Copy Coupon Code to Get

15% Off 🎉

ATFunded

Forex, Metals, oil, Indices, Crypto

VC

2025

CEO: Joshua Dentrinos

15% OFF on 2-Step and Pro & 50% OFF on 10k & 50k Pro.

Coupon Code:

MetaTrader

Wire Transfer/ Bank Transfer

Crypto

Neteller

Skrill

Crypto

Credit/Debit Card

ATFX

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

ATFunded Detailed Review 2025: Challenges, Rules, Payouts & Real Trader Insights

ATFunded Detailed Review 2025: Challenges, Rules, Payouts & Real Trader Insights

11/27/2025

Introduction

Are you looking to trade on funded trading accounts from ATFunded worth $10k, $50k, $100k, or $150k? Then this detailed ATFunded review should be your go-to manual for understanding how this prop firm works. We analyze their 2-Phase Challenge account, uncover the extremely important trading rules (Max Loss Limit, Daily Drawdown) that you must follow at all times, explain how you can go about withdrawing your profits smoothly, and tell you exactly what instruments you can trade. Get started with earning money - find out if the ATFunded Pro Program is the feasible, well-organized way that leads to your steady, sustainable growth of trading career over time.

About ATFunded

ATFunded prop firm launched around 2025 and is funded by ATFX. ATFunded allows traders to access funded capital after completing a trading challenge. You pay a one-time fee and trade under outlined rules (profit target, drawdown and minimum trading days) and if you pass the challenge, you will trade ATFunded's capital while payment you make up to 80% of the profit. You can receive funding up to $200,000 and ATFunded promotes itself as a simple, transparent and fast prop firm for traders to increase their account without risking their own funds.

ATFunded Evaluation Models & Challenge Explained

The ATFunded Review first sees the light with comprehension of prop firm challenge system. Traders willing to get a funded account at ATFunded need to finish a prop evaluation that is based on trading rules, risk limits, and profit targets.

Such a process is aimed at ensuring that traders are actually able to make profits without at the same time breaching their drawdown limits before going for simulated funding.

Purpose of ATFunded Challenge Phase

The challenge phase tests your trading abilities skills, limiting the amount of risk in your account, to allow the firm to confirm that you are able to generate profit without blowing the account up. The ATFunded Challenge evaluates:

- Profitability

- Risk control

- Drawdown discipline

- Minimum trading days consistency

Passing proves to the ATFunded prop firm that you can trade responsibly and qualify for bi-weekly payouts and high profit split earnings.

How the ATFunded Evaluation Works

Below we have made a detailed description of the key challenge elements you will see at ATFunded - Each ATFunded Evaluation includes:

- Profit targets

- Maximum total drawdown rules

- Daily loss limits

- Minimum days of trading

- Allowed strategies rules

- ATFunded payout process

- Funded account scaling opportunity

We have noted that actual specific values will vary depending on account size and when you signed up, please confirm on the ATFunded website.

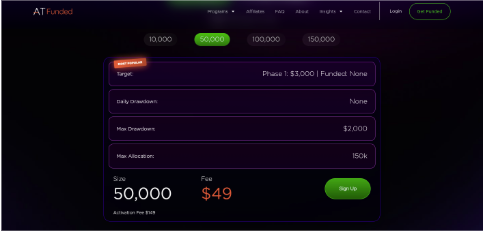

ATFunded Two-Phase Challenge (Standard)

First, the two-phase challenge is at least one of the main models offered at ATFunded. You must pass Phase 1 and then Phase 2 before you are able to be funded. The idea here is to allow you to show profitability across two phases. More importantly, consistency and repeated success beyond a one-time profitable period.

Two-Phase Challenge Breakdown

| Category | Details |

| Profit Target | Phase 1: 8% (e.g., grow $100,000 → $108,000) Phase 2: 5% (e.g., grow $100,000 → $105,000) |

| Maximum Total Drawdown | Around 10% of the initial account balance |

| Daily Loss / End-of-Day Drawdown | You cannot lose more than a fixed % in one day (depends on account size) |

| Minimum Trading Days | Must trade for a minimum number of days in each phase to show consistency |

| Account Sizes Available | Up to $200,000 funded accounts |

| Challenge Fees | Starts from around $25 for smaller accounts; increases with account size |

| Trading Strategies Allowed | Both manual and algorithmic trading allowed (within limits) |

| News Trading / Scalping Rules | News trading may have restrictions; trades opened and closed within 60 seconds may not count |

| Trading Behavior Rule | Must trade genuinely - not open trades just to meet the minimum-day requirement |

| Profit Split | Up to 80% of profits go to the trader |

| Payout Frequency | Bi-weekly (every two weeks) |

| Funding After Passing | Get a funded account after completing both phases successfully |

ATFunded Pro Program (One-Phase)

Besides that, ATFunded has a “Pro” model (one-phase) which is less complicated and can be funded faster, for traders who are sure of their trading skills. For instance, it may only require a single step with a lower profit target and then you are funded.

Pro Program Breakdown

| Category | Details |

| Profit Target | Around 6% total to pass the one-phase challenge |

| Maximum Total Drawdown | Around 10% of the starting balance |

| Daily Loss / End-of-Day Drawdown | Same daily loss rule applies - cannot lose more than set % in a single day |

| Minimum Trading Days | A minimum number of trading days still required |

| Account Sizes Available | Up to $200,000 funded accounts |

| Challenge Fees | Similar fee structure; may be slightly higher for quicker funding |

| Trading Strategies Allowed | Both manual and algorithmic trading allowed |

| News Trading / Scalping Rules | Same rules apply - scalping allowed if within risk and consistency limits |

| Trading Behavior Rule | Must follow genuine trading practices; no forced trades |

| Profit Split | Up to 80% of profits to the trader |

| Payout Frequency | Bi-weekly (every two weeks) |

| Funding After Passing | Get funded immediately after passing the one-phase challenge |

Pros & Cons of ATFunded Evaluation Models

ATFunded prop firm is new but promising in this industry, offering low-cost challenges, 80% profit split, fast payouts, and simple trading rules. Although it still lacks more transparency and the option for higher leverage, it is still a good prop firm choice for 2025 for any disciplined trader looking to grow and receive a funded account.

| Why People Prefer ATFunded | Reason to Consider ATFunded Before Joining |

| Low challenge fees (ATFunded prop firm review mentions fees as low as $25) | New firm - ATFunded review data still limited |

| 80% profit split - great for funded traders | Less transparency on some trading rules |

| User-reported fast payout process | Lower leverage than some prop firms |

| Simple ATFunded trading rules | News trading restrictions may frustrate scalpers |

| Good funded account sizes & scaling | Needs longer track record for trust |

ATFunded Challenge Comparison Table

| Category | Standard Two-Phase Challenge | Pro One-Phase Challenge |

| Profit Target | ~8% (Phase 1) + ~5% (Phase 2) | ~6% total |

| Daily Loss Limit | Specified by account (e.g., ~4–5%) | Specified by account |

| Max Loss Limit (Drawdown) | ~10% | ~10% |

| Minimum Trading Days | Around 3 to 5 days | Around 3 to 5 days |

| News Trading | Some restrictions | Likely similar |

| Leverage | Up to 1:30 for Forex (lower for other assets) | Similar leverage limits |

| Profit Split | Up to ~80% | Up to ~80% |

| Payout Frequency | Bi-weekly (every 2 weeks) | Bi-weekly (every 2 weeks) |

| Best For | Traders who prefer a structured, step-by-step evaluation | Experienced traders wanting faster funding |

Our Verdict on ATFunded Challenge Accounts

ATFunded is a promising 2025 prop firm, because of its Affordable entry fee, Clear challenge structure, Fast payout availability, Fair profit opportunities. However, risk management is key. Treat the ATFunded Challenge like a serious business, not a gamble.

ATFunded Rules to Keep in Mind

The ATFunded challenge rules are aimed at keeping the competition fair and at the same time requiring the traders to show a steady performance instead of just making a “lucky trade”. The main point is to handle the challenge as a business case rather than a gamble.

The whole set of details for rules that you need to follow once you get funded:

- Going beyond the maximum loss or drawdown limit of the account is not allowed. In case you do it, the challenge or the funded account may be terminated.

- Daily loss or “end-of-day drawdown” rule - in a day you are not allowed to lose more than a certain amount (this is done to protect the firm's capital and limit the occurrence of risky behavior).

- Minimum trading days - suppose you have achieved your profit target early, you may still be required to trade for a certain number of days.

- Maximum open trades per currency pair - you shouldn’t open more than 4 trades at the same time on one pair, the profit from the 5th trade may not be considered.

- Trade just for the sake of minimum requirements may be excluded (for instance, opening & closing trade in 60 seconds may not be recognized).

- Trading the news or trading around major economic events may be limited (find out the exact terms).

- After getting funded - keep up the rules for consistency and stay away from violations (such as employing banned strategies, using a hedge if not allowed, etc.).

ATFunded Activity Rules on Trading

Consistency implies that a trader cannot simply look for one big win and then stop trading. They have to demonstrate regular trading and acceptable drawdowns. At ATFunded, traders are encouraged to trade consistently rather than chasing quick profits. Below are the details:

- Minimum profitable days: For example, in the course of the challenge it may be required to have at least three days in which profit was made.

- Minimum number of trades in total: Before being allowed to receive payout or move to the next stage, the trader might need to have made at least five trades.

ATFunded Inactivity Rule

There is an inactivity rule according to which, if you do not trade for a certain number of days, your account may be considered inactive and the rules for it may come into force. It is always better to know the inactivity limits from the funded account agreement.

ATFunded Platform Access & Trading Conditions

In this ATFunded review, we examine how ATFunded offers traders to access MT5 and trade under transparent trading rules. These funded trading rules directly affect your skills to win the prop firm challenge and secure payouts.

Details:

- Platform: The trading platform used by ATFunded is MT5 (MetaTrader 5).

- Leverage: The most recent information indicates that the leverage can be up to 1:30 for FX, 1:20 for Indices & Metals, 1:10 for Oil and 1:2 for Crypto.

- Spreads & execution: The reports from users inform that traders experience tight spreads and quick execution which is a good sign.

- Account currency: USD (the most common).

- Funding size: The maximum cited allocation is up to $200,000.

- Risk management: The user has to follow the drawdown rules, daily loss limits, margin requirements and should not commit large risks in a single trade.

Our Verdict on Platform Access Supported by ATFunded

Platform access & trading conditions at ATFunded are very good and competitive in 2025. The ATFunded trading rules offer reliability over high-risk leverage. So, in case you are a trader who prefers reliability and a clear set of rules, then this prop firm is a good fit in 2025.

ATFunded Trading Instruments

The question of which markets you can trade is very important - trading may also be a matter of your preferences (FX, commodities, crypto, indices). It also affects your style (scalping vs swing).

Details:

ATFunded offers its clients a wide range of trading instruments. As per the information:

- Forex (major & minor pairs)

- Metals & Commodities (Gold, Silver, etc.)

- Indices

- Crypto (with a more limited leverage)

- Energies (Oil, etc.) if that is the case with your account

Our Verdict on Trading Instruments Offered by ATFunded

The instrument set is enough to satisfy the majority of traders. Crypto being allowed (even though the leverage is lower) is a plus. The moderate leverage for each asset class is also a good way of letting you control your risk. A good decision whether you are a FX-only trader or a diversified one.

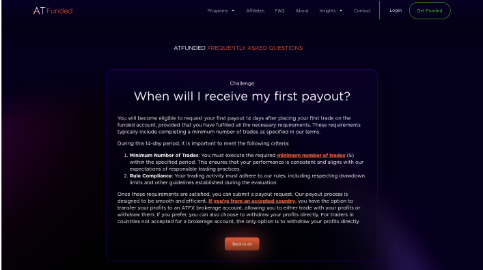

ATFunded Payout Processes and Reward System

One of the most important parts of the whole thing is getting payout. You want to know - when is it possible to request a payout, how fast is the money sent and under what conditions.

Details:

- Payout eligibility: You can only ask for a withdrawal after meeting profit targets, having a certain number of trades, a certain number of profitable days and following all rules without violating.

- Payout frequency: Bi-weekly is quite often mentioned (every two weeks) once all the withdrawal conditions are met.

- Profit split: As much as 80% can be yours (the trader).

- Minimum trades for payouts: Example - No less than 5 trades may be necessary before a payout account is allowed.

- Platform and Payment Methods: By complying with the withdrawal conditions, the option makes the withdrawal via such as credit/debit card, e-wallets and cryptocurrencies (depending on the region) according to some sources.

ATFunded Payout Eligibility

If you are already at the stage of a funded account, have made a profit beyond your target (if any), have done the minimum trading activity and have not violated any rules, then you may request a payout. You should check the terms for your account size.

ATFunded Payout Conditions by Account Type

The conditions of different account sizes or the challenge of different types of accounts may vary slightly (minimum number of trades, time in account, profit target). It is always better to be sure and check the exact terms of the account size you have chosen.

How Fast Are ATFunded Payouts Processed?

The majority of users' statements lead to the conclusion that money transfers are carried out without a hitch and in a short period of time after the conditions are met. For instance, Trustpilot reviewers say, "The payout

was carried through without a hitch and I am delighted with it."

ATFunded Payment & Payout Platforms

The payment methods at ATFunded are: Credit Card, or Neteller, or Skrill, or Bitcoin, or Ethereum, or USDT/USDC, depending on the region.

Traders can request profit withdrawals via VISA, MasterCard, Skrill, Neteller, Bitcoin, Ethereum, USDT, USDC and Diners Club.

To know more about ATFunded Payouts, head to their FAQs section: (https://tradingfinder.com/props/atfunded/?utm)

ATFunded Scaling Plan

A scaling plan is necessary if you want to increase your capital once you are funded and trading well. ATFunded states that one can increase his/her personal trading account with the profits from the funded account and is therefore only allowed to be funded up to $200,000.

Though there is only a little information about the details of the plan, the idea is basically: trade profitably, adhere to the rules, create a track record and then either get a higher funding or use your profits to increase your trading volume.

How to Pass ATFunded: Pro Tips from Real Traders

- Consider the challenge as a business: define your risk per trade, control your capital and do not fall into the trap of emotional overtrading.

- Be aware of the regulations even before you start trading: daily loss limits, maximum drawdown, the minimum trading days, restrictions of instruments.

- Focus on consistency: in this model several small wins may turn out to be better than one big win (the number of profitable days is what matters).

- Keep an eye on drawdown: It might be that you are winning, however, a big losing day can still result in hitting the limit and hence a reset.

- Use strategy aligned with leverage & instrument limits: as leverage is limited, select the strategies that work under those conditions (swing, day-trading, no high-frequency scalping unless it is allowed).

- Keep a record of everything: You will want to have clear records when you achieve your goal - don't engage in forced trades merely for the sake of meeting minimums.

- Plan your payout: After getting your funding, continue to trade with discipline and do not let the good times make you complacent.

- Stay updated: There are times when prop firms may update change rules, leverage or instruments - always refer to a website for latest terms.

Final Words

It is not an easy task to pass a prop firm challenge - discipline, skill and a clear strategy are what it takes. However, with such firms as ATFunded that provide clear routes, decent profit splits and reasonable rules, the task is achievable by many traders.

Real User Feedback & Trust Factor About ATFunded Prop Firm

What We’re Seeing Across the ATFunded Community

On Trustpilot, Most of the reviews are positive. To illustrate: “Pro One is the best. It only targets 6%, has an EOD drawdown, simple, uncomplicated trading rules, and uses MT5”

“Just received the payout smoothly, the whole program is set for long term sustainability”

Should You Trust ATFunded?

Certainly, but with some caution. The positive reactions, the representative rules and the broker's support are good indications. However, as the company has been on the market for a short time only (since 2025) and some information is not that abundant, you should treat it like any other investment opportunity - first, check if you are allowed to trade in your region, then carefully read the terms and conditions, take care of your risks and do not spend more than you can afford.

Final Verdict: Is ATFunded Worth It in 2025?

It could be a very good fit if you are a moderately experienced person, value consistency rather than getting rich quickly, are comfortable with moderate leverage and are willing to follow the rules. Overall, ATFunded is a very attractive choice when considering the cost against the benefit.

Bonus Tip for ATFunded Traders

Many prop firms frequently have promotions, discounts,or cash-back offers on challenge fees. In case you choose ATFunded, keep an eye on their website, newsletters or social media channels so that you can benefit from an offer and lower your upfront cost.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict