Copy Coupon Code to Get

Up to 25% Off 🎉

Forex Funds Flow

Forex, Metals, Crypto, Indices, Commodities

HK

2025

CEO: Yahya Abdul

Metatrader 5

Crypto

Wire Transfer/ Bank Transfer

Crypto

Mastercard

Credit/Debit Card

PayPal

Visa

Daman Markets

Forex Funds Flow Rules Explained (2025): Drawdown, Leverage & Trader Restrictions

In this article

Forex Funds Flow Rules Explained (2025): Drawdown, Leverage & Trader Restrictions

Complete guide on the 2025 regulations of Forex Funds Flow. Here, you can get a clear vision on the prop firms drawdown limits, leverage levels, types of challenges and restrictions.

Forex Funds Flow Rules Explained (2025): Drawdown, Leverage & Trader Restrictions

10/14/2025

Forex Funds Flow is a prop firm. It offers challenges for providing funding assistance to traders. To win the challenge, you need to follow the drawdown, leverage and trader restrictions of the firm. Here is the blog, which breaks down all the rules for traders' sake.

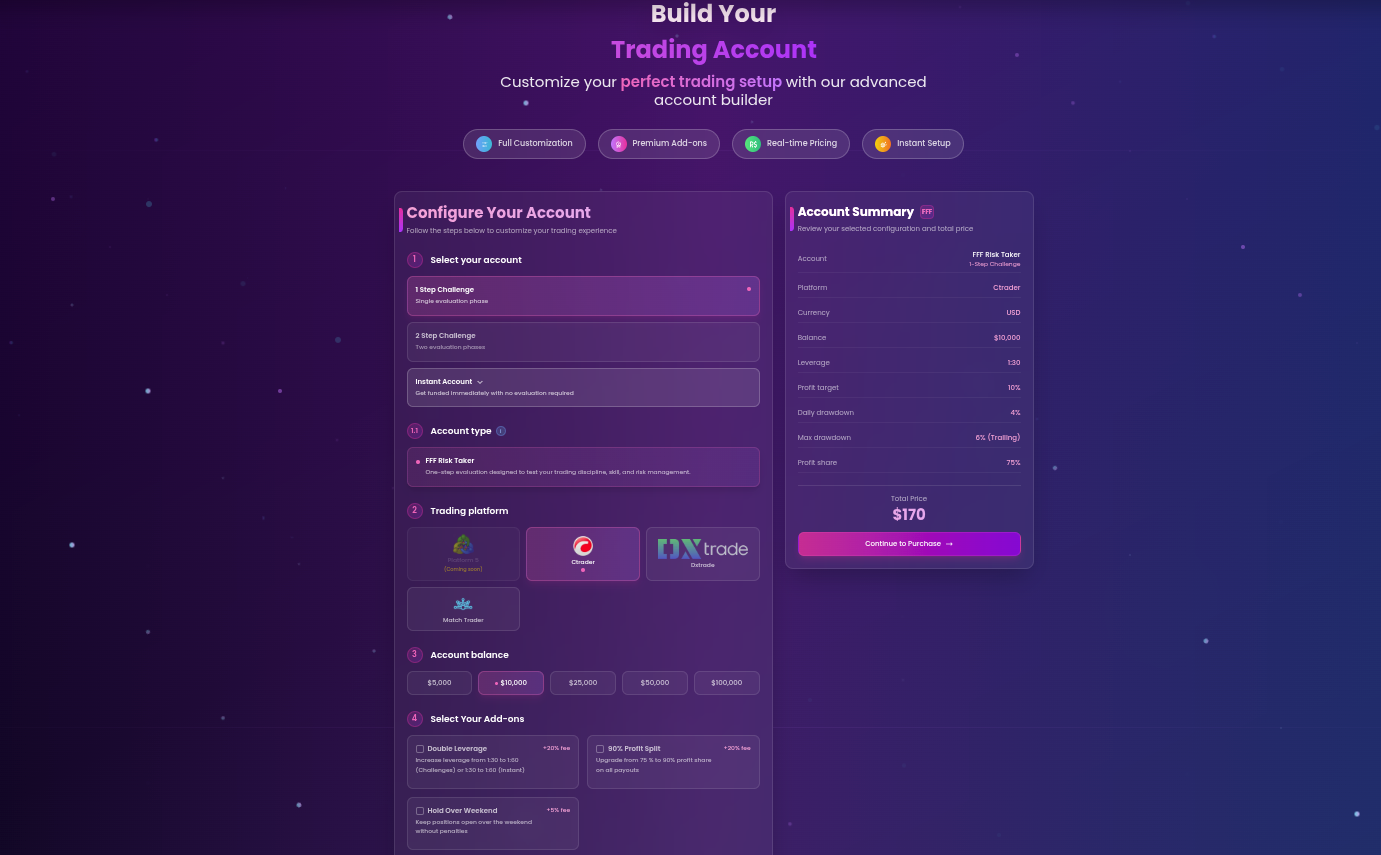

Forex Funds Flow Challenge Types

- A 1-Step Challenge is only one stage. Here, usually 10% of the profit is to be achieved.

- The 2-Step Challenge consists of two stages of the evaluation process. First 10%, then 5% profit.

- But, in Instant Funding(Boost/Static), Funds will be provided immediately, but drawdown rules may vary.

Drawdown Rules of Forex Funds Flow

These define how much you can lose before breaking the rules in the Forex Funds Flow prop firm.

| Rule | How It Works |

|---|---|

| Daily Drawdown Limit | The maximum loss permitted in one day. For many challenge types, this is 4% of the starting balance. |

| Maximum Drawdown | The overall maximum loss permitted (from the high point your account reaches) is above which you fail the challenge. In many cases, this is 6% for 1‑Step with maximum type or up to 12% in the 2‑Step Challenge. |

| Static Drawdown | A fixed maximum drawdown that does not trail. Used in some Instant Funding or ‘Static’ drawdown accounts. |

Leverage Rules of Forex Funds Flow

- On Average leverage is 1:30

- That average can grow up to 1:60 with a high leverage add-on

- For Instant Funding, Static or Trailing drawdown, the leverage may differ, depending on add‑ons.

Profit Target and Time Limits

In Forex Funds Flow Challenges, the 1-Step challenge is to take a profit of 10% of the initial equity. In the 2-Step Challenge, a profit target of 10% in the first stage and 5% in the second stage is established. In most challenges, at least 3 trading days of activity is important.

Restricted Practices in Forex Funds Flow

These are rules on what trading strategy is or is not allowed, to ensure risk control and fairness.

| Restricted Practice | Conditions |

|---|---|

| Grid / Martingale / Doubling Strategies | Not allowed. It is considered high risk. |

| High‑Frequency Trading, Tick Scalping | Not allowed. Scalping may be allowed if it follows normal market execution. But no illegal latency arbitrage. |

| News Trading | Allowed generally, but some restrictions around high-impact news (slippage, volatility, rules around time before/after). |

| Holding Positions Overnight / Over the Weekend | Usually allowed. But many plans require closing positions before the weekend unless a ‘Hold Over Weekend’ add‑on is purchased. |

| Trade Duration (Minimum Time per Trade) | Some restricted rules may apply in specific plans. |

Add-ons and Variations

Traders can buy additions to their challenge and funded accounts.

Double leverage: It increases leverage from the base, for example, 1:30 → 1:60 by paying an extra fee.

Profit Split: It upgrades from standard (75%) to a higher (90%) profit share of traders

Hold Over Weekend: add-on to permit positions over the weekend. Without it, positions may need to be closed before the weekend.

Violations and Consequences

If you violate any drawdown rule or use prohibited strategies, the challenge or funded account may be canceled. Always monitor equity, losses, trade strategy.

Examples & Comparisons

To illustrate, here are a couple of example scenarios,

- For example, if you choose the 1-Step Challenge with an initial balance of $10,000, the profit target is 10%. Which means your funded account must be $11,000. The daily drawdown limit is 4%, so you can't lose more than $400 in a day. The maximum trailing drawdown is 6%, which will be calculated based on the high value that has taken place in your account.

- On the other hand, in the 2-Step challenge, drawdown is allowed more. Which is up to 12% (for example), but you have to complete both stages.

Conclusion

Before taking a challenge in Forex Funds Flow, you need to understand your drawdown type (static or trailing). Make sure that your daily and total losses do not overtake the limit. If you plan to hold the position during the weekend or news events, check to see if an add-on for it is important. Let your leverage settings be clear - the greater the leverage, the greater the risk. Avoid banned strategies like martingale, grid, and latency arbitrage. Also, meet the minimum number of trading days and all evaluation demands.

Having trouble understanding the concept of prop firms? The Trusted Prop is here to assist you with honest prop firm reviews, discounts and more.

Ready to prove your trading skills and get funded? Join the Forex Funds Flow Challenge and choose between a 1-Step, 2-Step or Instant(Boost/Static) Funding method to match your style.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict