Copy Coupon Code to Get

20% Off 🎉

R u The 1

Forex, Crypto, Indices, Commodities, Metals, Energies

GB

2024

CEO: Eli Shirazi

Coupon Code:

cTrader

Crypto

Wire Transfer/ Bank Transfer

PayPal

Rise

Crypto

Wire transfer/ Bank Transfer

R U The 1 Review 2025: Challenges, Rules, Payouts & Trader Insights

R U The 1 Review 2025: Challenges, Rules, Payouts & Trader Insights

10/7/2025

Introduction

Ever stumbled upon a prop firm name that makes you stop for a second and go, “Wait, what?” - well, that is exactly what happened with R U The 1. The name sounds like a challenge in itself and fittingly so - because this firm is trying to carve a bold space in the prop trading world. But catchy branding aside, traders want to know the real deal:

Are their challenges fair? Are payouts reliable? And most importantly - is it worth your money and time in 2025?

That is exactly what we are breaking down here - from their evaluation models and rules to payouts, platforms and community trust- so you can decide whether this firm is worth your time and money.

About R U The 1 Prop Firm

R U The 1 is a broker-backed prop trading firm that allows traders worldwide to manage large capital accounts by proving their skills through structured challenges. Instead of risking personal savings - traders get a chance to access firm funded accounts once they clear evaluations.

The company markets itself around discipline, consistency and opportunity - offering funded account models that appeal to both aggressive and steady traders. According to community chatter - their approach to drawdowns and scaling is where they stand apart - not the loosest rules in the industry, but also not overbearing with restrictions.

By 2025, they have been growing steadily - attracting both forex enthusiasts and futures focused traders - plus a fair share of crypto scalpers testing their waters.

Here are the key facts about R u The 1 prop firm - laid out clearly:

R u The 1 operates under the legal name - R1 London Ltd; registered in the UK with the legal registration No. 16109046. R u The 1 was founded in the year 2024 and is led by the CEO Eli Shirazi. R u The 1 offers funded accounts from $5,000 up to $100,000 initially; possibility to scale up to $400,000+ based on performance. The 80% of profit split is given to the traders which is generous compared to many other prop firms. The firm supports trading markets like Forex, Indices, Metals, Energies, Cryptocurrencies while offering platform access to cTrader (Windows, Mac, Web, iOS, Android).

R u The 1 Evaluation Models & Challenges Explained

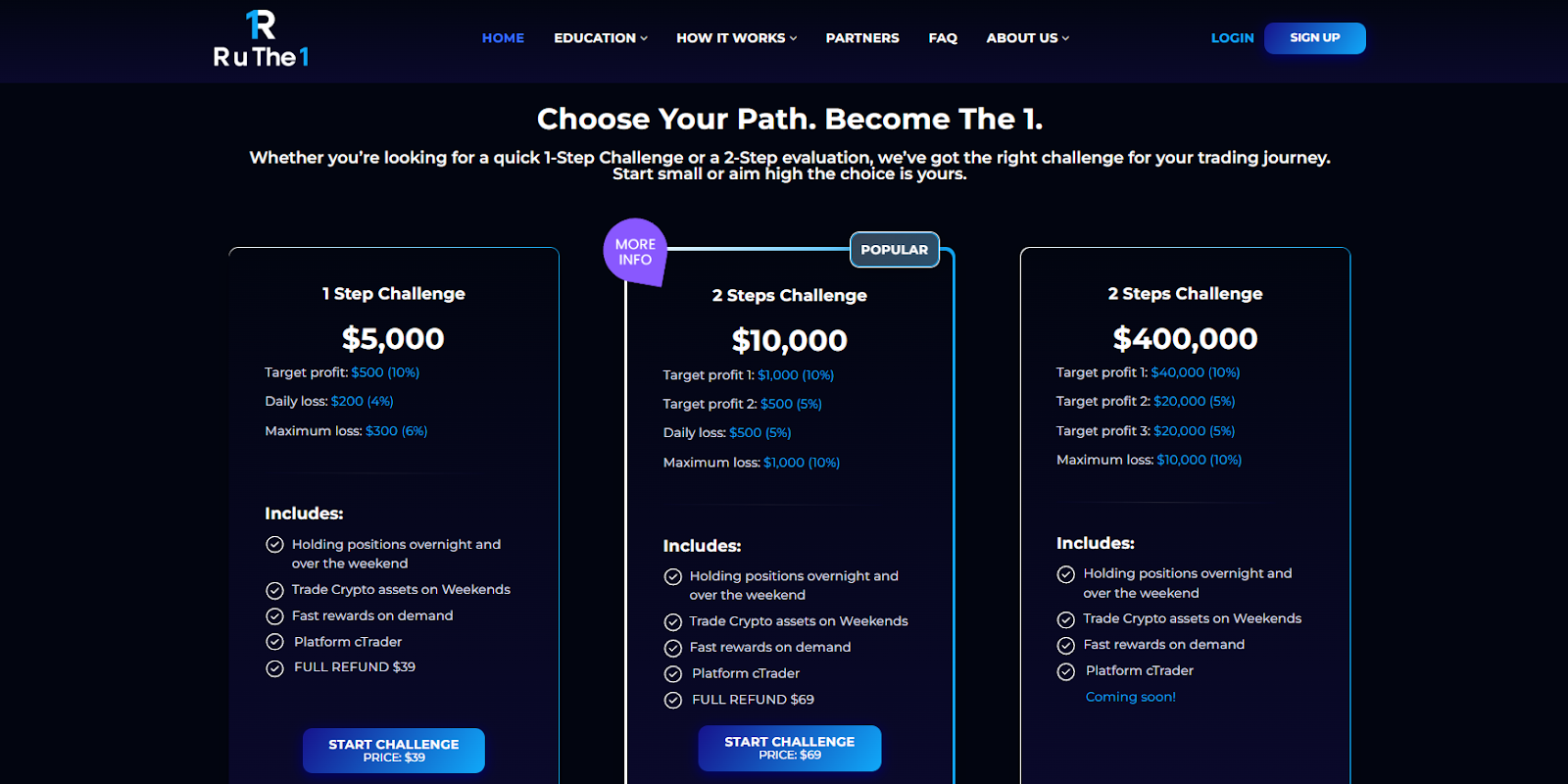

To fund a trader, R u The 1 has set two types of challenge models to test the trader's skills. You have options to choose from depending on your trading style: whether you prefer to prove yourself in a single step or take a phased approach.

Types of Challenges offered by R u The 1 prop firm

R u The 1 offers 1-Step and 2-Step challenges. Below are more detailed breakdowns of each challenge including their rules, advantages and things to watch out for.

1-Step Challenge

The 1-Step Challenge is designed for traders who want a more direct path to getting funded. There is only one phase to clear - hit the profit target while staying within drawdown limits and minimum trading days. No strict time limit - although inactivity of 30 days can cause account closure.

Details:

- Profit Target: 10%

- Daily Drawdown Limit: 4% of starting or entry equity.

- Max (Total) Loss / Drawdown Limit: 6%.

- Minimum Trading Days: 5 days.

- Time Limit: There’s no fixed deadline to hit the target, but if you remain inactive for 30 days, your account may be closed.

- The Challenge fees vary depending on account size; e.g. smaller accounts cost less, bigger ones more.

2-Step Challenge

The 2-Step Challenge splits the evaluation into two parts (Phase 1 & Phase 2). You complete Phase 1 by hitting its profit target under certain drawdowns, then Phase 2 to receive funding. This gives more buffer and opportunity to adjust your trading strategy between phases. Great for traders who prefer more gradual pressure.

Details:

- Phase 1 Profit Target: 10%

- Phase 2 Profit Target: 5%

- Daily Drawdown: 5%

- Max (Total) Drawdown: 10%

- Minimum Trading Days: 5 days per phase

No fixed deadline to finish phases, as long as you stay active (avoid 30-day inactivity).

R u The 1 Challenge Types Detailed Comparison Table

| Challenge Type | Profit Target | Daily Loss Limit | Max Loss Limit | Min Trading Days | News Trading | Leverage | Profit Split | Payout Frequency | Best For |

|---|---|---|---|---|---|---|---|---|---|

| 1-Step Challenge | 10% | 4% | 6% | 5 | Allowed (with some limits) | 1:50 for Forex, 1:25 for Indices/Metals/Energies, 1:2 Crypto | 80% | On-demand once ≥ US$150 profit in closed trades | Traders confident in their risk control, those preferring speed |

| 2-Step Challenge | Phase1: 10% / Phase2: 5% | 5% | 10% | 5 days per phase | Allowed (with some limits) | Same as above | 80% | On-demand once eligible (US$150 min) | Traders who prefer phased tests, conservative style |

Our Verdict on R u The 1 Challenge Accounts

R u The 1 gives traders a good degree of flexibility: No rigid overall time limit (just inactivity rules), sensible minimum trading days and two different paths to funding depending on risk appetite. The drawdowns are neither ultra-strict nor too loose - they manageable if you are disciplined.

The challenge fees are competitive for what you get (especially compared to some firms with similar profit targets but stricter time limits or harsher drawdowns). The standard profit split offered by R u The 1 is 80% which is generous for traders who are looking to get more share of the profits they make.

For those who trade very short term (scalping, HFT) or need MetaTrader, this firm may not suit due to strategy restrictions and platform choice.

R u The 1 Rules to Keep in Mind

When you get a funded account or trading during the challenge phase - there are several rules you must obey. These are meant to ensure fairness, risk control and long term viability - not to catch you off guard.

Just because the firm offers flexibility doesn't mean there are no boundaries. Knowing the rules ahead of time is crucial because breaking them can void your profits or even close your account. We have listed key rules set by R u The 1 prop firm below:

Trading Consistency Rules

- No scalping or ultra short term trading strategies (these are disallowed).

- No high frequency trading (HFT).

- If using EA or algorithmic tools then they must mimic human behaviour (i.e. not clearly mechanical “painted” bots).

Copy trading is allowed only from your own accounts. Sharing signals / accounts / unauthorized access is strictly prohibited.

Inactivity Rule

- If your account is inactive for 30 consecutive days then it may be closed. Staying active (placing trades on at least some days) ensures your challenge or funded account remains valid.

R u The 1 Platform Access & Trading Conditions (2025 Guide)

Understanding where and how you will trade is essential. Platform, leverage, spread and execution all affect your real performance - not just what the rules say.

R u The 1 prop firm has chosen cTrader as its sole trading platform with transparent trading conditions. Below are details on leverage, order size, spreads and other conditions.

R u The 1 supports cTrader trading platform which is available on Windows, Mac, Web, iOS, Android.

Below are the Leverage offered by R u The 1 prop firm:

- Forex: up to 1:50

- Indices / Metals / Energies: 1:25

- Cryptocurrencies: 1:2

While theMax lot size offered by the firm goes up to 50 lots across all assets. While the spreads are tight and competitive - they are realistic and not inflated. Real-market spreads are used by R u The 1 prop firm.

As far as trading conditions go - R u The 1 allows you to hold positions overnight, over weekends, trade through news events (with some limitations).

Our Verdict on Platform Access Supported by R u The 1

Having cTrader only might be a downside if you are accustomed to MT4/MT5 or other platforms. But cTrader is solid - modern interface, good execution speed and cross-platform compatibility. The leverage choices are reasonable; not overly high (which encourages risk control). While spreads being realistic is a big plus - it helps traders to avoid hidden cost surprises. Overall, the trading environment offered is clean, fair, and trader-friendly, especially for those who value transparency and consistency.

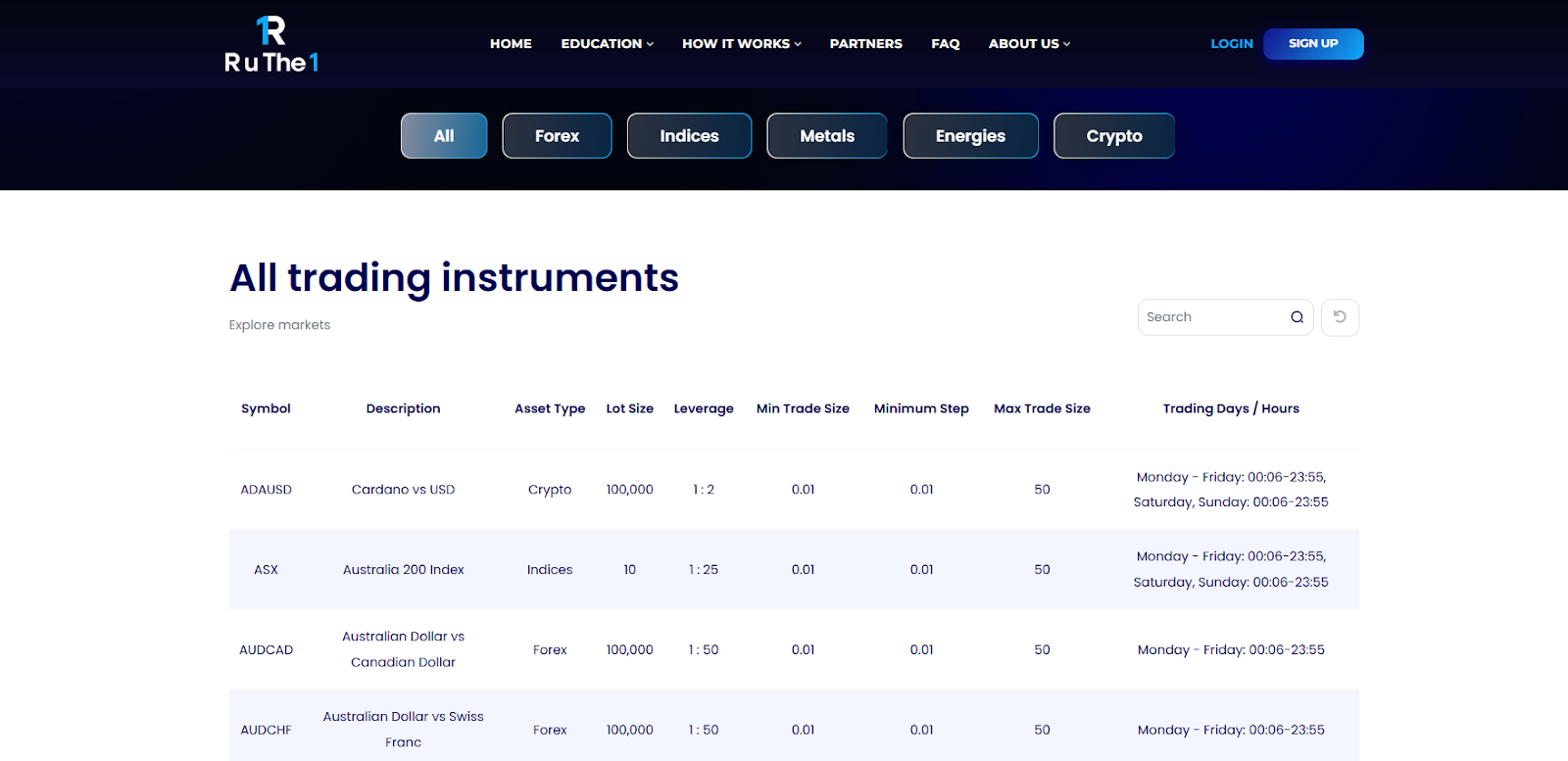

What Trading Instruments Can You Trade on R u The 1?

Knowing the markets you can access matters because some trading strategies depend on specific trading instruments. R u The 1 prop firm supports a broad variety of instruments - so you are not limited to just FX or crypto. That gives room for diversification and strategy flexibility.

Below are the trading instruments supported by R u The 1 prop firm:

- Forex: Major & minor currency pairs.

- Indices: Global indices are available (though the exact list may depend on the region / broker arrangement).

- Metals: Precious metals like gold and silver.

- Energies: e.g. oil ‒ energy markets are supported.

- Cryptocurrencies: but note leverage for crypto is very low (1:2) to reduce risk.

Our Verdict on Trading Instruments Offered by R u The 1

The diversity of instruments is solid - you can test strategies across FX, indices, metals, energies and crypto. The low leverage in crypto is prudent; these markets are volatile. If you mainly trade crypto then you will need to adjust your risk expectations. If you like to trade news driven moves, indices or FX around economic events then this setup allows that (subject to their news trading rules).

Overall, a good mix - not perfect for ultra-niche instruments but more than adequate for most serious prop traders.

R u The 1 Payout Process and Reward System (Explained Simply)

Let's break down how you get paid at R u The 1 prop firm - what you need to do and how the reward system works.

Getting funded is just the first step - knowing how payouts work and what rewards/freedom you get once funded separates a good prop firm from a great one.

Payout Eligibility: You must have at least US$150 in closed simulated profits (i.e., profitable trades in challenge mode).

All closed trades count; open ones don’t count toward the profit requirement.

Profit Split: Once funded - you get 80% of profits while R u The 1 retains 20%.

Payout Methods: They offer multiple withdrawal options - credit/debit cards, crypto, PayPal and Rise.

- Payout Frequency: On-demand - you don’t have to wait for monthly or fixed cycles. Once you meet eligibility, you can request withdrawal.

R u The 1 Payout Eligibility: When Can You Request a Payout?

After you are funded and have closed trades amounting to at least US$150 profit. All account rules must have been respected (drawdowns, strategy restrictions, inactivity etc.) with no violations.

R u The 1 Payout Conditions by Account Type

Whether you did the 1-Step or 2-Step challenge, the payout eligibility conditions largely remain the same from the firm’s published info: US$150, closed trades, and abiding by the trading rules. Some specific rule violations (e.g. using disallowed strategies) can nullify payout eligibility.

How Fast Are R u The 1 Payouts Processed?

Once you request, the payout is on-demand. That means as soon as you meet requirements and place the request, they process it rather than waiting for monthly windows. Processing times will depend on method (cards, crypto, PayPal etc.), but they emphasize flexibility and speed.

R u The 1 Scaling Plan

If you want to grow beyond your initial funded account - R u The 1 provides a path. But it is not an automatic or fixed timeline. They look for trading behavior - not just raw profit.

Key criteria: consistency, sound risk management, avoiding large drawdowns, steady account growth without overtrading.

If these criteria are fulfilled then they may increase your funded capital up to ~US$400,000+ across accounts.

How to Pass R u The 1: Pro Tips from Real Traders

Here are strategies drawn from trader-reports + analysis, to help you clear the challenge and do well after funding:

1.Trade with disciplined risk control. Daily drawdowns are tight, so never let one or two trades jeopardize those limits.

2.Stick to at least 5 distinct trading days early on. Don’t rush; ensure you’re showing activity consistently rather than bulk trades in one or two days.

3.Keep position sizing reasonable. Especially in crypto (lower leverage) and avoid large multiple-lot trades that blow daily drawdowns.

4.Avoid prohibited strategies. No scalping, no ultra HFT, no grid systems – adhere to the allowed strategy set.

5.Watch inactivity. Ensure at least one trade in every 30 days or your account may be closed.

6.Monitor news events carefully. News trading is allowed “with some limits” -know those limits in advance to avoid being flagged.

7.Focus on steady growth rather than over-aggressive profit chasing. Scaling depends on behavior, not just raw returns.

Final Words: You Got This

Joining a prop firm isn’t just about making money - it’s about proving consistency, discipline and understanding risk. R u The 1 seems built for traders who think long term, want fair conditions and don’t believe in shortcuts. If you align with that then you have a strong chance of doing well at R U The 1 prop firm.

Real User Feedback & Trust Factor About R u The 1 Prop Firm

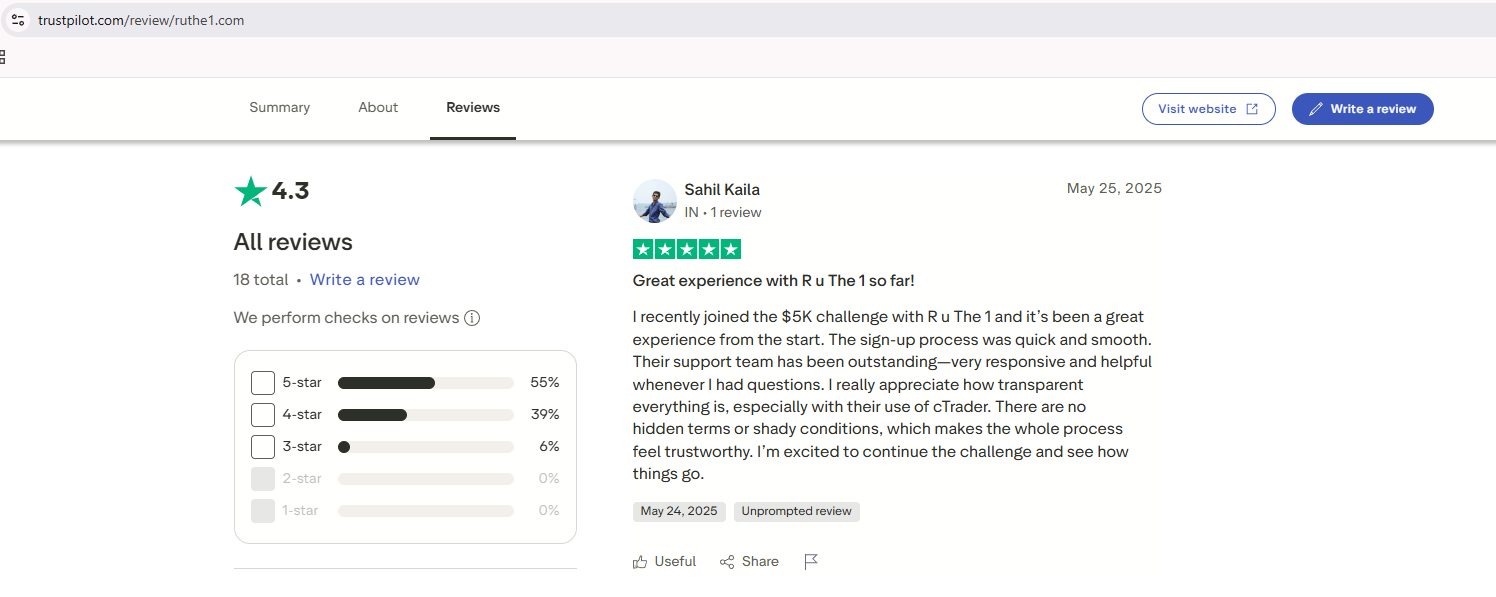

As per recent sources, Trustpilot rating of R u The 1 is about 4.2/5 based on ~18 user reviews. This isn't a huge sample size, but positive. The reviews are quite minimal given that the firm was launched in late 2024.

Nonetheless, the community feedback highlights transparency in rules, realistic drawdowns and helpful support. Some complaints from those who tried scalping or ultra short-term strategies and got flagged.

No major scandals found so far (as of mid‐2025). Regulatory status is UK registration - which adds credibility.

What We’re Seeing Across the R u The 1 Community

Traders who like methodical, swing / news-event style strategies are doing well. Those expecting super high leverage or extremely short-term trading are often disappointed, especially when trying to push the boundaries of allowed behavior. Many traders have shared that the payout process and profit split is transparent and trader-friendly - once you are in then you really get a fair share of profits hassle-free.

Should You Trust R u The 1?

Yes - but with caution and clarity.

If you abide by the rules, respect risk limits, and are okay with moderate leverage while looking for fairness over hype then R u The 1 appears to be one of the better newer prop firms in 2025.

If instead you want to do super aggressive scalping, or instantly huge leverage in crypto, this firm may not fit. Also, if your country is restricted or you are used to MT4/MT5 only, these are roadblocks.

Final Verdict: Is R u The 1 Worth It in 2025?

Short answer: Yes, for many traders.

R u The 1 offers a solid balance - fair challenges, good profit split, a supportive environment and real scaling potential. It’s particularly well suited to disciplined, consistent traders who want to grow methodically.

If you match that profile, R u The 1 is likely worth your time and fee. If you don’t, the mismatch in trading style or expectations may lead to frustration.

Bonus Tip: Stay Updated on The Trusted Prop for Discount Offers and Cashbacks

When signing up for their challenge, keep an eye on The Trusted Prop for latest verified coupon codes, discount offers or cash-backs for challenge fees. These can reduce cost, improving your risk-to-reward from the start.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict