Funded Trading Plus Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Funded Trading Plus review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.8

4.8

Funded Trading Plus

Forex, Crypto, Indices, Commodities

GB

2021

CEO: Simon Massey

10% Off + 5% Cashback or Upto 1200 Trust Points

Coupon Code:

Metatrader 5

MatchTrader

DXTrade

cTrader

Crypto

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

Funded Trading Plus Review 2026

Funded Trading Plus is a UK prop firm that mainly deals in Forex, commodities and crypto trading through simulated challenge programs. It offers one of the best trading conditions to disciplined swing and day traders who value high profit splits (up to 90%) and a no time limit evaluation style. Traders should be wary of the very demanding, relative drawdown rules which are strictly enforced on some account types and which can be more sensitive than static drawdown models that are commonly found.

In the context of our Funded Trading Plus review 2026, we have analyzed their offerings as of today to see if they still are a competitive option for funded trading accounts in an increasingly crowded market.

Funded Trading Plus Prop Firm Overview

The following information is gathered from the official website of Funded Trading Plus, public disclosures and available trader feedback as of 2026.

| Feature | Details |

| Company Name | The prop firm name is Funded Trading Plus. |

| Legal Name | Funded Trading Plus legal name is Funded Trading Plus Ltd. |

| Registration Number | Funded Trading Plus registration number is 13774561. |

| CEO | The CEO of Funded Trading Plus is Simon Massey. |

| Headquarters | The headquarters is located at London, United Kingdom. |

| Broker | The broker associated with Funded Trading Plus is ThinkMarkets (and others depending on jurisdiction). |

| Years in Operation | Funded Trading Plus has been operating since 2021. |

| Account Types | Funded Trading Plus offers 1-Step Express Challenge, 2-Step Classic Challenge and Instant Funding Model. |

| Account Sizes | Funded Trading Plus provides account sizes ranging from $5,000 to $200,000. |

| Profit Split | Funded Trading Plus offers a standard 80% up to 90% profit split. |

| Payout Cycle | The funded account size of Funded Trading Plans ranges from $5000 to $200,000 |

| Payout Method | The withdrawal methods supported by Funded Trading Plus are Rise, Deel and Crypto. |

| Trading Platforms | Funded Trading Plus supports trading on MT5, cTrader, DXTrade and Match Trader. |

| Financial Markets | Funded Trading Plus supports trading in Forex, Indices, Commodities and Crypto. |

| Max Allocation | Funded Trading Plus offers a maximum allocation of $2,500,000 via scaling. |

| Max Scaling | Funded Trading Plus provides scaling opportunities up to $2.5M. |

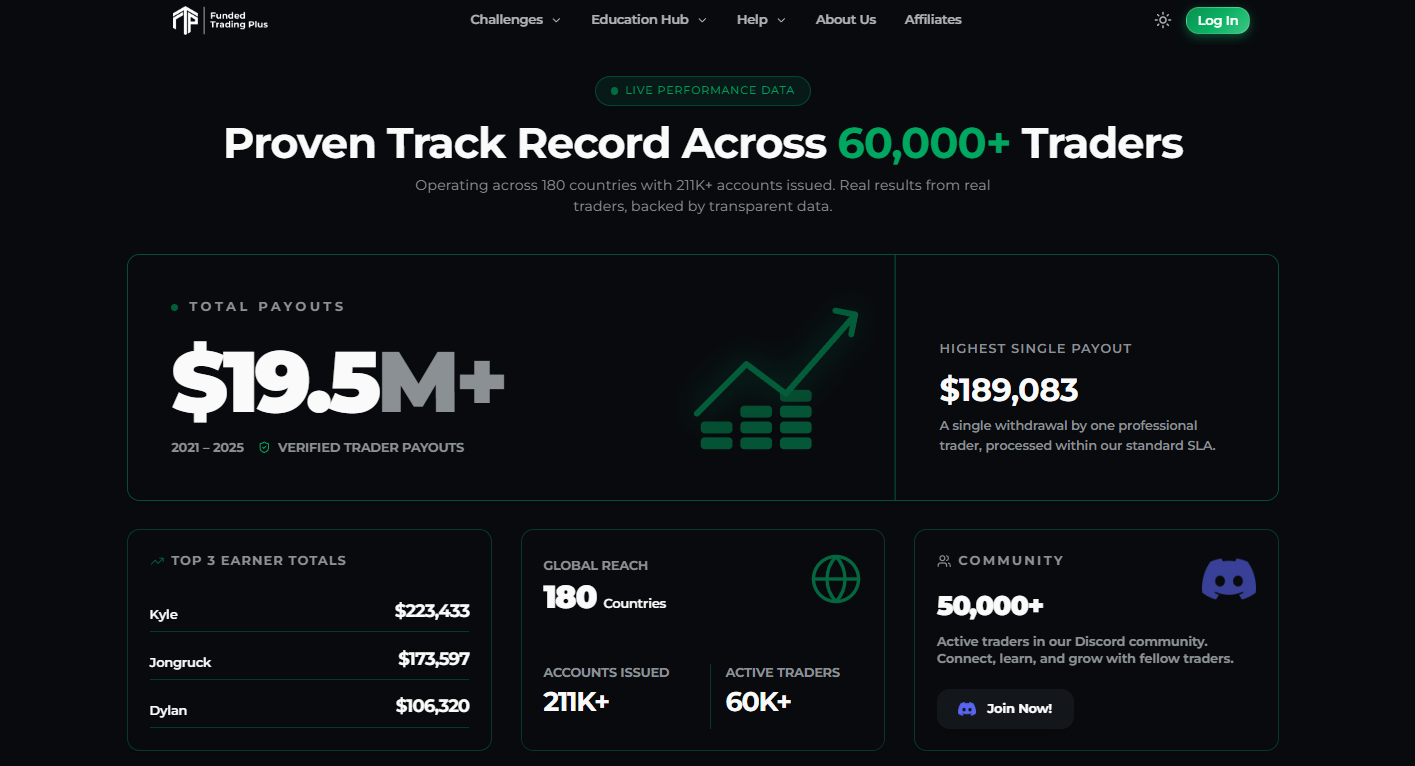

| Trustpilot Score | Funded Trading Plus has a 4.4/5 (as of Feb 2026) rating based on 2,617 trader reviews. |

Pros and Cons of Trading with Funded Trading Plus

Funded Trading Plus has upheld a reputation for providing one of the simplest prop firm evaluation processes in the prop trading space. By concentrating on trading conditions, they address the needs of both disciplined beginners and professional traders. But, just like in any high-leverage environment, it is crucial to understand the Funded Trading Plus drawdown rules and evaluation criteria thoroughly before investing money in a challenge.

Pros | Cons |

|---|---|

Traders can complete the Funded Trading Plus two step challenge at their own pace, removing the pressure of artificial deadlines. | The drawdown is calculated based on the account's high-water mark (equity/balance), which can be more restrictive than static models during winning streaks. |

The firm offers an industry-standard Funded Trading Plus profit split starting at 80%, with the potential to scale up to 100% for top performers. | The firm offers an industry-standard Funded Trading Plus profit split starting at 80%, with the potential to scale up to 100% for top performers. |

The Funded Trading Plus payout system is designed for efficiency, often processing withdrawals within 24 to 48 hours via multiple methods. | While not overly aggressive, the firm monitors for gambling-like behavior, requiring traders to adhere to professional risk management standards. |

A wide range of Funded Trading Plus account sizes (from $5k to $200k) allows traders to scale their strategy according to their experience level. | Depending on the platform used, some traders may find the commission-per-lot higher compared to firms with ‘raw spread’ only models. |

Navigating prop firm rules requires a balance between aggressive growth and capital preservation. Funded Trading Plus spells out its drawdown limits quite clearly but part of the deal is that traders stick to risk management guidelines so that they can trade for a long time.

The 1:30 leverage that most of the institutional-style strategies require is available but traders need to be very careful in calculating the way their equity moves have an impact on the trailing drawdown so as not to run into a situation where they are unknowingly violating rules during volatile periods.

The 1:30 leverage that most of the institutional-style strategies require is available but traders need to be very careful in calculating the way their equity moves have an impact on the trailing drawdown so as not to run into a situation where they are unknowingly violating rules during volatile periods.

Funded Trading Plus Account Types, Fees & Profit Split Explained (2026)

Funded Trading Plus offers three types of accounts which are 1-Step Express Challenge, 2-Step Classic Challenge and Instant Funding Model. Below are the details of each funding model including the account sizes, fees, profit target and drawdown limits.

Account Feature | 1-Step (Express) | 1-Step (Express) | Instant Funding |

|---|---|---|---|

Account Feature | $10k, $25K, $50K, $100K and $200k | $10k, $25K, $50K abd $100K | $5k, $10k, $25K, $50K and $100K |

Account Fees | $99 - $999 | $89 - $549 | $249 - $4,499 |

Profit Target | 10% | 7% (for both P1 and P2) | None |

Daily Drawdown | 4% | 4% | 6% |

Max Drawdown | 6% | 8% | 6% |

Drawdown Type | Trailing | Up to 90% | Up to 90% |

Min. Trading Days | 0 Days | 0 Days | 0 Days |

Max. Trading Days | Unlimited | Unlimited | Unlimited |

Leverage | 1:30 | 1:50 | 1:30 |

Consistency Rule | No | No | No |

Profit Split | 80% to 100% | 80% to 100% | 80% to 100% |

Payout Frequency | Every 7 Days | Every 10 Days | Every 7 Days |

Those traders who want to improve the way they use their initial capital can through Funded Trading Plus avail the different offers on discount of the evaluation fees. Lowering these upfront costs is a sensible way of keeping a trader's expenses for the business as a whole. Before paying fees to Funded Trading Plus accounts, checkout on The Trusted Prop to get 10% discount offer using coupon code ‘TRUSTED’.

The following information delves into the intricate details of the Funded Trading Plus evaluation procedure. By examining these details, traders can match their personal risk appetite with the firm's strict Funded Trading Plus drawdown rules. It has been said that not every trading style will be compatible with all the account types. So here is a detailed breakdown of each model has been included below.

Funded Trading Plus Account Breakdown

At The Trusted Prop, our evaluation process focuses on transparency and structural integrity. Here we are reviewing the 2026 features of Funded Trading Plus, particularly assessing how their three separate programs: 1-Step Express Challenge, 2-Step Classic Challenge and Instant Funding Model can fit various risk appetites and trading approaches.

Funded Trading Plus 1-Step Express Challenge

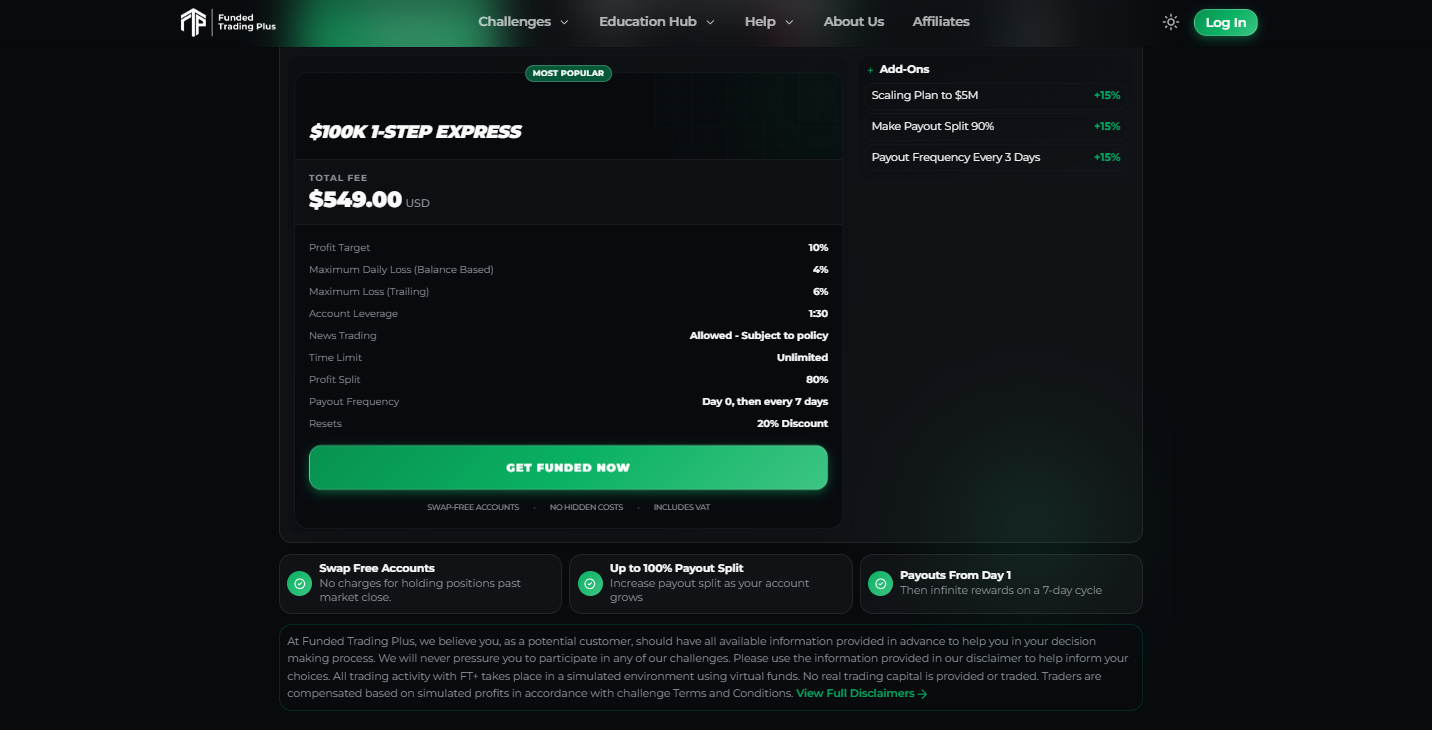

The Funded Trading Plus 1-Step Express Challenge is designed for traders who want to save time in getting to capital. One of the greatest perks is the 10% profit target without minimum trading days, scaling can be done at a record pace. Still, traders need to factor in the trailing drawdown risk that tracks the account high water mark and it can get difficult for those who do not take out profits during volatile sessions.

Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (4%) | Max Total Drawdown (6%) (Trailing) |

|---|---|---|---|---|

$10,000 | $99 | $1,000 | $400 | $600 |

$25,000 | $199 | $2,500 | $1,000 | $1,500 |

$50,000 | $349 | $5,000 | $2,000 | $3,000 |

$100,000 | $549 | $10,000 | $4,000 | $6,000 |

$200,000 | $949 | $20,000 | $8,000 | $12,000 |

Why Choose Funded Trading Plus 1-Step Express Challenge?

The Express account is designed for those who want fast speed and a simple ruleset.

• Fast track to the funded stage with a single phase assessment only.

• High profit share potential being as much as 100%.

• Perfect scalpers who are able to handle a trailing drawdown while continuously locking in small gains.

Funded Trading Plus 2-Step Classic Challenge

The Funded Trading Plus 2-Step Classic Challenge comes with a familiar evaluation format and a very competitive profit target of 7% for each of the two phases. Its main benefit is the static drawdown, which keeps a fixed floor regardless of how much the profit expands. At the same time, traders have to be aware of the 4% daily drawdown limit which necessitates very careful position sizing so as not to run the risk of unintentional breaches during intraday market swings.

Account Size | Account Fee | Profit Target (7% for both P1 and P2) | Max Daily Drawdown (4%) | Max Total Drawdown (8%) (Static) |

|---|---|---|---|---|

$10,000 | $89 | $700 | $400 | $800 |

$25,000 | $169 | $1,750 | $1,000 | $2,000 |

$50,000 | $319 | $3,500 | $2,000 | $4,000 |

$100,000 | $549 | $7,000 | $4,000 | $8,000 |

Why Choose Funded Trading Plus 2-Step Classic Challenge?

The Classic account is the Funded Trading Plus prop firm’s most powerful long-term sustainability offering.

• A static drawdown makes the environment more forgiving for equity growth.

• Entry fees lower in comparison to the Express and Instant models.

• Great for swing traders who need more breathing room for positions held overnight.

Funded Trading Plus Instant Funding Model

This Funded Trading Plus Instant Funding Model grants immediate access to the capital by skipping the evaluation phase and is perfect for seasoned traders who do not want to waste time on the challenge phases. Although having no profit target at all is a major plus, the increased entry fees along with the 1:30 leverage limitation might make the high-frequency and the high-exposure trading strategies less flexible as compared to the evaluation models.

Account Size | Account Fee | Profit Target | Max Daily Drawdown (6%) | Max Total Drawdown (6%) (Trailing) |

|---|---|---|---|---|

$5,000 | $249 | None | $300 | $300 |

$10,000 | $429 | None | $600 | $600 |

$25,000 | $1,099 | None | $1,500 | $1,500 |

$50,000 | $2,199 | None | $3,000 | $3,000 |

$100,000 | $4,499 | None | $6,000 | $6,000 |

Why Choose Funded Trading Plus Instant Funding Model?

Traders who have a good track record and want to skip the evaluation phase are the ones this account is designed for.

• There are no profit target requirements in order to start receiving payouts.

• With a payout every 7 days, rapid liquidity is available.

• Low-risk systematic traders who focus on capital preservation rather than aggressive growth are mostly suitable.

Our Verdict on Funded Trading Plus Account Types

After delving into Funded Trading Plus challenge models and funded account structures, we concluded that these accounts are designed to several trading styles. Day traders who are consistent and quite disciplined probably the best beneficiaries of this model as they prefer the freedom of no time limit to achieve their targets without countdown pressure. They are also experienced prop firm traders who are well-versed in the subtle differences of trailing versus static drawdown rules and swing traders who need the capacity to hold positions through news and weekends.

These accounts might be a bad call to beginners who do not properly handle risk and find the 4% daily drawdown too limiting. Also, they can be the wrong choice for over-leveraged scalpers who may have an issue with the 1:30 leverage on some models or generally any trader who is not adept with how relative trailing drawdown mechanics work and be caught by surprise inside of a breach when profits are not managed with accuracy.

See which firms offer static drawdown like the Funded Trading Plus Classic challenge versus those that use trailing models via The Trusted Prop comparison page.

Funded Trading Plus Drawdown and News Trading Rules

Funded Trading Plus is still a very popular option for traders who want to have different ways to prove themselves. In this Funded Trading Plus review 2026, we have looked at different drawdown limits for their 1-Step, 2-Step challenges and Instant Funding model as well as the rules of operation to give you a better idea of how to handle risk.

Funded Trading Plus Drawdown Details

At Funded Trading Plus, how drawdown is accounted for depends largely on the type of account that you have picked. It is vital to distinguish whether your funded trading account uses a Static or Trailing drawdown if you want to keep your account safe for the whole time.

- Funded Trading Plus 2-Step Classic Challenge: It has a Static Drawdown of 8%. This figure is taken from the starting balance and does not increase along with your profits.

- Funded Trading Plus 1-Step Express Challenge & Instant Funding: Such accounts have a Trailing Drawdown of 6%. This drawdown follows your ‘High Water Mark’ (your highest closed balance) until you hit a certain profit level at which point it normally stays at the starting balance.

Numerical Example ($100,000 1-Step): At a 6% trailing drawdown, your maximum loss limit will be $94,000 at the start. Suppose you increase the account to $102,000, your new drawdown limit will be at $96,000 ($102,000, $6,000). If after this you have a losing streak and the account equity goes down to $96,000 then your funded account will be breached.

Most Common Trader Mistake: The most typical mistake is that the trader does not realize that the 2-Step challenge is static whereas the drawdown on the 1-Step and Instant accounts is trailing. Traders frequently think that their buffer is fixed, but the realized profits have in fact pushed their liquidation floor higher and they have less room for error than they thought at the beginning.

Funded Trading Plus News Trading Details

Funded Trading Plus is a firm that favors its traders and does not put them at a disadvantage because of market volatility. Funded Trading Plus allows news trading in all account types in the challenge and funded phase. Traders are free to hold their positions and make new trades during any news events on any account types. There are no automatic red folder bans or deductions from profits for news related gains, therefore, the firm is a good fit for fundamental as well as event-driven traders.

The mode of operation at Funded Trading Plus allows traders to easily see the difference between the ‘Classic’ static risk and ‘Express’ trailing risk and choose the one that best suits their strategy. By granting unlimited trading days and having a news policy with no restrictions, the firm puts strategy execution ahead of strict time constraints. The rules of the Funded Trading Plus challenge that are transparent make Funded Trading Plus one of the easier prop firms in the current prop firm market, as an analyst for The Trusted Prop we find these rules very trademark.

Trading Platforms and Instruments Supported by Funded Trading Plus

Funded Trading Plus is offering various options for traders to have diversified trading strategies. Traders can enjoy trading a large number of financial markets, which generally include major, minor and exotic Forex pairs together with leading global Indices and Commodities. The prop firm also supports Cryptocurrency trading for those who prefer the modern asset class, which means a diversified approach is possible to solving the Funded Trading Plus challenge rules.

Funded Trading Plus makes these trading instruments available on different platforms which includes MT5, cTrader, DXTrade and Match Trader so that traders get technical analysis and accurate trade execution. But traders must also note that MT5 and the cTrader platform are not available to use for the US trader. Whether you are going through the Funded Trading Plus 2-step challenge or you have an Instant Funding account, these assets are at your disposal and you can simply apply your trading strategy wherever market liquidity is at its peak. The availability of instruments depends on the type of accounts and trading platform chosen.

From a risk management point of view, having lots of instruments is a way for traders to hedge and diversify their positions, which is very important when one has to deal with the Funded Trading Plus drawdown rules. By providing a stable environment for different asset classes, the firm is accommodating both scalpers and swing traders. Our examination indicates that the Funded Trading Plus rules for trading stay very competitive in 2026, especially for those who appreciate a ‘no consistency rule’ setting.

Funded Trading Plus Spreads & Commissions: What You Really Pay

When considering the Funded Trading Plus prop firm, a trader needs to figure out the total cost of participation besides the initial registration fee. In 2026, the firm is still attractive to those who want different ways to get funded, from the Funded Trading Plus two step challenge to instant funding models. Here we explain the effective trading costs and the real fee impact on your profit.

Spreads and Commissions Information

Looking at Funded Trading Plus trading conditions, the firm mainly trust on Tier-1 liquidity providers to offer competitive spreads on major asset classes. Commissions are usually per lot, which is typical for institutional grade platforms such as MT5 or DXTrade. You should remember that Funded Trading Plus account entry fees range from $89 for a 10K Classic account to $4,499 for high-tier Instant Funding, the actual cost for a trader includes the execution environment.

Funded Trading Plus challenge rules are committed to being clear and easier, especially with regard to Funded Trading Plus drawdown rules. As the 1-Step Express Challenge uses a trailing drawdown (6%), traders may want to consider the impact of spreads on their drawdown buffer during volatile news events. The 2-Step Classic Challenge comes with a static drawdown of 8%, offering a more predictable cost-of-risk environment.

Funded Trading Plus Rules (2026): What is Allowed and What is Not

Funded Trading Plus has been a flexible player in the prop firm industry by giving the traders three separate funding options to choose from: 1-Step, 2-Step and Instant Funding. The prop firm as of 2026 still is one of the leading prop firms because it is easier to start trading with and works harder to help traders succeed by getting rid of many of the restrictive hidden rules like requiring consistency or having time limits for trading. In this article, we explain in detail the technical trading rules as well as the account restrictions you will have to deal with both when trying to get a funded account and later when you have one.

Trading Strategy / Practice | Allowed / Not Allowed | Details |

News Trading | Allowed | No restrictions on trading during high-impact news events. |

Weekend Holding | Allowed | Traders can hold positions over the weekend across all programs. |

Expert Advisors (EAs) | Allowed | Use of EAs is permitted, provided they are not ‘off-the-shelf’ arbitrage bots. |

Scalping | Allowed | No minimum hold time for trades - high-frequency styles are accepted. |

Hedging | Allowed | Traders can hold opposing positions on the same instrument. |

Prohibited Practices at Funded Trading Plus

Although the firm operates with clear and strict rules, some trading practices may lead to account termination to avoid huge loss from trading and safeguard its capital.

• Arbitrage Trading: Any attempt at latency or statistical arbitrage that will take advantage of data feed delays is not allowed.

• Grid Trading (Excessive): It is generally allowed to engage in simple grid trading but one cannot use extreme high-frequency grid strategies as they are not only prohibited, but also can cause systemic risk.

• Account Sharing: Trading accounts for other people or having more than one person access the same account is a breach of security regulations.

• Collusive Trading: Doing the exact trades simultaneously on multiple accounts belonging to different users to offset the risk of the firm.

Soft Breach vs Hard Breach

Besides distinguishing between the rule types to protect your equity, you should know the basics of the breach types at Funded Trading Plus.

- Hard Breach: Exceeding Max Drawdown for example (8% on Classic) or Daily Drawdown (4%) limits. Suppose your $100k account equity falls below $96,000 during a single day - the account will be closed permanently.

- Soft Breach: While Funded Trading Plus primarily emphasizes hard drawdown limits, failing to close a position before a scheduled maintenance (if any) or using an unauthorized bot could lead to a warning or trade cancellation instead of immediate account forfeiture.

- IP Address Security: The prop firm checks IP addresses to verify that the person who registered is also the one who is trading. In case you are traveling, it is almost a must that you use a VPS (Virtual Private Server) to keep a stable IP location and avoid getting flagged as an impostor.

Our Verdict on Funded Trading Plus Rules

Here at The Trusted Prop, we have carefully studied the Funded Trading Plus rules and we find them to be among the one of the most transparent in the market right now. One of the benefit of this firm is that there is no consistency rule and trading days limitations which takes away the emotional stress that often results in traders failing the challenge or losing the funded account.

Traders need to be careful about the types of drawdown set by the firm and how they are calculated. Depending on the program, the drawdown rules for Funded Trading Plus differ quite a bit: the 1-Step Express Challenge has a trailing drawdown that goes down your highest balance whereas the 2-Step Classic Challenge uses a static drawdown. The 2-Step Classic is a better choice for more disciplined traders as it gives your account more breathing room as it grows.

Funded Trading Plus Scaling Plan – Grow Your Account Over Time

Funded Trading Plus provides traders with a clear trading path to increase the capital they manage and the earning potential through a performance-based scaling program. This program focuses on rewarding the consistent and steady profitable traders rather than the risk taking high gain traders, keeping with the firm's philosophy of retaining traders for the long run. Through the achievement of specified profit milestones, a trader can increase greatly the size of his initial trading account without having to pay any additional evaluation fees.

Details of the Scaling Plan

The Funded Trading Plus scaling plan is mainly performance-based. A firm like this one, instead of fixing a time frame (e.g., 90 days) for the traders to grow their accounts, offers the possibility of doing it with the help of reaching profit targets.

Performance Requirement: In order to scale up, a trader has to generate a profit equal to 10% of his initial capital. After the trader reaches that target, he can ask the prop firm to double his account.

- Consistency & Drawdown: Continuing with the scaling method is conditioned to the drawdown limits given by the original Funded Trading Plus rules. Besides that, the static drawdown setting that the 2-Step Classic Challenege still keeps is more conducive to growth than trailing models.

- Limit: Account doubling through the above method, can only go up to a certain level which depends on the first evaluation type chosen. A total buying power of up to $2.5 million is usually the maximum limit.

- Payouts: You can claim your profits from Funded Trading Plus even after scaling. The 10% increment for scaling has to be actually there in the account balance for the upgrade to be made.

Funded Trading Plus scaling plan showcases an obvious growth path. The shift from a $100k account to the next levels is automated, clarifying the softness that usually exists in prop firms that rely on subjective "manual reviews" for increasing accounts. This framework facilitates the growth of funded accounts by clearly specifying the reward that comes from keeping a correct risk-to-reward ratio over a high number of trades.

The approach is methodical and it explains why The Trusted Prop has not taken a side when it comes to the firm - internally the scaling plan is competitive at the industry level because it does not have very restrictive time limit on a monthly basis. By looking only at the profit you make instead of how fast you make it, Funded Trading Plus is giving priority to trading consistency and compensating traders who can show that they have a repeatable edge in the markets without being pressured by a ticking clock.

Payment Methods & Payout Process at Funded Trading Plus

The most important thing for traders joining the Funded Trading Plus prop firm is to make sure that they can get paid fast and consistently. So, the first factor that serious traders usually consider when deciding a prop firm is the reliability of the withdrawal process. In this Funded Trading Plus review 2026, we look closely at how the firm pays out and how the payout works for each funding model. By knowing the Funded Trading Plus payout structure, you will know exactly what to expect when it is time to withdraw your profits and grow your funded account.

Details of Payment Methods Supported at Funded Trading Plus:

Initially, the traders on the platform can pay their Funded Trading Plus account fees with a number of secure payment methods. In general, supported methods include:

• Credit or Debit Cards: The major issuers, such as Visa and Mastercard.

• Cryptocurrency: Decentralized payment methods are preferred by some - a handful of digital assets are accepted.

• Bank Wire: Direct transfers are possible though the exact time for the completion of the transaction may depend on the location of the sender and the recipient.

Details of Payout Options Supported at Funded Trading Plus:

Traders who obtained a Funded Trading Plus account through the challenge or instant model can make profits and withdraw a large portion (80% to 100%) of those profits. To promote worldwide access, the firm uses well-known payment processors that we mention below:

• Rise: A primary method used for easy, internationally streamlined payouts.

• Cryptocurrency: A couple of alternatives to enjoy faster settlement frequently are USDT or BTC.

• Bank Transfers: Direct deposits through Deel or the like will be made to the local bank accounts.

Details of How the Payout Process Works at Funded Trading Plus?

The payout cycle depends on the particular funding program in the selection. Funded Trading Plus provides flexible and trader favorite profit split and payout structure. Below are the details of Funded Trading Plus payout process.

• Profit Split: The Funded Trading Plus profit split for 1 step express, 2 step classic and Instant Funding model is 80% which can be increased up to 100% via the scaling plan.

• Payout Frequency: For 1-Step challenge and Instant Funding model, payout requests can be made every 7 days. For the 2-Step challenge, the frequency is every 10 days.

• Payout Process: After meeting the minimum withdrawal limit and using the Funded Trading Plus challenge rules, the trader uses their dashboard to make a withdrawal request. The company will then inspect the trader's account for violations of the 4% daily or 8% static drawdown (for 2-step) rules before releasing the money.

For example: If the trader requests a payout on Monday, the payout will most likely be made within 2 to 3 business days depending on the method selected and the time taken for the trader's records audited by Funded Trading Plus to ensure compliance with the drawdown rules before the funds are released. The firm has a competitive frequency, the firm, must first complete a review of the trading records to verify if the trading complies with Funded Trading Plus drawdown rules before the funds can be released.

Our Verdict on Funded Trading Plus Payout Process & Payment Methods

Funded Trading Plus has managed to keep withdrawal frequency at a level that is highly competitive in the prop firm space. While a majority of the prop firms in this field impose a waiting period of 14 days or 30 days, the cycle of 7 to 10 days offered here gives better liquidity to the trader. Also, the incorporation of a static drawdown on the 2-step accounts makes the payout qualification a lot easier than with the models of trailing drawdown. For those traders who consider stable access to their capital as a priority, the Funded Trading Plus payout trading conditions are some of the strongest in the market right now.

Countries Restricted at Funded Trading Plus

If you are considering to join the Funded Trading Plus prop firm, the first thing you should do is check if they allow funded trading with prop firms in your country. In our Funded Trading Plus review 2026, we have examined the current operational scope of the firm to give you a clear picture of whether the Funded Trading Plus funded account programs are available in your region or not. They have a broad international presence generally, but some jurisdictions are excluded because of changing legal and financial frameworks.

Funded Trading Plus, based on the present information, does not allow residents from the following countries:

- United States

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Russia

- Belarus

Traders need to note that, due to changes in regulations or requirements of payment providers, country restrictions can be different at any time. It is advisable for traders to check their eligibility at the official website before paying any Funded Trading Plus fees.

At The Trusted Prop, we always make sure the accuracy of our Funded Trading Plus evaluation. Because the regulatory environment for prop trading is constantly changing, we advise that traders in gray market jurisdictions get in touch with the firms’ support team to confirm their status before going for a Funded Trading Plus challenge on instant account.

Our Final Verdict on Funded Trading Plus

In 2026, Funded Trading Plus is still one of the top options for traders who demand flexibility. A major advantage of this prop firm is the complete elimination of time limits and consistency rules, enabling high probability setups without the pressure of a deadline. Traders can choose for the 2-Step Classic challenge which is popular because of its 8% static drawdown, while the 1-Step Express challenge or Instant Funding is known for instant market access right away.

Moreover, with profit splits reaching up to 100% and a swift 7 day payout cycle, the prop firm provides great value for the trading professionals who show discipline. Although the trailing drawdown in 1 step challenge necessitates careful risk management, the generally clear rules and a range of account sizes ($5k to $200k) make it a dependable, trader-centric in the continuously changing prop trading industry.

Check the latest pricing and verified offers for Funded Trading Plus on The Trusted Prop best offers page.