Copy Coupon Code to Get

35% Off 🎉

AquaFunded

Forex, Crypto, Commodities, Indices, Metals

AE

2023

CEO: Jason Blax

Get 35% OFF + 90% Profit Split + 150% Refund + Free Account on Payout

Coupon Code:

MatchTrader

Trade Locker

Crypto

Rise

Crypto

Credit/Debit Card

Visa

Mastercard

Apple Pay

ThinkMarkets

Try Our New Consistency Calculator

Advanced analytics to measure your trading edge and performance consistency

AquaFunded Prop Firm: Everything Traders Need to Know

AquaFunded Prop Firm: Everything Traders Need to Know

1/29/2026

Prop trading has changed a lot over the past few years. What once felt like a niche opportunity has now become a crowded space filled with bold promises, aggressive marketing and confusing trading rules. In 2026, traders are no longer asking “Which prop firm pays the most?”

But rather, they are asking “Which prop firm can I actually trust and trade with long term?”

AquaFunded is one of the top prop firm names that often comes up in these type of discussions. Some traders may see it as an opportunity - while others approach it with caution. This article breaks down how AquaFunded prop firm works, what traders should realistically expect and what benefits they can enjoy from this firm in 2026.

What Is AquaFunded Prop Firm?

AquaFunded is a prop firm based in UAE since 2023, offering traders access to simulated capital from $2,500 to $400,000 through - evaluation-based and instant funding models. Like most modern prop firms - traders are required to pass an evaluation or challenge phase by purchasing the challenge account with entry fees starting as low as $60 which goes up to $2,449 before they recieve a funded account. Traders can also opt for an instant funding account which relatively comes with a higher fee.

AquaFunded prop firm designed its funding models for the traders who can handle trading with structured rules, defined risk limits and a clear progression path to funded account scaling. The firm typically attracts prop traders who are looking to trade on larger account sizes without risking a large amount of personal capital upfront and AquaFunded fulfils their search by offering huge discounts on challenge models and instant accounts.

Rather than focusing on hype, AquaFunded positions itself as a rule based environment where discipline and consistency matter more than aggressive trading.

How AquaFunded Works: From Evaluation to Funded Account

The AquaFunded funding process generally follows a familiar prop firm structure:

- Account Purchase:

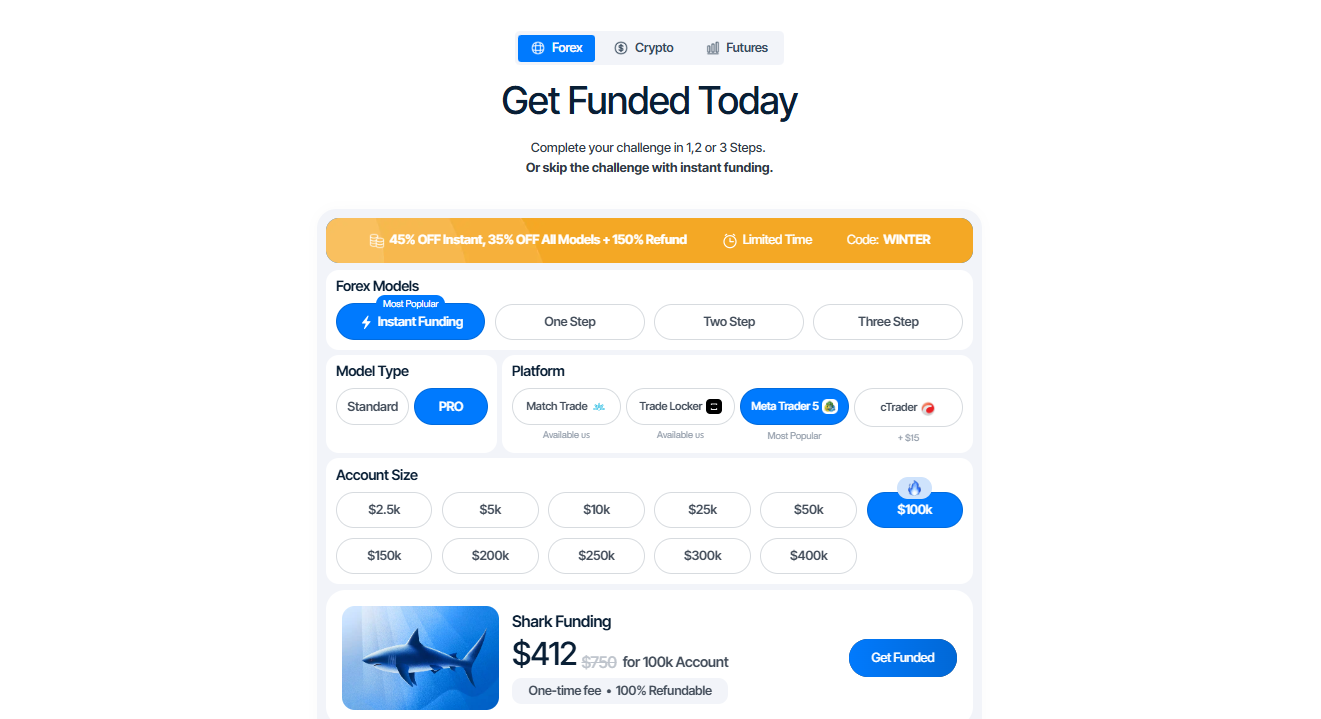

AquaFunded offers 1-step, 2-step, and 3-step challenge models along with an instant funding account type as well. Traders can select an account size and challenge type as per their trading style and goals. Traders have to pay an account fee, which can vary based on the account type a trader selects.

- Evaluation Phase:

If traders choose an AquaFunded challenge account then they have to go through an evaluation phase which varies based on which challenge model is selected. Traders must hit a profit target while respecting the drawdown and risk limits to pass the AquaFunded challenge.

- Funded Stage: Once the trader passes the AquaFunded evaluation - they are granted a funded account with profit-sharing eligibility.

One of the most common trader pain point is misunderstanding the timelines - many traders assume evaluations can be rushed. But in reality, most prop firm challenge failures happen because traders push too hard early - ignoring the drawdown limits. Like other prop firms, AquaFunded rewards traders who aim for steady execution over short term gains. Let us understand in detail about the AquaFunded account types, entry fees and rules to pass the challenge or become eligible for profit payouts.

AquaFunded Challenge Types, Account Sizes, Fees & Rules

The AquaFunded prop firm offers a wide range of challenge models and instant funding accounts – that gives traders the flexibility to choose a structure and account size that best aligns with their trading experience level and risk tolerance. Traders can also select from multiple trading platforms which is an important consideration for trade execution quality and strategy compatibility:

- MetaTrader 5 (MT5): The most popular choice among traders worldwide

- TradeLocker: This trading platform is available for US traders

- MatchTrader: This trading platform is available for US traders

- cTrader: Traders can choose this platform by paying an additional $15 fee

While larger account sizes often look appealing - experienced traders know they also come with greater psychological pressure and stricter risk discipline requirements. Many of the failed prop firm challenges are less about strategy and more about emotional mismanagement often tied to oversized funded accounts.

AquaFunded Challenge Types

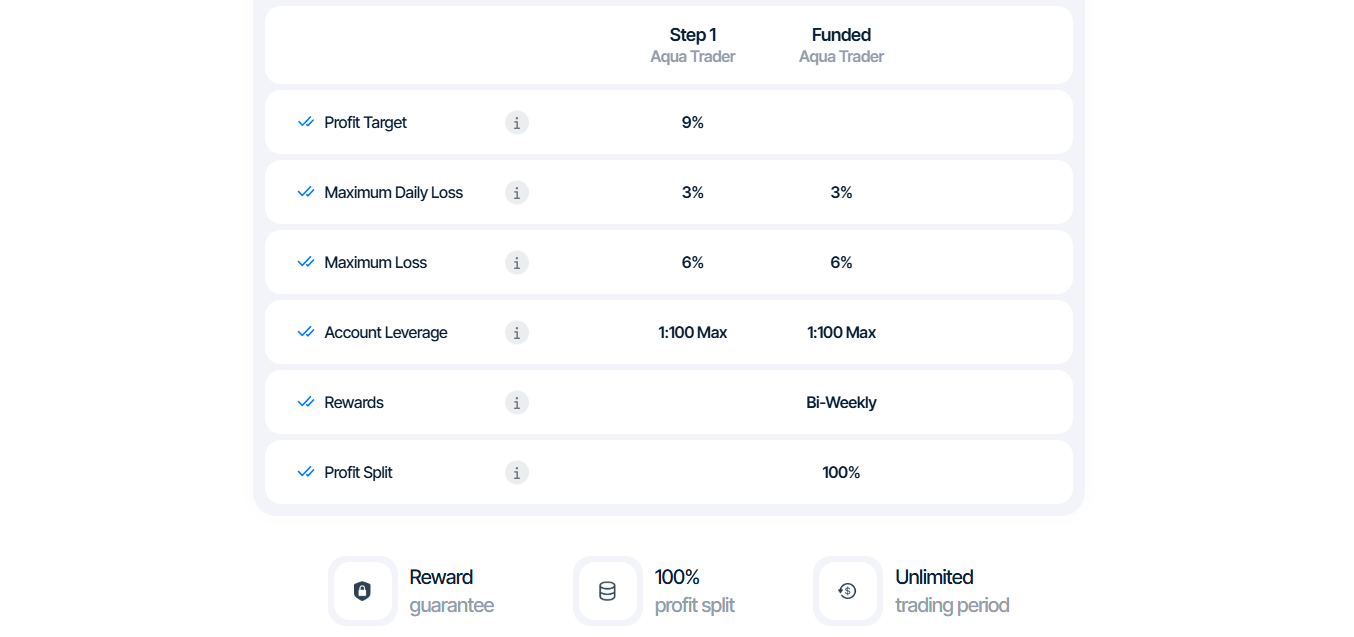

AquaFunded 1-Step Challenge

The 1-Step Challenge is a single-phase evaluation designed for traders who prefer a faster path to a funded account. It is available in Standard and Pro models.

1-Step Standard Challenge Account sizes and original fees:

- $5,000 – $67

- $10,000 – $113

- $25,000 – $227

- $50,000 – $327

- $100,000 – $527

- $200,000 – $1,017

1-Step Pro Challenge Account sizes and original fees:

- $5,000 – $59

- $10,000 – $99

- $25,000 – $199

- $50,000 – $289

- $100,000 – $459

- $200,000 – $899

For the AquaFunded 1-step standard and pro account, traders need to achieve a 9% profit target while staying within the 3% daily loss limit and 6% overall loss limit. Once traders pass the AquaFunded 1-step challenge, they get a funded account with 90% profit split and bi-weekly payouts.

Best Suited for: The AquaFunded 1-Step Challenge model suits traders confident in their consistency and risk control from day one.

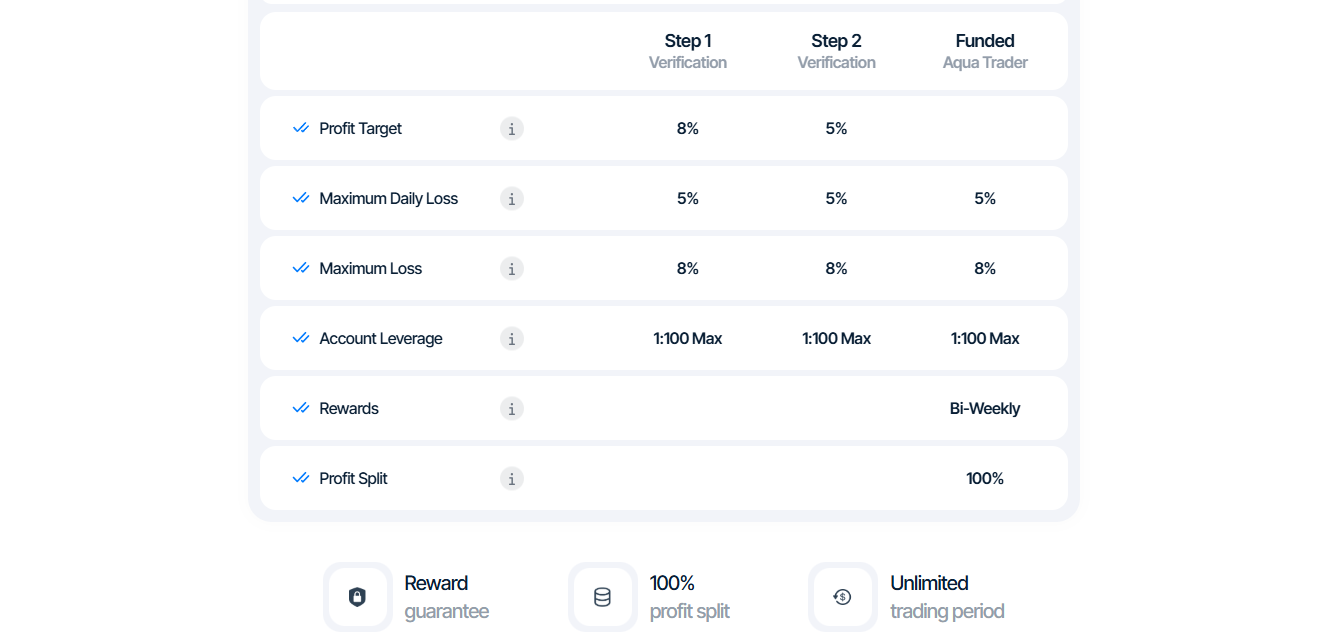

AquaFunded 2-Step Challenge

The 2-Step Challenge splits the evaluation across two phases - allowing traders more time to demonstrate discipline and their skills. Like the AquaFunded 1-step model, it is available in Standard and Pro versions for traders with different risk appetite.

2-Step Standard Challenge Account sizes and original fees:

- $5,000 – $57

- $10,000 – $103

- $25,000 – $217

- $50,000 – $317

- $100,000 – $517

- $200,000 – $997

2-Step Pro Challenge Account sizes and original fees:

- $5,000 – $39

- $10,000 – $76

- $25,000 – $138

- $50,000 – $247

- $100,000 – $460

- $200,000 – $925

For the AquaFunded 2-step standard and pro account, traders need to achieve a 10% profit target in phase 1 and 5% in phase 2 while staying within the 5% daily loss limit and 10% overall loss limit. Once traders pass the AquaFunded 1-step challenge, they get a funded account with 90% profit split and bi-weekly payouts.

Best Suited for: The AquaFunded 2-Step Challenge structure is often preferred by traders who want lower pressure per phase and a more gradual evaluation process.

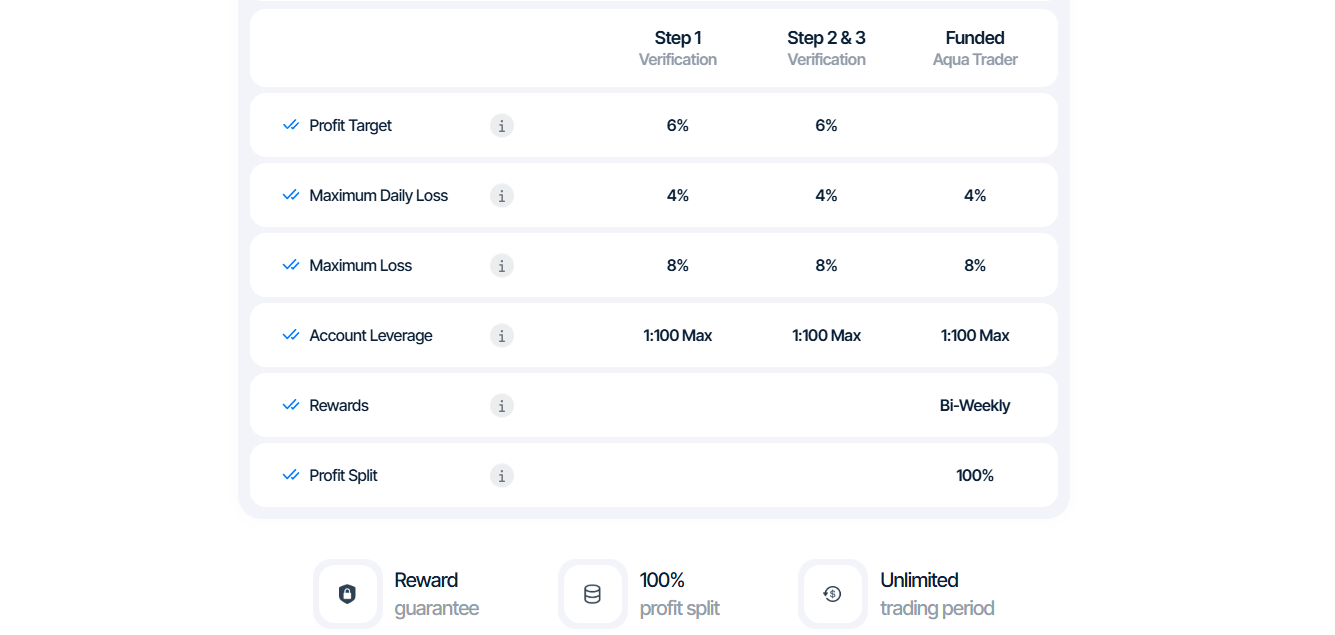

AquaFunded 3-Step Challenge

The 3-Step Challenge is the most conservative evaluation model, requiring traders to pass three separate phases.

Account sizes and original fees:

- $10,000 – $77

- $25,000 – $157

- $50,000 – $237

- $100,000 – $377

- $200,000 – $677

For the AquaFunded 3-step standard and pro account, traders need to achieve a 6% profit target in all 3 phases while staying within the 4% daily loss limit and 8% overall loss limit. Once traders pass the AquaFunded 1-step challenge, they get a funded account with 90% profit split and bi-weekly payouts.

Best Suited for: This funding model is generally better suited for traders who value longer confirmation periods and steady performance over speed.

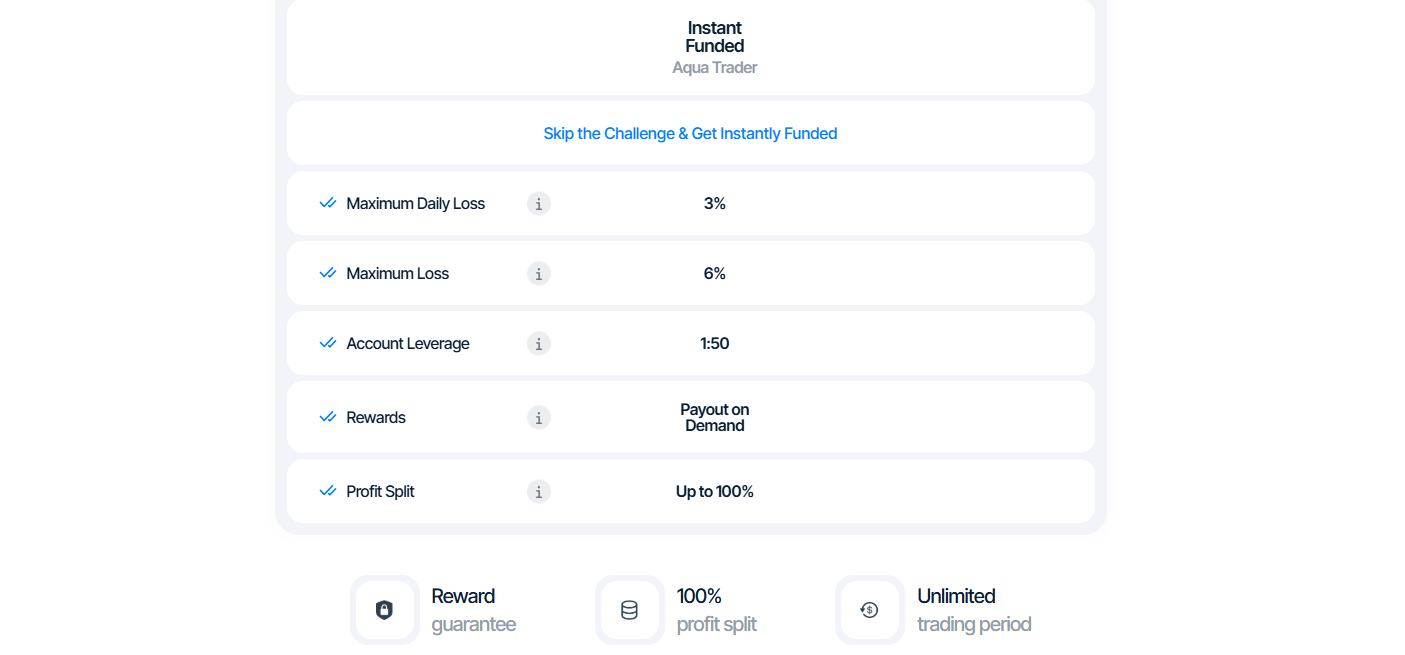

AquaFunded Instant Funding Accounts

For the traders who prefer to skip evaluations altogether, the AquaFunded prop firm offers Instant Funding accounts - providing traders with direct access to funded capital from day one.

AquaFunded Instant Funding Standard Account sizes and original fees are as follows:

- $2,500 – $64

- $5,000 – $117

- $10,000 – $158

- $25,000 – $317

- $50,000 – $475

- $100,000 – $767

- $200,000 – $1,265

- $250,000 – $1,560

- $300,000 – $1,810

AquaFunded Instant Funding Pro Account sizes and original fees are mentioned below:

- $2,500 – $60

- $5,000 – $115

- $10,000 – $155

- $25,000 – $310

- $50,000 – $465

- $100,000 – $750

- $150,000 – $980

- $200,000 – $1,250

- $250,000 – $1,540

- $300,000 – $1,790

- $400,000 – $2,449

For the AquaFunded Instant Funding standard and pro accounts, traders do not need to achieve any profit target as there is no evaluation phase - but once they receive the funded account, traders need to stay within the 3% overall loss limit to be eligible for profit payouts. Once traders pass the AquaFunded 1-step challenge, they get a funded account with up to 90% profit split and on demand payouts.

Best Suited for: Instant accounts appeal to experienced traders who already have a proven strategy and want to avoid evaluation constraints but they still require strict adherence to trading rules.

AquaFunded Crypto Account Options

In addition to the CFD accounts, AquaFunded also offers crypto specific account types, that are designed for traders with a focus on digital asset markets exclusively.

The Crypto 1-Step Challenge by AquaFunded comes with below account sizes and entry fees:

- $5,000 – $69

- $10,000 – $149

- $25,000 – $299

- $50,000 – $499

- $100,000 – $899

The Crypto Instant Funding Account by AquaFunded comes with below account sizes and entry fees:

- $5,000 – $99

- $10,000 – $179

- $25,000 – $329

- $50,000 – $599

- $100,000 – $999

These AquaFunded accounts follow similar evaluation and risk principles but are tailored to the volatility and structure of crypto markets.

Note: The firm also offers trading in futures markets via the AquaFutures official website. For futures traders who want to know more about futures funded accounts and challenge models, simply head to their official websites.

AquaFunded Refund Policy, Psychology & What Traders Often Miss

Each AquaFunded challenge or instant account comes with its own rules, trader benefits and account restrictions. One common mistake that traders make is focusing only on achieving the profit targets while underestimating how the account size impacts their emotional decision making.

AquaFunded offers a 100% fee refund on challenge accounts but only after a trader:

- Successfully passes the AquaFunded challenge, and

- Completes the fourth payout request

If a trader hard breaches the AquaFunded account before reaching the fourth payout - then the challenge fee is not refundable. This policy encourages traders towards long-term consistency rather than chasing short-term profits gains.

AquaFunded Add-Ons Explained

To enhance the trading account flexibility, AquaFunded provides optional account add-ons for both challenge and instant funding models. Traders can pay addition price and benefits like on demand payouts and 100% profit share.

Add-Ons for AquaFunded Challenge Accounts

- 100% Profit Split (instead of 90%)

Traders can get their full profits rather than just 90% by selecting this add-on for an additional 15% fee. - First Payout in 7 Days (instead of 14 days)

Using this AquaFunded add-on allows traders to request their first payout faster which can be opted at a 15% fee increase. - Combined Add-On Package (Best Value Option)

This includes both the 100% profit split and 7-day first payout feature with a 5% bundled discount - offered at a 25% fee increase (Most popular choice among traders).

Add-Ons for AquaFunded Instant Funding Accounts

- 100% Profit Split (instead of 90%)

Traders keep all their profits by upgrading their account for an additional 15% fee. - On-Demand First Payout (instead of waiting 14 days)

Traders can access their first payout immediately after meeting the required payout conditions. This can be opted with a 15% fee add-on during purchase. - Combined Add-On Package (Best Value Option)

Get both 100% profit split and instant first payout, while saving 5% overall, available at a 25% fee increase (Most popular choice among traders).

These AquaFunded add-ons are usually chosen by the traders who are looking for faster capital access or max profit retention.

A Tip for Traders: AquaFunded frequently runs promotional discounts throughout the year, allowing traders to access their challenge and funded accounts at reduced prices and additional benefits.

AquaFunded Trading Rules Every Trader Must Understand Before Starting

This is where most traders struggle - not because AquaFunded’s rules are unclear, but because they are overlooked by traders until it’s too late.

Most account losses happen not due to poor strategies, but because traders unintentionally breach a rule by a small margin. Understanding AquaFunded’s trading rules before placing the first trade is critical if you want to stay funded long term.

Key rules traders must pay close attention to in AquaFunded challenges include:

- Profit targets for each phase

- Daily drawdown limits

- Maximum overall loss

- Minimum trading daysNews or weekend holding or other strategy restrictions, if applicable

A common mistake traders make is assuming drawdown limits reset daily, without fully understanding whether AquaFunded applies static or trailing drawdown logic. This misunderstanding alone accounts for a large number of failed accounts.

In prop trading, rule awareness is not optional - it is the foundation of consistent funded trading success.

AquaFunded Trading Rules in 2026: Built for Consistency, Not Luck

In 2026, AquaFunded’s trading rules are designed to evaluate discipline, consistency, and risk control, rather than short-term gambling or aggressive leverage.

Unlike many restrictive prop firms, AquaFunded allows traders significant flexibility across all account types, including:

- Expert Advisors (EAs)

- Trade Copiers

- Holding trades overnight

- Weekend holding

- Hedging is allowed within the same account.

- Martingale strategies are permitted.

- 24/7 crypto trading – no weekend restrictions.

- No mandatory stop-loss requirement, traders can manage risk according to their own trading plan

This level of trading freedom enables traders to apply diverse trading styles while still operating within a controlled risk framework.

However, freedom does not mean unlimited risk.

AquaFunded Risk Management Rule: Wave Stop Explained

AquaFunded implements a unique risk control mechanism called Wave Stop, which applies only to funded accounts.

Wave Stop is designed to protect traders from excessive open-position losses during volatile market conditions.

How Wave Stop works:

- If your combined open trades reach a 2% unrealized loss of your account balance, Wave Stop will automatically close all open positions across all symbols.

- This is considered a soft breach, meaning:

- Your account remains active

- You can resume trading immediately

- No penalties or cooldowns apply

Example:

If you are trading a $100,000 funded account and your open positions collectively reach a loss of $2,000, then the AquaFunded’s Wave Stop will close all open trades to prevent further drawdown. You are free to continue trading right after.

Wave Stop acts as a safety net, not a punishment but to helping traders survive volatility without losing funded status.

Why Traders Fail: Over-Leveraging Early

One of the most common mistakes traders make is trying to “finish the challenge faster” by increasing lot size early. This often leads to:

- Emotional decision-making

- Overtrading

- Drawdown violations

- Rule breaches from small market spikes

Successful AquaFunded traders approach evaluations as if they are already funded. They focus on risk-adjusted returns, emotional control, and consistency rather than chasing quick wins.

The traders who succeed long term are not the most aggressive - they are the most disciplined.

Final Takeaway

AquaFunded offers generous trading freedom, but trading success depends on respecting the rules and managing risk intelligently. AquaFunded is one of the best prop firms for disciplined traders who understand drawdown mechanics, avoid over-leveraging, and treat evaluations seriously are far more likely to remain funded in 2026.

In prop trading, the edge isn’t just a trading strategy - it’s discipline.

AquaFunded Payout Structure: What Traders Can Expect

Payout rules are one of the biggest decision-making factors for traders choosing a prop firm. Before committing to any evaluation or instant funding model, most traders want clear answers to a few critical questions:

- What is the profit split?

- When is the first payout available?

- How often can withdrawals be requested?

- Which payout methods are supported?

AquaFunded uses a structured and rule-based payout system, meaning withdrawals are approved only when all trading conditions are met. Many payout delays reported across prop firms usually stem from misunderstandings around consistency rules, minimum trading days, or risk violations - not profitability itself.

As of 2026, AquaFunded payout system for traders includes below features:

- Bi-weekly payouts for its challenge-based funded accounts

- On-demand payouts for Instant Funding accounts

- 24 hours Payout Guarantee, if not fulfilled the firm pays an extra $1000 to traders

This setup allows instant-funded traders to request withdrawals as soon as they meet the payout criteria, without waiting for a fixed cycle. However, it’s important to understand that making profits alone does not guarantee a payout. Full compliance with risk limits, trading behavior guidelines, and consistency requirements is mandatory.

Key takeaway: AquaFunded rewards disciplined traders who follow the rules - not traders chasing fast profits while ignoring structure.

AquaFunded Scaling Opportunities: Can Traders Grow Their Account?

Scaling plans are often marketed as an easy path to large capital, but in reality, only firms with clear and achievable criteria make scaling worthwhile. AquaFunded’s scaling model is designed for long-term, rule-respecting traders, not short-term risk takers.

With the AquaFunded scaling plan, traders can grow their funded account up to $4,000,000 by consistently achieving 12% profit over a 3-month period, while strictly following all trading rules and restrictions.

To qualify for AquaFunded scaling, traders must demonstrate:

- Consistent and sustainable profitability

- Strict adherence to drawdown and risk rules

- A clean, violation-free trading history over time

In practice, only a small percentage of traders ever reach higher scaling tiers and that’s intentional. Scaling is not unrealistic, but it rewards patience, discipline, and risk control, not aggressive trading or shortcut strategies.

For traders focused on longevity rather than quick wins, AquaFunded’s scaling system offers a realistic path to meaningful capital growth.

Final Thoughts: Is AquaFunded Worth Considering in 2026?

AquaFunded is not a shortcut to instant funding, nor is it a guaranteed path to trading success. Like most modern prop firms, it is designed to reward consistency, discipline, and risk awareness - while quickly filtering out traders who rely on luck or over-leverage. So, if you are wondering, “is AquaFunded legit?” Then the answer is yes, it is a legit prop firm, and trusted by thousands of traders worldwide.

For traders who understand drawdown management, respect daily loss limits, and approach evaluations with a long-term mindset, AquaFunded can be a legitimate option worth considering in 2026. Its structure favors patient execution over aggressive betting. However, for traders who rush prop firm challenges, ignore risk rules or treat prop trading like a lottery, AquaFunded can become an expensive learning experience. In the end, no prop firm determines a trader’s success. The real edge comes from trader’s behavior, discipline and decision-making - not the brand name behind the funded account.

If you think this prop firm is worth considering, then

Start your funded trading journey with AquaFunded prop firm today!

You may also like

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Futures Rules for Challenge and Funded Phase (2026)

My Funded Futures Flex Challenge Explained (2026 Guide)

Moneta Funded Detailed Review 2026: Our Honest Verdict

Evercrest Funding Detailed Review 2026: Our Honest Verdict

Breakout Prop Detailed Review 2026: Our Honest Verdict

ThinkCapital Detailed Review 2026 – Our Honest Verdict