Copy Coupon Code to Get

40% Off 🎉

Goat Funded Futures

Futures, Stocks, Indices, Crypto, Metals, Energies

HK

2024

CEO: Edoardo Dalla Torre

Coupon Code:

Tradovate

Ninjatrader

ProjectX

Trading View

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

PayPal

NinjaTrader

Tradovate

Goat Funded Futures Instant Account Explained 2026: Rules & Payouts

Goat Funded Futures Instant Account Explained 2026: Rules & Payouts

2/2/2026

Introduction

Goat Funded Futures has an instant funded futures account which basically gives traders the opportunity to skip the traditional evaluation phases and get funded account instantly. In this Goat Funded Futures 2026 guide, we explain the firm’s details of the instant account type covering account sizes, trading rules, drawdown limits, trading restrictions and if this GFF instant funding model is really beneficial for futures traders in 2026.

This Goat Funded Futures Instant Account is a brilliant option for traders who desire to trade futures without the hassle of waiting for weeks to pass a prop firm evaluation. But, it is really important that you exercise caution because trading with a prop firm’s funded capital comes with rules and risks of loosing funded account due to violation. Traders should be aware of GFF trailing drawdown rules before joining as they can be strict for beginners and you can lose your account very fast if you are not managing your risk properly.

Let us first understand how the Goat Funded Futures instant account works, understanding its key features, pricing and how the GFF trading rules can impact your payouts.

What Is the Goat Funded Futures Instant Account?

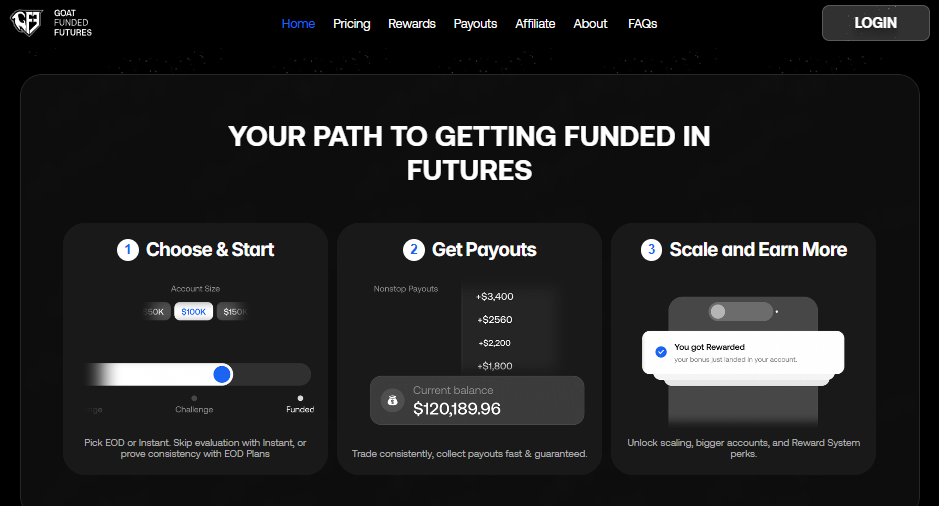

In terms that a trader can understand "instant funding" means that you pay a certain fee (relatively high compared to traditional challenge accounts) to get a funded account immediately. Most prop firms only offer challenge models to get a funded account where you are required to pass the evaluation first.

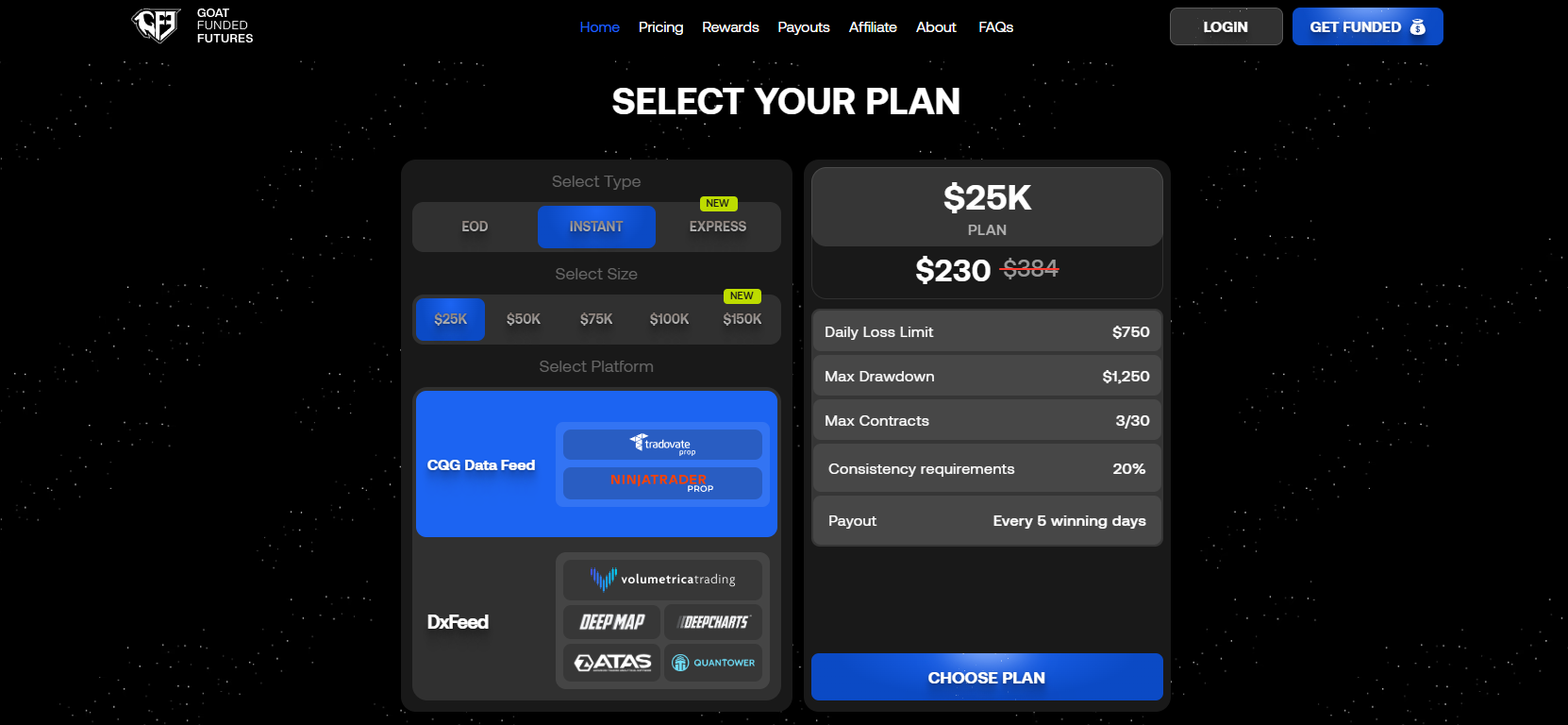

Once you get a simulated funded account from GFF, you can start trading without the need to achieve a profit target but you should stay within the drawdown limit to stay within the firm. Traders should also understand which trading strategies are allowed to avoid account violations. With the Goat Funded Futures instant account, you get access to account sizes ranging from $25K to $150K with fees starting from $384 and goes up to $1,248. The capital you get access to depends on the plan you buy, however, you must follow very strict risk limits.

With Goat Funded Futures, you are able to trade via top trading platforms like Volumetrica, Quantower Volsys, Atas and VolBook, Tradovate and Ninja. The markets allowed for trading are major futures like indices (NQ, ES), commodities (Gold, Oil) and currencies. Typically there are no harsh restrictions on news trading but volatile situations could cause you a drawdown loss.

Based on our Goat Funded Futures review – focusing on its instant funding account, below are the features that futures traders can benefit from.

Goat Funded Futures Instant Account - Key Features at a Glance

- No judging or testing phase.

- Trade immediately after purchase and setup.

- Many futures markets like Gold, Oil and Indices supported.

- Clear max loss and trailing drawdown rules to protect the capital.

- Professional payout eligibility structure for the successful traders.

- Overnight and weekend trading conditions available on certain plans.

- Direct access to the Goat Funded Futures Instant Plan.

Goat Funded Futures Instant Account Breakdown

Picking the prop firm account size is generally decided based on your trading style and how well you can do risk management in trading. Here are the GFF instant funding account details:

| Account Size | Account Fee | Max Contract | Max Drawdown (3%) | Daily Loss Limit (5%) |

|---|---|---|---|---|

| $25,000 | $384 | 3 Mini / 30 Micro | $750 | $1,250 |

| $50,000 | $554 | 4 Mini / 40 Micro | $1,500 | $2,500 |

| $75,000 | $764 | 5 Mini / 50 Micro | $2,250 | $3,750 |

| $100,000 | $978 | 6 minis / 60 micros | $3,000 | $5,000 |

| $150,000 | $1,248 | 8 minis / 80 micros | $4500 | $7500 |

The Goat Funded Futures instant funding account size starts from $25,000 which is great for futures traders who want to start small while getting a balanced set of risk rules. The $150,000 account is perfect for experienced futures traders who are looking more flexibility and capital growth. When you analyze the risk-to-reward ratio, smaller accounts feature tighter drawdown, while larger accounts offer the possibility of bigger trades but demand more discipline by following the risk rules and trading restrictions.

Want to know more about the other prop firm offers? – just checkout our The Trusted Prop Best Offers page.

Goat Funded Futures Instant Funding Rules

If you want to stay funded with the Goat Funded Futures prop firm then you will need to comply with the Goat Funded Futures trading rules for the instant funding account. Below are the trading rules and account restrictions you must know about:

GFF Max Drawdown Rule

The Goat Funded Futures instant funding account comes with a trailing drawdown. Now, what this basically means is that the drawdown limit moves up along with your account balance, so the maximum loss limit is not fixed at the starting point.

Let’s assume you purchase a $25,000 Goat Funded Futures Instant Funding account with a trailing max drawdown of $1,250 (5%). This means your account value can never drop more than $1,250 below your highest balance.

For example:

- Your starting balance is $25,000

- Your initial max loss level is set at $23,750 ($25,000 − $1,250)

- If you make $1,000 in profit, your account balance becomes $26,000

- The trailing drawdown moves up to $24,750

- From this point, your account must never fall below $24,750

- In a Goat Funded Futures Instant account, the drawdown moves up with your profits, but only up to a limit.

- Once the drawdown reaches $25,000 (your starting balance), it stops trailing further - it is now locked. So even if:

- Your balance goes to $27,000 or $30,000

- Your drawdown floor stays at $25,000

If an account breaches the drawdown limit, it is automatically suspended and can no longer be traded. To continue, the trader must reset the account and start again under the same program rules.

Daily Loss Limits

Even if a prop firm mainly focuses on total max loss then your daily loss limit (3%) still matters a lot. When you take a big loss in a single day, your account equity drops sharply. From that lower level, it becomes much harder to recover profits without hitting the trailing drawdown, which continues to move up as your balance grows.

For example:

On a $25,000 Goat Funded Futures instant funding account, a 3% daily loss limit equals $750. If your account equity drops by $750 or more in a single trading day then the account will breach the daily loss limit and be automatically suspended, even if your overall max drawdown has not been reached.

Position Sizing & Risk Control

A number of contracts is limited in each account and you can therefore not trade too many contracts at once. Over-leveraging or going too big, is the quickest way to wipe out instant accounts because the markets move quickly.

Goat Funded Futures Instant Funding Trading Restrictions

The Goat Funded Futures Instant Funding plan uses very strict risk limits to ensure that the capital of investors is secured at all times.

- Daily Loss Limit: The maximum permitted loss per day is 3% (e.g., 3% of a $25,000 account = $750). In case of a violation then the account will be suspended automatically.

Max Drawdown: It is a fixed amount (e.g., 5% of a $25,000 account = $1,250). In case of a violation, a reset is required.

Trading Style: Only manual trading is allowed. Use of bots, EAs or copy trading is not permitted.

Risk Management: The use of excessive leverage, using strategies like martingale, HFT trading, microscalping and grid strategies are not allowed.

Holding Rules: Overnight and news trading are permitted but loss limits still apply.

Violations: The breach of any rule leads to the suspension of the account and the requirement to reset it.

Ahead to the Goat Funded Futures prop firm’s official website to know about all of the restrictions and its payout rules in detail.

Goat Funded Futures Payout Rules – How Traders Get Paid

Goat Funded Futures payout rules are designed for disciplined futures traders who can trade well with risk management fro long-term rather than aiming for short-term profit gains.

In the Goat Funded Futures Instant Funding account traders can become eligible for profit withdrawals once they meet the firm’s profit target and trading day requirements without violating drawdown limits. Understanding these GFF payout conditions is important, as any rule breach can delay or fully cancel a withdrawal request.

When Can You Request a Payout at Goat Funded Futures?

To be eligible for your first reward, you must meet the following conditions during your first trading cycle.

- Profit Target: You need to reach 7% profit of your initial account balance.

- Consistency Requirement: No single trading day can exceed 20% of your total profits.

- Minimum Profit Days: Must complete 10 trading days with a profit.

- Minimum Payout Request: The minimum payout request is $250, while the maximum is based on your account’s selected payout limit.

Goat Funded Futures Instant Account Profit Split Explained

In the Goat Funded Futures instant account, traders are able to keep a 100% of profit split after meeting payout conditions.

Example: If you trade a $25,000 instant funding account and make $2,000 as a profit, then the firm reward you the total $2,000 - the firm does not take any percentage cut.

Such a profit split makes sure that the trader gets a share of the reward for their skill level while the firm bears the costs.

Goat Funded Futures Payout Methods

Goat Funded Futures offers flexible and trader-friendly payout options after the all eligibility conditions are met by traders. Withdrawals are processed through secure, verified channels, ensuring fast and reliable access to your trading profits.

- Bank Transfer (ACH / Wire) – Direct payout to your linked bank account

- Cryptocurrency – Fast withdrawals via supported crypto networks

- On-Demand Payouts – Available once eligibility conditions are met

- KYC Verification Required – Identity verification must be completed before payouts

- Rule-Based Approval – All payouts are subject to drawdown, consistency and trading rule compliance

Goat Funded Futures Instant Account Pros & Cons

Goat Funded Futures instant account offer fast access to capital with no evaluation phase, but they come with stricter drawdown rules that require disciplined risk management from the very first day. Below are advantage and disadvantage of the GFF instant funding account.

| Pros | Cons |

|---|---|

| No evaluation phase, no waiting. | Trailing drawdown requires experience to handle. |

| Faster access to funded capital. | Not a beginner without risk management skills. |

| Compatible with disciplined futures traders. | Instant funding means less margin for mistakes as you have paid more upfront. |

Who Should Choose?

This is excellent for futures traders who are continually profitable and have a strategy. It is also a perfect option for traders with risk management that have been failing evaluations due to minor mistakes. If you want to avoid long evaluation phases, this is the funded account for you.

Who Should Not Choose This Instant?

Beginners who do not know the concept of trailing drawdown should refrain from that. Moreover, high-frequency scalpers who can easily reach contract limits should be mindful. This Goat Funded Futures review shows that if you base your strategy on gambling during news, you will lose this account.

Goat Funded Futures vs Evaluation-Based Futures Prop Firms

The key difference is that one is faster, while the other is cheaper. Instant funding will cost you more than doing a challenge but you will cut the testing time of 10 to 30 days. In a traditional challenge, you put at risk less money upfront but spend more time. By using the Goat Funded Futures No Evaluation method, you pay for the option to start making profits immediately.

Is Goat Funded Futures Legit in 2026?

Of course, they are open about their help desk and publish relevant documentation there. The Goat Funded Futures review here discovers that their payout transparency and community feedback are some of the positives. Still, keep in mind that being legit does not mean that the trader is guaranteed to succeed - a trader must also follow the rules to stay funded.

Before paying to GFF, you can use our The Trusted Prop site’s 40% Off using the coupon code ‘TRUSTED’.

Final Verdict - Is Goat Funded Futures Instant Account Worth It in 2026?

Goat Funded Futures Instant Account is a suitable for a futures trader who already knows how to handle a trailing drawdown and wants to skip the line. The biggest potential loss is the up-front cost if you are without a firm trading plan. In general, we suggest it for the seasoned traders only. Traders who are knowledgeable about risk management in futures and desire instantaneous market access may consider Goat Funded Futures Instant Funding as a viable alternative to the conventional evaluation process in 2026.

- Stop waiting for evaluation phases – Know about instant account via The Trusted Prop and unlock now right away!

- Scale your trading potential instantly using a high-capital Goat Funded Futures professional funding account.

You may also like

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

Maven Trading Detailed Review 2026: Our Honest Verdict

Funded Trading Plus Detailed Review 2026: Our Honest Verdict

Goat Funded Trader Instant Pro Account Explained (2026)

.jpeg&w=1920&q=75)

Goat Funded Futures Trading Rules and Restrictions (2026)

.jpeg&w=1920&q=75)

ATFunded Detailed Review 2026: Our Honest Verdict