Lux Trading Firm Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Lux Trading Firm review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

5.0

5.0

Lux Trading Firm

Forex, Crypto, CFDs, Stocks, Indices

GB

2020

CEO: Oliver Olejár

Coupon Code:

MatchTrader

Metatrader 5

Metatrader 4

Wire Transfer/ Bank Transfer

Crypto

PayPal

Crypto

Wire transfer/ Bank Transfer

Credit/Debit Card

PayPal

GlobalPrime

Liquidity Providers

Lux Trading Firm Review 2025

If you have been looking into prop trading firms this year, you have probably seen Lux Trading Firm mentioned more than once. The firm has gained attention for its A-book model, 1-step evaluation process, instant withdrawals and the chance to scale up your trading capital all the way to $10 million. It positions itself as a professional environment for serious traders. But, is it really worth the fees and the rules that come with it? In this review, we will break down everything such as the challenges, fees, drawdown rules, payout process and whether Lux is a good fit for traders in 2025.

Lux Trading Firm Prop Firm Overview

Here is a quick look at the most important details about the Lux Trading Firm.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Lux Trading Firm |

| Legal Name | The prop firm’s legal name is Lux Trading Firm Ltd. |

| Headquarters | Its headquarters located in London, United Kingdom |

| Broker | A-Book Model with liquidity providers |

| Operating Since | The firm is operating since 2020 |

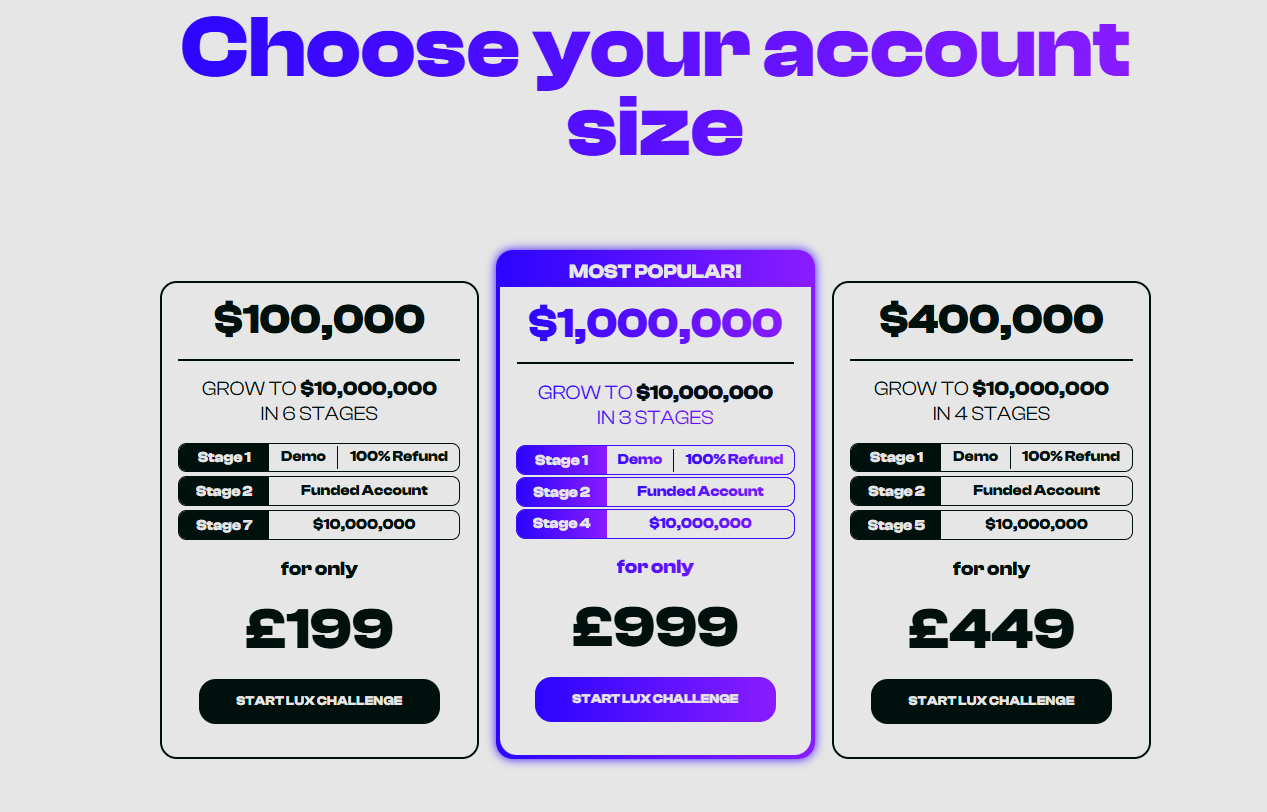

| Account Sizes | $100K, $400K, $1M |

| Drawdown type | Lux Trading Firm offers a static drawdown on all account types |

| Profit Split | Lux Trading Firm offers profit split up to 80% |

| Challenge Types | Lux Trading Firm offers 1-Step Evaluation |

| Payout Cycle | Lux Trading Firm offers Instant withdrawals, no fixed cycle |

| Payout Method | The withdrawal method supported by bank transfer, crypto, e-wallets |

| Trading Platforms | Trade on any platform you like and seamlessly copy your trades to Lux Trading via MatchTrader ,MT4 ,MT5 |

| Financial Markets | Lux Trading Firm supports Forex, indices, commodities, crypto |

| Max Allocation | Lux Trading Firm offers $10,000,000 |

| Refundable Challenge Fees | Lux Trading Firm offers a 100% refund of challenge fees once you pass the challenge |

| Trustpilot Score | Lux Trading Firm supports has 4.4/5 (as of 2025) based on 693 reviews |

Pros and Cons of Trading with Lux Trading Firm

Like any prop firm, Lux Trading Firm comes with strengths and some trade-offs. Many traders like the simple evaluation and scaling plan, but the rules may feel strict to others.

| Pros | Cons |

|---|---|

| Straightforward 1 -step evaluation | High challenge fees compared to other prop firms |

| Instant withdrawals, no payout cycles | Must set a stop-loss on every trade |

| Huge scaling potential up to $10M | Only 1-Step challenge, other evaluation models is not yet available |

| 80% profit split once funded | No transparency on company leadership |

| Evaluation fee refunded 100% after Stage One, provided you meet profit target and follow all rules | HFT, arbitrage and news bracketing banned |

| EA's are allowed | 6% static drawdown can feel restrictive |

Lux Trading Firm Challenge Types, Fees & Profit Split Explained

Lux Trading Firm keeps things simple such as there is only a 1-step evaluation to pass before you can access funded capital. Fees vary depending on account size, and once you are funded, you keep 80% of profits. 100% refunded after Stage One, but only if the trader completes the profit target and follows all rules. Refund is issued after review by the risk department of the prop firm.

| Feature | Details |

|---|---|

| Challenge Types | 1-Step Evaluation |

| Account Sizes | $100K, $400K, $1M |

| Challenge Fees Start From | £199 ($264), £449 ($597), £999 ($1329) |

| Profit Target | 10% to 15% |

| Daily Drawdown | Not specified |

| Max Drawdown | 6% (static) |

| Drawdown Type | Static (fixed) |

| Min. Trading Days | None |

| Max Trading Days | None |

| Leverage | 1:30 |

| Stop Loss Rule | Mandatory on all trades |

| Consistency Score Rule | Yes, fixed risk percentage required |

| News Trading Allowed | Limited, with restrictions |

| Profit Split | 80% |

| Payout Frequency | Anytime, which means instant withdrawals |

$100,000 Evaluation Account

Lux Trading Firm’s $100,000 account is available once you successfully complete the challenge models and meet all targets and trading rules. Below are the fees and target details.

| Account Size | Fee | Profit Target | Max Loss | Drawdown |

|---|---|---|---|---|

| $100,000 | £199 ($264) | $10,000 (10%) | $6,000 | Static $94,000 |

Why choose this challenge?

- Low cost entry fee compared to larger accounts

- Great starting point for scaling up

- Fee is refunded after passing

$400,000 Evaluation Account

The $400,000 evaluation account is designed for traders who are looking to start with more funds and improve their path to larger funding levels, all within a simple and single step challenge model. Below is the gist of this challenge model.

| Account Size | Fee | Profit Target | Max Loss | Drawdown |

|---|---|---|---|---|

| $400,000 | £449 ($597) | $48,000 (12%) | $24,000 | Static $376,000 |

Why choose this challenge?

- Higher capital from the start

- Scales faster into $1M+ levels

- Still a single step evaluation

$1,000,000 Evaluation Account

It is designed for experienced traders, which offer seven figure funding account size and a clear path to the $10M capital. Below are the details of Drawdown limits.

| Account Size | Fee | Profit Target | Max Loss | Drawdown |

|---|---|---|---|---|

| $1,000,000 | £999 ($1329) | $150,000 (15%) | $60,000 | Static $940,000 |

Why choose this challenge?

- For experienced traders with larger strategies

- Immediate access to 7-figure funding

- Clear path to the $10M cap

Account Reset Fee

- $100K account reset → £139 ($184)

- $400K account reset → £299 ($397)

- $1M account reset → £699 ($930)

Our verdict on Lux Trading Firm’s challenges

The single step evaluation is a strong advantage compared to firms with multi stage challenges. The fees are higher, but if you are serious about long-term scaling, Lux Trading Firm gives a lot of room to grow.

Lux Trading Firm Drawdown and News Trading Rules

Lux Trading Firm uses a 6% static drawdown across all accounts. This means the drawdown limit is fixed at 6% of the initial balance and does not trail as your balance grows. Some traders prefer static drawdowns because they are predictable, while others might find it limiting.

As for news trading, Lux Trading Firm allows it. But, there are restrictions. You can’t adjust stop-losses within 30 seconds before or after major economic events and news bracketing strategies like placing opposite trades before announcements are strictly restricted.

Lux Trading Firm Spreads & Commissions

Lux Trading Firm operates on an A-Book model, which means trades are sent directly to liquidity providers with no dealing desk interference. Spreads are variable and depend on market conditions, but traders generally report competitive pricing. Commissions vary slightly depending on instruments, but they are in line with other top tier prop firms.

Trading Instruments Offered by Lux Trading Firm

Traders with Lux can access a variety of markets, which includes,

- Forex pairs like majors, minors, exotics

- Indices like US30, NAS100, GER40, etc.

- Commodities like gold, silver, oil, etc.

- Cryptocurrencies like BTC, ETH and more

This selection covers most strategies, though futures and stocks are not part of their offering yet.

Trading Platform supported by Lux Trading Firm

At Lux Trading Firm - You can use any trading platform you prefer. Simply connect your existing broker or prop firm account and copy your trades directly to your Lux Trading account on the MatchTrader platform.

Lux Trading Firm Trading Rules - What is Allowed and What is Not

Lux Trading Firm doesn’t really overcomplicate their rules, which I like, but you still have to play inside the lines. Some trading styles are fine, some are strictly restricted.

| Strategy or Rule | Allowed or Not | Details |

|---|---|---|

| Stop-Loss Placement | Mandatory | Every trade must have a stop loss before entering. Protects both your fund and the firm’s funds. |

| Adjusting Stop-Loss | Yes | Can move stop loss to break even or lock in profits once trade moves favorably. |

| News Event SL Adjustment | No | Stop loss cannot be adjusted within 30 seconds before or after major news events to prevent volatility risk. |

| Remaining Risk Capital (RRC) | No | RRC = Current Balance - Drawdown Limit (6% of starting account). It determines the capital you risk per trade. |

| Fixed Risk % per Trade | Yes | Max 5% of RRC per trade. Must remain consistent across all trades. |

| Multiple Positions | Yes | Combined risk for all open positions cannot exceed 5% of RRC. Neutralize existing risk before adding new trades. |

| Single Trade Profit Limit | Yes | Max realized profit per trade = 5% of funded account balance to maintain controlled trading. |

| Risk Manager Guidance | Mandatory | Funded or Elite Package traders get a dedicated risk manager for advice and supervision. Avoiding rules repeatedly can lead to account closure. |

| High-Frequency Trading (HFT) | No | 2,500+ server messages per day or automated EAs and robots creating excessive trades are not allowed. |

| News Bracketing | No | Placing simultaneous buy or sell orders around news events to exploit volatility is strictly restricted. |

| Arbitrage Trading | No | Exploiting price gaps or latency across accounts and brokers for risk free profits is restricted. |

| Swing Trading | Yes | It is fully allowed |

| Scalping | Yes | Allowed, but moderate risk recommended. |

| Copy Trading | Yes | Allowed, but all trades must follow stop loss rules. |

| EA/Robots | Yes | Automated trading is definitely allowed. |

Trading Practices to Avoid at Lux Trading Firm

- No arbitrage, period. Doesn’t matter how clever it is.

- No news bracketing either, if you place orders around announcements hoping to catch the spike, that is a quick way to lose the account.

- Manual trading is fully allowed, but any attempts to manipulate or exploit the system are strictly not allowed.

So basically, manual trading styles like swing or scalping are good. Anything that looks like gaming the system? Not happening here.

Lux Trading Firm – Trading Rules & Risk Management

Lux Trading Firm emphasizes disciplined risk management to protect both traders and firm capital. Below is a detailed breakdown of the trading rules, risk management guidelines, and prohibited strategies.

1. Stop Loss Rules

- Mandatory Stop Loss

- Every trade must have a stop loss set before entering the market.

- This allows proper risk calculation and protects both the trader and the firm.

- Failure to set a stop loss is considered a rule breach. Repeated violations may lead to evaluation failure, requiring the trader to restart the evaluation stage.

- Moving Stop Loss

- Traders may move their stop loss to break even or lock in profit once the trade moves favorably.

- News Events

- Stop-loss adjustments are not allowed within 30 seconds before or after high-impact news events to prevent exposure to extreme volatility.

- Market Conditions

- During high volatility or unexpected events, trades might close at the next available price, which can differ from the intended stop-loss.

2. Trading Strategies

- Copy Trading is allowed at Lux Trading Firm

- Traders may copy or mirror other accounts as long as all trades adhere to risk rules and drawdown limits.

- High-Frequency Trading (HFT) is strictly prohibited at Lux Trading Firm

- This includes generating more than 2,500 server messages per 24 hours or using fully automated EAs/robots creating excessive trades. Violation may lead to account termination.

- News Bracketing is prohibited at Lux Trading Firm

- Traders may not place simultaneous buy and sell orders around scheduled news events to exploit volatility. Violation results in immediate account termination and forfeiture of profits.

- Arbitrage Trading is prohibited at Lux Trading Firm

- This includes exploiting price feed differences, latency issues, or mirroring trades across brokers for risk-free profits. Violation results in immediate account termination and forfeiture of profits.

3. Risk Management

- Risk Manager

- Traders are assigned a dedicated risk manager starting from Funded Stage (or Evaluation Stage in Elite Package).

- The risk manager advises and supports traders to meet targets while safeguarding firm capital.

- Serious negligence or repeated poor risk management may lead to account closure.

- Risk Consistency

- Traders must maintain consistent risk allocation across all trades during each stage.

- The percentage of risk per trade must remain uniform whether trading one position or multiple positions.

- Remaining Risk Capital (RRC)

- RRC = Current Balance – Drawdown Limit

- Drawdown Limit = Starting Account Balance – 6%

- RRC defines the capital buffer available and is used to calculate permissible position sizing.

- Fixed Percentage Risk

- Traders must select a fixed percentage of RRC to risk per trade and apply it consistently.

- Maximum permissible risk = 5% of RRC

- Risk Calculation

- Risk is calculated at the moment a trade is opened:

- Monetary risk = Distance between opening price and stop loss × Lot size

- Percentage risk = Monetary risk ÷ Current RRC

- Multiple Positions

- Combined risk of all open positions must not exceed 5% of RRC.

- To open a new position, existing risk must be neutralized by moving an existing stop to break-even or closing a position.

- Single Trade Profit Limit

- Each trade is limited to a maximum realized profit of 5% of the account balance to ensure controlled and consistent trading.

Key Takeaways

- Always use a stop loss before entering a trade.

- Maintain consistent risk allocation.

- Avoid prohibited strategies like HFT, news bracketing, and arbitrage.

- Follow your risk manager’s guidance.

- Total risk exposure (including multiple positions) should never exceed 5% of RRC.

- Keep profits and trading disciplined to protect both your capital and Lux Trading’s funds.

Scaling Plan at Lux Trading Firm

Now, here is the fun part called scaling. Lux Trading Firm has one of the better plans out there. Every time you make 10% on your funded account, they boost you up. Simple as that.

From $100K, then $200K, then $400K, then $1M, then $2.5M, then $10M

Details of the scaling plan are provided under each Account Size.

$100,000 Evaluation Scaling Plan

| Stage | Account Size | Profit Target | Maximum Loss | Profit Split/ Fee Refund |

|---|---|---|---|---|

| #1 Demo | $100,000 | $10,000 | $6,000 | 100% Refund |

| #2 Funded | $100,000 | $10,000 | $6,000 | 80% |

| #3 Funded | $200,000 | $20,000 | $12,000 | 80% |

| #4 Funded | $400,000 | $40,000 | $24,000 | 80% |

| #5 Funded | $1,000,000 | $100,000 | $60,000 | 80% |

| #6 Funded | $2,500,000 | $250,000 | $150,000 | 80% |

| #7 Fund Manager | $10,000,000 | $600,000 | 80% |

$400,000 Evaluation Scaling Plan

| Stage | Account Size | Profit Target | Maximum Loss | Profit Split/ Fee Refund |

|---|---|---|---|---|

| #1 Demo | $400,000 | $48,000 | $24,000 | 100% Refund |

| #2 Funded | $400,000 | $48,000 | $24,000 | 80% |

| #3 Funded | $1,000,000 | $100,000 | $60,000 | 80% |

| #4 Funded | $2,500,000 | $250,000 | $150,000 | 80% |

| #5 Funded Manager | $10,000,000 | $600,000 | 80% |

$1,000,000 Evaluation Scaling Plan

| Stage | Account Size | Profit Target | Maximum Loss | Profit Split/ Fee Refund |

|---|---|---|---|---|

| #1 Demo | $1,000,000 | $150,000 | $60,000 | 100% Refund |

| #2 Funded | $1,000,000 | $150,000 | $60,000 | 80% |

| #3 Funded | $2,500,000 | $250,000 | $150,000 | 80% |

| #4 Fund Manager | $10,000,000 | $600,000 | 80% |

That is not small money either. The catch is, of course, you have got to be consistent. Anybody can have one lucky month, but to climb this ladder you need to keep your head straight and trade within their rules. If you can do that, scaling up feels realistic, not just marketing fluff.

Lux Trading Firm Payment Methods & Payout Process

Here, Fees can be paid in the usual ways such as credit or debit card, bank transfer, even crypto. Nothing shocking there.

But payouts, that is where Lux Trading Firm actually stands out with it's instant payout feature. Most prop firms force you into a cycle like bi-weekly or monthly payouts. But here, they let you withdraw profits whenever you want, instantly as long as your trades are closed. That is a big deal if you hate waiting around for your money.

And here is the twist, whatever you withdraw still counts toward your scaling target. So, you don’t have to choose between cashing out or growing your account. You can do both. Honestly, that is one of the best trader-friendly feature offered by the firm.

Lux Trading Firm – Reset Fees, Refunds & Withdrawals

Lux Trading Firm provides transparent policies on evaluation fees, withdrawals, and account resets to make trading straightforward and trader-friendly.

1. Evaluation Fee Refund

- 100% Refund After Stage One:

- All evaluation fees are refunded once Stage One is successfully passed.

- Stage One is considered passed only when the trader:

- Achieves the required profit target.

- Complies with all trading and risk management rules.

- Refunds are processed after review and approval by the risk desk.

- Non-Refundable Otherwise: If the stage is not passed, the evaluation fee is not refunded.

2. Instant Withdrawals

- Traders can withdraw profits instantly at any time once the account is in profit.

- No fixed payout cycles: You decide when to withdraw.

- Conditions: All positions must be closed at the time of withdrawal.

- Withdrawn profits still count toward your profit target, so you can secure earnings without slowing progress in funded stages.

3. Refund Policy

- Once the enrollment fee is paid and evaluation account login details are issued via email, the fee becomes non-refundable.

4. Account Reset Fee

- Eligibility for Reset: Can be requested if a trader breaches the Maximum Drawdown, or voluntarily chooses to reset their account.

- Process: A new trading account is issued with fresh login details for the selected platform.

- Reset Fees:

| Account Size | Reset Fee |

|---|---|

| $100K | £139 ($184) |

| $400K | £299 ($397) |

| $1M | £699 ($930) |

Key Takeaways:

- Stage One completion is required for a 100% evaluation fee refund.

- Withdraw profits instantly with no fixed schedule.

- Enrollment fees are non-refundable after login credentials are issued.

- Account resets are possible with a fee, either due to a drawdown breach or voluntary choice.

Countries Restricted at Lux Trading Firm

LUX Trading Firm welcomes traders globally, with only a minor restriction — individuals from countries on international sanctions lists can still participate but must process all fees and withdrawals via cryptocurrency

Our Final Verdict on Lux Trading Firm

So here is the bottom line. Lux Trading Firm has some major strong points including an A-Book model trading conditions, a simple 1-step evaluation, instant withdrawals which is a huge plus and a scaling plan of up to $10 million. On top of that, an 80% profit split is definitely a plus traders who want keep more profits.

Now, for the downsides like the fees are not low and the strict stop-loss requirement might annoy some traders who like more flexibility. They want risk under control, but we can also see some traders walking away because of it.

Finally, Lux Trading Firm is not for hobby traders or who are looking for a get rich fast setup. It is more for disciplined, patient traders who want a realistic shot at managing big capital. If that is you, then Lux Trading Firm could be a solid pick in 2025.