Copy Coupon Code to Get

40% Off 🎉

Goat Funded Futures

Futures, Stocks, Indices, Crypto, Metals, Energies

HK

2024

CEO: Edoardo Dalla Torre

Coupon Code:

Tradovate

Ninjatrader

ProjectX

Trading View

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

PayPal

NinjaTrader

Tradovate

What Is Goat Funded Futures and How It Works in 2026?

What Is Goat Funded Futures and How It Works in 2026?

1/17/2026

Introduction: Why Goat Funded Futures Is Gaining Attention in 2026

To succeed as a professional futures trader, you require two things: skill and capital. Many skilled futures traders struggle to make profitable trades, not because of poor strategy but because of limited personal capital that restricts position sizing and growth. This is where top futures prop firms like Goat Funded Futures helps futures traders.

Goat Funded Futures provides traders with access to large simulated capital to trade regulated futures markets such as CME without risking their own money. What sets Goat Funded Futures apart in 2026 is its End-of-Day (EOD) drawdown model, rather than the stressful intraday trailing drawdowns used by many other futures prop firms.

This Goat Funded Futures review breaks down how the firm works, why its user base is growing rapidly and whether this futures prop firm is a good fit for serious futures traders. Looking for the best prop firm offers and full account breakdown? Check out our detailed ‘Goat Funded Futures Review’ on The Trusted Prop.

What Is Goat Funded Futures?

Goat Funded Futures is a prop firm that allocates trading capital to skilled futures traders by evaluating trading skills through evaluations and drawdown rules. The firm’s primary mission is to offer funded futures trading opportunities to the traders that are capable of managing risks effectively. Instead of trading very small amounts in your funded account, you get to access funded capital account sizes starting from $5,000 and scaling up to $150,000+, depending on the challenge model. This guide explains how traders can qualify for funded futures accounts by meeting predefined risk and performance rules instead of trading personal capital.

How Goat Funded Futures Works: Step-by-Step Process

Understanding how Goat Funded Futures prop firm works with payouts and rules is easy to understand. The steps that make the whole process are so simple even a new trader can understand them:

Step 1: Choose an account which is suitable for your current trading strategy and trading level.

Step 2: You will start with one of their futures challenge models. Please note that in Goat Funded Futures majority of traders go for the 1-Step Evaluation.

Step 3: Along with following the Goat Funded Futures rules you have to achieve the profit target.

Note: Failing to respect daily loss limits or maximum drawdown will result in challenge failure, regardless of the profit performance made.

Step 4: Once you passed the challenge you will be provided with a funded account where you will be allowed to keep most of the profits.

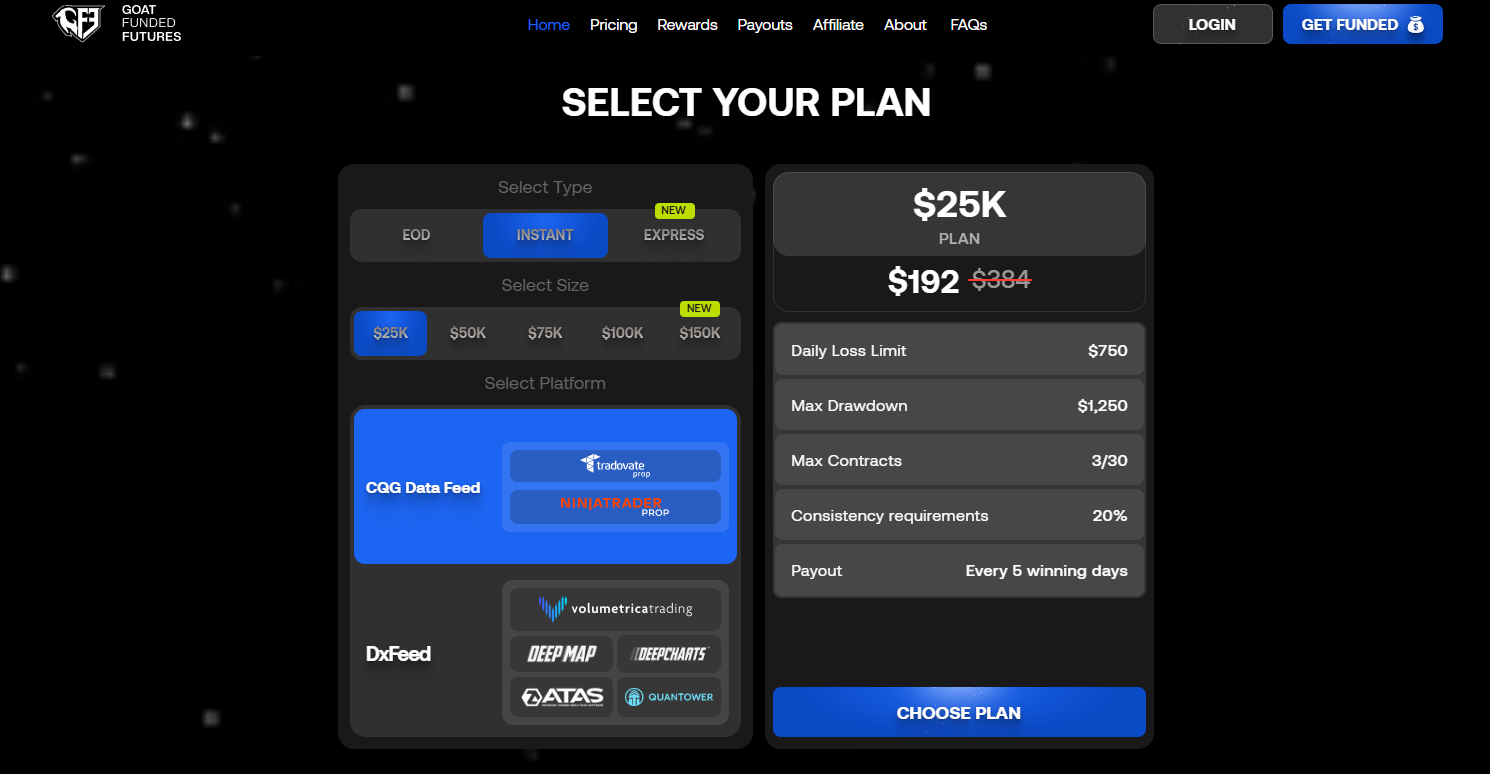

Goat Funded Futures Account Types Explained

The Goat Funded Futures offers a lot of different futures challenge models which are also explained in their dashboard. Whether you are a small trader or a pro trader there is a futures funded account available for you. Goat Funded Futures currently offers an End-of-Day (EOD) Challenge, Express and Instant Funding account.

Below is a simplified overview of the main Goat Funded Futures account options and their key risk parameters.

| Feature | EOD Evaluation | Instant Funding | Express Model |

| Account Types | Evaluation Phase | Direct Funded | Advanced Evaluation |

| Account Sizes | $50K, $100K, $150K | $25K, $50K, $75K, $100K, $150K | $25K, $50K, $100K, $150K |

| Account Fees (Start From) | $101 | $230 | $89 |

| Profit Target | 9% | N/A | 6% |

| Daily Drawdown | Evaluation - No / Funded - 2.5% | 3% (Trailing) | No Daily DD (on select) |

| Max Drawdown | 5% (End of Day) | 5% (Trailing) | 4% (EOD) |

| Drawdown Type | End of Day | Trailing | End of Day |

| Min. Trading Days | 5 Days | 0 Days | 3 Days |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| Profit Split | 100% then 90% | 90% | Up to 100% |

| Payout Frequency | 5 Winning Days | 10 Days | Bi-Weekly |

Note: Profit targets, drawdown limits, and rules may vary slightly depending on the selected challenge model and updates from the firm. Mean while 20% of consistency rule apply for all account types.

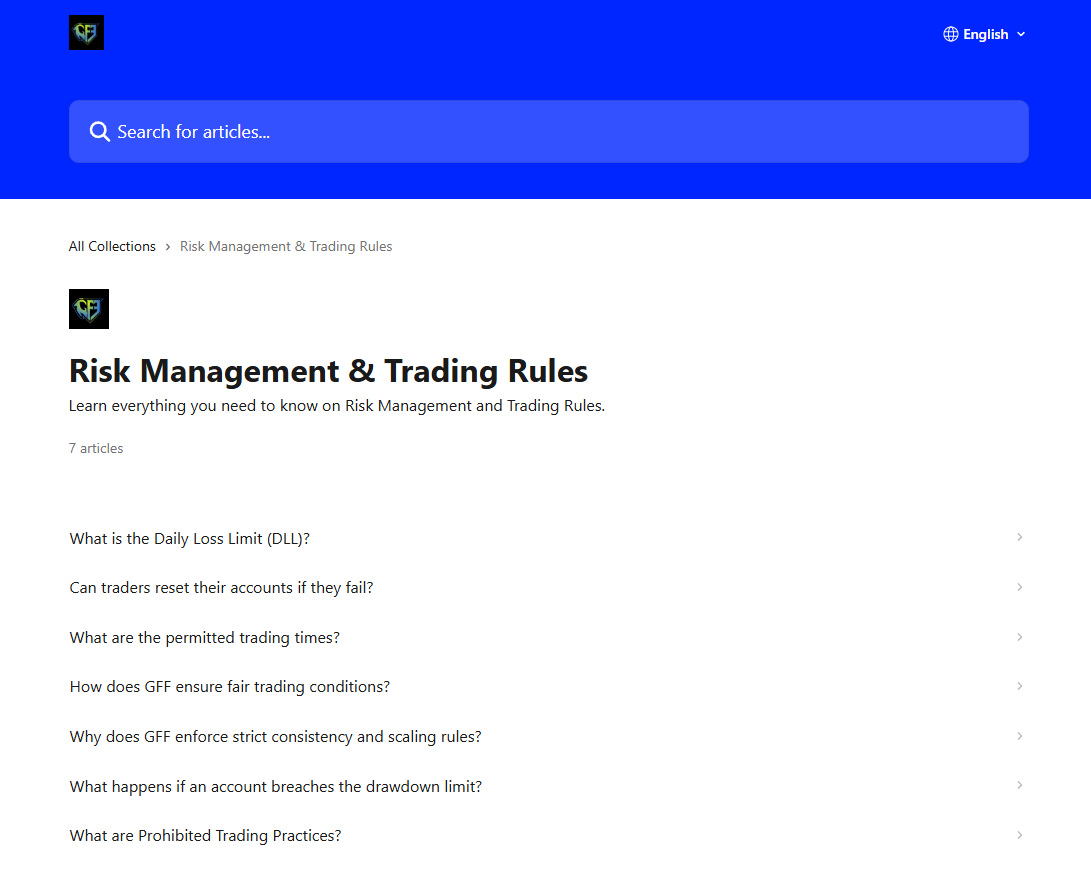

Goat Funded Futures Trading Rules, Risk Limits & Key Conditions

Following the Goat Funded Futures rules is the only way to continue as a successful trader. Basically these rules work as a protection for the firm's money and also as a means of improving your trading skills. The most important rule is the Goat Funded Futures drawdown.

- Trailing Drawdown: The drawdown level adjusts based on End-of-Day account balance rather than intraday fluctuations. Goat Funded Futures is known for "End-of-Day" drawdown which is very easier because it only updates when the market closes.

- Daily Loss Limit: When you lose a large amount in a single day, your account will be closed. This protects you from losing everything on just one bad session.

- No Time Limits: There are no restrictions on how many days you can take to pass.

This structure helps traders avoid unnecessary stop-outs caused by temporary intraday volatility.

Goat Funded Futures Payout Structure & How Traders Get Paid

One of the standout features of Goat Funded Futures is its trader-friendly payout structure. The GFF firm offers a 90% profit split, meaning traders keep 90% of the profits they generate on their funded futures account.

Traders are typically eligible to request withdrawals on a 14-day or 30-day cycle, depending on their account terms. The Goat Funded Futures payouts are generally processed within the stated withdrawal cycle, based on trader feedback and available reports. This consistent and transparent payout process is one of the reasons Goat Funded Futures is considered a strong option in the funded futures trading space.

Who Should Choose Goat Funded Futures?

- Futures traders who want to trade regulated instruments like Gold, Crude Oil or the S&P 500

- Trader who are looking for a high profit split (up to 90%)

- Traders who prefer no time pressure during evaluations

- Traders who value structured risk rules with reliable payouts

Who Should Not Choose Goat Funded Futures?

- People who gamble and have no intention of using a stop-loss.

Traders who are unable to follow the strict daily loss limits.

Pros & Cons Of Goat Funded Futures

When evaluating a futures prop firm, understanding the advantages and dis-advantages against the strict requirements is essential for long-term success in funded trading with prop firms. Based on our GFF review, below is a quick breakdown of the pros and cons of trading with the firm to help you decide if this prop firm fits your trading style in 2026.

Pros Of Goat Funded Futures

- Evaluation process is very simple 1-Step.

- Using high-quality platforms like Tradovate and Rithmic.

- Strong track record of payouts mighty Goat Funded Futures.

- Large account scaling options.

Cons Of Goat Funded Futures

- Small activation fees after passing the challenge.

- Strict rules on maximum drawdown.

Goat Funded Futures is best suited for those traders who are disciplined and want a fair drawdown model with high profit split. Traders should always check prop firm rules and trading condition before starting challenge.

Is Goat Funded Futures Legit and Worth It in 2026?

Based on our research, this Goat Funded Futures review (2026) confirms that the prop firm operates as a legitimate and established futures prop firm. GFF has supported a large trader base and reports substantial payouts to successful participants over time.

Goat Funded Futures provides access to professional market data and allows traders to operate in regulated futures markets, which adds an extra layer of transparency compared to many unregulated or offshore alternatives. For futures traders who are serious about building profit consistency in futures trading, the firm offers a structured and realistic path to scaling capital.

Final Verdict: Should You Start with Goat Funded Futures?

Our comprehensive Goat Funded Futures review and guide for 2026 shows why the firm continues to attract futures traders worldwide. They have managed to combine straightforward rules, End-of-Day risk management and high profit payout structure - making it an attractive option for disciplined futures traders.

If you can manage risk, follow the rules, and trade consistently, then the Goat Funded Futures prop firm can serve as a practical stepping stone towards trading larger simulated capital and earning real payouts. Starting with a smaller evaluation account is often the smartest way to test whether the firm aligns with your trading style and risk tolerance.

Visit ‘The Trusted Prop’ for more in-depth prop firm reviews, detailed comparisons and the latest prop firm updates for 2026.

Explore Goat Funded Futures accounts and start your futures challenge with entry options starting from as low as $50.

You may also like

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

Maven Trading Detailed Review 2026: Our Honest Verdict

Funded Trading Plus Detailed Review 2026: Our Honest Verdict

Goat Funded Trader Instant Pro Account Explained (2026)

.jpeg&w=1920&q=75)

Goat Funded Futures Trading Rules and Restrictions (2026)

.jpeg&w=1920&q=75)

ATFunded Detailed Review 2026: Our Honest Verdict