Copy Coupon Code to Get

Up to 25% Off 🎉

OneFunded

Forex, Crypto, Indices, Metals, Stocks

GB

2024

CEO: Anastasiia Kaplunenko

Trade Locker

Crypto

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

Liquidity Providers

TradeLocker

OneFunded Trading Rules: Drawdown Limits, Leverage and Restrictions | The Trusted Prop

OneFunded Trading Rules: Drawdown Limits, Leverage and Restrictions | The Trusted Prop

11/12/2025

Introduction

If you want to join a prop firm like OneFunded and get paid for trading, you need to clearly know about OneFunded trading rules. Such rules include drawdown limits, leverage, account restrictions, etc. In this article, we provide a very easy explanation of the OneFunded rules, so you can start trading.

What is OneFunded?

OneFunded is a prop firm that offers funded accounts to traders who complete a challenge. Through OneFunded trading rules, you can trade with virtual capital and receive real profits. The OneFunded funded account program allows you to trade numerous assets and the OneFunded payout structure rewards traders for their successful trading. Therefore, it is essential to understand the OneFunded account rules.

OneFunded Trading Rules

Before you can start a OneFunded challenge, it is important you know the OneFunded drawdown limits, OneFunded leverage, and OneFunded restrictions on trading style. The OneFunded trading rules protect both you and the firm. It allows you to minimize risk while also establishing exactly what you are allowed to do and what you are not allowed to do with your OneFunded funded account.

OneFunded Drawdown Limits

An important component of OneFunded trading rules is the drawdownlimit. This is the maximum amount of money you can lose in a particular period against your account or capital. If you violate these drawdown limits, you may lose your challenge or funded account.

For example:

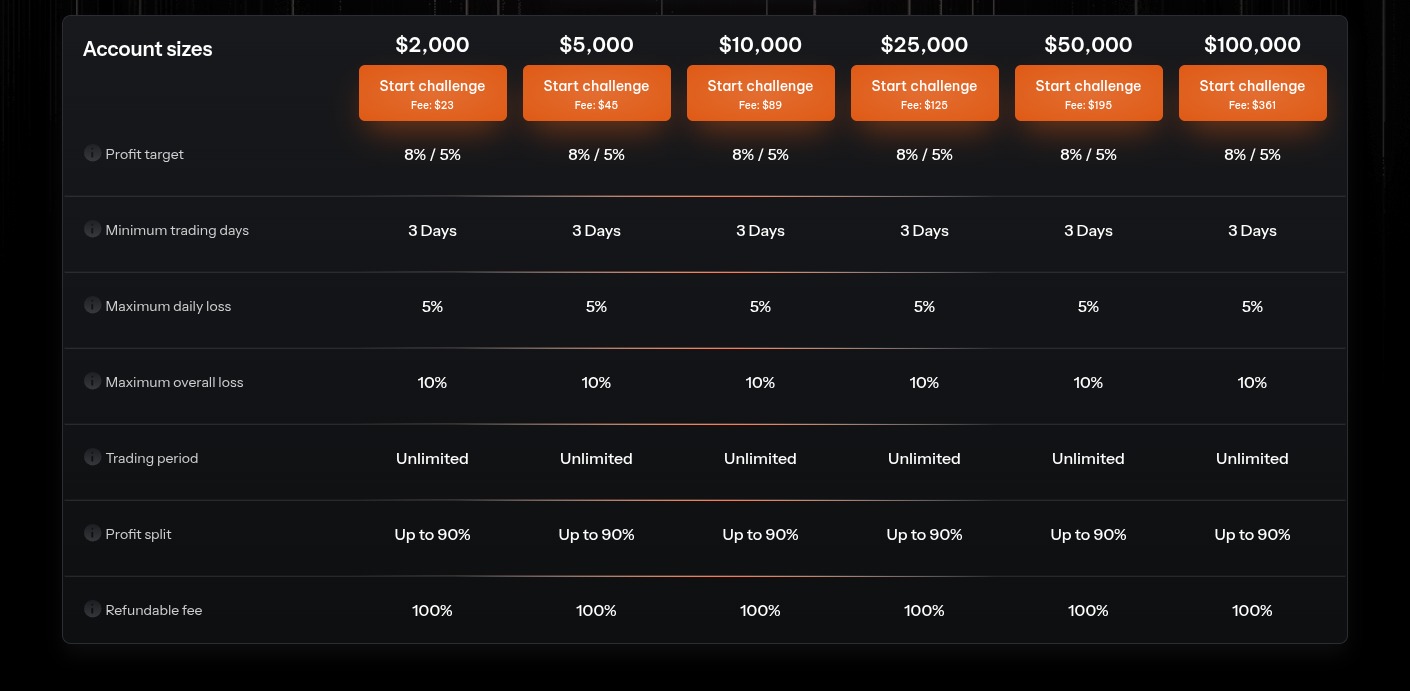

- OneFunded sets clear and specific drawdown limits to help traders to manage risk effectively. These include a daily drawdown limit (maximum loss allowed in a single day) and a total drawdown limit (overall loss limit for the account).

- To protect your OneFunded funded account, it’s important to follow these limits strictly. Staying within OneFunded’s drawdown rules helps you trade smarter, use stop-loss strategies effectively and maintain strong risk control.

OneFunded Leverage

provides you the ability to select larger trades without using more equity, but more leverage equals more risk. OneFunded will have a maximum leverage for your funded account and following the OneFunded leverage limit is important. You should find a way to check the OneFunded account rules for clear leverage numbers on various asset classes (forex, stocks, crypto).

Yes, when you are trading your funded account under OneFunded, you can't exceed the allowed OneFunded leverage. If you go over OneFunded’s leverage limit, you could break their rules and lose your funded account.

OneFunded Trading Restrictions

In addition to drawdown limits and leverage caps, OneFunded has additional rules, that is OneFunded restrictions, that define how you are expected to trade.

These include:

- OneFunded has payout rules on the minimum number of trading days before you can accept a payout.

- Your OneFunded account may only allow certain instruments like forex pairs, stocks or crypto. There may also be rules such as no scalping or holding trades overnight without permission.

- OneFunded account size rules: You choose a OneFunded account size as your challenge (e.g., $10K, $25K) and you will need to follow the OneFunded challenge rules.

- OneFunded profit split rules: you earn profit, you get a larger share according to OneFund payout terms if you play by OneFundedTrading rules.

By following OneFunded restrictions, you are ensuring compliance and being eligible for payouts.

OneFunded Trading Rules

These are some simple rules to follow the OneFunded trading rules and become successful:

- Read and understand the OneFunded challenge rules and OneFunded account rules completely before you start trading.

- Know what your drawdown limits are - both daily and total drawdown. When you know those limits, you treat your trades accordingly.

- Use proper risk management; don't risk the full account all at once. Respect OneFunded risk management and the OneFunded drawdown limits.

- Use the allowed leverage only. Don't go over the OneFunded cap on leverage.

- Follow the requirements: trade allowed instruments, trade minimum days, follow OneFunded funded account rules.

- Track your progress and make sure you are within OneFunded drawdown limits, OneFunded leverage limits, and OneFunded restrictions.

- Once you pass the challenge you unlock your funded account and the OneFunded profit split and payout

.jpeg)

Why Are These Rules Good For You?

While the OneFunded trading rules may seem strict. But these rules help you while trading. The drawdown limits force you to trade with discipline and save the capital. The leverage cap keeps risk under control. Restrictions help make sure you are trading responsibly and preserving OneFunded funded accounts. Following the OneFunded rules, you build the habits of a professional trader to maximize your chances of passing the challenge, earning profits, and getting a payout from OneFunded.

Conclusion

If you are thinking about joining OneFunded, please take the OneFunded trading rules seriously. Truly understand the OneFunded drawdown limits, respect the OneFunded leverage cap and stick to the OneFunded restrictions. When you move away from the usual way, problems are more likely to happen. Next time. Remember, the better you follow these rules, the higher your chances of getting a funded account and earning payouts from OneFunded.

Want to master the prop firm? - Head to The Trusted Prop, turn your trading skills into real funded profits!

Read the full OneFunded trading rules guide - Take your first step toward financial freedom!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict