Copy Coupon Code to Get

Up to 25% Off 🎉

Bridge Funded

Forex, Crypto, Indices, Commodities, Metals, Stocks

AE

2025

CEO: Ali Berke Tukenmez

DXTrade

Crypto

Rise

Crypto

Rise

Bridge Funded Evaluation Rules, Profit Targets & Drawdown 2025 Guide

.jpeg&w=3840&q=75)

Bridge Funded Evaluation Rules, Profit Targets & Drawdown 2025 Guide

10/3/2025

Introduction

Looking for a prop firm this year? You will probably hear the name Bridge Funded sooner or later. It’s new on the scene, but already turning heads because the buy-in isn’t heavy, the rules don’t feel like a trap and traders actually get paid on time. In this guide, we will walk you through the parts that matter most: the evaluation setup, profit targets and drawdown rules.

Bridge Funded Overview

Bridge Funded launched in August 2025, Its legal name is Bridge Financial Group FZCO. This firm keeps things simple and lets traders prove themselves. You take the challenge, you pass and you are in.

One thing we like? Bi-weekly withdrawals. Most firms drag that out, but here you can actually see your payout hit faster, which makes a big difference if you are trading actively. They have also kept account sizes flexible and fees on the lower end.

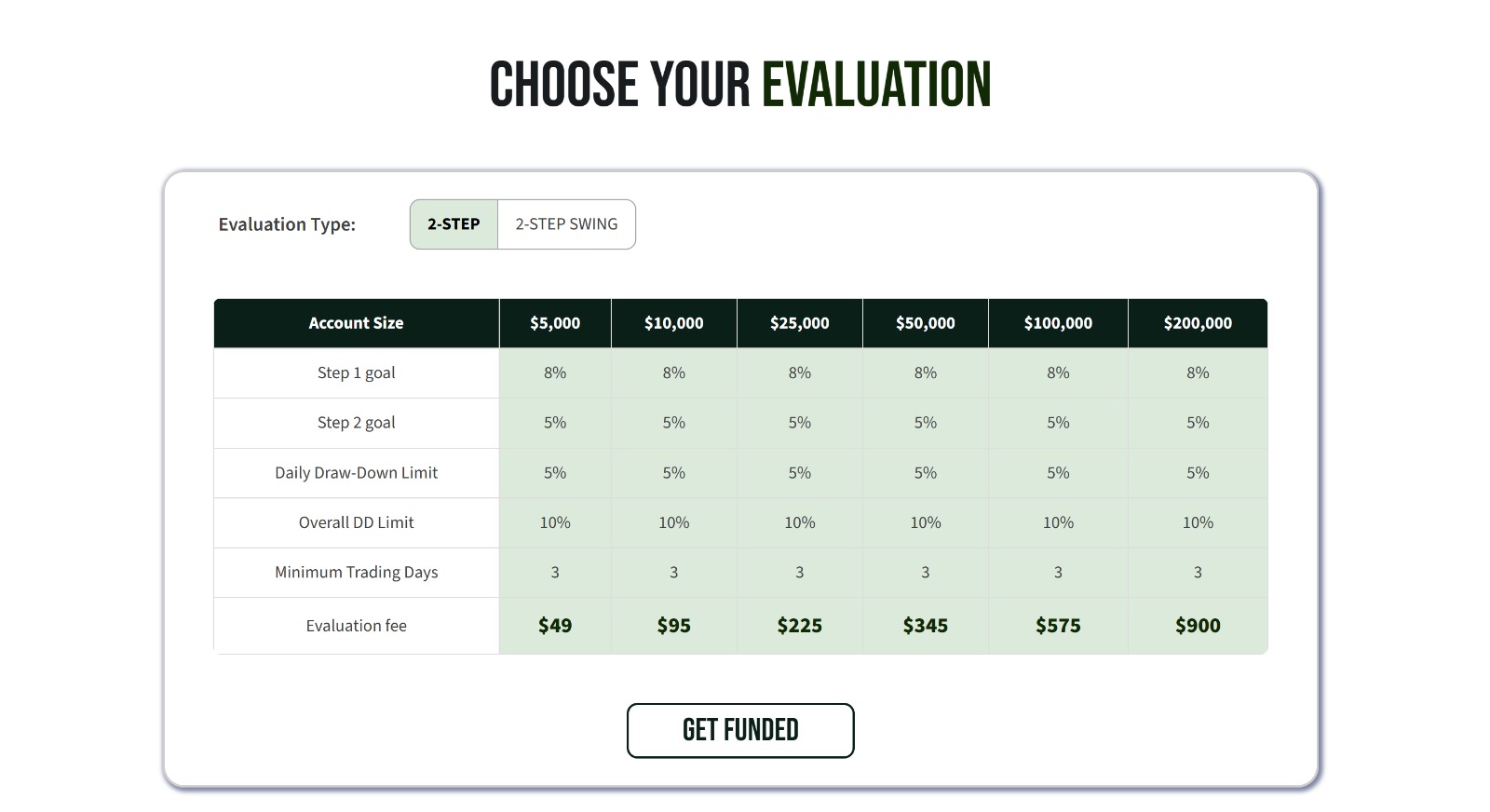

Bridge Funded Challenge Types and Profit Target

Bridge Funded doesn’t drown you in a dozen different evaluations. Instead, they stick to two challenge types, each with profit goals you need to hit. Pretty straightforward, right? The idea is simple, prove you can trade with discipline, stay within limits and actually grow the account. If you are the kind of trader who likes a simple setup, you will probably find this part refreshing.

| Challenge Type | Profit Targets | Details |

|---|---|---|

| 2‑Step Standard Challenge | Phase 1: 8%, Phase 2: 5% | “Standard” account - affordable fee, no weekend or news trading. |

| 2‑Step Swing Challenge | Phase 1: 8%, Phase 2: 5% | Allows news trading and holding over weekends - but slightly higher fee. |

Bridge Funded Drawdown Rules

The maximum total allowable loss is 10%, based on the account balance. The maximum loss permitted each day is 5%, which will be calculated at the end of the day. Also, no variable equity based losses are taken into account, all are calculated on the basis of account balance.

Bridge Funded Rules and Features

The minimum trading days are 3 days, but there are no limitations on those days. A maximum of 100 times leverage is provided in the trade. In Bridge funded, DXTrade is used as a trading platform. In the profit split the trader receives an 80% share. Payment will be received bi-weekly.

Trading Strategy Restrictions at Bridge Funded

| Allowed | Not Allowed |

|---|---|

| Scalping and Day Trading, provided they are within risk limits | EA and Automated Trading |

| Hedging | Copy Trading and Account Mirroring |

| Swing Trading - in Swing accounts | Martingale and High risk doubling strategies |

| News Trading and Weekend holding also limited to Swing accounts | Layering and Order‑stacking manipulation |

Bridge Funded Fees and Account Size Breakdown

Bridge Funded offers funded accounts in the following sizes such as, $5,000, $10,000, $25,000, $50,000, and $1,00,000. Based on these account sizes, the challenge fees vary. The standard challenge starts at $49 for a $5,000 account and scaling up by account size. Swing Challenge comes with a slightly higher fee. For example, the fee for a $5,000 account is $59.

Restricted Countries at Bridge Funded

Due to some regulations and cooperation, the purchase of challenges and the opening of accounts for traders in certain countries is restricted at Bridge Funded. For example Afghanistan, Iran, Iraq, North Korea, UAE, Turkey etc. For a full list read our Bridge Funded Review on The Trusted Prop.

Pros and Cons of Trading with Bridge Funded

Bridge Funded has some stuff that’s good. Like basically any firm, the good thing is that you don’t need money to get started, the rules are not strict - but yes, some trading methods are banned and if you live in certain countries then you might not be able to join this firm. Still, it’s enough to give you a rough idea of the good and the bad before you even bother.

| Pros | Cons |

|---|---|

| Affordable entry, especially for Standard challenge | No structured scaling plan yet, in place to grow funded accounts over time |

| Flexible rules with no time limits to complete evaluation | Some trading styles like EA, copy trading, martingale are prohibited |

| High leverage up to 100 times | Restricted in certain countries like Afghanistan, Iran, Iraq, North Korea, UAE, Turkey etc. |

Conclusion

Bridge Funded is a prop firm that offers trading challenges at affordable cost. It has flexible terms, high leverage of up to 100 times and 2 types of challenge models such as, Standard and Swing Challenge. So it can adapt to different trading styles.

However, the current lack of a scaling plan, the ban on some trading strategies and the lack of availability in some countries can be considered a downside. But, it can be a good opportunity for both new and experienced traders - especially for those who want to prove their skills with low investment.

Want to find the best prop firms of 2025? - The Trusted Prop has got you covered every step of the way.

Get your funded trading journey started - visit Bridge Funded now!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict