Copy Coupon Code to Get

25% Off 🎉

ThinkCapital

Forex, Crypto, Indices, Commodities

AE

2024

CEO: Faizan Anees

25% OFF + FREE Account on Payout

Coupon Code:

ThinkTrader

Trading View

Metatrader 5

Crypto

Rise

Crypto

Credit/Debit Card

ThinkMarkets

ThinkCapital Detailed Review 2026 – Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

2/19/2026

Introduction

ThinkCapital is one of the few broker-backed prop firms operating since 2024 which is powered by ThinkMarkets infrastructure. But the real question is, does that actually make it safer or better than independent prop firms?

ThinkCapital may suit traders who prefer broker-backed infrastructure and structured risk parameters over aggressive, high-risk funding models. However, you must be careful with the ThinkCapital challenge rules explained in their dashboard, as failing to follow the daily loss limits or other trading rules may lead to losing the account.

In this ThinkCapital review 2026, we break down its evaluation models, risk rules, payout process, scaling plan, and real trader feedback to help you compare and decide whether ThinkCapital funded account is the right move for your trading journey in 2026.

Want to know more about this firm, you can read our ‘ThinkCapital Review 2026’ in The Trusted Prop page.

What is ThinkCapital?

ThinkCapital is a prop trading firm that has in the market since 2024, offering traders with virtual capital after prove trading skills via a prop firm evaluation. The firm is backed by a regulated broker, ThinkMarkets which helps to increase perceived trader trust when compared to newly launched independent prop firms.

ThinkCapital provides multiple account types for traders choose from, including Lightning (1-Step), Dual Step (2-Step) and Nexus (3-Step) evaluations. Once you hit the profit goals without breaking the risk rules, you get a funded account and you can keep a large share of the profits you make ranging from 80% to 90%.

Key points about the ThinkCapital prop firm:

• You pay a one-time fee to start a challenge.

• The trading happens on a simulated account that feels like the real market due to the firm’s broker-backed trading environment.

• You are not responsible for any trading losses - you only risk the entry fee.

• The firm uses the ThinkTrader platform and has ThinkCapital TradingView integration benefits.

ThinkCapital Evaluation Models Explained

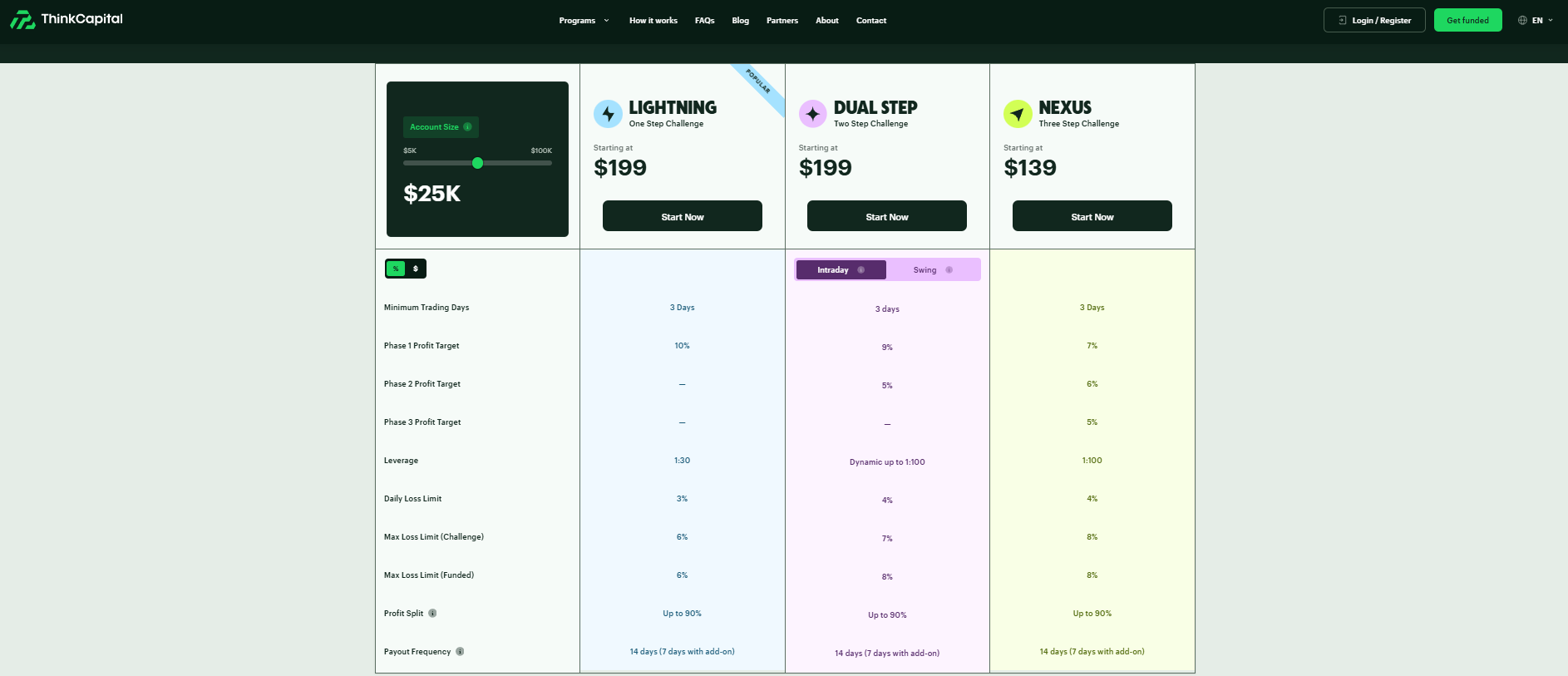

In this ThinkCapital review, we have broken down the specific requirements for each account type to help you choose the best path as per your trading style. Below are the details for the Lightning (1-Step), Dual Step (2-Step) and Nexus (3-Step) models as of 2026.

ThinkCapital Lightning Challenge (1-Phase)

This Lightning Challenge model is built for speed and simplicity, allowing traders to reach a ThinkCapital funded account in 2026 with just a single evaluation phase.

• Profit target: You are required to achieve a 10% profit target on your simulated balance without violating any risk parameters to successfully pass the evaluation.

• Drawdown rules: The account features a 3% daily loss limit (balance-based) and a 6% maximum trailing drawdown that locks at your initial balance once your account grows by 6%.

• Trading conditions: You will trade with a leverage of 1:30 and have access to professional conditions including ThinkCapital TradingView integration benefits for seamless charting.

• Account sizes & fees: Challenges range from $5,000 to $100,000, with entry fees starting as low as $59 for the smallest account size.

• Allowed strategies: Manual trading and Expert Advisors (EAs) are permitted, though high-impact news trading is restricted within a 4-minute window unless an add-on is purchased.

• Profit split: The standard reward is an 80% profit split, which can be increased to 90% through scaling or specific add-ons.

• Payout frequency: Your first ThinkCapital payout can be requested after 14 days, with the option to reduce the payout frequency to 7 days with an add-on.

ThinkCapital Dual Step Challenge (2-Phase)

The Dual Step model is the most popular choice in this ThinkCapital review, offering a balanced approach for consistent traders.

• Profit target: You must hit a 9% profit target in Phase 1 and a 5% profit target in Phase 2 to prove your consistency over time.

• Drawdown rules: This challenge enforces a 4% daily loss limit and a 7% maximum drawdown during the challenge, which expands to 8% once you reach the funded stage.

• Trading conditions: Traders enjoy higher leverage up to 1:100 and can choose between Intraday (equity-based drawdown) or Swing (balance-based drawdown) account styles.

• Account sizes & fees: Its account size range from $5,000 to $100,000, with the $5,000 challenge starting at approximately $59 (standard) or $82 (swing).

• Allowed strategies: All standard strategies are allowed, and the Swing model specifically permits weekend holding and news trading without the usual restrictions.

• Profit split: You start with a competitive 80% profit split, with the potential to scale your way up to a 90% share of the gains.

• Payout frequency: Payouts are processed on a bi-weekly cycle, though active traders often upgrade to the weekly payout schedule.

ThinkCapital Nexus Challenge (3-Phase)

The Nexus model is the most affordable entry point for the ThinkCapital prop firm, designed for those who prefer a low-risk, multi-step journey.

• Profit target: To gain a funded account, you must navigate three phases with profit targets of 7% (Phase 1), 6% (Phase 2) and 5% (Phase 3).

• Drawdown rules: Risk is tightly managed with a 4% daily loss limit and a total maximum loss limit of 8% that stays fixed to your initial balance.

• Trading conditions: This model provides a leverage of 1:100, making it suitable for traders who use smaller stop-losses and higher position sizing.

• Account sizes & fees: Account size is same as other two models. But, it is the most budget-friendly option, with a $5,000 account costing only $39, making it highly accessible for beginners.

• Allowed strategies: You are free to use your own strategies or EAs, provided you maintain a minimum of 3 profitable trading days (at least 0.5% gain) per payout cycle.

• Profit split: Like other models, you receive an 80% profit split by standard, which is among the best in the industry for a 3-step program.

• Payout frequency: Payouts occur every 14 days, ensuring a reliable flow of income for traders who respect the ThinkCapital challenge rules explained in the dashboard.

ThinkCapital Challenge Types Comparison

| Challenge Type | Lightning (One-Phase) | Dual Step (Two-Phase) | Nexus (Three-Phase) |

|---|---|---|---|

| Profit Target | 10% | 9% / 5% | 7% / 6% / 5% |

| Daily Loss Limit | 3% (Fixed) | 4% (Equity or Balance) | 4% (Fixed) |

| Max Loss Limit | 6% (Trailing) | 7% for challenge, 8% for funded phase (Static for Swing / Trailing for Intraday) | 8% (Fixed to Initial) |

| Min Trading Days | 3 Days | 3 Days | 3 Days |

| News Trading | Restricted (4-min window) | Allowed (Swing) / Restricted (Intraday) | Limited (Rules apply) |

| Profit Split | 80% to 90% | 80% to 90% | 80% to 90% |

| Payout Frequency | 14 days (7 with add-on) | 14 days (7 with add-on) | 14 days (7 with add-on) |

| Best For | Fast traders | Consistent traders | Beginner traders |

Which ThinkCapital Challenge Account to Choose?

Choosing the right path at the ThinkCapital prop firm depends on your experience level and how much risk you are comfortable with.

• For Beginners: The Nexus Challenge (3-Step) is the best fit for new traders who want to test their trading skills and risk management. It has one of the lowest entry fee ($39) and gives you more time to learn the rules across three smaller phases.

• For Disciplined Traders: The Dual Step Challenge (2-Step) is the standard choice for traders who want fast funding yet take time to prove themselves. It offers balance-based drawdown (on Swing accounts) and a higher profit target, making it a stable way to earn a ThinkCapital funded account in 2026.

• For Professionals: The Lightning Challenge (1-Step) is built for traders seeking speed and fast funding access. If you have a high win rate and understand trailing drawdown, this gets you to a payout faster than any other ThinkCapital funding model.

ThinkCapital Rules To Keep In Mind

The most important part of this ThinkCapital review is understanding how to keep your account. Most traders fail because they do not read and understand the actual prop firm rules in both challenge and funded phase.

Trading Consistency Rules

ThinkCapital has not set a consistency rule on any of its accounts. The firm values professional behavior over chasing prop firms.

• Minimum Profitable Days: You must have at least 3 trading days where you make a profit of at least 0.5% of your starting balance.

• No Gambling: High-risk bets or doubling down (Martingale) are strictly prohibited and can lead to account closure.

• News Trading: You must avoid opening or closing trades 2 minutes before and after high-impact news on most account types.

Inactivity Rules

Your account will expire if you do not stay active.

• 30-Day Limit: You must place at least one trade every 30 consecutive days.

• Consequence: Failure to trade results in account termination without a refund. Always check your dashboard to ensure you remain active.

Understanding and strictly following these rules is is important for traders to successfully pass the challenge and maintain a funded account. Traders who stay disciplined, manage risk and remain active significantly has chances to increase their long-term success with ThinkCapital.

ThinkCapital Platform Access & Trading Conditions (2026 Guide)

The ThinkCapital prop firm provides top-tier trading conditions because it is backed by the ThinkMarkets broker.

• ThinkTrader & TradingView: You can use the ThinkTrader platform or enjoy ThinkCapital TradingView integration benefits, which let you trade directly from your charts.

• Execution: Trades are executed with very low latency and raw-style spreads.

• Leverage: Depending on your challenge selection, leverage ranges from 1:30 (Lightning) up to 1:100 (Dual Step and Nexus).

What Trading Instruments Are Available on ThinkCapital?

Traders have access to over 4,000 instruments, which is much higher than most other firms. The instruments that are supported include:

• Forex: All major, minor and exotic pairs.

• Indices: Global markets like the US30, NAS100 and GER40.

• Commodities: Gold, Silver and Oil with very competitive spreads.

• Cryptocurrencies: Popular digital assets like Bitcoin and Ethereum are available for 24/7 trading.

ThinkCapital offers a highly competitive trading environment supported by institutional-grade infrastructure and broad market access. With flexible leverage options and availability of over 4,000 instruments, the firm provides both conservative and high-performance trading strategies.

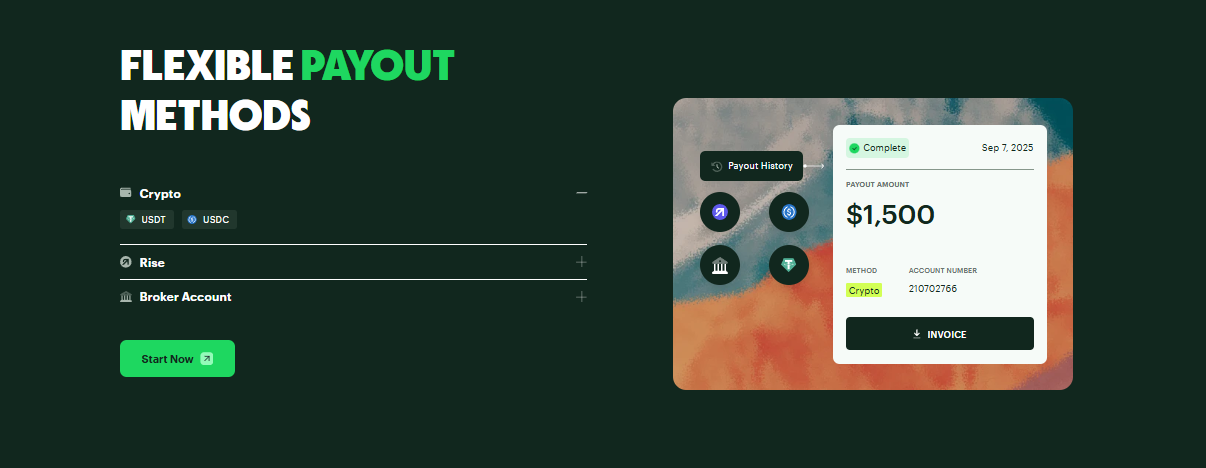

ThinkCapital Payout Process and Reward System

The ThinkCapital payout rules and withdrawal system is transparent and built to reward those who follow the ThinkCapital rules explained on the firm’s FAQs, and terms of service page.

ThinkCapital Payout Eligibility: When Can You Request a Payout?

To receive your ThinkCapital profit, you must meet these simple payout conditions:

• Your funded account must be in profit (at least $100).

• All open positions must be closed before requesting.

• You must have completed the required 3 profitable trading days (0.5% each).

ThinkCapital Payout Terms by Account Type

• Profit Split: In each ThinkCapital account type profit split starts at 80% and it can be increased to 90% via an add-on.

• Frequency: Standard payouts are every 14 days (bi-weekly).

• Add-ons: You can purchase a "Weekly Payout" add-on which is available all account types to get ThinkCapital payouts every 7 days.

How Fast Are ThinkCapital Payouts Processed?

Once payout is requested, ThinkCapital usually processes it within 1 to 3 business days. After approval, the funds typically arrive in your wallet within 24 to 48 hours.

Platform Supported for Payment & Payout at ThinkCapital?

You can pay for challenges or withdraw profits using:

• Cryptocurrency: USDT (TRC20/ERC20) and USDC.

• Rise: A secure global payment platform.

• ThinkMarkets Account: Direct transfer to your personal live broker account (in supported regions).

ThinkCapital Scaling Plan

If you are a consistent trader, the ThinkCapital prop firm will increase your capital.

• Requirement: Achieve a 10% total profit over a 3-month period.

• Growth: Your account size increases by 20% of the original balance for each scaling milestone.

• Maximum: You can scale up to a maximum allocation of $600,000.

ThinkCapital scaling plan rewards disciplined and consistent tradres rather than traders who are seeking for short-term gains. For traders focused on steady growth, the firm offers a structured path toward managing significantly larger capital allocations.

How to Pass ThinkCapital: Pro Tips from Real Traders

Implementing these strategies will increase your chances of success:

• Use the Swing Account: If you trade the Dual Step, choose the Swing option to avoid equity-based drawdown and hold trades over the weekend.

• Target Small Wins: Focus on hitting your 3 profitable days early with low-risk trades to satisfy the consistency requirement.

• Check the Calendar: Always have a news calendar open to avoid the 2-minute news restriction.

Real User Feedback & Trust Factor About ThinkCapital Prop Firm

The ThinkCapital legit and trust rating is currently high in the community because of the broker backing.

What We Are Seeing Across the ThinkCapital Community

• Fast Support: Users on Discord and Trustpilot often praise the support team for quick replies.

• Reliable Technology: Most traders find the TradingView integration very stable compared to MT4/MT5 firms.

• Strict Enforcement: Some traders have lost accounts due to news trading; this highlights the need to follow the rules exactly.

Should You Trust ThinkCapital?

ThinkCapital operates in partnership with ThinkMarkets, a globally regulated broker. This broker-backed structure may provide greater infrastructure stability compared to standalone prop firms. However, as with all prop trading firms, payouts are subject to internal risk policies and terms of service.

Final Verdict: Is ThinkCapital Worth It in 2026?

Based on our research, this ThinkCapital review concludes that this is one of the most trusted broker-baked prop firms available in 2026. The firm offers a fair profit split and payouts system, advance platform technology and the security of a regulated broker. While the ThinkCapital rules on news events and consistency might be strict for new traders, they are fair for professional traders. If you seek a long-term broker-backed for your funded trading career in 2026, then the ThinkCapital prop firm is a good choice.

Join The Trusted Prop today to access the latest ThinkCapital challenge offers and start your professional funded trading journey at a discounted price!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.