Copy Coupon Code to Get

Up to 25% Off 🎉

Fundedlions

Forex, Crypto, Metals, Indices, oil

AE

2023

CEO: Noman Iqbal

This firm is not listed on our Trusted or Affiliate list.

We have not evaluated this firm yet.

Wire Transfer/ Bank Transfer

Crypto

Wise

Crypto

Wire transfer/ Bank Transfer

WISE

FundedLions Temporarily Stops Their Services!!

FundedLions Temporarily Stops Their Services!!

9/9/2024

FundedLions, a well-known proprietary trading firm, has unexpectedly paused its operations, causing concern among traders and the prop trading community. Based in Dubai and led by professional trader Noman Iqbal, FundedLions had earned a big reputation for offering traders instant access to capital. However, the firm has temporarily stopped all services due to a major disagreement with its broker, Dominion Markets.

Who Is FundedLions?

FundedLions is a proprietary trading firm that provides traders with access to trading capital, allowing them to trade without risking their own money. The firm has gained a strong reputation, particularly for its instant funding accounts, which offer traders fast access to capital. This approach has been popular among both professional and retail traders.

The firm is led by CEO Noman Iqbal, a professional trader with years of experience in the industry. Under his leadership, FundedLions grew rapidly and became a trusted name in the prop firm space.

FundedLions’ Instant Funding Accounts

What made FundedLions stand out was its offering of instant funding accounts. This service allowed traders to access funds quickly, without going through lengthy evaluation processes like other firms require. The convenience and speed of this process attracted many traders looking to get into the markets fast.

These accounts were especially appealing to traders who didn’t want to deal with the challenges of typical evaluation periods, which can take weeks or even months. FundedLions’ ability to provide traders with funds quickly helped build trust and a strong reputation in the community.

Partnership with Dominion Markets

To operate smoothly, FundedLions partnered with Dominion Markets, a brokerage firm founded by Raja Banks in 2021. Dominion Markets, legally registered under the name Dominion Markets LLC, is based in the Comoros Union. As a brokerage firm, Dominion Markets was responsible for providing the trading infrastructure that FundedLions used to operate its accounts.

Dominion Markets played a key role in handling the technical side of trading for FundedLions, such as providing the trading platforms and managing the funds. This partnership was essential to FundedLions' operations until the recent dispute occurred.

What Led to the Temporary Stop?

The pause in FundedLions' operations was caused by a disagreement with Dominion Markets. The broker suddenly increased its fees, which caught FundedLions off guard. According to FundedLions, the broker raised their fees without any prior notice, putting the firm in a difficult financial position.

FundedLions decided to temporarily stop all services as they tried to resolve this issue. CEO Noman Iqbal has been very vocal about what happened, accusing Dominion Markets of acting unfairly and making unreasonable demands.

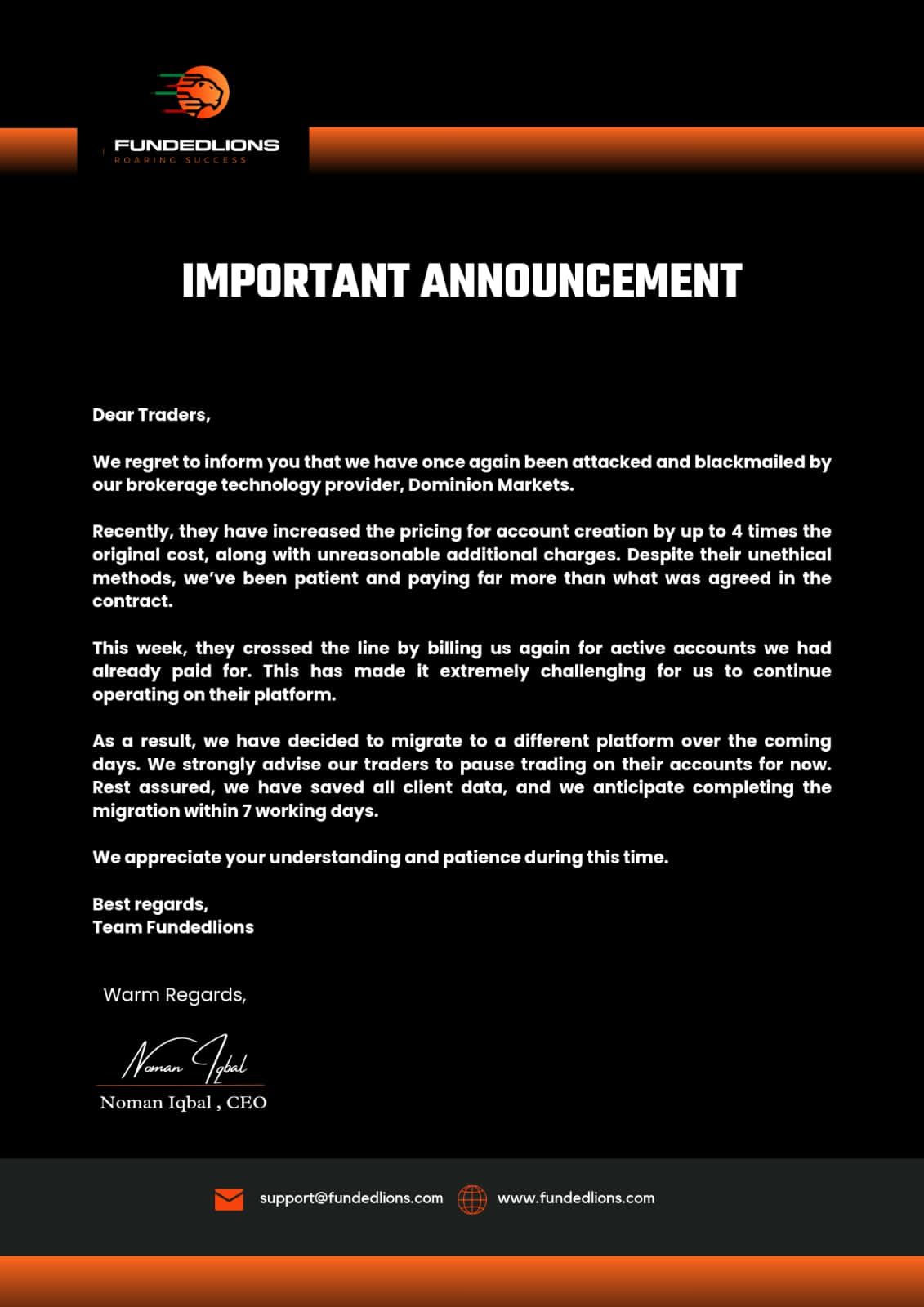

CEO Noman Iqbal’s Public Announcement

On September 6, 2024, Noman Iqbal made a public announcement about the situation. In his statement, he accused Dominion Markets of taking unfair advantage of FundedLions. According to Iqbal, Dominion Markets took control of FundedLions' data and then demanded that FundedLions pay four times their usual brokerage fees.

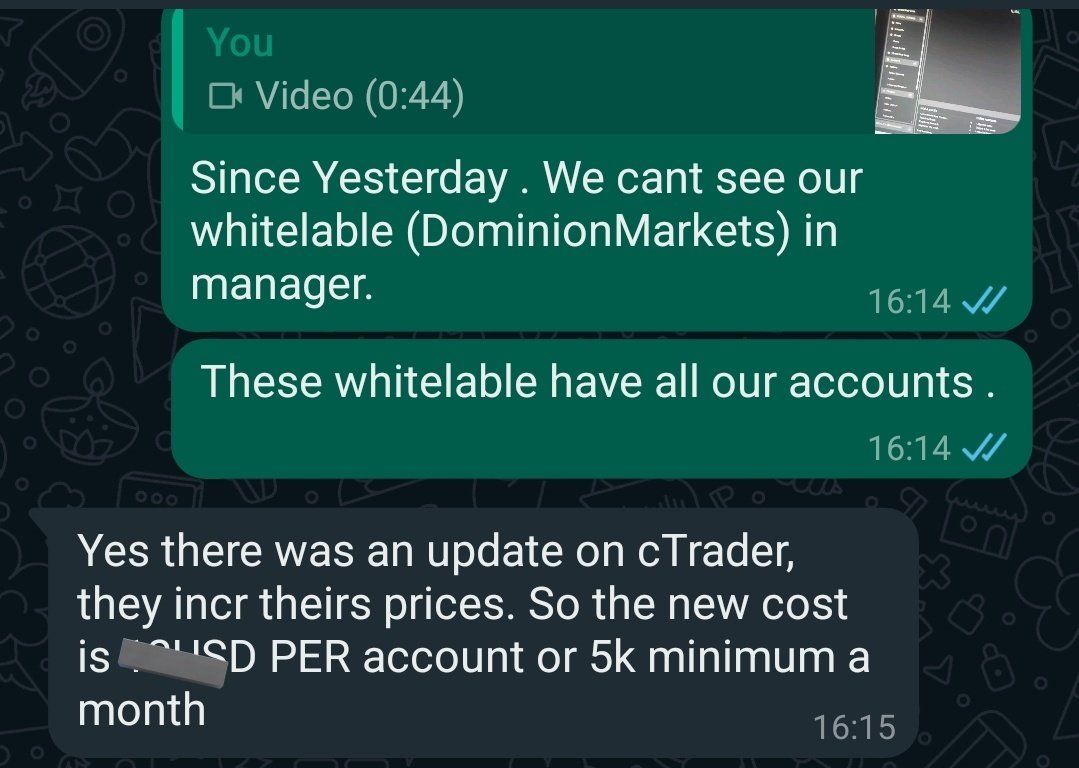

Iqbal explained that he was not made aware of these changes until he noticed that the whitelabels (which allow customization for different users) were no longer visible in the system. When he reached out to Dominion Markets for clarification, he was told that the fees had increased, and FundedLions had no choice but to pay the higher price.

The Issue with Pricing

The primary issue that led to the temporary stop in FundedLions’ services was the sudden price hike by Dominion Markets. According to CEO Noman Iqbal, Dominion Markets increased the cost of managing accounts by four times the original price. This not only applied to new accounts but also to accounts that had been created in the previous month, putting a significant financial burden on FundedLions.

FundedLions felt that this price increase was unfair and unjustified, especially since they were not informed about it in advance. The unexpected financial pressure forced FundedLions to pause operations as they worked to resolve the situation.

Retroactive Charges

What made the situation even worse for FundedLions was that Dominion Markets not only increased their fees for future accounts but also demanded retroactive payments for accounts that had already been created. This meant that FundedLions was forced to pay four times the original price for accounts they had set up in the past month.

This unexpected charge added more strain to FundedLions’ finances, leaving them with few options other than to halt their services while they figured out how to move forward.

Dominion Markets’ Side of the Story

On the other side of the dispute, Dominion Markets had their own explanation. According to the brokerage firm, there was an update on cTrader and they increased their prices and FundedLions had exceeded the limits of their original agreement. Dominion Markets stated that FundedLions had gone over the number of accounts they were allowed to manage under their $5,000 credit limit.

In a message sent to FundedLions, Dominion Markets informed them that they would be charged for the extra accounts they had created, which led to an additional fee of $3,024. Dominion Markets also gave FundedLions a 48-hour deadline to make the payment, or else they would lose access to their accounts.

Clarifications via Terms and Conditions

In response to the sudden price hike, CEO Noman Iqbal pointed to the terms and conditions of their agreement with Dominion Markets. According to these terms, any changes or amendments to the agreement must be made in writing and signed by both parties. Iqbal argued that Dominion Markets had not followed these terms, as FundedLions was never informed of the changes or asked to sign any new documents.

This failure to communicate the new fees in advance was a major point of contention for FundedLions and one of the reasons they refused to pay the higher costs.

FundedLions’ Response to Traders

Despite the chaos, FundedLions has reassured its traders that their accounts are safe. In a public statement, CEO Noman Iqbal advised traders not to worry and to pause trading for a week while the firm transitions to a new trading platform. Iqbal emphasized that the data and accounts of traders have been secured, and that the pause is only temporary.

FundedLions has been working to resolve the issue as quickly as possible, with the goal of minimizing any impact on their traders.

Moving to a New Platform

As part of their plan to resolve the situation, FundedLions has decided to move its trading operations to a new platform. This migration is expected to take about a week, during which traders have been asked to refrain from making trades on their cTrader accounts.

By switching to a new platform, FundedLions hopes to avoid further conflicts with Dominion Markets and ensure smoother operations moving forward.

Impact on Traders

For traders who rely on FundedLions for access to capital, this temporary stop can be disruptive. Timing is everything in trading, and a week-long pause may affect some traders’ strategies and plans. While FundedLions has reassured traders that their data is safe, the uncertainty created by the situation may still cause some stress for traders who rely on quick access to the markets.

Lessons for Other Prop Firms

The situation between FundedLions and Dominion Markets has come out to be an important lessons for other proprietary trading firms. One of the key takeaways is the importance of having a reliable broker that can be trusted to maintain clear communication and transparency. Without a strong and stable partnership, prop firms can face serious disruptions, which can directly impact their traders.

Other firms should take note of this incident and make sure that they have strong agreements in place with their brokers to avoid similar issues.

Conclusion

FundedLions’ decision to temporarily stop its services is a direct result of a significant dispute with their broker, Dominion Markets. While the situation is unfortunate, FundedLions has taken steps to protect their traders and ensure that their data remains safe. As they work through this issue, the prop trading community will be watching closely to see how things unfold.

For now, traders can rest easy knowing that their accounts are protected, but the situation also serves as a reminder of the importance of strong partnerships and clear communication in the trading world.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.