Copy Coupon Code to Get

30% Off 🎉

Wall Street Funded

Forex, Metals, Commodities, Crypto, Indices

AE

2023

CEO: ALBERT SURIOL NAVARRO

Coupon Code:

MatchTrader

MetaTrader

cTrader

DXTrade

Trade Locker

Crypto

Rise

Crypto

AstroPay

Wire transfer/ Bank Transfer

Credit/Debit Card

Mastercard

PayPal

Visa

Google Pay

Apple Pay

WSF

Wall Street Funded Challenge Models, Profit Split & Payout | 2025 Guide

.jpeg&w=3840&q=75)

Wall Street Funded Challenge Models, Profit Split & Payout | 2025 Guide

10/30/2025

Introduction

If you want to find a funded trading account provider that you can trust, then the first thing you have to do is to look into the Wall Street Funded Challenge Models, Profit Split, and Payout structure. Knowing the model of a funded trader used by a firm such as Wall Street Funded can help a trader with the right mindset to gain access to a funded trading account, be able to enjoy a nice profit split and have a transparent payout structure.

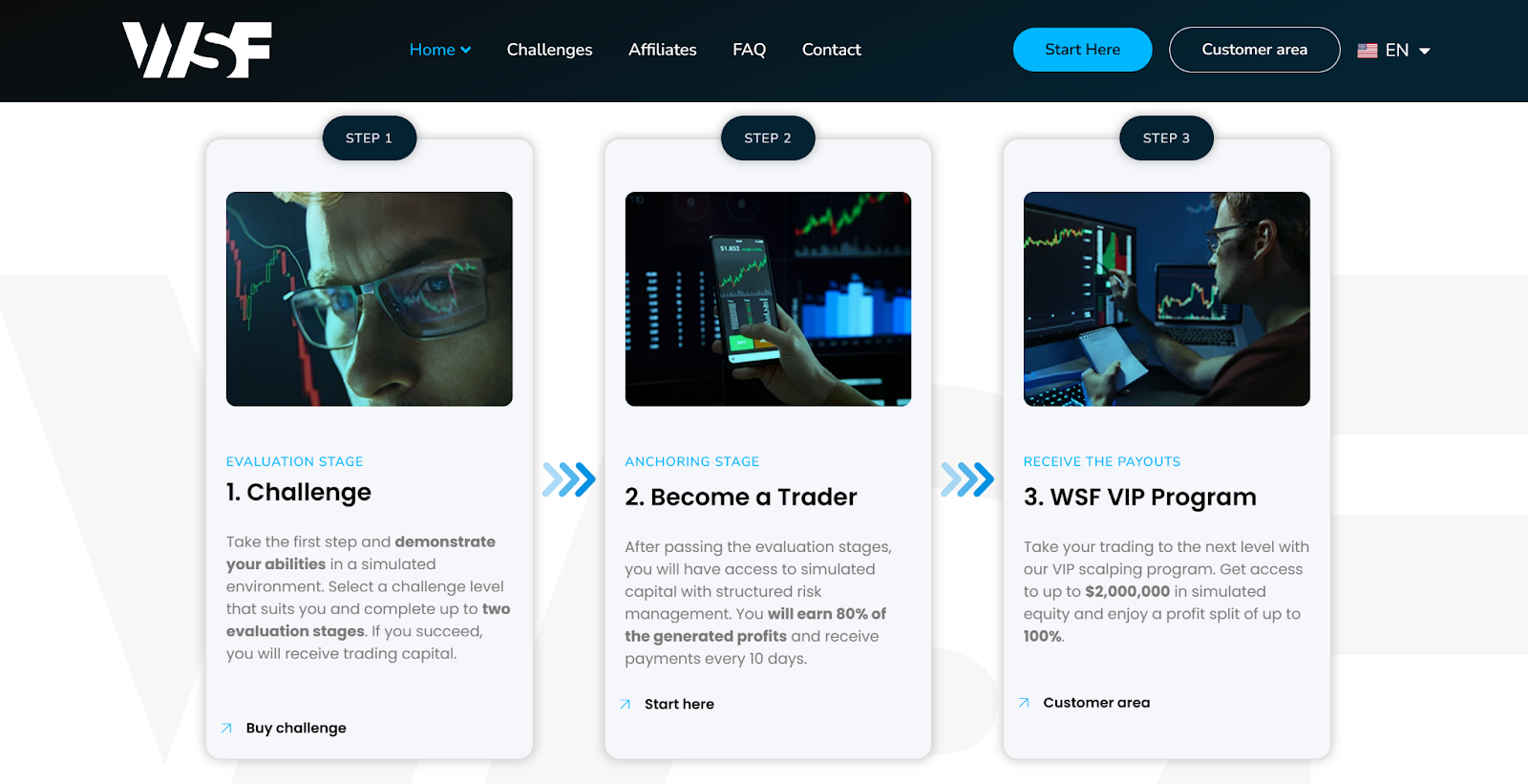

Wall Street Funded Challenge

The funded trader challenge at Wall Street Funded is a performance-based program, in which future traders pay a fee to demonstrate their trading abilities under controlled risks. Upon successful completion, access to the funded account with real capital is given to you and you will be able to trade with a large profit share. This trading challenge format is a way of getting a funded trader without the need to risk your own money.

Challenge Models & Evaluation Rules

The company Wall Street Funded has a number of challenge models such as one-step and two-step challenges. Each model has a set of evaluation rules governing it that specifies limits for drawdown, profit, holding period and maximum loss. These risk management rules serve to ensure that trading is done in a disciplined manner and that the financial institution remains stable.

- Phase 1 (Challenge): Work on a simulated account to achieve a profit target within a specified period of time and at the same time keep to drawdown rules.

- Phase 2 (Verification): Trade for verification if available, following the same risk parameters, but without a profit target, thus ensuring consistency.

Such clear evaluation rules as these help the best prop firm-funded accounts stand out from the weaker offers.

Profit Split & Payout Structure Explained

What is most appealing about the Wall Street Funded plan is the prop firm profit share that the trader gets to keep while trading with a funded account. After the trading stage (i.e. after the challenge/verification), the trader opens live trades and is allowed to keep a large part of the profits. Below is a typical profit split & payout scenario:

- The trader uses the funded account to trade and make profits.

- The firm takes its portion; the trader gets theirs.

- Transactions are carried out according to a plan (most of the time monthly) - this is the payout schedule.

- To ensure that this is always the case, some prop firm-funded trading accounts may come with a scaling plan that allows the firm to provide you with even more capital over time.

The terms of the payout are quite good, actually: there is no ceiling on your earnings, the percentages for profit splits are clearly stated and there are clear rules governing withdrawal requests. This funding journey thus becomes more rewarding for the trader who has proved their discipline.

Why Choose Wall Street Funded’s Program?

There are good reasons for deciding to go with the model of Wall Street Funded as opposed to taking the traditional funding routes. For example:

- Utilization of greater capital without causing any risk to your own money — this is made possible by the funded account provider model that they operate.

- Fair and transparent challenge and evaluation rules.

- A good profit split that allows you to keep a bigger share of your profits.

- Quick handling of payouts - a perfect payout structure for those who have been serious throughout their trading journey.

Different challenge models available to suit different trader personalities, for example, scalpers or

swing traders - due to the presence of flexible funded trading accounts.

Tips for Success in the Challenge

To most effectively play your cards and to fully reap the benefits of the prop firm-funded account, you can implement these tips:

- First of all, make sure you understand and comply with the risk management rules from the very first day.

- Pick the challenge model that uses your trading style and is suitable for your timeframe.

- It is a good idea to always keep a trade log, which can then be used to show that you have been trading disciplined and that you are trustworthy.

- Focus on saving the capital since drawdown limits are quite tight in challenge models.

- Think of your withdrawal strategy and payout account as if you were planning to make the most of the profit split & payout system by optimizing your earnings.

Final Thoughts

For those traders who are looking to take their career to the next level, the Wall Street Funded Challenge is one of the clearest and most rewarding ways in which this can be achieved. With the help of the challenge models, the generous profit split, and the fair payout structure, what you really should be thinking about is trading, not capital constraints. Stepping up and becoming a funded trader is what you should be doing next if that is what you want. Your very first important move towards success is to acquaint yourself with the Wall Street Funded Challenge Models, Profit Split & Payout.

Unlock your funded trading account now - Login prop firms via The Trusted Prop site!

Join the Wall Street Funded Challenge today - Start trading real capital with profit split opportunities!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict