Copy Coupon Code to Get

30% Off 🎉

Wall Street Funded

Forex, Metals, Commodities, Crypto, Indices

AE

2023

CEO: ALBERT SURIOL NAVARRO

Coupon Code:

MatchTrader

MetaTrader

cTrader

DXTrade

Trade Locker

Crypto

Rise

Crypto

AstroPay

Wire transfer/ Bank Transfer

Credit/Debit Card

Mastercard

PayPal

Visa

Google Pay

Apple Pay

WSF

Wall Street Funded Detailed Review 2025

Wall Street Funded Detailed Review 2025

11/3/2025

Introduction

This is a comprehensive review of the Wall Street Funded (Wall Street Funded) for 2025, covering an overview of the firm, the evaluation (challenge) models, rules to follow, trading conditions, payout process, scaling plan and general trust signals for real users, plus some advanced recommendations for successful funding. Wall Street Funded provides you with a valuable playbook to assist with deciding if it is a suitable prop firm for your trading methodology.

About Wall Street Funded

Wall Street Funded is a prop firm with a challenge-based model that gives traders the opportunity to trade funded accounts after a one or two-step evaluation. Wall Street Funded uses a traditional profit-split model, offers multiple account sizes, and highlights quick payouts to appeal to more active trading styles or traders who want to trade funded accounts frequently. The Wall Street Funded’s one or two-step evaluations use a similar program structure and rules found in most prop firms, and a trader can find more details about the program structure, unique rules, and terms on their official pages and FAQ. Overall, their reviews on multiple 3rd party review sites and multiple traders indicate a mix of good experiences, with a focus on withdrawal reliability and customer support on the positive side and rules, discipline and drawdowns are also important features in these reviews.

Wall Street Funded - Explaining Evaluations & Models

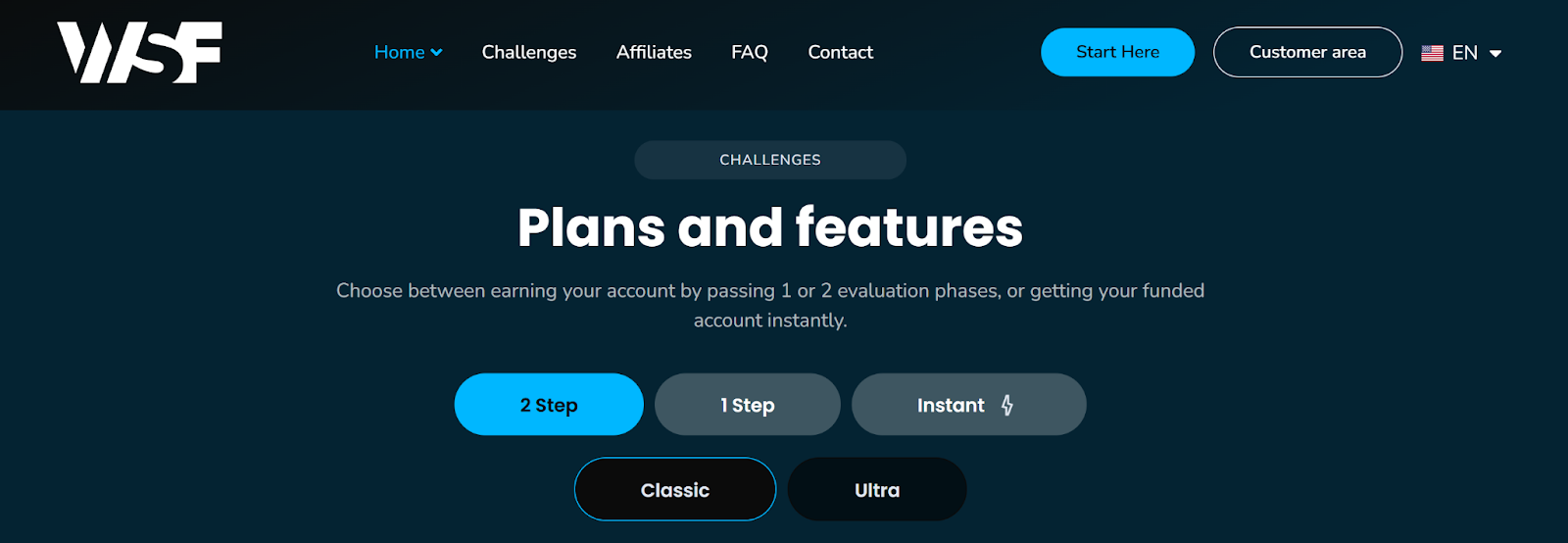

Wall Street Funded implements models used in evaluations and challenges typically found in modern prop firms: the main categories are 1-step (instant), 2-step (classic/standard) and variations of those, branded by Wall Street Funded (Classic, Ultra, Instant) and specific to Wall Street Funded to help differentiate. Each challenge category features a different balance of profit target, drawdown limits, and minimum trading days to accommodate quicker scalpers, swing traders or into longer time frame traders. We will then outline the rules and trading conditions for each challenge, as general guidelines can be provided for all traders can assess the trading challenge, which has potential value to their edge.

Challenge - Common Elements

For each challenge type, you can expect to see:

- A short intro overview of who the challenges are for

- The overall profit target, daily drawdown, and maximum drawdown rules with specific language

- The account sizes available and the challenge cost

- The category of trading strategies allowed in the challenge phase

- The profit split and payout frequency when funded (after the challenge period ends)

Classic/Two-Step Challenge

The Classic (two-step) challenge is suited for traders who prefer a progressive evaluation process - a first phase with a higher profit goal and a second phase with a smaller number that evaluates consistency. This is preferred for discretionary traders who can change their approach across the two phases.

Profit target, drawdown rules and trading conditions to pass the challenge: Wall Street Funded's most common two-step model has Phase 1 targets (similar to a profit goal) typically around 8 -10% and Phase 2 targets around 4 - 5% (Daily loss rules or max daily drawdown are often around 5% and max loss or static drawdown is often in the 8-10% range, exact numbers are changed per product in accounts). Minimum days of trading is, at times, not an explicit requirement in some Wall Street Funded programs in time-framed challenges.

Account Size and challenge fees for that account: Wall Street Funded has multiple account sizes listed within their program; a common cost for the two-step programs in the market fluctuates based on starting capital (ie, less amount for smaller accounts to lose). Use either Wall Street Funded's challenge purchase page and/or tiered pricing table to find out the exact challenge fees for 2025.

Trading strategies allowed during the challenge phase: Wall Street Funded permits most well-known strategies (FX spot, indices, CFDs). What is typically not allowed (this could be noted within the terms) is excessive latency arbitrage or trading during restricted news rules if it is stated in the terms or using an EA or Robot that's specifically prohibited. Check the FAQ on the program to see if EAs/scalping/news trading is allowed for the exact program.

Profit split and Payout frequency: Wall Street Funded states profit splits are as high as high percentages (some of its pages state up to 100% profit split in promotional language for certain plans or tiers) and distributions are at intervals (Wall Street Funded states payments every ~10 days for some accounts). The actual split depends on the product as well as your stage (evaluation vs funded). Always check the terms of the product for the actual split.

Ultra/Higher - Target Challenge

Ultra-style challenges are for traders who prefer a single larger target or a faster path to greater capital and do not mind a little tighter max drawdowns. This is for the experienced, higher-risk intraday trader to attain larger funded accounts quicker.

Profit goal & drawdown: Both can be higher (for example, Phase 1 up to ~10% and Phase 2 ~5%) for similar

loss caps in a day (often ~5%) and sometimes larger static drawdowns (10%). Varied values exist in Wall Street Funded products; always check the individual challenge rules.

Account size & fees: Higher-tier/ultra challenges relate to larger funded account sizes and higher entry fees.

Allowed strategies: Generally similar allowance as Classic, but some instant/ultra accounts may have

news/hold over weekend rules or do not permit certain automated strategies.

Profit split & payouts: Similar payout cadence as any other Wall Street Funded accounts, with profit split dependent on tier and whether one qualifies for promotional splits.

Instant/One-Step Funding

For traders who want to access capital immediately and do not want to go through the stage evaluations. They are typically more expensive, but they eliminate the multi-phase grind. A good solution for traders who have confidence in their edge and want instant access to their capital.

Profit target & drawdown: Instant accounts will typically have defined daily and total loss limits, while qualifying for instant funding has smaller profit targets.

Fees & account sizes: Instant programs will typically have higher up-front fees compared to staged challenges. Account sizes will vary. For exact 2025 pricing, see Wall Street Funded's Instant Funding product page.

Allowed strategies: Policies on strategies and payout cadence mirror the firm’s other offers - be sure to check the product terms for details.

Challenge Types Comparison

| Feature | Classic (2-step) | Ultra / High Target | Instant / One-step |

| Profit Target | ~8–10% Phase 1 / 4–5% Phase 2 (varies) | ~10% / 5% (example) | Lower target but instant funding |

| Daily Loss Limit | ~5% | ~5% | Specified per product |

| Max Loss Limit | ~8–10% | ~10% | Specified |

| Min Trading Days | Varies (often none) | Varies | Often none |

| News Trading | Usually allowed (check rules) | Often allowed (read terms) | Depends on the product |

| Leverage | Market dependent | Market dependent | Market dependent |

| Profit Split | Varies by plan | Higher tiers may have better splits | Varies; sometimes promotional |

| Payout Frequency | Often every ~10 days (per Wall Street Funded) | Regular payouts (see product) | Fast (few days) |

| Best For | Discretionary & swing traders | Experienced intraday traders | Traders wanting immediate funded access |

Our Verdict on Wall Street Funded Challenge Accounts

Wall Street Funded presents a competitive variety of challenge formats that meet mainstream prop-firm standards in 2025: staged evaluations, instant funded account, and a clear set of drawdown/profit plan. The pluses are timely payments and relative transparency in the published rules. The downsides are the same as they are everywhere - read the fine print, verify acceptable strategies, and manage your drawdowns. For many traders, Wall Street Funded is worth serious consideration as you look analytically toward prop firm structures

Wall Street Funded - Key Rules to Consider

Wall Street Funded has a rule set that is typical of challenge-based prop firms: strict daily loss limits, maximum drawdown limits, prohibited instruments or more complicated strategies in the terms, and conduct rules (name-calling, market manipulation, prohibited software, etc.). Once funded, you will migrate to live account terms outlined that include risk management, target and payout eligibility. Make sure to read the fine print and FAQ before you purchase.

Trading Consistency Rules

Wall Street Funded checks for trading consistency across phases; that profit is legit because of real market activity. Sudden unexplained spikes during or overnight, consistent overnight exposure or a similar type of risk without an explanation or position size limits (minimum and maximum) can lead to account closure or loss of funding. Please see the terms.

Inactivity Rule

Several proprietary trading firms, including Wall Street Funded, have inactivity or dormancy policies in place: if you are funded and do not log in or trade for a specified period of time, there may be restrictions on withdrawals or account reactivation charges. Please refer to Wall Street Funded’s FAQ/terms for specifics regarding their inactivity timeframe and penalties.

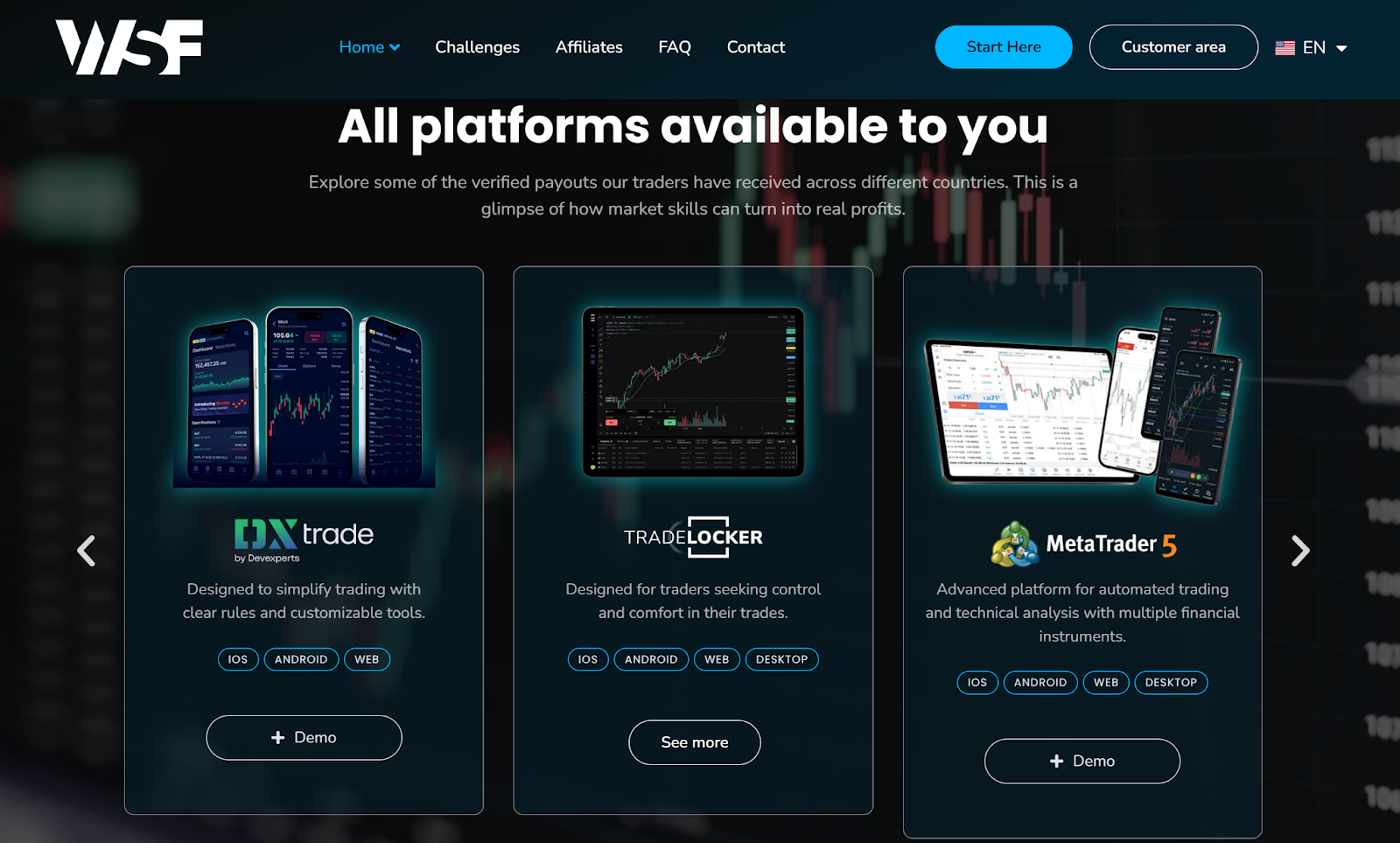

Wall Street Funded Platform Access & Trading Conditions (2025 Guide)

Wall Street Funded allows traders to utilize trading platforms that are consistent and widely used in the industry (please check the FAQ or product page for full details on which platforms your product enables). The exact execution model, spreads, and order types permitted for your accounts will always depend on the setup of your account and the setup of the provider account.

- Platforms and connections: Check the product pages of Wall Street Funded for the current platforms supported.

- Execution and spreads: The trading platform Wall Street Funded utilizes may give users direct market access to raw spreads based on the product you are trading.

- Order types: All trading platforms will support standard market orders, limit orders, and stop orders and depending on the platform, OCO orders.\

- Allowed timeframes: Some products or firms will restrict holding orders through major news events or weekend holds. It is critical to read the terms of the product you are trading carefully.

Our Verdict on Platform Access supported by Wall Street Funded

The availability of trading platforms and the quality of execution are reviewed positively by the community of users, but your experience will ultimately be determined by server latency and the connection of the brokerage. If you do rely on extremely low latency or custom infrastructure or have very customized or proprietary parameters, confirm the technical details before purchase.

What Trading Instruments Can You Trade on Wall Street Funded?

Wall Street Funded usually lets you trade a pretty extensive array of instruments like: forex major/minor pairs, indices, commodities and some CFDs. When it comes to crypto, however, it will depend on the account/product you have and the regulatory region you are in. Please be sure to check the instrument list for the challenge you choose to ensure that you can trade that instrument.

- Typical instruments: FX, indices, commodities, CFDs.

- Crypto: may be available on some accounts.

- Leverage: it is dependent on the instrument and the account size - verify the relevant product page and terms.

Our Opinion on Trading Instruments

Wall Street Funded covers all of the common instruments that the majority of prop traders or retail traders would want to trade. If you are trading some really exotic products, be sure to check if they have those instruments and the margin/ leverage rules.

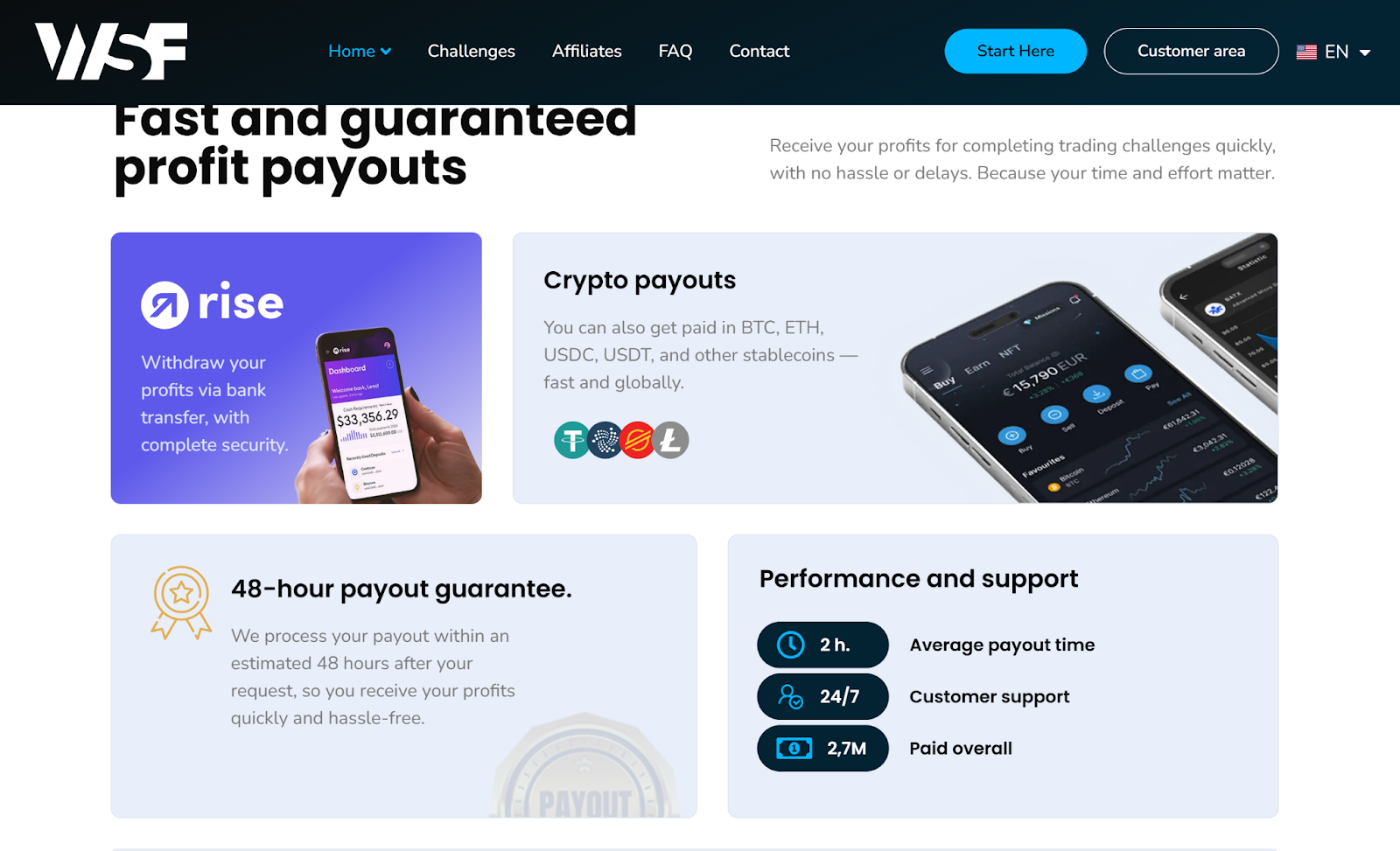

Wall Street Funded - Payout Process & Reward System

The payout process of Wall Street Funded is simple: after you are funded and satisfy payout criteria such as the minimum funded-period rules, minimum number of winning days (if necessary) and no breaches of their drawdown rules, you can request payout on the payout cycle posted for your account according to Wall Street Funded guidelines. Wall Street Funded promotes payout options that are frequent - in certain cases, the promo mentions a payout once every ~ 10 days.

- How payouts are requested: usual way is through the dashboard, where you have satisfied, at a minimum, any Wall Street Funded criteria.

- Payout methods: Check Wall Street Funded payout/delivery options again, and be aware of a bank transfer, crypto or payment processors, depending on geographical reasons.

- Payout fees: There can be withdrawal fees associated with the method selected, and confirm that with Wall Street Funded while requesting a payout.

Wall Street Funded Payout Eligibility: When Can You Request a Payout?

You can request a payout after you are funded and have been converted to a funded account, you meet and satisfy the funded account rules, and you meet any minimum trading/winning day account rules. The terms should have the minimum thresholds.

Wall Street Funded Payout Conditions by Account Type

Withdrawal eligibility and criteria will vary depending on whether you have Classic, Ultra, or Instant account. Each has different minimum levels for requesting withdrawals and different payout cycles/limits - can confirm with account type.

How Quickly Are Payouts Processed by Wall Street Funded?

Wall Street Funded has noted that payouts can be made fairly quickly (for some products, there is a payout window approximately every 10 days) but payment is subject to the processing time of KYC and your selected payment method. User reviews reveal that payouts are being issued, however, the timing can vary.

Wall Street Funded Scaling Plan

Wall Street Funded allows for account scaling, like many modern prop firms, if you meet a profit threshold and consistency criteria, you can scale to higher allocations, occasionally through an automated process or with a request for a larger allocation. Make sure to check the scaling policy in your terms, or expansion in the Product FAQ, to find out the exact threshold and allowance for scaling.

How to Pass Wall Street Funded: Pro Tips from Real Traders

- Know the specific rules inside and out; the daily loss value and the max drawdown amounts are hard stops and let you know the rules. Read your terms.

- Risk management comes first in your methodology, protect your capital. Consistency is better than one big win.

- Practice on demo accounts using the exact same platform settings - recreate your learning environment.

- Don’t engage in grey area strategies around the rules (some questionable EAs or overnight exposure on a news day, for example) - if it is not explicitly allowed, don't risk it.

- Be thoughtful about sessions relative to payout criteria, and you will begin to see many small behavioral edges build up.

- Use good position sizing methodology and keep notes - a record will show consistency and help to debug your performance.

Final Thoughts: You Have the Ability

To pass any funded (prop) trading challenge is a combination of emerging skill, discipline, and some adherence to the rules. Wall Street Funded may be a great option for traders who want a firm that will provide funded trading capital period in 2025, as the firm is clear about the rules and provides payouts and different account options - your ability to pass challenges really lies within your edge and respect for the rules.

Real User Feedback & Trust Factor About Wall Street Funded Prop Firm

The Trustpilot and community posts depict happy traders praised for payouts and customer service. But like any prop firm, there were some complaints here and there (their response time or conflicting information about rules). In total, the community vibe signals positive towards Wall Street Funded in 2025 - just do your research and establish a conservative plan to test.

What We’re Seeing Across the Wall Street Funded Community

- Regular promotional discounts and some affiliate deals.

- Community posts displayed reviews of stable payouts and funded accounts for traders who were approved to trade.

- The FAQ and User Terms have changed and have been updated periodically (be sure to review their pages for the information just before purchase).

Should You Trust Wall Street Funded?

Yes, but do your due diligence. Wall Street Funded is literally transparent. They post their program structure and payout cadence publicly, where active past/present users have provided reviews reporting payouts. That’s a good indication of trust, but you should always confirm the terms, the instrument list and any geographic restrictions before entry, at the time you enter.

Final verdict - should Wall Street Funded be on your radar in 2025?

If your preference is to have account types (classic/ultra/instant), have payouts frequently and rules published and generally transparent, Wall Street Funded is worth your consideration as a prop or fund. Treat Wall Street Funded as a trading discipline and business - with clear rules, a focus on managing risk and trading consistency - for many traders, Wall Street Funded can be a positive path to funded capital in 2025.

Bonus Tip

Prop firms will run seasonal discounts; sign up for Wall Street Funded's newsletter or follow their official channels (as well as other reputable review sites) to see if your firm is providing a legitimate discount or affiliate deals. If your prop firm offers a "discount," always check the discount against the company's official product page at the time of sale to confirm that the product bought is the product sold at the discount you are entitled to and that the price is appropriate.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict