Copy Coupon Code to Get

Up to 25% Off 🎉

.jpeg&w=1080&q=75)

Seacrest Markets

Forex, Crypto, Indices, Commodities, Energies

CY

2022

CEO: Kevin Warner

This firm is not listed on our Trusted or Affiliate list.

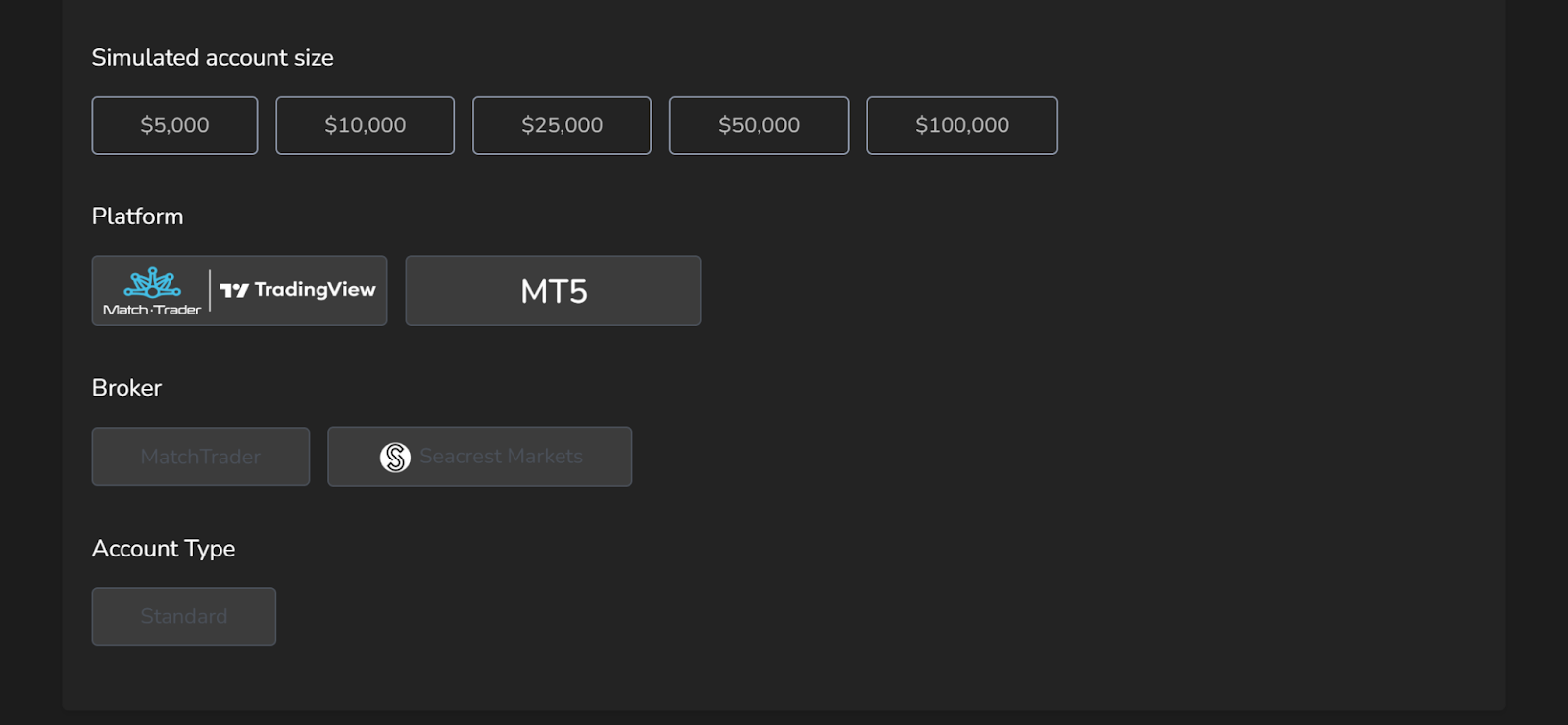

MatchTrader

Metatrader 5

Rise

Crypto

Crypto

Credit/Debit Card

Apple Pay

Seacrest Markets (PTY) Ltd

Seacrest Markets Evaluation Model Explained | 2025 Guide by The Trusted Prop

.jpeg&w=3840&q=75)

Seacrest Markets Evaluation Model Explained | 2025 Guide by The Trusted Prop

10/27/2025

Introduction

If you are considering a future funded trader challenge or a prop-trading opportunity in 2025, you may hear the name Seacrest Markets (or SeacrestFunded) increasingly often. This blog will break down the Seacrest Markets evaluation process; how it works, their rules, phases, scaling plan, profit splits, and tips for being successful.

If you are a forex trader, CFD trader, or a multi-asset trader, learning about the Seacrest Markets evaluation process can help you determine whether or not this is a process you would want to pursue. Let’s dive in.

What Is Seacrest Markets?

Seacrest Markets is a prop firm in which traders participate in simulated account challenges to qualify for a "live simulated" account with profit splits and scaling potential. According to their website, Seacrest offers up to $400,000 in funds during the evaluation process in simulated capital.

Some of the highlights regarding their service are

- Unlimited trading days - no set time to complete evaluation phases. The same is true for phase 1 completion (aka trial account).

- Allowable trading styles - no mandated style, but you must adhere to and respect risk objectives.

- Daily simulated loss limit and overall simulated loss limit policies.

- A scaling plan - successful traders can scale into accounts with up to $1M worth of simulated capital.

- Profit share splits (if you pass evaluation) are available in “net simulated gains” to be as high as an 80% split.

They endeavor to promote a model suitable for traders who seek a low time pressure style, freedom of style and scaling potential.

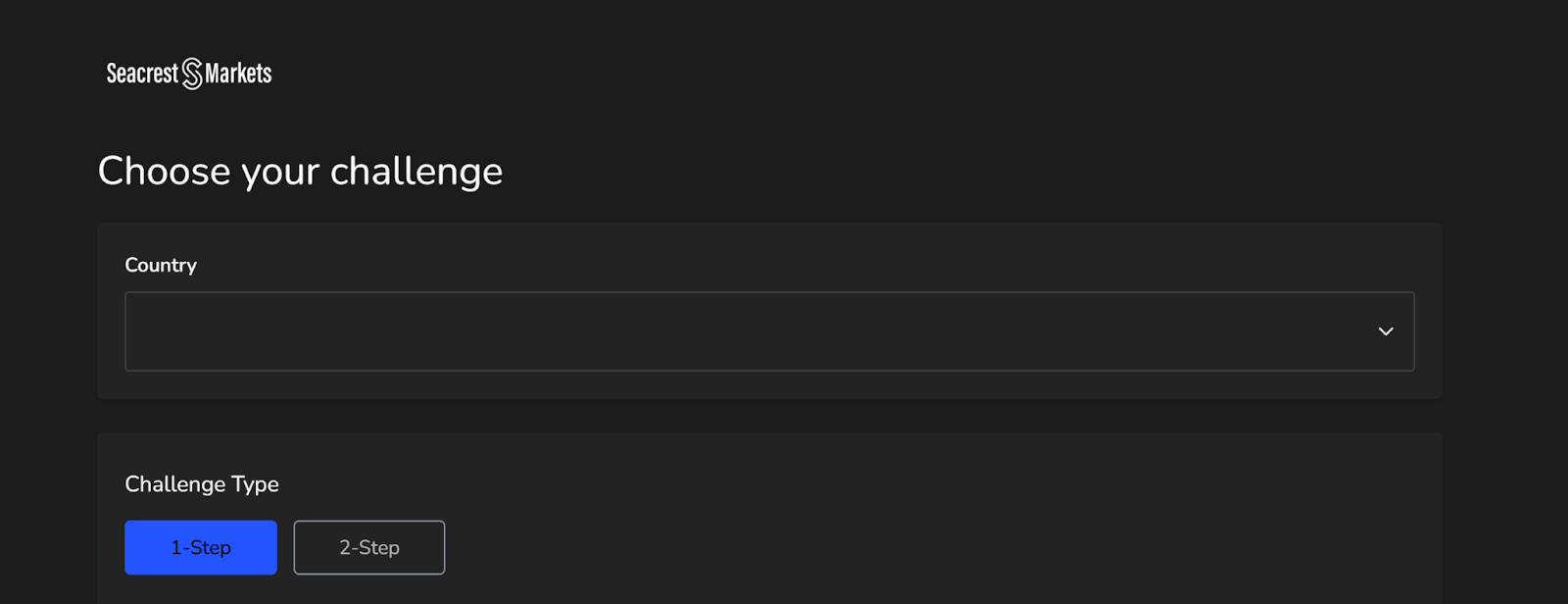

Evaluation Formats

The Seacrest market model formats evaluations into three phases. Each phase has its own rules, goals, and thresholds.

Phase 1: Challenge

- Traders select an account size (e.g., $5K, $10K, $25K, $50K, $100K)

- The Sim Gain Target is 8% of the account balance

- Rules include a maximum daily simulated loss of 5%.

- Overall simulated loss is limited to 8%.

- The minimum number of profitable days is 3 days - i.e. you must have 3 trading days (at least) with a profitable outcome.

- There is no time limit to complete the challenge - you can take as long as needed.

Once you have successfully finished all the required conditions, you will automatically go to Phase 2

Phase 2: Verification

- Sim Gain Target: 5% on the verification (comparison/confirmation) account.

- Daily 5% simulated loss limits are still in place.

- Overall simulated loss is still capped at 8%.

- Minimum profitable days remain 3.

- Days to complete verification are unlimited.

After successfully passing verification, you would qualify for Phase 3.

Phase 2: Live Simulated Trader (Scaling Account)

- At this point, there are no further profit targets - you have reached a "live simulated" environment and traded freely (within risk parameters).

- You must continue to adhere to the daily simulated loss and total simulated loss limits.

- Profit split: Commission is up to 80% of net simulated profit.

- Payouts every 14 days.

- You can scale up to a larger simulated capital (up to $1 million) through the scaling plan.

Thus, it sounds like the model has changed from performance targets to ongoing performance in a live simulated environment.

Account Sizes, Leverage & Fees

Account Sizes

Seacrest Market has a range of tiers available; these are typically $5K, $10K, $25K, $50K, and $100K for your evaluation accounts. How much you choose depends on your risk appetite and management of capital.

Leverage

The leverage here on all phases is 30:1. That's nice and moderate for forex / CFD trading and requires you to manage position sizing.

Registration/Challenge Fee

You'll pay a registration or challenge fee to take the challenge. For example, a fee of USD 50 is listed for small accounts. Always double-check the fees, though, prior to participating, as these will likely change.

Rules & Risk Management Breakdown

As mentioned earlier, understanding the rules is an important consideration in order to be successful in the Seacrest Markets evaluation. Here's a breakdown:

| Rule | Details |

| Daily Simulated Loss Limit | If losses in a day exceed 5% of the initial balance, you fail that phase. |

| Overall Simulated Loss Limit | Maximum drawdown of 8% across the life of the phase. |

| Minimum Profitable Days | Must have at least 3 separate profitable days. |

| Trading Period | Unlimited - no fixed deadline to complete the challenge or verification. |

| Trading Style | No style restrictions (e.g. scalping, swing, day trading allowed) as long as rules are respected. |

It is significant to note: All accounts are simulated/demo accounts, even during the "live simulated" phase. There is no real capital at risk, on your side or theirs. Also, they make a disclaimer that it is clearly noted that this is not investment advice and that leveraged products carry risk.

Scaling Plan & Profit Splits

A notable takeaway from Seacrest Market is their scaling plan and attractive profit splits:

- Upon passing Phase 2, you will begin trading a live simulated account with a profit split of 80% on net simulated gains.

- The gains will be payable every fourteen days.

- If you continue to be consistent, you may be able to scale it up to larger simulated capital (reportedly up to $1 million).

This system is much more geared toward long-term consistency rather than explosive short-term performance.

Pros & Cons of the Seacrest Markets Model

Pros

- You won’t feel under any time pressure during phase evaluations - trade at your own pace.

- Flexibility in style - you are not tied to a single methodology.

- Once you are funded, an 80% split of profits is very good.

- Established risk parameters you can work with (5% daily, 8% overall).

- Ability to scale up to $1M of simulated capital.

Cons

- All accounts are simulated, and you are never trading actual company capital.

- You are not refunded the registration fee/entry cost if you fail.

- The limits of strict risk parameters can hurt in the event of one bad day.

- Some jurisdictions will restrict you (e.g., U.S., Russia, etc.).

- It is still a viable account to become funded, you will still need solid trading skills and discipline to pass the phases and maintain performance.

Tips & Methods to Pass the Evaluation

Here are some practical examples to enhance your chances of success:

- If you are unsure, start with a smaller account size - it takes fewer pips to meet the gain target.

- Be firm with your daily loss limit - do not risk more than the amount that will put you over 5%.

- Focus on making the target consistently - spread the profit to another day to help justify the minimum profitable day clause.

- Utilize very low drawdown strategies - do not be too aggressive with your entries.

- Track and review every trade - maintain a trading journal.

- Don’t overtrade after a winning day - we always want to press the gain and the challenge stays riskaverse.

- Again, stay emotionally disciplined through losing streaks - remember, your edge is consistency.

- Make sure you know the rules well before starting - mistakes like violating the rules often end in a non-negotiable failure.

Is Seacrest Markets Right for You in 2025?

If you are a trader who values independence, would prefer no deadlines, and wants a high profit split structure, a funded evaluation model from Seacrest Markets may be perfect for you. The unlimited time and scaling component fit well with disciplined and patient traders.

However, if you would prefer real capital deployment, no demo model, or simply want a quicker turnaround, then another firm may fit your needs better. Always read the fine print, know if it is right for you, and compare it with a demo and funded account model for comparisons to others.

Conclusion

Seacrest's Funded evaluation model is like a road map comprising three stages for achieving trading success which is consistent. The way it is designed with rules, small profit goals, profit sharing up to 80% and an increase plan, it is really a remuneration system for traders who are disciplined. Keeping up with the advice, being in control of the risk, and using this model would be the best way to increase your capital in the simulation account in a safe manner.

Claim Your Funded Trader Account - Pass the Evaluation with the help of The Trusted Prop

Boost Your Trading - Join the Seacrest Markets Community Today!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict