Copy Coupon Code to Get

25% Off 🎉

Goat Funded Trader

Forex, Crypto, Stocks, Indices, Commodities, Metals, CFDs, Crypto CFDs

ES

2022

CEO: Dalla Torre Edoardo

25% OFF + BOGO

Coupon Code:

MatchTrader

cTrader

Trade Locker

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

Crypto

PayPal

MatchTrader

Goat Funded Trader 3 Step Challenge Explained (2026)

.jpg&w=3840&q=75)

Goat Funded Trader 3 Step Challenge Explained (2026)

1/29/2026

Introduction

Goat Funded Trader offers 1 step, 2 step and 3 step challenge types that have simple rules and targets. The Goat Funded Trader 3 Step Challenge is a three phase evaluation where traders must achieve a 6% profit target in each step while respecting a 4% daily loss and 8% maximum drawdown. Completing all phases while following the GFT rules, qualifies traders for a funded GOAT account with payouts starting at 80%.

In this Goat Funded Trader 3 step challenge guide 2026, we will focus particularly on the GFT 3 step challenge, its key features, evaluation passing criteria, targets and risk rules. We will also help you with the key steps to pass the Goat Funded Trader challenge and the risks associated with it that you must watch out for.

If you want to know more about Goat Funded Trader Challenge types, you can refer to our verified review on Goat Funded Trader prop firm at The Trusted Prop site.

What Is the Goat Funded Trader 3 Step Challenge?

The Goat Funded Trader 3 Step Challenge is a trading program that lets you prove your trading skills. Unlike several challenges, which are limited to only one or two steps, this one has three steps to prove your skills and pass the challenge. Since there are more steps the profit targets for each step are lower. This feature makes this GFT 3 step challenge as an excellent option for beginner traders who want less pressure when attempting to get a funded account.

How the Goat Funded Trader 3 Step Challenge Works (Step-by-Step)

Before you begin your trading journey, you need to know how the Goat Funded Trader 3 step challenge works comparing to 1 step, 2 step and Instant Funding. A trade-off for three evaluation rounds is meeting a series of small profit targets during each round while also following the Goat Funded Trader drawdown limits. The idea of the process is to assure that you are a trader that takes minimal risks while following the trading rules. After completion of the last stage, the GFT challenge account is reviewed and once the KYC process is completed - you get a Goat Funded Trader funded account to trade, make profits and withdraw real money from. The below is a step-by-step process of how Goat Funded Trader evaluation works:

Step 1 - The First Evaluation (Phase 1): Here in Phase 1, you begin trading with a demo account. Your mission is to achieve a profit of 5%. You also have to adhere to the Goat Funded Trader drawdown rules that prohibits a daily loss of more than 4%. There is no time pressure as GFT has a “no maximum time limit” feature.

Step 2 - The Verification (Phase 2): After you successfully complete Phase 1, you proceed to Phase 2 where the Goat Funded Trader profit target and drawdown limits are the same as Phase 1. You have to generate another 5% profit. The point of this step is to validate that your trading strategy will be consistently profitable and your first successful trade was not merely a stroke of luck.

Step 3 - The Final Stage (Phase 3): This is the final phase of the Goat Funded Trader 3 step challenge where you demonstrate your trading skills once more by reaching another 5% goal. Splitting the 15% profit target into 3 phase is the firm’s way to provide you with smaller, achievable profit targets so that you can trade consistently without taking big risks.

Step 4 - Partner with a Goat (Funded Stage): When you have successfully passed all three stages, your Goat Funded Trader Challenge completion will be reviewed by the team. Afterwards, you will get your GFT funded account. At this point, you are geared up to make real profits and relish the Goat Funded Trader profit sharing which starts at 80% and can rise as high as 95%.

By strictly following the Goat Funded Trader 3 step challenge rules and targets, you not only skill up your risk management and trading strategy, but also showcase that you are capable of long-term trading with the firm.

Goat Funded Trader 3 Step Challenge Rules & Targets (2026)

All traders must follow the Goat Funded Trader challenge rules if they want to get GFT funded account. The two main things that you should always monitor are your profit targets and your loss limits. If you violate a rule then you could loss the funded account.

Goat Funded Trader Profit Targets, Drawdown Limits & Risk Rules Explained

Knowing exactly how Goat Funded Trader profit target and drawdown work is the key to passing the challenge.

- Profit Targets: In Phase 1, you have to earn 5% profit, 5% in Phase 2 and 5% in Phase 3.

- Daily Drawdown: You must not run a loss of over 4% of your funded account balance in one trading day.

- Maximum Drawdown: Your losses cannot surpass 8% of your total account balance.

- Trading Days: There is no minimum number of trading days, so you can pass the challenge whenever you want.

- Copy Trading: You must own both the master account and the slave account while trading in this firm.

- News Trading: It is allowed but you cannot make more than 1% profit per day.

- Weekend Holding: Keep your trades open over the weekend without any time limit pressure.

- EA’s Trading: The trading bot must be your own - not a shared or public account-passing bot.

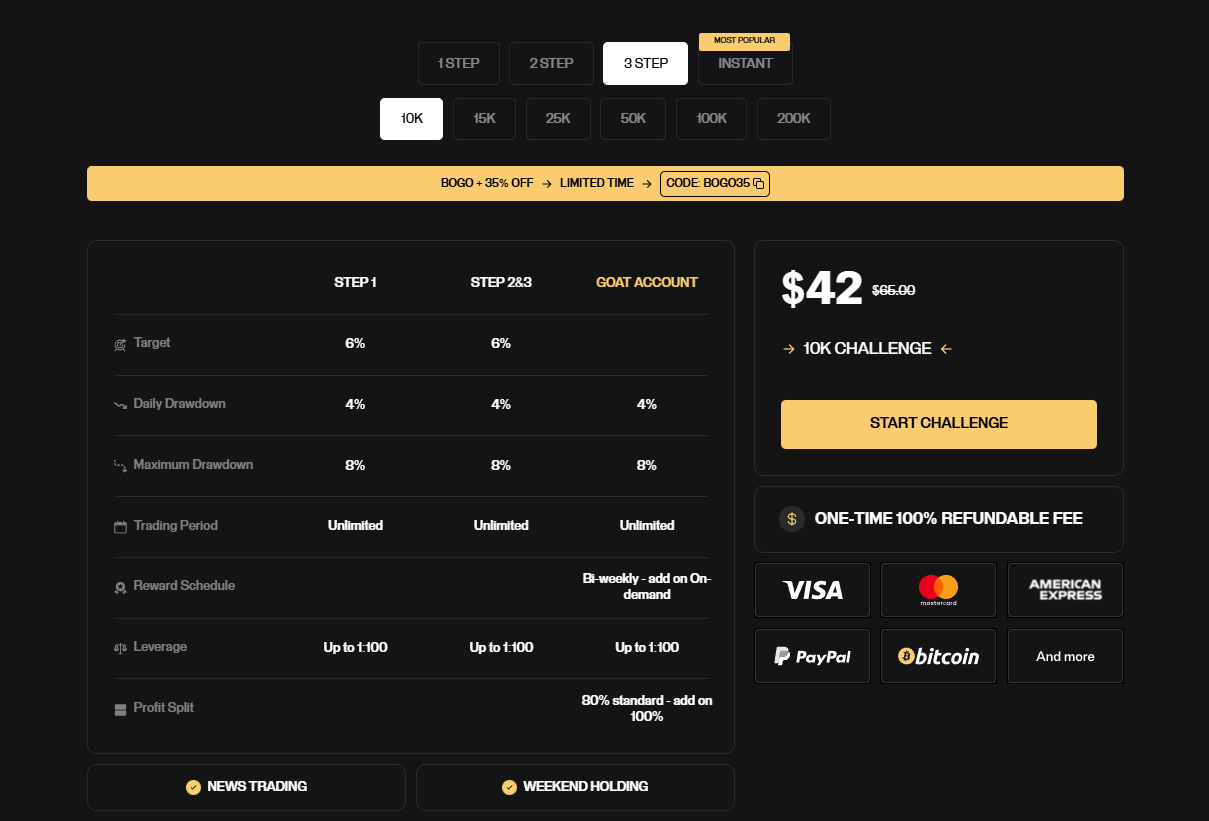

Goat Funded Trader 3 Step Challenge Fees & Account Sizes

The Goat Funded Trader 3 Step Challenge comes with a variety of account sizes to meet your risk tolerance and budget. The entry fees are lower compared to other GFT challenge accounts starting from $65 which goes up to $665 depending on the account size that you choose. When you break down the Goat Funded Trader 3-Step Challenge rules for 2026 and compare them with the entry fees, it is clear that these funded accounts are designed to remain affordable for a wide range of traders.

Below are the details of account sizes and the original entry fees for the Goat Funded Trader 3 Step Challenge:

| Account Size | Account Fee | Profit Target (6%) | Max Daily Drawdown (4%) | Max Total Drawdown (8%) |

| $10,000 | $65 | $600 | $400 | $800 |

| $15,000 | $85 | $900 | $600 | $1,200 |

| $25,000 | $145 | $1,500 | $1,000 | $2,000 |

| $50,000 | $225 | $3,000 | $2,000 | $4,000 |

| $100,000 | $365 | $6,000 | $4,000 | $8,000 |

| $200,000 | $665 | $12,000 | $8,000 | $16,000 |

In this Goat Funded Trader Challenge review, the main thing is that the entry cost you pay is a one-time fee - It is not a subscription. Moreover, when you successfully complete all three evaluation stages, make profits in funded account and request your first payout, the Goat Funded Trader payout rule states that this initial challenge fee will be completely refunded to you if you have adhered to all GFT rules.

Payout Rules After Successfully Completing Goat Funded Trader 3 Step Challenge

When you have become a funded trader then the first thing Goat Funded Trader payout rules state that your first payout can be requested only 14 days after you have passed the challenge and received your funded account. Goat Funded Trader allows you to keep a huge share of the profit you make from trading while also benefiting from 100% refund on challenge fees.

- Profit Split: You are given an 80% profit split at the start. You can scale it up to 95%.

- Refund: Get 100% refund on the challenge fee which was you initially paid will be returned to you on your first payout with Goat Funded Trader.

Goat Funded Trader Trading Platforms and Allowed Strategies

When choosing a Goat Funded Trader Challenge you should also look at the trading platforms and strategy flexibility that the firm offers, as these directly impact a trader’s execution and risk management. Goat Funded Trader supports trading platforms that are well known, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5) and DXTrade. These platforms are widely trusted by forex and prop firm traders for their stability, fast execution and advanced charting tools.

In terms of trading freedom, Goat Funded Trader allows most common trading strategies. Most trading strategies are allowed and this includes News Trading and holding trades you made over the weekend - which is a major advantage for swing traders and traders who prefer higher-timeframe setups.

Who Should Choose the Goat Funded Trader 3 Step Challenge

- Traders who are new to trading and wish to have lower profit targets for each phase.

- Traders with limited funds who want low cost entry fees.

- Those who are patient and don't mind three step process to getting funded.

Who Should Stay Away From the 3 Step Challenge

- Traders at a professional level who are looking for a way to get funded quickly in just one step.

- Traders who have a hard time being consistent for an extended period of time.

Goat Funded Trader 3 Step vs 2 Step Challenge

When comparing Goat Funded Trader’s 3-Step and 2-Step challenges, the main differences come down to evaluation structure, profit targets, and entry cost. Here’s a clear breakdown to help traders choose the right model:

Number of Phases:

The GFT 3 step challenge consists of three phases, whereas its 2 step challenge only has two phases for traders to pass. The GFT 2 step challenge also comes with 3 account versions: GOAT, Standard and Pro account to suit different trading style. The 3-step challenge offers more flexibility and recovery time, while the 2-step suits confident, aggressive traders.

Profit Targets:

The Goat Funded Trader 3 step challenge offers lower targets (5% per phase) than the 2 step (mostly 8% and 5%).

Challenge Pricing:

Generally, the 3 step is less expensive, comparing to the 2 step challenge. The 3-step challenge is often preferred by budget conscious traders or those testing a new strategy.

Final Verdict

- Choose the 3-Step Challenge if you prefer lower targets, lower fees, and a more gradual evaluation.

- Choose the 2-Step Challenge if you want faster funding and are comfortable trading under higher pressure.

Pros & Cons of the Goat Funded Trader 3 Step Challenge

As we come to a conclusion, here is a quick list of pros and cons of the Goat Funded Trader 3 step challenge to help you make an informed decision as to whether this challenge suits your trading style or not.

| Pros | Cons |

|---|---|

| You only need to reach a 6% goal in each phase which is much lower and easier to hit than standard 1-step or 2-step challenges. | There are three separate phases to complete, it takes more time and patience to reach the funded stage. |

| The entry prices are among the lowest in the industry that makes it is easier for traders with a small budget to start. | The 4% daily and 8% total loss rules are tight which means you must have very strong risk management to avoid a breach. |

| You can take as much time as you need to pass each step which removes the pressure of hitting targets within a specific deadline. | During your first two rewards, there are limits on how much you can withdraw, which might be a challenge for traders who want large payouts in short time. |

Final Verdict: Is Goat Funded Trader 3 Step Challenge Worth It in 2026?

Based on this Goat Funded Trader challenge review, the firm stands out as a reliable and trader-friendly prop firm in 2026, especially for traders who prefer a structured and low-pressure evaluation model. The Goat Funded Trader 3 Step Challenge explained clearly shows why it appeals to both beginners and disciplined intermediate traders. Setting a 5% profit target per phase means that it takes away the feeling of being under pressure that usually comes with the faster challenges.

If you stay within the Goat Funded Trader drawdown limits and remain patient throughout all three phases then there is no doubt that this will give you an access to a large funded account with fair trading conditions. This Goat Funded Trader Challenge review states that the prop firm will continue to be a top pick in 2026, becoming an ideal choice for traders who want to achieve consistent results rather than short-term, high-risk speed trading.

- Read full review of Goat Funded Trader via The Trusted Prop, where prop firm accounts are evaluated using verified rules, transparent pricing and real trader feedback.

- Keep up to 95% of all your profits and take advantage of the lowest entry fees in the industry – Visit Goat Funded Trader and get funded with today!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict