Copy Coupon Code to Get

30% Off 🎉

WeMasterTrade

Forex, Crypto, Stocks

CA

2020

CEO: Andrew Anth

Coupon Code:

MatchTrader

Metatrader 5

Wire transfer/ Bank Transfer

Crypto

PayPal

WeMasterTrade Detailed Review 2025

WeMasterTrade Detailed Review 2025

10/29/2025

Introduction

This blog post has an overview of WeMasterTrade’s prop-firm offers, challenge accounts, payouts, platform access and the real trader feedback. If you are thinking about becoming a member of a prop-trading firm, we pull back the curtain on WeMasterTrade’s evaluating models and rules and ask, is it worth it in 2025?

About WeMasterTrade

WeMasterTrade is a modern prop firm with a challenge and instant funding model with up to 1:100 leverage and up to 90% profit share. It allows for news trading and weekend holds, has low fees and reset discounts, offers different instruments and is rated as “legit and safe” by ScamAdviser. It has options for new traders and professional traders.

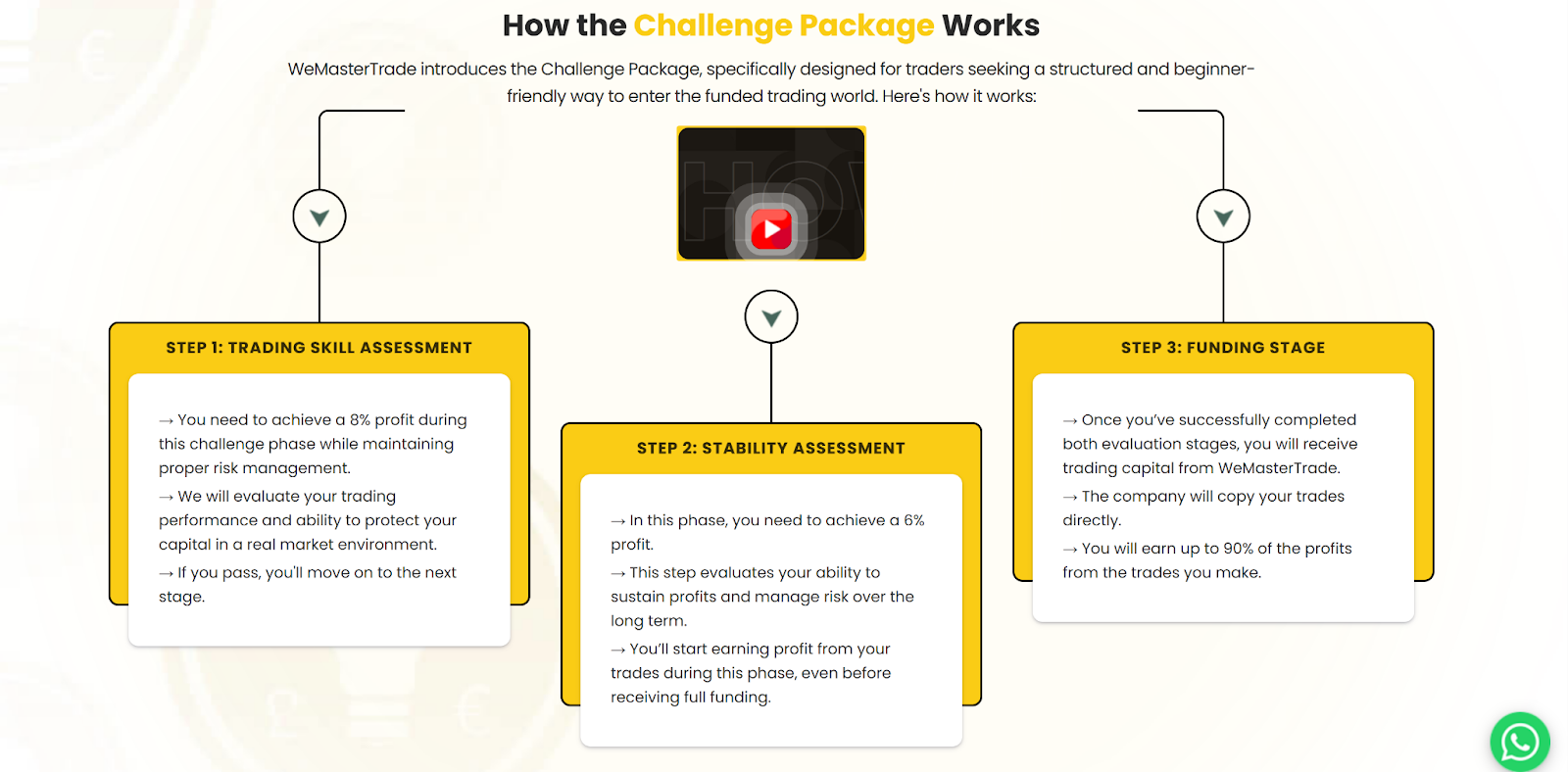

WeMasterTrade Evaluation Models and Challenges Explained

Before going deep into each challenge, here's what you should know: evaluating a prop-firm means passing a certain number of rules about profit, drawdown, trading conditions and trading strategies. In the case of WeMasterTrade these vary based on the challenge model. We will then explain each type of challenge with its own rules, fees, trading-strategies allowances and payout splits.

Challenge Type: Standard Challenge (Evaluation Phase)

The standard challenge calls for traders to demonstrate consistent performance under preset drawdowns and defined trading conditions, which traders must do before going into a funded account. The purpose of the standard challenge is for you to show that you can trade within limits. Once passed, you receive the funded account, which is accompanied with a profit split.

Profit target, Drawdown Rules &Trading Conditions to Pass the Challenge

For instance, one listing shows a profit target of ~6% with a maximum overall loss/drawdown of ~10% and a daily loss limit that may be ~5% also. Trading news and holding positions over the weekend is permitted too.

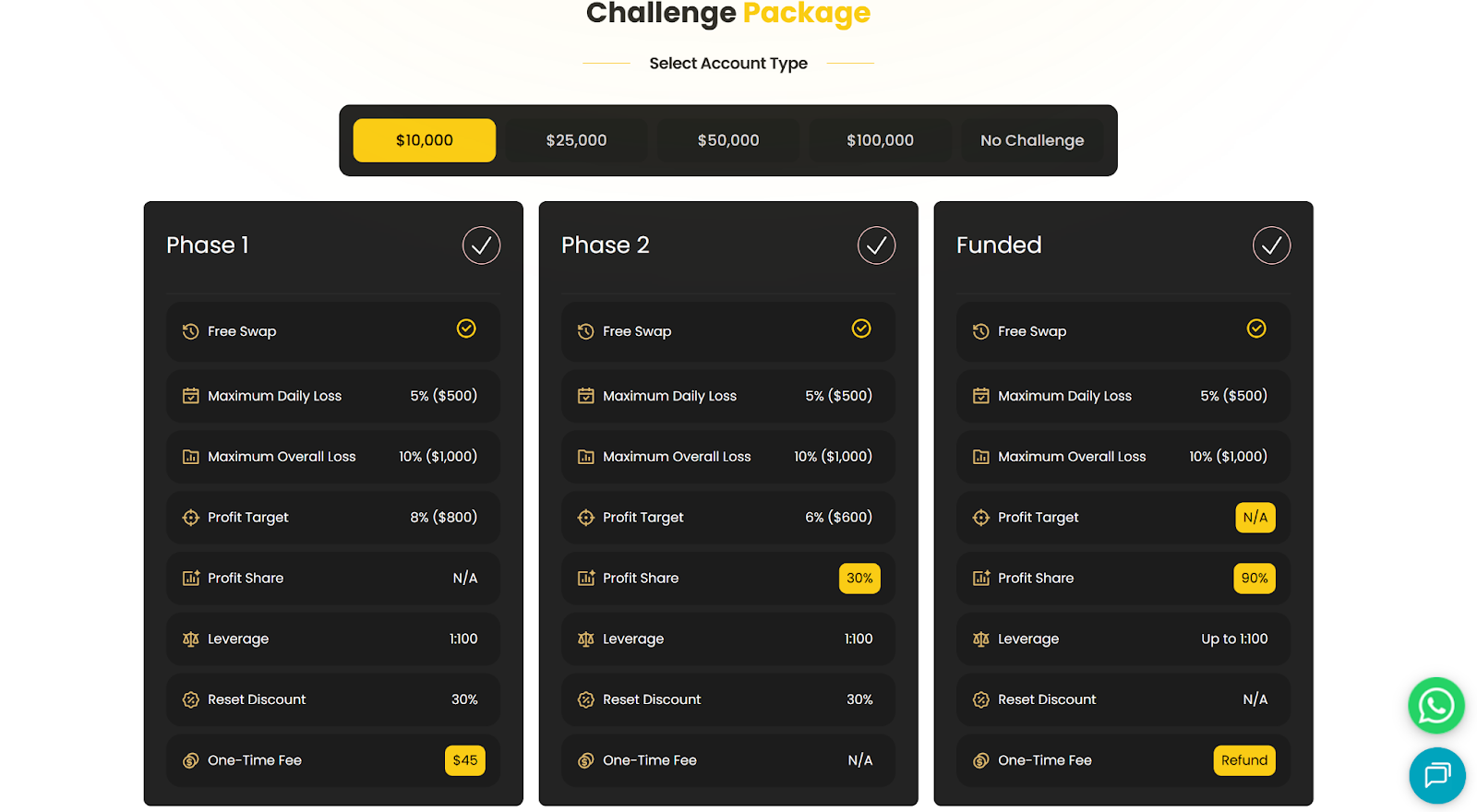

Account size and challenge fees for that account

Fees start out rather cheap: one review shows a USD 10k account challenge is around ~$55, USD 25k is around ~$125, USD 50k is around ~$220, USD 100k is almost ~$400.

Trading strategies allowed during the challenge phase

They allow for news trading, swing, scalp, and overnight/weekend holding and have no contract-size limits (according to their website).

Profit split and payout frequency

According to the website and in reviews, they claim up to 30% profit share during the challenge phase and then up to 90% profit share after the funded phase. The frequency of payout for funded accounts is shown as "1-3 business days" in reviews.

Challenge Type: Instant Funding Model

With WeMasterTrade’s instant funding model, you can skip or shorten the two-phase challenge and start trading with real capital sooner - though it may cost more up front or come with extra restrictions.

Profit target, Drawdown Rules &Trading Conditions to Pass the Challenge

To an extent, one post in the forum helped clarify, "Those models did not have any challenge at all, just reach the profit target and then you can get the payout." The rules for instant models also mention a profit target of ~6% and a drawdown of ~10%.

Account Size and Fees of Challenge to Open the Account

There is no consensus on fees; this was not always broken out publicly. The instant account typically has a higher fee or fixed cost but with fewer steps. A review from one user stated, "Instant accounts, you don't need to take any challenge. You just need to reach 6% to withdraw."

Trading Strategies Allowed During Challenge Phase

Again, same flexibility: news trading allowed; no contract size limitations; weekend holds allowed.

Profit split and payout timeframe

When you reach the target, you can begin receiving profit splits, or in some cases as much as 90% after funding. There are user posts that report payout being "a few hours."

Challenge Types Detailed Comparison Table

| Feature | Standard Challenge | Instant Funding Model |

| Profit Target | ~6% | ~6% |

| Daily Loss Limit | ~5% | ~5% |

| Max Loss Limit | ~10% | ~10% |

| Min Trading Days | – (varies) | Possibly none |

| News Trading | Allowed | Allowed |

| Leverage | Up to 1:100 | Up to 1:100 |

| Profit Split | 30% (challenge) → up to 90% when funded | Up to 90% |

| Payout Frequency | ~1–3 business days (funded) | Often, “hours” are claimed |

| Best For | Traders building skills | Experienced traders wanting fast access |

Our Conclusion Regarding WeMasterTrade Challenge Accounts

WeMasterTrade offers challenge accounts as well as instant funding account models that are competitive and come with reasonable fees. They offer a profit split of up to 90%, leverage of 1:100and they allow news and weekend trading. However, as a new prop firm, WeMasterTrade does not have a long-term history. We also find some reports of delayed payouts, which is not uncommon with newer firms. Confident traders will certainly see WeMasterTrade as a viable option, but if you are more hesitant with your trading, a more established firm may provide you peace of mind.

WeMasterTrade Rules to Consider

Before making any commitments, note that once you are funded with a prop-firm like WeMasterTrade, there will be rules to abide by, which may affect your trading activities. This section reviews some important rules.

Trading Consistency Rule

Users have mentioned that there is some “consistency rule” in place prior to a trader requesting a payout. E.g., you will want to have no days of zero trading or a minimum number of trading days. You’ll want to check the details of their rules, as written in the terms, to find out about the minimum number of trades, the minimum number of trading days or limitations on loss per day, etc.

Inactivity Rule

Most firms penalize inactivity (e.g., if you go a period of time not trading, you may lose your funded status). For WeMasterTrade, there are user forums that suggest that it’s better to occupy the account with trades rather than sit idle. You should always check the not-in-use rule clauses in the contract before taking funding.

WeMasterTrade Platform Access and Trading Conditions (2025)

When you become a client of WeMasterTrade, you gain access to their supported trading platform and experience certain trading conditions related to leverage, instruments, trading hours, etc.

Details

- Platform(s): They support the widely used MetaTrader 5 (MT5), including mobile versions.

- Leverage: Up to 1:100 in most of the plans.

- News trading: Allowed.

- Weekend holding: Allowed, depending on the account model.

- No contract size restrictions (according to their site) → gives flexibility for scalpers or large positions.

- Swap/overnight fees: They claim to have “free swap” on certain accounts or a minor fee for swap-free.

- Asset coverage: They claim a “wide range of simulated symbols” for their challenge/instant accounts.

Our Verdict on Platform Access as supported by WeMasterTrade

The platform access and trading conditions look to be transparent and trader-friendly: MT5 is widely respected, leverage of 1:100 can be thought of as moderate, news trading and weekend holds can be a positive to many strategies and a “free/low swap” claim would be good for an investor wanting to hold positions longer. The most important consideration remains: as a newer firm, you want to verify the quality of live execution (spreads, slippage, platform uptime) in your trading. Reviews show a generally positive experience with the platform.

What Trading Instruments Can You Trade on WeMasterTrade?

A key factor in choosing a prop firm is what markets/instruments you can trade. WeMasterTrade has provided a fairly wide range of instruments, which suggests they enable a variety of particular trading strategies.

Details

- Forex currency pairs (major and minor all likely supported via MT5.

- Indices - as indicated on their website, "all asset types"

- Commodities - implied as "asset types."

- Cryptoforward/simulated assets possible - user forums referencing BTC withdrawal and BTC payment.

- Allow weekend holds - useful for indices/commodities that cross days.

Our Verdict on the Trading Instruments Available from WeMasterTrade

WeMasterTrade appears to provide the opportunity for a broad range of traders as multi-asset instruments. This simply adds flexibility for traders of all disciplines and is clearly a plus if employing diversified trading strategies (scalp, swing, long-term trade). I suggest, during the onboarding process, reviewing/specifying exact instruments, spreads, hours of trading and commission/swap rates prior to becoming fully engaged.

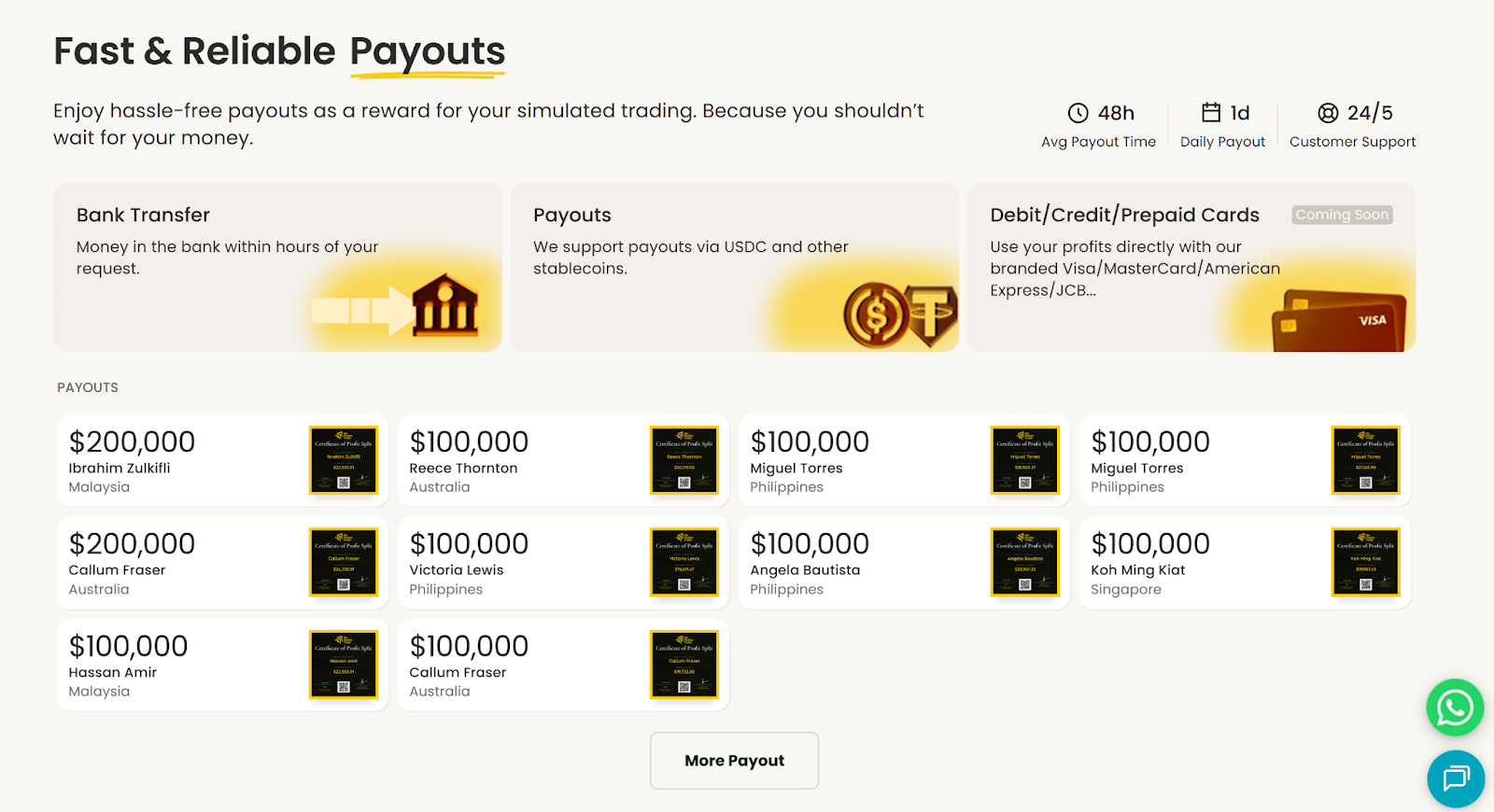

WeMasterTrade Payout Process and Reward System (Simplified)

As always, one of the most important things when looking at a prop-firm, how do you get paid and how rewards are split? Let's dig in and break everything down for WeMasterTrade.

Details

- Profit split: Up to 90% to the trader once funded.

- During the challenge: 30% profit sharing is stated on their website.

- Payment Method: Multiple options indicated in some reviews, including bank transfer, Crypto (BTC/USDT), PayPal, Wise, etc.

- Processing times: In some reviews, payouts are stated and reported as taking "a few hours" to "1-3 business days" on funded accounts.

- No withdrawal fees are listed in other reviews.

When Do You Get Paid? (WeMasterTrade payout eligibility)

- Pass the challenge/instant funded target

- Meet any consistency or minimum trading day time period

- Have not broken any drawdown or risk parameters

- Possibly meet any account type criteria (e.g., funded account has minimum trading days)

What Is WeMasterTrade Payout Eligibility Based on Account Type

- Standard Challenge → get past the challenge → get funded account → get your share of the reward, up to 90 %

- Instant Funded → You hit the profit target directly, with fewer hurdles to clear, and then you start to profit split.

- Largest accounts or scaling up/funding to larger accounts, there may be additional rules, (e.g., minimum trading days, consistency). Check the terms and conditions on specific accounts.

How Quickly are WeMasterTrade Payouts Paid Out?

Feedback from users seems to consistently indicate:

- Some users are having payouts processed in a few hours.

- Others report waiting 1-3 business days based on the method used.

- The takeaway: faster than many other firms, but as always, it depends on the method, country and verification process.

WeMasterTrade Scaling plan

WeMasterTrade has mentioned a scaling plan that permits growing a funded account to USD 2 million for some reports. The scaling plan for WeMasterTrade is an important element for retail traders who will eventually want to trade a larger amount of capital, but you will want to clarify the conditions for scaling, which should, at a minimum, lay out the timeframe for minimum months trading a funded account with the firm, drawdown limits should apply, the frequency of withdrawing profits, etc.

How to Pass WeMasterTrade: Pro Tips from Real Traders

- Start with the smallest account you can afford → build confidence and learn the rules.

- Be sure to understand the specific drawdown, daily loss, max loss, consistency and instrument rules before trading live.

- Leverage is up to 1:100, but use the correct lot size and watch your risk.

- Recognizing that news trading is allowed, if you trade the news, know the risks of slippage, the risk of spread expansion and have an exit strategy.

- Keep detailed records of your trades - many funded firm audits may ask for performance records.

- Stay active and don’t get caught out in inactivity rules. Just because you are funded doesn’t mean you have a license to stop trading.

- When you are funded, start making withdrawals of part of your profits regularly -- this helps teach discipline and relieves stress.

- Read feedback from real traders - forum traders note WeMasterTrade's responsive customer support and fast payouts are positives.

Final Words: You Got This

If you already have a proven strategy and discipline, you can use a prop firm like WeMasterTrade to meet your trading goals. The terms are reasonably clear, the split is attractive and the investment instruments are numerous. If you are able to stay consistent, understand the parameters etc. and manage risk, you have a good opportunity.

Real User Feedback & Trust Factor in Relation to WeMasterTrade:

- Trustpilot: 4.5/5 based on ~2000 reviews, many commented on "fast payout" “great support” and "instant account."

- Review Sites: a few cautionary comments due to being a firm and lacking a mid- to long-term track record. (i.e. investfox occasionally notes we “in the super young... safety is questionable).

- Forum Posts: I have read, real traders say “I had 2 payouts…. one in a few hours,” but also other traders say "but remember the consistency rules matter” and “just reach the profit target to withdraw the instant model".

- ScamAdviser: The website says it's considered a legit and safe site by automated review; they had noted the owner maintains anonymity and a few MLM references.

What We’re Seeing Across the WeMasterTrade Community

- There is strong sentiment around fast payout, fast feedback from support, and reasonable fees associated with the account are reasonable.

- Some concerns are about not understanding all the rules, longer wait times with payouts, of being a newer firm.

- “Low-key” firm, at this point, is a note to start small.

Should You Trust WeMasterTrade?

Yes, but with some reservations. There are indications that WeMasterTrade is legitimate, is paying out and has clear terms - but like all prop firms, there is risk: you must read the rules, understand that a "funded account" may still require any number of obligations and recognize how recent the firm is compared to much older established firms.

Final Verdict: Is WeMasterTrade Worth It in 2025?

In summary, if you follow your own trading discipline, understand the rules, you will benefit from WeMasterTrade as a viable prop trading firm option if you are eligible.

The positives: The fees are fairly competitive, shares a portion of the profits (up to 90 ), provides flexible trading options (such as weekend trading or news trading) and has a fairly good reputation.

The limitations: it is a newer firm (thus having a lesser long-term reputation), some debate around transparency in rules for specific account types (i.e. consistency) and slight delays in payouts for some reports that appear to be explained. So if you are a trader looking to level up and rent (or borrow) an account to trade, WeMasterTrade is worth considering. Approach it like you would a business: Read the contract, manage risk and trade smart.

Bonus Tip: Stay Updated on the Trusted Prop for Discount Offers and Cashbacks

Prop firms often advertise special promotions (discounts on challenge fees, resets, etc.). A reliable company to watch for these types of promotions is WeMasterTrade. They will send out discount opportunities through a newsletter, social media or on their site, for example, they run a “30% reset discount” promotion.

Make sure you also belong to trade-community forums, social media and/or Telegram groups; sometimes other experienced traders will share coupon codes, discounts or referrals, which will further reduce your cost of entry.

You may also like

Maven Trading Detailed Review 2026: Our Honest Verdict

Funded Trading Plus Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

Goat Funded Futures Trading Rules and Restrictions (2026)

.jpeg&w=1920&q=75)

Goat Funded Trader Instant Pro Account Explained (2026)

.jpeg&w=1920&q=75)

ATFunded Detailed Review 2026: Our Honest Verdict

Blueberry Funded Detailed Review 2026: Our Honest Verdict