Copy Coupon Code to Get

Up to 25% Off 🎉

Evercrest Funding

Forex, Crypto

AE

2025

CEO: Michael Thomas

Metatrader 5

Wire Transfer/ Bank Transfer

Crypto

Crypto

Wire transfer/ Bank Transfer

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

2/18/2026

Introduction

Evercrest Funding is a prop firm that has emerged as a popular choice for traders who want to trade Forex and Crypto without risking their own capital. By understanding Evercrest Funding challenge accounts, you can choose a prop firm funding model that aligns with your trading style and financial goals.

In this detailed Evercrest Funding review, we break down account types, fees, rules, payout speed, scaling plan, and real user feedback - so you can decide whether this firm fits your trading style.

What Is Evercrest Funding?

Launched in December 2025 and based in the UAE, Evercrest Funding is a multi-asset prop firm. It allows skilled traders to trade with simulated capital up to $300,000 and keep real profits from their performance.

Instead of risking personal capital, you can leverage the firm’s funds. First, traders must complete an evaluation to demonstrate their risk management skills. Once you pass by achieving profit target while following the rules, you can take a Evercrest Funding payout and profit split of 100%.

Key Highlights about Evercrest Funding Prop Firm:

• Operates with its own MT5 license for better execution and RAW spreads.

• Offers a standard 80% profit split, scalable up to 100%.

• Supports both Forex and Cryptocurrency trading.

• Features a flexible environment allowing news trading and weekend holding.

Evercrest Funding Challenge Account Details (2026)

In this Evercrest Funding review, we analyze that this firm offers multiple funding models for different trading styles. Many traders ask: What account types does Evercrest Funding offer in 2026? Below is the detailed explanation of each account type.

Evercrest Funding Instant Funding

Evercrest Funding Instant Funding model skips the evaluation phase completely and you get direct access to a funded account. However, it comes with tighter drawdown rules (3% daily, 6% overall trailing drawdown), which means risk control is critical from day one.

• Profit target: None - focus is on risk management.

• Drawdown rules: 3% daily limit and 6% maximum trailing drawdown.

• Trading conditions: Leverage up to 1:30.

• Allowed strategies: News trading and weekend holding allowed - 20% consistency rule applies.

• Profit split: 80% to 100%.

• Payout frequency: Bi-weekly.

Account Size Entry Fee (One-Time)

$10,000 $139

$25,000 $279

$50,000 $419

$100,000 $729

$150,000 $1,079

$200,000 $1,449

Evercrest Funding 1-Step Standard Challenge

The Evercrest Funding 1-Step Standard Challenge is built for speed and affordability, offering a streamlined single-phase evaluation. It is the ideal choice for disciplined day traders looking for the fastest and most cost-effective path to a funded account, requiring only a single 10% profit target to move into the funded stage.

• Profit target: 10% profit to achieve in one phase.

• Drawdown rules: 4% daily limit and 6% maximum trailing drawdown.

• Trading conditions: Leverage up to 1:100 (1:50 when funded).

• Allowed strategies: News trading allowed - 45% consistency rule applies when funded.

• Profit split: 80% to 100%.

• Payout frequency: Bi-weekly.

Account Size Challenge Fee (One-Time)

$10,000 $97

$25,000 $179

$50,000 $279

$100,000 $479

$200,000 $997

Evercrest Funding 1-Step Plus Challenge

For traders who prioritize capital protection, the Evercrest Funding 1-Step Plus Challenge offers a premium single-phase evaluation with a distinct advantage: a Static Max Drawdown. Unlike the Standard model, your loss limit doesn't trail your peak balance, providing a much more stable and predictable safety net for those who prefer a more conservative approach to risk.

• Profit target: 10% profit to achieve in single phase.

• Drawdown rules: 4% daily limit and 6% static maximum loss.

• Trading conditions: Professional MT5 execution - Leverage up to 1:100 (1:50 when funded).

• Allowed strategies: Most strategies allowed - 35% consistency rule applies when funded.

• Profit split: 80% to 100%.

• Payout frequency: Bi-weekly.

Account Size Challenge Fee (One-Time)

$10,000 $119

$25,000 $239

$50,000 $329

$100,000 $579

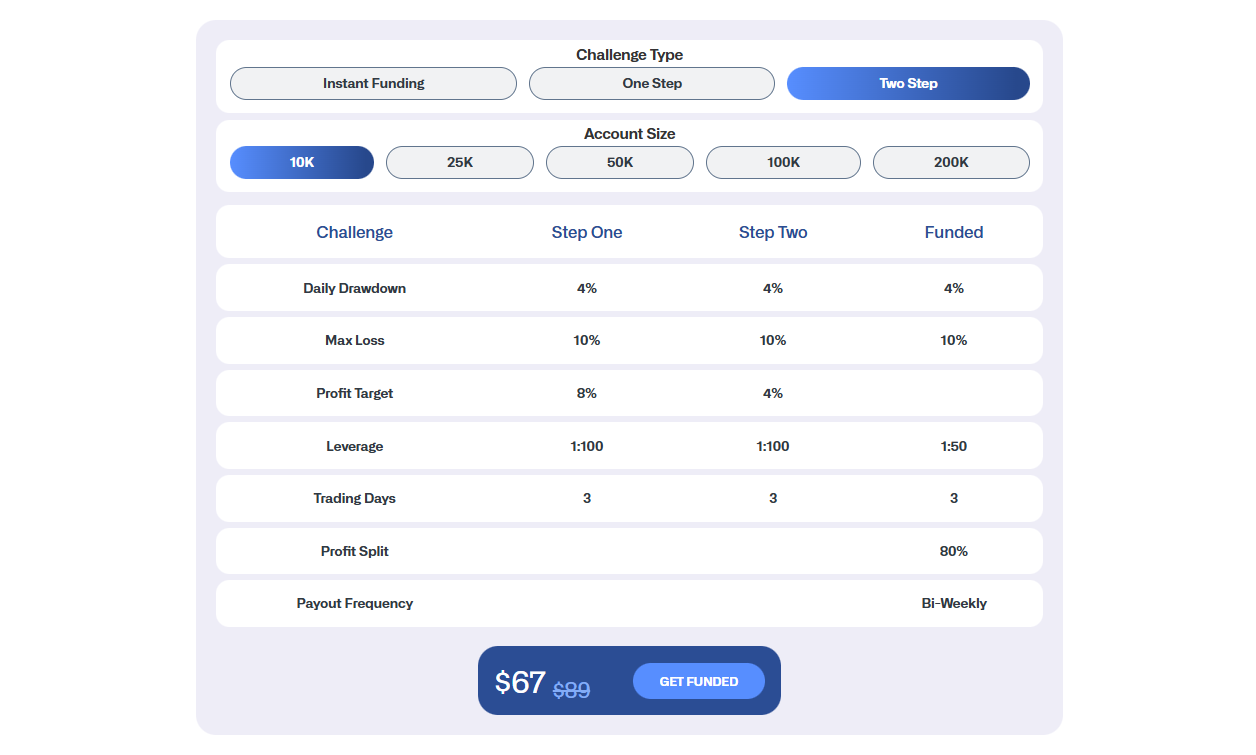

Evercrest Funding 2-Step Challenge

The Evercrest Funding 2-Step Challenge is the firm’s most robust and flexible evaluation model, mirroring institutional trading standards. By splitting the evaluation into two phases, it offers the highest loss allowance (10% Static Drawdown) and removes daily consistency rules, making it the premier choice for swing traders and systematic traders who want maximum space to navigate market volatility.

Profit target: 8% for Phase 1 and 4% for Phase 2.

Drawdown rules: 4% daily limit and 10% static maximum loss.

Trading conditions: Leverage up to 1:100.

Allowed strategies: Institutional standard trading.

Profit split: 80% to 100%.

Payout frequency: Bi-weekly.

Account Size Challenge Fee (One-Time)

$10,000 $89

$25,000 $219

$50,000 $319

$100,000 $559

$200,000 $1,099

Evercrest Funding Challenge Types Comparison

Feature Instant Funding 1-Step Standard 1-Step Plus 2-Step Challenge

Profit Target None 10% 10% 8% / 4%

Max Loss 6% (Trailing) 6% (Trailing) 6% (Static) 10% (Static)

Leverage Up to 1:30 1:100 (1:50 Funded) 1:100 (1:50 Funded) 1:100 (1:50 Funded)

Profit Split 80% to 100% 80% to 100% 80% to 100% 80% to 100%

Payout cycle Bi-weekly Bi-weekly Bi-weekly Bi-weekly

Consistency Rule 20% 45% 35% None

Best For Pro Traders Fast Results Low Risk Disciplined Traders

Which Evercrest Funding Account to Choose?

Selecting the right account depends on your risk tolerance and how often you trade. Whether you prefer the security of a static drawdown, the speed of a single-phase evaluation or the immediate access of instant funding, there is a specific model designed to match your professional goals.

• Evercrest Funding 1-Step Standard: Best for high-accuracy scalpers who want the lowest entry price.

• Evercrest Funding 2-Step Challenge: Ideal for traders who want the most "breathing room" with a 10% static drawdown.

• Evercrest Funding 1-Step Plus: Perfect for systematic traders who dislike trailing drawdowns but want a fast 1-step path.

• Evercrest Funding Instant Funding: Best for experienced pros who want to earn Evercrest Funding fast payouts immediately.

Based on our prop firm review specifically targeting the firm’s challenge and instant account rules, Evercrest Funding stands out for traders who specifically want to trade Crypto on MT5 with high static drawdown options.

Evercrest Funding Rules You Must Know

This Evercrest Funding review states that, to protect your funded status, you must stay within the firm's strict but transparent guidelines. Understanding these Evercrest Funding rules and trading conditions, specifically the drawdown types and consistency caps, is the difference between a successful payout and an accidental account breach.

Evercrest Funding Risk Limits:

• Daily Drawdown: 3% to 4% depending on the account.

• Max Drawdown: 6% (Trailing for Instant/Standard) or 10% (Static for 2-Step).

• Minimum Trading Days: 3 to 5 days depending on the model.

Trading Consistency Rules

Trading Consistency Rules ensure that profits are generated through disciplined, steady performance rather than a single over-sized winning trade, helping traders demonstrate sustainable risk management skills.

• Evercrest Funding Instant: No single day's profit can exceed 20% of total profit.

• Evercrest Funding 1-Step Standard: 45% daily cap on funded accounts.

• Evercrest Funding 1-Step Plus: 35% daily cap on funded accounts.

Inactivity Rules

At Evercrest Funding there is an inactivity rule applied where your account will be terminated if no trade is placed for 30 consecutive days. Traders are advised to always keep their account active.

Prohibited Trading Strategies at Evercrest Funding

There are some trading strategies and account activities that are prohibited by Evercrest Funding. Using the mention below trading strategies will lead to an immediate account ban:

• High-Frequency Trading (HFT): Ultra-fast execution bots.

• Arbitrage: Latency or price-feed exploitation.

• Tick Scalping: Opening and closing trades in seconds.

Evercrest Funding Platform Access & Trading Conditions (2026 Guide)

Based on our analysis, this Evercrest Funding review shows that this prop firm sets itself apart by using its own MT5 license, providing traders with a professional, institutional-grade environment. This setup offers RAW spreads and high-speed execution, ensuring your Evercrest Funding review of the trading experience is both smooth and cost-effective.

• Direct Liquidity: RAW spreads starting from 0.0 pips.

• Low Commissions: Only $5 per lot, which is lower than many competitors.

• Asset Variety: Full access to major Forex pairs and top Cryptocurrencies.

Evercrest Funding Profit Split and Scaling Plan Explained

The reward structure at Evercrest is designed to grow alongside your success, offering a standard 80% split that can scale up to 100% profit share. Their scaling plan allows disciplined traders to double their capital milestones, making it a top contender in any Evercrest Funding vs Moneta Funded comparison.

Evercrest Funding Profit Split

Traders start with a high 80% profit split. Through consistent performance, this can be increased all the way to 100%, letting you keep every dollar you earn.

Evercrest Funding Scaling Plan

The scaling plan is designed for long-term growth:

• Review Period: Every 3 months (quarterly).

• Requirement: Reach a 10% net profit within the period.

• Reward: Increase your account size by 25% of the original balance.

• Max Scaling: Up to $560,000 in total capital.

Note: Scaling is subject to rule compliance and consistency requirements.

Evercrest Funding Payout Rules and Withdrawal Process

Getting paid is the ultimate goal and Evercrest has streamlined its bi-weekly payout cycle for maximum efficiency. In this section, we break down the Evercrest Funding fast payouts process and the simple steps you need to take to move your profits from the MT5 platform to your wallet.

Evercrest Funding Payout Rules

To receive your share of the profits:

• Eligibility: Complete the minimum trading days and reach the 14-day bi-weekly mark.

• No Open Trades: All positions must be closed before requesting.

• Consistency Check: The firm will verify you didn't break the daily profit cap rules.

Evercrest Funding Withdrawal Process

Evercrest Funding fast payouts are a major highlight:

• Methods: Crypto (USDT) and Bank Transfer. (Rise coming soon in 2026).

• Speed: Most traders report receiving payouts within 24 to 72 hours, though processing time may vary depending on payment method.

• Minimum Payout: $100.

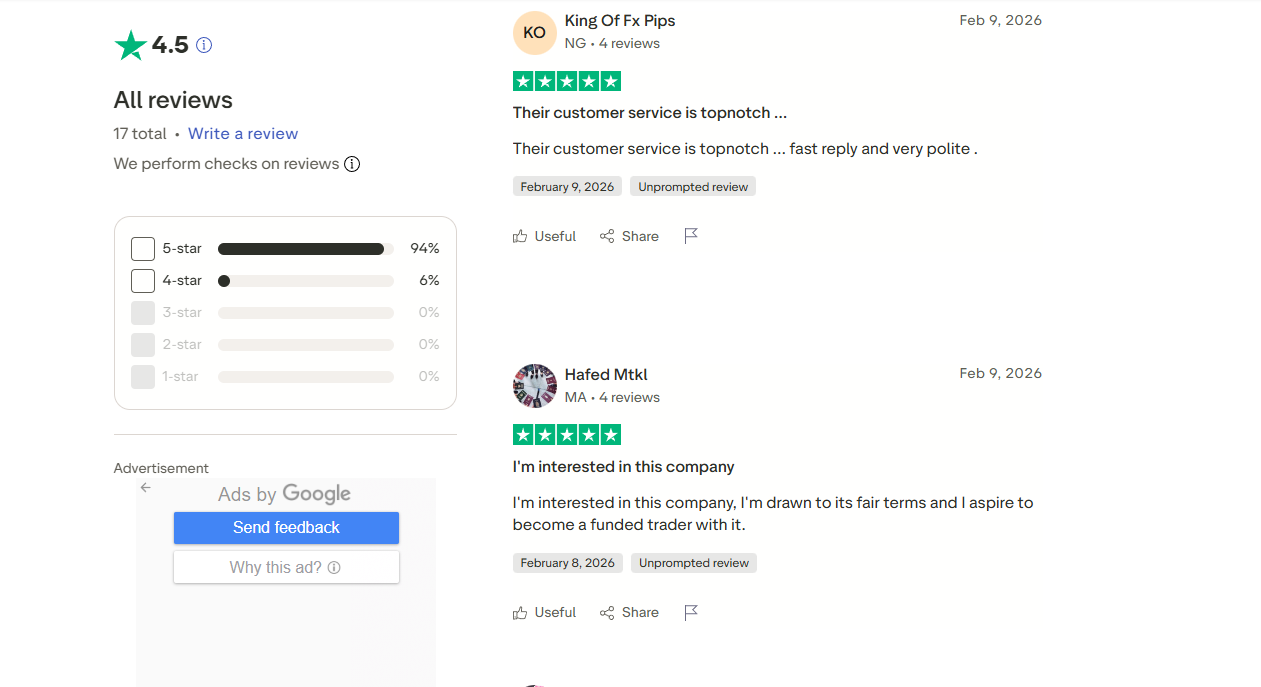

Real User Feedback & Trust Factor

While most Trustpilot reviews praise execution quality and fast crypto withdrawals, some traders mention strict consistency checks and trailing drawdown misunderstandings as common reasons for account breaches.

What We Are Seeing Across the Community About Evercrest Funding?

Many traders reviewed and reported that the Evercrest Funding profit split, payout speed and challenge explained in their dashboard is transparent and trader-friendly. Most trader reviews are positive mentioning the firm’s helpful support team and simplicity of trading Crypto on MT5 trading platform.

Is Evercrest Funding a Legit or a Scam?

Based on our prop firm analysis and understanding of trader reviews and feedback, the Evercrest Funding is a legit prop firm in 2026 and there is no indication that this firm operates as a scam. However, as with all prop firms, traders must understand the prop firm rules, risk limits and trader eligibility before purchasing a prop trading account.

Tips to Pass Evercrest Funding Challenges

- Understand Trailing Drawdown: If you pick the Standard account, remember the limit moves up with your peak profit.

- Spread Your Profits: Don't try to pass in one trade; keep the consistency rule in mind.

- Use the Static Accounts: If you are a swing trader, the 1-Step Plus or 2-Step static models are much safer.

- Watch the News: Major economic releases can trigger sharp volatility and unpredictable price swings, so trade cautiously and apply strict risk management during news periods.

Final Verdict - Is Evercrest Funding Worth It in 2026?

Based on our research and analysis, this Evercrest Funding review explains that this prop firm is legit and a good choice for disciplined traders in 2026. Its own MT5 license ensures superior execution, while the 80% to 100% profit split is industry-leading. While the consistency rules and trailing drawdowns on standard accounts require careful management, the static drawdown options provide a safer alternative for swing traders. However, the trailing drawdown on Standard accounts can be restrictive for aggressive traders and consistency rules may limit high-return strategies. If you value fast payouts, forex and crypto friendly trading infrastructure then the Evercrest Funding is absolutely worth the investment for long-term capital growth.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.