ThinkCapital Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full ThinkCapital review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.4

4.4

ThinkCapital

Forex, Crypto, Indices, Commodities

AE

2024

CEO: Faizan Anees

25% OFF + FREE Account on Payout

Coupon Code:

ThinkTrader

Trading View

Metatrader 5

Crypto

Rise

Crypto

Credit/Debit Card

ThinkMarkets

ThinkCapital Review 2026

ThinkCapital is a broker-backed prop firm, strategically powered by the multi-regulated infrastructure of ThinkMarkets, providing a professional ecosystem for trading Forex, Indices and Commodities. ThinkCapital prop firm might be suited for disciplined traders who prioritize institutional-grade execution and the security of an established broker over high-leverage schemes. However, traders should be careful about the news trading restrictions and the consistency requirement necessary to secure withdrawals.

This ThinkCapital review, we examines whether their prop firm trading rules offer a sustainable path for your trading strategy and also evaluates funded account structure and payout sustainability.

ThinkCapital Prop Firm Overview

The following information is compiled from the official website of ThinkCapital, public disclosures and available trader feedback as of first quarter of 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is ThinkCapital. |

| Legal Name | ThinkCapital's legal name is Think Capital Services UK Ltd. |

| Registration Number | ThinkCapital registration number is 11054653. |

| CEO | The CEO of ThinkCapital is Faizan Anees. |

| Headquarters | The headquarters is located at London, United Kingdom. |

| Broker | The broker associated with ThinkCapital is ThinkMarkets. |

| Operating Since | ThinkCapital has been operating since 2024. |

| Account Sizes | ThinkCapital provides account sizes ranging from $5,000 to $100,000. |

| Profit Split | ThinkCapital offers a standard 80% up to 90% profit split. |

| Challenge Types | ThinkCapital offers Lightning (1-Step), Dual Step (2-Step) and Nexus (3-Step) Challenges. |

| Payout Cycle | ThinkCapital offers payouts bi-weekly (14 days), with weekly options available via add-ons. |

| Payout Method | The withdrawal methods supported by ThinkCapital are USDT, USDC, Rise and Broker Transfer. |

| Trading Platforms | ThinkCapital supports trading on ThinkTrader, TradingView and MT5. |

| Financial Markets | ThinkCapital supports trading in Forex, Indices, Commodities and Crypto. |

| Max Allocation | ThinkCapital offers a maximum allocation of $600,000. |

| Max Scaling | ThinkCapital provides scaling opportunities up to $1.5M. |

| Trustpilot Score | ThinkCapital has a 4.2/5 (as of 2026) rating based on over 615 trader reviews. |

Pros and Cons of Trading with ThinkCapital

In our ThinkCapital prop firm analysis, we find that the firm bridges the gap between retail prop trading and institutional brokerage. While the broker-backed model adds a layer of safety, the prop firm rules are designed to ensure only professional-grade risk management succeeds.

| Pros | Cons |

|---|---|

| Direct liquidity from ThinkMarkets may reduce slippage under normal market conditions. | High-impact news trading is prohibited unless an add-on is purchased. |

| Traders can execute directly through TradingView charts. | Payouts requires at least 3 separate days with 0.5% profit while the account is above the starting balance, which may slow evaluation progress for inconsistent traders. |

| Fast ThinkCapital payout speed with crypto and Rise support. | The Lightning model uses a trailing drawdown based on equity. |

| Evaluation fees are returned with the 3rd successful payout - No separate refund request is required. | Strict enforcement of IP consistency to prevent account sharing. |

Traders must strictly follow the drawdown limits and consistency metrics outlined in the prop firm rules. While the profit split is attractive, the environment is designed for consistent traders.

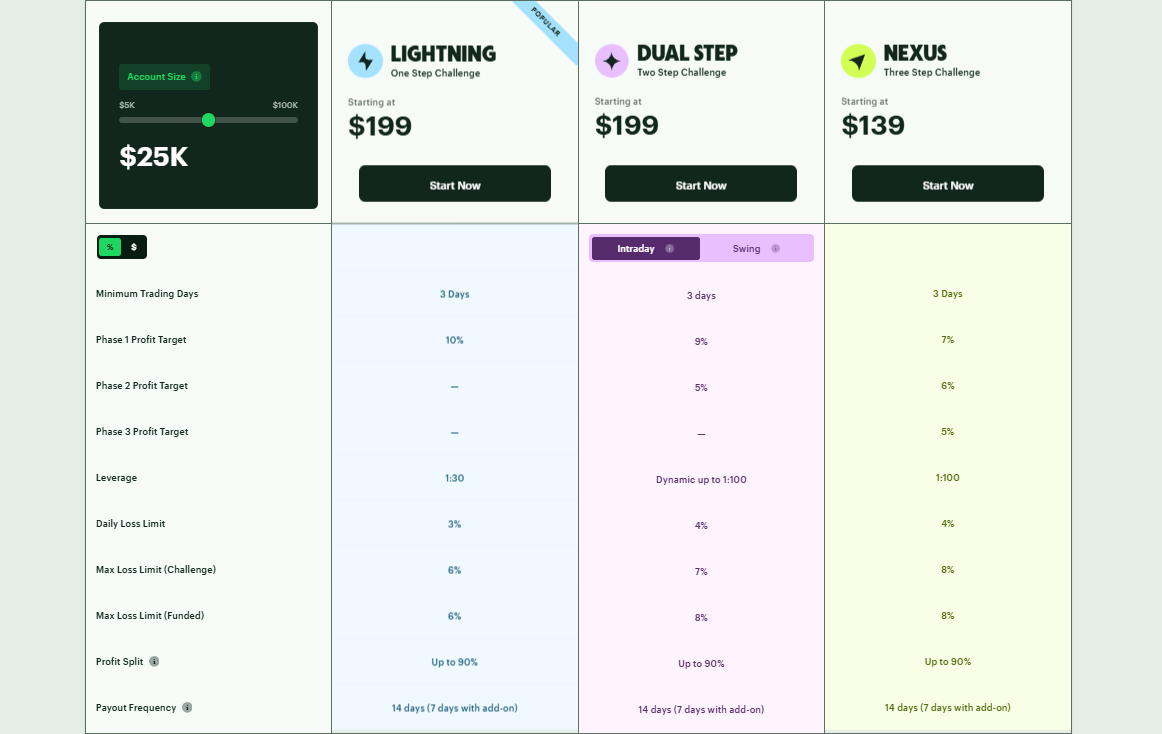

ThinkCapital Account Types, Fees & Profit Split Explained (2026)

Understanding account structure is critical, as fees, drawdown type and profit targets directly impact long-term profitability. ThinkCapital funded account structure is divided into three evaluation tiers designed to balance risk and reward across different trading experience levels.

| Account Types | Lightning (1-Step) | Dual Step (2-Step) | Nexus (3-Step) |

|---|---|---|---|

| Account Sizes | $5K - $100K | $5K - $100K | $5K - $100K |

| Account Fees | $59 - $499 | $59 - $499 for Intraday Trader / $82 - $698 for Swing Trader | $39 - $349 |

| Profit Target | 10% | 9% (P1) / 5% (P2) | 7% / 6% / 5% |

| Daily Drawdown | 3% | 4% | 4% |

| Max Drawdown | 6% | 7% (8% in Funded Stage) | 8% |

| Drawdown Type | Trailing | Static | Static |

| Min Trading Days | 3 Days | 3 Days | 3 Days |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| Leverage | 1:30 | Dynamic up to 1:100 | 1:100 |

| Profit Split | 80% (Up to 90%) | 80% (Up to 90%) | 80% (Up to 90%) |

| Payout Frequency | Bi-Weekly | Bi-Weekly | Bi-Weekly |

ThinkCapital occasionally offers promotional discounts on challenge and funded accounts. Traders can check the latest verified pricing and get 25% offer using code ‘TRUSTED’ at The Trusted Prop site before purchasing. Not all account types suit every trading style. A detailed breakdown of each funding model is provided below to assist traders in selecting the path that aligns with their specific risk management strategy and capital goals.

ThinkCapital Lightning Challenge (1-Step)

The ThinkCapital Lightning challenge model offers a streamlined path to funding with only a single 10% profit target to achieve. The primary advantage is the single-phase structure, allowing traders to reach a funded account faster compared to multi-step evaluations. However, the 6% trailing drawdown remains a core risk, as it tracks the peak account equity, requiring high precision in trade exits to avoid hitting the breach levels during volatile market conditions. Below is the breakdown of ThinkCapital Lightning challenge account sizes, fees profit target and drawdown limits.

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (3%) | Max Total Drawdown (6%) (Trailing) |

|---|---|---|---|---|

| $5,000 | $59 | $500 | $150 | $300 |

| $10,000 | $99 | $1,000 | $300 | $600 |

| $25,000 | $199 | $2,500 | $750 | $1,500 |

| $50,000 | $299 | $5,000 | $1,500 | $3,000 |

| $100,000 | $499 | $10,000 | $3,000 | $6,000 |

Why Choose ThinkCapital Lightning Challenge?

- Rapid Progression: Eliminate the wait time of multi-phase evaluations to reach a real-time profit share environment.

- Fast-Track Scalping: May suit high-accuracy scalpers who aim to reach the profit target before strict trailing drawdown.

- Competitive Entry: Lower account size options allow traders to test the platform with minimal financial risk.

ThinkCapital Dual Step Challenge (2-Step)

As part of our ThinkCapital prop firm analysis, the Dual Step challenge model is positioned as a balanced evaluation structure for traders seeking structured progression. The standout benefit is the 7% static drawdown, which does not move with profits, providing more breathing room than the Lightning account. The main challenge is the profit target requirement across two phases (9% and 5%), which demands sustained discipline. If traders fail in Phase 1, they must reset and repay the evaluation fee before attempting again. Below are the details of ThinkCapital Dual step challenge account sizes, fees profit target and drawdown limits.

| Account Size | Account Fee (Intraday / Swing) | Profit Target (9% / 5%) | Max Daily Drawdown (4%) | Max Total Drawdown (7%) (Static) |

|---|---|---|---|---|

| $5,000 | $59 / $82 | $900 / $500 | $400 | $700 |

| $10,000 | $99 / $138 | $2,250 / $1,250 | $1,000 | $1,750 |

| $25,000 | $199 / $278 | $4,500 / $2,500 | $2,000 | $3,500 |

| $50,000 | $299 / $418 | $9,000 / $5,000 | $4,000 | $7,000 |

| $100,000 | $499 / $698 | $18,000 / $10,000 | $8,000 | $14,000 |

Why Choose ThinkCapital Dual Step Challenge?

- Strategy Diversity: Offers specific pricing for Intraday and Swing Traders, catering to different holding period needs.

- Fixed Risk Buffer: The static drawdown remains locked at the starting balance, supporting swing traders who need stability.

- Balanced Leverage: Offers leverage up to 1:100, which may support structured position sizing when used with proper risk management.

ThinkCapital Nexus Challenge (3-Step)

The ThinkCapital Nexus challenge model is specifically designed for budget-conscious traders who can handle a longer evaluation process in exchange for a lower entry fee. A significant advantage is the 8% static drawdown, the highest allowance among ThinkCapital trading conditions. The risk is the increased "time-at-risk" across three separate phases, which can lead to psychological fatigue for those looking for quick capital access. Extended evaluation duration increases exposure to additive trading mistakes across phases. A quick breakdown of ThinkCapital Nexus challenge account sizes, fees profit target and drawdown limits are given below.

| Account Size | Account Fee | Profit Target (7%/6%/5%) | Max Daily Drawdown (4%) | Max Total Drawdown (8%) (Static) |

|---|---|---|---|---|

| $5,000 | $39 | $350 / $300 / $250 | $200 | $400 |

| $10,000 | $79 | $1,750 / $1,500 / $1,250 | $1,000 | $2,000 |

| $25,000 | $139 | $3,500 / $3,000 / $2,500 | $2,000 | $4,000 |

| $50,000 | $199 | $7,000 / $6,000 / $5,000 | $4,000 | $8,000 |

| $100,000 | $349 | $14,000 / $12,000 / $10,000 | $8,000 | $16,000 |

Why Choose ThinkCapital Nexus Challenge?

- Cost Efficiency: The most affordable path to a $200k account for traders who can showcase discipline across 3 phases.

- Maximum Risk Room: Offers an 8% maximum static drawdown, providing comparatively more flexibility to manage positions during volatile or extended market cycles.

- Low-Risk Systematic Traders: Ideally suited for those who prioritize a slow and steady growth model over a fast payout.

Our Verdict on ThinkCapital Account Types

Based on our research and analysis of ThinkCapital challenge models and funded account structures, the firm provides multiple account types designed to suit specific trading styles rather than a following one-size-fits-all approach.

These prop firm accounts may suit consistent day traders, swing traders and traders who have prior experience with prop firms, as understanding trailing and static drawdown limits is necessary for passing the challenge. Traders who can typically benefit from this firm are those with structured risk management and defined entry-exit models.

These accounts may not be suitable for beginners without risk management discipline, over-leveraged scalpers or traders unfamiliar with trailing drawdown limits. Traders who may struggle are those who depend heavily on high-risk news-based volatility.

Overall, the choice between ThinkCapital Lightning, Dual Step and Nexus depends on risk tolerance, psychological endurance and preferred evaluation speed.

ThinkCapital Drawdown and News Trading Rules

Effective risk management is the cornerstone of any long-term trading career and at ThinkCapital, this is enforced through specific possible thresholds. Understanding the ThinkCapital drawdown rules is essential for maintaining your funded account, as even a minor breach can lead to immediate disqualification. These rules are designed to align trader behavior with the risk management framework associated with ThinkCapital and its broker infrastructure.

ThinkCapital Drawdown Details

In this ThinkCapital review, The Trusted Prop analyzes the firm’s drawdown rules and news trading rules to help traders understand how risk controls impact their funded account. ThinkCapital utilizes different drawdown models depending on the challenge type you select. For the Lightning challenge (1-Step), the firm uses a Trailing Drawdown of 6%. This means the maximum loss limit trails your account’s highest recorded balance until you have achieved a 6% return, at which point it locks at your starting balance.

Numerical Example ($100k Account): If you grow your $100,000 account to $102,000, your drawdown floor trails up from $94,000 to $96,000. Once the account hits $106,000, the floor locks at $100,000 and stops trailing.

Daily Drawdown: It is calculated based on the higher of balance or equity at the end of the previous trading day, meaning unrealized floating losses are included in breach calculations.

Common Trader Mistake: Many traders calculate their daily limit based only on closed balance, forgetting that floating losses (unrealized P&L) also count toward the daily drawdown breach level.

ThinkCapital News Trading Details

Based on our ThinkCapital review 2026 analysis, the firm follows a structured and restrictive news trading policy designed to limit volatility exposure.

- News Trading Restricted: During the 4-minute blackout window (2 minutes before and 2 minutes after high-impact news), traders are restricted from any account activity such as closing trades, executing trades, stop loss hits, or taking profit hits during this time period.

- Fully Prohibited: Executing any account activity during the blackout window on restricted accounts results in a hard breach.

Quick Tip: Traders who want to fully take benefit of high-impact news can choose the Dual Step Swing account where news trading is fully permitted. For ThinkCapital Lightning and Nexus accounts if a trader purchases the News Trading Add-on during the checkout process – they can trade during high-impact news events.

\Overall, ThinkCapital drawdown rules and news trading rules are structured to enforce disciplined risk control rather than aggressive trading. Traders must carefully understand daily drawdown calculations and blackout windows before attempting evaluation or funded account trading. Failure to respect these possible thresholds is the most common reason for evaluation failure in this prop firm model.

Trading Instruments offered by ThinkCapital

ThinkCapital offers a diversified range of trading instruments across global financial markets, making it a multi-asset broker-backed prop firm. For traders operating under a ThinkCapital funded account, they can access multiple asset classes which allows greater strategy flexibility and portfolio diversification.

Trading Instruments and Assets

Traders can access over 150+ instruments, with specific leverage limits designed to balance buying power with risk management. Below is the breakdown of what you can trade on a ThinkCapital funded account:

- Forex: Over 50 major, minor and exotic currency pairs (e.g., EUR/USD, GBP/JPY) with leverage up to 1:100.

- Indices: Major global benchmarks including the US30, NAS100 and GER40, typically offered at 1:20 leverage.

- Commodities: Hard and soft commodities such as Gold (XAU/USD), Silver and Oil (WTI/Brent) with leverage up to 1:20.

- Cryptocurrencies: Popular digital assets like Bitcoin and Ethereum, generally traded at a lower 1:2 leverage to account for extreme volatility.

Instrument availability may vary depending on the selected account type and trading platform.

The trading instruments available under a ThinkCapital funded account provides flexibility for traders who want to trade across multiple asset classes. However, leverage limits and instrument availability should be reviewed carefully before selecting an account type. As always, traders should align instrument choice with their risk management plan.

ThinkCapital Spreads & Commissions: What You Really Pay

When evaluating is ThinkCapital a legit prop firm in 2026, looking at the cost of execution is vital. Unlike many white-label firms that hide costs in wide markups, ThinkCapital provides transparent pricing that reflects its broker-backed roots. The effective trading costs are structured to remain competitive compared to many broker-backed prop firm models, particularly for traders using the MT5 Raw pricing environment.

Spreads and Commissions Details

The spread and commission structure at ThinkCapital is designed to mimic a professional trading environment. On major pairs like EUR/USD, spreads often start at 0.0 pips, while the commission is a flat rate - typically around $7 per round turn lot. For indices and certain commodities, ThinkCapital often utilizes an All-In spread model with zero commission, which can be more cost-effective for day traders who execute frequent, smaller positions.

This realistic fee impact ensures that execution costs do not materially decay your profit split before a payout request. Since payouts are calculated based on net realized profit after trading costs, tighter spreads can improve long-term funded account sustainability.

ThinkCapital spread and commission model reflects a broker-backed prop firm structure rather than a simplified demo-style environment. Traders should evaluate effective trading costs alongside drawdown rules and payout conditions to understand the full financial impact. For disciplined traders, realistic execution pricing can support more sustainable funded account performance over time.

ThinkCapital Rules (2026) - What is Allowed and What is Not

Understanding ThinkCapital’s trading rules is essential before purchasing a funded account in the firm. This ThinkCapital review 2026 breaks down the firm’s drawdown rules, trading strategy rules and account restrictions to clarify what is allowed and what may trigger a breach. As a broker-backed prop firm, ThinkCapital maintains structured compliance standards designed to mirror real market conditions.

| Trading Strategies | Allowed or Not | Details |

|---|---|---|

| Scalping | Allowed | High-frequency manual scalping is permitted, but automated tick scalping is banned. |

| Swing Trading | Allowed | Permitted across all accounts - news trading is natively allowed on the Dual Step Swing model. |

| News Trading | Restricted | Prohibited 2 minutes before/after Red Folder events unless the News Trading Add-On is purchased. |

| Martingale | Not Allowed | Prohibited due to risk exposure and violation of prop firm risk parameters - doubling down after losses will lead to a breach. |

| Hedging | Partial | Hedging within a single account is allowed - hedging across multiple accounts or firms is prohibited. |

| Copy Trading | Restricted | Allowed only between your own ThinkCapital accounts - requires the EA Add-On to be active. |

Prohibited Practices at ThinkCapital

To maintain the integrity of a ThinkCapital funded account, the firm monitors for specific behaviors that do not translate well to real market environments:

- Gambling & Punting: Placing "all-in" trades or high-risk bets without a stop loss to "pass fast" is considered as a violation of the firm’s risk management standards.

- Arbitrage: Latency arbitrage, gap trading and exploiting data feed delays are strictly forbidden.

- Grid Trading: Prohibited due to the high risk of over-leveraging and lack of institutional replicability.

- Account Sharing: Sharing credentials or using "challenge passing services" is a direct violation of the terms of service.

- IP Address Consistency: ThinkCapital tracks IP addresses to ensure the account holder is the sole trader. While a Forex VPS is permitted for EAs, using a standard VPN during KYC or trading can trigger a security audit or breach.

Soft Breach vs. Hard Breach Example:

- Soft Breach: If you fail to place a trade for 30 days, your account may be paused (Soft Breach), but it does not always lead to immediate termination.

- Hard Breach: If you violate the ThinkCapital drawdown rules (e.g., hitting the 4% daily loss limit) or trade during a restricted news window, it is a hard breach. This results in immediate account closure and forfeiture of all profits.

Our Verdict on ThinkCapital Rules

The ThinkCapital prop firm analysis indicates that their rules are generally transparent but require high discipline. Because they are broker-backed, they expect traders to behave like professional liquidity providers. ThinkCapital rules are strict and may not suit aggressive trading styles. If you are a trader who relies on position strategies during NFP or CPI news events without the proper add-on, you will likely find the environment restrictive. However, for those who trade with a systematic approach and use stop-losses religiously, these rules provide a stable framework that supports long-term funded account sustainability for disciplined traders.

ThinkCapital Scaling Plan – Grow Your Account Over Time

The ThinkCapital scaling plan is designed to reward trading consistency over long period rather than short-term aggressive profit gains. The prop firm’s scaling plan focuses on funded account growth through sustained quarterly performance, making it more suitable for disciplined traders than high-risk strategies.

Scaling Plan Details

ThinkCapital scaling performance operates on a quarterly review cycle, rewarding traders who prioritize capital preservation alongside steady growth. Unlike firms that scale based on a single lucky month, ThinkCapital requires sustained performance over a longer duration.

- Time-Based Condition: Accounts are reviewed every three months (quarterly). To qualify, a trader must have successfully processed at least three separate withdrawals within the review period.

- Performance Requirement: Traders must achieve a total profitability of at least 10% over the three-month review cycle equivalent to an average of roughly 3.33% per month (though performance is evaluated cumulatively).

- Scaling Increment: Upon successful review, the initial virtual starting balance is increased by 20% of the original amount. Scaling does not reset drawdown limits or trading rules - standard risk parameters continue to apply even after the balance increase.

- Maximum Allocation Caps: The maximum account scaling depends on your chosen trading platform. MetaTrader5 accounts can scale up to $1 million, while those exclusively using ThinkTrader can reach a maximum of $1.5 million.

- Trader Responsibility: Scaling is not automatic and requires the trader to manually contact the support team after meeting all eligibility criteria for review and approval.

This prop firm scaling plan is built on a linear model. For a $100,000 account, each successful scaling event adds $20,000 to the balance (e.g., $120k, then $140k, then $160k). It is important to note that account merging or splitting is prohibited - the growth must occur within the specific account passed during the evaluation phase.

The three-month review window and withdrawal requirement indicate that ThinkCapital prioritizes measurable trading consistency over short-term volatility-driven performance. While the 10% cumulative target is achievable for consistent traders, maintaining this performance across three months requires disciplined risk control. Traders who rely on aggressive position sizing or news-driven volatility may find this prop firm scaling plan more restrictive compared to firms offering monthly scaling.

ThinkCapital scaling plan rewards disciplined execution and structured risk management. Traders aiming for long-term funded account growth must treat scaling as a gradual capital expansion process rather than a rapid account multiplier. Understanding these scaling conditions is essential before committing to higher allocation targets.

Payment Methods & Payout Process at ThinkCapital

In this section of our ThinkCapital review, we examine the payment methods and payout process offered by this broker-backed prop firm. Understanding how withdrawals work, processing timelines and compliance checks is important before trading a ThinkCapital funded account. Below is a detailed breakdown based on official information and trader feedback.

Details of Supported Payment Methods at ThinkCapital

ThinkCapital provides three primary channels for withdrawing profits from a ThinkCapital funded account. Each method is designed to cater to different geographical and speed requirements:

- Cryptocurrency: Supports USDT (TRC20/ERC20). This is generally the fastest method with the lowest transactional friction.

- Rise: A secure, email-based financial service. Note that a flat fee of $50 is deducted once per month for Rise processing.

- ThinkMarkets Live Account: Traders can transfer profits directly to a personal ThinkMarkets live trading account, provided they do not reside in a restricted country.

Details of Payout Options at ThinkCapital

The flexibility of the ThinkCapital profit split and payout frequency depends on the trader's initial setup:

- Bi-Weekly Payouts: The default cycle for all accounts (Lightning, Dual Step, and Nexus), starting from the day of the first trade.

- Weekly Payouts: Available as an "Add-On" feature during the challenge purchase phase.

- Affiliate Payouts: Requires a minimum commission balance of $100 and completed KYC verification.

How the Payout Process Works at ThinkCapital

Understanding how does ThinkCapital payout process is essential to avoid a breach during the request phase. The process follows a strict protocol:

- Position Management: All open positions must be closed at the time of the request. Leaving positions open creates a risk - if the account breaches while a request is pending, the payout is forfeited. This is a common area where traders make mistakes, especially if market volatility causes a rule breach during the review window.

- Request Submission: Traders submit the request via their dashboard once the 14-day (or 7-day) cycle is met.

- Verification: The account undergoes a manual or automated review to ensure compliance with ThinkCapital drawdown rules and news trading restrictions.

- Minimum Threshold: The ThinkCapital prop firm has not published an official minimum withdrawal amount.

The payout workflow follows a structured compliance review to ensure all prop firm rules are met before capital distribution.

Realistic Timeline Example: For example, a payout requested on Monday is typically processed within 3 business days. Once processed, funds usually reflect in your account within 24 to 48 hours, though bank-related transfers via the broker method can take up to 5 business days.

The above information is compiled from official ThinkCapital documentation and verified trader experiences as of 2026.

Our Verdict on ThinkCapital Payout Process & Payment Methods

Based on our analysis at The Trusted Prop, the ThinkCapital payout process appears structured and compliance-focused. The requirement to close all positions before requesting withdrawals may not suit aggressive traders, but it does reduce risk during the review phase. The $50 Rise processing fee should be factored into effective trading costs. Overall, payout timelines are competitive compared to other broker-backed prop firms, provided traders strictly follow the drawdown rules and request cycle conditions.

Countries Restricted at ThinkCapital

ThinkCapital pro firm maintains strict adherence to global financial regulations and OFAC sanctions. This compliance ensures the long-term stability of the ThinkCapital funded account ecosystem but necessitates specific geographic restrictions. A key part of any ThinkCapital prop firm analysis is verifying your eligibility based on your residency and citizenship to ensure a smooth ThinkCapital payout process.

The following countries and regions are currently restricted from accessing ThinkCapital services:

• Afghanistan

• Albania

• Australia

• British Columbia (Canada)

• Burma (Myanmar)

• Burundi

• Central African Republic

• Cuba

• Cyprus

• Guinea

• Haiti

• Iran

• Iraq

• Kosovo

• Lebanon

• Libya

• Mali

• Midway Islands

• North Korea

• Republic of the Congo

• Russia

• Samoa

• Somalia

• Sudan

• Syria

• Ukraine

• Vatican City State

• Venezuela

• Vietnam (New onboarding paused; existing accounts remain active but cannot purchase new challenges)

• West Bank

• Western Sahara

• Yemen

• Zambia

Traders need to note that this country restrictions may change due to regulatory or payment provider requirements.

For permitted regions, the ThinkCapital trading conditions are some of the most strong in the industry. However, traders in the United States and certain territories (including Canada, Pakistan and Puerto Rico) should note that they are restricted to using the ThinkTrader platform and cannot access MetaTrader.

Our Final Verdict on ThinkCapital

Based on our research, ThinkCapital review concludes that this broker-backed prop firm offers a funded account program with a solid structure supported by the regulated infrastructure of ThinkMarkets. These accounts can be a good fit for consistent day traders, swing traders and low-risk systematic traders who value clear drawdown rules and disciplined risk controls. Conversely, complete novices without risk-management skills, scalpers with excessive leverage and heavily news-based traders might struggle with some restrictions and risk limits. The total cost in relation to the value is reasonable, however, traders ought to thoroughly evaluate the drawdown and news-trading rules in relation to their strategy before making a commitment. The firm’s rules are mostly clear, but a high level of discipline and risk management is necessary.

View the latest pricing and verified prop firm offers, reviewed by The Trusted Prop.