Copy Coupon Code to Get

Up to 25% Off 🎉

Klein Funding

Crypto

GB

CEO: David Allard

Bybit

Wire Transfer/ Bank Transfer

Crypto

Wise

Crypto

Credit/Debit Card

PayPal

Bybit

Klein Funding Evaluation Model Explained | 2025 Guide by The Trusted Prop

Klein Funding Evaluation Model Explained | 2025 Guide by The Trusted Prop

10/18/2025

Introduction

By 2025, Klein Funding has really started to catch people's attention in the crypto prop firm space - and for all the right reasons. Their innovative evaluation model is a big part of that - so let's break down how it all works, highlight the key features, and give you some tips on how to pass - and get funded. Whether you're a crypto trader looking into prop firms or already familiar with challenge models, this guide to the Klein Funding evaluation will be super useful, whatever your level.

What is Klein Funding?

Klein Funding is a prop trading firm that's specifically focused on crypto - and they offer a pretty enticing deal. They'll give you simulated capital to trade with, without you having to risk any real money. So if you can prove yourself to be a successful trader on their platform, you can trade with as much as $200,000 in virtual funds and even take home a 100% split of the profits from your simulated account. Klein Funding is pretty keen on making it as appealing as possible.

Some of their biggest selling points include:

- Deep liquidity and super low spreads

- The ability to customise the parameters of the evaluation itself

- Support for 700+ different crypto pairs

- And if you go for certain plans, they don't charge an up-front evaluation fee - you only pay once you have actually passed.

How the Klein Funding Evaluation Model Actually Works

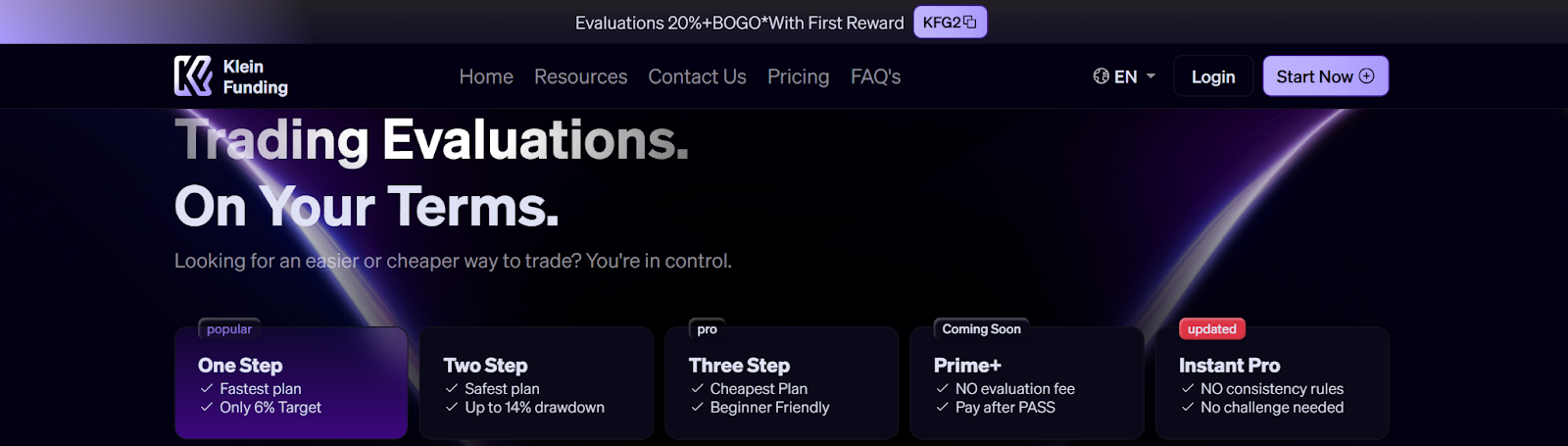

Pick Your Evaluation Plan

Klein Funding offers a bunch of different challenge or evaluation plans with varying degrees of risk involved. These plans can come with some pretty typical parameters:

- Max drawdown (you know, like 6%)

- Daily drawdown limits - don't get too carried away

- Profit target - aim for 6% like most places

- Leverage - go up to 1:100 if you want

- And the reward share percentage - generally 40% all the way up to 100% with Klein Funding

Some of their plans are effectively "pay after pass" - which means you are only required to pay the evaluation fee if you actually succeed in completing it - which can be a nice perk.

Pretend to Trade (Virtual Money)

So after you've been accepted to this evaluation thing, you get a demo account set up. Your goal is to hit your profit target without blowing through the drawdown limits - in other words, you're trading with fake money.

Pass the Challenge/Evaluation

If you meet all the requirements (profit goal, consistency, no drawdowns), you've passed the evaluation. Some of these plans might even require multiple rounds.

Get Access to the Funded/Master Account

Alright, so you've passed the test - Klein grants you access to their "Master" account. You can now trade live (depending on the specific terms of course) and keep a substantial share of your real profits.

Pros & Cons of Klein’s Evaluation Model

Pros

- Traders love the low risk - you won't lose real capital during the evaluation phase\

- High potential payout splits - up to 100% with Klein Funding

- Customizable risk parameters mean you get to pick the plan that actually fits your trading style

- Crypto focused - they offer a bunch of crypto pairs

- Global access - most countries are good to go with Klein Funding

Cons

- Rules like those drawdown limits can be pretty strict

- Some plans still require payment, whether you pass or not

- The simulation environment isn't the same as actual live trading

- Success is basically all about discipline, strategy and risk management

How to Ace the Klein Funding Evaluation

Plan Your Trades in Advance

Have a plan that includes entry, exit, stop loss, and target levels.

Adhere to the Drawdown Rules

Breaking your daily or overall drawdown means you have failed the challenge.

Be Consistent, Not Aggressive

Avoid large swings. More frequent, smaller wins will establish more account equity.

Practice Proper Risk Management

Risk a small percent of your balance each trade to mitigate excessive drawdown.

Trade Fewer Pairs and Know the Market

Trade a few crypto pairs where you are familiar with price moves.

Keep a Trading Journal

Write down mistakes, drawdowns, and patterns as you trade.

Keep Your Emotions in Check

Don’t get emotional and revenge trade right after a drawdown, remain calm and stick to your rules.

What Traders Should Know Before Joining Klein

- Read all of the terms and conditions of the evaluation plan you opt-in for.

- Understand the rules concerning withdrawals and profit splitting.

- Make sure your country allows for participation (Klein claims it has a wide access footprint).

- Practice on a demo account to familiarize yourself with some of the nuances of the trading platform.

- Initially, you want to trade on the lowest or conservative risk plan and scale your plan to greater risk if you can.

Conclusion

The Klein Funding evaluation model finds itself as one of the top options for crypto traders wanting to get funded with little upfront risk. In addition to a flexible risk model, high splits, and an easy-to-grasp crypto environment, it is gaining traction as one of the better options in the world of prop firms in 2025. Like every model, success is about discipline, a strategy and having a good grasp on the rules of operation.

Get Funded and Trade Crypto Today! - Level Up Your Trading with the help of The Trusted Prop

Want Risk-Free Trading? - Start Your Klein Funding Challenge Now!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict

Maven Trading Detailed Review 2026: Our Honest Verdict