Copy Coupon Code to Get

Up to 25% Off 🎉

TEFS

Forex, Crypto, Stocks, Commodities, Futures

AE

2017

CEO: Not publicly available

Trader Evolution

Crypto

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

Credit/Debit Card

Mastercard

Visa

TEFS Detailed Review 2025

.jpeg&w=3840&q=75)

TEFS Detailed Review 2025

11/5/2025

Introduction

Ever wondered if you could trade without risking your own funds? That’s where TEFS steps in. It’s a prop firm that gives traders a chance to earn real payouts through simulated accounts. Whether you are just starting out or already deep in the trading game, TEFS offers a challenge model that’s flexible, fair and surprisingly rewarding.

About TEFS

TEFS is built for traders who want to prove their skills and get paid without putting their own funds on the line. Instead of handing over a deposit, you take on a challenge. Hit the profit target, stay within the drawdown limits and then you get a TEFS-funded account.

What makes TEFS stand out? For starters, they offer both evaluation-based accounts and instant funding options. You can trade forex, crypto, indices and even over 2,500 US stocks. The platform feels real, the rules are clear and the payouts are legit. Plus, with profit splits going up to 90%, it’s one of the most generous setups out there.

TEFS Evaluation Models & Challenges Explained

Alright, let’s make it simple. TEFS gives you two ways to get funded that is either you prove yourself through a challenge or you skip the test and pay for instant access. One’s for the patient and precise. The other’s for one who want faster payouts.

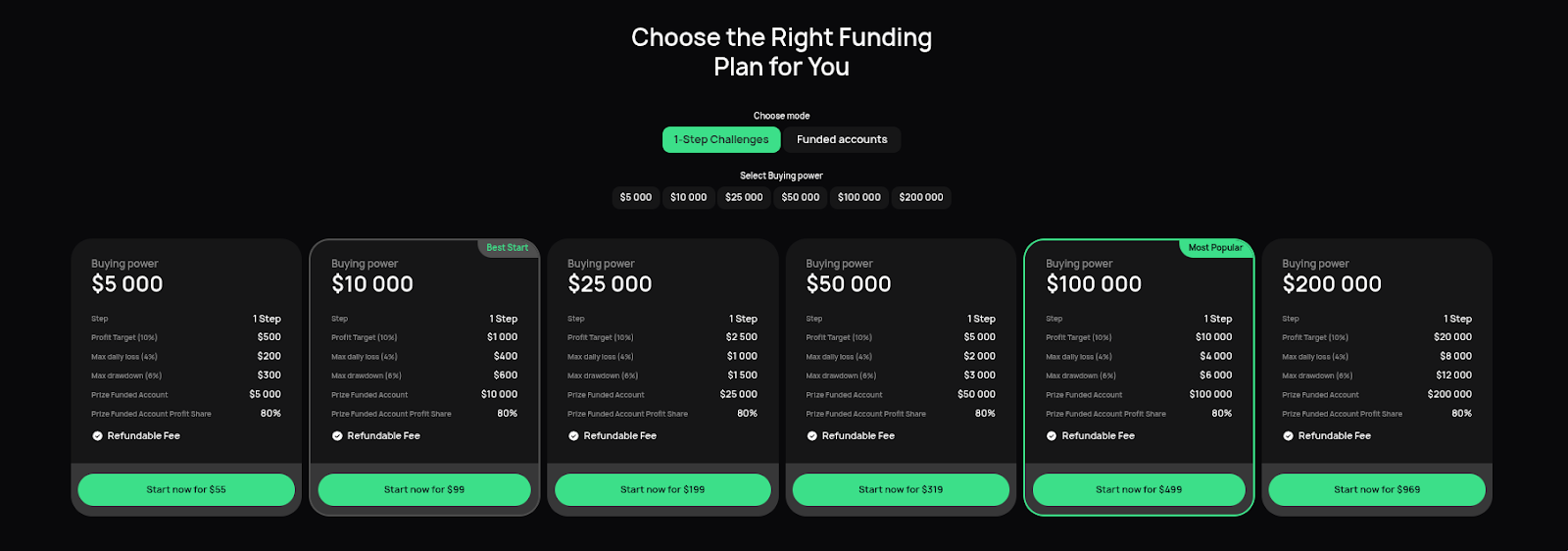

The 1-Phase Challenge

This is the classic route. You get a demo account, and your job is to grow it by 10%. Sounds simple, right? Not quite. You have got to stay within the risk limits, no blowing up your account on one wild trade.

Here’s the breakdown:

- You need to hit a 10% profit target.

- Daily loss can’t go over 4%.

- Total drawdown? 6% max.

- You have to trade for at least 4 days. No time limit.

Account sizes start at $10K and go up. Fees depend on the size, but they are not outrageous.

You can trade however you like, scalping, swing, or news events. Just don’t try anything shady like arbitrage or copy trading.

Once you pass, you get up to 90% of your profit splits, and payouts land monthly, usually on the 15th.

Instant Funding

No patience? No problem. Pay the fee, get the funded account and start trading. No challenge, no waiting.

But here’s the catch:

- No profit target, but you still have to manage risk.

- Max drawdown is 5%.

- Daily loss isn’t enforced, but 4% is the soft ceiling.

- No minimum trading days. You could trade once.

You have got two tiers, which are Intro and Pro. Fees vary and so does your profit split, anywhere from 65% to 90%. There’s a limit of $15K per month and payouts hit on the 15th.

TEFS Challenge Rules Comparison Table

| Rule / Feature | 1-Phase Evaluation | Instant Funding (Intro) | Instant Funding (Pro) |

| Profit Target | 10% | None | None |

| Daily Loss Limit | 4% | Suggested 4% | Suggested 4% |

| Max Loss Limit | 6% | 5% | 5% |

| Minimum Trading Days | 4 | None | None |

| News Trading Allowed | Yes | Yes | Yes |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

| Profit Split | Up to 90% | 65% | Up to 90% |

| Payout Frequency | Monthly (15th) | Monthly (15th) | Monthly (15th) |

| Best For | Strategic, patient traders | Fast starters, low risk | Experienced, high-volume |

Our Verdict on TEFS Challenge Types

At TEFS, the rules are clear, the payouts come on time and the profit split is better than most of the firms. The 1‑Phase Challenge is for traders who like structure. No time pressure, just targets and limits you can actually work with. If you are patient and disciplined, this one feels fair. Instant Funding is a different vibe. You pay in advance, skip the evaluation model and start trading. It’s quick, but the chain is shorter, the drawdown rules will catch you if you are reckless.

So which is better? Depends on you. If you are methodical, go with the challenge. If you are confident and want to skip the challenge model, instant funding makes sense.

TEFS Rules You Can’t Ignore

Once you get a funded account, you need to stick to the rules. TEFS isn’t just watching if you make money, they are watching how you make profit. If there are any confusions or violations then your funded account is gone.

- Consistency Rule: If you are trading 0.5 lots all week and suddenly drop a 5-lot position, that’s a red flag. They want steady risk.

- Inactivity Rule: Leave your account sitting too long and they will shut it down. Even a couple of small trades will keep you safe.

- No hedging games: You can’t go long on EUR/USD in one account and short in another. TEFS will catch that.

- No copy trading or arbitrage: TEFS wants your trades, not some bot or signal service.

TEFS Platform Access & Trading Conditions

Once you get a TEFS-funded account, the last thing you want is to deal with complicated software or unusual restrictions. TEFS keeps it pretty straightforward. You are trading on familiar platforms (think MT4/MT5 style), the data feed is live and execution feels close to what you would get with a decent broker.

A few things worth noting:

- Leverage goes up to 1:100, which is more than enough for most setups.

- News trading is allowed, so if you like catching those big moves around NFP or CPI, you are good.

- Account sizes range from small starter accounts to six‑figure balances.

- Risk rules don’t disappear once you are funded. Daily loss and max drawdown still apply, so you can’t just go wild.

- Strategic freedom is there. Scalping, swing, day trading, all fine, as long as you are not trying to violate the system with arbitrage or copy trading.

Our Take on Platform Access

Honestly, TEFS doesn’t complicate things. The prop firm is fast, the rules are clear and the conditions feel realistic. You can focus on trading instead of fighting the tech.

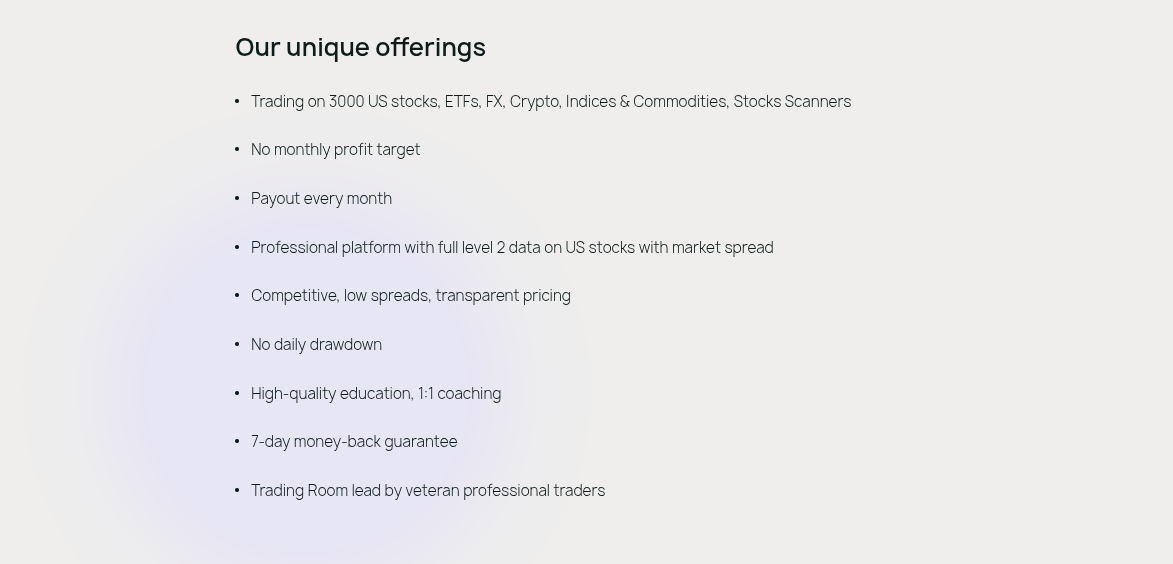

What Trading Instruments Can You Trade on TEFS?

One of the biggest advantages of TEFS is the variety. You are not stuck trading just forex pairs or a handful of indices, the instruments for trading in TEFS are wide enough to fit almost any style. That’s important because the more instruments you can access, the easier it is to stick to setups that actually make sense for you.

- Forex: All the majors, plus a good mix of minors and exotics.

- US Stocks: Over 2,500 names, plenty of room for stock traders and profit traders.

- Crypto: The big ones like BTC and ETH and a few others.

- Indices: S&P 500, NASDAQ, Dow, DAX, FTSE, the usual suspects.

- Commodities: Gold, silver, oil and other popular contracts.

Why it matters

Having this range means you can adapt. If forex is dead quiet, maybe stocks are moving. If equities are choppy, gold or oil might be trending. TEFS doesn’t box you in, you can shift gears without breaking the rules.

Our Take on Instruments Offered by TEFS

AT TEFS, trading instruments, the lineup is strong. Whether you are a scalper chasing quick moves in EUR/USD, a swing trader holding NASDAQ positions or someone who likes to ride momentum in Tesla or Bitcoin, TEFS has you covered. It feels like a real trading environment.

TEFS Payout Process and Reward System

At the end of the day, in any firm, payouts are what matter. TEFS keeps it pretty straightforward. You trade on a simulated account, but when you hit profits, you get paid with real money.

How it works

- Eligibility: You need to hit at least $400 in profit (or $200 if you are on an Intro account).

- Request Window: Payout requests are made by the 10th of the month.

- Payout Day: Payouts go out on the 15th, like routine.

- Profit Split: Depending on your funded account type, you will keep anywhere from 65% up to 90%.

- Cap: Instant accounts have a $15K monthly payout limit, while evaluation accounts don’t.

Processing Speed

TEFS is known for being quick. Once the payout date hits, funds are usually processed without any delays. The firm also covers outgoing fees, which is a nice touch.

Our Take on the Payout System

TEFS is clean, predictable and fair. You know exactly when you will get paid and the splits are among the best in the prop firm industry. Profit splits are good, up to 90% and they don’t play games with delays or hidden fees. It’s one of the more transparent systems out there.

TEFS Payout Eligibility - When Can You Request a Payout?

Alright, so you have made some profit. Now what? TEFS doesn’t make you wait forever to get paid, but there are some targets to finish first.

Here’s the deal:

- You need to hit at least $400 in profit if you are on a standard account.

- If you are on an Intro account, the threshold is lower. It’s just $200.

- You have to request your payout by the 10th of the month.

- Payouts drop on the 15th, as scheduled.

No unwanted delays. If you have hit the mark and followed the rules, you are good to go.

TEFS Scaling Plan

With TEFS, the journey doesn’t stop at your first payout. If you can stay consistent, the firm will actually increase the size of your funded account. Think of it as a reward for proving you can handle bigger funds offered by the firm, without careless mistakes.

Here’s the deal:

- Hit the profit target: Around 10% is the target and it needs to be earned without breaking any rules.

- Stay consistent: No wild swings between tiny trades and oversized positions.

- Keep the account active: Without any activities, your funded account won’t get you a scale-up.

Do these things right and TEFS will move you up the ladder. It’s not instant and it’s not automatic, you have to show you can treat the account like it’s your own money. Show discipline, and the firm will reward you with more profits. Simple as that.

How to Pass TEFS: Traders’ Tips to Passing It

Passing TEFS is not just a matter of luck. There is no one big trade that gets you through the finish line and being lucky is never a factor in passing. What the passing traders all say is: follow the rules, do not risk much, keep trading steadily.

Try to pull off that big trade to finish the challenge? That almost never works. Take your time, some good trades here and there, no rule-breaking and you will get there.

Final Words

The difficult part is the calmness. This calmness will give you the feeling that you have to take trades that are not worth it. It is in such instances that everything starts going down. Simply do these things: slow down and trade as if it were your own funded account. Be calm, have a plan and stick to it, then you will pass the TEFS challenges.

What Traders Say About TEFS

We have seen traders talking in prop firm forums and groups. Mostly, they say good things about TEFS. Rules are clear and payouts are made on time. Some say the profit target is difficult, but that is normal with respect to prop trading. The main thing is the firm gives funds to traders and on time.

TEFS Community

The TEFS community feels real. They share screenshots of their payouts, and they give each other advice and warnings against overtrading. This is not fake hype. It is people helping fellow members.

Is TEFS Trustworthy?

These firms are pretty well established. They do pay their traders with no strings attached. A few newer firms sometimes come and go. In that sense, TEFS seems to be more of a reliable option.

Is TEFS Worth It in 2025?

If you want to learn trading and grow your funded account, TEFS is well worth trying. The challenge is tough but fair. Trade steadily and wisely, and they will increase your capital.

Bonus Tip - Never Pay Full Price

Look for discounts or cash back. TEFS offers them every so often. Just don't pay full price if you can avoid it, all that extra money comes in handy.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict