My Funded Futures Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full My Funded Futures review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

5.0

5.0

My Funded Futures

Forex, Futures, Stocks, Crypto

US

2023

CEO: Matthew Leech

50% OFF on Pro + 20% OFF on Rapid + Upto 1200 Trust Points

Coupon Code:

Tradovate

Ninjatrader

QuantTower

Trading View

Rise

Credit/Debit Card

Visa

Crypto

Tradovate

Rithmic

My Funded Futures is a reliable futures-focused prop firm providing traders with access to simulated capital across major CME exchanges. It is best suited for disciplined futures scalpers and intraday traders those who prioritize low entry costs, as the firm is highly celebrated for its $0 activation fees. However, traders must be careful about the strict 50% consistency rule during the funded account evaluation and the specific news trading restrictions on Rapid and Pro account types.In this My Funded Futures review 2026, we analyze the firm’s structural shift toward its Flex, Rapid and Pro models that evaluating whether their End-of-Day drawdown approach remains a competitive advantage for professional traders in the current market.

My Funded Futures Overview

The following information is gathered from the official website of My Funded Futures, public disclosures and available trader feedback as of 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is My Funded Futures. |

| Legal Name | My Funded Futures legal name is My Funded Futures LLC. |

| Registration Number | My Funded Futures registration number is associated with its filing in the state of Delaware/Texas, USA. |

| CEO | The CEO of My Funded Futures is Matthew Leech. |

| Headquarters | The headquarters is located in the United States (with support operations in Texas). |

| Broker | The broker associated with My Funded Futures is Tradovate and Rithmic. |

| Operating Since | My Funded Futures has been operating since 2023. |

| Account Sizes | My Funded Futures provides 3 account sizes which are $50,000, $100,000 and $150,000. |

| Profit Split | My Funded Futures offers an 80% to 100% profit split (100% of the first $10,000). |

| Challenge Types | My Funded Futures offers Rapid, Flex and Pro accounts. |

| Payout Cycle | My Funded Futures offers payouts as quickly as every 5 winning days for Core/Rapid or bi-weekly for Pro. |

| Payout Method | The withdrawal methods supported by My Funded Futures are Rise, Crypto and Bank Wire. |

| Trading Platforms | My Funded Futures supports trading on Tradovate, NinjaTrader, Quantower and TradingView. |

| Financial Markets | My Funded Futures supports trading in CME, CBOT, NYMEX and COMEX futures markets. |

| Max Allocation | My Funded Futures offers a maximum allocation of up to $600,000 in sim-funded capital. |

| Max Scaling | My Funded Futures provides scaling opportunities up to $1,000,000. |

| Trustpilot Score | My Funded Futures has a 4.9/5 (as of 2026) rating based on over 14,854 reviews. |

Pros and Cons of Trading with My Funded Futures

When choosing an account type, it is important to note the advantages as well as the disadvantages of that prop firm. The main thing My Funded Futures is popularly known for are $0 activation fees and high profit shares - it would be wise for a trader to understand the differences in the structure of their account types before making a decision.

| Pros | Cons |

|---|---|

| Zero Activation Fees on all plans | No Forex or CFD trading (Futures only) |

| End-of-Day drawdown on most accounts | 50% consistency rule during evaluation |

| Payouts in as little as 24 hours for Pro accounts | Tier 1 News restricted on Rapid/Pro accounts |

| First $10,000 in profits are 100% yours | Withdrawal buffers required for Pro plans |

| Integration with TradingView and NinjaTrader | Different payout caps on Flex/Rapid accounts |

While the profit split and lack of activation fees make My Funded Futures a highly competitive option for funded traders, the firm’s integrity relies on its Fair Play policies. Traders must align their trading strategies with the 50% consistency rule and the daily closure rules to maintain their standing. Ultimately, MFFU serves as a strong platform for intraday scalpers who value transparency and a lower cost-of-capital over the flexibility of swing trading.

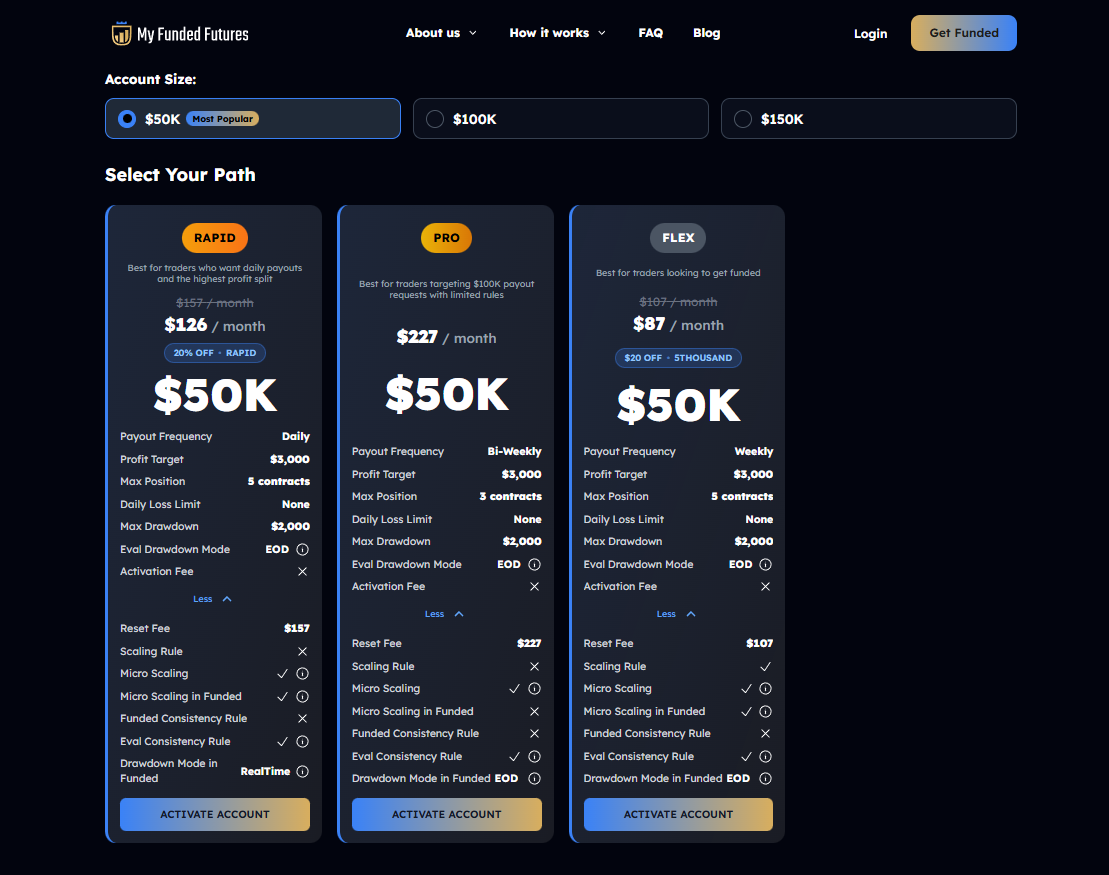

My Funded Futures Account Types, Fees & Profit Split Explained (2026)

My Funded Futures (MFFU) offers a diverse range of funding account models specifically designed for the futures market traders. This section breaks down the financial requirements, drawdown structures and earning potential across their three primary account categories: Rapid, Pro and Flex.

Understanding account structure is essential as fees, drawdown type and profit targets directly impact long-term profitability.

| Feature | Flex Account | Rapid Account | Pro Account |

|---|---|---|---|

| Account Sizes | $50k Only | $50k, $100k, $150k | $50k, $100k, $150k |

| Account Fees (Start) | $107 | $157 | $227 |

| Profit Target | $3,000 | $3,000, $6,000, $9,000 | $3,000, $6,000, $9,000 |

| Daily Drawdown | None | None | None |

| Max Drawdown | $2,000 | $3,000 | $4,500 |

| Drawdown Mode | EOD | Real Time | EOD |

| Min. Trading Days | 2 Days | 2 Days | 2 Days |

| Consistency Rule | 50% (Eval Only) | 50% (Eval Only) | 50% (Eval Only) |

| News Trading | Allowed (T1 Included) | No T1 News Allowed | No T1 News Allowed |

| Profit Split | 80% (After 100% Start) | 80% (After 100% Start) | 80% (After 100% Start) |

| Payout Frequency | Weekly | Daily | Bi-Weekly |

My Funded Futures frequently provides discount codes and promotional offers on challenge fees, allowing their traders to significantly reduce upfront costs. The data provided below is designed to help traders identify which specific account structure is best suited for their risk management, trading style and execution speed. Not all account types suit everyone’s trading style. A detailed breakdown of each model is provided below.

My Funded Futures Flex Account

My Funded Futures Flex account is essentially a loss leader and provides entry-level access to professional capital for traders who want to start at the absolute lowest cost.

| Account Size | Account Fee | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown (4%) |

|---|---|---|---|---|

| $25,000 | $84 | $1,500 | None | $1,000 |

| $50,000 | $107 | $3,000 | None | $2,000 |

Why Choose My Funded Futures Flex Account?

- The lowest priced entry for the futures industry.

- Enables Tier 1 news trading without any restrictions.

Perfect for Micro contract traders experimenting with a new strategy.

My Funded Futures Rapid Account

My Funded Futures Core Account is for traders who want high contract limits and the ability to withdraw their funds fast after having achieved bi-weekly.

| Account Size | Account Fee | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown (4%) |

|---|---|---|---|---|

| $50,000 | $157 | $3,000 | None | $2,000 |

| $100,000 | $267 | $6,000 | None | $3,000 |

| $150,000 | $347 | $9,000 | None | $4,500 |

Why Choose My Funded Futures Rapid Account?

- Provides the highest contract limits (up to 15 Minis on 150k).

- The quickest way to payout (weekly) with no buffer required.

Allows a high degree of flexibility for aggressive intraday scalpers.

My Funded Futures Pro Account

The Pro account is the elite plan that removes any caps on daily payouts and facilitates a direct transition to an Instant Funding environment.

| Account Size | Account Fee | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown (4%) |

|---|---|---|---|---|

| $50,000 | $227 | $3,000 | None | $2,000 |

| $100,000 | $344 | $6,000 | None | $3,000 |

| $150,000 | $477 | $9,000 | None | $4,500 |

Why Choose My Funded Futures Pro Account?

- No maximum single request payout limit (user total cap up to $100k).

- After 3 consecutive payouts, transition directly to an Instant Account.

Funded stage: no consistency lockdowns.

Our Final Verdict on My Funded Futures Account Types

Based on our research as well as the analysis that My Funded Futures challenge models and funded account structures were subjected to we detect that these types of accounts are for certain trading styles. These accounts could fit perfectly with the lifestyle of disciplined day traders who can handle the 50% evaluation consistency rule and at the same time take full advantage of the forgiving End-of-Day drawdown feature on Flex plans, as well as the low-risk systematic traders who are mainly attracted by the absence of the funded stage consistency shutdowns in the Pro account even though the evaluation period there is longer.

These accounts may not be appropriate for a first-timer sans risk management who will likely be shocked by the real time trailing drawdown on Rapid accounts or for the over leveraged scalpers whose trading style is frequently in violation of the 50% consistency requirement of the Flex and Rapid models.

My Funded Futures Drawdown and News Trading Rules

Understanding the exact trading limits of My Funded Futures (MFFU) is very important if you want to have a long-term trading relationship. In this section, you can find the drawdown rules and news trading rules for the three types of accounts: Flex, Rapid and Pro. It is the firm's risk management framework that sets these rules and the traders need to ollow them.

Drawdown Details:

My Funded Futures is using a trader-friendly End-of-Day (EOD) drawdown for its Flex and Pro accounts and the Rapid account has a real-time trailing drawdown. The EOD drawdown is only adjusted at the close of the trading day (5:00 PM EST). This means the traders are protected against being forcibly closed out due to intraday price swings that at the end of the day have made no actual loss to their positions.

Numerical Example:

- You are handling a $50,000 trading account with a maximum loss limit of $2,000.

- Your liquidation level starts at $48,000.

- Lets say you gain $1,000 in profits during the day but at the end of the session then you break even ($50,000).

- Your EOD drawdown limit is still $48,000.

- However, on a real time trailing account (Rapid) that intraday high would have permanently set your drawdown limit at $49,000.

Common Trader Mistake:

Most traders are confused and don't realise that EOD model is quite different from the real time trailing model. A lot of traders who have a Rapid account have the same expectations of it as a Flex account for example and hence they get unintentionally violating a rule when their drawdown limit trails their peak unrealized equity during a winning trade that subsequently pulls back.

News Trading Details:

My Funded Futures news volatility handling strategy depends completely on the account type which has been selected:

- Flex Accounts: Allowed, no restriction Traders can freely open/close or hold positions during any high impact events including Tier 1 news.

- Rapid/Pro Accounts: Allowed with restriction Only normal news trading is allowed but Tier 1 events like CPI, FOMC or NFP are not allowed. Traders must not have any open positions or place new trades 2 minutes before and 2 minutes after these specific releases.

By following these news trading rules and knowing your particular daily drawdown (if applicable) you are protecting your simulated capital. These configurations are put in place to promote professional risk behavior and discourage high stakes gambling during volatile market windows.

Trading Instruments offered by My Funded Futures

My Funded Futures as a futures prop firm that has its finger on the pulse of the major global exchanges through the provision of a professional grade environment. The firm specialises in index, commodity and currency futures traders and this focus enables tight spreads and a direct market replica.

Trading Instruments Details:

The traders at My Funded Futures will be able to benefit from a wide range of products available on the following exchanges: CME, NYMEX, COMEX and CBOT.

- Equity Indices: The major contracts include the Nasdaq (NQ), S&P 500 (ES), Russell 2000 (RTY) and Dow Jones (YM).

- Commodities: The high liquidity markets cover Gold (GC), Silver (SI), Crude Oil (CL) and Copper (HG).

- FX Futures: Among others, the currency based futures include the Euro (6E), British Pound (6B) and Japanese Yen (6J).

- Agriculture: For example, the specialized contracts are Corn (ZC) and Wheat (ZW).

The availability of instruments is most likely going to depend on the account type and the trading platform chosen.

Through the provision of these diverse markets with typical CME commissions about $0.50 per side for Micros and $2.50 for Minis MFFU is making the simulated experience identical to live market conditions. With such an extensive range of instruments, traders not only get the opportunity to employ multi strategy across various asset classes but also enjoy the deep liquidity of the firm.

My Funded Futures Spreads & Commissions

For futures traders that use high frequency trading strategies, it is important to understand the total cost of execution. As a futures-specific prop firm - My Funded Futures runs a direct futures trading environment that reflects the live exchange conditions. Here, we look at the realistic fee impact of trading on their platform and how regular commissions influence your profit.

- Commission Rates: Traders are roughly charged $0.50 for each side of the Micro contracts and $2.50 for each side of the Standard Mini contracts.

- Immediate Deduction: The charges are withdrawn from the account balance immediately after the trade is executed that allowing a profit and loss statement that is accurate in real time.

- Market Access: These prices are the same for all major supported exchanges, the CME, NYMEX, COMEX and CBOT being included.

- Platform Efficiency: Connecting with TradingView, NinjaTrader and Quantower, the firm gives the traders an opportunity to use expert tools for effective cost management.

The lack of a conventional activation fee on any of the accounts types lessens the total financial load on the trader even more and makes the commission based model the major factor of the recurring cost. My Funded Futures simulate the real market environment with typical market commissions which offers a professional experience that allows traders to precisely work out their net profits after all realistic fees are taken into account.

My Funded Futures Trading Rules (2026)

It is essential to understand the My Funded Futures rules inside out if one wants to hold a My Funded Futures account filled with the firm's capital and also get a payout from My Funded Futures. The prop firm has set a clear structure which caters to futures traders that are disciplined and consistent in their trading while being careful with risk through their Flex, Rapid and Pro plans. Here is an explanatory account of the trading strategy permissions and business rules for 2026.

| Trading Strategy | Allowed or Not | Details |

|---|---|---|

| Scalping | Allowed | Manual or semi-automated scalping is welcomed. |

| Swing Trading | Prohibited | Positions must be closed by 4:10 PM EST daily. |

| Grid Trading | Not Allowed | High-risk automated grid strategies are banned. |

| Trade Copiers | Allowed | You can copy trades between your own MFFU accounts. |

| News Trading | Restricted | Allowed on Flex - restricted 2 mins before/after T1 news on Rapid and Pro. |

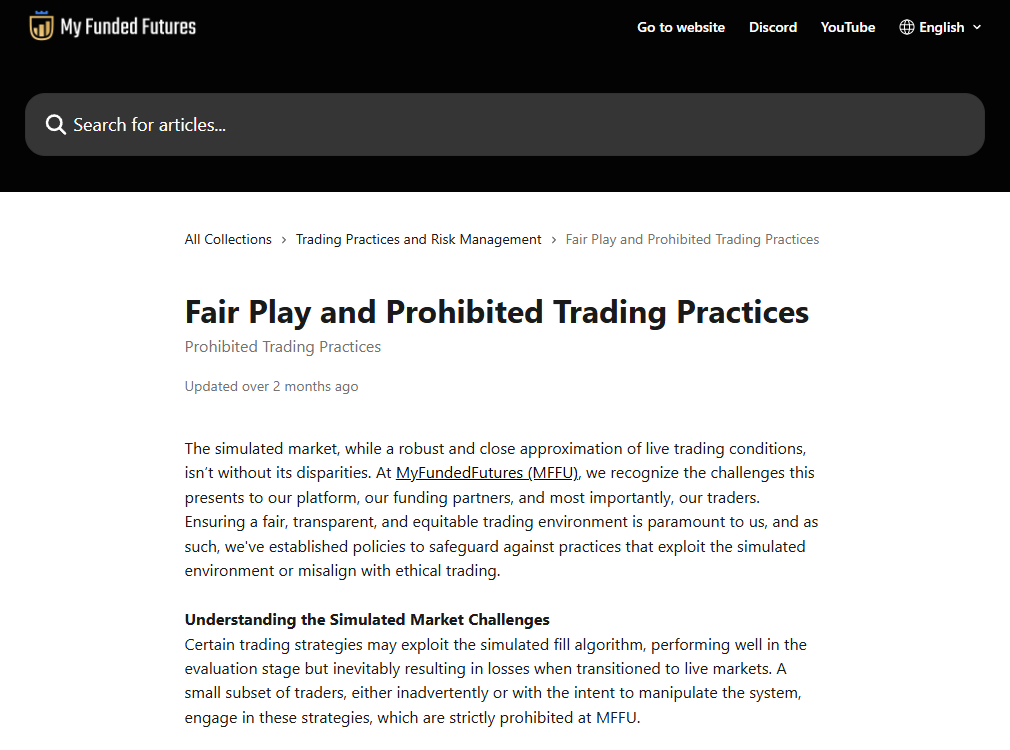

Prohibited Practices At My Funded Futures

What My Funded Futures Doesn't AllowI order to maintain the quality of the simulated environment and also make the journey of a My Funded Futures funded trader comfortable, the behavior that is against the rules is closely monitored. Usually, such behavior leads to the account being breached hard.

- Latency of Simulator was not exploited: Any tactic that is based on the exploitation of broken fills or feed delays and not the movement of the futures market is explicitly prohibited.

- News Trading was Limited: On the Rapid and Pro accounts, the positions kept during the Tier 1 events (CPI, FOMC, NFP) are considered a violation.

- Hedging in Opposite Directions is not allowed: A trader cannot hedge the same instrument live on two different MFFU accounts to figure out the My Funded Futures drawdown rules.

- Account Sharing and IP Security: Each trader should be the one to operate their funded account. The prop firm offers some degree of flexibility, however, an abrupt change of IP address or location in the KYC/AML process might lead to a security check for the prevention of account sharing.

Soft vs Hard Breaches:

- Soft Breach Example: Some platforms allow you to trade a restricted news event but your order may not be filled as a way of limiting you without closing the account.

Hard Breach Example: If you break the My Funded Futures drawdown (EOD or Intraday) rule or fail the My Funded Futures - consistency rule, your account will be terminated immediately.

Our Verdict on My Funded Futures Rules

According to our The Trusted Prop research, we have made a thorough examination of the My Funded Futures rules which are mostly clear but at the same time, requires a professional discipline. The major drawback for many traders who prefer to trade intraday is the My Funded Futures maintaining End-of-Day (EOD) drawdown determination for most plans. But the My Funded Futures consistency rule which sets a limit that no single day could exceed 50% of the profit target during the evaluation means these accounts would be unsuitable for the aggressive one-shot traders. Essentially, the scheme is aimed at clever, well recorded traders rather than those playing pure luck or gambling high volatility.

Scaling Plan at My Funded Futures - Grow Your Account Over Time

The My Funded Futures scaling plan is intended for traders who exhibit their competence in the market for a long time through steady performance rather than high risk volatility. The prop firm by concentrating on the consistency of trading permits those who are successful to gradually handle larger amounts of capital thereby obtaining the maximum allocation which can support a professional career path. The growth of the funded account through a well organized structure in this way makes sure that the risk for both the trader and the firm is managed effectively.

- Details of the Scaling Plan: My Funded Futures has a progressive growth system in place that can take a trader's maximum allocation up to $1,000,000. This scaling is not on the basis of marketing hype but on achieving set profit milestones and keeping a disciplined approach.

- Contract Limits: At the beginning of the funding process, the number of contracts that a trader can use is limited for Flex and Rapid accounts.

- Performance Requirements: In order to get more contracts, traders have to meet certain profit targets. For example, on a $50k account that making a profit of $1,500 raises the limit from 2 Minis to 3 Minis.

- Time and Consistency: The evaluation has a 50% consistency rule to stop lucky winners from scaling but the Pro account gives more immediate contract availability while still requiring a profit buffer for withdrawals.

- Automated Growth: The system is designed to progressively unlock more contracts as profit milestones are reached which rewards trading consistency with greater buying power.

This methodical approach of the prop firm scaling plan reinforces The Trusted Prop's neutral, trust-first stand by demonstrating that capital increments are the result of merit. By associating account growth with realized profits, My Funded Futures is effectively making sure that traders do not utilize excessive leverage before they have the experience to handle larger position sizes. Knowing these scaling mechanics is a must for anyone who desires a viable route to becoming a professional trader. This funded account growth scheme offers a precise path from a standard challenge to a high value portfolio. We suggest that traders concentrate on their daily routine as the My Funded Futures scaling plan will in essence reward those who put risk management ahead of fast profits.

Payment Methods & Payout Process Of My Funded Futures

My Funded Futures (MFFU) has built up an excellent reputation for having one of the fastest withdrawal systems in the futures prop industry. The firm uses advanced financial tools to make sure that traders worldwide can get their money with very little hassle. It is important for traders especially those who focus on cash flow and ready capital to understand such logistical details.

For example, if a payout is requested on a Monday it is usually approved and processed within 24 to 48 hours and the payment is often credited to the trader's account by Wednesday.

Details of Payment Methods Supported:

My Funded Futures review highlights that the prop firm is very accommodating when it comes to payment methods for account purchases. Traders are able to use the very popular Credit/Debit cards, Google Pay or Apple Pay. These methods make it possible for the account to be set up immediately the trader can start the challenge the moment after the transaction is confirmed.

Details of Payout Options Supported:

When it comes to withdrawal of profit split, My Funded Futures uses the Rise platform for worldwide distribution. The payout methods that have been supported by My Funded Futures are:

- Bank Wire: Good for straightforward transferring to conventional savings or checking accounts.

- Crypto: Through the Rise interface, it is available to those traders who choose digital assets for their portfolio.

- ACH: A trustworthy option for traders in those supported areas like the United States.

Details of How the Payout Process Works:

The payout process at My Funded Futures is dependent on which trading account type the trader has:

Flex and Rapid Accounts: Traders must have at least 5 winning days each with a minimum profit of $100 per day before they can make a request.

- Pro Accounts: These accounts need a trading period of at least 14 days and the trader has to keep a certain profit buffer (for example, $2,100 for a $50k account) before he is able to make a withdrawal.

- Approval and Speed: After you have submitted your request via your dashboard, most withdrawals are either approved immediately or within 24 hours.

- Earnings Cap: For their first $10,000 of profits traders get to keep 100%, after that the standard 80% profit split applies.

Our Verdict on My Funded Futures Payout Process & Payment Methods

Here at The Trusted Prop, we really see My Funded Futures payout system as a model for the whole industry regarding not only speed but also openness. Not having to pay any activation fees and getting 100% initial profit share together imply the trader's considerable financial benefits. The 50% consistency rule during the evaluation period certainly demands a very disciplined trader, however, the drawdown and quick 24 to 48 hour payout turnaround perfectly suit professional futures traders. We are suggesting this method to traders who appreciate dependable, rapid withdrawals facilitated in a secure, broker integrated setting.

Countries Restricted at My Funded Futures

My Funded Futures keeps a strict list of prohibited areas to stay fully compliant with international trade laws and financial oversight standards. Being a prop firm located in the US, it is required to follow the stringent legal frameworks that specify the territories in which they are allowed to offer simulated funding services. Therefore, it is essential for traders to go through these location restrictions in advance of a My Funded Futures challenge to confirm they qualify for a possible My Funded Futures payout. At present, the below countries are not allowed to take part in any of the My Funded Futures programs:

- Afghanistan

- Albania

- Algeria

- Angola

- Bahamas

- Barbados

- Belarus

- Bosnia & Herzegovina

- Botswana

- Bulgaria

- Burkina Faso

- Burma (Myanmar)

- Burundi

- Cambodia

- Cameroon

- Central African Republic

- China

- Côte d'Ivoire

- Crimea

- Croatia

- Cuba

- Democratic Republic of Congo

- Ecuador

- Ethiopia

- Ghana

- Gibraltar

- Haiti

- Hong Kong

- Iceland

- Indonesia

- Iran

- Iraq

- Jamaica

- Jordan

- Kenya

- Kosovo

- Laos

- Lebanon

- Liberia

- Libya

- Macedonia

- Malaysia

- Mali

- Mauritius

- Mongolia

- Montenegro

- Mozambique

- Namibia

- Nicaragua

- Nigeria

- North Korea

- Pakistan

- Panama

- Papua New Guinea

- Philippines

- Qatar

- Romania

- Russia

- Senegal

- Serbia

- Slovenia

- Somalia

- South Africa

- South Sudan

- Sri Lanka

- Sudan

- Syria

- Taiwan

- Tanzania

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- Ukraine

- United Arab Emirates

- Venezuela

- Vietnam

- Yemen

- Zimbabwe

Traders please note that, eligibility restrictions may be modified owing to changes in regulations or payment provider requirements.

At The Trusted Prop, we stress that regional eligibility is a fundamental pillar of a safe My Funded Futures funded trader experience. Double check your place of residence with the most recent terms of service of the firm to keep your account in good standing for a long time and ensure that you continue to have access to your My Funded Futures profit share.

Our Final Verdict on My Funded Futures

My Funded Futures is a top choice of market traders who want the utmost in transparency and long term cost reduction through a unique $0 activation fee model. Such an institution will be most attractive to stable day traders and low-risk systematic traders who will find a generous 90% to 100% profit split and trader favourable End-of-Day (EOD) drawdown rules very helpful.

While its 50% consistency rule and Tier 1 news restrictions on certain accounts require the traders to be very disciplined, the firm indeed offers a professional environment with a clear path to $1,000,000 in scaling. In the end, My Funded Futures merges very tight professional standards with financial terms that are relatively easy to access and it is a first level recommendation especially for those who are focused on the CME, NYMEX and COMEX markets.