Copy Coupon Code to Get

17% Off 🎉

Instant Funding

Forex, Metals, Commodities, Indices, Crypto

GB

2022

CEO: Lewis

17% Off + 7.5% Cashback or upto 1200 Trustponts

Coupon Code:

cTrader

MatchTrader

MetaTrader

Rise

Crypto

Wire transfer/ Bank Transfer

IF Pro

Instant Funding IF1 Account Explained (2026 Guide)

Instant Funding IF1 Account Explained (2026 Guide)

1/3/2026

The Instant Funding IF1 account is a new addition to its instant funding account types. This instant funding program is for aggressive traders who love fast-paced trading and payouts with high profit splits. The Instant Funding IF1 offers instant access to a funded trading account active for 24 hours from the first trade. Traders can enjoy the trading benefits for a 24-hour window. The account closes automatically when the 24-hour period ends.

The profit split of the Instant Funding IF1 is 90% and withdrawal after the 24-hour trading window closes. You can request a withdrawal if you reach 3% profit and meet the consistency rule. It will qualify for a payout. In this article, we’ll explore the Instant Funding IF1 account sizes, costs, rules, strategies, prohibitions, how to get started with the Instant Funding IF1 account, and why traders choose IF1 account.

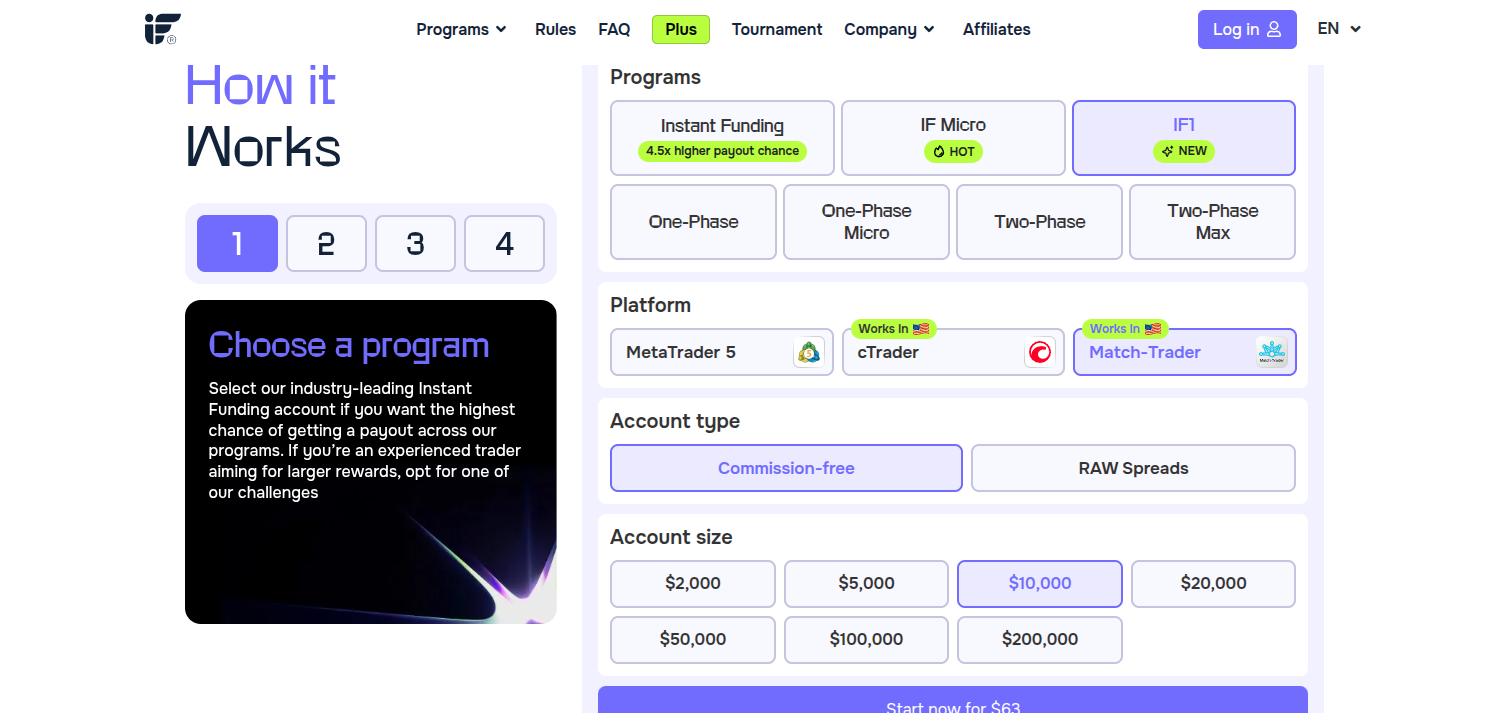

Instant Funding IF1 Account Size and Costs (Commission-Free)

The IF1 Account sizes help traders utilize large capital for trading without risking their own personal capital. The account sizes range from $2,000 to $200,000, and the starting IF1 Account cost is $25.

Instant Funding IF1 Account Size and Costs

Instant Funding IF1 account size starts at $2,000 and goes up to $200,000. It suits both beginners and experienced traders to choose the account size according to their style, goals, and budget.

- $2,000 - starts at $25

- $5,000 - starts at $38

- $10,000 - starts at $63

- $20,000 - starts at $119

- $50,000 - starts at $289

- $100,000 - starts at $484

- $200,000 - starts at $939

Instant Funding IF1 Account Breakdown

The Instant Funding IF1 account is tailored for a specific style of trading and trader. Instant Funding IF1 has unique rules that are more prop trader friendly. It is a 24 hour brief window trading for traders who want to trade and earn profits and close trades on the same day. Instant Funding IF1 rules are tailored to match the 24 hour trading window trading style.

- This instant funding account doesn't have a profit target or smart drawdown.

- But it has a daily drawdown of 2% and a static drawdown of 4%.

- The standard profit split is 90%. There is no scaled profit split.

- There is no scaling option available.

- There is a time limit of 24 hours for trading.

- There is no minimum trading days.

IF1 account Leverages:

Instant Funding IF1 leverages vary with the instruments you are trading. While Forex offer the highest leverage and strong position control, crypto, indices, and commodities offer relatively low leverages.

- Currencies leverage: up to 1:100

- Commodities leverage: up to 1:20

- Indices leverage: up to 1:20

- Crypto leverage: up to 1:2

- There is no add-on boost on leverage.

Instant Funding IF1 Account Trading Window

The uniqueness of the IF1 account offered by Instant Funding prop firm is its 24-hour trading window. It is a 24-hour-long instant funding account with a high profit split and specific payout rules.

Instant Funding IF1 Account Key Highlights

Before starting with Instant Funding IF1 account, ensure you understand the features, benefits, targets, and Instant Funding IF1 risk management limits. Knowing these Instant Funding IF1 rules and targets can help you plan your strategies and protect your account and capital within the 24 hour trading window.

- Trading Time: 24 hours from the first trade. The account automatically closes after this period.

- Profit Split: A 90% profit split is offered.

- Payout Cycle: Eligible for a payout after 24 hours if conditions are met.

- Profit Threshold: A minimum of 3% profit is required for a payout.

- Consistency Rule: Your single best trading day must not account for more than 15% of your total profit.

- Risk Limits: Daily Loss and Drawdown targets

- Daily Loss: A Maximum of 2% loss of your account value per day. Static Drawdown: Maximum total loss is limited to 4% of your starting balance.

Instant Funding IF1 Account Rules

Traders must maintain and trade within these rules at all times to continue trading on the Instant prop trading platform.

| Parameter | Specification |

| Trading time | 24 hours from the first trade |

| Profit split | 90% |

| Payout cycle | Eligible after 24 hours |

| Profit threshold for payout | 3% |

| Consistency rule | 15% best trade rule |

| Scaling | Not available |

Instant Funding IF1 Account Key Targets & Risk Parameters

Let us discuss the crucial targets and risk managment parameters to maintain a healthy funded account and continue trading for the entire 24 hour trading window on the instant funding prop firm platform.

IF1 Payouts: You can request a payout after your 24-hour trading window ends. The instant funding IF1 account is live for 24 hours from your first trade. You can request one payout after the 24-hour account period closes. The condition for payout to be processed is that your best trade does not exceed 15% of your total profit, and your net profit is at least 3% of your initial account balance.

IF1 Profit Target: The best thing about the Instant Funding IF1 account review is that it has no profit target, providing traders the freedom to set their own targets. But to request a payout or be eligible for a payout withdrawal, traders must earn a profit of 3% of the initial account balance and meet the consistency rule of 15%.

IF1 Daily Drawdown: It is a very critical parameter for continuing trading on an instant funding platform and avoiding account closure. It says a trader must never exceed 2% of their balance to prevent account closure. For example, if your account balance is $5,000, you cannot lose more than $100. It is your maximum daily loss limit in a given day.

IF1 Max Drawdown: It is another very critical parameter for continuing trading on an instant funding platform and avoiding account closure. It takes about the permissible total or overall loss of 4%. Your maximum drawdown or total losses must never exceed 4%. For example, if your account balance is $5,000, and 4% of it is $200. Hence, your account balance can never drop below $4800.

IF1 Profit Split: The Instant Funding IF1 account offers a high profit split of 90%. You can take home 90% of all the profits earned. If you have earned $5,000, you can request a withdrawal of $4,500.

IF1 Scaling: Unfortunately, it does not offer scaling because the account closes 24 hours after the first trade

IF1 Minimum Trading Days: For the same reason as in scaling, there are no minimum trading days. The IF1 account closes 24 hours after the first trade.

IF1 Overnight Holding: You can hold trades as long as the 24-hour trading window is open. Once the 24-hour window expires, so does your holding.

IF1 Weekend Holding: It is allowed, but it may get automatically closed if the 24-hour trading window expires. If the market closes before the expiry of your 24-hour window, you can keep the position open until the 24-hour window is valid. Crypto positions can stay open.

IF1 Leverage: It varies with the asset/instrument type.

- Currencies – 1:100

- Commodities – 1:20

- Indices – 1:20

- Crypto – 1:2

How Leverage helps traders: It helps traders capture a larger position size with a small capital. For example, if you are using $1,00 capital, and if your leverage is 1:100, you can capture a position equivalent to $100,000.

IF1 Risk Limits

A word on the most critical risk management parameters to prevent any automatic account closure.

- Daily Loss: Your maximum daily loss must not exceed 2% of your account in.

- Maximum Static Overall (Total) Drawdown: Your maximum loss must never exceed 4% of your starting balance.

- IF1 Max Lot Rule: The Maximum Lot Rule states how much a trader is allowed to use maximum lot sizes for every asset class. With the IF1 Max Lot Size restriction, traders can stay within the risk well. It helps traders with consistent and responsible trading. In Instant Funding, every asset class is assigned a specific Lot size limit.

Maximum Permissible Lot Sizes for Instant Funding IF1 accounts

| IF1 account size | FX | Commodities/ Metals | Indices | Crypto |

| $2,000 | 0.8 | 0.06 | 0.4 | 0.2 |

| $5,000 | 2 | 0.15 | 1 | 0.5 |

| $10,000 | 4 | 0.3 | 2 | 1 |

| $20,000 | 8 | 0.6 | 4 | 2 |

| $50,000 | 20 | 1.5 | 10 | 5 |

| $100,000 | 40 | 3 | 20 | 10 |

| $200,000 | 80 | 6 | 40 | 20 |

Risk per Trading Instrument: It is another critical parameter to avoid account closure. The rule says that a trader must not risk more than 1% of the initial account balance in a single trade. A single trade involves all open positions on the same instrument in the same direction, such as either Buy or Sell. Exceeding this limit will result in a hard breach.

Payouts: Payout request after the 24-hour period ends, payout conditions apply:

Payout Conditions - Minimum and Maximum Profit Cap

- Minimum Net profit: You must have reached a minimum net profit of 3% of your starting balance

- Maximum Total profit cap: Your best trade does not exceed 15% of your total profit

For example, if you have earned a total profit of $1,000, your best trade must be equal to or less than 15% of $1,000, which equals $150

Condition for Requesting a withdrawal:

- Your account has passed its 24-hour window.

- To request a payout withdrawal, visit the Instant Funding account dashboard. Then choose your preferred withdrawal mode, such as crypto, bank transfer, etc.

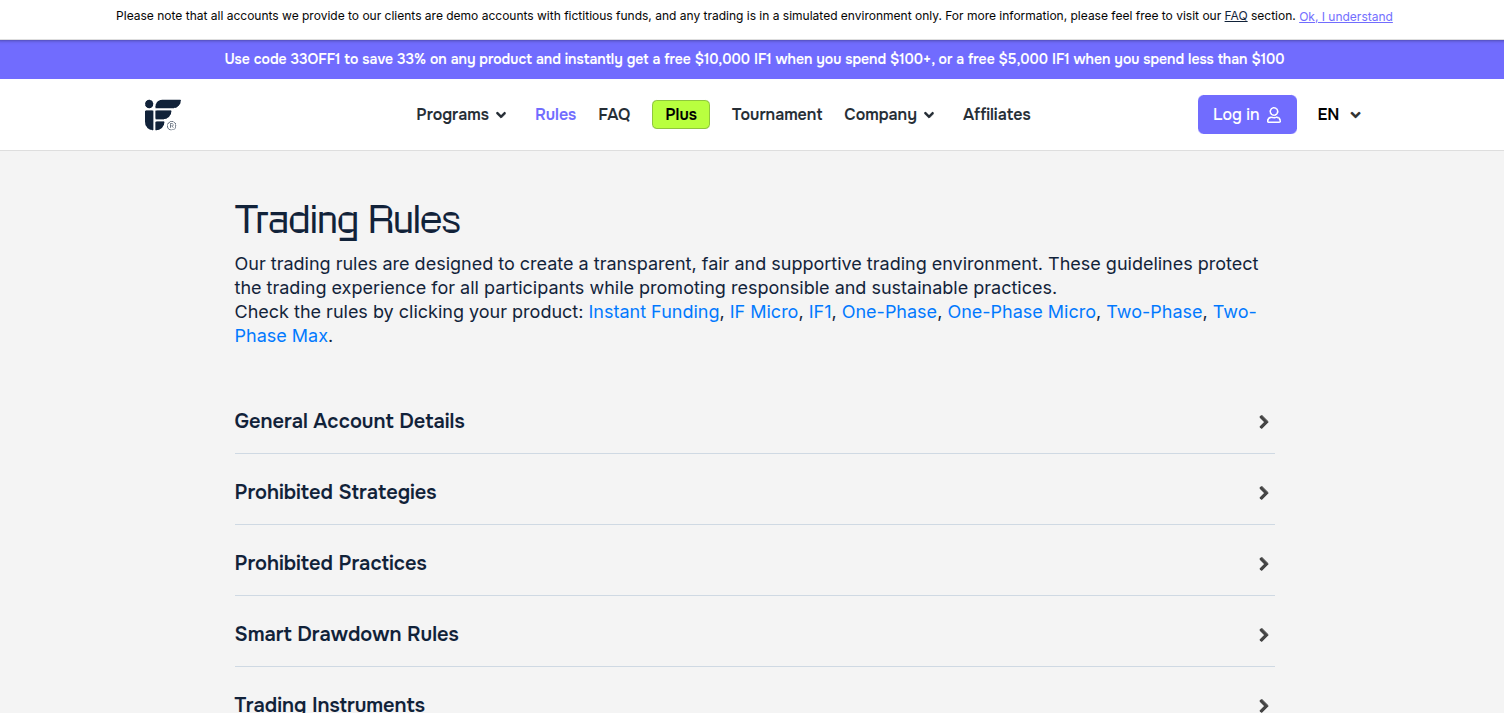

Instant Funding Prohibited Trading Strategies and Practices

Certain strategies and behaviors are not allowed and may result in account termination or profit removal. This includes:

- Betting and gambling strategies

- Grid & Martingale trading

- High-frequency trading: high volume at a frequency under 60 seconds)

- Copy trading

- Expert advisors (EAs), Bots, Algorithmic

- Reverse trading

- Group hedging

- Group copying

- Account management

- Account churning (Rolling)

- Exploiting system errors & glitches

- Exploiting inefficiencies of trading platforms, such as latency or feed errors

- For detailed definitions and examples, see our Trading Rules.

News Trading

News trading is allowed by default on all IF1 accounts. You can benefit from news trading within two minutes before or after a major newsbreak, by opening and closing trades during major economic news or events.

Holding Rules

You can hold trades overnight and keep your position open. Weekend holding is technically allowed. Because the trading window is 24 hours, the trade closes automatically if the market closes before your 24-hour account period expires. Crypto positions can remain open for the full 24 hours.

Instrument Commissions

Commission-free accounts have no commissions. The following commissions apply exclusively to RAW spreads accounts:

| Instrument | Commission per lot |

| FX | $5 |

| Metals | $5 |

| Commodities | $2 |

| Crypto | $1 |

| Indices | USD-based: $2 per lot. Other indices: Approximately $2 per lot (varies with interest rates/exchange rates of the base currency) |

Conclusion

The Instant Funding IF1 is a 24-hour window trading for traders who want to make it big in a single day. Traders looking for big funded trading opportunity to quickly capitalize on the trading opportunities can start the Instant Funding IF1 Account. Instant Funding IF1 enables traders to make huge profits within the 24-hour time period. But before starting, Instant Funding IF1 traders must learn and understand how to protect their accounts from the strict drawdown, lot size restrictions, payout eligibility conditions, and the 15% consistency rule.

Learn more about the Instant Funding IF1 account on the top prop firm review platform - The Trusted Prop.

Get started with the Instant Funding IF1 account by signing up on the firm’s official website.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict