Funded Trader Markets Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Funded Trader Markets review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.7

4.7

Funded Trader Markets

Forex, Indices, Metals, Energies, Crypto

AE

2024

CEO: Revin Zabala

Coupon Code:

MatchTrader

cTrader

Metatrader 5

Trade Locker

Crypto

Rise

Crypto

Credit/Debit Card

Funded Trader Market Review 2026

If you are a trader who is tired of jumping through hoops just to prove your skill, Funded Trader Markets might be the breath of fresh air you have been waiting for. Funded Trader Markets was launched in August 2024 and registered in Saint Lucia. Funded Trader Markets prop firm is quickly making waves in the prop trading space with its straightforward approach and flexible trading models.

Whether you are just starting out or have years of experience behind the charts, they offer something for every style from one-step fast tracks to two step evaluations to instant funding for those who don’t want to deal with challenges at all.

You can start small with a $5,000 account, or go big with up to $200,000 in simulated capital, and the profit split goes all the way up to 100%. Plus, there are no time limits, on-demand payouts.

What really sets them apart? Real flexibility, real freedom, and no mess. Trade on your terms during news, over weekends, swap free and when you are ready to get paid, they usually process payouts in just a few hours. No delays, no excuses.

Funded Trader Markets prop firm overview:

| Feature | Details |

|---|---|

| Company Name | Funded Trader Markets |

| Company Legal Name | Funded Trader Markets LTD |

| Company legal number | Funded Trader Markets' legal number is 2025-00239 |

| Headquarters | Funded Trader Markets is based in Saint Lucia |

| Years in Operation | Funded Trader Markets has been operating since August 9, 2024 |

| Broker | Funded Trader Markets associated broker name not specified yet |

| CEO | The CEO of Funded Trader Markets is Revin Zabala |

| Challenge Types | Funded Trader Markets offers challenge types: One Step Nitro, One Step Nitro Pro, Two Step Speed, Two Step Standard, Instant Funding Standard, and Instant Funding Pro. |

| Challenge Fees | Funded Trader Markets challenge fee starts from $39 to $1258 |

| Profit Split | Funded Trader Markets offers up to 100% profit split and for Instant Funding, the profit split is up to 80% |

| Account sizes | Funded Trader Markets account sizes range from $5k to $200k |

| Payouts | Funded Trader Markets offers on-demand payouts |

| Trustpilot | Funded Trader Markets is rated 4.5/5 on Trustpilot |

Funded Trader Markets: Pros & Cons

Before jumping into any prop firm, it is important to weigh the good and the not-so-good. Funded Trader Markets has a lot going for it flexible challenge types, fast payouts, and a trader-first mindset. Here is a simple breakdown of the pros and cons to help you decide if this is the right fit for your trading journey.

Pros and Cons Comparison Table:

| Pros | Cons |

|---|---|

| Multiple Challenge Options | No Real Money Traded |

| Low Entry Fees | No MT5 Support for U.S. Residents |

| Fast Payouts | Profit Split Drops to 80% |

| 24 Hour Payout Guarantee | Strict Consistency Rules |

| Unlimited Time Limits | Some Bot Types Banned |

| Fair Risk Rules | Instant Accounts Have Lower Splits |

| Swap-Free Accounts | Not Available in Some Countries |

| Freedom to Trade News | VPNs Not Allowed |

Funded Trader Markets Challenge Types, Fees and More

If you are someone who has been trading and just wants a fair chance to show your trading skills, Funded Trader Markets could be that opportunity. They offer different types of trading challenges, including low cost evaluation programs and even instant funding accounts where you can start trading right away no need to pass any test.

No matter what kind of trader you are, aggressive, careful, or somewhere in between there is a challenge that fits your trading style. You can pick how tough you want it to be, how much risk you are okay with, and how soon you would like to start earning from your trades.

The best part? Most of these programs come with no time limits and payouts on demand.

Below is a simple comparison of all the main challenge options they offer, so you can quickly see which one suits your trading style.

Funded Trader Markets Challenge comparison table:

| Feature | 1 Step Nitro | 1 Step Nitro Pro | 1 Step Nitro X | 2 Step Speed | 2 Step Standard | Instant Funding Standard | Instant Funding Pro |

|---|---|---|---|---|---|---|---|

| Phases | 1-Step | 1-Step | 1-Step | 2-Step | 2-Step | Instant Funding | Instant Funding |

| Profit Target | 10% | 10% | 6% | 8% (Phase 1), 5% (Phase 2) | 10% (Phase 1), 5% (Phase 2) | None | None |

| Max Overall Drawdown | 6% | 3% | 3% | 8% | 10% | 5% | 3% |

| Max Daily Drawdown | 4% | 2% | 3% | 4% | 4% | 3% | None |

| Profit Split | Up to 100% | Up to 100% | Up to 100% | Up to 100% | Up to 100% | Up to 80% | Up to 80% |

| Evaluation Phase | Yes | Yes | No | Yes | Yes | No | No |

| Time Limit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | None | None |

| Payout System | On-Demand | On-Demand | On-Demand | On-Demand | On-Demand | On-Demand | On-Demand |

| Special Notes | One-phase, fast-track for experienced traders | Slightly tighter risk limits | No evaluation, but has activation fee | Speedy route to funding with reasonable targets | More conservative, designed for long-term traders | No evaluation; trade and get paid from day one | No daily loss cap; great for confident risk-takers |

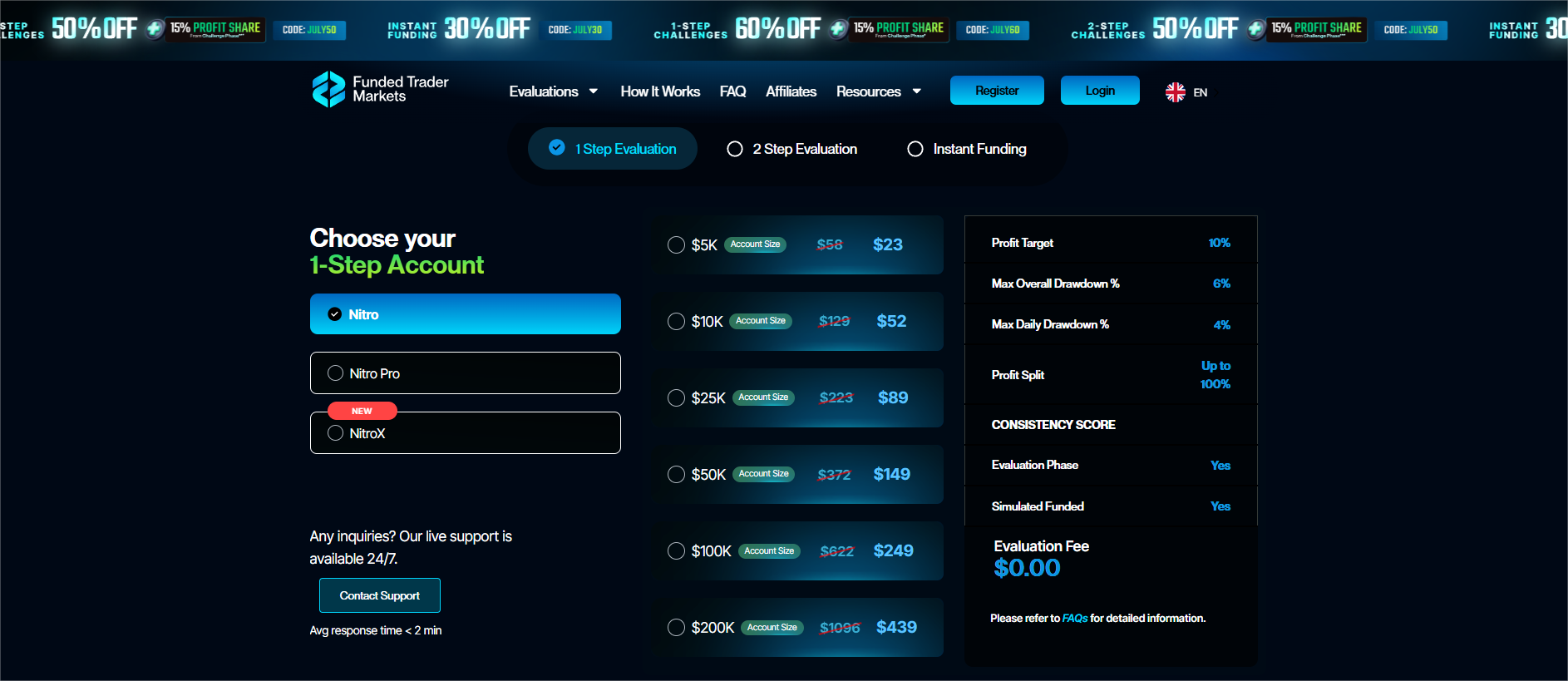

Funded Trader Markets 1 Step Account Nitro Challenge - Fees & Sizes

This is the go to option if you want a fast track way to get funded. You only need to complete one phase, and you keep up to 100% of your profits after hitting a 10% profit target. The rules are simple: 6% max loss, 4% daily loss, and that is it.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $58 |

| $10,000 | $129 |

| $25,000 | $223 |

| $50,000 | $372 |

| $100,000 | $622 |

| $200,000 | $1,096 |

Why Choose Funded Trader Markets 1 Step Nitro Challenge?

- Great for confident traders who want quick access to funded accounts

- No second phase hit the target once and you are in

- High reward with fewer steps

Funded Trader Markets 1 Step Nitro Pro Challenge - Account Sizes & Fees

This one is like the Nitro, but slightly tougher rules. Lower drawdown: 3% overall, 2% daily. But the fees are lower too! Still a 10% profit target and 100% profit share.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $39 |

| $10,000 | $49 |

| $25,000 | $99 |

| $50,000 | $199 |

| $100,000 | $349 |

| $200,000 | $672 |

Why Choose Funded Trader Markets Nitro Pro Challenge?

- Cheaper than Nitro, with tighter rules

- Ideal for risk-managed traders

- Perfect if you trade smaller but smarter

Funded Trader Markets 1 Step Account Nitro X Challenge - Account Sizes & Fees

This is a unique one no evaluation phase. Just pay, start trading, and follow the drawdown rules. Lower 6% profit target, 3% drawdown daily and overall, but you get unlimited resets.

| Account Size | Challenge Fee |

|---|---|

| $25,000 | $147 |

| $50,000 | $222 |

| $100,000 | $297 |

| $150,000 | $347 |

Why Choose Funded Trader Markets Nitro X?

- No need to “pass” anything just start trading

- Best if you want to skip evaluations and dive right in

- Good for high-frequency or active traders

Funded Trader Markets 2 Step Speed Challenge - Account Sizes & Fees

A fast-paced two-step evaluation. You will need to hit 8% in Phase 1 and 5% in Phase 2 with 8% max loss and 4% daily limit. It’s designed to be faster than traditional models.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $70 |

| $10,000 | $138 |

| $25,000 | $278 |

| $50,000 | $418 |

| $100,000 | $678 |

| $200,000 | $1,178 |

Why Choose Funded Trader Markets 2 Step Speed Challenge?

- Quicker path to funding than regular 2-step plans

- Balanced rules with good drawdown limits

- Perfect for traders who prefer some structure but want to move fast

Funded Trader Markets 2 Step Standard Challenge - Account Sizes & Fees

A more traditional evaluation path. Here, you will face 10% target in Phase 1 and 5% in Phase 2, with 10% total drawdown and 4% daily.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $78 |

| $10,000 | $158 |

| $25,000 | $298 |

| $50,000 | $458 |

| $100,000 | $718 |

| $200,000 | $1,258 |

Why Choose Funded Trader Markets 2-Step Standard?

- Best for traders who prefer a clear long-term plan

- Generous max loss rules compared to other models

- Ideal for swing and position traders who need more space

Funded Trader Markets Instant Funding Standard - Account Sizes & Fees

No challenges. No evaluations. Just pick your size, pay the fee, and start trading a live sim account. 5% max loss, 3% daily loss, and up to 80% profit split.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $99 |

| $10,000 | $139 |

| $25,000 | $259 |

| $50,000 | $549 |

| $100,000 | $1,099 |

Why Choose Funded Trader Markets Instant Funding Standard?

- Get funded instantly no testing

- Start earning immediately

- Best for experienced traders ready to go live

Funded Trader Markets Instant Funding Pro - Account Sizes & Fees

Like Standard Instant, but more advanced. No daily loss cap, only a 3% overall drawdown, with up to 80% profit split.

| Account Size | Challenge Fee |

|---|---|

| $5,000 | $69 |

| $10,000 | $109 |

| $25,000 | $199 |

| $50,000 | $399 |

| $100,000 | $769 |

Why Choose Funded Trader Markets Instant Funding Pro?

- Cleaner rules, no daily loss restriction

- Tighter risk for serious traders

- Great for pros who know how to manage capital carefully

Which Funded Trader Markets Challenge Should You Choose?

- Go for 1 Step Nitro or Nitro Pro if you are confident in your skills and want to start earning fast with minimal steps.

- Pick the 2 Step Standard if you prefer a slower, more deliberate approach and want a higher margin of safety.

- Try Nitro X if you hate evaluations and want a fresh start with less pressure just remember you’ll need to pay a higher initial fee.

- Choose Instant Funding only if you want to trade right away with no evaluation perfect if you're already confident with your trading strategy and just want to get paid.

Our Review of Funded Trader Markets Challenges

If you have been trading for a while and feel like you just need someone to give you a proper chance no games, no delays then Funded Trader Markets might be exactly what you are looking for.

The best part? They have got choices. Whether you want to go through a quick one-step challenge, take the traditional two-step path, or skip the challenge altogether and jump straight into instant funding they have got all those options lined up. And they don’t hit your wallet too hard either. From small $5K accounts to large $200K accounts, there is something for everyone.

What really stands out is the freedom. You can trade over the weekend. You can trade during big news. No hidden swaps. Most of their plans don’t have any ticking clock either so you can trade at your own pace. And when you're ready, you can withdraw profits anytime without waiting for a fixed payday.

If you are the type who trades fast and is not afraid to take chances, the 1-Step Nitro or Nitro X accounts might be right up your alley. Prefer to go slow and steady? Then check out the 2-Step Standard it gives you a bit more breathing room. And if you already know your strategy works and don’t feel like proving anything, just grab an Instant Funding account and get straight to trading.

At the end of the day, Funded Trader Markets gives you room to trade your way no pressure, no weird restrictions, just a clear path to funding.

Funded Trader Markets Scaling Plan Explained

If you are aiming to grow your trading journey with real rewards and steady progress, the Scaling Plan from Funded Trader Markets is one of the most trader-friendly systems out there. It is built to reward consistency, effort, and discipline, not just wild profits.

This is not about rushing to a high balance in one lucky trade. It is about showing steady growth over time and being rewarded with more capital, better conditions, and even a monthly salary.

Let us walk through it stage by stage Pioneer, Legend, and VIP.

Pioneer Stage

How to Qualify:

- Make 8% total profit over 2 months

- Earn at least 2% profit each month

- Submit 3 payout or withdrawal requests

- Your ending balance should be above your starting balance

- Profit counted per month is capped at 5% (even if you make more)

What You Get:

- 30% account growth added to your current balance

- 100% profit split you keep everything

- Slight boost in max drawdown by 1%

- No change in daily drawdown

- On-demand payouts stay active

- Fixed monthly salary up to $1,000

- Free retry if the account fails

- No personal rep at this stage

Why It Matters:

This stage helps serious traders who’ve proven themselves even if you are not crushing 20% months, slow and steady can still scale your account and get you paid monthly.

Legend Stage

How to Qualify:

- Keep trading for another 60 days under the same rules after completing Pioneer

- Again, hit 8% profit in 2 months

- Make 2% per month minimum, plus at least 3 payouts

- Stay above your original balance

What You Get:

- 35% increase in account balance

- Still get 100% profit split

- +1% added to daily drawdown

- +1% added to max drawdown

- Monthly salary jumps to $3,000

- Still no personal account rep

- Free retry if you fail

Why It Matters:

This stage rewards traders who not only hit targets but also stick to the grind. It gives more cushion to manage trades and boosts your monthly income too.

VIP Stage

How to Qualify:

- Complete 60 days of Legend and meet the same scaling rules again

- Profit target stays the same: 8% in 2 months, 2% per month, 3 withdrawals

What You Get:

- 40% increase in account balance

- 100% profit share continues

- +2% added to daily and max drawdowns

- Monthly salary jumps up to $5,000

- You now get a dedicated personal rep

- Free challenge reset if your account fails

Why It Matters:

This is where you are treated like a pro. You get higher risk limits, a steady monthly income, and someone to support you one-on-one. It is built for long-term traders who want to trade seriously without risking their own money.

Important Notes

- This Scaling Plan does not apply to 1-Step Programs

- You must actively trade to qualify for the monthly salary

To be eligible:

- Place at least 5 trades, each held for 2 minutes minimum

- Each trade should use at least 50% of your past month’s average lot size

Our Review on Scaling with Funded Trader Markets

The Funded Trader Markets Scaling Plan is one of the few that actually supports real growth without forcing unrealistic targets. It is clear, fair, and structured to reward traders who show up, stick to their strategy, and stay consistent.

You don’t have to chase massive gains every day. You just need to manage risk well, trade regularly, and hit your monthly goals. And even if you don’t have a winning month? The salary still comes in for two months straight which is rare in this space.

If you are ready to grow with a prop firm that actually gives back as you succeed, this scaling plan is worth aiming for.

Commissions at Funded Trader Markets

If you're thinking about trading with Funded Trader Markets, it is good to know exactly how commissions work both for your trades and your referrals. Whether you are a trader trying to understand costs or an affiliate looking to earn by promoting Funded Trader Markets, this section breaks it all down for you.

Trading Commission at Funded Trader Markets

Every time you place a trade, there is a small fee known as a commission. Here is how it works at FundedTraderMarkets:

Forex & Commodities:

You’re charged $7 per lot this is a round-turn commission (which means it covers both opening and closing the trade).

Indices & Cryptocurrencies:

No commission. Yep, you read that right these assets have zero commission, making them great for lower-cost trading.

This makes the trading environment pretty fair and predictable, especially for those who manage their lot sizes carefully.

Our Review on Commissions at Funded Trader Markets

Whether you are here to trade or promote, Funded Trader Markets keeps it clear and fair. Traders get a simple, flat trading commission structure, and affiliates have a real chance to grow their earnings with one of the most rewarding tier-based systems in the industry.

And remember, every trade and referral counts toward building your path to bigger payouts, better rewards, and more free accounts.

Trading Rules at Funded Trader Markets

When you trade with Funded Trader Markets, you are stepping into a system built for fairness, discipline, and long-term growth. While they give you a lot of flexibility with strategies and trading styles, there are some important rules you need to follow not just to pass, but to protect your account and earn your payouts.

Allowed Strategies (With Conditions)

Martingale & Layering - Allowed, but Only Within One Account

You can use martingale or layering methods, but only inside one account. If you try to copy or mirror those same trades across multiple accounts (even your own), it’s considered manipulation and is not allowed.

Example:

You can open a Buy on XAUUSD in Account A and another Buy in Account B, but only if both are opened within 5 minutes. If you delay, you must wait for the first position to close before placing another.

If this timing rule is broken, you won’t get paid for any profits made from that setup.

Strictly Not Allowed: High-Frequency Trading (HFT)

If more than 20% of your trades are opened and closed within 1 minute, it is considered high-frequency trading. You won’t get banned for this but profits made from trades under 1 minute will not count toward your payout.

Funded Trader Markets does not support HFT because it is often used to exploit systems rather than build real trading skill.

Consistency Rule - What It Means

The Consistency Rule exists to make sure you're not just lucky with one big trade. It pushes you to show steady growth, not quick wins. Here is how it works:

- During Challenge Phases (1-step or 2-step): No single day should make up more than 50% of your total profits.

- During the Funded Stage: Your best day should not be more than 45% of your total profits.

- For Instant Funding Accounts: Even tighter only 20% of total profit can come from one day.

Example:

If your best day earned you $6,000 and your total profit is $10,000, your score is 60% too high. You will need to keep trading until your profit grows to at least double your best day’s profit to meet the rule.

Minimum Trading Days

No minimum for the challenge phase

(That’s true for all: Nitro, Nitro Pro, Nitro X, Speed, and Standard)But when you reach the funded phase, you need:

- 5 trading days minimum

- Only days with at least 0.5% profit count

Instant Funding plans also require 5 trading days, unless you buy an add-on (only available on Instant Pro).

Margin Calls - What Happens?

If your account hits a margin call, it won’t be considered a rule break but all your open trades will close automatically.

Tip: Use their free Margin Calculator (on their website) to avoid this. Don’t over-leverage or guess your lot size.

Trading Bots - Use with Caution

Yes, bots are allowed but not all types.

These bots are banned:

- HFT bots

- News scalpers

- Latency or reverse arbitrage bots

- Tick scalping bots

- Demo exploiters

- Account mirroring bots

- Group/multi-account coordination bots

Accounts using banned bots will be terminated with no payout or refund.

Prohibited Practices At Funded Trader Markets

FTM is serious about keeping trading clean and fair. Here’s what you must not do:

- Group trading or copy trading across accounts

- Reverse trading on multiple accounts or platforms

- Hedging across different prop firms

- Using data delays or errors to your advantage

- Buying or selling account management services

- Sharing your account login or letting someone else trade for you

If you are caught doing any of the above, your account will be shut down and any payout you earned will be gone no second chances.

News Trading at Funded Trader Markets

Yes Funded Trader Markets allows news trading across all of its programs. Whether you are in an evaluation phase, funded stage, or using an instant account, you are free to trade during economic news releases.

But just because it is allowed does not mean it is easy.

Trade News, But Be Cautious

News events like interest rate decisions, jobs reports, or inflation data can cause wild price movements. One second you are in profit, the next you're slipped into a loss. That’s how fast it can flip.

Here is what usually happens around big news:

- Markets become super volatile

- Liquidity drops, so your orders might not get filled where you want

- Spreads widen, making it harder to get in or out at a fair price

- Slippage is common, meaning your trade might open or close far from your set price

Think Before You Click

Even though you are allowed to trade news, it’s important to manage risk wisely. Don’t go in blind. If you're unsure, skip the release and come back when the market calms down. There's no rule saying you have to trade every news event.

Final Thoughts on Trading Rules at Funded Trader Markets

Funded Trader Markets does not ask for perfection. What they do ask for is fairness, consistency, and discipline. Their rules are built to protect serious traders and give everyone a level playing field.

If you are trading smart, using proper risk management, and focusing on steady gains you will be just fine. Break the rules though, especially the ones around bot abuse, account sharing, or copy trading and your account is gone.

Funded Trader Markets Payments & Payouts

When it comes to money, Funded Trader Markets keeps things simple, fast, and fair. Whether you are paying to start a challenge or requesting a payout from your profits, the system is designed to make the process smooth and hassle-free.

How You Can Pay for Your Challenge

To get started with a challenge account at Funded Trader Markets, you can pay using:

- Credit Card

- Debit Card

- Cryptocurrency

If you are choosing crypto, make sure you use the correct network and wallet address. Funded Trader Markets won’t be able to recover your funds if it is sent to the wrong place.

Supported crypto networks include:

- TRX (Tron)

- ETH (ERC20)

- BTC (Bitcoin)

- SOL (Solana)

- LTC (Litecoin)

- POL (Polygon)

- USDC (Arbitrum, Polygon, ERC20)

- USDT (Arbitrum, Polygon, Tron, ERC20)

Important: You are not allowed to use a VPN while purchasing or doing your KYC. The IP address and the KYC country must match. If they don’t, your account could be terminated, and there is no refund in that case. If you are traveling, it’s best to complete the process in your home country or contact support first.

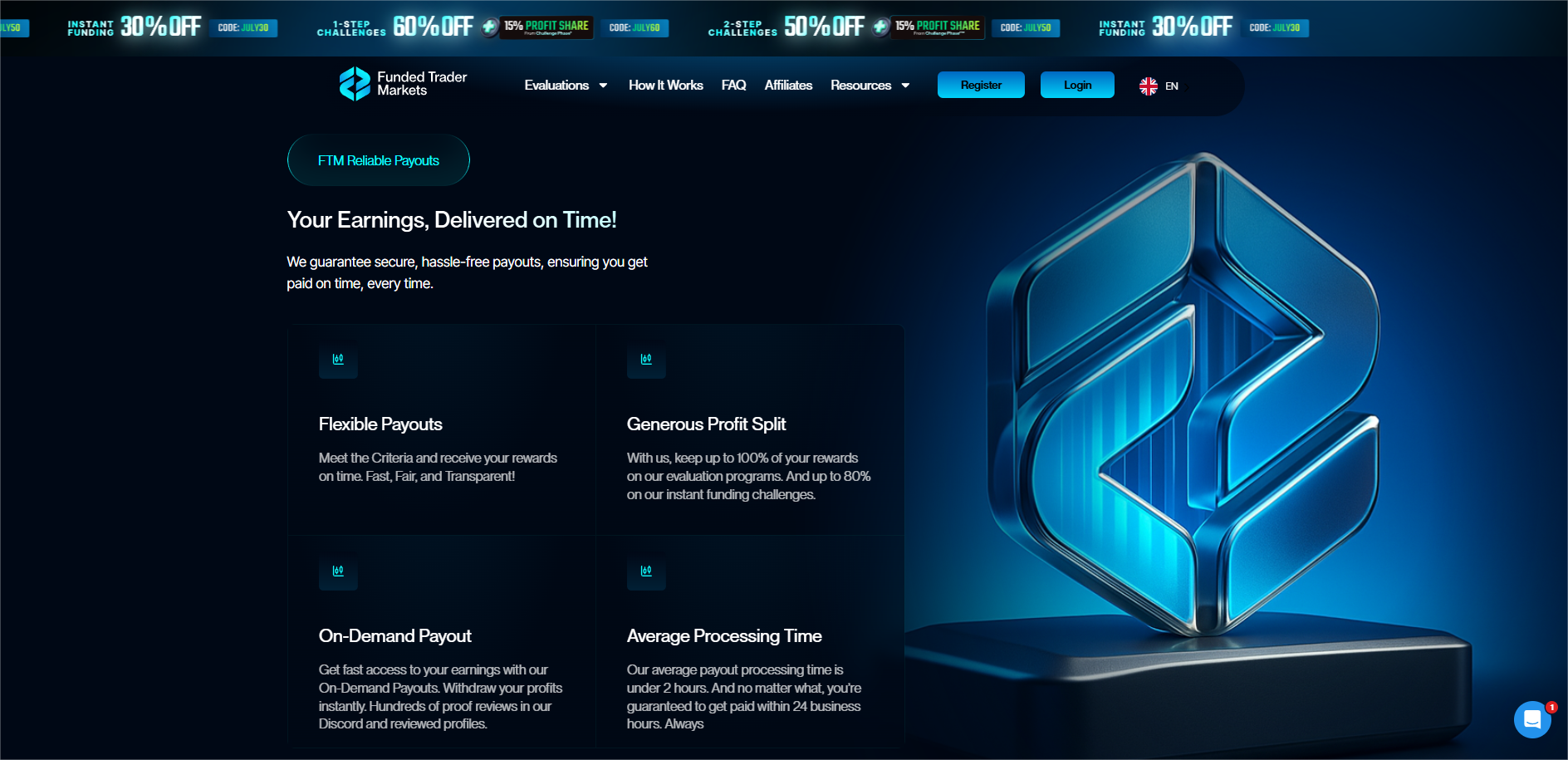

How Payouts Work at Funded Trader Markets

Funded Trader Markets offers On-Demand Payouts, meaning you can request your profits whenever you are ready no waiting for a specific payout window. But you need to meet a few basic rules first:

Payout Rules You Must Follow:

- Close all trades before making a payout request

- Have at least 1% profit of your starting balance

- Follow the consistency rule

- Meet the required minimum trading days (varies by account type)

After you request, your simulated profits are deducted from your account, and you can start trading again right after.

24-Hour Payout Guarantee

Funded Trader Markets offers one of the fastest payout systems in the prop firm space. Here is the deal:

- The average payout time is under 2 hours

- But they guarantee it will never take more than 24 business hours

And here is the kicker if they fail to send your payout within 24 hours, you get:

- Double the payout amount

- A free challenge account of the same size

To qualify for this:

- Your request must be under $1,000

- You must respond if they ask to change the payment method

- Business hours are 8:00 AM to 5:00 PM EST, Monday to Friday

If you don’t reply when they reach out, the guarantee is no longer valid.

Payout Methods You Can Choose

Funded Trader Markets supports fast, flexible payment options:

1. Crypto Withdrawals

USDT (ERC20 or TRC20)

2. Rise

Sign up on Rise and withdraw via:

- USDC (Arbitrum)

- Bank Transfer

They don’t resend payouts if you enter wrong info, so double-check everything before you hit submit.

What If You are in Profit But Broke a Rule?

You might still be eligible for a 50% payout if:

- You used a Stop Loss on all trades

- No single trade lost more than 1% of your account size

- Only applies to Evaluation Accounts, not Instant Funding

Bonus After Your 3rd Payout

You don’t get a refund on your purchase fee. But, if you stick with it, Funded Trader Markets rewards your effort:

- After your 3rd payout, you get a performance bonus

- That bonus equals 100% of your purchase fee or even more if you used a promo code

- Not available for Instant Funding or 1-Step Nitro X accounts

Our Review on Funded Trader Markets Payments & Payouts

Funded Trader Markets puts traders first when it comes to handling money. You get:

- Fast payouts (often within 2 hours)

- Flexible payment methods

- A real guarantee on payment speed

- And a chance to earn bonus rewards if you stay consistent

If you are tired of long payout delays or confusing rules, Funded Trader Markets is one of the few prop firms making it easier for serious traders to earn and withdraw their profits no games, no stress.

Country Restrictions at Funded Trader Markets

At Funded Trader Markets, trading opportunities are open to most countries but not all. Due to legal and compliance reasons, there are some places where their services cannot be offered.

If you live in any of the following countries, you won’t be able to open an account or use Funded Trader Markets services:

- Cuba

- Syria

- Iran

- Lebanon

- Ira

- Yemen

- North Korea

- Russia

- United Arab Emirates (UAE)

- Cyprus

Also, while Funded Trader Markets allows traders from many parts of the world, their MetaTrader 5 (MT5) services and related content are not meant for U.S. residents or for use in areas where using these services would break local laws.

Why These Restrictions?

It is not personal. These rules exist to follow international laws and sanctions, and to make sure Funded Trader Markets stays compliant with all regulations.

If you are unsure whether your country is eligible, it is always a good idea to contact their support team before signing up.

Final Thoughts on Funded Trader Markets

Funded Trader Markets is not just another name in the prop firm crowd it is built with a clear purpose: give traders real chances without the unnecessary noise. No strict timers, no hard-to-pass phases, and definitely no tricks buried in fine print. What you see is pretty much what you get and in today’s funding world, that alone makes a difference.

Whether you are a scalper, swing trader, weekend holder, or news trader, you will find room to breathe here. You are allowed to trade the way you know best. Want fast-track funding with their Nitro plans? Go for it. Prefer the classic two-step path? That is there too. Or maybe you just want to skip the tests and start trading? Their instant funding is built for exactly that.

What stands out most is their payout system. Fast, fair, and backed by a 24-hour guarantee they even promise double the payout if they miss the deadline. That kind of confidence is rare. And their scaling plan? It does not just offer bigger accounts it offers salaries. Real, monthly pay for consistent performance. That is a huge vote of trust in traders.

Now, it is not all roses. U.S. traders can’t use MT5. Some strict consistency rules may trip up over-leveraged strategies. Instant accounts come with a lower profit split. But for what it offers flexibility, variety, and speed Funded Trader Markets earns its place as a strong pick for 2026.

If you are tired of firms that make you feel like you are jumping through hoops, this one is worth a serious look. Funded Trader Markets gives you a platform, not pressure and that is exactly what more traders need today.