Copy Coupon Code to Get

5% Off 🎉

Lux Trading Firm

Forex, Crypto, CFDs, Stocks, Indices

GB

2020

CEO: Oliver Olejár

Coupon Code:

MatchTrader

Metatrader 5

Metatrader 4

Wire Transfer/ Bank Transfer

Crypto

PayPal

Crypto

Wire transfer/ Bank Transfer

Credit/Debit Card

PayPal

GlobalPrime

Liquidity Providers

Lux Trading Firm Detailed Review 2025 Guide

Lux Trading Firm Detailed Review 2025 Guide

10/23/2025

Introduction

Trading with prop firms is everywhere now, but let’s be real, most firms feel like traps designed to take your fee and fail you with tricky rules. When we first came across Lux Trading Firm, we were curious. They talk about real A-book execution, instant withdrawals and scaling up to a $10M account. Sounds amazing, right? But is it really that good?

This blog is my breakdown of Lux Trading Firm’s evaluation model, rules, payouts and whether or not it is worth your time in 2025.

About Lux Trading Firm

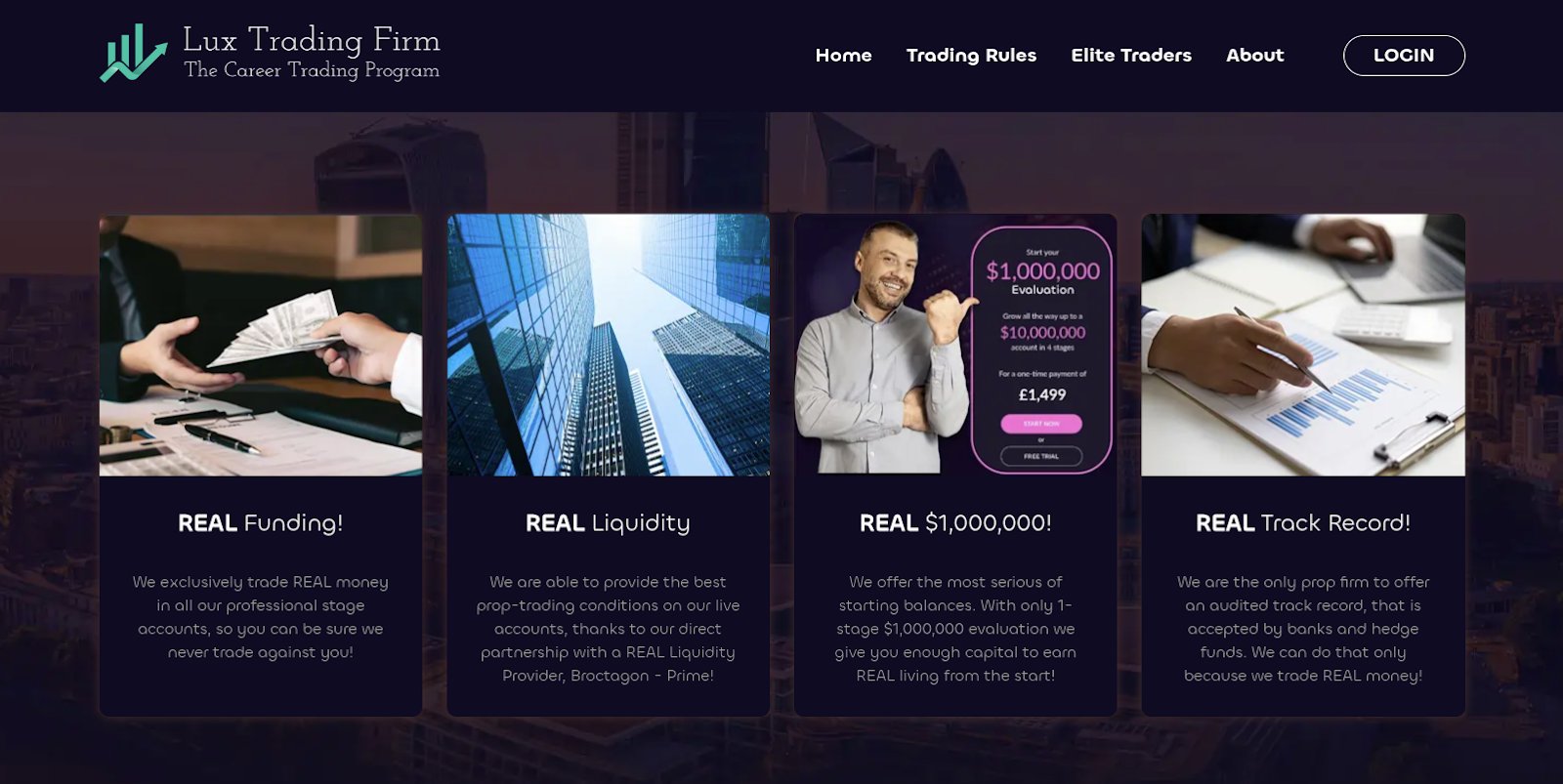

Lux Trading Firm is not just another pop-up prop firm. They have been around long enough to build a name and they stand out for one key reason, all their trades are executed on an A-book model. What does that mean for you? It means, your trades go straight to liquidity providers. No dealing desk, no manipulated fills.

Another thing we actually like, their accounts use a static 6% drawdown. Unlike trailing drawdowns, which can feel quick, Lux Trading Firm sets it once and leaves it. That alone makes risk management less stressful.

And yes, their headline feature is the scaling plan. Hit your targets consistently and you can grow from a $100K funded account all the way to $10M. That is the attractive offer and honestly, it is what makes traders stop scrolling and pay attention.

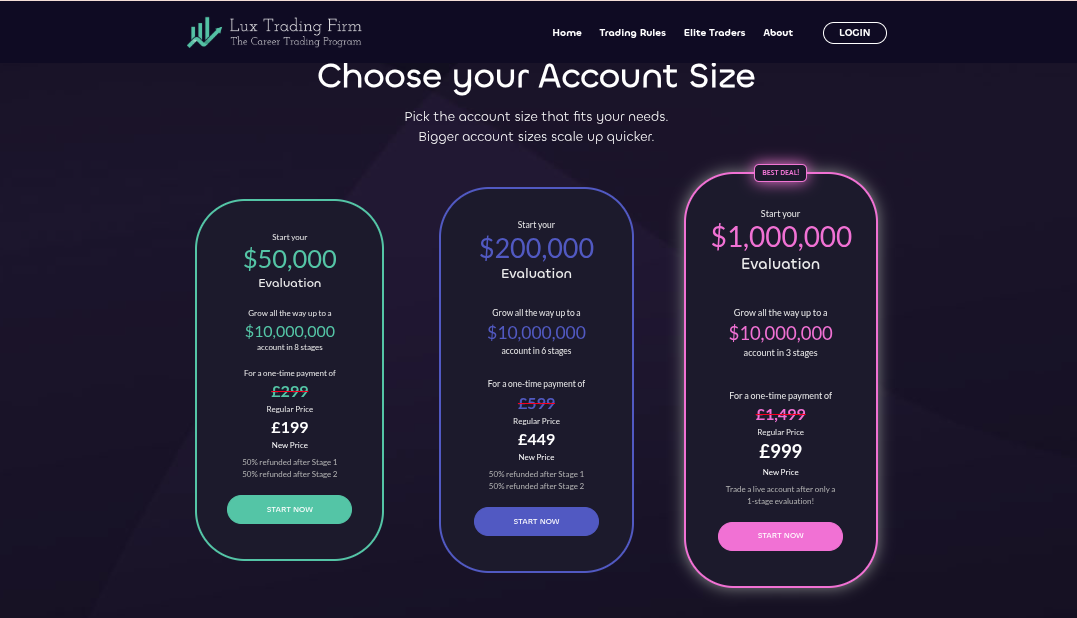

Lux Trading Firm Evaluation Models & Challenges Explained

Here is the refreshing part that Lux Trading Firm uses a 1-step evaluation model. You hit the target, stay inside the rules and you are in.

Each evaluation account has slightly different targets and fees.

$100,000 Evaluation

- Profit target: 10% ($10,000)

- Maximum loss: 6% ($6,000)

- Drawdown limit: $94,000

- Fee: £199 (refunded if you pass)

- Profit split once funded: 80%

$400,000 Evaluation

- Profit target: 12% ($48,000)

- Maximum loss: 6% ($24,000)

- Drawdown limit: $376,000

- Fee: £449 (refunded if you pass)

- Profit split once funded: 80%

$1,000,000 Evaluation

- Profit target: 15% ($150,000)

- Maximum loss: 6% ($60,000)

- Drawdown limit: $940,00

- Fee: £999 (refunded if you pass)

- Profit split once funded: 80%

Challenge Types - Quick Comparison

| $100K | $400K | $1M | |

| Profit Target | 10% ($10K) | 12% ($48K) | 15% ($150K) |

| Daily Loss Limit | None | None | None |

| Max Loss Limit | 6% ($6K) | 6% ($24K) | 6% ($60K) |

| Min Trading Days | No min/max | No min/max | No min/max |

| News Trading | Allowed (with SL rules) | Allowed (with SL rules) | Allowed (with SL rules) |

| Leverage | 1:30 | 1:30 | 1:30 |

| Profit Split | 80% | 80% | 80% |

| Payout Frequency | Instant | Instant | Instant |

| Best For | New prop traders | Experienced traders | Advanced/serious traders |

Lux Trading Firm Rules You Shouldn’t Ignore

I’ll be upfront with you: Lux Trading Firm’s rules aren’t some sneaky traps, but they’re strict enough that you can’t just trade wild and hope for the best. If you don’t follow them, you’re out. Simple as that.

Here’s the gist:

- You must have a stop-loss. No stop-loss means no trade.

- Don’t risk more than 5% of your Remaining Risk Capital on a single trade.

- Be consistent - if you’re risking 1% on most trades, don’t suddenly throw in 5%. They’ll notice.

- Each trade is capped at 5% profit.

Lux Trading Firm has established rules to promote disciplined and responsible trading. Specific to the firm, high-frequency trading (HFT), trading around news, and any other arbitrage manipulation will have no place in this firm.

Copy trading is allowed by the firm if all trading rules and risk parameters are obeyed. If the trading policies are routinely disregarded, the account will be terminated permanently.

Platforms & Trading Conditions

Lux Trading Firm gives you access to MT4, MT5, and cTrader. That covers pretty much everyone. And because they run on an A-book model, execution is smooth, and spreads are basically what you’d see in the live market.

You can trade almost anything here:

- Forex (majors, minors, even exotics)

- Indices (NASDAQ, S&P 500, DAX, FTSE)

- Commodities (gold, silver, oil)

- Stocks & CFDs

- Crypto (yep, BTC and ETH too)

So whether you’re scalping EUR/USD or swinging indices, there’s room to play.

How Payouts Work at Lux Trading Firm: Explained

This is where Lux Trading Firm really shines: instant payouts.

- No waiting for a payout cycle.

- Withdraw as soon as you’re in profit.

- You keep 80% of the profits.

- And yes - your evaluation fee gets refunded once you pass.

That last one matters more than people think. Most prop firms just take your fee and shrug. Lux actually gives it back, which makes it feel less like they’re cashing in on failed traders.

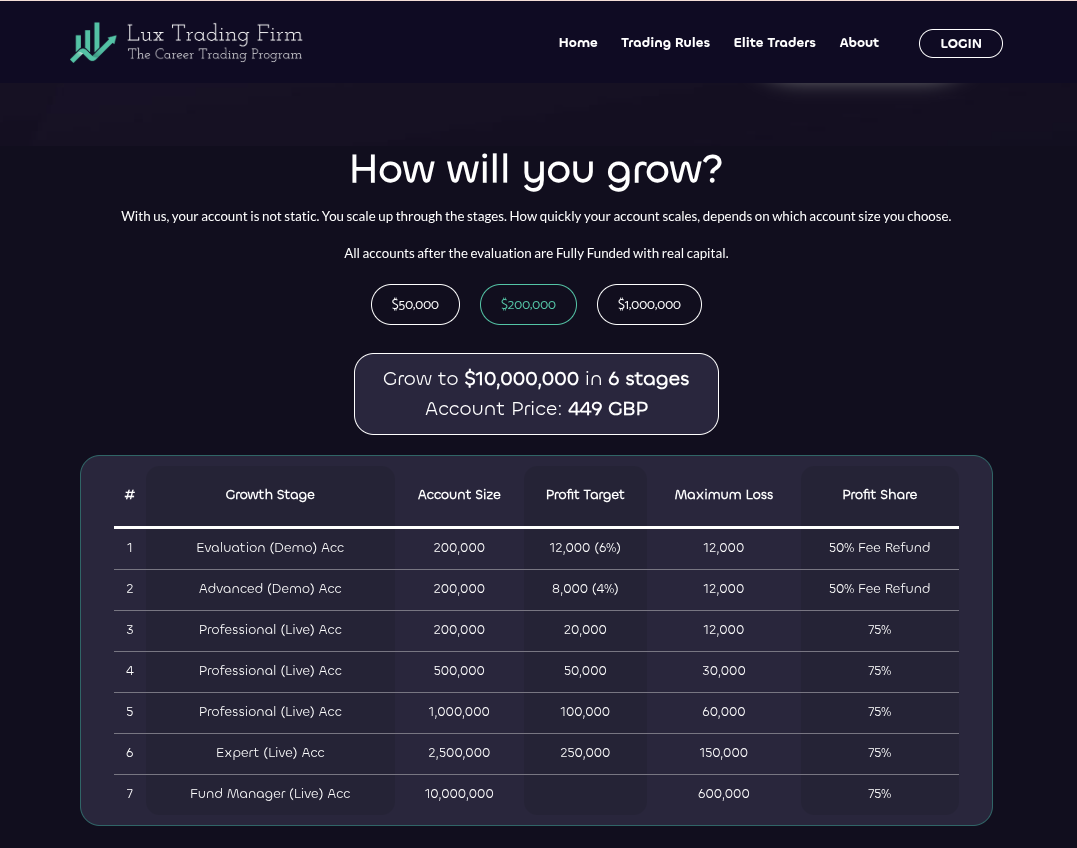

Lux Trading Firm Scaling Plan Explained

Lux’s scaling plan is dead simple. Every time you grow your account by 10%, it doubles. Keep it up and you can hit a $10M funded account.

The ladder looks like this: $100K → $200K → $400K → $1M → $2.5M → $10M.

Not many firms offer that kind of growth path. If you’re consistent, it’s one of the fastest ways to manage serious capital.

Our Tips for Passing the Challenge

- Keep risk at 1-2% per trade. Don’t flirt with 5%.

- Respect the stop-loss rule - they’re strict.

- Stick to London and NY sessions when the market’s alive.

- Don’t rush. There’s no time limit, so patience is your friend.

Final Thoughts - Is Lux Worth It?

Here’s the thing: Lux Trading Firm isn’t easy. If you want to use strategy or flip accounts, you’ll hate it here. But if you actually care about building consistency, their rules make sense.

Personally, we like that they offer real market execution, instant payouts, and a clear scaling plan. It’s not for everyone, but for serious traders in 2025, Lux is one of the better prop firms out there.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict