Copy Coupon Code to Get

60% Off 🎉

AquaFutures

Futures

AE

2024

CEO: Jason Blax

QuantTower

ProjectX

Crypto

Rise

Credit/Debit Card

Crypto

ProjectX

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

AquaFutures Review: Evaluation, Rules & Payouts Explained

AquaFutures Review: Evaluation, Rules & Payouts Explained

7/17/2025

Introduction

Prop trading has become the go to path for traders who want to trade big without risking their own cash. And in 2025, the prop trading space is heating up especially for futures traders. With increased volatility and tighter retail conditions - more traders are exploring funded accounts.

Why use your own money when a prop firm can hand you $100K to trade with?

Among the many futures prop firms entering the spotlight - AquaFutures is making waves for all the right reasons. It offers trader friendly rules, rapid payouts and flexible evaluation models without putting pressure on traders with aggressive deadlines.

In this blog, we’ll see AquaFutures review of funded account structure, evaluation models, payout system, trading platforms, and more. If you’re eyeing a futures funded account in 2025 then this guide is your complete walkthrough.

What is AquaFutures?

AquaFutures is a futures prop trading firm designed for serious traders who want access to large capital without all the red flags. It launched with a clear mission: give traders a chance to grow their careers without forcing them to risk their own savings. In a market crowded with flashy firms that overpromise and underdeliver, AquaFutures quietly carved its niche by staying transparent, flexible, and focused on what traders actually need - capital, freedom and fair rules.

Unlike many other prop firms that lean heavily into forex or synthetic instruments, AquaFutures focused on futures contracts. That includes big names like the S&P 500 (ES), Nasdaq (NQ), Crude Oil (CL), and Gold (GC). These are markets with deep liquidity and real world impact - making them ideal for both scalpers and longer-term futures traders.

What really makes AquaFutures stand out is its hybrid approach. It offers both evaluation based funding models and instant funding options. That means whether you are someone who wants to prove their trading skills first or someone who's confident and ready to trade live immediately, there's a path that suits every trader. You’re not locked into a one-size-fits-all kind of trading challenge.

AquaFutures operates in partnership with its main brand, AquaFunded, which shares the same vision to get skilled traders into the markets faster, with fewer restrictions and more earning potential. Their challenge structures are built with the trader in mind. There are no forced time limits, no sneaky fees and no over complicated rules that sabotage your progress. And if you hit a drawdown or fail a challenge? You can try again with no shady blacklist or hidden bans.

At its core, AquaFutures is built by actual traders who understand the mental game and the technical grind. That’s reflected in everything from their clean user dashboard to their rapid payout system. In short, if you are serious about trading futures and want a partner that treats you like a pro not just a client - AquaFutures is one of the most exciting Futures prop firms to watch in 2025.

AquaFutures Evaluation Models & Challenges Explained

AquaFutures offers three primary paths to getting funded, each designed for a different kind of trader from cautious beginners to confident pros.

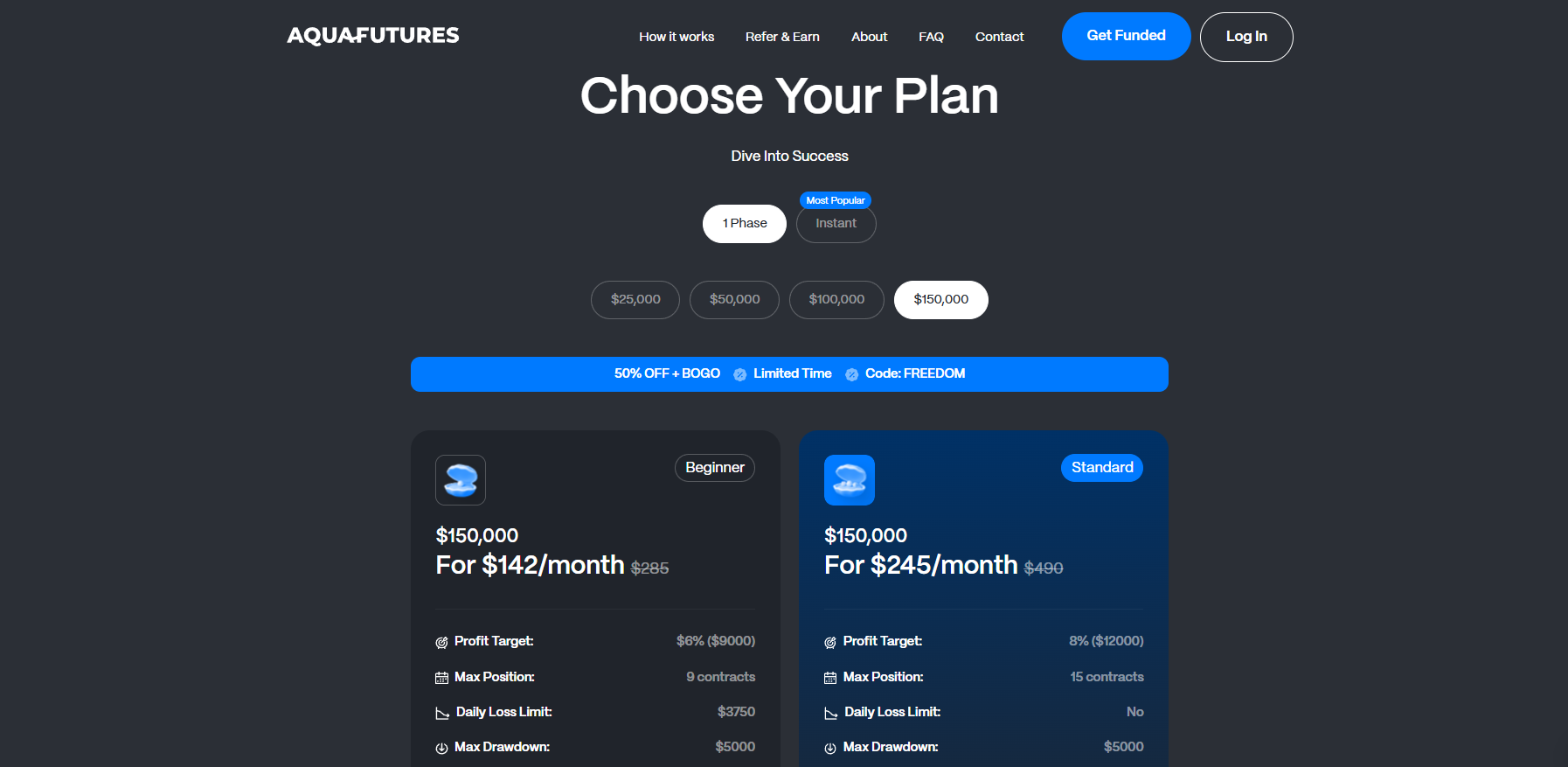

AquaFutures 1 Step Evaluation (Beginner):

This model is perfect for traders who are just stepping into the prop trading world or want to start with smaller risks. With account sizes like $25,000 or $150,000, the rules are beginner friendly. You will need to reach a 6% profit target. For instance, $1,500 on the $25K account while staying within a daily loss limit and an end of day (EOD) trailing drawdown model. The maximum number of contracts you can trade is limited - usually around 1 to 3 - depending on the account size. These limitations are intentional, helping new traders avoid over-leveraging while still experiencing real market conditions. If you breach the loss limit or hit the drawdown cap then your challenge ends but you can restart anytime.

AquaFutures 1 Step Evaluation (Standard):

The 1 Step Standard Challenge is tailored for more experienced traders looking for greater flexibility and higher profit potential. The profit target is set at 8% and daily loss limits are typically removed, leaving only a trailing maximum drawdown and EOD enforcement in place. Position sizes go up significantly up to 10 or 15 contracts on the larger accounts giving traders the space they need to fully implement their strategies. You’re expected to manage your risk without the firm stepping in to limit your daily trading losses, which gives more freedom but also requires more discipline.

AquaFutures Instant Funding model:

For traders who want to skip the evaluation entirely, AquaFutures also offers real instant funding accounts. You pay an upfront fee, receive a funded account immediately and can begin trading with live capital right away. However, this is not a free for all. These accounts come with strict trailing drawdown rules and no second chances if you break the rules, the account is closed. But if you know your system works and you are confident in your consistency then instant funding model of AquaFutures can be a fast track to payout eligibility.

Across all the AquaFutures Challenge types, you will find:

- No time limits, so you can trade at your pace

- Account sizes ranging from $25K to $150K

- Drawdown types are usually trailing and EOD based

- Payouts that can start in as little as 10 days

Want a detailed breakdown of each model, account fee and drawdown rule?

[Read our full AquaFutures Review here]

AquaFutures Platform Access & Trading Conditions (2025 Guide)

If you are thinking about trading futures with AquaFutures, the good news is that they have got you covered when it comes to reliable trading platforms and smooth trade execution. Whether you are a beginner - learning the ropes or a seasoned futures trader - looking for clean fills and tight spreads then this futures prop firm offers a solid setup for you.

AquaFutures currently supports two top-tier trading platforms that combine charting power, speed, and flexibility:

ProjectX - Built for Visual Traders

If you are someone who trades based on chart patterns, market structure and visual cues then ProjectX is a solid choice. It’s AquaFutures’ default trading environment and is designed for advanced charting, smooth execution and clean data feeds.

- Built-in execution tools

- Fast price updates

- Modern layout and visuals

- Intuitive for both new and experienced traders

ProjectX is especially popular with scalpers and day traders - thanks to its responsive interface and real-time tick data.

Pro Tip: Once you receive your AquaFutures login - make sure to log into ProjectX at least once to accept all platform and market data agreements. You will find the link to access it in your credentials email after signup.

Quantower - Flexible, Feature-Rich and Fast

Want a customizable interface with more control over your workspace? AquaFutures lets you connect your ProjectX account to Quantower which is one of the most loved platforms in the futures trading space.

Here is how to do it step by step:

- Download Quantower from its official website.

- After installation, click “Extract” when prompted.

- The platform launches with DXFeed selected by default. You can leave this as-is.

- Click on the "Connections" button in the top menu bar.

- Disconnect from any default data feeds.

- Select “ProjectX” from the list of available connections.

- In the Server dropdown, choose “AquaFutures”.

- Enter your AquaFutures ProjectX credentials and click Login.

That’s it! You’ll now be connected and can start trading live.

Quantower is great for:

- Traders who need multiple layouts

- Users who want order flow tools, DOM or depth analysis

- Anyone who enjoys customizing every part of their workspace

Trading Conditions That Actually Work for You

Here’s where AquaFutures really stands out - they don’t overcomplicate the trading environment.

- Execution Quality: Thanks to fast data feeds from Rithmic and others, your trades go through quickly and accurately. No weird delays or mystery slippage.

- Server Reset Time: Accounts reset daily at 9 PM UTC, which works well for traders in the U.S., Europe, and Asia. This helps you reset drawdowns and restart fresh every trading day.

- Smooth Platform Integration: Once you purchase your evaluation or funded account, you’ll receive login credentials based on your chosen platform - usually within hours.

Risk Conditions & Fair Limits

AquaFutures balances freedom with rules:

- Fixed or Trailing Drawdown: Depends on the account type you pick

- Contract Limits: Clear limits based on account size (no hidden restrictions mid challenge)

- No Daily Time Restrictions: You are free to trade any session - London open, New York open or even the Asia session if that’s your style

And yes, you can hold trades overnight or over the weekend in many models just be sure to confirm the rules for your specific account.

Our Verdict on Platform Access supported by AquaFutures

At the end of the day, choosing the right trading platform isn’t about what’s popular - it’s about what fits you. Whether you love clean charts and easy setups or crave a fully customizable order flow system - AquaFutures gives you that flexibility.

So, you’re not stuck using one rigid system. You’ll be given the tools that match your trading strategy, trading hours, and skill level.

And most importantly, everything works smoothly so you won’t be facing any buggy setups or third-party nonsense.

Summary: Why It Matters

- ProjectX is perfect for fast, visual trading.

- Quantower gives you extra power and layout control.

- ES, NQ, CL, GC, YM and other popular CME instruments are all available.

- Server reset at 9 PM UTC keeps global traders in sync.

- Smooth onboarding and no additional platform fees.

AquaFutures may not overload you with 5+ platform options like some other firms, but what they do offer is precisely what futures traders actually need. So if you’re planning to get funded through AquaFutures, rest assured because you’ll have the platform tools, speed, and asset access to perform at your best.

What Trading Instruments Can You Trade on AquaFutures?

AquaFutures gives you access to a huge range of tradable futures contracts across popular asset classes like equity indexes, currencies, commodities, metals, energies and even cryptocurrencies. Whether you are scalping Micro E-minis or swing trading Gold, there’s something here for every trading style.

You can trade CME, COMEX, CBOT, and NYMEX instruments - all under one prop firm account. And yes - these are the same futures contracts used by institutional traders across the globe.

Let’s dive into what’s available, what it costs and when the markets are open.

Access to Full Futures Market Coverage

AquaFutures supports trading on a broad range of regulated futures instruments, including:

- Stock Index Futures: E-mini S&P 500 (ES), Nasdaq (NQ), Dow (YM), Russell (RTY), and their micro versions (MES, MNQ, MYM, M2K)

- Currency Futures: Euro (6E), British Pound (6B), Australian Dollar (6A), Japanese Yen (6J), and more

- Energy Futures: Crude Oil (CL), E-mini Crude (QM), Natural Gas (NG), Heating Oil (HO), Micro Crude (MCL)

- Precious Metals: Gold (GC), Silver (SI), Copper (HG), Micro Gold (MGC), Platinum (PL)

- Agricultural Futures: Corn (ZC), Soybeans (ZS), Wheat (ZW), Cattle (LE, GF), Hogs (HE)

- Interest Rate Futures: 2-Year, 5-Year, and 10-Year Treasury Notes (ZT, ZF, ZN), plus Micro 10Y Yield

- Crypto Futures: Micro Bitcoin (MBT) and Micro Ethereum (MET)

These contracts allow you to diversify your strategy, hedge exposure and take advantage of volatility across global markets. They come with clearly defined specs, including:

Trading Hours

Most markets run Sunday to Friday from 5:00 PM to 4:00 PM CT with a 1 hour daily reset applied between 4:00 PM and 5:00 PM CT.

AquaFutures trading hours are officially listed as 5:00 PM to 3:10 PM CT, in line with their server resets.Tick Size & Tick Value

Each contract has a minimum price movement (tick) and a fixed tick value. For example:ES: 0.25 tick size = $12.50

NQ: 0.25 tick = $5

CL: 0.01 tick = $10

MBT (Micro Bitcoin): 5.00 tick = $0.50

GC (Gold): 0.10 tick = $10Total Cost Per Side

AquaFutures keeps the cost structure competitive, with per-side costs (including commissions and exchange fees) ranging from as low as $0.56 for Micros to just around $2.22 for most currency futures.

Note: AquaFutures provides the full contract details like tick size, tick value and fees in their FAQ section (Click Here). You can also check their dashboard once funded to view updated live specs.

Examples of Popular Contracts You Can Trade

Here is a quick snapshot of key AquaFutures contracts:

| Instrument | Code | Tick Value | Total Cost/Side | Good For |

|---|---|---|---|---|

| E-mini S&P 500 | ES | $12.50 | $1.90 | Index scalping/swing |

| Micro E-mini NASDAQ | MNQ | $0.50 | $0.62 | Low-cost beginner trades |

| Crude Oil | CL | $10.00 | $2.12 | Volatility chasers |

| Gold | GC | $10.00 | $2.17 | Commodity swing trades |

| Euro FX | 6E | $6.25 | $2.22 | Currency market play |

| Micro Bitcoin | MBT | $0.50 | $1.15 | Crypto futures trading |

| Soybean | ZS | $12.50 | $2.13 | Agri-trading strategies |

Pro Tip: AquaFutures’ cost structure is clearly laid out in their official guidelines. They keep it transparent so you won’t get any hidden fees or confusing rebates.

Our Verdict on Trading Instruments offered by AquaFutures

Based on our AquaFutures review, the firm has one of the most well-balanced and transparent instrument lists in the futures prop firm world. Whether you’re scalping micros, trading news events on ES or CL, or diversifying with metals and crypto - you will have plenty of choices without being overwhelmed.

And because all trading specs, costs, and hours are clearly documented, you can trade with confidence knowing exactly what you’re dealing with.

So, before you enter your next trade, make sure to explore what each instrument offers. Matching your trading strategy with the right product could be the game changer you’ve been waiting for.

AquaFutures Payout Process and Reward System (Explained Simply)

Getting funded is exciting but getting paid is the real deal.

At AquaFutures, the payout process is designed to be fair, fast and built for real traders. Whether you are just getting started with a Beginner account or trading full time with an Instant Funded model, the firm makes it easy to withdraw your profits with flexible options, high profit splits and a consistency based reward structure.

Let’s break down exactly how the payout system works, what to expect and how much you can withdraw from each account.

Profit Split: Keep Up to 100% of Your Earnings

Here’s how it works:

- You can keep 100% of your first $15,000 in profits.

- After that, you’re eligible for up to a 90% profit split on all future rewards.

But there is a catch (a fair one): your trading consistency affects how much you get.

Profit Split Tiers Based on Consistency:

| Consistency % (during payout period) | Profit Split |

|---|---|

| 0% - 20% | 100% |

| 20.01% - 30% | 90% |

| 30.01% - 40% | 70% |

So the more consistent your profits, the higher your reward cut. It’s AquaFutures’ way of rewarding disciplined, long term traders - not just lucky streaks.

AquaFutures Reward Eligibility: When Can You Request a Payout?

Here’s how often you can request a payout (called a “reward”):

| Account Type | Payout Frequency |

|---|---|

| Beginner | Every 7 days |

| Standard | Every 14 days |

| Instant Funded | Every 7 days |

But before you hit that “withdraw” button - make sure you meet the minimum conditions 👇

AquaFutures Payout Conditions by Account Type

Beginner Accounts:

- At least 6% total profit

- 5 winning days with minimum daily gains ($75 to $300 - based on account size)

- Must follow the 40% consistency rule

- Minimum withdrawal: $250

Standard Accounts:

- At least 6% total profit

- Must follow 40% consistency rule

- Minimum withdrawal: $500

- Optional: Withdraw from Buffer Zone (more below)

Instant Funded Accounts:

- At least 6% profit

- 7 winning days with a minimum of $75 or $100 daily profit

- 20% consistency rule

- Minimum withdrawal: $250

What Happens on AquaFutures’ First Payout?

On your first reward:

- Your max drawdown is adjusted to your starting balance + $100.

- This gives you a clean slate to continue trading, without a trailing drawdown.

- Be careful not to over-leverage right after your first payout, especially if your buffer is tight.

How Fast Are AquaFutures’ Rewards Processed?

AquaFutures aims to keep it quick and predictable:

- Processing Time: Within 48 hours

- Review Window: Market hours only (Sunday 5 PM CST to Friday 3 PM CST)

- Methods: Riseworks (standard payment system) and Confirmo (for crypto payouts like BTC, USDT, etc.)

Flat processing fee of $35 applies but only once per calendar month, no matter how many payouts you request.

The Buffer Zone (Standard Accounts Only)

This unique rule helps protect your account capital while still allowing partial payouts.

| Account Size | Buffer Zone (Min Balance to Stay Above) |

|---|---|

| $25,000 | $26,300 |

| $50,000 | $52,600 |

| $100,000 | $103,600 |

| $150,000 | $155,100 |

If you request a payout while your balance is within the buffer zone:

- You must withdraw 60%, and the remaining 40% stays in your account.

- Minimum withdrawal is $500.

If your balance is below the buffer, your drawdown resets to starting balance + $100, and you can continue trading with more flexibility.

AquaFutures Maximum Reward Cap (First 60 Days)

To help you start strong and manage risk, AquaFutures sets a maximum withdrawal cap during your first 60 days. After 60 days and 3 successful rewards, the cap is lifted and you can withdraw full profits.

Max Reward Per Request:

| Account Type | $25K | $50K | $100K | $150K |

|---|---|---|---|---|

| Beginner/Standard | $750 | $1,500 | $3,000 | $4,500 |

| Instant Funded | $1,000 | $2,000 | $4,000 | — |

This tiered system is designed to help traders grow gradually while minimizing risk early on.

AquaFutures Reward Guarantee

Yes, there is a guarantee too. If your reward request meets all the rules and isn't processed in 48 hours then AquaFutures will add an extra $100 to your payout - no questions asked.

To qualify, your request must:

- Follow all firm rules

- Pass identity verification

- Be submitted with complete info

- Be free of external issues like platform delays or KYC issues

Basically: play fair, and they’ll pay you fast - guaranteed.

How to Pass AquaFutures: Pro Tips from Real Traders

Let’s be honest - passing a prop firm evaluation is no cakewalk. But with AquaFutures, you don’t need magic. You just need a clear plan, some patience and smart trading. Whether you are taking the Beginner, Standard or Instant Funded account route - these tips can give you the edge you need to pass with confidence.

Here’s what successful traders are doing and what you should be doing too 👇

1. Understand the Rules Like Your Own Trading Plan

Before you place even one trade, read every rule. Sounds obvious, but you'd be surprised how many traders fail because they miss something simple like:

- The drawdown type (trailing vs static)

- Daily profit target or max loss

- Minimum winning days or consistency requirements

Pro Tip: Screenshot the rules or write them down on a sticky note. Keep them in front of you while trading.

2. Don’t Rush. Take the Full Evaluation Period

There’s no prize for passing in 2 days. AquaFutures lets you take your time, and consistency is rewarded more than speed.

- Use small lot sizes early on

- Focus on winning more days than losing

- Avoid overtrading just to hit a target

Remember: You’re not just trying to “win,” you’re trying to prove you're reliable.

3. Pick the Right Instruments for Your Strategy

With AquaFutures, you get access to a lot of instruments - ES, NQ, CL, GC, MNQ, MES, and even Micro Bitcoin.

Stick to what you know. If you are a scalper, maybe Micro Nasdaq (MNQ) fits better than full size contracts. If you are a swing trader, Gold or Oil might give you better setups.

Don’t try to trade everything. Specialize, focus and grow from there.

4. Manage Your Drawdown Like a Pro

This one is HUGE.

Trailing drawdown catches traders off guard all the time. If your account has trailing drawdown:

- Never let unrealized profits float too long

- Lock in profits often

- Don’t go all-in after a win

Start slow, grow slow, finish strong.

5. Use a Journal or Tracking Sheet

Every funded trader you admire? They probably journal.

Track your trades, your mindset, what you felt, what you ignored. Especially during evaluations it helps you:

- Spot patterns

- Catch repeated mistakes

- Improve your consistency score

Even a simple spreadsheet can save your account.

6. Follow the 40% or 20% Consistency Rule

AquaFutures has a consistency rule built into its reward system. That means:

- No wild, one day $2,000 gains while all other days are $50

- Aim for balanced profit across the required number of winning days

- Spread your gains instead of front loading them

Payouts and profit splits depend on this. Don’t ignore it.

7. Withdraw Smart (Especially on Instant Accounts)

Once you pass - don’t celebrate too hard.

- Know the minimum withdrawal amounts

- Respect the buffer zone (for Standard accounts)

- On your first reward - your drawdown resets to starting balance + $100 and make sure you are not withdrawing everything at once

Be strategic about withdrawals so you can keep growing your account.

8. Mindset Matters More Than You Think

This isn’t talked about enough, but:

- Don’t chase revenge trades

- Don’t FOMO into setups

- Don’t compare your progress with other traders in Discord

Stay calm, stay sharp. Prop trading isn’t just about charts rather it’s about discipline.

Bonus Tip: Use The Trusted Prop's Discount Code

If you are not already in the challenge, you can save money using our exclusive discount on the Aquafutures challenges with the coupon code TRUSTED at checkout via The Trusted Prop. You might also qualify for giveaways or cashback once funded.

Why pay full price when you don’t have to?

Final Words: You Got This

Passing AquaFutures isn’t about being perfect. It’s about:

- Following rules

- Staying consistent

- Managing risk

- Knowing when to stop

If you can do that, you’re already ahead of 90% of traders out there. And once you pass? AquaFutures rewards you not just with funding but with one of the fastest and fairest payout systems in prop trading.

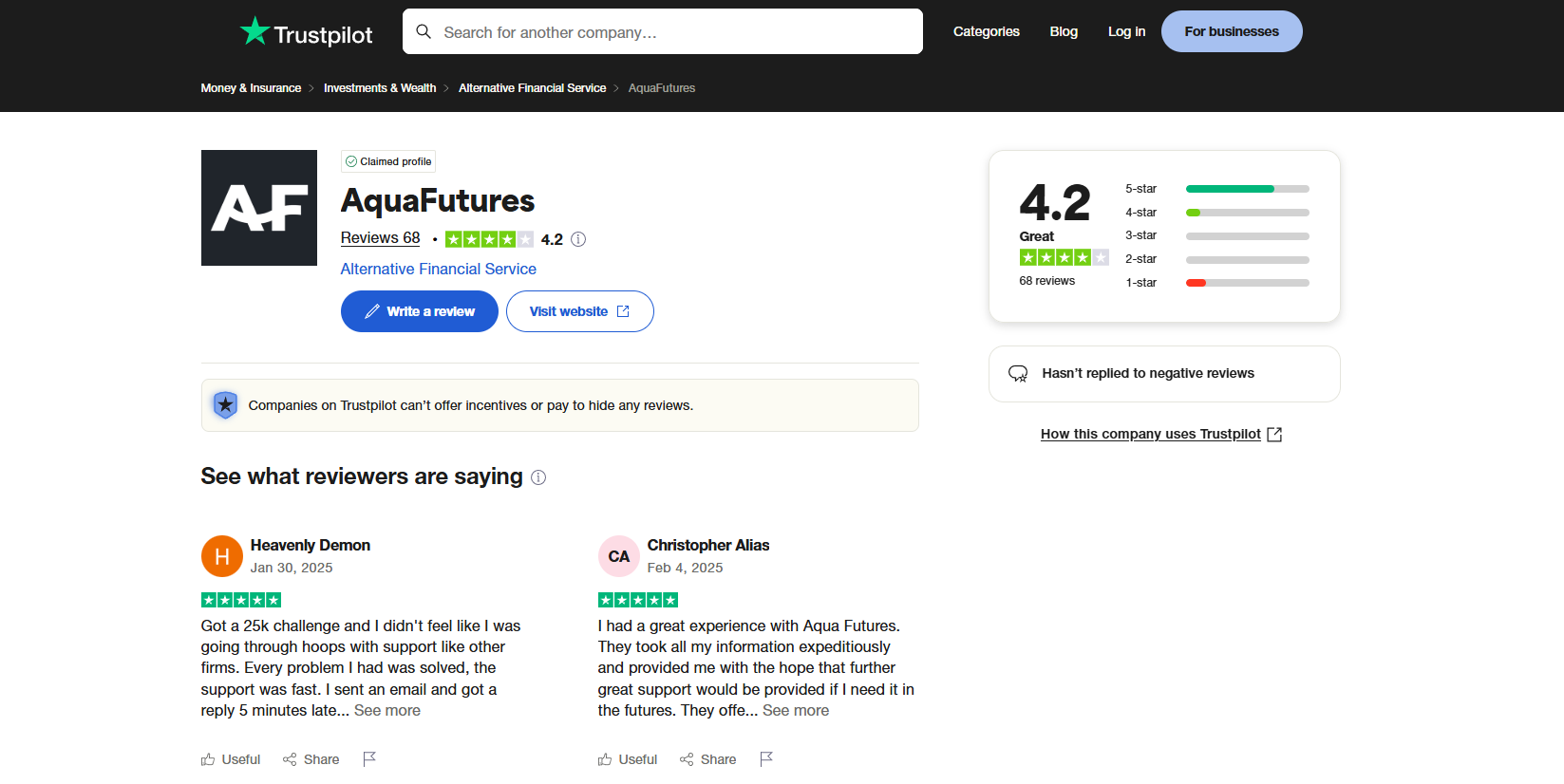

Real User Feedback & Trust Factor About AquaFutures Prop Firm

In the world of prop trading, trust is everything.

It doesn’t matter how sleek a platform looks or how attractive the payout sounds - what traders really want to know is: “Will they actually support me? Will they pay out? And will someone be there when things go wrong?”

With AquaFutures, the early signs are strong and the community feedback says a lot. Here’s what real traders are saying about their experience with AquaFutures:

“They offer great opportunity for traders in the Futures space.”

- Christopher Alias – 🇺🇸 USA

- Rating: 5 out of 5 stars

- Date: February 3, 2025

“I had a great experience with Aqua Futures. They took all my information expeditiously and provided me with the hope that further great support would be provided if I need it in the future. They offer great opportunity for traders in the Futures space. I spoke with Larry to handle my issues and they were resolved swiftly.”

Why it matters:

This isn’t just about funding - Christopher’s review reflects confidence in AquaFutures’ customer support. When issues arise (and they always do in trading), having a responsive team that handles things fast is a big green flag.

“Kyle and his team were top-tier.”

- Jeffery Muckle – 🇺🇸 USA

- Rating: 5 out of 5 stars

- Date: March 4, 2025

“Kyle and his team were the utmost professionals and response time was amazing. Still pending my funded account after passing the eval, but this company, from a customer service and platform perspective, are top tier.”

Why it matters:

Even before the funded account gets activated, Jeffery’s already impressed. That says a lot about how professional and attentive the AquaFutures team is, especially during those key moments when traders are waiting to level up.

What We’re Seeing Across the Community

The prop trading space isn’t always known for customer service. But AquaFutures seems to be breaking the mould with:

- Fast and responsive support (shoutout to Kyle and Larry!)

- Genuine conversations, not robotic replies

- Smooth onboarding process

- Platform clarity, even for newer traders

Add to that their transparent rules, active Discord community, and real payout proof and AquaFutures is quickly becoming one of the most trusted new futures prop firms in 2025.

Should You Trust AquaFutures?

No prop firm is perfect but when a company:

- Replies fast,

- Fixes problems quickly,

- And treats traders like humans (not just account numbers)…

…it earns trust.

If you’re on the fence about joining AquaFutures, know that real traders like Christopher and Jeffery are not just trading - they’re staying and that’s often the best sign of long term value.

Final Verdict: Is AquaFutures Worth It in 2025?

Yes - if you are serious about futures trading and want a fair shot at growth then AquaFutures is absolutely worth it.

Here’s why:

- Transparent Rules: No hidden fees or sneaky limitations

- Fast Payout System: Processed in 48 hours, guaranteed (if you comply with trading and firm rules

- Generous Profit Splits: Up to 100% of your first $15K

- Flexible Account Types: One step evaluations, instant funding and beginner-friendly options

- Consistency Based Rewards: Encourages sustainable, long term trading habits

- Responsive Support: Real people behind the platform, not bots

Sure, it’s not the biggest name yet but that’s exactly why they are building with care, transparency, and a community first approach.

So, if you are done with broken promises and want a prop firm that actually respects your trading skill, AquaFutures could be your new home in 2025.

And hey - don’t forget to use the AquaFutures discount code TRUSTED via The Trusted Prop for the best offers on their evaluations and funding plans.

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

No FAQs are available for this topic yet.