Copy Coupon Code to Get

2% Off 🎉

Breakout Prop

Crypto

US

2023

CEO: Alex Miningham

Get 2% OFF

Coupon Code:

DXTrade

Crypto

Crypto

Breakout Prop Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

2/18/2026

Introduction

You know that feeling when a prop firm looks… almost too simple and checks all the must haves? No minimum trading days. Static drawdown. On-demand payouts. That is exactly what caught our attention with Breakout Prop. So we did what we always do at The Trusted Prop - we dug deep. The prop trading space is crowded and evolving in 2026. New prop firms pop up every quarter with new funding structure, rules and complex payout processes. Because of these dynamics, traders often get confused and frustrated.

So where does Breakout Prop stand? From what we have analysed considering the fee structure, drawdown logic, payout terms, challenge flexibility - Breakout Prop positions itself as a simplified, trader friendly crypto prop firm with both 1-step and 2-step evaluation models. But simplicity doesn’t always mean easy.

Through this article, we aim to provide you with clear understanding of Breakout Prop challenge model, trading rules, account restrictions, entry fees, payouts and real trader reviews. But let us first know what the Breakout Prop is all about.

This is not a surface level overview of the firm but rather this is a real, experience driven, research-backed Breakout Prop review for 2026.

What Is Breakout Prop?

Breakout Prop is a crypto prop firm that has been operating sine 2023, offering funded accounts to traders worldwide through structured evaluation challenges. Traders can choose between:

- 1-Step Evaluation Models

- 2-Step Evaluation Models

Once you pass, you receive a funded account and trade to qualify for profit splits up to 90%. These Breakout Prop evaluation challenges come with multiple account sizes from $5,000 to $200,000 and account fees varying based on different account size and add-ons selected.

Key Highlights About Breakout Prop:

- Static drawdown in 1-step models

- Trailing drawdown in 2-step model

- No minimum trading days

- Unlimited maximum trading days

- 100+ Crypto pairs

- 5x leverage (Majors)

- News trading allowed

- Overnight and weekend holding allowed

- On-demand payouts

- 80% profit split (upgradeable to 90%)

Sounds flexible on the surface, doesn’t it?

But here is the thing - in prop trading, what may look generous can be very different once real trading and strict risk parameters come into play. The real story is always hidden in the numbers: the firm’s drawdown rules, payout structure, profit targets and the strictness of account terms and conditions.

That is why, in this Breakout Prop review, we are not stopping at just the firm’s account features. We are breaking down the actual evaluation model, risk framework and funded account terms because serious traders don’t trade based on promises… they trade based on the prop firm rules and structure.

Breakout Prop Challenge and Instant Accounts Explained (2026)

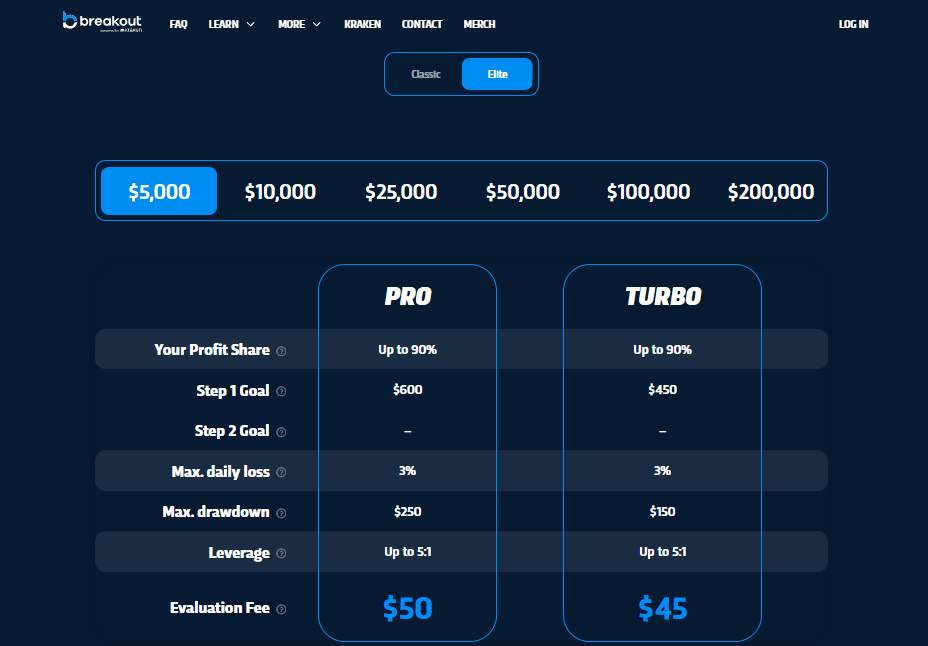

Choosing the right Breakout Prop challenge by only considering the account with cheapest fees and high profit split is not the right way to start your funded trading journey in 2026. Traders must first understand the risk structure, drawdown type, rules and restrictions of each prop firm evaluation and how it aligns with your trading style - before purchasing any account. As of Feb 2026, Breakout Prop offers four main evaluation types designed for different trader profiles. These include:

- 1-Step Classic

- 1-Step Elite Pro

- 1-Step Elite Turbo

- 2-Step Classic

Each Breakout Prop challenge has distinct profit targets, drawdown rules and capital allocation logic and those differences matter more than most traders would initially realize. Below is a break down of each account type one by one so you can choose the right Breakout Prop funded account with confidence.

Breakout Prop 1-Step Classic

The Breakout Prop 1-Step Classic challenge is designed for disciplined traders who want to pass the evaluation instantly and avoid multi-evaluation complexity. Based on our review of the official rules and funding terms, the 1-Step Classic model is built around a single phase evaluation with a fixed risk structure. The static drawdown model being a key feature of this account - is calculated from your starting balance and does not increase as your account grows. So as you make profits, your risk limit stays fixed which gives you more breathing room to trade confidently.

Breakout Prop 1-Step Rules and Key Features

• Profit Target: 10%

• Daily Drawdown: 3%

• Max Drawdown: 6% (Static)

• Leverage: 5x (Majors)

• Min Trading Days: 0

• Profit Split: 80% (90% available upon choosing an add-on)

• Payout Frequency: On Demand

• News / Overnight Trading: Allowed

• Stop Loss Rule: Not required

Account Size & Entry Fee (One-Time)

Account Size Entry Fee

$5,000 $60

$10,000 $110

$25,000 $275

$50,000 $495

$100,000 $999

If you are looking for a prop firm challenge in 2026 that combines simplicity, transparent rules and on demand payouts then this funding model by Breakout Prop is one of the top choices that traders consider.

Breakout Prop 2-Step Classic

For the traders who are looking for a structured trading challenge over fast funding then the Breakout Prop 2-Step Classic model follows a more traditional prop firm evaluation style. Instead of rushing to a funded account in one phase, you prove consistency and discipline across two stages – which many professional traders prefer as it aids in avoiding impulsive trading.

From our analysis at The Trusted Prop, this funding model balances affordability with flexibility. The 8% trailing drawdown offers a slightly wider risk limit as compared to the 1-step accounts – which makes it more suitable for swing traders and for those traders who are trading volatile forex or indices setups.

Breakout Prop 2-Step Rules and Key Features

• Profit Target: 5% (Phase 1) / 10% (Phase 2)

• Daily Drawdown: 5%

• Max Drawdown: 8% (Trailing)

• Leverage: 5x

• Min Trading Days: 0

• Profit Split: 80% (90% upgrade)

• Payout Frequency: On-Demand

Account Size & Entry Fee (One-Time)

Account Size Entry Fee

$5,000 $50

$10,000 $100

$25,000 $250

$50,000 $450

$100,000 $749

If you are looking for a more traditional prop firm evaluation with room to manage market volatility in 2026 then the Breakout Prop 2-Step Classic model can definitely be considered an option.

Breakout Prop 1-Step Elite Pro

The Breakout Prop Elite Pro a unique 1-Step challenge designed for experienced traders who are comfortable in achieving a higher 12% profit target while trading under a tighter 5% static max drawdown. After reviewing the official evaluation structure and funding terms, this funding model clearly suits experienced disciplined traders who can manage risk precisely and execute with consistency.

Breakout Prop Elite Pro Rules and Key Features

• Profit Target: 12%

• Daily Drawdown: 3%

• Max Drawdown: 5% (Static)

• Leverage: 5x

• Min Trading Days: 0

• Profit Split: 80% (90% upgrade)

• Payout Frequency: On-Demand

Account Size & Entry Fee (One-Time)

Account Size Entry Fee

$5,000 $50

$10,000 $89

$25,000 $199

$50,000 $365

$100,000 $699

$200,000 $1,399

If you are looking for a more performance driven competitive prop firm challenge in 2026 that offers a fast track funding and on demand payouts then the Breakout Prop Elite Pro stands out as a serious contender.

Breakout Prop 1-Step Elite Turbo

If you are the kind of trader who prefers tight control over risk rather than wide breathing room, then the Breakout Prop Elite Turbo (1-Step) model might immediately stand out. Based on our detailed Breakout Prop review and rule analysis - this version is built for disciplined pro traders who can trade within a very strict loss limit while achieving a comparatively lower profit target of 9%. Traders who are professional and an aim for precision rather than reckless aggression will have higher chance of passing this prop firm challenge.

The static 3% max drawdown is the defining factor here – which means that your total loss limit will not trail upwards but it also gives you very little margin for error. In other words, this is Breakout Prop funding model is for controlled execution and not emotional trading.

Breakout Prop Elite Turbo Rules and Key Features

• Profit Target: 9%

• Daily Drawdown: 3%

• Max Drawdown: 3% (Static)

• Leverage: 5x

• Min Trading Days: 0

• Profit Split: 80% (90% upgrade)

• Payout Frequency: On-Demand

Account Size & Entry Fee (One-Time)

Account Size Entry Fee

$5,000 $45

$10,000 $79

$25,000 $179

$50,000 $335

$100,000 $599

$200,000 $1,199

If your trading style involves high lot sizes, grid systems, martingale concepts or wide stop-loss strategies, then this model will likely feel restrictive. Traders making even one or two impulsive trades can get their account wipe out quickly.

So while the lower 9% profit target might sound easier to achieve, the risk control requirements demands professional-level discipline from traders. And for the traders who lack consistency or emotional control - this could become one of the more difficult Breakout Prop challenges to pass.

Which Breakout Prop Account to Choose?

Based on our detailed Breakout Prop review 2026 and evaluation model comparison, each account type fits a different trader profile and trading psychology.

• 1-Step Classic is best suited for balanced traders who want reasonable drawdown room.

• Elite Pro is made for high confidence, aggressive traders who often target higher returns.

• Elite Turbo would be suited for tight risk managers who are comfortable with tight drawdown limits.

• 2-Step Classic is suitable for patient traders who prefer a structured, multi-phase evaluation.

If your goal is speed and quick access to a funded account then you can go for the Breakout Prop 1-step challenge.

If you prefer a more traditional, structured evaluation with wider total risk allowance then the Breakout Prop 2-step challenge may be the smarter choice.

Breakout Prop Rules and Restrictions You Must Know

Before starting any Breakout Prop challenge, understanding the risk rules is as important as understanding the passing rules and limits. As highlighted in our Breakout Prop review, this crypto prop firm has implemented strict drawdown policies and industry standard trading restrictions to protect the firm’s capital and maintain fair trading conditions for traders.

Risk Limits of Breakout Prop Challenge and Funded Accounts

• Daily drawdown enforced strictly

• Static vs trailing differs by model

• Breach = account termination

Consistency Rules

Currently Breakout Prop does not impose any consistency rule on it’s challenge and funded accounts which is pretty rare in 2026.

Inactivity Rules

All Breakout Prop accounts must remain active and traders must avoid long inactivity.

Prohibited Strategies during Breakout Prop Challenge and Funded Stage

• Exploiting price errors, latency, or platform glitches

• Using any strategy banned by liquidity providers

• Trading on material non-public information or front-running

• Using third-party, off-the-shelf or signal based strategies

• Copying trade ideas from communities, analysts or social media

• Passing the evaluation with one strategy and switching to another in the funded account

• Taking trades that create excessive margin risk or abnormal unrealized swings

• Engaging in activity that may create regulatory issues or harm relationships with exchanges or market makers

In simple terms, Breakout Prop expects traders to perform original, consistent and responsible trading. Any activity that appears manipulative, exploitative or system abusive - can result in account termination at the firm’s discretion.

To conclude in short, Breakout Prop follows a structured, transparent risk management standards that are similar to the leading prop firms in 2026. If you respect drawdown limits and avoid prohibited strategies then the trading path to a funded account remains clear and achievable for you.

Breakout Prop Platform Access & Trading Conditions

Breakout Prop provides access to 100+ Crypto pairs through Dxtrade, a professional grade trading platform where traders get 5x leverage on majors which offers traders with balanced risk exposure without excessive overleveraging.

Key Trading Conditions:

• News trading allowed

• Weekend holding allowed

• No mandatory stop-loss rule

• Access to deep order book liquidity

Liquidity is sourced from tier-1 centralized exchanges which helps traders to ensure competitive spreads and stable execution. Overall, the trading conditions position Breakout Prop among the more flexible and trader friendly crypto prop firms in 2026.

Breakout Prop Profit Split and Scaling Plan Explained

In this section of our in-depth Breakout Prop review article, we break down how the profit split and scaling plan actually work in 2026. Understanding the profit split structure across different evaluations is important before choosing any prop firm or funded account.

Profit Split

• 80% standard profit split is provided in all Breakout Prop Challenge models

• Traders an also opt to increase the profit split to 90% via the add-on option

Scaling Plan

As you consistently withdraw profits, scaling opportunities are available by putting a scaling request but it is based on performance metrics. To qualify, traders must demonstrate consistent profitability for at least three consecutive months on their funded account. After that period, scaling is not automatic or fixed. It is reviewed individually based on overall trading performance, discipline and activity. And traders must understand that there is no guaranteed “scale from X to Y” formula applied in this firm as account scaling approvals are handled case by case.

If you want faster capital growth in prop trading, the only shortcut is passing a larger Breakout Prop evaluation and earning that bigger funded account.

Overall, Breakout Prop offers a competitive 80% standard split with a 90% upgrade path, which aligns with current best prop firm 2026 standards. For the traders who are aiming for long term prop trading growth - the scaling opportunity is an additional advantage for them.

Breakout Prop Payout Rules and Withdrawal Process

Understanding the payout rules of Breakout Prop is one of important considering factor before starting any trading challenge. In this 2026 breakdown, we explain exactly how the Breakout Prop n-demand payouts work, what risk rules apply and how the withdrawal process is handled for funded account holders.

Payout Rules

The Breakout Prop payout system follow a structured two step approval approach and traders can request profit withdrawal on both weekdays and weekends.

Here is how the payout actually works:

• On-Demand Requests: You can request a payout anytime once you are eligible.

• Minimum Amount: $50 (after Breakout’s performance split is deducted).

• No Open Trades: All positions must be closed before requesting a payout.

• No Rule Breach: Your funded account must be in good standing.

• Immediate Balance Adjustment: Once the profit withdrawal is requested, the payout amount is instantly deducted from your trading balance but you can continue trading.

• Approval Required: The Breakout Prop payout must be approved by Payward Oceanic, Ltd (POL).

Trader must note that the:

- Breakout Prop payouts are made in USDC (ERC-20 network) only. They are not insured and are not protected by institutions like the FDIC or SIPC.

- Additionally, payments may be impacted by blockchain related risks such as network congestion, gas fee issues, smart contract errors, sanctions restrictions or transaction delays.

- No adjustments are made for USDC price fluctuations during processing.

Withdrawal Process

The withdrawal process at Breakout Prop is handled directly through your Breakout dashboard and it follows a clear two stage system:

1. Submit Payout Request

◦ Log into your dashboard.

◦ Enter the payout amount (minimum $50).

◦ Ensure no open trades and no rule violations.

2. Provide Wallet Details After Approval

◦ Once POL approves the request – you will be prompted to submit your USDC ERC-20 wallet address.

◦ Funds are sent in USDC via the ERC-20 network.

Overall, Breakout Prop’s on demand payout model stands out in 2026 - especially with no minimum trading day restriction. As long as you respect the risk rules, the firm’ withdrawal process is straightforward - making it a competitive option in today’s prop firm landscape.

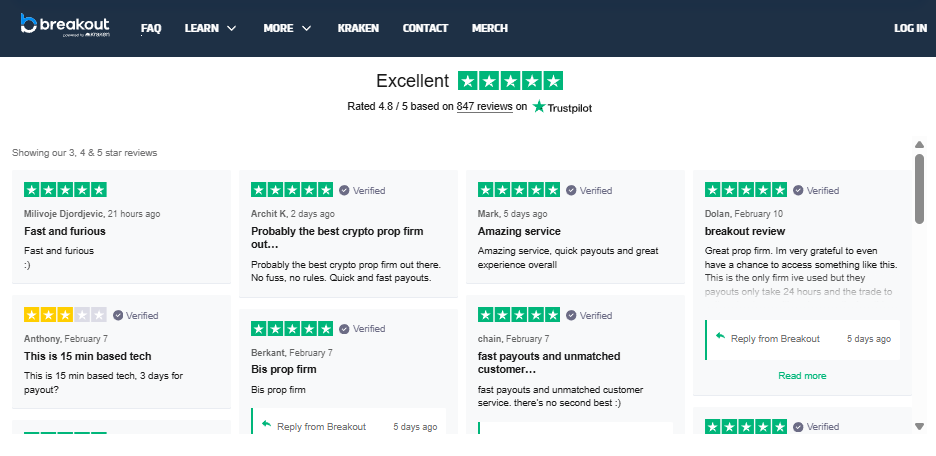

Real User Feedback & Trust Factor

Across trader communities and review discussions, Breakout Prop is often mentioned for its clean rules and static drawdown model. Many traders appreciate the simplicity that the firm offers but some traders remain cautious about the tighter 3% max drawdown limit in Turbo account.

The overall trader sentiment across the community is that – they are cautiously optimistic with traders advising disciplined risk management.

Is Breakout Prop a Legit and Trusted Firm?

Based on the firm’ transparent rules, structured payout model and clearly defined evaluation system - Breakout Prop appears to operate as a legit crypto prop firm in 2026. But as always, traders are advised to trade with small funded account first, see if they can follow the drawdown rules and test the firm’s payout system. And then scale only after consistent performance.

How to Pass Breakout Prop Challenges (Practical Tips)

Passing a Breakout Prop challenge requires structured risk control, not luck. Based on common prop trading best practices - traders who manage risk at 0.5 to 1% per trade and avoid emotional overtrading can statistically improve their odds of securing a prop firm funded account in 2026.

• Risk 0.5–1% per trade

• Avoid overtrading

• Focus on high-probability setups rather than quick profits

• Don’t rush in the 1-step model

• Treat evaluation like live capital and manage carefully

At the end of the day, clearing a trading challenge is more about discipline and psychology than flashy strategies - treat these prop firm evaluation like real capital, stay patient and consistency will do the heavy lifting.

Final Verdict – Is Breakout Prop Worth It in 2026?

Based on our structured analysis of the firm’s rules, drawdowns, payout terms and overall prop firm transparency - Breakout Prop stands out for its static drawdown model, zero minimum trading days and on demand payouts. While it may not fit every trader’s style, it remains one of the more straightforward and trader aligned prop trading options that we have reviewed in 2026.

If you value:

• Static drawdown

• No minimum trading days

• On-demand payouts

• Clean rule structure

Then yes - Breakout Prop is worth considering. But is it the absolute best prop firm 2026? That depends on your trading style and goals. But it is definitely one of the more simplified, trader aligned funding models we have reviewed this year.

Ready to Try Breakout Prop?

Before starting your Breakout Prop challenge, compare account types carefully, align the risk model with your trading strategy and begin with a size that matches your experience level.

If you want more side-by-side comparisons of funded account models, explore our full prop firm review section on The Trusted Prop and approach every prop firm challenge or instant account with discipline, patience and a clear risk plan.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.