AquaFunded Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full AquaFunded review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.6

4.6

AquaFunded

Forex, Crypto, Commodities, Indices, Metals

AE

2023

CEO: Jason Blax

Get 35% OFF + 90% Profit Split + 150% Refund + Free Account on Payout

Coupon Code:

MatchTrader

Trade Locker

Crypto

Rise

Crypto

Credit/Debit Card

Visa

Mastercard

Apple Pay

ThinkMarkets

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

In this AquaFunded review 2026 by The Trusted Prop, we look at a Forex prop firm that mainly focuses on providing simulated trading evaluations to disciplined traders who are looking for a funded account. AquaFunded is most suitable for intraday and swing traders who are operating consistently and like clearly defined trading rules and flexible execution conditions. However, traders need to be very attention about the firm's consistency rule, as passing the evaluation is more about repeatable performance and controlled drawdowns than occasional high profitable trades.

AquaFunded is a Forex and CFD prop firm that is a Dubai based firm launched in 2023. It provides access to structured evaluation models and instant funding options for traders. The firm offers account sizes of up to $200,000, supports multiple trading platforms including cTrader and DXTrade and gives profit splits of up to 90%. AquaFunded targets traders who are able to operate within the specified drawdown limits while maintaining consistent performance over time.This AquaFunded review covers account types, trading rules, drawdown structure, payouts and scaling plan of the firm, so that traders can make an informed decision whether this prop firm matches their trading style and risk approach.

AquaFunded Prop Firm Overview

The below information is gathered from the official website of the firm, public disclosures and available trader feedback as of 2026.

| Category | Details |

| Company Name | The prop firm name is AquaFunded. |

| Legal Name | The prop firm legal name is AquaFunded FZCO. |

| Registration Number | The registration number of AquaFunded is DSO-FZCO-32537. |

| CEO | The CEO of AquaFunded is Jason Blax. |

| Headquarters | The headquarters of AquaFunded is located at Dubai, UAE. |

| Broker | AquaFunded does not clearly disclose a single named broker or liquidity provider. Instead of that, it uses multiple trading platforms connected to external price feeds. |

| Prop Firm Type | AquaFunded is a Forex and CFD prop firm. |

| Operating Since | AquaFunded has been operating since 2023. |

| Account Sizes | AquaFunded provides account sizes ranging from $5,000 to $200,000. |

| Profit Split | AquaFunded offers up to a 90% profit split. |

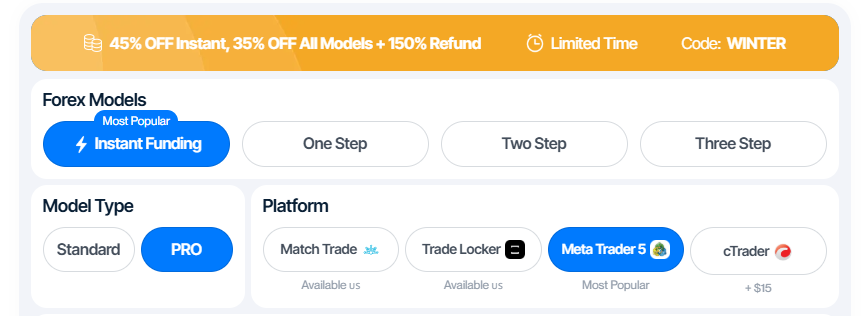

| Challenge Types | AquaFunded offers 1 Step Standard/Pro, 2 Step Standard/Pro, 3 Step, Instant Funding Standard/Pro. |

| Payout Cycle | The AquaFunded payouts are available bi-weekly (14 days) after the first trade on a funded account. |

| Payout Method | The profit withdrawal methods supported by AquaFunded are Rise, Crypto (USDT) and Bank Wire. |

| Trading Platforms | AquaFunded supports trading on DXTrade, Match-Trader and cTrader platforms. |

| Financial Markets | AquaFunded supports trading in Forex, Commodities, Indices and Crypto financial markets. |

| Max Allocation | AquaFunded offers a maximum allocation of $400,000 (primary capital). |

| Max Scaling | AquaFunded provides scaling opportunities up to $1,000,000. |

Pros and Cons of Trading with AquaFunded

Choosing a correct and suitable prop firm involves evaluating their strengths in operation and the extent to which their trading rules restrict their traders. AquaFunded is a prop firm that offers high scaling potential and is equipped with modern trading infrastructure. The traders' actions can be limited by strict drawdown and consistency based rules that aim to preserve the account balance over the long-term.

| Pros | Cons |

| High profit split of up to 90% | Strict AquaFunded consistency rule on 1-Step accounts |

| No minimum trading days on 2-step challenges | Trailing drawdown applied on specific account models |

| Relatively fast payout processing via Rise | Weekend holding restrictions on certain evaluation types |

| Competitive leverage up to 1:100 on select accounts | Inactivity rule: account breached if inactive for 30 days |

| User-friendly AquaFunded dashboard with performance analytics | News trading limitations during high-impact economic events |

Traders need to know how to handle these drawdown limits and the prop firm rules is what really sets them up for success with AquaFunded in the long run. The profit split is quite attractive by highest industry standards - but most of the traders find that using the consistency score and drawdown rules requires them to practice disciplined position sizing and to deliver steady performance rather than going for short-term aggressive gains.

AquaFunded Account Types, Fees & Profit Split Explained (2026)

Knowing the structure of AquaFunded's accounts is essential for traders because its account fees, types of drawdown and profit targets have a direct impact on long-term profitability after getting funded account. AquaFunded has a variety of challenge and account types such as 1-Step, 2-Step, 3-Step and Instant Funding models. Also, AquaFunded changes drawdown rules and trading conditions by offering a standard and a pro version of the challenge and Instant Funding accounts.

AquaFunded Challenges and Instant Accounts Comparison

Here we breakdown AquaFunded’s evaluation and instant funding models to assist traders understand the capital requirements, risk limits and performance expectations.

| Account Type | 1 Step Standard/Pro | 2 Step Standard/Pro | 3 Step Evaluation | Instant Funding Standard/Pro |

| Account Size | $5,000 - $200,000 | $5,000 - $200,000 | $10,000 - $200,000 | $2,500 - $400,000 |

| Account Fees | $67 - $1,017 (Std) $59 - $899 (Pro) | $57 - $997 (Std) $39 - $925 (Pro) | $77 - $677 | $64 - $1,810 (Std) $60 - $2,449 (Pro) |

| Profit Target | 9% (Std) 6% to 10% (Pro) | P1: 8% - P2: 5% (Std) P1: 10% - P2: 5% (Pro) | P1: 8% P2: 4% P3: 4% | No Target (Direct Funded Stage) |

| Daily Drawdown | 3% | 4% - 5% | 4% | None (Daily Limit) |

| Max Drawdown | 6% (Trailing) | 8% - 10% (Static) | 8% (Static) | 3% - 6% (Static) |

| Drawdown Type | Trailing | Static / Balance-based | Static | Static |

| Min Trading Days | 3 Days | 3 Days (Std) / 5 Days (Pro) | 3 Days | 5 Days |

| Max Trading Days | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | 1:100 Max | 1:100 Max | 1:100 Max | 1:100 Max |

| Consistency Rule | 25% (Only pro) | 25% (Only pro) | No Rule | 15% (Std) / 20% (Pro) Consistency |

| Profit Split | Up to 100% | Up to 100% | Up to 100% | Up to 100% |

| Payout Frequency | Bi-Weekly | Bi-Weekly | Bi-Weekly | On Demand / 48hr |

The comparison above describes the differences in AquaFunded fees, drawdown limits and trading day requirements across the various account types, which enables traders to figure out which structure fits their risk tolerance and trading style best

From time to time, AquaFunded offers discounted access to its evaluation and instant funding accounts, which might be of help to traders in lowering their upfront costs depending on the model they choose. Be sure you check for a valid AquaFunded discount code before committing to a purchase.

AquaFunded Challenges and Instant Accounts Breakdown

The various AquaFunded account models provides different trading styles and risk profiles. We explain in this section, each of the AquaFunded challenge models and account types in detail to aid traders in figuring out which trading approach faster funding, higher drawdown buffers or lower fees matches their style better.

AquaFunded 1-Step Standard/Pro Model

The AquaFunded 1-Step challenge has Standard and Pro accounts which are designed for traders those who prefer a faster route to a funded account by completing a single evaluation phase. The main advantage is quicker capital access - while the key risk lies in managing a tight trailing drawdown combined with consistency score requirements.

| Account Size | Account Fee (Std/ Pro) | Profit Target (10%) | Max Daily Loss (3%) | Max Total Loss (6%) |

| $5,000 | $67 / $59 | $500 | $150 | $300 |

| $10,000 | $113 / $99 | $1,000 | $300 | $600 |

| $25,000 | $227 / $199 | $2,500 | $750 | $1,500 |

| $50,000 | $327 / $289 | $5,000 | $1,500 | $3,000 |

| $100,000 | $527 / $459 | $10,000 | $3,000 | $6,000 |

| $200,000 | $1,017 / $899 | $20,000 | $6,000 | $12,000 |

Why Choose AquaFunded 1-Step Standard/Pro Model?

The AquaFunded 1-Step challenge type’s standard and pro model structure is designed for traders who prioritize speed to funding and are comfortable managing tighter risk limits in exchange for faster evaluation completion.

- This models are best suited for intraday and short term traders who can achieve profit targets quickly while maintaining strict risk management.

- Only a single evaluation phase is required - reducing the overall time needed to reach a funded account.

It is best for traders those who actively monitor equity, as the trailing drawdown increases alongside account performance which traders get a real time view on the AquaFunded dashboard.

AquaFunded 2-Step Standard/Pro Model

Those traders who want a more balanced evaluation can choose for the AquaFunded’s 2-Step Standard and Pro models. These challenges have the classic two step evaluation structure and the traders are given larger static drawdown limits. More freedom during the market fluctuations. But, the catch is that the traders performance has to be consistent in both phases for them to be eligible for a funded account.

| Account Size | Account Fee (Std / Pro) | Phase 1 Target (8%) | Phase 2 Target (5%) | Max Daily Loss (5%) | Max Total Loss (10%) |

| $5,000 | $39 / $29 | $400 | $250 | $250 | $500 |

| $10,000 | $89 / $69 | $800 | $500 | $500 | $1,000 |

| $25,000 | $139 / $125 | $2,000 | $1,250 | $1,250 | $2,500 |

| $50,000 | $299 / $259 | $4,000 | $2,500 | $2,500 | $5,000 |

| $100,000 | $469 / $429 | $8,000 | $5,000 | $5,000 | $10,000 |

| $200,000 | $947 / $897 | $16,000 | $10,000 | $10,000 | $20,000 |

Why Choose AquaFunded 2-Step Standard/Pro Model?

This funding model is best suited for traders who are more comfortable with a traditional method of evaluation but would also want wider drawdown buffers that allow them to have more flexibility with their trade during market fluctuations.

- Perfect for swing traders who take their positions for more than a day and would require a larger static drawdown buffer.

- Gives a well designed two phase evaluation that balances risk control with a generous Max Drawdown of 10%.

Allows traders to use higher leverage, giving them more flexibility in adjusting their position size on major instruments.

AquaFunded 3-Step Challenge Model

The AquaFunded 3 Step Evaluation is ideal for cautious traders who are more concerned with the downside of the entry fee and would be comfortable with smaller profit targets but spread over the 3 evaluation phases. The disadvantage of this funding solution lies in the fact that its longer overall process for a successful completion and the trader has to be patient and at the same time need to have a very good risk management discipline.

| Account Size | Account Fee | Profit Target (Per Phase) (6%) | Max Daily Loss (4%) | Max Total Loss (8%) |

| $10,000 | $77 | $600 | $400 | $800 |

| $25,000 | $157 | $1,500 | $1,000 | $2,000 |

| $50,000 | $237 | $3,000 | $2,000 | $4,000 |

| $100,000 | $377 | $6,000 | $4,000 | $8,000 |

| $200,000 | $677 | $12,000 | $8,000 | $16,000 |

Why Choose AquaFunded 3-Step Challenge Model?

AquaFunded 3-Step challenge structure is aimed at traders who look for lower entry costs and who are also in favor of gradually improving their performance before they can get funded capital.

- Designed towards consistency and low risk style traders who can make smaller profit targets test over multiple phases.

- Come with relatively lower upfront fees as compared to faster track evaluation models.

Encourages disciplined trading behavior by reducing their pressure within each individual evaluation stage.

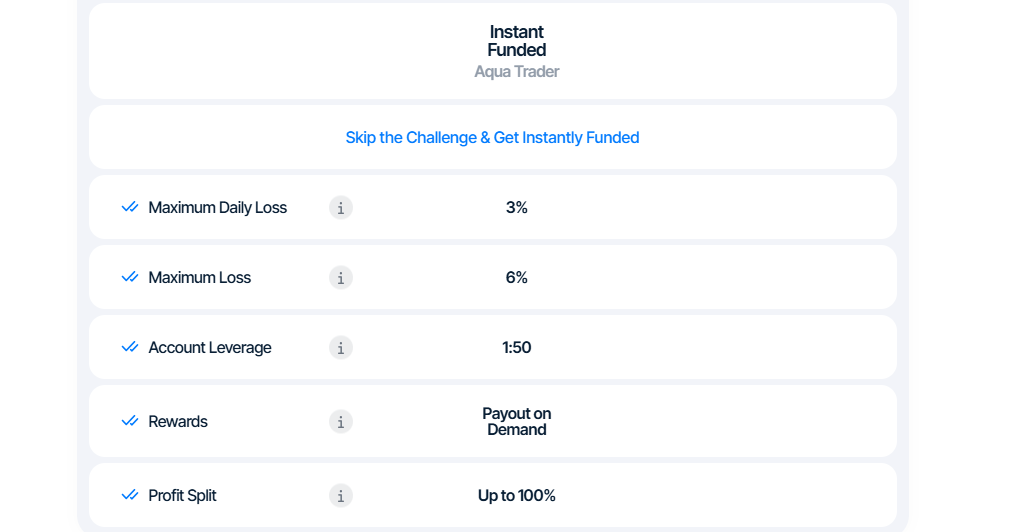

AquaFunded Instant Funding Standard/Pro Model

The AquaFunded Instant Funding account type’s Standard and Pro models allow traders to access a funded account immediately without completing an evaluation phase. The most significant advantage is the ability to trade with the firm's money on the very first day and instant eligibility for payouts, while the main risk is trading under stricter static drawdown limits and lower leverage compared to evaluation based accounts.

| Account Size | Account Fee (Std / Pro) | Profit Target | Max Daily Loss (3%) | Max Total Loss (3% Static) |

| $2,500 | $64 / $60 | $0 | $75 | $75 |

| $5,000 | $117 / $115 | $0 | $150 | $150 |

| $10,000 | $158 / $155 | $0 | $300 | $300 |

| $25,000 | $317 / $310 | $0 | $750 | $750 |

| $50,000 | $475 / $465 | $0 | $1,500 | $1,500 |

| $100,000 | $767 / $750 | $0 | $3,000 | $3,000 |

| $150,000 (Pro Only) | $980 | $0 | $4,500 | $4,500 |

| $200,000 | $1,265 / $1250 | $0 | $6,000 | $6,000 |

| $250,000 | $1,560 / $1,540 | $0 | $7,500 | $7,500 |

| $300,000 | $1,810 / $2,099 | $0 | $9,000 | $9,000 |

| $400,000 (Pro Only) | $2,699 | $0 | $12,000 | $12,000 |

Why Choose AquaFunded Instant Funding Standard/Pro Model

The AquaFunded Instant Funding account type is designed for traders who want to get a funded account right away and who are confident in being able to handle stricter drawdown limits from day one.

- This account models are best suitable for experienced traders with proven consistency who want to avoid evaluation phases entirely.

- It Allows traders to become payout eligible immediately, which are subject to AquaFunded account rules.

This model requires disciplined risk management due to lower leverage and tighter static drawdown limits comparing to the evaluation based models.

Our Verdict On AquaFunded Account Types

During our research at The Trusted Prop, we discovered that AquaFundeds account setups are structured to fit certain trading styles rather than a single universal approach. These accounts may be good for consistent day traders, swing traders and traders with prior prop firm experience who understand static and trailing drawdown mechanics.

These account types, may not be good choices for beginners without structured risk management, scalpers who use too much leverage or traders who are not familiar with the consistency rules and drawdown calculations.

Make sure to grab the AquaFunded discount code before you start trading. This code will help you save on account fees and make sure that you use the minimum trading days requirement for a successful AquaFunded payout.

AquaFunded Drawdown and News Trading Rules

Understanding the risk limits of an AquaFunded challenge and accounts is important if you want to stay funded for a long term with the firm. The firm uses specific drawdown rules and daily drawdown limits for the dual purpose of protecting the capital and giving room to traders to demonstrate their consistency. Grasping these mechanics can make the difference between a successful AquaFunded payout and a breached account.

This section explains AquaFunded’s drawdown rules, daily drawdown limits and news trading rules that traders must follow to avoid account breaches.

AquaFunded Drawdown Details:

Depending on the challenge type, AquaFunded’s 2-Step Evaluation, the drawdown is Balance-based (Static), whereas the 1-Step and Instant Evaluation mostly uses a Trailing Drawdown. While the 3-Step challenge uses a Static Drawdown.

1. AquaFunded 1-Step Challenge & Instant Accounts (Trailing Drawdown)

Accelerated funding basis, these models also call for tighter risk management. The maximum allowed loss "trails" your highest equity point until you hit a predetermined begining.

- Trailing Mechanic: Your max loss limit goes up along with your account equity.

- Intraday Tracking: The drawdown usually mirrors your high water mark either live or at the end of the day.

- Locked-in Risk: Once the trailing drawdown equals the original balance, it ceases to trail (becomes fixed at the starting balance).

Example: Let's say your account is $100,000 with a 6% ($6,000) Trailing Drawdown. Your starting limit is $94,000. After making a $2,000 profit (equity reaches $102,000), your limit now trails up to $96,000. If after that you lose the $2,000 profit, you have only $4,000 to a breach now.

2. AquaFunded 2-Step Evaluation (Static / Balance-Based)

This is the most classic type of model and swing traders are very fond of it. You total allowed drawdown corresponds to your initial balance or the balance at the beginning of the day.

- Static Calculation: Your maximum loss limit is never allowed to "trail" your profit - it stays at a fixed floor.

- Daily Limit: Determined based on the beginning balance of each new trading day.

- Breathing Room: Gives you the opportunity to run your winning trades without the fear of the "floor" moving up and locking in your equity.

Example: You start with a $100,000 account and set a 10% ($10,000) Max Drawdown. Your end line is permanently fixed at $90,000. If you increase the account to $110,000 then your maximum loss limit remains at $90,000, giving you a $20,000 buffer.

3. AquaFunded 3-Step Evaluation (Static)

This model corresponds to the 2-step logic but with smaller daily loss caps and lower profit targets in order to promote long term discipline.

- Fixed Floor: Just like the 2-step, it uses a static drawdown to help traders avoid the excessive fluctuations of trailing stops.

- Lower Stress: Smaller targets (e.g., 4% - 5% per phase) permit a slower more deliberate way of working.

- Balance-Based: All computations are transparent and refreshed daily on your AquaFunded dashboard.

Example: Your 8% total drawdown on a $100,000 3-Step account remains static. The drawdown will still be calculated based on your balance, even if you have passed Phase 1 and Phase 2, not trailing your peak equity.

Traders often fail to closely monitor the AquaFunded dashboard during high volatility and thus break the daily limit unknowingly as they mix up "equity" with "balance" during floating drawdowns in the act.

AquaFunded News Trading Details:

AquaFunded has a generally easy approach to the usage of trading strategies While there are no restrictions for traders to buy or sell during news events in the evaluation phases, certain news trading rules only apply to the funded stages. On funded accounts, there is a news trading restriction which states that traders cannot trade 2 minutes before and 2 minutes after the release of major news events. Profits from trades in these windows will be deducted and traders won’t benefit from these trades.Adhereing to the AquaFunded news rule will keep your account secure and your consistent, rule-following trading performance will make you eligible for the AquaFunded scaling plan.

AquaFunded Consistency Rule Explained:

The AquaFunded consistency rule aims to make sure that a trader's success from a steady trading strategy over time rather than from one single high-risk trade. This rule puts a cap on the portion of the total profit that can be generated through any individual trading day during the evaluation or funded stage.

AquaFunded Accounts with Consistency Rules

In the below mentioned AquaFunded account types, the given percentage indicates the largest portion of total profit that can be derived from a single trading day:

- Instant Funding Standard: 20% consistency rule

- Instant Funding Pro: 15% consistency rule

- 1-Step Pro Challenge: 25% consistency rule

- 2-Step Pro Challenge: 25% consistency rule

AquaFunded Accounts without Consistency Rules

The following funding models do not require a specific consistency rule which allows for more flexibility in different trading styles

- 1 Step Standard Challenge

- 2 Step Standard Challenge

- 3 Step Challenge

Following the AquaFunded consistency rule is essential for a successful payout from the prop firm. If a single day exceeds the allowed percentage you do not lose the account but you cannot withdraw profit until you reach that percentage. So, simply continue trading until the profit distribution falls within the required limits. You have the possibility to check your current position any time through the AquaFunded dashboard.

Trading Instruments offered by AquaFunded

The broad selection of assets at AquaFunded gives traders an opportunity to increase their portfolios not only in one market but all over the world. If you are the type that likes trading pairs with big price movements or you just want stable commodities, the platform offers professional-grade liquidity and competitive AquaFunded leverage to different styles. This fact is one of the main reasons why the prop firm is highly rated on AquaFunded Trustpilot.

Trading Instruments Details:

- Forex: Major, Minor and Exotics (e.g., EUR/USD, GBP/JPY, USD/ZAR).

- Indices: Global benchmarks including the US30, NAS100 and DAX40.

- Commodities: Precious metals like Gold (XAUUSD) and Silver, plus Energy assets like Oil.

- Crypto: Major digital assets including Bitcoin and Ethereum (availability may be platform, dependent).

Instrument availability may vary depending on the selected account type and trading platform.

AquaFunded Leverage Details:

Understanding the AquaFunded leverage structure is essential for proper position sizing and risk management across different markets. While the firm offers high purchasing power, the specific ratios are designed to the volatility of each asset class to protect the firm's capital and your account equity. This firm traders to utilize competitive leverage across various asset classes to optimize their strategies within the firm's risk limits.The account leverage is 1:100 Max for all evaluations phase.

For the AquaFunded 1-Step, 2-Step and 3-Step challenge models, the leverage based on trading instruments is as follows:

AquaFunded (1-Step, 2-Step, 3-Step) Challenge Model Leverage

- Forex: 1:50 – 1:100

- Indices: 1:10 – 1:20

- Commodities: 1:10 – 1:20

- Crypto: 1:2

And for the AquaFunded Instant Funding accounts, the leverage based on trading instruments is as follows:

AquaFunded Instant Model Leverage

- Forex: 1:30 – 1:50

- Indices: 1:10

- Commodities: 1:10

- Crypto: 1:1 - 1:2

Besides manual markets trading, traders can also utilize the AquaFunded copy trading features or trade manually through the supported platforms like DXTrade or cTrader. This wide range of market choices plus the seasonal AquaFunded offer turns the platform into a very flexible one for the retail traders. Always check the exact contract specifications from the AquaFunded dashboard before going for a large trade so that you know for sure they meet your margin requirements.

AquaFunded Spreads & Commissions

Knowing your effective trading costs is a key factor for a successful trading journey. Many brokers advertise "zero commissions", an AquaFunded review discloses that the reality of fee impact is often higher. Traders mainly pay market, standard spreads and fixed commissions that differ with the choice of the trading platform and the asset class.

Spreads and Commissions Details:

AquaFunded has secured the partnerships of some major tier liquidity providers to introduce the clientele to top class ECN style spreads.

For example: spreads on major currency pairs like EUR/USD are normally between 0.0 and 0.5 pips at the times of the most active London and New York sessions. Commissions are generally designed as a fixed amount per lot (around $3 to $7 per round turn), which is in line with institutional, grade execution standards in 2026.

Such expenses are directly taken from the demo account balance and the trader is expected to keep track of how these charges are depleting the fuzzy profit mark through the AquaFunded dashboard. The ability to handle trade numbers in relation to these execution costs determines the caliber of a funded trader.

AquaFunded Rules (2026) - What is Allowed and What is Not

In order to be eligible for the profit split and continue trading, trading under an AquaFunded account must implement a strategy that follows the AquaFunded’s trading rules and which aim to limit the traders risk exposure in volatile market conditions to a minimum. Drawdown limits and trading restrictions during high impact news announcements are the key focal points of AquaFunded rule enforcement. So, it is very important that you understand these rules well to avoid account breaches which are really unnecessary.

| Trading Strategies | Allowed or Not | Details |

| Expert Advisors (EAs) | Allowed | EAs must be unique. Widely used or mass-market EAs may trigger IP or behavior-based risk flags. |

| News Trading | Allowed with Restriction | Prohibited 5 mins before & 5 mins after high-impact (Red Folder) news events on Funded Accounts. |

| FOMC Events | Prohibited | Traders must refrain from trading during FOMC speeches and statements entirely. |

| Automated Triggers | Restricted | Pending Orders, Stop Losses (SL) and Take Profits (TP) must not trigger during the 10-min news events. |

| Copy Trading | Allowed | Only permitted between your own personal funded accounts. |

| Hedging | Allowed with Restriction | Permitted within a single account - group hedging across accounts is banned. |

| HFT / Arbitrage | Not Allowed | High-frequency trading and latency arbitrage are strictly prohibited. |

Prohibited Practices at AquaFunded

- Hard Breach: Violating a daily drawdown limit or maximum total drawdown in excess leads to a hard breach. Your funded account will be closed instantly after this.

- Soft Breach: An example of a soft breach is when a trader places positions in restricted news time windows or breaks risk rules such as using a stop loss when a trader is required to have one. In most cases, when there is a soft breach, the wrong trade is closed or the profits are taken away but the account is not terminated.

- IP Address Security: If trading activity is from frequently changing locations or shared VPN IP addresses, this may lead to compliance concerns and the account may be under review. It is a good thing that you always use the same network when you log in to your AquaFunded account.

Our Verdict on AquaFunded Rules

From our analysis at The Trusted Prop, AquaFunded rules is quite clear and understandable, it demands very high discipline that is especially around consistency and news related restrictions. These rules will be a good fit for traders who trade daily on a very consistent basis and for risk managed traders who avoid high leverage exposure during volatile events. Traders who depend upon very aggressive news based strategies or extreme leverage will probably find these rules too restrictive.

AquaFunded Scaling Plan

AquaFunded's prop firm scaling plan aims to encourage long-term trading consistency by increasing the trader's funded account size and capital allocation as they reach various performance milestones.

- Scaling Plan Details: Traders can increase their account balance up to $4,000,000. The main requirement is hitting a 12% profit target within 3 months. After that AquaFunded will raise the starting balance by 25%.

- Performance Requirement: The trader must be profitable during the entire 3 month period and not have any hard breaches.

- Consistency Check: Only traders with at least 3 payouts under their belt can move to the "Aqua Elite" tiers that will give them a monthly salary.

This structured approach ensures that only those who respect drawdown rules and show steady growth are entrusted with higher capital levels.

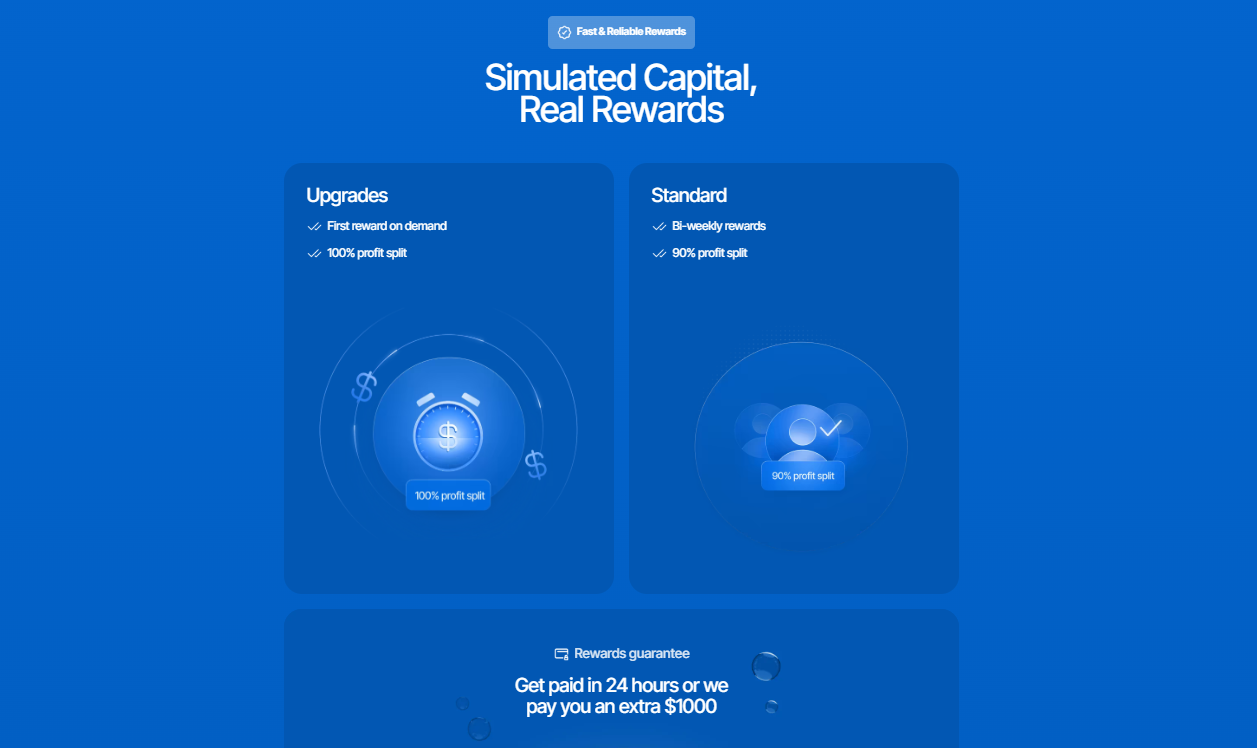

Payment Methods & Payout Process at AquaFunded

The AquaFunded payout process very smooth and flexible with several withdrawal options available for traders. For an example, a payout request on Monday will most probably be processed within 2 to 5 working days depending on the method chosen by traders.

- Payment Methods Supported: Credit/Debit Cards, Apple Pay, Korapay (region-dependent) and Crypto.

- Payout Options: Rise (Bank/Local Transfer), Crypto (USDT) and Deel (varies by region).

- Payout Procedure: Once hitting after the minimum trading days requirement, traders can withdraw through the AquaFunded dashboard. The profit split (up to 90%) is calculated based on the applicable profit split and the money is transferred after a short compliance check.

Payout Guarantee (Tier-Specific): AquaFunded commits to a 24 hour payout guarantee or the prop firm compensates traders with an additional $1,000. According to official disclosures, compensation may apply if this timeline is exceeded which are subject to terms and eligibility.

Our Verdict On AquaFunded Payout Process

According to our review at Trusted Prop, the payout structure of AquaFunded is quite attractive, especially for those traders who are eligible for its on-demand payout facility at certain account tiers. The use of Rise makes international transfers easier, the speed of processing and access may depend on the region and payment method. Once a payout request has been made through the dashboard, it is first checked for compliance with the rules and then the selected withdrawal method is used to process it.

Countries Restricted at AquaFunded

Due to changes in the law and the issue of payment providers, AquaFunded cannot offer services in all areas.

Restricted Countries:

- Cuba

- Iran

- North Korea

- Syria

- Vietnam

- Senegal

Restricted (Specific Models Only):

- Kenya

- Albania

- Algeria (may have limitations on specific instant funding offers).

Note: Country embargoes could change due to regulatory or payment provider requirements. It is advisable to check the official website before buying a challenge.

Our Final Verdict on AquaFunded

After our thorough review at The Trusted Prop, we consider AquaFunded to be a leading choice in 2026 for offering high leverage combined with very well defined, professional grade trading rules. For the time, the prop firm has designed its trading model around traders who already know how drawdown works and are able to run consistency based evaluation models instead of aggressive, high risk trading styles.These trading accounts could be good for consistent day traders as well as disciplined swing traders who place a high value on structured risk management, dependable payouts and have a need for a transparent trading dashboard. The traders who tend to benefit are those having had the experience of working with a prop firm before and also having a systematic approach to position sizing and daily risk limits. These accounts could be a bad fit for over leveraged scalpers, high risk gamblers or traders who are not familiar with the concepts of strict daily drawdown and consistency rules, as rule breaches can happen very fast under aggressive trading styles.

In terms of cost effectiveness, AquaFunded discloses quite competitive terms, including profit sharing of up to 90% and a full refund of the account fee, on the first payout under qualifying conditions. The prop firm mainly takes a moderate to strict approach to rule enforcement, especially around the contradictory and vulnerable daily drawdown limits and news trading restrictions. Consequently, traders must make disciplined execution their habit.Overall, AquaFunded shows up as a legitimate and well rated prop firm option for traders who mainly focus on the long, term funded account growth rather than short-term speculation. Traders who are planning to sign up with this firm need to analyze thoroughly if the firm's rules are compatible with their trading styles and risk taking props.

Check the latest pricing and verified AquaFunded offers reviewed by The Trusted Prop.