Alpha Capital Group Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Alpha Capital Group review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.4

4.4

Alpha Capital Group

Forex, Metals, Indices, oil

GB

2021

CEO: George Kohler

Get 15% OFF

Coupon Code:

cTrader

DXTrade

Trade Locker

Metatrader 5

Wise

Rise

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

PayPal

ACG Markets

Alpha Capital Group Review 2026

Alpha Capital Group prop firm also known by the acronym ACG, is a prop trading firm that has been making headlines recently and is based in the UK. Alpha Capital Group offers Forex and CFD trading opportunities and provides its clients with capital access through a challenge evaluation system, encouraging both novice and experienced traders.

To put it simply, demonstrate your abilities, and your efforts will be rewarded so you may trade and keep a set profit share.

However, it is not just about capital. Alpha Capital Group prop firm has been advertising itself as “trader-first,” integrating professional funding with trader education, modern platforms, reasonable flexibility alongside non-restrictive policies. Let us now go into the depths.

Alpha Capital Group Prop Firm Overview

| Feature | Details |

|---|---|

| Company Name | Alpha Capital Group |

| Company Legal Name | Alpha Capital Group Limited |

| Company Legal Number | Alpha Capital Group Legal number is 13719951 |

| Headquarters | The Alpha Capital Group is based in London, England |

| Years in Operation | The Alpha Capital Group has been operating since November 2021 |

| Broker | The broker associated with Alpha Capital Group is ACG Markets |

| CEO | Andrew Blaylock and George Kohler are the CEO of Alpha Capital Group |

| Challenge Types | The Alpha Capital Group includes One Phase Challenge, Two Phase Challenge and Three Phase Challenge. |

| Challenge Fees | The Alpha Capital Group challenge Fees starts from $50-$1097 |

| Profit Split | Alpha Capital Group offers up to 80% profit split. |

| Account Sizes | The Alpha Capital Group funded accounts range from $5000-$200000 |

| Payouts | Payouts with Alpha Capital Group are available every 14 days |

| Financial Markets | Trading Instruments supported by Alpha Capital Group are Forex, Metals, Indices, oil. |

| Trading Platform | Trading Platforms supported by Alpha Capital Group are cTrader, DXTrade, MT5, TradeLocker. |

| TrustPilot Score | Alpha Capital Group is rated 4.⅘ on TrustPilot |

Alpha Capital Group Pros & Cons - Quick Comparison

Alpha Capital Group is a UK based prop firm that offers multiple evaluation models and competitive profit splits along with a structured scaling plan. While there are several advantages of Alpha Capital Group's prop firm for the traders, there are some cons to consider too.

Alpha Capital Group Pros and Cons:

| Pros | Cons |

|---|---|

| Offers multiple challenge types and account sizes, suitable for all trading styles. | Lower leverage on some account types (e.g., Swing and Alpha One) may limit short-term strategies. |

| No profit caps and flexible payout options, including on-demand withdrawals. | Evaluation fees can be relatively high for larger accounts. |

| Generous leverage (up to 1:100) with clear and consistent risk parameters. | Restricted news trading may not suit high-impact event traders. |

| High proft split of 80% on all account types | Limited platform options (MT4/MT5 only). |

| Unlimited trading days allow traders to progress at their own pace. | Scaling and withdrawal processes can take time compared to instant funding firms. |

Alpha Capital Group Challenge Types, Fees, Profit Split and more

Alpha Capital Group has no evaluation time limits or comprehensive profit split structures of up to 80%, which is ideal for short and long term traders alike. Traders are also able to enjoy low fees, clear scaling plans, flexible trading conditions, and access to MT5, cTrader, and DXTrade, which enable streamlined trading on different platforms.

Alpha Capital Group Challenge Comparison

| Feature | Alpha One | Alpha Pro 6% | Alpha Pro 8% | Alpha Pro 10% | Alpha Swing | Alpha Three |

|---|---|---|---|---|---|---|

| Account Sizes | $5k – $200k | $5k – $200k | $5k – $200k | $5k – $200k | $5k – $200k | $10k – $200k |

| Challenge Fees (Start From) | $50 | $40 | $77 | $50 | $77 | $67 |

| Phases | 1 Phase | 2 Phases | 2 Phases | 2 Phases | 2 Phases | 3 Phases |

| Profit Target | 10% | 6% (both phase) | 8% (both phase) | 10% (both phase) | 10% (both phase) | Step 1: 8% / Step 2–3: 4% |

| Daily Drawdown | 4% | 3% | 4% | 5% | 5% | 4% |

| Max Total Drawdown | 6% | 6% | 8% | 10% | 10% | 6% |

| Leverage | 1:30 | up to 1:100 | up to 1:100 | up to 1:100 | up to 1:30 | up to 1:50 |

| Drawdown Type | Balance-Based | Balance-Based | Balance-Based | Balance-Based | Balance-Based | Balance-Based |

| Profit Cap | None | None | None | None | None | None |

| Minimum Trading Days | None | None | None | None | None | None |

| Maximum Trading Days | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Payout Type | On-Demand | Biweekly / On-Demand | Biweekly / On-Demand | Biweekly / On-Demand | On-Demand | Biweekly / On-Demand |

| Profit Split (Analyst Performance Fee) | 80% | 80% | 80% | 80% | 80% | 80% |

| News Trading Allowed | Yes (restricted) | Yes (restricted) | Yes (restricted) | Yes (restricted) | Yes (restricted) | Yes (restricted) |

| Holding Overnight / Weekend | Allowed | Allowed | Allowed | Allowed | Yes (Swing) | Allowed |

| Scaling Plan | Available | Available | Available | Available | Available | Available |

| Trading Platform | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 |

| Evaluation Goal | Fastest route to funding | Conservative target | Moderate risk-reward | Higher reward setup | Swing-friendly | Multi-step consistency |

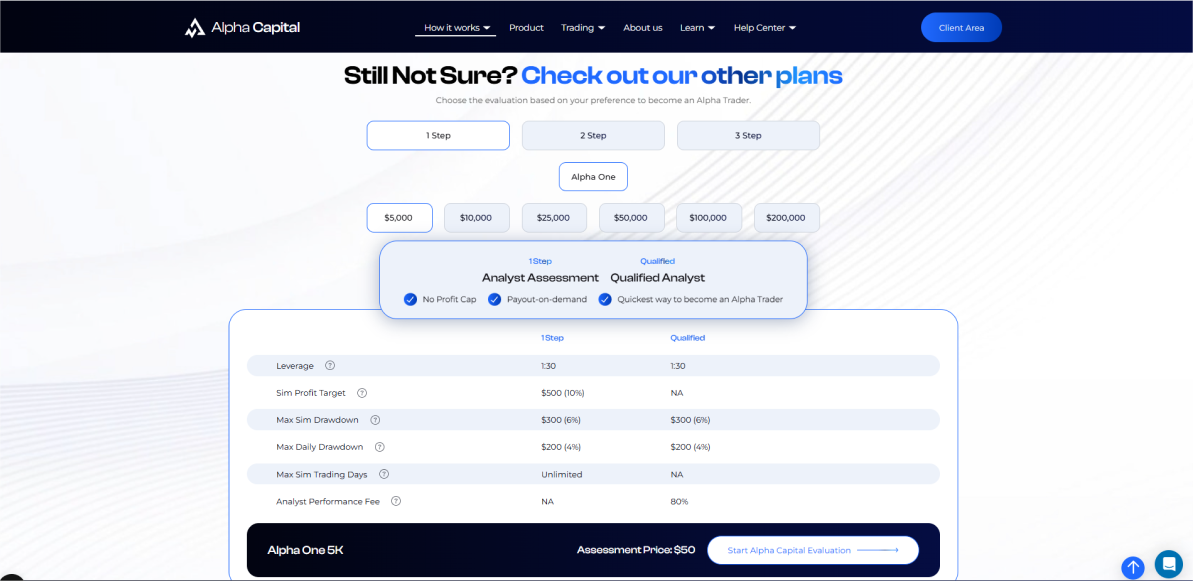

Alpha One Challenge

The Alpha One Challenge by Alpha Capital Group is the fastest route to becoming a funded Alpha Trader. Designed as a 1-step evaluation, it offers simplicity and transparency for traders who want to demonstrate consistency and discipline without going through multiple stages. With no profit cap, payout-on-demand, and 1:30 leverage, traders can trade freely while maintaining strict risk management rules.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $5,000 | $50 | $500 (10%) | $250 (5%) | $300 (6%) |

| $10,000 | $97 | $1,000 (10%) | $500 (5%) | $600 (6%) |

| $25,000 | $197 | $2,500 (10%) | $1,250 (5%) | $1,500 (6%) |

| $50,000 | $297 | $5,000 (10%) | $2,500 (5%) | $3,000 (6%) |

| $100,000 | $497 | $10,000 (10%) | $5,000 (5%) | $6,000 (6%) |

| $200,000 | $997 | $20,000 (10%) | $10,000 (5%) | $12,000 (6%) |

Alpha Pro 6% Challenge

The Alpha Pro 6% evaluation is perfect for traders seeking slightly lower profit targets and more forgiving risk limits. It features 1-step or 2-step assessments, up to 1:100 leverage, and biweekly or on-demand payouts. It’s ideal for analysts who value flexibility and a quick path to becoming a Qualified Analyst.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $5,000 | $40 | $300 (6%) | $150 (3%) | $300 (6%) |

| $10,000 | $67 | $600 (6%) | $300 (3%) | $600 (6%) |

| $25,000 | $137 | $1,500 (6%) | $750 (3%) | $1,500 (6%) |

| $50,000 | $237 | $3,000 (6%) | $1,500 (3%) | $3,000 (6%) |

| $100,000 | $427 | $6,000 (6%) | $3,000 (3%) | $6,000 (6%) |

| $200,000 | $847 | $12,000 (6%) | $12,000 (3%) | $12,000 (6%) |

Alpha Pro 8% Challenge

The Alpha Pro 8% challenge balances opportunity and risk, making it a great choice for traders seeking achievable goals and high leverage. With 1-step and 2-step paths, no profit cap, and biweekly/on-demand payouts, traders can scale steadily while maintaining strong consistency.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $5,000 | $77 | $400 (8%) | $200 (4%) | $400 (8%) |

| $10,000 | $147 | $800 (8%) | $400 (4%) | $800 (8%) |

| $25,000 | $247 | $2,000 (8%) | $1,000 (4%) | $2,000 (8%) |

| $50,000 | $357 | $4,000 (8%) | $2,000 (4%) | $4,000 (8%) |

| $100,000 | $577 | $8,000 (8%) | $4,000 (4%) | $8,000 (8%) |

| $200,000 | $1,097 | $16,000 (8%) | $8,000 (4%) | $16,000 (8%) |

Alpha Pro 10% Challenge

The Alpha Pro 10% program is a classic 1-step or 2-step challenge designed for traders aiming for higher profit targets with generous drawdown limits and 1:100 leverage. With no maximum trading days, no profit cap, and biweekly or on-demand payouts, it provides ultimate flexibility.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $5,000 | $50 | $500 (10%) | $250 (5%) | $500 (10%) |

| $10,000 | $97 | $1,000 (10%) | $500 (5%) | $1,000 (10%) |

| $25,000 | $197 | $2,500 (10%) | $1,250 (5%) | $2,500 (10%) |

| $50,000 | $297 | $5,000 (10%) | $2,500 (5%) | $5,000 (10%) |

| $100,000 | $497 | $10,000 (10%) | $5,000 (5%) | $10,000 (10%) |

| $200,000 | $997 | $20,000 (10%) | $10,000 (5%) | $20,000 (10%) |

Alpha Swing Challenge

The Alpha Swing account is tailored for swing traders who prefer holding trades overnight or over weekends. With 1:30 leverage, 1-step or 2-step assessments, and on-demand payouts, it caters to traders who rely on medium- to long-term setups without restrictions.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $5,000 | $77 | $500 (10%) | $250 (5%) | $500 (10%) |

| $10,000 | $147 | $1,000 (10%) | $500 (5%) | $1,000 (10%) |

| $25,000 | $247 | $2,500 (10%) | $1,250 (5%) | $2,500 (10%) |

| $50,000 | $357 | $5,000 (10%) | $2,500 (5%) | $5,000 (10%) |

| $100,000 | $577 | $10,000 (10%) | $5,000 (5%) | $10,000 (10%) |

| $200,000 | $1,097 | $20,000 (10%) | $10,000 (5%) | $20,000 (10%) |

Alpha Three Challenge

The Alpha Three program is a 3-step evaluation designed for traders who prefer gradual scaling and proving consistent profitability over time. With 1:50 leverage, no profit cap, and biweekly/on-demand payouts, it provides a structured pathway for developing disciplined trading habits.

| Account Size | Challenge Fee | Profit Target | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $10,000 | $67 | Step 1: $800 (8%) Step 2-3: $400 (4%) | $400 (4%) | $600 (6%) |

| $25,000 | $157 | Step 1: $2,000 (8%) Step 2-3: $1000 (4%) | $1,000 (4%) | $1,500 (6%) |

| $50,000 | $247 | Step 1: $4,000 (8%) Step 2-3: $2,000 (4%) | $2,000 (4%) | $3,000 (6%) |

| $100,000 | $397 | Step 1: $8,000 (8%) Step 2-3: $4,000 (4%) | $4,000 (4%) | $6,000 (6%) |

| $200,000 | $697 | Step 1: $16,000 (8%) Step 2-3: $8,000 (4%) | $8,000 (4%) | $12,000 (6%) |

Our Review of Alpha Capital Group Challenge Types

Alpha Capital Group offers one of the most versatile and trader-friendly evaluation programs in the industry. Whether you’re a fast-paced day trader, a conservative swing trader, or someone who prefers gradual scaling, there’s a challenge designed for your style.

With flexible leverage (up to 1:100), no profit caps, unlimited trading days, and payouts on demand, Alpha Capital Group strikes an excellent balance between freedom and discipline. Overall, it’s a strong choice for traders seeking a transparent, fair, and scalable path to becoming a fully funded professional.

Alpha Capital Group Scaling Plan Explained

If you are growing as a trader and want your account size to grow with you, Alpha Capital Group has a scaling plan that actually rewards your progress. But here is the thing it is not automatic, and it is not endless. So let us break down exactly how it works and what you need to do to scale up.

Think of it like leveling up your trading account. If you grow your account by 10%, you can request a bump in virtual capital. And each time you qualify, you are also eligible to get paid your performance fee and scale up at the same time.

The cap? You can scale up to a total of $2 million across all your Alpha accounts. So yeah, there’s room to grow but it is still structured and controlled.

Which Alpha Capital Group Plans Are Eligible?

Not every plan gets the scaling feature. Only these Alpha Capital Group plans allow you to scale:

- Alpha Pro

- Alpha Swing

- Alpha Three

If you are on one of those, you are good to go.

How to Request a Scale-Up With Alpha Capital Group

Here is the step-by-step, simple as it gets:

- You must be at the withdrawal stage, meaning you have hit profit and are ready for a payout.

- Once you withdraw your profits, your account resets to its original balance.

- In your Performance Fee Request, write a note saying: “I’d like to join the scaling plan and scale up my account.”

- Also, send an email to:[email protected]

Clearly state you want your account scaled up. - Wait about 24 to 48 business hours. That is their window for processing.

Important: You need to have a 10% gain present in the account at the time of request. Past gains that you have already withdrawn don’t count.

Real Example: How Alpha Capital Group Scaling Works

Let us say you start with a $100,000 account.

- You grow it to $110,000 (that’s 10% growth).

- You now request: Your 80% performance fee ($8,000) and your new scaled account, which becomes $110,000.

Pretty clean, right? But heads up on your first scale, your lot size does not increase. You just get a bigger account.

Now for your Alpha Capital Group 2nd account Scaling:

- You start from $110,000.

- You grow it to $120,000 (another $10k gain).

- You again request your $8,000 payout.

- Your new account size becomes $120,000.

- This time, your max lot size increases by 10%.

Example:

- At $100k → Max Lot Size: 40

- At $120k → Max Lot Size: 44

So, you are not just trading more you are trading bigger with permission.

A Quick Heads Up

After your account gets scaled, you cannot request another payout immediately. You will need to trade for at least 5 more trading days before you are eligible for your next performance fee. It is their way of keeping things fair and giving you time to work the new capital.

Our review of the Alpha Capital Group Scaling Plan

Alpha Capital Group's scaling plan is super structured no scheduled. You grow, they reward you with more capital and keep bumping your limits. But only if you play it clean, withdraw properly, and stay within the rules.

If you are looking for a long-term path with a prop firm that actually lets you scale like a pro, Alpha Capital Group is a solid setup.

Spreads & Commissions at Alpha Capital Group

Standard Assessment

This account type offers floating spreads starting from 0.1 pips for major forex pairs, as well as zero commission fees across all asset classes. It is favorable for traders whose trading style does not require extra costs for trades.

Raw Assessment

For traders who need lower spreads, the Raw Assessment offers access to interbank raw spreads, for a commission of $2.5 per lot per side (totaling $5 for a round turn). This works best for clients who prefer to pay commission in exchange for lower spreads.

Note: Commissions for both account types are free on indices.

Alpha Capital Group Drawdown Rules

Let us talk about one of the most important rules in any prop firm challenge: drawdown. If you are new, think of it like this: drawdown is the maximum amount you are allowed to lose before your account gets shut down. Now, at Alpha Capital Group, this limit depends on which account type you are trading with. Some accounts have a fixed drawdown, while others use a trailing drawdown, which changes as your account grows.

Let us break it down like a real trader would understand it:

Alpha Capital Group Static vs. Trailing Drawdown: What is the Difference?

- Static Drawdown = Your loss limit never moves. It is locked at a fixed level based on your starting balance.

- Trailing Drawdown = This one moves upward as your profits grow but only until a certain point.

Alpha Capital Group Drawdown Limits by Account Type

Account Type | Drawdown Type | Max Loss % |

|---|---|---|

Alpha Pro | Static | 10%, 8%, or 6% |

Alpha Swing | Static | 10% |

Alpha Three | Static | 6% |

Alpha One | Trailing | 6% |

Real Life Examples:

Let us put this into numbers so it is easier to picture.

Alpha Pro or Alpha Swing (Static 10%)

- Starting Balance: $100,000

- Drawdown Limit: 10%

That means you can’t go below $90,000 ever.

Even if you grow your account to $110,000, the drawdown doesn’t shift. It is still $90k.

Alpha Three (Static 6%)

- Starting Balance: $100,000

- Drawdown Limit: 6%

You can't drop below $94,000.

Same story: even if your balance grows to $120,000, the drawdown stays fixed at $94k.

Alpha One (Trailing 6%)

Now this one is a bit different.

- Starting Balance: $100,000

- You’re allowed to lose 6%, which is $6,000.

But here is where the “trailing” part comes in…

Let us say your balance grows to $102,000.Now, your drawdown trail moves up too. It becomes:

$102,000 - $6,000 = $96,000.

If you drop below $96,000 after reaching $102k, you’re in violation.

As your profits go up, the buffer moves up with you until your high watermark hits $106,000.

Why that number?

Because: $106,000 - $6,000 = $100,000 (your original balance). Once your drawdown level hits your starting balance, it locks. That is your new line in the sand.

Our review of Alpha Capital Group's Drawdown Rules

Drawdowns at Alpha Capital Group are strict and fair. They don’t sneak up on you, but they will take you out if you are careless.

- Static drawdown? Simple. Just don’t go below the loss limit.

- Trailing drawdown? Manage your risk like a pro, especially once you are in profit.

At the end of the day, the drawdown is not your enemy it is your risk manager. Respect it, and you will stick around long enough to get funded.

Alpha Capital Group Trading Rules Explained

Alpha Capital Group has set policies and rules on trading and risk management in order to provide a level trading field for all traders. All traders participate in favorable trading conditions such as zero commission for all assets and leverage of 1:100, but must follow stipulations to maintain account integrity.

Alpha Capital Group: What Trading Strategies Are Allowed and Prohibited?

Rule | Allowed? | Details |

|---|---|---|

Expert Advisors (EAs)/Bots Trading | ✅ Yes (with conditions) | EAs are permitted during evaluation periods. In funded accounts, only manual trading is allowed. |

High-Frequency Trading (HFT) | ❌ No | Strategies based on fast execution and cancellation of trades are not allowed. |

Overleverageing | ❌ No | The account can be terminated for being too aggressive with margin usage or allowing the margin level to dwindle too low. |

One-Sided Bets | ❌ No | Aggressive trading in one direction without risk mitigation through diversification is not allowed. |

Hyperactive Trading | ❌ No | Frequent impulsive trades without a strategy, including over-scaling, are not allowed. |

Martingale Strategy | ✅ Yes | Martingale strategies are allowed following the lifting of previous restrictions. |

Grid Trading | ✅ Yes (with conditions) | Grid trading is permitted as long as it follows the risk management policies of the firm. |

All-In Approach | ❌ No | Placing a large lot size that is disproportionate to the account equity results in a breach of terms. Such method is not acceptable. |

Reverse Trading/Group Hedging | ❌ No | Reverse trading or group hedging strategies are not allowed. |

Tick, latency, or hedge arbitrage | ❌ No | Strategies exploiting market gaps or delays using arbitrageare not allowed. |

Use of Emulators | ❌ No | Manipulative software simulating a trading activity to yield certain results is disallowed. |

Third-party account management | ❌ No | Account management via third-party traders is not allowed. |

Data feed manipulation | ❌ No | Exploiting pricing discrepancies or intervals that occur are strictly forbidden. |

IP Address Usage (Single Account Per IP) | ✅ Yes | Numerous IP addresses and devices can be used, as long as trading is done by the account holder who completed KYC verification. |

IP Address Misuse | ❌ No | Masking or hiding IP addresses, changing between countries, or engaging in trade concealment can lead to account suspension. Repeated violations may incur stricter consequences. |

Multiple Trading Accounts | ✅ Yes (with conditions) | Provided that the total simulated capital does not exceed $400,000, multiple accounts can be opened with separate user credentials. |

Copy Trading (Own Accounts) | ✅ Yes | Allowed between your own Alpha accounts. |

Swing & Overnight Trades | ✅ Yes | Fully supported in the Alpha Swing plan |

Weekend Holding | ✅ Yes | Allowed across most challenges |

Alpha Capital Group News Trading Policies

As for news trading, different rules apply for Alpha Capital Group Alpha Pro, Alpha One and Alpha Three plans.

For Alpha Pro - In evaluation phases traders are free to trade along news, but for funded accounts, traders can’t trade 2 minutes before or after high impact news for funded accounts. If a trade is made, profit removal will happen if any gains are made and it will also be considered a soft breach. Due to the nature of swing trading, traders are allowed during news in Alpha Swing Accounts to trade without any restrictions and in fact, it will be encouraged.

For Alpha One and Alpha Three Plans - In this case traders can’t trade for 5 minutes before a high impact news and 5 minutes after high impact news. In this time frame, traders cannot alter the trades either. The same profit removal and soft breach apply here as well.

Our Review of Alpha Capital Group Trading Rules

To Alpha Capital Group, it is important to have balanced and controlled policies that maintain the long term capabilities of the firm.

The above mentioned prohibited trading strategies are not allowed to be used by traders. Trading behavior must ensure a fair, sustainable, and disciplined environment. The Alpha Capital Group positions itself as trader-friendly prop firm and allows numerous styles but heavily restricts high-risk, predatory strategies that could be detrimental to long term performance or violate contract terms.

Alpha Capital Group Trading Competitions

Alpha Capital Group regularly hosts trading competitions and giveaways, providing traders with chances to win free challenges, merchandise, or even direct funding. These events not only encourage trader engagement but also offer an opportunity to showcase skills in a competitive environment.

What instruments can you trade with Alpha Capital Group?

If you are wondering what you can actually trade once you are funded with Alpha Capital Group, the good news is you’re not stuck with just a handful of forex pairs. They give you a solid mix of markets to work with, so you can trade your style, your way.

Here is the full rundown of assets you will have access to once you are inside.

Forex Pairs

First up, you get access to a wide range of major and cross currency pairs. Whether you like trading the classics like EURUSD or you are into those AUD/NZD cross setups, you are covered.

Here is everything in the Forex section:

- AUDCAD

- AUDCHF

- AUDJPY

- AUDNZD

- AUDUSD

- CADCHF

- EURAUD

Whether you are a scalper on GBPJPY or a swing trader riding EURUSD trends there is something in here for everyone.

CFD Indices & Commodities

If you trade CFDs, especially indices or oil, you will be happy with what Alpha Capital Group offers. You can take advantage of big moves in the global markets with some of the most popular instruments around.

Here is what is included:

- EUSTX50

- GER30

- HK50

- JPN225

- NAS100

- UK100

- UKOIL

- US30

- US500

- USOIL

So if you have got setups on US indices like NAS100 or US500, or you love the volatility of oil, Alpha Capital Group has got your back.

Metals

Last but not least, you can trade precious metals and yes, that means Gold and Silver, which are favorites among many funded traders.

- XAUUSD (Gold)

- XAGUSD (Silver)

Gold scalpers, this one is for you.

Our final review of the Instruments offered by Alpha Capital Group

At the end of the day, Alpha Capital Group gives you just enough variety without overwhelming you. You can focus on your preferred market be it forex, indices, oil, or metals and stick to your strategy without feeling limited.

If you are still figuring out your trading lane, this list gives you the freedom to explore without jumping through hoops.

Alpha Capital Group Payment method and payout process

Getting paid is the part we all look forward to after putting in the work. So how does Alpha Capital Group handle performance fees and payouts? Surprisingly smooth, with a few things to note so you don’t get tripped up. Here is how it works:

Bi-Weekly or On-Demand? You Get to Choose

Alpha Capital Group gives traders two ways to collect their profits:

- Bi-Weekly Payouts – A regular schedule, great if you like predictable paydays.

- On-Demand Payouts – You decide when you want to get paid, as long as you meet the criteria.

When you are ready to request a payout, just head to your dashboard and go to the:

Payout and Achievements page → Payout tab.

That is where you submit your performance fee request. Once submitted, Alpha Capital Group processes it within 2 business days.

For example, if you file your request on a Tuesday, expect your funds to land in your account by Thursday EOD.

Pro Tip: If it is your 4th successful withdrawal, mention it in the “Reason” field when you submit the request that is when you unlock your performance fee bonus.

Before You Click Withdraw: Important Rules

- All trades must be closed before you submit the request.

- While your payout is being processed, your account will be temporarily locked no trading during this time.

- Once the payout is complete and the account resets, you can resume trading right away.

But here is the big one…

If Alpha Capital Group finds any rule breaches during your payout review, they may:

- Remove profits from invalid trades, or

- Delay your entire payout window, depending on how serious the issue is.

So yeah… follow the rules, keep it clean, and your payout will go through hassle-free.

What Payment Methods Does Alpha Capital Group Use?

You have got options and that is always a plus. They support:

- Rise

- Wise

- Bank Transfers – WIRE / ACH / SWIFT supported

No direct crypto payouts.

Due to regulatory concerns, Alpha Capital Group does not allow crypto withdrawals directly. However, if you really want to get paid in crypto, there is a workaround:

You can use Riseworks, one of Alpha Capital Group's official payment partners, which supports crypto withdrawals through their own platform.

Our Final review on Alpha Capital Group's Payment method and payout process

Payouts at Alpha Capital Group are fast, flexible, and professional. Whether you want steady bi-weekly payments or prefer calling the shots with on-demand requests, the system works as long as you follow the rules.

And if you are someone who likes using services like Wise or Rise? Even better.

Country Restrictions at Alpha Capital Group

Alpha Capital Group operates in more than 150 countries, although for regulatory and risk management reasons, there are some countries restricted by Alpha Capital Group where traders cannot register or buy challenges from.

Restricted Countries

These regions are blocked from accessing Alpha Capital Group programs:

- Afghanistan

- Belarus

- Burundi

- Central African Republic

- Chad

- Democratic Republic of the Congo

- Region of Crimea

- Eritrea

- Iran

- Iraq

- Cuba

- North Korea

- Libya

- Myanmar

- Somalia

- Sudan

- Russia

- South Sudan

- Syria

- Yemen

- Venezuela

- Vietnam

The traders from these countries are under numerous restrictions when trying to register or purchase evaluations due to international restrictions from sanctions, politically motivated violence, or anti-money laundering rules.

Our Conclusion Regarding Alpha Capital Group Prop Firm

By providing optimal growth scalability, clearly defined rules, and well-structured evaluation frameworks, Alpha Capital Group has secured a unique place within the prop trading realm. Alpha Capital’s $2 million funding potential, 80% profit split, and multiple account types (raw spread and commission-free accounts) create conditions for long-term development among traders.

The Alpha Capital Group prop firm’s 1-step, 2-step, swing trading, and even 3-step evaluation challenges are designed keeping in mind traders of all skill levels and strategy types. From scalpers to long-term swing traders, there is something for everyone.

What also sets Alpha Capital Group apart is the support provided through rapid bi-weekly payouts, no time limits on evaluations, and helpful risk management policies. Although the range of available instruments (especially regarding crypto) is more limited than some rivals offer, the firm makes up for it with great infrastructure, educational materials, and pro-trader policy changes like the removal of the Martingale restriction.

Overall, Alpha Capital Group's prop firm offers an unmatched experience by prioritizing reliability and growth in prop trading. It is a prop trading firm of choice for serious traders who want to scale their capital responsibly because of its focus on consistency, discipline, and transparent progression.