Copy Coupon Code to Get

Up to 25% Off 🎉

YRM Prop

Futures

US

2025

CEO: Mohamed Saidi

Rise

Credit/Debit Card

DxFeed

CQG

Marex

YRM Prop Detailed Review 2025

YRM Prop Detailed Review 2025

11/4/2025

Introduction

The prop trading world has exploded in the last few years. Every other week, it feels like a new firm pops up, promising traders the chance to handle serious capital without risking their own money. Sounds amazing, right? But as most traders know, not all prop firms are created equal.

But, YRM Prop is one of the newer firms in 2025, making some noise. The question is simple, are they the real deal or just another prop firm trying to cash in on the hype? That’s what we want to find out.

About YRM Prop

YRM Prop runs on the standard model that proves yourself in a challenge, gets a funded account and then profit split with them. Nothing new there. But the reason traders are paying attention is that their rules don’t feel suffocating and their payouts are on time.

You can trade Forex pairs, indices, commodities like gold or oil and even crypto. They let you scale accounts up if you stay profitable and the profit split can go as high as 85%. That’s pretty competitive compared to some of the bigger firms.

Now, are they perfect? No. They are still relatively new and like any prop firm, there’s always risk. But, YRM Prop looks a lot more trader friendly than many firms we have reviewed in the past.

YRM Prop Evaluation Models & Challenges Explained

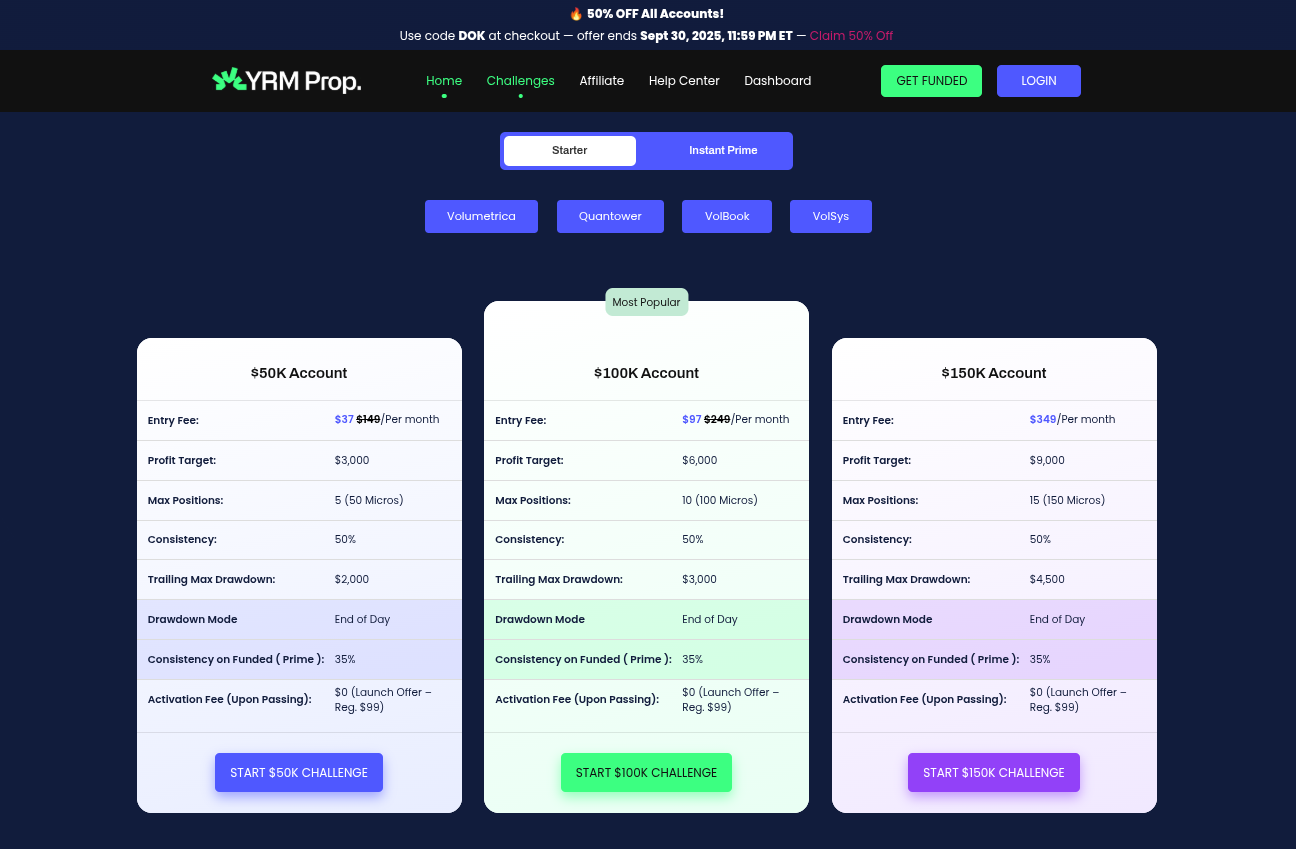

YRM Prop offers two primary pathways for traders, which are the Challenge Account and the Instant Prime Account.

Challenge Account

The Challenge Account is designed for traders who prefer to prove their skills before managing firm capital.

Account Sizes & Fees:

1. For $50K is $37 per month

2. For $100K is $97 per month

3. For $150K is $349 per month

Profit Target:

1. For $50K is $3,000

2. For $100K is $6,000

3. For $150K is $9,000

Trailing Max Drawdown Rules:

1. For $50K is $2,000

2. For $100K is $3,000

3. For $150K is $4,500

Drawdown Mode: End of Day

Trading Conditions:

1. Consistency Rule: 50%

2. Max Positions:

- $50K: 5 (50 Micros)

- $100K: 10 (100 Micros)

- $150K: 15 (150 Micros)

Profit Split: 90/10 in favor of the trader

Payout Frequency: 24 hours

Activation Fee Upon Passing: $0 (Launch Offer - Regular $99)

Instant Prime Account

The Instant Prime Account allows traders to skip the evaluation phase and start trading live capital immediately.

Account Sizes & Fees:

- For $25K one-time fee is $399

- For $50K one-time fee is $599

- For $100K one-time fee is: $749

- For $150K one-time fee is $899

Trailing Max Drawdown Rules:

- For $25K is $1,250

- For $50K is $2,000

- For $100K is $4,000

- For $150K is $6,000

Drawdown Mode: End of Day

Trading Conditions:

1. Consistency Rule: 20%

2. Max Positions:

- $25K: 1 Mini (10 Micros)

- $50K: 2 Minis (20 Micros)

- $100K: 4 Minis (40 Micros)

- $150K: 7 Minis (70 Micros)

Daily Loss Limit:

- For $50K is $1,500

- For $100K is $3,000

- For $150K is $4,500

Profit Split: 90/10 in favor of the trader

Payout Frequency: 24 hours

YRM Prop Challenge Types Detailed Comparison Table

| Feature / Account Type | $50K Challenge | $100K Challenge | $150K Challenge | $25K Instant Prime | $50K Instant Prime | $100K Instant Prime | $150K Instant Prime |

| Profit Target | $3,000 | $6,000 | $9,000 | - | - | - | - |

| Max Loss | $2,000 | $3,000 | $4,500 | $1,250 | $2,000 | $4,000 | $6,000 |

| Min Trading Days | 2 | 2 | 2 | 10 | 10 | 10 | 10 |

| News Trading | Allowed | Allowed | Allowed | Allowed | Allowed | Allowed | Allowed |

| Profit Split | 90% | 90% | 90% | 90% | 90% | 90% | 90% |

| Payout Frequency | Daily | Daily | Daily | Daily | Daily | Daily | Daily |

| Best For | Beginners | Intermediate | Experienced | Fast Funding Seekers | Fast Funding Seekers | Fast Funding Seekers | Fast Funding Seekers |

Our Verdict on YRM Prop Challenge Accounts

YRM Prop firm’s Challenge Accounts are easy to understand. You don’t have to run through complicated hurdles, just meet your profit targets and stick to the YRM Prop rules. The 90% profit split is very attractive and getting your payout is fast. This firm suits traders who want to test their trading skills and access real funds, this is a good choice.

YRM Prop Rules that Actually Need to be Followed

YRM Prop is not going to give you a free ride. The rules exist to protect both your account and theirs. After you are funded:

- End-of-Day Drawdown: Don’t go over your daily or overall limit. It’s strictly monitored.

- Position Limits: Each account has a max number of contracts you can hold.

- Consistency Matters: Prime accounts require 35% trading consistency, Instant Prime 20%.

- Minimum Trading Days: You need to trade at least 10 days before requesting payouts.

- Funded Accounts Limit: You can have up to 3 at the same time.

One thing many traders underestimate is inactivity. Even if you are careful, if you stop trading, you risk losing access to payouts.

Platforms and Trading Conditions at YRM Prop

YRM Prop supports professional-grade platforms. I found them simple and fast:

- Supported Platforms: Volumetrica, Quantower

- Trading Style Options: Start with a Challenge Account or go straight to Instant Prime if confident

- Conditions: End-of-day drawdown, position limits, profit targets vary ($3K to $9K depending on account)

- Accounts: Unlimited Challenge accounts, 3 funded accounts maximum

Our Verdict

At YRM Prop, Volumetrica and Quantower platforms are solid. They give you everything you need without complicating your workflow.

What Trading Instruments Can You Trade on YRM Prop?

Let’s get this out of the way right now, because it’s a dealbreaker for some: YRM Prop only trades futures.

Forget about being a forex prop trading firm here. If you trade EUR/USD or Bitcoin, move along. They are strictly focused on listed Futures products, which means their playground is the CME Group of exchanges.

The singular focus on Futures is a massive strength for serious traders. It means their infrastructure, platforms (Volumetrica and Quantower), and risk desk are all optimized for the mechanics of this high-stakes market.

Details about YRM Prop Instruments

When you secure a funded account with YRM Prop, you are trading simulated capital exclusively on major Futures markets:

- Allowed Products: Listed Futures products only.

- Allowed Exchanges: CME, CBOT, NYME, and COMEX.

- Prohibited Products: Stocks, Options, Forex, Cryptocurrency and CFDs are not permitted.

Our Verdict on Trading Instruments offered by YRM Prop

YRM Prop focus creates an institutional style environment suited for pure futures scalpers and intraday traders. If your strategy relies on trading index futures (like ES or NQ), metals or commodities on the main U.S. exchanges, this is a clean, optimized setup.

YRM Prop Payout Process and Reward System Explained

Look, we are all here for the money. The YRM Prop payout process is where they really shine,

They offer a 90/10 profit split. That means for every $100 you make, you keep $90. That's the top tier in the prop industry. The profit target is to provide fast and reliable payouts once you prove your skills.

Details about YRM Prop Payout Process

The YRM Prop system ensures you keep the vast majority of your profits, with a clear withdrawal limit and very quick processing times:

- Profit Split: An attractive 90% of profits goes to the trader.

- Maximum Withdrawal: Traders can withdraw up to $21,000 per request.

- Processing Time: Payouts are processed quickly, generally within 24 hours of approval.

YRM Prop Payout Eligibility - When Can You Request a Payout?

You have completed the YRM Prop challenge and moved into your funded account. Now what? You can request a payout once you hit two main criteria:

- You must complete a minimum of 10 trading days on the funded account.

- You must adhere to the required consistency rule for your specific account type.

YRM Prop Payout Conditions by Account Type

The main rule controlling your eligibility is the Consistency Rule. This prevents one huge trade from being your only source of income, demanding steady, sustainable performance.

| Account Type | Consistency Requirement (Funded Account) |

| Prime Account (Passed Challenge) | 35% |

| Instant Prime Account (Bought Funding) | 20% |

How Fast Are YRM Prop Payouts Processed?

Once your request is approved and your consistency is verified, YRM Prop claims one of the fastest processing times in the industry, which means within 24 hours.

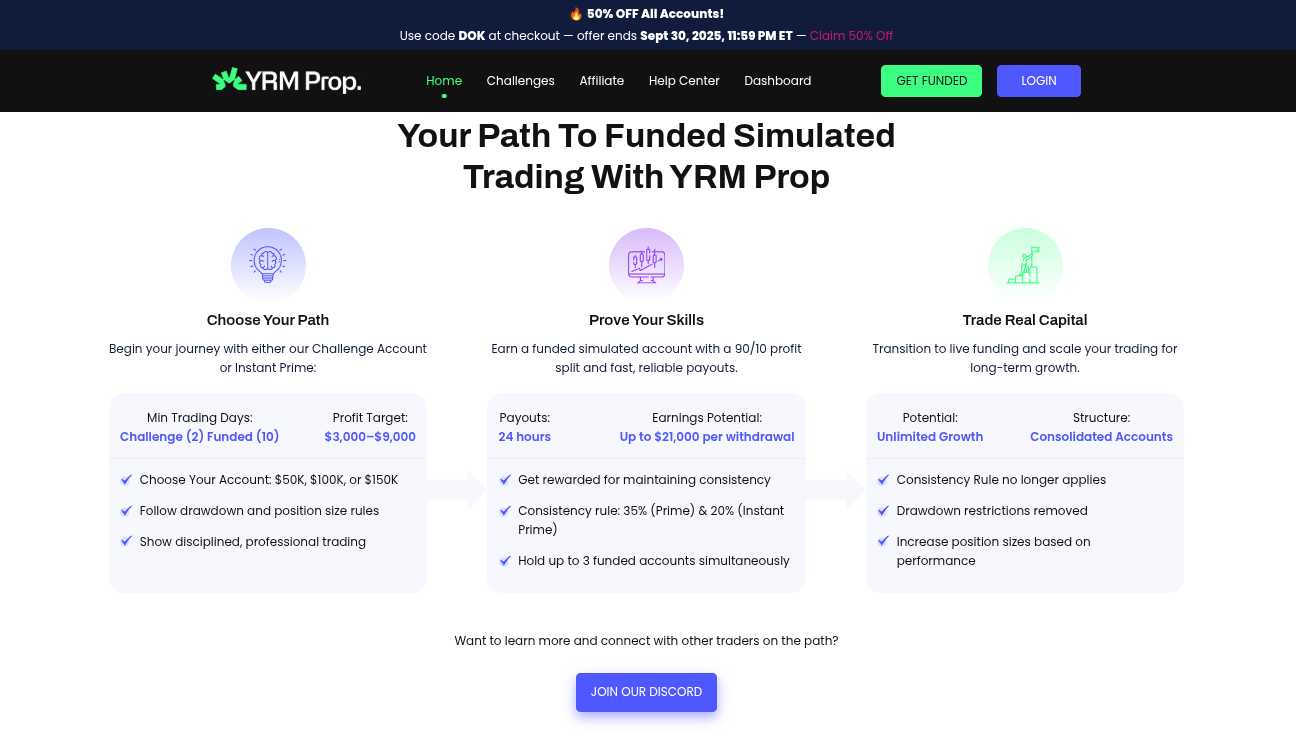

YRM Prop Scaling plan

The YRM Prop scaling plan is the true endgame. It’s structured to reward long term success by progressively removing the most restrictive rules seen in the evaluation phase.

Details of YRM Prop Scaling Plan

This plan is about transitioning you from the simulated Prime account to a genuine, consolidated structure with unlimited growth potential.

- Transition to Live: Successful traders can transition to live funding and consolidate accounts.

- Rules Go Away: The restrictive Consistency Rule no longer applies, and drawdown restrictions are removed as you transition to the live, scaled stage.

- True Growth: You are allowed to increase position sizes based on performance, allowing for exponential growth without the constraints of the challenge metrics.

How to Pass YRM Prop

Passing the YRM Prop evaluation rules requires strict discipline, but you can use their rules to your advantage.

1. Master the End of Day (EOD) Drawdown: This is the most crucial tip. YRM Prop uses an End of Day Drawdown mode. Unlike real-time trailing drawdowns, your drawdown is only calculated after the close of the trading day. This means you can suffer a mid day paper loss and as long as you recover and close above the limit, you are safe. Your focus should be on managing your risk before the daily close.

2. Respect the Consistency Rule: The evaluation phase requires 50% consistency. Don't hit your entire profit target in one session, spread your profit over a minimum of two trading days.

3.Trade the Minimum Days: The Challenge only requires a 2-day minimum. Once you hit your profit target and satisfy the consistency rule, stop trading. Don't risk a drawdown violation chasing extra profits.

Real User Feedback & Trust Factor About YRM Prop Firm

The trust factor is always a serious concern in this industry. YRM Prop has generated significant interest because of its foundation.

The firm asserts it was "Built by Professional Traders, Backed by Broker Expertise" and was "Founded by the team behind Ocean-One Securities, a regulated broker dealer."

This claim, associating the firm with a regulated entity, provides a strong basis for operational trust, suggesting they have serious infrastructure and risk management in place.

What We’re Seeing Across the YRM Prop Community

While every firm has its detractors, the presence of an active community (they encourage traders to Join their Discord) and claims of dedicated, professional customer support are good signs. They are positioned as a transparent and sustainable option compared to less established challenge firms.

Should You Trust YRM Prop?

The combination of the high 90/10 profit split, fast 24-hour payouts and the endorsement from a regulated broker dealer team provides a compelling reason to trust the firm. YRM Prop appears structured for longevity and sustainable trader growth.

Final Verdict: Is YRM Prop Worth It in 2025?

Yes. Absolutely, if you are a futures day trader. The combination of the End of Day Drawdown rule (easier to manage than real-time), the attractive 90% profit split and the robust YRM Prop scaling plan that ultimately removes restrictions makes their model one of the most competitive options available. If you are serious about a funded account YRM Prop in 2025, their structure is designed for sustained, disciplined trading.

Bonus Tip: Stay Updated on the Trusted Prop for Discount Offers and Cashbacks

Prop firms frequently run promotions. Before purchasing any account, especially for the YRM Prop challenge models, always check their homepage or social media for current discount codes. This can significantly reduce the entry cost for your YRM Prop evaluation attempt!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict