Maven Trading Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Maven Trading review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.3

4.3

Maven Trading

Forex, Crypto, Indices, Commodities

GB

2022

CEO: Jon Alexander

Get 8% off + a free same-size account after payout (excludes $100K & Instant accounts)

Coupon Code:

MatchTrader

cTrader

Metatrader 5

Wire Transfer/ Bank Transfer

Crypto

Rise

Crypto

Credit/Debit Card

MatchTrader

Purple Trading

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

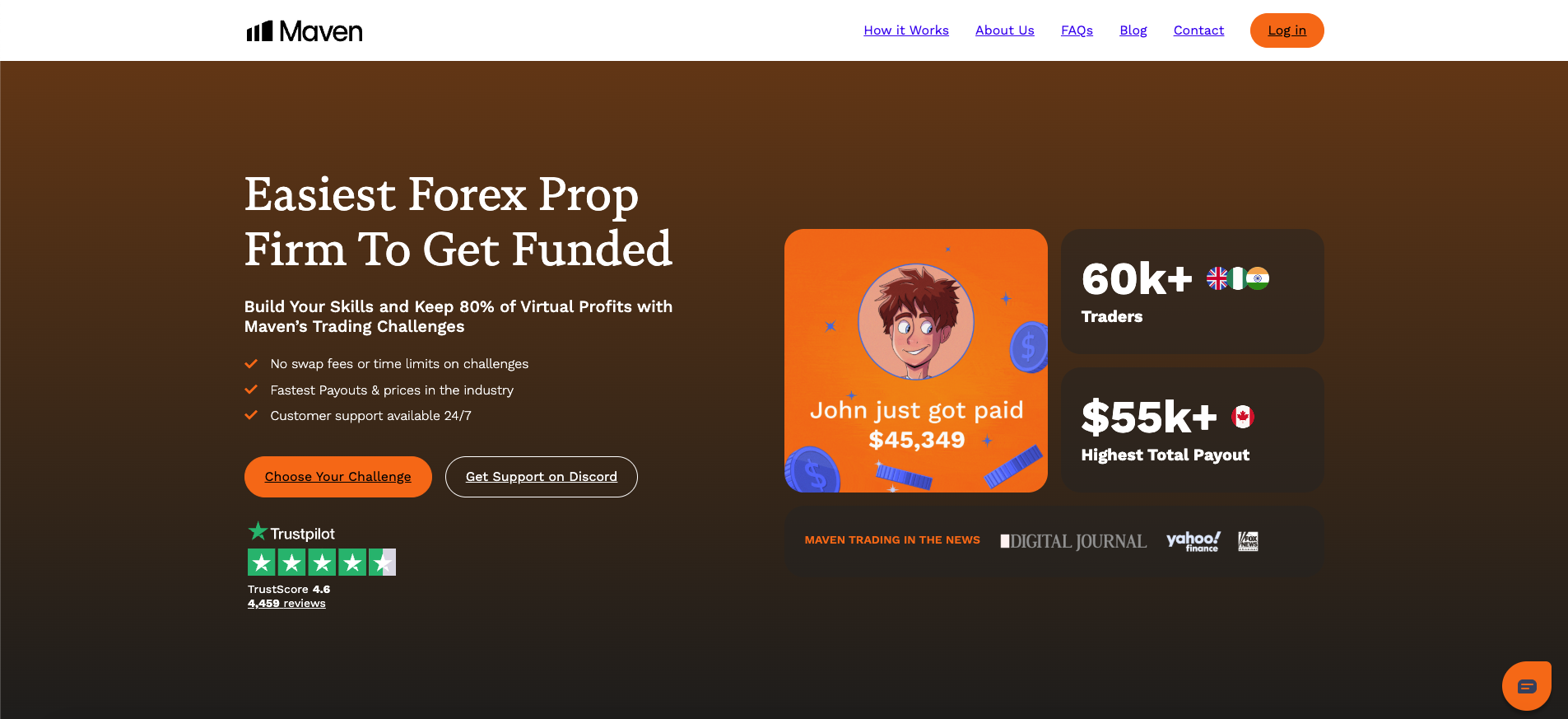

Maven Trading is a UK-based prop trading firm which allows traders to manage as much as $1,000,000 in funded capital.

With flexible challenge options and their low fees, coupled with competitive profit splits sustain trader growth, Maven Trading emerges as one of the most sophisticated prop trading firms.

However, is Maven Trading the most suitable option for you? Read below to learn more!

Maven Trading - Prop Firm Overview:

| Feature | Details |

|---|---|

| Company Name | Maven Trading |

| Company Legal Name | Maven Trading Group |

| Company Legal Number | The legal registration number of Maven Trading is BC1363148 |

| Headquarters | Maven Trading is registered in the United Kingdom |

| Years in Operation | Maven Trading has been operating since 2 years |

| Broker | MatchTrader Purple Trading |

| CEO | The CEO of Maven Trading is Jon Alexander |

| Challenge Types | Maven Trading offers One Step Challenge, Two Step Challenge, Three Step Challenge, Instant Funding. |

| Challenge Fees | Maven Trading challenge fees range from $15 – $380 |

| Profit Split | Maven Trading offers profit split from 80% to 100% |

| Account Sizes | The account sizes range from $2,000 to $100,000 |

| Payouts | Maven Trading payout are processed every 10 business days |

| Financial Markets | Trading instruments like Forex, Indices, Commodities, and Cryptos are offered by Maven Trading |

| Trading Platform | Maven Trading supports cTrader, and Match-Trader trading platforms |

| TrustPilot Score | Maven Trading has a 4.6/5 rating on Trustpilot |

Maven Trading Pros & Cons - Quick Comparison

Maven Trading provides a lower entrance fee and flexible challenge options for an exceptional cost of entry. Additionally, traders can scale accounts over a million dollars with an 80% profit split. Profound traders will find value in the account with no minimum trading days, high leverage, and access to numerous trading platforms. While there are benefits, some traders may find the rigid IP rules, wider spreads, and lack of MT4/MT5 less desirable. In summary, Maven strikes a balance between structure and opportunity which provides traders a great option if growth and performance is the goal.

| Pros | Cons |

|---|---|

| Starting challenge fees are as low as $15 | Less competitive spreads |

| 1-Step, 2-Step, and 3-Step Challenges offer flexibility with up to 100% profit share is available | Pricing and liquidity providers are a closely guarded secret |

| No minimum trading days | Restrictive payout policy capped at $10,000 per two cycles |

| Up to $1,000,000 in Funding is achievable with Scalable Funding | MT4/MT5 platforms not offered |

| No overnight swap fees for positions held overnight | Use of IP addresses is heavily monitored |

Maven Trading Challenge All You Need To Know About Types, Fees, And Profit Split

Maven Trading has aligned their challenges appropriately with the experience and style of prop traders with fully funded accounts by introducing a 1 Step, 2 Step and 3 Step Challenge. All these challenges differ with regards to specific evaluation criteria like profit and drawdown limits.

With no time restrictions, trailing drawdown, and a target of 8% profit, The Maven Trading 1-Step Challenge is suited for seasoned traders who want to go through a single-phase evaluation. It is best for seasoned prop traders who want an expedited path to a funded account through a simple evaluation process.

For prop traders who are systematic in their approach, Maven Trading 2-Step Challenge offers two phases. Phase 1 and Phase 2 are each respectively 8% and 5% profit goals which, when used with static drawdown limits, offer a one of a kind opportunity in prop trading. This is best suited for traders who wish to practice smart risk management strategies.

The Maven Trading Rapid or 3-Step Challenge is best suited for swift prop traders who thrive in high-intensity environments and short term strategy. With only a 3% target in profit per phase, a 7-day window to complete each phase, and a maximum drawdown cap, it is designed for those who can prove themselves under the skill Showcase pressure.

Maven Trading Challenges Breakdown Table:

| Requirements | 1-Step Challenge | 2-Step Challenge | 3-Step Challenge | Instant Funding - Standard | Instant Funding - Mini |

|---|---|---|---|---|---|

| Account Balance | $2,000 – $100,000 | $2,000 – $100,000 | $2,000 – $100,000 | $2,000 – $100,000 | $2,000 – $100,000 |

| Challenge Fees | $15 refundable (with $2k) | $19 refundable (with $2k) | $13 refundable (with $2k) | $15 refundable (with $2k) | $17 refundable (with $2k) |

| Time Limit | None | None | None | None | None |

| Profit Split (Funded Stage) | 80% | 80% | 80% | 80% | 80% |

| Profit Target | 8% | 8% (Phase 1), 5% (Phase 2) | 3% per step | 3% (Minimum Withdraw) | 3% (Minimum Withdraw) |

| Max Total Loss | 5% (Trailing) | 8% | 3% | 3% (Trailing) | 3% (Trailing) |

| Daily Drawdown | 3% | 4% | 2% | 2% | 2% |

| Min Trading Days | 0 | 0 | 0 | 0 | 0 |

| Drawdown Method | Trailing (5%) | Static (8%) | Static (3%) | Trailing (3%) | Trailing (3%) |

| Leverage | Not mentioned | Not mentioned | Not mentioned | Not mentioned | Not mentioned |

| Payout Frequency | Every 10 Business Days | Every 10 Business Days | Every 10 Business Days | Every 10 Business Days | Immediate |

| Special Features | Weekend Holding, Swap Free, Buyback | Weekend Holding, Swap Free, Buyback | Weekend Holding, Swap Free, Buyback | Weekend Holding, Swap Free | Weekend Holding, Swap Free |

Every individual trading challenge at Maven Trading is created to match the distinct preferences of traders, whether you like a rapid assessment framework or a multi-step method. With refundable fees, profit areas of division to eighty percent, and reasonable limits on drawdowns, Maven Trading guarantees off traders a fair, transparent evaluation process.

Let’s take a closer look at each of the Maven Trading challenges!

1-Step Challenge Overview

Accelerate your funding journey and fulfill your trading aspirations with Maven Trading's 1-Step Challenge: 1 phase, 1 profit target, funded account without an evaluation.

1-Step Challenge

| Account Size | Challenge Fee | Profit Target (8%) | Max Daily Drawdown (3%) | Max Total Drawdown (5%) (Trailing) |

|---|---|---|---|---|

| $2,000 | $15 | $160 | $60 | $100 |

| $5,000 | $25 | $400 | $150 | $250 |

| $10,000 | $35 | $800 | $300 | $500 |

| $20,000 | $55 | $1,600 | $600 | $1,000 |

| $50,000 | $95 | $4,000 | $1,500 | $2,500 |

| $100,000 | $185 | $8,000 | $3,000 | $5,000 |

Why Choose the 1-Step Challenge

- One phase: fewer steps.

- A simpler set of rules means quicker access to a funded account.

- Once you are funded, you retain 80% of profit.

2-Step Challenge Overview

Maven Trading's 2-Step Challenge consists of an evaluation in two phases: Show us your style and strategy in Phase 1 and Phase 2 before accessing a funded account.

2-Step Challenge

| Account Size | Challenge Fee | Profit Target (8% (Phase 1) / 5% (Phase 2)) | Max Daily Drawdown (4%) | Max Total Drawdown (8%) (Static) |

| $2,000 | $19 | Step 1: $160 / Step 2: $100 | $80 | $160 |

| $5,000 | $29 | $400 / $250 | $200 | $400 |

| $10,000 | $39 | $800 / $500 | $400 | $800 |

| $20,000 | $59 | $1,600 / $1,000 | $800 | $1,600 |

| $50,000 | $109 | $4,000 / $2,500 | $2,000 | $4,000 |

| $100,000 | $199 | $8,000 / $5,000 | $4,000 | $8,000 |

Why Choose the 2-Step Challenge

- Two phases mitigate risk and offer a balance of risk and reward.

- Profit targets are clearer, 8% for Phase 1 and 5% for Phase 2.

- Once funded, you retain 80% of the profit.

3-Step Challenge Overview

Maven Trading's 3-Step Challenge offers a progression of 3 phases, with lower profit targets for each phase. This challenge format is best suited for the trader who is focused on consistency and wishes to progress slowly toward a funded account.

3-Step Challenge

| Account Size | Challenge Fee | Profit Target (3%) (per phase ×3) | Max Daily Drawdown (2%) | Max Total Drawdown (3%) |

| $2,000 | $13 | $60 | $40 | $60 |

| $5,000 | $19 | $150 | $100 | $150 |

| $10,000 | $29 | $300 | $200 | $300 |

| $20,000 | $49 | $600 | $400 | $600 |

| $50,000 | $89 | $1,500 | $1,000 | $1,500 |

| $100,000 | $159 | $3,000 | $2,000 | $3,000 |

Why Choose the 3-Step Challenge

- Reduced profit targets per step (3% for each phase) encourage consistency.

- Take your time; there is no strict limit on the time it takes to complete each phase.

- Once funded, you retain 80% of profit.

Instant Funding Overview

Maven Trading's Instant Funding gives you funded accounts without challenges: access to a funded account and start trading real capital without the evaluation phase process.

Instant Funding

| Account Size | Challenge Fee | Profit Target (3%) | Max Daily Drawdown (2%) | Max Total Drawdown (3%) (Trailing) |

| $2,000 | $15 | $60 | $40 | $60 |

| $5,000 | $25 | $150 | $100 | $150 |

| $10,000 | $35 | $300 | $200 | $300 |

| $20,000 | $55 | $600 | $400 | $600 |

| $50,000 | $95 | $1,500 | $1,000 | $1,500 |

| $100,000 | $175 | $3,000 | $2,000 | $3,000 |

Why Choose Instant Funding

- There is no multi-phase evaluation, direct funding access.

- From the start, you are trading with live funds, amplifying your profitability.

- You retain 80% of profits.

Instant Funding (Mini) Overview

Expedited access to live capital with Maven Trading’s Instant Funding mini; low-cost entry point; can complete trades intraday of up to 24 hours; proceeds go directly into a funded account.

Instant Funding (Mini)

| Account Size | Challenge Fee | Profit Target (3%) | Max Daily Drawdown (2%) | Max Total Drawdown (3%) |

| $2,000 | $13 | $60 | $40 | $60 (trailing) |

| $5,000 | $17 | $150 | $100 | $150 |

| $10,000 | $38 | $300 | $200 | $300 |

| $20,000 | $76 | $600 | $400 | $600 |

| $50,000 | $190 | $1,500 | $1,000 | $1,500 |

| $100,000 | $299 | $3,000 | $2,000 | $3,000 |

Why Choose Instant Funding (Mini)

- Budget - friendly start with a low entry fee - ideal for trying out prop firm funding with minimal cost.

- Fast access to funding: trade live accounts sooner by avoiding multiple phases of challenges.

- Designed for intraday traders: trade for a maximum of 24 hours, use risk rules to mitigate your exposure and profit sharing remains consistent.

Which Maven Trading Challenge Is Right for You?

| Challenge Type | Best For |

|---|---|

| 1-Step Challenge | Maven Trading 1-step challenge is for traders who are confident and who want fast results |

| 2-Step Challenge | Traders who like a balanced, traditional approach should go with Maven Trading 2-step challenge |

| 3-Step Challenge | Maven Trading 3- step challenge is best for risk-conscious traders and who like taking it slow |

| Instant Funding (Standard) | Experienced traders who want capital right away should go with Instant Funding standard challenge. |

| Instant Funding (Mini) | Newer or budget-focused traders who want quick access and small size testing |

Our Review on Maven Trading Challenges

As per our evaluation, Maven Trading’s set of trading challenges stands out as one of the most flexible and trader-friendly options in the prop firm industry. With numerous evaluation types, drawdown limits that adapt to performance, and no rigid trading time windows, Maven Prop Trading goes above and beyond in catering to distinct traders.

Maven Trading should absolutely be on your shortlist if you are actively looking for prop firms with evaluation processes that are more hands-off. Trade within reasonable limits no strict weekly limits apply with fair rules and realistic benchmarks reflecting advancement. Such traits denote a prop firm that aims to equip traders with funds while at the same time fostering their professionals.

Maven Trading Funded Accounts Scaling Plan – Capital Limit $1 Million

Maven Trading has set a clear path to account scaling and offer a competitive scaling plan to prop traders, which will enable them to make greater profits as they become more skillful with their trading. This plan ensures allocation of up to $1 million which provides maximum profit potential over time.

In order to increase the size of the funded account, the prop traders need to achieve a 10% net profit in 4 sequential months at an average rate of 2.5% per month along with at least one successful payout per month during that time. After the trader meets those requirements, he will be rewarded with a 25% increase on his provided prop account.

As the prop trader increases his profits, he can also take advantage of being able to withdraw more money while also increasing his margin. This cycle can be done every four months. Consistently profitable traders require time to grow their account balance significantly, increasing the withdraw cap.

Maven Trading Scaling Example:

| Elapsed Time | Account Balance |

|---|---|

| 0 months | $200,000 |

| 4 months | $250,000 |

| 8 months | $312,500 |

| 12 months | $390,625 |

| 16 months | $488,281 |

| 20 months | $610,351 |

| 24 months | $762,939 |

| 28 months | $953,674 |

| 32 months | $1,000,000+ |

By maintaining consistent performance and withdrawals, traders can grow their account from $200,000 to over $1 million in just over two and a half years.

Key Features of Maven Trading’s Scaling Plan:

| Scaling Criteria | Details |

|---|---|

| Scaling Interval | Every 4 months |

| Profit Target | 10% net profit (2.5% per month) |

| Payout Requirement | Minimum of 1 successful payout per month |

| Capital Growth Rate | 25% increase in account size per scaling cycle |

| Profit Split | Starts at 80%, may scale up to 90% |

| Maximum Capital | $1,000,000 (or more, depending on firm approval and trader performance) |

| Trading Rules | No change in trading rules as capital increases |

Why Choose Maven Trading’s Funded Scaling Plan?

- Steady Capital Growth: With a predictable increase in trading capital, you can steadily scale your account while maintaining the same trading strategy.

- Increased Profit Splits: Profit splits start at 80% but can increase up to 90%, maximising earning potential as your account size grows.

- Consistent Trading Conditions: No changes to trading rules, allowing you to scale using your existing trading strategies without additional pressure.

- Long-Term Growth: Ideal for traders with a disciplined approach who seek to grow their capital over time, ultimately reaching up to $1 million.

Our Review of Maven Trading’s Funded Scaling Plan

Based on our review, Maven Trading’s Scaling Plan is a standout feature that sets the firm apart in the proprietary trading space. Where many prop firms lock traders into fixed capital limits or apply rigid restrictions, this proprietary firm takes a more flexible and trader-friendly approach.

By tying growth opportunities to consistent prop trading performance and ongoing payouts, Maven ensures that scaling is earned, measurable, and aligned with trader success. This creates a mutually beneficial relationship traders grow their capital and profits, while the firm works with reliable, disciplined market participants.

Whether you're an ambitious new prop trading beginner or a seasoned pro looking to expand your capital base, this scaling plan offers a powerful pathway to reach up to $1 million in funded capital while maintaining full transparency and control over your trading approach.

Daily Drawdown Calculation of Maven Trading

Maven Trading calculates the daily drawdown based on either balance or equity, whichever is higher, at 00:00 UTC each day.

The drawdown limit recalculates daily, adjusting based on account performance. The limit will increase or decrease as the account balance or equity changes, providing a dynamic but fair drawdown system.

Maven Trading - Trading Rules Explained

Maven Trading has defined rigid trading rules and risk management policies to help maintain order and ensure responsible trading. Prop traders enjoy competitive leverage as well as raw spreads, but have to comply with specific Maven Trading policies.

| Trading Rules | Allowed? | Details |

|---|---|---|

| High-Impact News Trading | ❌ No | Traders are not allowed to open or close trades two minutes before or after a red-folder news event. |

| Weekend Trading | ✅ Yes | Traders are allowed to copy trades within their own Maven Trading accounts for some challenges. |

| Copy Trading (Own Accounts) | ✅ Yes | Copy trading is not allowed in the Maven Trading One-Phase Challenge. It is permitted in the Two-Phase and Three-Phase challenges. |

| Trade Copying (External) | ❌ No | Copying trades from other traders or using mirroring tools across third-party platforms is not allowed. |

| High-Frequency Trading (HFT) | ❌ No | HFT and server-exploitative methods are forbidden. |

| Overleveraging | ❌ No | Traders must manage risk and avoid using leverage that exceeds account tolerance. Accounts may be flagged if the margin level drops to a certain level. |

| One-Sided Bets | ❌ No | All-in trading, or placing trades without stop-losses, intending to pass/fail in one shot, is strictly forbidden. |

| Excessive Scalping | ❌ No | Impulsive, frequent trades without strategic consideration, including excessive scalping, are not permitted. |

| Martingale Strategy | ❌ No | Opening five or more positions in drawdown on the same pair violates risk management rules. |

| Grid Trading | ❌ No | No approval for strategies that layer multiple orders without structured exits. |

| Reverse Hand Post-Taking Losses | ❌ No | Entering the opposite direction of a losing trade within a short time frame to recover losses is prohibited. A minimum wait time of 5 minutes is required. |

| Tick, Latency, or Hedge Arbitrage | ❌ No | Engaging in arbitrage strategies that exploit market inefficiencies or latency is banned. |

| Data Feed Manipulation | ❌ No | Taking advantage of pricing errors or delays is forbidden. |

| IP Address Usage (Single Account Per IP) | ✅ Yes | Only one funded account per household/IP is allowed. International travel should be notified to avoid account suspension. |

| IP Address Misuse | ❌ No | Manipulating or masking IP addresses or trading from multiple locations without proper notification could result in account suspension. |

| Swap-Free Accounts | ✅ Yes | swap-free funded accounts are available on request. |

News Trading Rules of Maven Trading:

Maven Trading, like with many proprietary firms, has rules in place when it comes to news trading.

Maven trading prohibits traders from opening or closing trades two minutes before or after a major red folder news event / High Impact News Event. This is to ensure that traders cannot game the system using volatility spikes in the market.

These rules prevent traders from becoming too risky, protecting both the trader and the firm from undue exposure.

Our Review of Maven Trading's Rules

According to a review we recently conducted, Maven Trading permits the use of Expert Advisors (EAs) and allows weekend holding trades which shows that Maven Trading practices responsible trading. At the same time, Maven Trading has a zero tolerance policy concerning the use of manipulative and abusive trading strategies.

Through these proprietary trading rules, the firm seeks to cultivate professional risk management skills among its traders, increasing their chances of success within proprietary trading over time.

Trading Competitions at Maven Trading

Presently, Maven Trading does not hold any competitions. This prop firm primary concentrates on defined challenges and funding models, which allows traders to develop their skills in a controlled environment.

Trading Instruments Offered by Maven Trading

Beginners and expert traders have the luxury of financial tools offered in this prop firm. These are the most relevant trading instruments that Maven Trading has to offer.

Forex Trading with Maven Trading

With Maven Trading, numerous Forex currencies are easily accessible. The major pairs, for example;

EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs, will be included. These pairs come with high liquidity, low spread, and deep market access which ensures an efficient and dynamic experience in Forex trading.

Trading Indices with Maven Trading

Maven Trading gives traders direct access to major global indices such as S&P 500, Dow Jones, and Nasdaq.

Maven Trading provides traders with generous leverage and tighter spreads, allowing traders to exploit the sharp movements and the potential that the indices markets offer. Thus, any trading style can be accommodated.

Cryptocurrency Trading with Maven

Maven Trading facilitates the trading of cryptocurrencies, enabling access to the major ones, Bitcoin (BTC), Ethereum (ETH), and others. This platform offers cryptocurrency traders competitive spreads and leverage, enabling them to take advantage of the highly volatile crypto markets while minimizing their exposure.

Maven Trading and Commodity Trading

Traders have access to a variety of commodities like precious metals and energy, for instance, Gold (XAU/USD) and WTI Crude Oil. Maven Trading offers well-capitalized markets for commodities, thus greatly enabling traders to diversify their portfolios.

Our Review of Trading Instruments Offered by Maven Trading

Based on our review, Maven Trading gives traders a solid range of instruments, including Forex, indices, cryptocurrencies, and commodities, making it versatile for a variety of trading strategies. While this prop firm offers competitive spreads and low fees for entry, its lack of some advanced platform options may limit experienced traders.

However, the platform’s diverse instruments make it an attractive choice for those looking to explore different financial markets.

Whether traders are looking for Forex, indices, cryptocurrencies, or commodities, Maven Trading offers a well-rounded trading environment for prop traders to plan their trading strategies.

Maven Trading Challenge Fee Payment Methods

Maven Trading enables traders to pay for challenge fees through several payment methods including credit cards and cryptocurrencies. Traders can transact through Bitcoin, Ethereum, and stablecoins through Boomfi Payment Gateway.

Maven Trading - Payout Methods and Requirements

Maven Trading offers secure payout methods via Crypto, Direct Bank Transfer, or through Rise.

Payout Requirements:

- A minimum of 3 trading days with at least 0.5% closed profit per day.

- Ensure a positive funded account with no active trades before requesting a payout.

Payout Schedule:

At Maven Trading, payout requests can be made after 14 days of funded account activation, or traders can choose a 7-day payout option.

Country Restrictions at Maven Trading

As a prop firm Maven Trading has come under increasing scrutiny regarding their regulatory compliance policies. Because of this only selected eligible traders from specific countries are allowed to access their programs. Due to other financial rules and limitations in certain regions, traders from these countries are not allowed to buy or take part in challenges held by Maven Trading:

- Afghanistan

- Belarus

- Bosnia And Herzegovina

- Burundi

- Central African Republic

- China

- Congo (Brazzaville)

- Congo (Kinshasa)

- Cuba

- Eritrea

- Guinea

- Haiti

- Hong Kong

- Iran

- Lebanon

- Libya

- Mali

- Moldova

- Myanmar

- Nicaragua

- North Korea

- Palestinian Territory

- Papua New Guinea

- Russia

- Saint Helena

- Saint Lucia

- Saint Pierre and Miquelon

- Samoa

- Sierra Leone

- Somalia

- South Sudan

- Sudan

- Syria

- Tunisia

- Ukraine

- Vanuatu

- Venezuela

- Virgin Islands (British)

- Yemen

Our Final Thoughts on Maven Trading Prop Firm

After reviewing the Maven Trading prop firm, it stands out in the competitive prop trading industry, offering a wide array of financial instruments, including Forex, indices, commodities, and cryptocurrencies. With a clear focus on providing traders with scaling opportunities, Maven offers capital scaling up to $2 million and profit splits as high as 90%, making it an attractive choice for both beginners and experienced traders.

The prop firm ensures transparency with its prop trading rules, offers structured challenges, advanced trading platforms and maintains high leverage limits, all of which contribute to a well-rounded trading experience.

However, it’s important to note that Maven enforces restrictions on strategies such as high-frequency trading, news trading, and arbitrage, which may affect certain prop trading styles.

Overall, Maven Trading is a prop firm that offers a robust platform for traders looking for well-regulated, professional trading conditions and a clear path to scaling up their funds.