Copy Coupon Code to Get

Up to 25% Off 🎉

Bridge Funded

Forex, Crypto, Indices, Commodities, Metals, Stocks

AE

2025

CEO: Ali Berke Tukenmez

DXTrade

Crypto

Rise

Crypto

Rise

Bridge Funded Review 2025: The Real Truth About Trading with BRIDGE FINANCIAL GROUP - FZCO

Bridge Funded Review 2025: The Real Truth About Trading with BRIDGE FINANCIAL GROUP - FZCO

9/8/2025

Introduction

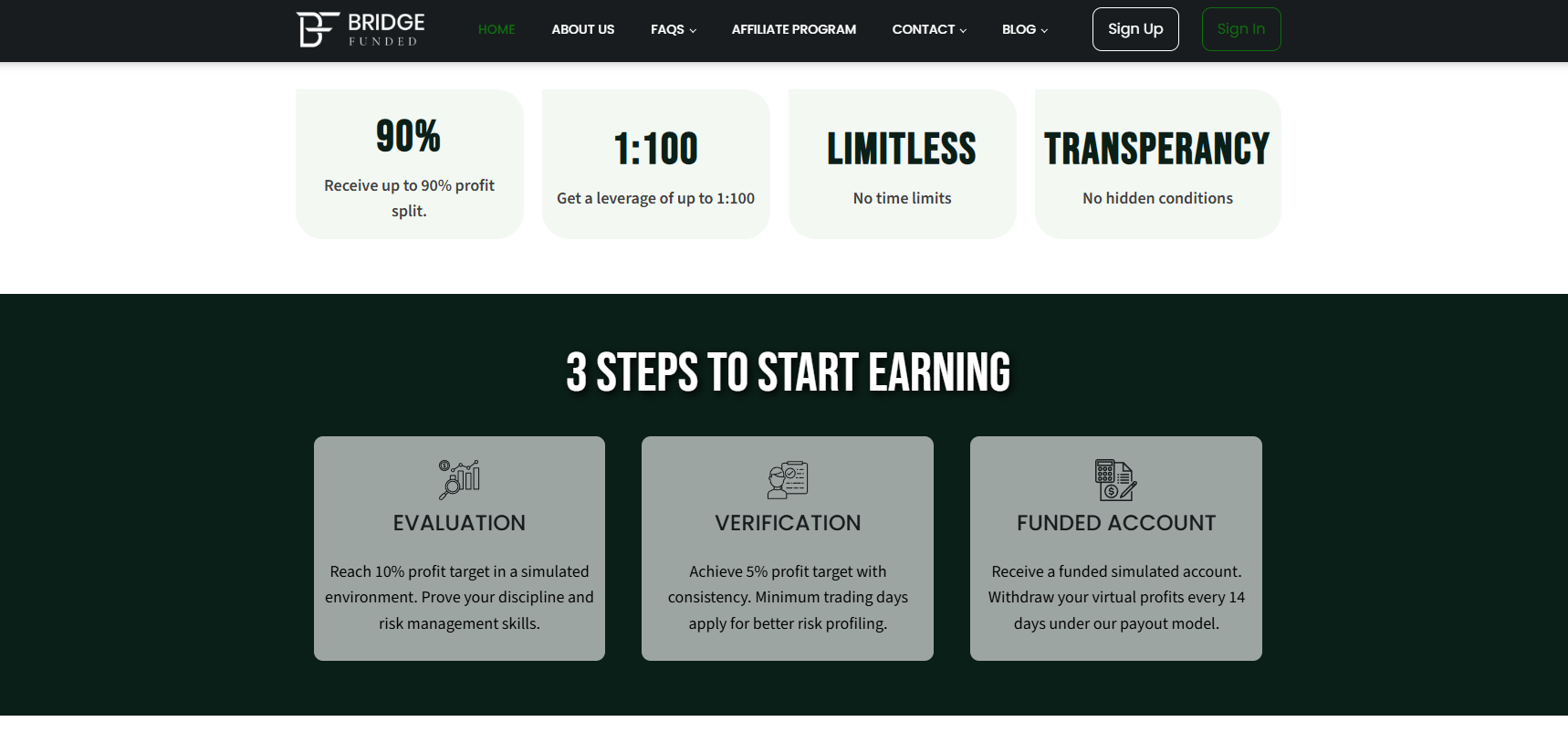

Are you a trader dreaming of accessing substantial capital without risking your own money? Proprietary trading firms like Bridge Funded are revolutionizing the industry by offering talented traders funded accounts to trade forex, crypto, and more. Based in Dubai and led by CEO Ali Berke Tukenmez, Bridge Funded (legally BRIDGE FINANCIAL GROUP - FZCO) provides a transparent, trader-friendly platform with competitive profit splits and flexible evaluation models. In this comprehensive guide, we’ll explore everything you need to know about Bridge Funded, from its evaluation process and trading rules to its unique features and restricted jurisdictions. Whether you’re a beginner or a seasoned trader, this blog will help you decide if Bridge Funded is your path to trading success.

About Bridge Funded

Bridge Funded, officially BRIDGE FINANCIAL GROUP - FZCO, is a cutting-edge proprietary trading firm headquartered in Dubai, a global hub for innovation and finance. Launched in August 2025, the firm is led by CEO Ali Berke Tukenmez, whose vision is to empower traders worldwide with access to capital and advanced trading tools. Bridge Funded stands out for its low-cost challenges, high leverage, and an 80% profit split, making it an attractive choice for traders looking to scale their careers.

Key Features

- Account Sizes: Offers funded accounts ranging from $5,000 to $100,000.

- Profit Split: Traders keep 80% of profits, with the firm retaining 20%.

- Trading Instruments: Trade Forex, Crypto, Indices, Commodities, Metals, and Stocks.

- Platform: Utilizes the DXtrade platform, known for its robust features and low spreads starting at 0.1 pips.

- Leverage: Up to 100x for Forex, 30x for Metals, 20x for Indices, 10x for Oil, 5x for BTC & ETH, and 2x for other cryptocurrencies.

- Global Reach: Welcomes traders from over 150 countries, subject to eligibility restrictions.

Bridge Funded’s mission is to provide a fair and transparent trading environment, with bi-weekly payouts and no maximum time limits for evaluations, catering to both novice and experienced traders.

Bridge Funded Evaluation Models:

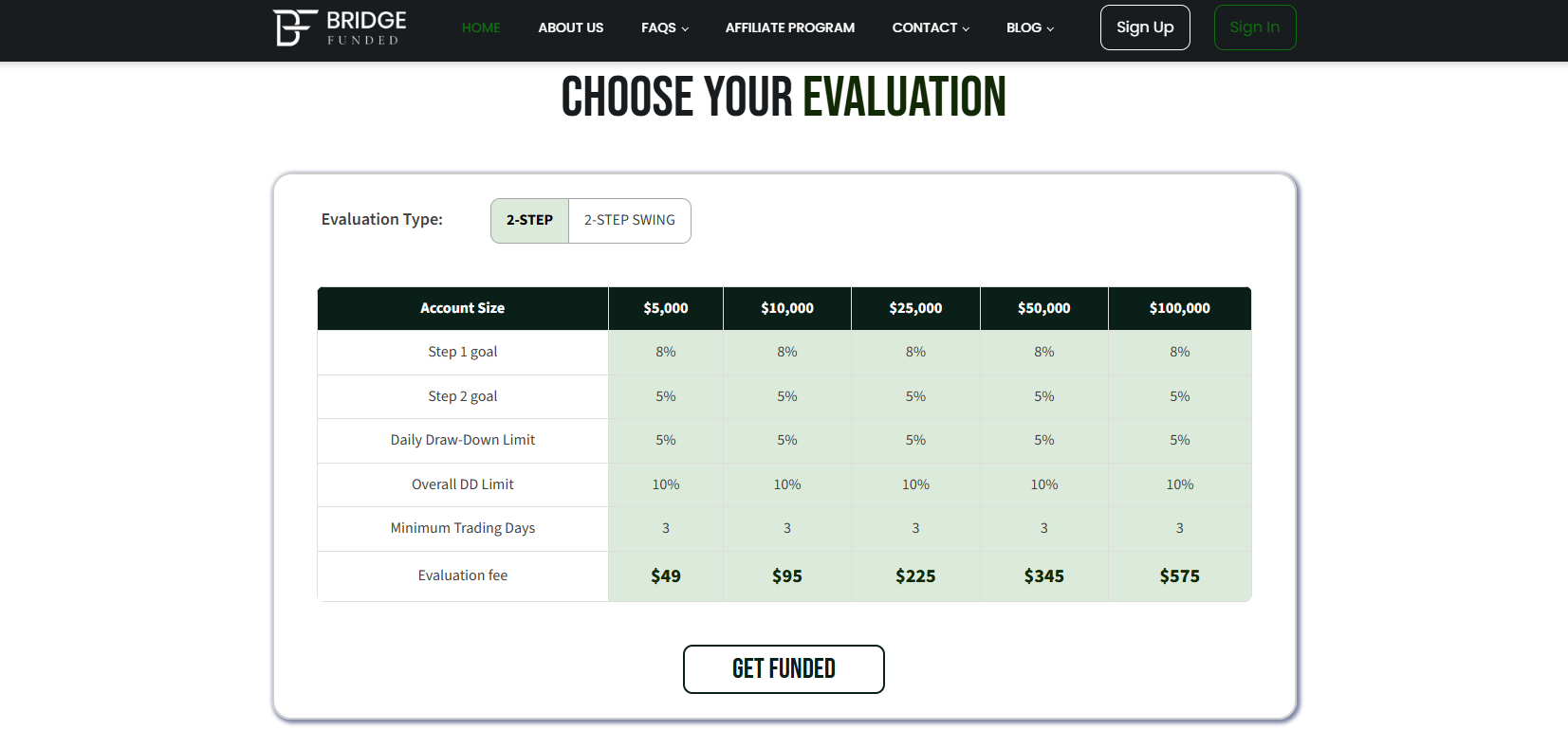

Bridge Funded offers two evaluation models—2-Step Standard and 2-Step Swing—designed to test traders’ skills and discipline. Both models offer account sizes from $5,000 to $100,000, with no maximum time limits, allowing traders to progress at their own pace. To pass, traders must meet profit targets, adhere to risk parameters, and trade for a minimum of 3 days on a demo account. Below is a detailed breakdown of each model.

Pricing:2-Step Standard Model

The 2-Step Standard model is ideal for traders who prefer structured trading with restrictions around news events.

- Profit Target: Achieve 8% (Phase 1) & 5% (Phase 2 )

- Max Daily Drawdown: 5% of account balance or equity.

- Max Total Drawdown: 10% of initial account balance (trailing).

- Trading Restrictions: No trading within a 10-minute window (5 minutes before and after) high-impact news events.

Minimum Trading Days: 3 days.

Pricing

- $5,000 account: $49

- $10,000 account: $95

- $25,000 account: $225

- $50,000 account: $345

$100,000 account: $575

Funded Stage: Upon passing both phases, traders receive a funded account with the same drawdown limits and no news trading within the 10-minute window.

2-Step Swing Model

The 2-Step Swing model offers more flexibility, allowing trading during news events and holding positions over weekends.

- Profit Target: 8% (Phase 1) & 5% (Phase 2)

- Max Daily Drawdown: 5%.

- Max Total Drawdown: 10%.

- Trading Flexibility: No restrictions on trading during economic releases or major news events; weekend holding allowed.

Minimum Trading Days: 3 days.

Pricing:

- $5,000 account: $59

- $10,000 account: $115

- $25,000 account: $249

- $50,000 account: $378

$100,000 account: $619

Funded Stage: Funded accounts maintain the same drawdown limits and allow news trading and weekend holding.

Note: Bridge Funded does not offer refunds for evaluation fees, so traders should be confident in their skills before enrolling.

Withdrawal Rules

Bridge Funded supports bi-weekly payouts, allowing traders to access their profits quickly. Key withdrawal rules include:

- Profit Split: Traders receive 80% of profits, with the firm retaining 20%.

- Payout Methods: Withdrawals are processed via Crypto or Rise (a payment platform), ensuring secure and fast transactions.

- Minimum Payout: A minimum profit threshold (e.g., $100) may apply, though exact details are confirmed upon funding.

- Funded Account Requirements: Traders must maintain the account balance above the initial capital and adhere to drawdown limits to remain eligible for withdrawals.

Processing Time: Payouts are typically processed within 24-48 hours after request submission.

These rules ensure transparency and efficiency, allowing traders to focus on trading while enjoying regular payouts.

Trading Platform: DXtrade

Bridge Funded uses the DXtrade platform, a modern, user-friendly trading solution tailored for prop trading. DXtrade offers:

- Low Spreads: Starting at 0.1 pips for major forex pairs.

- Advanced Charting: Real-time analytics and technical indicators.

- Multi-Asset Support: Seamless trading across Forex, Crypto, Indices, Commodities, Metals, and Stocks.

- Mobile and Desktop Access: Trade on the go or from your desk with full functionality.

Risk Management Tools: Built-in features to monitor drawdown and comply with Bridge Funded’s rules.

DXtrade’s intuitive interface and low-latency execution make it ideal for traders of all levels, ensuring a smooth trading experience.

Scaling Plan: The Missing Piece

Bridge Funded does not currently offer a structured scaling plan, which may be a drawback for traders seeking to grow their account sizes significantly. However, the firm emphasizes flexibility and performance-based opportunities:

Restricted Strategies

To ensure fair trading and protect its capital, Bridge Funded prohibits certain strategies:

- High-Frequency Trading (HFT): Automated systems executing trades in milliseconds are banned due to demo account limitations.

- Latency Arbitrage: Exploiting price discrepancies between demo and live accounts is prohibited.

- Martingale and Grid Trading: Doubling down on losing positions or using grid strategies to inflate profits artificially is not allowed.

- Expert Advisors (EAs) and Copy Trading: Automated trading systems and copying trades from other accounts are restricted.

- Account Sharing: Traders cannot share accounts or allow others to trade on their behalf.

Hedging Across Accounts: Opening opposing positions on multiple accounts to manipulate risk is banned.

Violating these rules results in account suspension or termination, with potential loss of profits and evaluation fees.

Comparison Table of Bridge Funded Challenges

Below is a side-by-side comparison of the 2-Step Standard and 2-Step Swing challenges to help you choose the right model.

Feature | 2-Step Standard | 2-Step Swing |

| Account Sizes | $5K, $10K, $25K, $50K, $100K | $5K, $10K, $25K, $50K, $100K |

| Challenge Fees | $49–$575 | $59–$619 |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Max Daily Drawdown | 5% | 5% |

| Max Total Drawdown | 10% | 10% |

| Minimum Trading Days | 3 | 3 |

| News Trading | Restricted (no trading 5 min before/after news) | Allowed |

| Weekend Holding | Not allowed | Allowed |

| Leverage | FX: 100x, Metals: 30x, Indices: 20x, Oil: 10x, BTC/ETH: 5x, Other Crypto: 2x | Same |

| Refunds | Non-refunded | Non-refunded |

The 2-Step Swing model is ideal for traders who value flexibility around news events and weekend trading, while the 2-Step Standard suits those comfortable with stricter rules at a lower cost.

Inactivity Rule

Bridge Funded enforces an inactivity policy to ensure active trading:

- Inactivity Period: Accounts inactive for 30 days (no trades placed) may be suspended or terminated.

Consequences: Inactive funded accounts may lose access to capital, and evaluation accounts may require restarting the challenge process.

To avoid issues, maintain regular trading activity, even if minimal, within the 30-day period.

Banned Countries

Bridge Funded is unable to offer services to traders from or currently located in the following jurisdictions due to regulatory and compliance requirements:

- Ineligible Countries & Regions: Afghanistan, Antigua and Barbuda, Belize, Bhutan, Bouvet Island, Burundi, Cape Verde, Central African Republic, Chad, Comoros, Congo, Cook Islands, Cuba, Djibouti, Eritrea, Eswatini, Fiji, Guinea, Haiti, Iran, Iraq, Kiribati, Lesotho, Liberia, Libya, Malawi, Mali, Marshall Islands, Myanmar, Niue, North Korea, Qatar, Republic of Belarus, Russian Federation, Saint Barthelemy, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Sao Tome and Principe, Saudi Arabia, Seychelles, Sierra Leone, Solomon Islands, Somalia, South Sudan, Sudan, Syria, Timor-Leste, Tokelau, Tonga, Turkey, Tuvalu, UAE, Ukraine, Vanuatu, Venezuela, Yemen, Western Sahara.

This list is subject to change, so traders should verify eligibility on Bridge Funded’s website before applying.

Final Conclusion

Bridge Funded, operated by BRIDGE FINANCIAL GROUP - FZCO under the leadership of Ali Berke Tukenmez, offers a compelling opportunity for traders to access funded accounts ranging from $5,000 to $100,000 with an 80% profit split. Its DXtrade platform, high leverage (up to 100x for Forex), and flexible evaluation models (2-Step Standard and 2-Step Swing) make it a standout choice in the prop trading industry. The lack of maximum time limits and bi-weekly payouts cater to traders of all experience levels, while the Swing model’s allowance for news trading and weekend holding adds flexibility for advanced strategies.

However, traders should be mindful of the non-refunded evaluation fees, restricted strategies (e.g., no EAs or copy trading), and the absence of a formal scaling plan. The long list of banned countries may also limit accessibility for some. Despite these considerations, Bridge Funded’s low-cost challenges (starting at $49), transparent rules, and robust support make it an excellent option for disciplined traders aiming to scale their careers without personal financial risk.

Ready to take your trading to the next level?

Visit Bridge Funded’s website to sign up, choose your challenge, and start your journey to becoming a funded trader. Always review the firm’s terms and conditions to ensure compliance and maximize your success.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.