My Crypto Funding Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full My Crypto Funding review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.8

4.8

My Crypto Funding

Forex, Commodities, Indices, Crypto, Stocks

GB

2024

CEO: Vitor Antunes Alcalde

Get 20% OFF

Coupon Code:

MatchTrader

MetaTrader

Crypto

Crypto

Credit/Debit Card

PayPal

In-House Broker

My Crypto Funding Review 2026

What if crypto traders had the same kind of institutional tools, leverage and funding that stock or forex traders do but with no upfront investment risk beyond a one time challenge fee?

That’s the entire vibe behind My Crypto Funding (MCF) - a crypto prop trading firm. In a market still figuring itself out between DeFi dreams and centralized chaos, MCF steps in like a trader’s secret weapon - offering funded crypto accounts, two-step evaluations and access to over 35+ popular and altcoin crypto pairs.

Launched with the bold mission to make crypto prop trading accessible, My Crypto Funding combines the best of traditional prop models (profit splits, challenge phases, capital growth paths) with the flexibility that modern crypto traders demand such as BTC, ETH, SOL, XRP, DOGE, ADA, SHIB, LINK, and a dozen others you probably follow on CoinMarketCap.

So, whether you are a weekend swing trader or a scalping degen with spreadsheets full of fib levels, this firm might just be the funding partner you didn’t know you needed. And in this review, we’ll break it all down: challenges, rules, payouts, platforms and how MCF stacks up in the growing crowd of crypto prop firms in 2026.

Let’s dig in.

My Crypto Funding Prop Firm Overview

| Features | Details |

|---|---|

| Company Name | My Crypto Funding |

| Company Legal Name | The legal name for My Crypto Funding is My Crypto Funding Ltd |

| Registration Number | The registration number of My Crypto Funding is 15795471. |

| Headquarters | My Crypto Funding is registered in London, Uk |

| Years in Operation | My Crypto Funding has been operating since July 2024 |

| Broker | The broker associated with My Crypto Funding is an In-House Broker. |

| CEO | The CEO of My Crypto Funding is Vitor Antunes Alcalde. |

| Challenge Types | 2 Step evaluation is offered by My Crypto Funding |

| Challenge Fees | The challenge fees of My Crypto Funding range from $64 |

| Profit Split | My Crypto Funding offers standard 80% profit split which increases by 5% every 5 payouts hence traders get up to 100% of the profits. |

| Account Sizes | My Crypto Funding Account Size range from $5,000 - $200,000 |

| Payouts | Payouts with My Crypto Funding are available every 15 days |

| Financial Markets | Financial Markets offered by My Crypto Funding are cryptocurrencies, forex, indices, commodities, and stocks |

| Trading Platform | My Crypto Funding supports trading on MetaTrader5 and they have their own MCF platform with Tradingview Integration. |

| TrustPilot Score | My Crypto Funding is rated 4.8/5 on Trustpilot |

Pros & Cons of My Crypto Funding - Quick Comparison

Before diving headfirst into the crypto trading challenge world, let’s pause for a second. Every prop firm - no matter how promising - has its strengths and quirks and My Crypto Funding (MCF) is no exception.

It’s got a solid setup for crypto lovers: access to tons of pairs, clean evaluation rules and a platform that doesn’t feel like it was built in 2012. But like any prop firm, there are trade offs, especially for traders who expect instant funding, advanced tools or heavy hand-holding.

So here is the real talk. Below is a balanced view of what works for traders at MCF and what might make some think twice.

Quick Pros & Cons Comparison Table

| Pros ✅ | Cons ❌ |

|---|---|

| 35+ popular crypto pairs & altcoins supported | assets - no forex/stocks |

| trader-friendly 2-Step evaluation model with reasonable rules | No 1-Step or Instant Funding options |

| Up to 100% profit split after funding | First withdrawal capped at $1,000 |

| No min. trading days; fast pass allowed | No scaling plan currently available |

My Crypto Funding Type of Challenges, Fees, and Profits Split

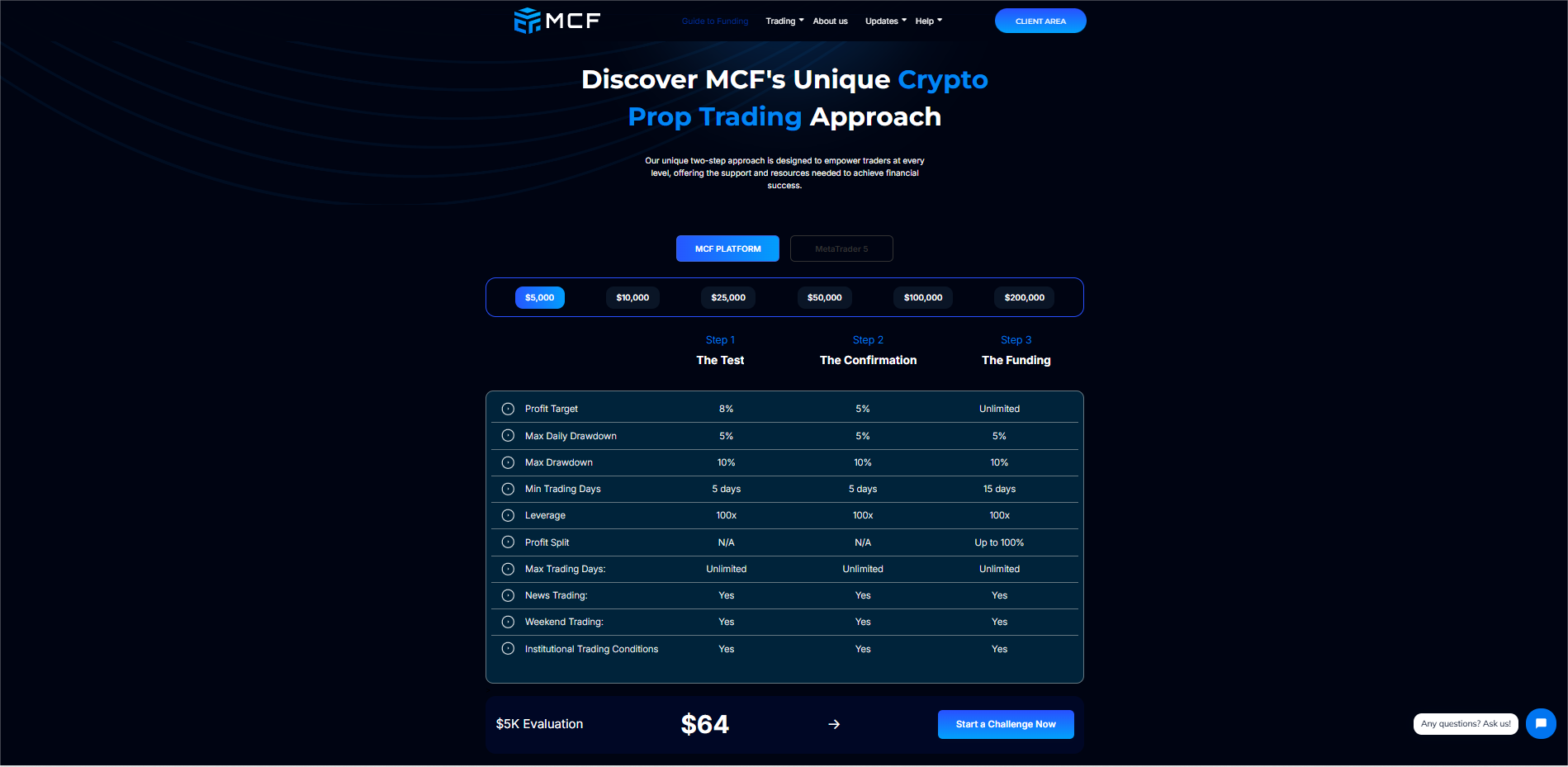

My Crypto Funding evaluation has two phases. First, you will need to hit a profit target while staying within the risk limits. In the second step, it is all about showing you can stay consistent. Pass both, and you will get a fully funded crypto trading account ready to trade for real.

My Crypto Funding 2-Step Challenge Breakdown:

| Criteria | Step 1: The Test | Step 2: The Confirmation | Step 3: The Funding |

|---|---|---|---|

| Available Account Sizes | $5K, $10K, $25K, $50K, $100K, $200K | Same as Step 1 | Same as Step 1 |

| Profit Target | 8% | 5% | Unlimited (No Target) |

| Max Daily Drawdown | 5% | 5% | 5% |

| Max Overall Drawdown | 10% | 10% | 10% |

| Minimum Trading Days | 5 Days | 5 Days | 10 Days |

| Leverage | 100x | 100x | 100x |

| Profit Split | N/A | N/A | 80% (up to 100% with scaling) |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| News Trading Allowed | Yes | Yes | Yes |

| Weekend Trading Allowed | Yes | Yes | Yes |

| Institutional Conditions | Yes | Yes | Yes |

| Starting Fee (for $5K) | $64 | – | – |

My Crypto Funding 2-Step Evaluation Process Breakdown

If you are eyeing funding from My Crypto Funding then you’ll first need to pass their 2-Step Evaluation Model - a structure that tests your skills without throwing in unreasonable conditions. They call it:

Step 1: The Test

Step 2: The Confirmation

Step 3: The Funding

Each step is designed to check whether you can grow capital responsibly, keep risks under control, and follow proper trading discipline.

No tricks, no weird scoring algorithms - just clear profit targets and drawdown limits. And once you pass, you unlock real funding and start earning from your trades.

Here’s a full breakdown of the evaluation structure:

| Account Size | Challenge Fee | Step 1 The Test: Profit Target (8%) | Step 2 The Confirmation: Profit Target (5%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

|---|---|---|---|---|---|

| $5,000 | $64 | $400 | $250 | $250 | $500 |

| $10,000 | $104 | $800 | $500 | $500 | $1,000 |

| $25,000 | $219 | $2,000 | $1,250 | $1,250 | $2,500 |

| $50,000 | $349 | $4,000 | $2,500 | $2,500 | $5,000 |

| $100,000 | $649 | $8,000 | $5,000 | $5,000 | $10,000 |

| $200,000 | $1149 | $16,000 | $10,000 | $10,000 | $20,000 |

Pro Tip:

The drawdown limits are hard caps, meaning if your account equity ever drops beyond that limit even for a moment then you are out. So, keep your position sizes tight and emotions tighter.

Our Review on My Crypto Funding Challenges

My Crypto Funding's challenge models are tailored for modern traders who value speed, transparency, and control. Their appeal is in offering no hidden rules and rapid processing under funded trading. The unique offer of profit split ensures traders are rewarded for their performance. Automatic and manual profit earning strategies enjoy the same transparent split structure.

Many traders choose My Crypto Funding is for their reliable profit split policies. The firm prioritizes trader success with one of the best split deals in prop trading encouraging every funded trader to perform.

And here is a major update: My Crypto Funding now also supports trading on MetaTrader5, and they have launched their own MCF platform fully integrated with TradingView. So whether you prefer MT5’s familiar interface or TradingView’s advanced tools, you are covered.

My Crypto Funding Scaling Plans

My Crypto Funding does not possess a scaling plan as of now.

This allows traders to remain within the bounds of their capital limits. Minimal trader performance needs to be met for delegated capital milestones.

Spreads & Commissions at My Crypto Funding

My Crypto Funding keeps things trader-friendly with some of the tightest spreads in the industry, giving you better control over entries and exits, especially during high-volatility moments.

When it comes to commissions, they are low and transparent:

- Crypto: 0.015% per side

- Commodities: 0.0005% per side

- Stocks: 0.002% per side

- Forex: $1.5 per lot (per side)

- Indices: $0 commission

- no hidden fees just clean pricing built for serious traders.

Drawdown Limits at My Crypto Funding

- Daily Drawdown: 5%

- Each day at 00:00 UTC, your risk resets. You can’t lose more than 5% of your starting balance for that day.

- Example: If you start the day with $100,000, your limit is $5,000 so don’t drop below $95,000.

- Max Drawdown: 10%

You also have a hard 10% loss cap from your original balance.

So with a $100,000 account, falling below $90,000 at any time means the account is breached.

Stick to these limits, and you stay in the game. Simple and clear.

My Crypto Funding Trading Rules Explained

At My Crypto Funding, the rules are not there to restrict good traders they are there to protect the firm and reward real skill. If you are planning to take on an evaluation or manage a funded account, you will want to be clear on what’s allowed and what’s not.

They are strict where they need to be, and fair where it matters most. Stick to real, replicable strategies and you’re good. Try to game the system? That’s where things get messy.

What’s Allowed and What’s Not at My Crypto Funding

| Trading Rule | Allowed? | Details |

|---|---|---|

| Demo Environment Abuse | No | Strategies must act like real-market trades. Abusing demo quirks or trade execution glitches will get you flagged. |

| Pricing Exploits / Arbitrage / HFT | No | Using latency, arbitrage tools, or unreal fast execution systems to "beat the feed" is not permitted. |

| Unrealistic EA Use | No | EAs can’t place trades by themselves. Only risk management tools are allowed. Full EA logs must be shared if requested. |

| EA for Risk Management Only | Yes | You can use EAs for SL/TP or risk controls but not for auto-trading. |

| Fast-Flip EA Trades (<30s) | No | If more than 5% of your trades on MT5 last under 30 seconds, that’s a red flag. |

| One-Sided Betting / Overrisking | No | Relying on massive all-in trades or risking over 4% per setup is treated as gambling. That’s not trading, and it won’t pass. |

| Reverse Trading (Across Accounts) | No | You can’t hedge across multiple accounts like long BTC on one and short BTC on another at the same time. |

| Large Single-Trade Profit Cap | No | No single trade or group of trades should make over $10,000 in one day. That’s considered abnormal. |

| Funding Cap Limit ($200K) | No | You can’t exceed $200,000 in combined funded capital (excluding profits). |

| Group Trading / Signal Buying | No | Accounts must be managed individually. No team accounts, signal copying, or buying “pass this challenge” services. |

| Shared IP / Multi-ID Usage | No | Using the same device or IP for multiple people or accounts is not allowed. |

| Account Sharing / Selling | No | Trading for someone else or giving your login to others will result in termination. |

| News & Weekend Trading | Yes | Allowed across all stages, including crypto. No restriction on news or weekend positions. |

| Public Complaints About Rules | No | Publicly criticizing My Crypto Funding’s decisions or policies on social media may result in account suspension. |

| Disrespect Toward Staff | No | Rude or abusive behavior = instant and indefinite suspension. |

| Gambling Trades (All-In Style) | No | If 80%+ of your profit came from one high-risk trade with no clear plan, it’s gambling. That fails the evaluation.

|

News Trading at My Crypto Funding

At My Crypto Funding, you are free to trade during major news events no restrictions. Whether it’s NFP, CPI, or rate decisions, news trading is fully allowed in both evaluation and funded phases.

So if your strategy thrives in high-volatility moments, you’re good to go. Just manage your risk and trade smart.

Our Review of My Crypto Funding’s Rules

My Crypto Funding is not trying to catch you out they just want clean, fair, real trading. If you are using your own strategies, managing risk, and respecting the rules, you will have no problems. But if you are trying to take shortcuts especially with bots or high-risk flips they will catch it, and you will lose everything.

Payouts, Payments & What You Can Trade at My Crypto Funding

Fees & Payment Details

To join My Crypto Funding’s evaluation, you’ll need to pay a one-time registration fee starting at $64 for a $5K account and scaling up to $1040 for $200K.

Once you pay, your account is created right away, and the fee is considered used no refunds if you breach or don’t complete the evaluation.

Accepted payment methods:

- Credit/Debit Card

- PayPal

- Crypto (like BTC, ETH, USDT)

All fees are in USD, and if you’re paying in another currency, your processor will convert it at their rate. And yep, taxes are on you so follow your local laws.

Reminder: Funds used during the evaluation are demo funds. Profits are not real or withdrawable until you pass and go live.

Payouts

Once you’re funded, you will trade with real money and keep up to 100% of your profits. Just follow the rules, avoid breaches, and your payout is all yours.

What Can You Trade with My Crypto Funding?

While My Crypto Funding focuses on crypto, that’s not all you can trade. You also get access to:

- Forex pairs

- Commodities

- Indices

- Other CFD instruments

All with tight spreads, solid execution, and no weird platform restrictions.

Our Review on My Crypto Funding payments, payouts requirement,s and trading instruments

If you are looking for a prop firm that offers clean payouts, clear fees, and more than just crypto, My Crypto Funding delivers. It is built for traders who want real opportunities without all the clutter. You fund once, follow the rules, trade what you want, and keep what you earn.

Fair? We think so.

Countries Banned from Purchasing of My Crypto Funding:

Currently My Crypto Funding allows traders from all countries.

Our Final Review on My Crypto Funding

My Crypto Funding will appeal the most to traders looking for immediate access to capital, raw spreads, and funded trading accounts. It takes the lead amongst competitors for 2023 with its crypto-first funding model, prop-to-live funding approach, and rigorous evaluation processes. Apart from its lack of scaling for now and weekend holding restrictions, its speed of execution and funding makes up for a lot. Prop firms for crypto, EAs and scalpers focusing on genuine outcomes not simulations stand to gain the most.