MegaTrader Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full MegaTrader review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

5.0

5.0

MegaTrader

Futures

2024

CEO: Hansel

Crypto

Rise

Crypto

Rise

MegaTrader is a modern prop firm in the prop trading world operating since 2024. Targeting futures traders, the firm offers a high 90% profit split across all its funding programs. MegaTrader wants to offer traders multiple ways ways to gain capital and does so by offering flexible account types including Elite and Growth evaluations, as well as an Instant Funding option with accounts ranging from $25,000 to $150,000. The firm works on its developed MegaTraderX platform, which is based on DXtrade XT.

MegaTrader Prop Firm Overview

| Category | Details |

| Company Name | The prop firm name is MegaTrader. |

| Legal Name | MegaTrader's legal name is MegaTrader Holdings Inc. |

| Registration Number | MegaTrader's registration number is 33-2161751. |

| CEO | The CEO of MegaTrader is Hansel. |

| Headquarters | The head office of MegaTrader is located in the USA. |

| Broker | The broker associated with MegaTrader is MegaTraderX (DXtrade XT). |

| Operating Since | MegaTrader prop firm has been operating since 2024. |

| Account Sizes | MegaTrader provides account sizes ranging from $25K – $150K. |

| Profit Split | MegaTrader offers a 90% profit split. |

| Challenge Types | MegaTrader offers Elite 1-Step Challenge, Growth 1-Step Challenge, Funded Plan (Instant Funding). |

| Payout Cycle | MegaTrader offers daily payouts to traders. |

| Payout Method | The profit withdrawal methods supported by MegaTrader are RiseWorks, and Crypto. |

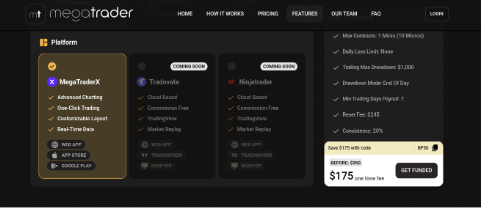

| Trading Platforms | MegaTrader supports trading on MegaTraderX. |

| Financial Markets | MegaTrader supports trading in Futures only. |

| Max Allocation | MegaTrader offers upto $150k in capital allocation via funded accounts. |

| Max Scaling | MegaTrader provides scaling opportunities up to Performance-Based (No specific limit given). |

| Trustpilot Score | MegaTrader has a 4.5 (as of 2025) rating based on 21 reviews. |

Pros and Cons of Trading with MegaTrader

Before a trader decides to partner with MegaTrader as a prop firm there are pros and cons to consider. MegaTrader’s package of benefits, such as a high profit split and various evaluation models, is attractive but there are some rules, details, and fees that should be examined before taking the challenge.

| Pros | Cons |

| High 90% profit split on all accounts. | The Elite Plan has an activation fee and a monthly fee. |

| Instant Funding is available with a Funded Plan and no need for an evaluation. | The trailing drawdown on the Elite and Funded plans is considered to be from the end of the day or intraday equity, which can be limiting. |

| In the challenge phase, the minimum trading days is as low as 1 day. | Reset fees are applicable for the Elite and Growth challenges. |

| In all trading account plans, news trading is allowed. A huge plus for traders. | There is no allowance for hedging or arbitrage. |

| The payouts are available to request daily for funded accounts. | VPS is not allowed, and there are strict IP rules (no account sharing). |

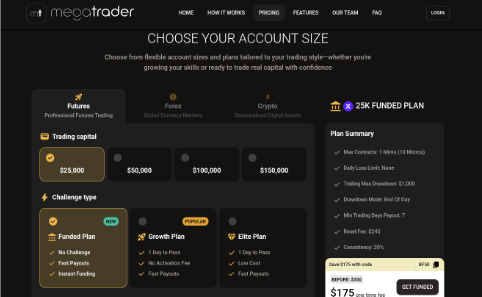

MegaTrader Account Types, Fees & Profit Split

MegaTrader provides three primary means of becoming funded: the Elite 1-Step Evaluation, Growth 1-Step Evaluation, and Funded Plan (Instant Funding). All programs have a 90% profit split and traders can only trade futures. The distinctions are based upon the start-up costs, drawdown method used and trading rules.

Overview of MegaTrader Account Features

| Feature | Elite 1-Step Evaluation | Growth 1-Step Evaluation | Funded Plan (Instant Funding) |

| Account Types | 1-Step Evaluation | 1-Step Evaluation | Instant Funding |

| Account Sizes | $25K, $50K, $100K, $150K | $25K, $50K, $100K, $150K | $25K, $50K, $100K, $150K |

| Account Fees (Start From) | $50 Monthly Fee + $125 Activation Fee | $60 Monthly Fee | $350 One-Time Fee |

| Profit Target | $1,500 – $9,000 (6% of $25K) | $1,500 – $9,000 (6% of $25K) | None (Already Funded) |

| Daily Drawdown | N/A (Only Trailing Drawdown) | N/A (Only Trailing Drawdown) | None |

| Max Drawdown | $1,000 – $4,500 | $1,000 – $5,000 | $1,000 – $6,000 |

| Drawdown Type | Intraday Trailing | End of Day Trailing | End of Day Trailing |

| Min. Trading Days | 1 | 1 | N/A |

| Max Trading Days | Unlimited | Unlimited | N/A |

| Consistency Score Rule | N/A | N/A | 20% |

| News Trading Allowed | Yes | Yes | Yes |

| Profit Split | 90% | 90% | 90% |

| Payout Frequency | N/A | N/A | Daily |

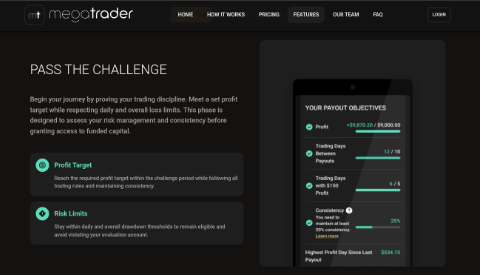

Elite Plan (1-Step Evaluation)

The Elite Plan by MegaTrader is a one-phase challenge for traders who want to be measured on intraday equity. That means the drawdown limit adjusts with your highest profit for the trading day, and not just at market close. It has an initial activation fee and an ongoing monthly fee, but it comes with the most extreme maximum drawdown limit.

| Account Size | Monthly Fee | Activation Fee | Profit Target | Trailing Drawdown |

| $25K | $50 | $125 | $1,500 | $1,000 |

| $50K | $70 | $125 | $3,000 | $2,000 |

| $100K | $110 | $125 | $6,000 | $3,000$3,000 |

| $150K | $130 | $125 | $9,000 | $4,500 |

Why Choose Elite Plan (1-Step Evaluation)

- Fast-Track to Funding: Just one-step away from funded account.

- Intraday Drawdown: For traders who are comfortable with the intraday trailing drawdown logic.

- Lowest Reset Fee: This plan has the lowest reset fees of the three.

Growth Plan (1-Step Evaluation)

A similar one-step evaluation is also available by the Growth Plan but formulated with a small variation on the risk model: the trailing drawdown using the EOD balance. This gives day traders quite a bit more room to trade without having their drawdown limit move upward off the bat. It has higher monthly fees, but no activation fee to begin with.

| Account Size | Monthly Fee | Activation Fee | Profit Target | Trailing Drawdown |

| $25K | $60 | $0 | $1,500 | $1,000 |

| $50K | $120 | $0 | $3,000 | $2,000 |

| $100K | $220 | $0 | $6,000 | $3,500 |

| $150K | $300 | $0 | $9,000 | $5,000 |

Why Choose Growth Plan (1-Step Evaluation)

- EOD Trailing Drawdown: The drawdown is only adjusted at the close of each day enabling it to fluctuate with intraday movements.

- No Activation Fee: The only fee traders are responsible for is the cost of the monthly account that starts them in the challenge.

- Higher Drawdown Limits: The maximum drawdown is a little bit higher on the $100K and $150K accounts (drawdown limit) compared to the Elite Plan.

Funded Plan (Instant Funding)

The Funded Plan by MegaTrader eliminates the evaluation phase completely, you get funded capital instantly. This is the easiest way to get a funded account and has the highest drawdowns. But, it adds a daily loss cap and a Consistency Rule.

| Account Size | One-Time Fee | Max Position Size | Trailing Drawdown | Daily Loss Limit |

| $25K | $350 | 1 / 10 | $1,000 | None |

| $50K | $500 | 5 / 50 | $2,000 | $1,250 |

| $100K | $600 | 10 / 100 | $4,000 | $2,500 |

| $150K | $700 | 15 / 150 | $6,000 | $3,750 |

Why Choose Funded Plan (Instant Funding)

- No Evaluation: You don’t have to meet an income mark before securing a fund advance.

- Highest Drawdown Limits: Highest maximum floating drawdown available on all account types.

- Daily Payouts: You can submit payout requests every 7 days and you will be paid in 24 hours except on the weekends, which will be carried forward to the next working day.

Our Verdict on MegaTrader Account Types

MegaTrader account types are created to accommodate various risk preferences. The two strategies, Elite and Growth, are appealing thanks to their one-step simplicity and a low number of minimum trading days. There is a trade off between them. Trading Challenge to be a great fit for veteran traders who would rather skip the challenge - provided they can manage the daily loss limits and $1,399 one-time, non-refundable fee.

DrawDown and NewsTrading Rules for MegaTrader

After all, Understanding the risk rules when it comes to trading with any prop firm and Megatrader’s drawdown types and what they mean for news are clear.

The firm provides a Trailing Drawdown model across its account types. The reason is the manner in which this drawdown is measured:

- Elite Plan: Designed off an Intraday Trailing Drawdown. The drawdown limit follows the peak a trader secured throughout any given trading day.

- Growth Plan: End of Day Trailing Drawdown. The limit can be adjusted only higher to follow the EOD balance, providing additional space for intraday fluctuations.

- Funded Plan: They use an end of day trailing drawdown and also include a static daily loss limit for the 50k+ accounts.

News Trading is Allowed. This applies on all MegaTrader plans, during the evaluation and when you are funded. It's an added bonus for traders that base their decisions on fundamentals.

MegaTrader Spreads & Commissions

MegaTrader offers its own in-house developed platform, MegaTraderX, based on DXtrade XT and is

dedicated to the Futures instruments only.

The data do not furnish information on the actual spreads and commissions. But as a futures exchange, traders do pay for exchange data and commissions, which is the norm in commodities futures trading. The costs are generally highly competitive across the futures market, yet no firm details on the commission per contract including other fees was found. Traders can pretty much rely on the fact that they will be subject to exchange fees and a small commission paid per trade to the platform - it is standard practice.

Trading Instruments offered by MegaTrader

MegaTrader dedicates its whole product to one liquid financial market so that this is what the traders

specialise in.

The single trade devices that are offered at MegaTrader are Futures. They don’t provide Forex, Crypto, Stocks or any of other market compounds. This emphasis is aimed at certain professional traders who deal in futures contracts.

MegaTrader Trading Rules - What is Allowed and What is Not

MegaTrader is governed by strict rules that span both trading and accounts management.

| Strategy | Permitted | Details |

| Copy Trading | Yes | Allowed during both the challenge and funded account stages. |

| Weekend Holding | No | You must close your position before the market closes for the weekend. |

| News Trading | Yes | Allowed in all plans (Challenge and Funded). |

| Hedging | No | Prohibited. |

| Arbitrage | No | Prohibited. |

| Microscalping | Limited | Limited up to 50% of the total gain/profit. |

| VPS Use | No | Not allowed (Virtual Private Server). |

| Account Sharing (IP Rules) | No | No account sharing is permitted. |

Prohibited Practices

- No hedging: You will not be able to open contrary positions in order to hedge risk.

- No arbitrage: You're not going to get rich running small price gaps between markets.

- Microscalping is restricted: The earnings you make from trading in microscalps can not be more than 50% of your total profit.

- VPS is not accepted: You cannot trade using a Virtual Private Server.

- No account sharing: The same account isn't allowed to be accessed and or played but on more than one person and different addresses (non approved IP).

Scaling Plan at MegaTrader

It is one of the MegaTrader scaling plans, and it tells a successful trader how to grow their funded account size with MegaTrader over time.

MegaTrader has a Performance-Based scaling plan. As the trader has continued to demonstrate good gains and achieved certain profit targets, with a limited amount of risk, the firm may decide to allocate more capital towards that trader. The max assignment is Unlimited, so top earners can make a lot more.

Payment Methods & Payout Process at MegaTrader

MegaTrader simplifies the payout procedure with its various options and quick cycle, funded traders particularly.

- Details of payment method supported: However it would likely be credit/debit card.

- Details of payout options supported: Payout through RiseWorks or with Crypto.

- How payout process works: Once a trader is funded the payout frequency is Daily. For the Instant Funded Plan the minimum days to first request payout is 7days after first trade. The profit division is 90% to the trader and very generous for any program.

Countries Restricted at MegaTrader

Traditionally, prop firms have limitations due to international financial regulation and compliance.

Not all countries can purchase their programs. The list of countries are given below.

- North Korea

- Iran

- Syria

- Cuba

- Myanmar

- OFAC Regions

Our Final Verdict on MegaTrader

Being established in 2023, MegaTrader can be considered as an excellent option for a futures trader who is in search of a high payout prop firm with low restrictions on an entry-level. The firm’s feature that is most outstanding is the decent 90% payout, which is one of the most generous in the industry. With two 1-step evaluations (Elite/Growth) and IntraDay or End of Day Drawdowns variations to discriminate different risk profiles and Instant Funding, MegaTrader is differentiating according to risk management. They do allow news trading, which is a considerable advantage. However, the firm does not allow hedging, exchanges, or trading with a VPS system but serves to the futures market and will be attractive to profit-driven performance traders seeking expedited paths to increased splits.