Copy Coupon Code to Get

40% Off 🎉

Goat Funded Futures

Futures, Stocks, Indices, Crypto, Metals, Energies

HK

2024

CEO: Edoardo Dalla Torre

Coupon Code:

Tradovate

Ninjatrader

ProjectX

Trading View

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

PayPal

NinjaTrader

Tradovate

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

2/13/2026

If you are considering trading with Goat Funded Futures in 2026 then understanding the prop firm rules is not optional but rather it is essential for traders. Many traders fail not because of bad strategy, but because they misunderstand drawdown limits, consistency requirements or restricted practices.

In this guide, we will break down the complete Goat Funded Futures rules where we will be covering both the Challenge (Evaluation Phase) and the Funded Phase - including the firm’s drawdown structure, daily loss rules, payout conditions, news restrictions and prohibited trading strategies.

Let us break it down clearly by first starting with a quick overview of Goat Funded Futures prop firm.

About Goat Funded Futures Trading Rules

Goat Funded Futures is a well-known futures prop firm operating since 2024 and is located in Hong Kong. The firm offers 3 types of funding models including EOD, Express and Instant account – each of these accounts come with different profit targets, drawdown rules, max contracts per account size, consistency rule, etc. Goat Funded Futures operates on a simulated evaluation model designed to replicate real futures trading conditions.

Each GFF account comes with different structures for drawdown, daily loss, and consistency rules.

Trading Platforms Supported

Goat Funded Futures supports below mentioned trading platforms:

- CQG Data Feed (Tradovate Prop, NinjaTrader Prop)

- DxFeed (Volumetrica Trading, DeepCharts, ATAS, Quantower, etc.)

General Goat Funded Futures Rule Highlights

- Trades a be held overnight (under conditions).

- No weekend holding allowed.

- Tier 1 news events require positions to be closed 5 minutes before and after release.

- CME compliance rules apply.

- Payouts are available after 7 winning days.

Based on official Goat Funded Futures documentation and verified trader feedback as of February 2026, here is the complete breakdown of every rule that can impact your account.

Goat Funded Futures Challenge Rules (Evaluation Phase)

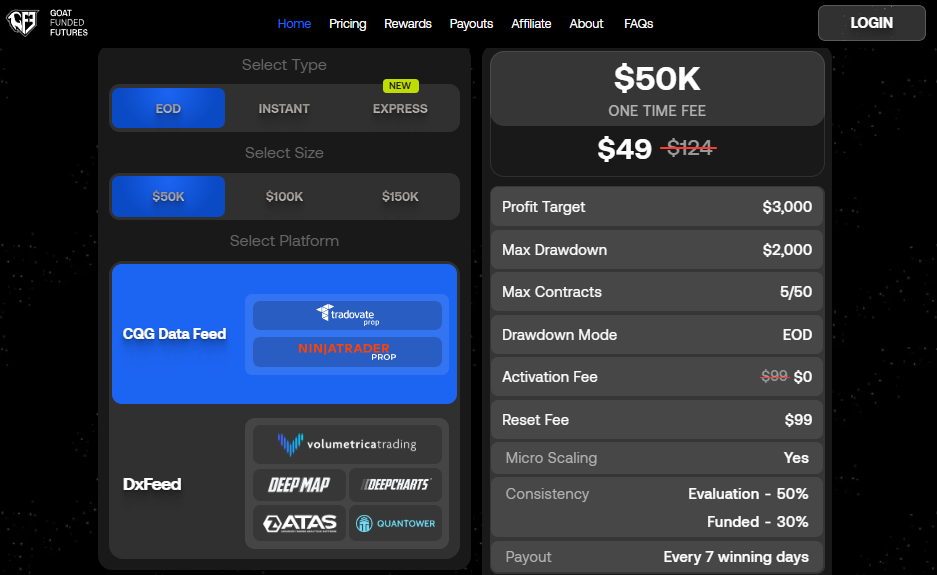

EOD Accounts (Evaluation)

The EOD model uses an End-of-Day drawdown system, which many traders prefer over trailing intraday drawdown.

$50K Account

- One-Time Fee: $49 (original fee is $124)

- Profit Target: $3,000 which is 6% of $50k

- Max Drawdown: $2,000 which is 4% of $50k

- Max Contracts: 5 / 50 micros

$100K Account

- One-Time Fee: $101 (original fee is $254)

- Profit Target: $6,000 which is 6% of $100k

- Max Drawdown: $3,000 which is 3% of $100k

- Max Contracts: 9 / 90 micros

$150K Account

- One-Time Fee: $145 (original fee is $364)

- Profit Target: $9,000 which is 6% of $150k

- Max Drawdown: $4,500 which is 3% of $150k

- Max Contracts: 12 / 120 micros

Below are the common requirements and features for EOD all account size:

- Consistency Requirement: 50% for Evaluation and 30% for Funded phase

- Reset Fee: $99

- Activation Fee: $0 (original fee is $99)

- Maximum profit per day is capped at 5% (in Funded Phase) which if exceeded, there is an automatic cutoff applied

- Payout: Every 7 winning days (Funded Phase)

Goat Funded Futures EOD Drawdown Explained

With the Goat Funded Futures EOD model - your drawdown is calculated at the end of the trading day rather than trailing intraday. This gives traders more breathing room during volatile sessions.

Compared to trailing intraday drawdown models used by many futures prop firms, the Goat Funded Futures end-of-day structure offers more flexibility during volatile trading sessions.

Goat Funded Futures Express Accounts (Evaluation)

The Goat Funded Futures Express model has slightly different structures and in some cases no daily loss limit.

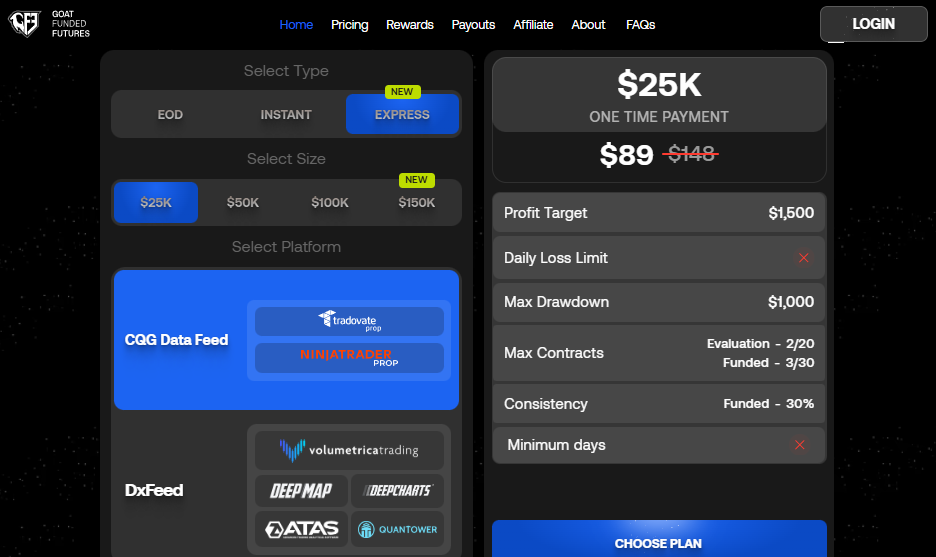

Express $25K

- One-Time Payment: $89 (original fee is $148)

- Profit Target: $1,500 (6% of the $25,000 account size)

- Max Drawdown: $1,000 (4% of the $25,000 account size)

- Max Contracts:

◦ Evaluation: 2 / 20

◦ Funded: 3 / 30

- Maximum Reward Limit: $800 (Funded)

Express $50K

- One-Time Payment: $139 (original fee is $231)

- Profit Target: $3,000 (6% of the $50,000 account size)

- Max Drawdown: $1,500 (3% of the $50,000 account size)

- Max Contracts:

◦ Evaluation: 3 / 30

◦ Funded: 5 / 50

- Maximum Reward Limit: $1,500 (Funded)

Express $100K

- One-Time Payment: $233 (original fee is $388)

- Profit Target: $5,000 (5% of the $100,000 account size)

- Max Drawdown: $2,000 (2% of the $100,000 account size)

- Max Contracts:

◦ Evaluation: 5 / 50

◦ Funded: 7 / 70

- Maximum Reward Limit: $2,500 (Funded)

Express $150K

- One-Time Payment: $359 (original fee is $598)

- Profit Target: $7,500 which is 5% of $150k (5% of the $150,000 account size)

- Max Drawdown: $3,000 which is 2% of $150k (2% of the $150,000 account size)

- Max Contracts:

◦ Evaluation: 6 / 60

◦ Funded: 8 / 80

- Maximum Reward Limit: $2,500 (Funded)

In the Goat Funded Futures Express account there is no daily loss limit and no minimum days requirement. In the funded stage of the Express account, traders have to ensure that no single trading day end with more than 30% profit or more. Violating the consistency rule will not result in account termination but you won’t be able to withdraw profits until your highest profit trading day is below 30% of your total profits.

Traders must also note that violating the Maximum EOD Trailing Drawdown Limit will result in account closure. On the other hand one you reach the maximum reward limit per payout cycle in your Goat Funded Futures Express account, you can request another payout you are eligible for another payout cycle.

Goat Funded Futures Instant Account

Traders can also choose the Instant Funding model as Goat Funded Futures offers an Instant Account type. This account comes with a relatively higher account fees and consistency requirement. Below is a quick Goat Funded Futures Instant account overview:

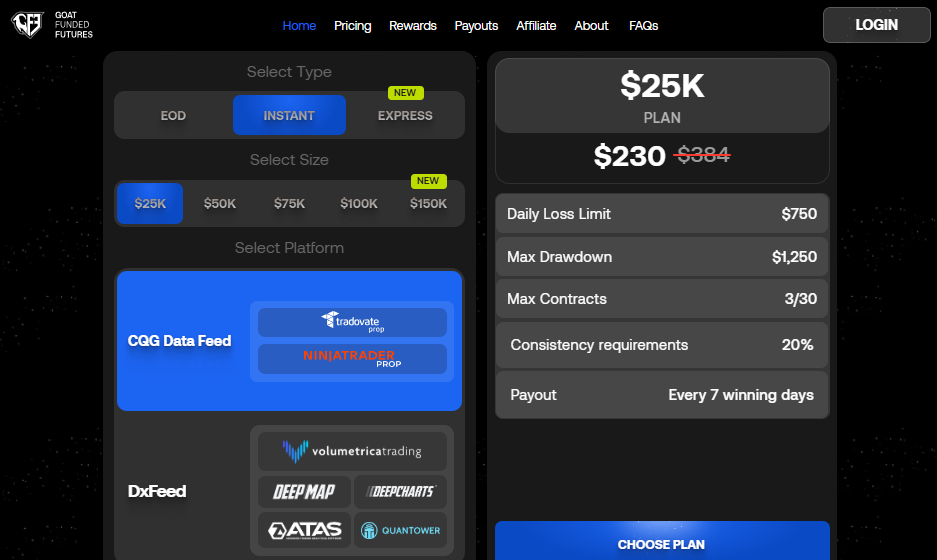

Instant $25k

- One-Time Payment: $230 (original fee is $384)

- Daily Loss Limit: $750 (3% of the $25,000 account size)

- Max Drawdown: $1,250 (5% of the $25,000 account size)

- Max Contracts: 3 / 30

Instant $50k

- One-Time Payment: $332 (original fee is $554)

- Daily Loss Limit: $1,500 (3% of the $50,000 account size)

- Max Drawdown: $2,500 (5% of the $50,000 account size)

Max Contracts: 4 / 40

Instant $75k

- One-Time Payment: $458 (original fee is $764)

- Daily Loss Limit: $2,250 which is 3% of $75k (3% of the $75,000 account size)

- Max Drawdown: $3,750 which is 5% of $75k (5% of the $75,000 account size)

Max Contracts: 5 / 50

Instant $100k

- One-Time Payment: $489 (original fee is $978)

- Daily Loss Limit: $3,000 (3% of the $100,000 account size)

- Max Drawdown: $5,000 (5% of the $100,000 account size)

- Max Contracts: 6 / 60

Instant $150k

- One-Time Payment: $728 (original fee is $1248)

- Daily Loss Limit: $4,500 (3% of the $150,000 account size)

- Max Drawdown: $7,500 (5% of the $150,000 account size)

- Max Contracts: 8 / 80

The Goat Funded Futures Instant Account is designed for traders who want immediate access to a prop firm funded account without going through a traditional multi-step evaluation phase. However, payouts are not automatic traders must first meet the specific Goat Funded Futures payout conditions before becoming eligible for withdrawals.

Instant Account Payout Conditions

To qualify for your first payout at Goat Funded Futures, you must fulfil below payout conditions:

- Achieve a 7% profit target based on your initial account balance

- Maintain a 20% consistency requirement

- Complete a minimum of 10 profitable trading days

Once these conditions are met, payouts are available weekly, with a minimum withdrawal of $250 (maximum limits depend on account performance and internal scaling rules).

After Your First Payout: What Changes in Your Instant Account?

Once you receive your first reward form the Goat Funded Futures Instant plan - the account enters a new performance cycle with updated trading and payout conditions. Both the maximum drawdown and daily loss limit reset to their original starting values. But here you must exceed the highest equity point reached in the previous payout cycle before becoming eligible for the next withdrawal.

Daily Profit Requirement in Instant Plan (Per Cycle)

For the Goat Funded Futures Instant account, in each new payout cycle - traders must meet a minimum daily profit requirement based on the account size they choose:

| Account Size | Minimum Daily Profit |

|---|---|

| $25,000 | $100 |

| $50,000 | $150 |

| $75,000 | $200 |

| $100,000 | $250 |

| $150,000 | $300 |

The Instant Account model by Goat Funded Futures rewards traders who perform with consistency and structured growth plan rather than aggressive short term gains. Traders must maintain disciplined daily performance and gradually build equity above previous highs in order to continue qualifying for the profit payouts.

This structure makes the Instant plan by Goat Funded Futures attractive for consistent, process driven traders but less suitable for high risk or inconsistent trading styles.

Goat Funded Futures Funded Phase Rules (Live Phase)

Once traders have passed the Goat Funded Futures EOD or Express challenge or purchased the Instant account, there is a KYC verification process you must go through after which you get a funded account. In the funded phase the account structure slightly adjusts.

Key Funded Phase Rules and Features:

Goat Funded Futures imposes trading restrictions to ensure traders are aiming for long term profit making and consistency rather than short term profit gains from volatile or high risk trades.

- Consistency Requirement: 30% applicable across all account types

- Daily Loss Limit: 2.5% of account balance. Breaching the daily drawdown will results in account suspension

- Payout: Every 7 winning days

- No weekend holding

- Overnight holding is allowed on all plans except the Instant plan

- News trading is allowed but it comes with a time restriction where all trade positions must be closed 5 minutes before and after release

- Max Contract limits differ between evaluation and funded stages

- Micro scaling available

- Activation fee: $0

This makes the Goat Funded Futures news trading rule something that swing traders must carefully plan around. While the reduced consistency requirement (30% vs 50%) gives more flexibility compared to evaluation.

Prohibited Trading Strategies

Before purchasing or activating any GFF account – it is absolutely necessary for traders to understand the Goat Funded Futures prohibited strategies. These Goat Funded Futures trading rules and restrictions are specifically made in such a way that prevent traders from exploiting simulated market conditions and to ensure performance can realistically translate into live markets. Violating these policies can lead to immediate account termination and forfeiture of profits.

Automated Trading Restrictions

- No HFT (rapid trades consistently under 30 seconds)

- No fully automated bots

- No AI-driven hands-free systems

- Semi-automated tools allowed only with active management

- No 24/7 continuous automation

Order Execution Manipulation

- Order stacking / layering

- Exploiting illiquid or gapped markets

- Slippage manipulation

- Bracket abuse

- Collusion across accounts

Scalping vs Microscalping

Allowed Scalping

- Trade duration: Minutes

- Targets: 5–10 points or more

- Controlled frequency

Microscalping (Prohibited)

- Trades held for seconds

- High-frequency bursts

- Fractional point targeting

Microscalping is banned because it exploits simulated conditions and does not translate well to live markets.

Goat Funded Futures takes rule enforcement seriously. Even if a trading strategy appears profitable during evaluation - it must align with the firm’s compliance standards. The safest approach is to trade with realistic execution, disciplined risk management and full account transparency - this helps traders to significantly reduce the risk of account breach.

Common Prop Firm Rule Violations That Lead to Account Breach

One of the biggest reasons why traders might fail at Goat Funded Futures is not because poor strategy but rather it is about breaking the rules or violation the restrictions. Even profitable traders can lose their accounts instantly if they violate risk limits or trading policies. Understanding what triggers an account breach is one of the most important part of trading with prop firm funded account if you want to protect your progress and profit payouts.

Here is how traders most commonly fail:

- Violating max drawdown limits

- Breaking daily loss limits (Express model)

- Failing the 50% evaluation consistency rule

- Trading during restricted Tier 1 news

- Using bots or automation

- Weekend holding

- Attempting execution exploits

Consequences:

Immediate termination

- Profit forfeiture

- Revoked evaluation

- No refund in certain cases

Staying within the Goat Funded Futures rules is not complicated but it does require discipline from traders. If you respect drawdown limits, avoid restricted strategies and follow the consistency requirements then you can significantly reduce the risk of a Goat Funded Futures account breach and improve your chances of long-term trading success with the firm.

Our Verdict on Goat Funded Futures Rules (2026 Update)

After reviewing the full Goat Funded Futures rules for both the Challenge and Funded Phase, the structure is clear: this firm rewards disciplined, risk-managed traders.

In 2026, Goat Funded Futures remains a competitive option in the futures prop space - especially for traders who value clarity and structured risk management over relaxed rules. The Goat Funded Futures rule framework is strict but transparent. If you understand how the EOD drawdown model, consistency requirements, and news restrictions work, the path to funding is straightforward. The problems usually arise when traders ignore risk management and not because the rules are unclear.

As always, success in prop trading depends less on the firm and more on how well you follow the prop firm rules. For disciplined traders, the path is clear but for rule breakers – it is not very forgiving.

Goat Funded Futures is best suited for those futures traders who can manage drawdown carefully and trade consistently. If you prefer steady performance over high risk spikes and understand how the consistency rule works then this can be a strong prop option in 2026.

Before purchasing an account, read our full Goat Funded Futures review for detailed look at the firm’s performance breakdowns, payout reliability analysis and discount codes.

You may also like

Goat Funded Futures Instant Account Explained 2026: Rules & Payouts

My Funded Futures Drawdown Rules Explained (2026 Guide)

.jpg&w=1920&q=75)

FTMO 1-Step Challenge Explained (2026): Rules & Payouts

The5ers Trading Rules & Risk Limits Explained (2026 Update)

.jpg&w=1920&q=75)

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

DNA Funded Detailed Review 2026: Our Honest Verdict

.jpg&w=1920&q=75)