Update)

In this MFFU Flex Challenge Review we cover the detailed rules which makes this plan different from the other futures prop firms available in the market in 2026. Here is the quick overview of My Funded Futures Flex Challenge passing rules and trading conditions:

• Profit Target: The goal is to make a profit of 6%.

• Maximum Drawdown limit: The maximum loss limit is set at 4% which will be calculated at the end of the day.

• Daily Loss Limit: One of the biggest advantages for futures traders in the Flex Challenge is that there is no daily loss limit. You just have to ensure to stay within the max drawdown limit.

• Minimum Trading Days: You just need to have completed 2 trading days in profit in order to pass the Flex evaluation.

• Consistency Rules: During the evaluation, you are not allowed to have a single day that counts for more than 50% of your total profit. The moment you get funded, this rule will be removed.

• Inactivity Rules: You must trade at least once every 7 calendar days to keep the account active.

• News Trading Rules: You can trade during the news releases. It is good for the traders who like the market volatility.

Want to learn more about My Funded Futures drawdown rules, check our ‘My Funded Futures Drawdown Rules Explained’ blog.

My Funded Futures Flex Challenge Pricing Breakdown (2026)

The Flex plan is famous for being the most affordable option. There is an MFFU no activation fee policy for this plan, which saves you a lot of money.

• Account Size: $25,000 and $50,000

• Evaluation Fee: $84 or $25K and $107 for $50K

• Activation Fee: $0

• Reset Fee: Available if you fail

My Funded Futures Challenge Types Comparison

Choosing the right plan is the first step toward your trading success, so here is a clear comparison of the available options at My Funded Futures.

| Plan Name | Monthly Fee | Activation Fee | Drawdown Type | Max Contracts |

|---|---|---|---|---|

| Flex Plan | $107 ($50K) | $0 | End-of-Day (EOD) | 5 Mini / 50 Micro |

| Rapid Plan | $157 | $0 | Intraday Trailing | 5 Mini / 50 Micro |

| Pro Plan | $227 | $0 | Static (Locks at $50,100) | 3 Mini / 30 Micro |

Whether you prefer the low-cost Flex Plan or the higher-tier Pro Plan, each path is designed to lead you straight to professional funding. Before paying to the My Funded futures challenge types, check The Trusted Prop discount page to get 50% OFF on all Pro Plans for New users and 30% for Existing users + 20% OFF on Rapid Plans.

Payout Structure & Profit Split of My Funded Futures

Traders who want to understand how do My Funded Futures Flex Plan payouts work? Here are the complete My Funded futures payout details you must know for the flex account:

• Initial Payout: You have to be 5 winning days at which time you earn at least $150 each day. However, note that Pro Plans require a 14-day window instead.

• Profit Split: You get to keep 80% of the profits while the firm takes 20%.

• Minimum Withdrawal: The minimum amount you can withdraw is $250.

• Withdrawal Cap: You have permission to take 50% of your profits for each payout.

• Static Drawdown: Once you have made your first payout, your drawdown limit becomes $100 and stays there.

Who Is Best Suited for MFFU Flex Challenge?

The My Funded Futures Flex Plan is ideal for:

• Swing traders who commit holding trades for an extended time.

• Part-time traders who also have a regular job.

• Low-risk traders who are looking to safeguard their account.

But, it is not suitable for high-risk scalpers due to the scaling contract rules in the funded stage.

Real Example - Passing a $50K Flex Account

If you start an MFFU $50k Flex Evaluation, your profit target will be $3,000.

• Strategy: Risk $200 per trade to make $400.

• Day 1 to Day 10: If you win 10 trades and lose 5, you will be able to reach the target without any trouble.

This slow approach helps you follow the 50% consistency rule easily.

Common Mistakes By Traders Who Fail Prop Firm Challenge

• Violating Trailing Drawdown: At the very least it is at the end of day, but forgetting where your limit is will definitely cause a fail.

• Over-leveraging: Using 5 contracts all at once is quite a risky decision.

• Ignoring Consistency: Making all your profit in one minute, for example, might break the 50% rule.

• Revenge Trading: Trying to win back money fast will most likely result in reaching the maximum loss limit.

Final Verdict of My Funded Futures Flex Plan

The My Funded Futures Flex Plan is undoubtedly a 2026 top pick and this MFFU Flex Challenge Review justifies it by showing that the absence of both activation fees and daily loss limits provides the best value for money. If we take a look at MFFU Flex Plan vs Rapid Plan for comparing which might be better prop firm account for beginners, then the Flex Plan by My Funded Futures is the winner because it has lower costs and simpler rules, catering perfectly to those entering low-cost futures funded accounts. It also provides a clear sim-to-live trading path that respects your time and capital.

If you are ready to stop dreaming and start trading with professional capital, launching your MFFU Flex Evaluation is the most direct path to securing your financial future in the 2026 market. Please keep in mind that trading carries high risks, so only use money for investing which you can afford to lose.

Secure your path to funding through the My Funded Futures Flex Plan by signing up via The Trusted Prop.

You may also like

Goat Funded Futures Instant Account Explained 2026: Rules & Payouts

My Funded Futures Drawdown Rules Explained (2026 Guide)

.jpg&w=1920&q=75)

FTMO 1-Step Challenge Explained (2026): Rules & Payouts

The5ers Trading Rules & Risk Limits Explained (2026 Update)

.jpg&w=1920&q=75)

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

DNA Funded Detailed Review 2026: Our Honest Verdict

.jpg&w=1920&q=75)

No FAQs are available for this topic yet.