Copy Coupon Code to Get

20% Off 🎉

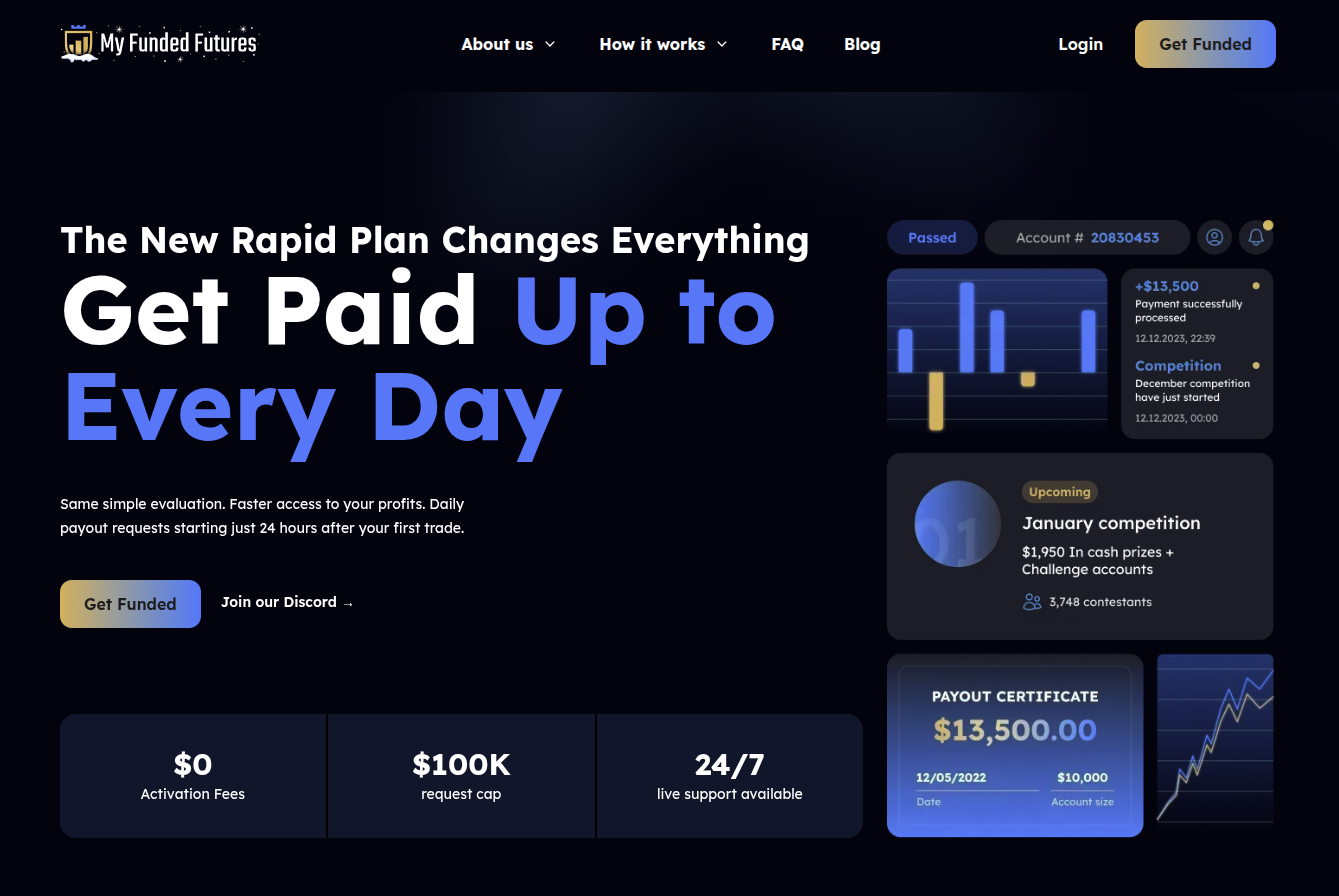

My Funded Futures

Forex, Futures, Stocks, Crypto

US

2023

CEO: Matthew Leech

50% OFF on Pro + 20% OFF on Rapid + Upto 1200 Trust Points

Coupon Code:

Tradovate

Ninjatrader

QuantTower

Trading View

Rise

Credit/Debit Card

Visa

Crypto

Tradovate

Rithmic

My Funded Futures Drawdown Rules Explained (2026 Guide)

.jpg&w=3840&q=75)

My Funded Futures Drawdown Rules Explained (2026 Guide)

2/2/2026

Introduction

Starting your career as a professional trader with My Funded Futures requires a clear understanding of the firm’s futures trading rules and drawdown limits. Among all the prop firm rules, the My Funded Futures drawdown rules are the most important - as they determine how much risk you can take and whether your funded account remains active.

My Funded Futures drawdown rules define the maximum amount a trader can lose in a day or overall before their funded account is disabled. These limits vary by account type and include intraday, end-of-day trailing, and static drawdown models. These drawdown rules are designed to encourage traders to use proper futures trading risk management, helping them to stay consistent, avoid account violations and trade sustainably over the long term.

Whether you are in the evaluation phase or already trading a funded account - understanding how drawdown limits work is essential for securing payouts. For a complete overview of the My Funded Futures prop firm, its account types, rules and payout structure - then you can also read our detailed My Funded Futures Review 2026.

About My Funded Futures

My Funded Futures is a prop firm that supports traders by providing trading capital in the futures market.

The firm provides a variety of evaluation plans like the Starter and Expert plans. Traders need to demonstrate through an evaluation that they can handle trading in funded account within risk limits like drawdown limits, trading instructions and payout conditions. After passing, you can switch to a funded account where you can trade with simulated capital and make real profits. But before requesting payouts, you need to understand the trading rules of My Funded Futures to successfully withdraw profits and grow as a funded futures trader.

Let us dive deeper into, how My Funded Futures drawdown limits and other trading conditions work.

What Are My Funded Futures Drawdown Rules?

During the challenge phase, My Funded Futures imposes daily loss limit and maximum drawdown limit, besides other trading restrictions. The MFFU drawdown rule is one of the main reason traders fail their account not because the rules are strict but rather because traders often fail to adhere one of the either.

My Funded Futures implements these rules to limit the risk that traders may take. When your account balance reaches the drawdown level, your account will be closed.

| Feature | Description |

|---|---|

| Max Drawdown | The total amount you can lose before account closure |

| Daily Loss Limit | The maximum you can lose in a single trading day |

| Breach | What happens if you hit these limits - account fail |

By knowing exactly where your drawdown line stands then you can trade with confidence and keep your funded account safe while you focus on your profit targets.

My Funded Futures Intraday vs End-of-Day Drawdown

My Funded Futures calculates drawdown in two principal ways. Whether you are doing a single trade or multi day trading depends on which account type that you select.

Intraday Drawdown

This goes up continuously as your profit goes up during the trade. So if you are winning $500 and then the price goes down, the drawdown limit stays at the highest level. This is applied to some type of My Funded Futures evaluations.

- How it works: Drawdown level rises based on the highest unrealized profit you can achieve.

- The Risk: Imagine that you are $2,000 up on a trade but you do not close it and then the price reverts back. Your drawdown limit will stay at that high point. You can get into trouble even when you are still in profit.

- Example: When you are trading the Rapid Plan, if a single trade reaches a maximum profit, the drawdown limit follows that maximum instantly.

If you want to track My Funded Futures trailing drawdown in Tradovate account, follow the procedure mentioned in the official website of My Funded Futures FAQ.

End-of-Day (EOD) Drawdown

The My Funded Futures EOD Drawdown works different from Intraday Drawdown. The value changes only after the close of a trading day. It considers the account balance when the market closes. Generally, it is easier for the traders as it does not fluctuate when you are trading.

- How it works: The system only checks your balance once daily at market close (5:00 PM EST).

- The Benefit: Let's say you are in a trade and the market goes against you for a short period, then it won't increase your drawdown. Only your total daily profit at the end of the day will move the limit upward.

- Example: Starting with $50,000 and making $1,000 today, your drawdown limit only moves up after the market closes.

My Funded Futures Daily Loss Limit & Max Drawdown Rules

In order to be a successful futures trader, you need to know these drwadown rules that keeps your funded account safe: the daily loss limit and the maximum drawdown limit.

It is very important to choose the right My Funded Futures account based on your trading style and risk apetite. My Funded Futures offers different evaluation plans each of these accounts comes with different drawdown rules. Below are the details My Funded Futures account drawdown rules.

| Account Plan | Drawdown Type | Risk Level | Best For |

|---|---|---|---|

| Flex (Starter/Expert) | End-of-Day (EOD) | Low (Safe) | Beginners & Swing Traders |

| Rapid Challenge | Intraday (Real-time) | High (Strict) | Fast Scalpers |

| Pro Challenge | Trailing to Static | Medium (Professional) | Professional and consistent traders |

Each My Funded Futures account comes with these two primary safety nets – Daily Loss limit and Maximum Drawdown.

How Trailing Drawdown Works in My Funded Futures

Trailing drawdown means that it follows your profit. So, whenever your account balance increases, the minimum balance that you are required to stay above also increases. The trailing drwadown is the max drawdown limit, which is applicaple on My Funded Futures Pro account.

Quick example:

• Suppose that your account is originally $50,000 and your drawdown limit is $2,000, then your fail point would be $48,000.

• If your account increases to $52,000, your fail point will become $50,000.

• The most significant thing to bear in mind is that when your account balance decreases, the drawdown limit will not decrease. Rather, it will remain at the highest point it reached.

How to Avoid My Funded Futures Drawdown Violations

It is highly doable to avoid hitting a drawdown limit if you have a clear tarding strategy to back you. Just imagine, with a great plan, you can dodge unintentional breaches of My Funded Futures drawdown rules and still reach your destination by wisely looking at position sizing and enforcing absolute discipline in setting limits.

In order to safeguard your account, it is important that you implement the following practices:

• Make trades with small sizes so that a single bad trade would not cause you to hit your daily loss limit.

• For each trade, always practice risk management by placing a stop loss.

• Resist the temptation to over-trade when you are facing a losing streak.

• Be aware of your drawdown level every day.

Common My Funded Futures Drawdown Mistakes

There are probably thousands of traders who lose because they make simple mistakes and misunderstand the risk rules rather than the strategies are bad. Understanding these risk related mistakes, such as neglecting the impact of commissions and trailing your profits that will provide you with a safety net while others are throwing their accounts down the drain.

Some of the ways traders lose money are by:

• Assuming that the drawdown changes do not occur during the day on some plans.

• Not taking commissions and fees into account when calculating their total loss.

• Trading without a plan during high-volatility news releases.

• Trying to recover losses quickly, which eventually results in reaching the daily loss limit.

However, even when you come into a funded account or a Sim Funded account, the rules about the drawdown are still in effect.

How My Funded Futures Payout Rules Affect Drawdown?

To qualify for My Funded Futures payout, you need to be at a certain level of profit and at the same time not exceed your drawdown limit. A few of the My Funded Futures accounts have the feature that when the drawdown reaches the initial balance, it stops trailing. This is known as "capping" the drawdown and it certainly makes trading less risky when you already have a profit In your funded account.

Conclusion

The proper way to interpret the My Funded Futures drawdown regulations is the primary focus at the beginning of your trading journey. Today's intraday drawdown being different than the end-of-day trailing, you always have to manage your risk. If you stay away from your daily loss limit and keep an eye on your max drawdown then you can save your funded account and proceed to get your payout. The key to success is always trading a plan and respecting the risk rules.

- Want a Huge Profit? – Study rules and join in prop firms via The Trusted Prop site!

- Stop waiting and start trading - Click here to open your My Funded Futures account now!

You may also like

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

Maven Trading Detailed Review 2026: Our Honest Verdict

Funded Trading Plus Detailed Review 2026: Our Honest Verdict

Goat Funded Trader Instant Pro Account Explained (2026)

.jpeg&w=1920&q=75)

Goat Funded Futures Trading Rules and Restrictions (2026)

.jpeg&w=1920&q=75)

ATFunded Detailed Review 2026: Our Honest Verdict