Free Prop Trading Tools for Traders by The Trusted Prop

Free Prop Trading Tools for Traders by The Trusted Prop

6/13/2025

The prop trading industry is changing quickly, and it`s predicted to continue changing in 2025. Today, prop firms are becoming more popular since they enable traders to get a funded account without requiring a huge investment.

Many prop firms offer differing challenge types, fees, rules, and even unique trading regulations, which leaves the big question:

How do you choose the right prop firm and actually succeed in it?

That's why The Trusted Prop's free tools are so useful.

These tools are made for all levels of traders, and aim to assist decison making, streamline strategies, and help traders pass challenges. All at no cost.

Let’s answer the question, what makes these tools so popular among traders in 2025?

The answer lies in The Trusted Prop’s top free tools for prop trading and their incredible features.

The Trusted Prop: A Complete Prop Trading Companion

Before we dive into tools, let us explain something first:

The Trusted Prop is not a prop firm.

It’s a central hub built for traders, by traders. The platform curates the best prop firm reviews, compares funded account offers, delivers exclusive discount codes, and helps you track live challenge opportunities.

And the best part?Almost everything is free to use from challenge calculators to prop firm comparison tool.

Let’s look at the tools every prop trader should use in their trading journey.

Free Prop Trading Tools You’ll Find on The Trusted Prop

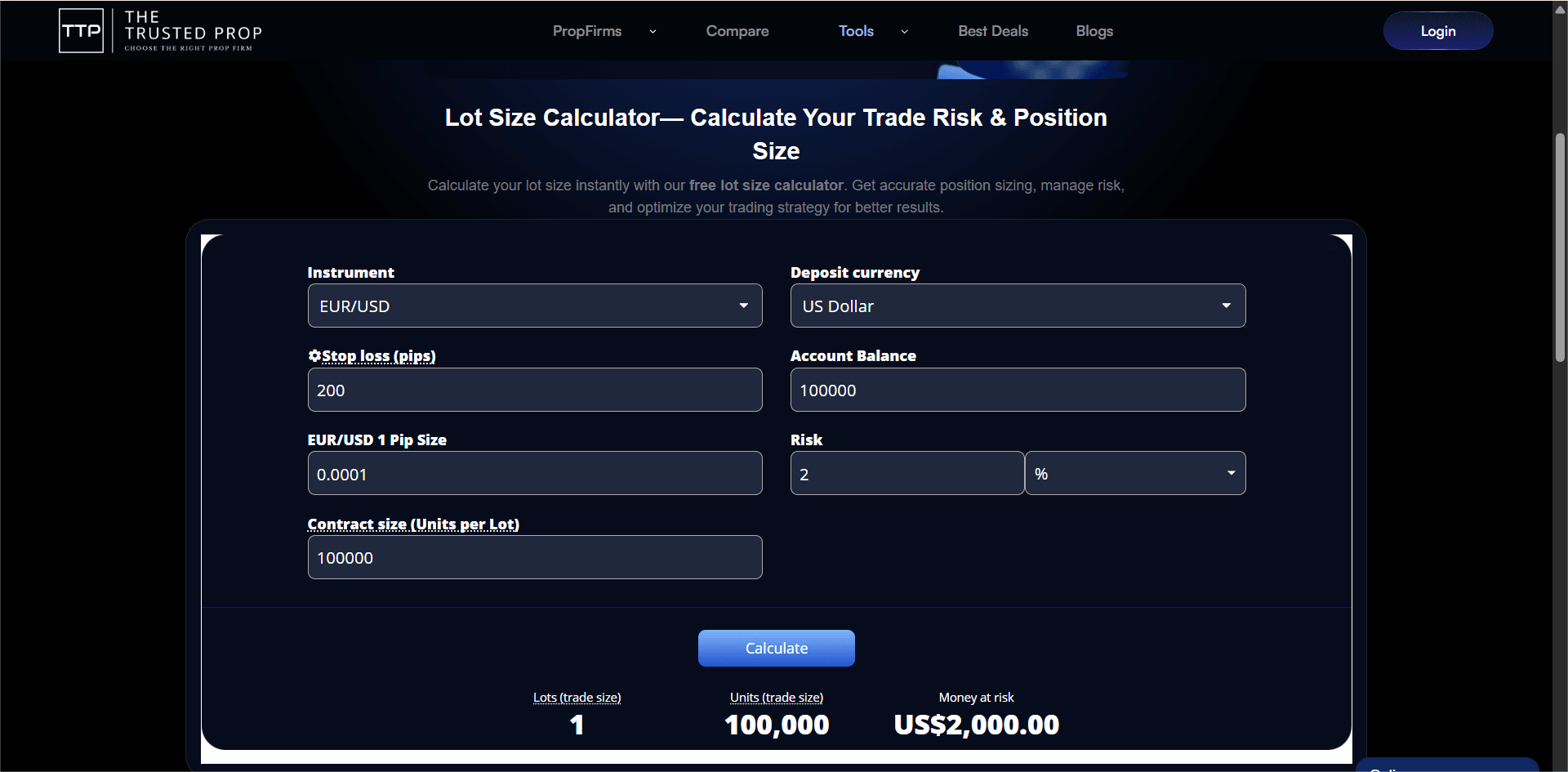

Lot Size Calculator

What is the Lot Size Calculator?

A Lot Size Calculator is particularly important for forex traders who need to effectively manage the trades they carry out, their risks, and the size of each trade. By entering details such as account balance, risk percentage, and stop loss distance, a trader is able to compute the lot sizes where in managed risks are maintained across different trades.

A Lot Size Calculator does consider the following inputs:

- Account Balance:Total capital/investment by a trader while trading.

- Risk Percentage:Portion of the account balance that a trader is willing to risk, usually set at 1-2%.

- Stop-Loss (in pips):Limit on how much a trader is willing to loose in trade over a specified time usually given in pips.

- Currency Pair:Refers to the forex pair a trader is dealing with as it influences the value of pips.

- Account Currency:The base currency of a trader which is used for measuring the value of pip with respect to the account.

Advantages of Using a Lot Size Calculator

- Regular Risk Control: Guarantees that your account will risk the same percentage in every trade you take.

- Avoids Overleveraging: Helps in avoiding overly aggressive positions relative to your account size.

- Improves Trading Discipline: Promotes compliance to a defined trading system.

- Useful for Different Instruments: Applicable across other currency pairs and within different trading strategies.

Give it a try today: Calculate Lot Size Now

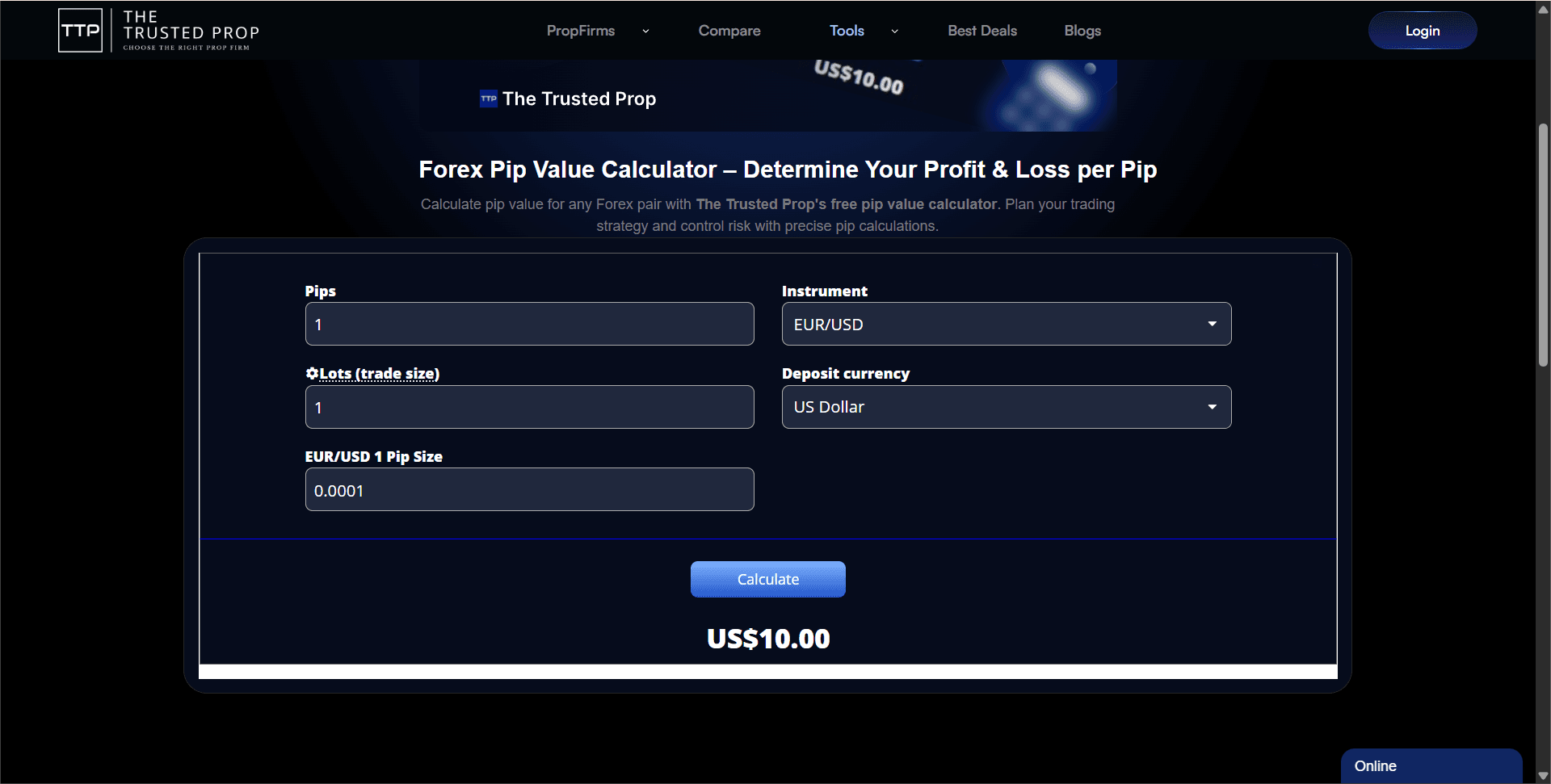

2. Pip Value Calculator

What Is a Pip?

A pip or “percentage in point” is the basic unit of price movement in forex. Forex pairs are priced in units and for most currency pairs one pip is equal to quarter of a cent (0.0001). However, for pairs with Japanese yen (JPY), one pip is 0.01 due to the lower value of the currency.

How Does A Pip Value Calculator Work?

In the Forex market, a Pip Value Calculator is used to calculate the worth of one pip in a currency pair and is helpful for Forex traders.

This evaluation is important in determining the profits and losses and also in implementing effective risk management strategies

A Pip Value Calculator determines the pip of value a currency pair earns using ,among others, the following factors:

- Currency Pair: The forex pair being traded like EUR/USD or GBP/JPY.

- Trade Size: The volume of the trade expressed in lots. (A standard lot is 100,000 units.)

- Account Currency: The currency in which your trading account is denominated.

- Exchange Rate: The current rate of currency pair.

The general formula for calculating pip value is:

Pip Value = (One Pip / Exchange Rate) × Lot Size

For example, if you're trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.2000:

Pip Value = (0.0001 / 1.2000) × 100,000 = $8.33

This means that each pip movement is worth $8.33.

Why Use a Pip Value Calculator?

- Risk Management: Knowing the pip value helps in setting appropriate stop-loss and take-profit levels.

- Position Sizing: Determines the optimal trade size based on risk tolerance.

- Profit and Loss Estimation: Calculates potential gains or losses for each trade.

- Currency Conversion: Assists in understanding pip values across different account currencies.

Try it now:

Use the Pip Value Calculator

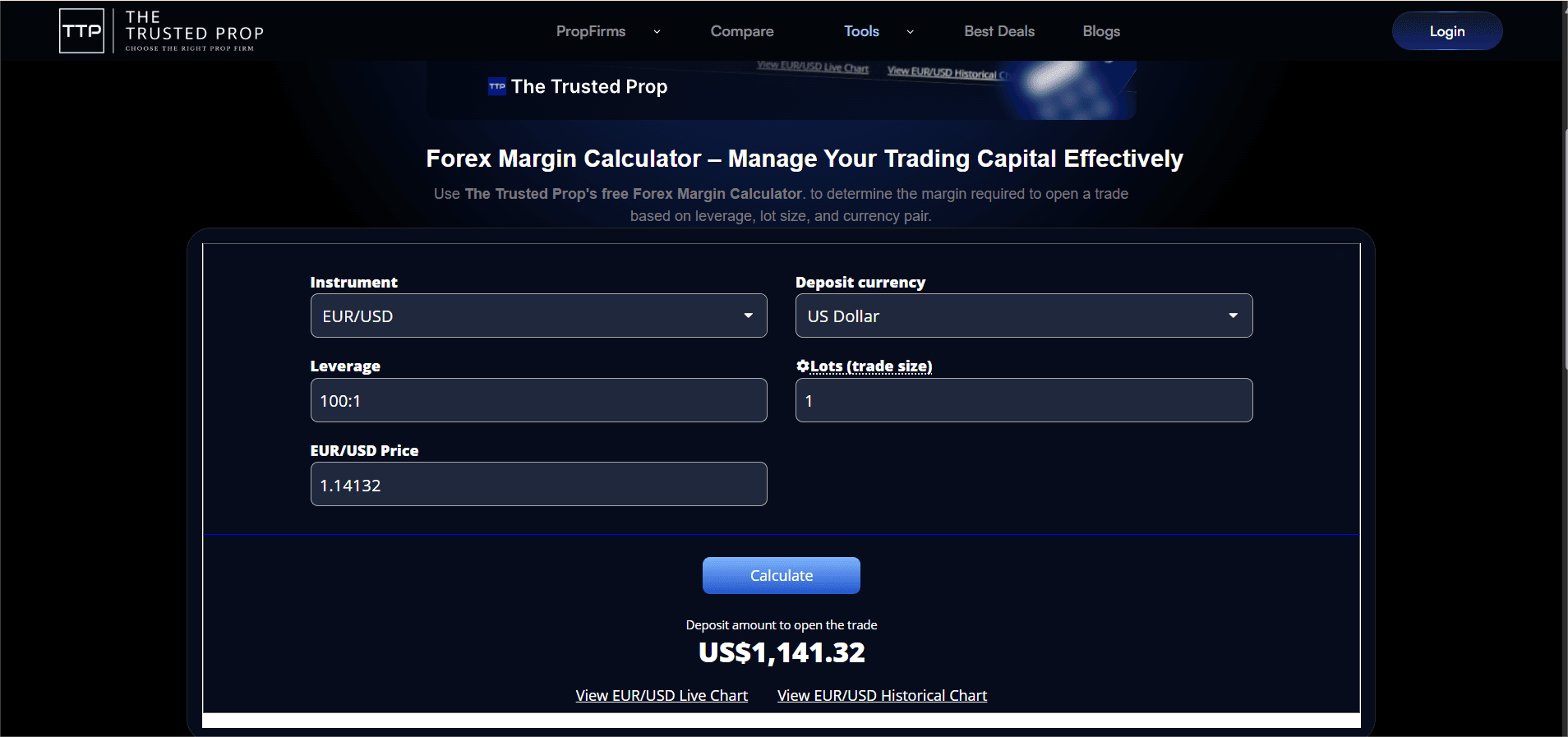

3. Forex Margin Calculator

What Is a Margin in Forex?

Margin means a fraction of your account balance that your broker retains as a security deposit for opening a trade. It is not a charge but rather a form of security to protect against possible losses.

The trade amount, leverage, and the currency pair being traded all impact the required margin.

How Does a Forex Margin Calculator Works?

A Forex Margin Calculator is an important tool for traders which helps in determining the capital needed to open and sustain a leveraged position in foreign exchange trading. Forex margin calculators enable forex traders to assess additional levels of margin, aiding in effective risk management and prevention of margin calls.

A Forex Margin Calculator calculates the required margin based on the following particulars.

- Currency Pair: Forex pair which a trader intends to trade (for example EUR/USD).

- Trade Size: Volume of trade which is usually measured in lots.

- Leverage: Ratio given by broker that allows you to control of bigger position with smaller actual capital.

- Account Currency: Base currency of the trading account.

The Forex Margin calculator uses the formula

Margin Required = (Trade Size × Contract Size × Price) / Leverage. This calculation provides the amount of margin needed in your account's base currency to open the specified position.

Why Use a Forex Margin Calculator?

- Risk Management: Ensures you have sufficient funds to open and maintain positions.

- Prevent Margin Calls: Helps avoid unexpected liquidation of positions due to insufficient margin.

- Trade Planning: Assists in determining optimal trade sizes relative to your account balance and leverage.

- Efficiency: Saves time by automating complex calculations.

Try it now:

👉 Use the Forex Margin Calculator by The Trusted Prop for FREE

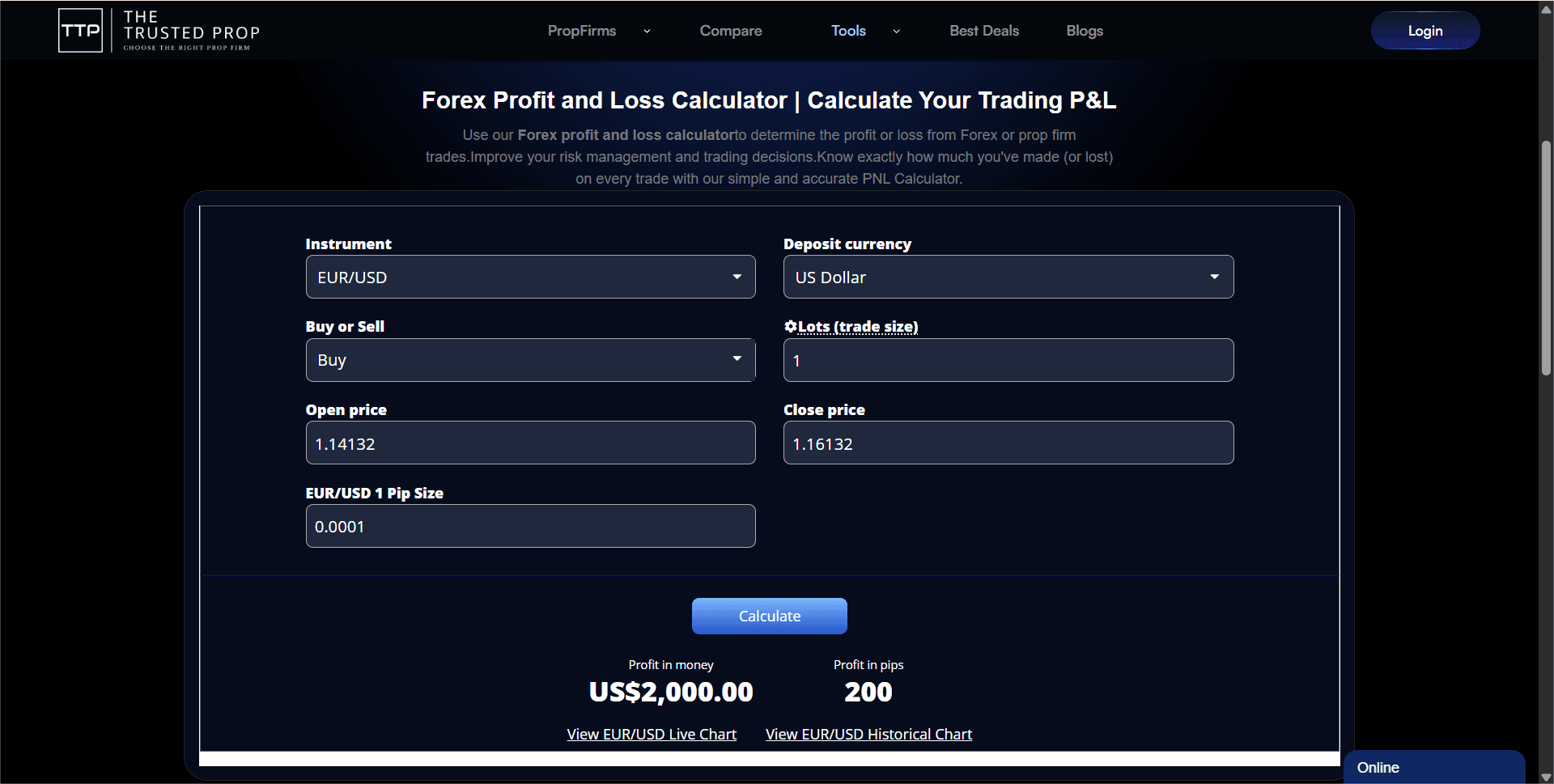

4. P&L Calculator (Profit and Loss Calculator)

What Is a Forex P&L Calculator?

With a Forex P&L Calculator, you can track how much you’ve gained on a particular trade or how much you’ve lost in case of a reversal.

P&L stands for Profit and Loss. Soforex traders use this tool, this tool works as it sounds and defines the profit or loss from your forex positions based on your entry price, exit price, lot size, and the currency pair you are trading.

Here’s how this tool works:

- You enter what pair you traded (like EUR/USD)

- Add the size of your trade (like 1 standard lot or 0.1 lot)

- Type in your entry and exit price

- Select your account currency (like USD or INR)

And it shows you whether you’re in the green (profit) or the red (loss), and by how much.

This tool is a must-have for any serious trader.

Whether you are using a prop firm funded account or trading your own money, knowing your P&L clearly keeps you in control.

Advantages of using a P&L Calculator tool

- Risk Control: Effective in setting appropriate stop-loss and take-profit margins.

- Strategic Business Management: Helpful in assessing the risk and reward of the trades.

- Saving Time: Completes multifaceted calculations automatically saving time and eliminating mistakes.

- Informed Decision-Making: Provides clarity on potential outcomes, aiding in better trade decisions.

Try it now:

Use the P&L Calculator now.

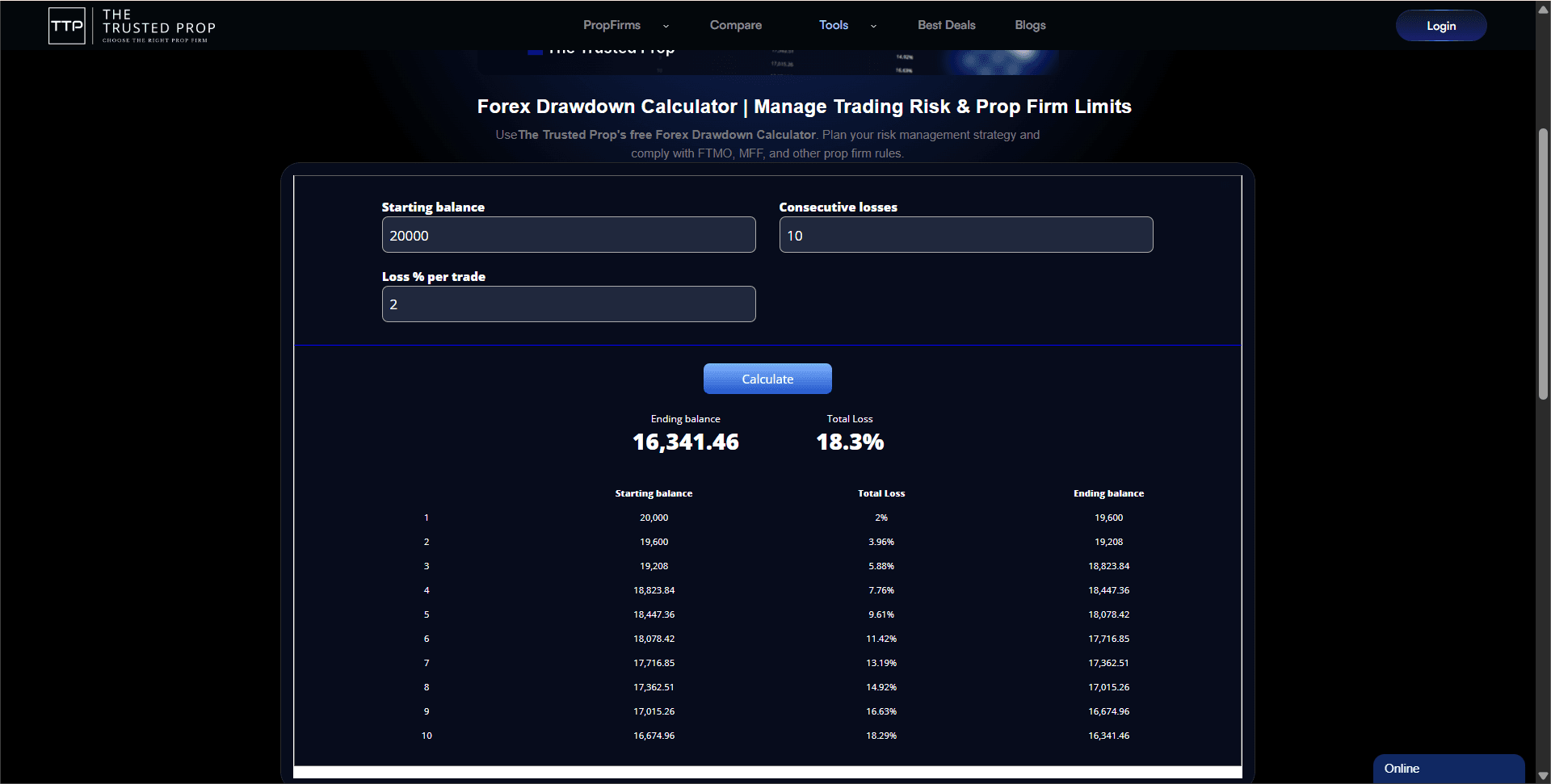

5. Drawdown Calculator

What Is a Drawdown?

In trading, drawdown is defined as the decrease in equity within a period of time from the highest level to the lowest and vice versa. It shows the total amount of loss a trading account has before it gets back to the peak figure. It is very important to evaluate every risk and how strategy performs well to know the parameters of drawdown.

For every trader, there should be a drawdown calculator to estimate the possible decrease in balance after a number of losing trades. From a number of losing trades,It helps in understanding the risk associated with trading strategies and in planning effective risk management.

How Does a Drawdown Calculator Work?

A Drawdown Calculator typically requires the following inputs:

- Starting Balance: Your initial trading account balance.

- Consecutive Losses: The number of losing trades in a row you want to simulate.

- Loss per Trade (%): The percentage of the account balance lost on each trade.

- Upon entering these values, the calculator computes:Ending Balance: The account balance after the specified number of consecutive losses.

- Total Loss (%): The overall percentage loss from the starting balance.

Why Use a Drawdown Calculator?

- Risk Assessment: Understand the potential risk of your trading strategy.

- Capital Preservation: Plan to limit losses and preserve trading capital.

- Strategy Evaluation: Evaluate and compare the risk profiles of different trading strategies.

- Discipline Enforcement: Set predefined loss limits to maintain trading discipline.

Try it now:

Use the Drawdown Calculator by The Trusted Prop

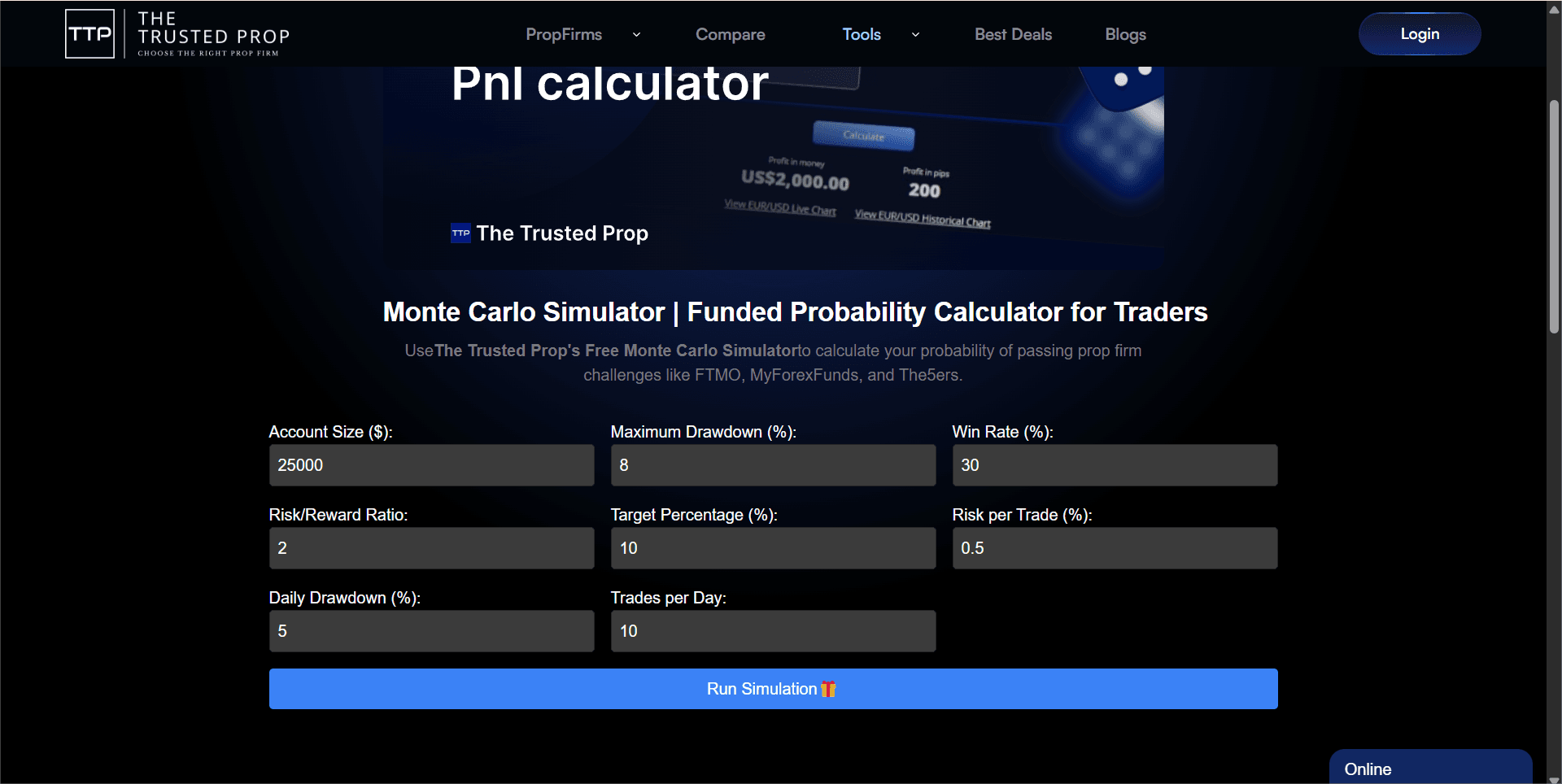

6. Funded Probability Calculator

What Is Funded Probability Calculator?

Ever wondered, Do I really have a shot at passing this prop firm challenge?

That’s exactly why the Funded Probability Calculator exists.

This handy tool by The Trusted Prop helps you to figure out your real chances of getting funded before you spend your money on the challenge. It looks at your trading stats things like how often you win and your risk-to-reward ratio, and tells you if you’re likely to hit the profit goal without breaking the trading rules like drawdown limits.

How It Works

To use the calculator, just fill in a few things:

- Win rate - How many trades you usually win out of 100

- Risk/reward ratio - How much you risk versus how much you aim to gain

- Number of trades - How many trades you take during the challenge

- Profit target - The goal you need to reach (say, 8% or 10%)

- Drawdown limit - The most you’re allowed to lose before you’re out

Once you plug that in, the calculator shows you your odds basically how likely you are to pass the challenge without failing the rules.

Why It’s Helpful

- Plan smarter - You’ll know what kind of strategy you need

- Manage risk better - No more blind gambling, just data-backed confidence

- Tweak your trading - Small changes in your win rate or reward can mean a big difference

- Save money - If your odds are super low, you’ll know when to pause and improve first

Try it now:

👉 Use the Funded Probability Calculator

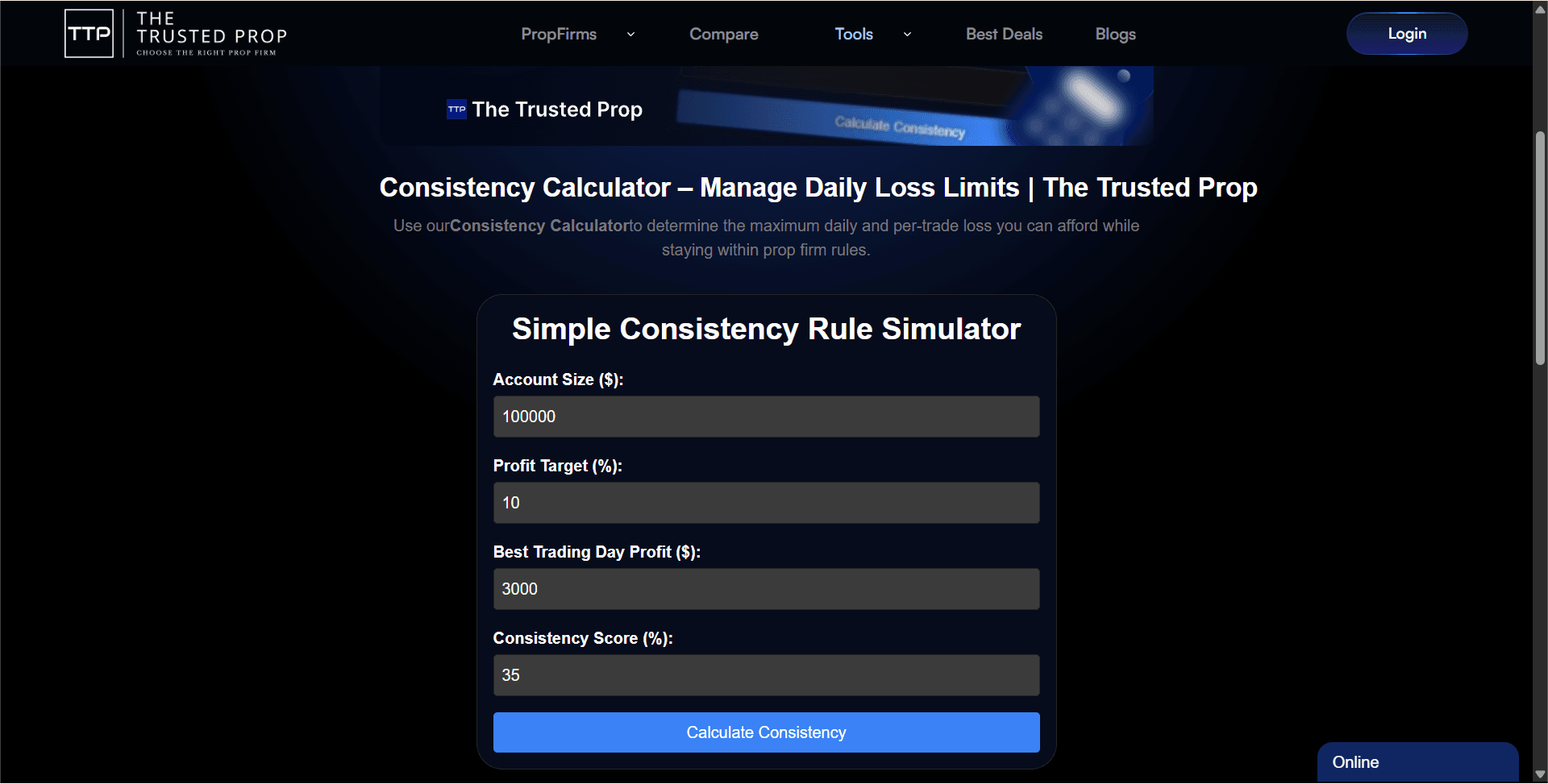

7. Consistency Calculator

What Is a Consistency Calculator?

A Consistency Calculator assists prop firm traders in analyzing trades and ensuring their performance is consistently good, not just down to “good luck.”

Most prop firms want to see consistent returns as opposed to a one-shot profit hit. Meaning your profits should be spread out over a reasonable time frame, rather than being locked in a single bold move followed by silence.

This kind of calculator helps firms assess how profits are distributed. Are you making a little each day? Or did you just get lucky in one trade? If your trading resembles a one-hit-wonder, you might not receive the funded account even after passing the challenge.

How Does It Work?

In most cases, users provide the following parameters when it comes to using the Consistency Calculator:

- Account Size ($): Refers to the total amount of capital assigned for trading.

- Profit Target (%): Percentage gain which needs to be achieved for one to pass the evaluation.

- Best Trading Day Profit ($): The profit achieved in one day.

- Consistency Score (%): The percentage of total profits that the best trading day represents.

Why use it?

- Avoids rejections because of “inconsistent trading.”

- It shows you how stable your results are.

- Helps you identify issues before you submit your challenge.

With The Trusted Prop’s Consistency Calculator, you can check your results before the payout or challenge evaluation, this determines the difference in getting ‘approved’ and ‘denied’.

Why Trading Tools Matter in Prop Trading (Especially in 2025)

Most traders don’t fail their prop firm challenges because they can’t trade; it’s because they picked the wrong prop firm, got confused over the trading rules, or made a mistake about their risk per trade.

The current prop trading scenario is more complex.

There is a lot on the plate of the traders:

- Minimum trading days,

- Maximum daily and total drawdown limits,

- Differing profit share split offers,

- Diverse fee structures with complicated refund policies,

- Complex tiered scaling policies,

- Multiple trading platforms and account sizes.

- In this ultra-competitive ecosystem, your edge is to have the right tools.

Gone are the days when a prop firm’s cheapest challenge fee or the highest profit split offered was the only consideration. Today, traders are more intelligent than that. They require:

- Transparency in trading rules and payouts

- Clarity in challenge structures

- Speed in decision-making

- Support throughout their trading journey

That is exactly what The Trusted Prop provides.

It is not only that The Trusted Prop reviews prop firms; they design and build smart tools tailored for prop traders which are free and easily accessible.

With The Trusted Prop tools, you can:

- Avoid rookie mistakes that cost time and money

- Choose prop firms that align with your trading strategy

- Track your challenge progress and optimize your performance

- Save money through verified discount codes and special offers

In 2025 and later, succeeding in prop trading is beyond just having the skills it depends on having the right tools. The Trusted Prop is ready to support you throughout your funded journey.

How These Trading Tools Help New vs. Experienced Traders

New Traders

- Learn how to compare funded account options

- Understand trading rules before making mistakes

- Find the best prop firm for low capital entry

Experienced Traders

- Track multiple challenge metrics in one place

- Optimize profit targets with calculators

- Stay updated on firms with flexible scaling plans

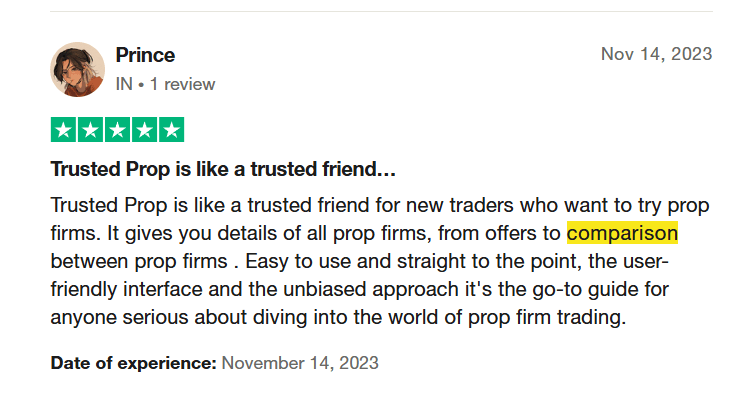

What Traders Are Saying About The Trusted Prop

Traders are sharing positive experiences about The Trusted Prop, a platform renowned for its comprehensive reviews and comparisons of proprietary trading firms.

“I used the comparison tool to switch from a 2-step challenge to an instant funding model It saved me $90 in fees and weeks of stress.”: Aditya, Mumbai

“The real-time payout updates helped me avoid a firm with payout delays. The transparency is unmatched.”: Arun, Pune

Join the Trusted Prop Community For Free Bonuses and Insights

The Trusted Prop is not only focused on providing reviews and tools for prop firms; it is also an informative

community for prop traders which includes:

- Support on Discord

- Giveaways every week

- News updates

- Exclusive videos on prop firm reviews

Follow The Trusted Prop on Social Media

- Instagram – @thetrustedprop

- YouTube – The Trusted Prop

- Discord – Join the Discord community for daily and weekly prop trading insights, live interactions, and free challenges account giveaways.

- X (Twitter) – @thetrustedprop

Final Thoughts: Prop Trading Isn’t Easy But Smart Tools Help

In the modern world of prop trading, information is everything. And tools like these offered by The Trusted Prop don’t just help you make better decisions they help you trade smarter, scale faster, and avoid costly mistakes.

If you're a trader looking for the best prop firm, a way to simplify your next challenge, or just want to stay informed on trading platform changes, payouts, and rules these tools are your edge.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.