Copy Coupon Code to Get

40% Off 🎉

Goat Funded Futures

Futures, Stocks, Indices, Crypto, Metals, Energies

HK

2024

CEO: Edoardo Dalla Torre

Coupon Code:

Tradovate

Ninjatrader

ProjectX

Trading View

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

PayPal

NinjaTrader

Tradovate

Goat Funded Futures 1-Step Challenge Review 2025

.jpeg&w=3840&q=75)

Goat Funded Futures 1-Step Challenge Review 2025

12/6/2025

If you are looking for the fastest way to get a funded trading account, then the Goat Funded Futures 1-Step EOD Challenge is a top choice for you.

With the Goat Funded Futures 1-step challenge - you only need to hit a single profit target while maintaining the EOD Max Drawdown. There is no daily drawdown in the evaluation - making it one of the easiest-to-pass futures prop challenges. GFF traders can choose from $50K, $100K and $150K accounts, access 80 to 100% profit splits, trade on their preferred trading platform and get their 100% refund of the challenge fee after passing. This makes the GFF 1-step challenge one of the lowest-risk futures-funded programs in 2025.

In this article, we have analysed and listed all the GFF EOD Challenge features in detail - such as Goat Funded Futures rules, account prices, important trading rules and tips to become a successful futures trader at Goat Funded Futures.

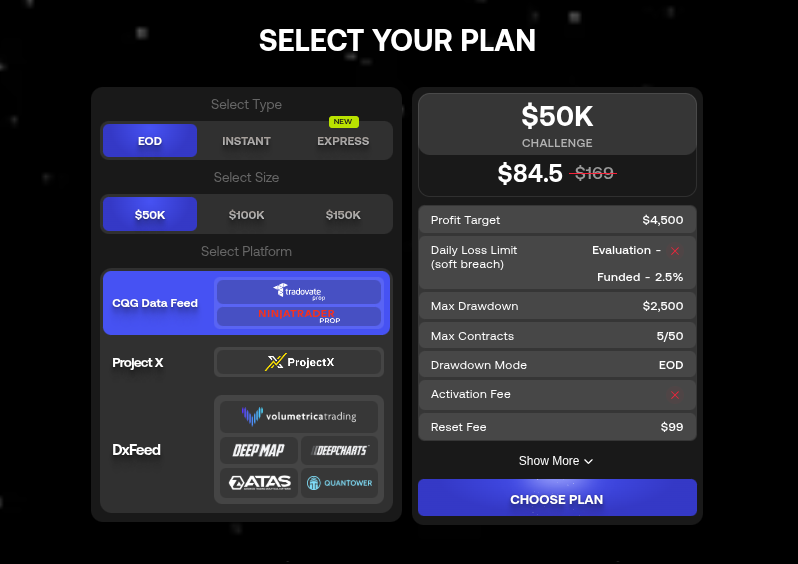

About Goat Funded Futures Challenge Types

Goat Funded Futures offers traders three types of prop firm accounts, which include: 1-step EOD challenge, Instant Funding account and 1-step Express challenge. These GFF account types suit every kind of trader. In the EOD Challenge, there are differently sized Goat Funded Futures accounts resulting in $50K, $100K and $150K variations. Goat Funded Futures is a prop firm for futures traders where you will be able to trade with trading platforms such as Tradovate, Project X and more.

Goat Funded Futures EOD Challenge Breakdown (1-Step)

The Goat Funded Futures EOD Challenge is the firm’s main 1-Step Challenge model designed for futures traders who want a simple, low-pressure prop firm account structure for trading in the futures market. Instead of using a constantly updating trailing drawdown - common in many futures prop firms - the EOD model only calculates your Max Drawdown at the end of the trading day.

This means your largest loss can be calculated only once at the end of each day, not by continuously checking every moment during the day. For traders, this single change makes the GFF 1-Step Challenge far more flexible, especially for futures traders who hold positions for a longer time, trade with volatility or scale into futures contracts. The EOD rule in prop firms allows normal intraday fluctuations without instantly failing your account - which is why it is one of the most preferred challenge types among U.S., U.K., Indian and global futures traders.

The following is a clear overview of all Goat Funded Futures 1 step EOD Challenge account sizes, fees, profit targets and drawdown rules - helping you compare the GFF $50K, $100K and $150K accounts with ease:

| Account Size | Challenge Fee | Profit Target | Daily Loss Limit (Evaluation) / (Funded) | Max Drawdown | Max Contracts (Contracts/Contracts with Scaling) | Reset Fee |

| $50K Challenge | $84.5 | $4,500 | N/A / 2.5% | $2,500 | 5/50 | $99 |

| $100K Challenge | $144.5 | $9,000 | N/A / 2.5% | $4,000 | 9/90 | $99 |

| $150K Challenge | $199.5 | $12,000 | N/A / 2.5% | $5,550 | 12/120 | $99 |

Goat Funded Futures Rules: Which Strategies are Allowed

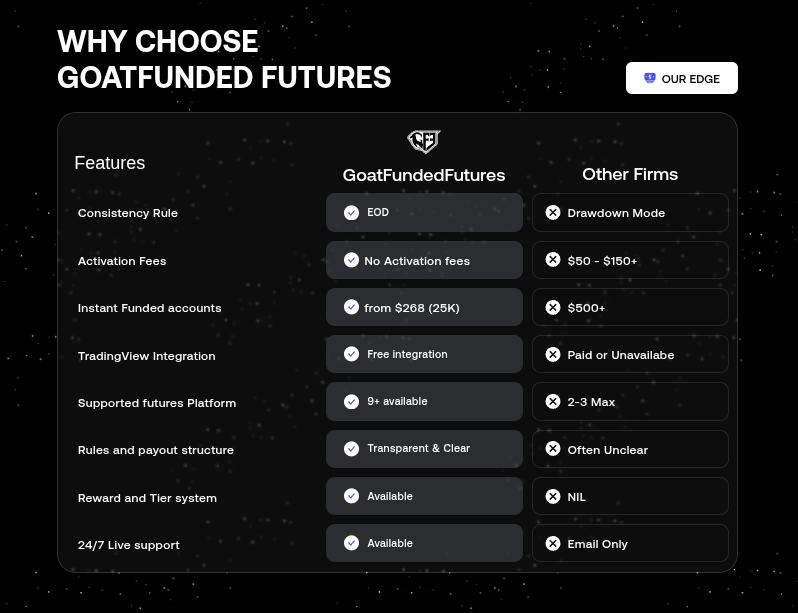

Goat Funded Futures rules and regulations are pretty much open to futures traders. The firm allows multiple trading styles, platform choices and position sizing methods - thus traders are enabled to apply their favorite trading strategies. Such freedom allows them to carry out the same activities as if it were their own personal accounts.

- Trading Platform Choice

Through Goat Funded Futures - traders get access to the widely-used trading platforms like CQG Data Feed, Rithmic, Tradovate or Project X. The decision is entirely yours. Such a liberty is an excellent service to those who already have a platform in mind and are used to trading there.

- EOD Drawdown Type (End-of-Day Drawdown)

The EOD Drawdown Mode is one of the biggest advantages for Goat Funded Futures traders. It basically calculates only the loss limit at the very end of the day, giving freedom for daily fluctuations that are restful to traders without them having to be automatically failed.

- Max Contracts & Scaling

Goat Funded Futures uses a clear Max Contracts + Scaling structure. For example, the $50K EOD Challenge starts with 5 contracts, which can further be scaled up to 50 contracts. This is a strong feature if you aim to grow position size without violating the firm's rules.

- 100% Refundable Fee

When you successfully complete the Goat Funded Futures 1-Step Challenge and activate your funded account - your One-Time challenge fee becomes 100% refundable. This helps in reducing the financial risk that comes with taking the Goat Funded Futures challenge types and makes GFF a cost-effective choice compared to other futures prop firms.

Goat Funded Futures Rules: Which Strategies are Prohibited

While Goat Funded Futures offers flexible trading conditions - certain trading rules still act as strict boundaries to protect both the trader and the firm. Understanding these restrictions clearly helps traders avoid unnecessary account violations and improves their chances of passing the Goat Funded Futures 1-Step (EOD) Challenge.

- Max Drawdown Violation (Strict Breach)

The Max Drawdown rule is the most important restriction at Goat Funded Futures. If your account equity falls below the Max Drawdown level at the end of the trading day, then the challenge is automatically counted as failed. For example:

A $50K Goat Funded Futures account has a Max Drawdown limit of $2,500. If your end-of-day balance breaches this loss limit, then the EOD Challenge ends immediately and is marked as failed.

- Daily Loss Limit (Soft Breach in Evaluation, Hard Rule in Funded Phase)

The Daily Loss Limit is considered a soft breach during the evaluation phase. This means the challenge may not fail instantly. However, GFF still expects traders to maintain discipline and keep their losses within the allowed level. In funded accounts - the Daily Loss Limit is 2.5% and breaching this loss limit can highly impact your trading eligibility. This rule is crucial for traders in regions like India, USA, UK, Nigeria and the Middle East - where many futures traders look for prop firms with clear risk management rules.

Although being a ‘soft breach’ in the evaluation, the daily loss limit should still be respected, as it is the basis of trading discipline and risk management that leads to the successful passing of the Goat Funded Futures 1-Step Challenge. There is usually such a limit set for the funded account, being that 2.5% for the funded phase of the EOD account.

- Non-Refundable Reset Fee

If you fail the GFF challenge, then the reset fee of $99 is available but it will be non-refundable. To retake the challenge, you are required to pay this fee.

Goat Funded Futures Payout Process

Once you pass the Goat Funded Futures 1-Step EOD Challenge and are trading a funded account, the payout structure is very rewarding:

- Profit Split: The default profit split is 80% in favor of the trader. You can upgrade this to a 100% Profit Split with an add-on purchase at checkout.

- Payout Cycle: Payouts are typically made on a bi-weekly (every 14 days) basis.

- Reward on Demand (Add-on): When you check out, you can add on an option called ‘Reward on Demand’ to receive your first reward in as little as 3 days. After the initial reward, subsequent rewards typically revert to the bi-weekly schedule.

- Minimum Withdrawal: The minimum profit you must have to request a payout is $100.

- Processing Time: Payout requests are typically processed in about 2 business days or 48 hours.

- Payout Methods: Payments are processed only via the Riseworks platform.

Conclusion

Goat Funded Futures 1-Step EOD Challenge appears as a good option for futures traders in 2025. It brings clear and easy-to-understand rules along with a user-friendly EOD Drawdown Mode that is far from the usual continually trailing drawdowns of other prop firms. Besides that, the only single profit target along with the One-Time 100% Refundable Fee, turns the GFF EOD Challenge into a low-risk prop firm account to look for as a futures trader. Any skilled trader who follows the simple GFF rules and stays within the Max Drawdown will find an obvious way to become a successful Goat Funded Futures trader.

Want to master trading with prop firms?

The Trusted Prop is the only site where you can find everything - how prop firms work, the latest discounts and which one to choose.

Ready to trade futures with Goat Funded Futures EOD evaluation? - Start the Goat Funded Futures 1-Step challenge immediately!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict