WeFund Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full WeFund review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.6

4.6

WeFund

Forex, Crypto, Commodities, Indices, Metals

AE

CEO: Sven

Metatrader 5

Rise

Wire Transfer/ Bank Transfer

Crypto

Credit/Debit Card

Crypto

What if your trading skills were enough to access serious funding without risking your own capital?

That’s exactly the promise behind WeFund, a rising prop trading firm based out of the United Arab Emirates. Whether you are a high frequency strategist looking to fast track your way to capital or a methodical trader who thrives under multi phase evaluations, WeFund seems to have built something for everyone.

Founded under the legal name WEGROUP VENTURES FZCO, WeFund is on a mission to bridge the gap between talent and opportunity. Although the firm hasn't publicly disclosed its CEO or registration number, it’s gained notable traction within the global prop trading community, especially with its instant payouts, scaling up to $2 million, and 10X A-booked funding model. That’s a lot more flexibility than what most prop firms offer - especially in a landscape flooded with restrictive terms and low transparency.

WeFund Prop Firm Overview

| Feature | Details |

|---|---|

| Company Name | WeFund |

| Legal Name | The Legal Name of WeFund is WEGROUP VENTURES FZCO |

| Headquarters | WeFund is registered in United Arab Emirates (UAE) |

| Years in Operation | Not Disclosed |

| Broker | Not Disclosed |

| Trading Platform | WeFund supports MetaTrader 5 (MT5) platform with TradingView Integration |

| Trading Environment | WeFund provides Simulated (Virtual funds, real market conditions) |

| Challenge Types | WeFund offers 1-Step HFT, 2-Step Evaluation, and 10X-trader Program for Funded Traders |

| Account Sizes | The account size of WeFund range from $5,000 to $200,000 (up to $400,000 via scaling) |

| Profit Split | WeFund offers up to 90% profit split (standard 80% in 2-step, up to 100% in 10X Program) |

| Payout Frequency | WeFund offers fast payouts via Rise, daily or bi-weekly (based on plan) |

| Markets Offered | Forex, Indices, Commodities, Metals, Crypto are the trading instruments offered by WeFund |

| Trustpilot Rating | WeFund has a 4.5/5 rating on Trustpilot (with 46 reviews Trustpilot) |

Simulated But Real Enough

It's important to note that WeFund does not offer real capital accounts in the traditional sense. Like most prop firms, all trading is done in a simulated environment, meaning the money isn’t real but the pressure sure is. You are executing trades based on live market data but using virtual capital provided by the firm. Your profits however, are real - paid out through their partnered platform, Rise.

What Makes WeFund Stand Out?

- Unlimited time to pass challenges (a relief for patient traders).

- 10X-Trader Program that mirrors live market execution without eval phases.

- Up to $2 million in scalable capital, making it ideal for traders who plan long term.

- Integrated TradingView charts directly within their dashboard - a surprisingly thoughtful touch.

Whether you are just testing the waters or already managing six figures, WeFund’s flexible approach to trading challenges, fair rules, and rapid payouts make it an appealing option in the prop firm landscape. In the next sections, we’ll dive deep into their 1-step and 2-step evaluations, payout system, trading rules and what you need to watch out for.

Pros and Cons of Trading with WeFund Prop Firm

Trading with WeFund feels like stepping into a modern trader’s toolkit - clean dashboard, flexible evaluations, fast payouts and some solid innovations. But like every prop firm - it has its own trade offs. Some rules can feel strict and others might confuse new traders if they are not fully prepared. Before jumping in, here’s a clear look at what WeFund gets right and where you may need to tread carefully.

✅ Pros and ❌ Cons of WeFund at a Glance

| Pros | Cons |

|---|---|

| Flexible Challenge Models: Offers both 1-step (fast-track with HFT) and 2-step (traditional) evaluations with no time limit to pass. | Profit Caps on Live Accounts: Capped profits per cycle (6% on 1-step, 12% on 2-step) can limit high volume traders. |

| Fast Payouts via Rise: You can withdraw earnings quickly - often within 24 hours once approved. | Strict Rule Enforcement: Violations (even unintentional) can lead to payout deductions or account closure. |

| HFT & EAs Allowed (1-Step): High-frequency trading and Expert Advisors are allowed during 1-step evaluations. | No Refund Policy: Once you buy a challenge then there are no refunds even if no trades are made. |

| 10X-Trader Program: A-booked, real-market execution with up to 100% profit split and daily payouts. | Live HFT is Banned: HFT is allowed for passing, but not once you are funded - which might surprise traders. |

| No Time Pressure: Unlimited time to pass evaluations removes unnecessary stress from the trading journey. | Complex Rulebook: From consistency rules to trade aggregation - the policies can overwhelm beginners. |

WeFund Challenge Types, Rules & Profit Split

So, what’s the real deal with WeFund?

At first glance, it looks like just another prop firm offering funded accounts. But dig a little deeper, and you'll realize it’s playing a whole different game especially when it comes to scaling, payout flexibility and high frequency trading. WeFund gives traders not just one but three distinct paths to getting funded and growing their capital: the 1-Step HFT Challenge, the 2-Step Traditional Challenge, and for the elite few, the powerful 10X Trader Program - their signature A-Book scaling model built for serious, performance driven traders.

If you are just starting, you’ll likely choose between the 1-step and 2-step challenges. The 1-step is fast paced and HFT friendly while the 2-step is built more like a professional endurance test - slow, consistent and risk managed. But if you are someone who crushes those phases, gets funded, earns consistently and plays the long game, then WeFund might just send you a golden invite to the 10X Trader Program. It’s their high reward, no challenge, A-Book path where traders can scale up to $2 million, access real broker execution and even earn up to 95% profit split.

No marketing scheme. Just performance based access to serious capital and real payouts - sometimes daily. Oh, and yes, TradingView is integrated right into the dashboard, so you can analyze, trade and execute with pro-level tools, without switching tabs.

Let’s break down how each WeFund challenge works, what trading rules you need to follow, and how you can scale your account to seven figures if you’re good enough to get invited.

WeFund Challenge Models Explained

At WeFund, traders get to choose how they want to prove their skills with a fast track 1-step challenge that welcomes high-frequency trading or a more structured and steady 2-step evaluation built for those who trade with surgical precision. There’s no one-size-fits-all here. Whether you are a scalper who thrives on speed or a position trader who waits for high-conviction setups, there’s a model built just for your style.

Let’s break each one down:

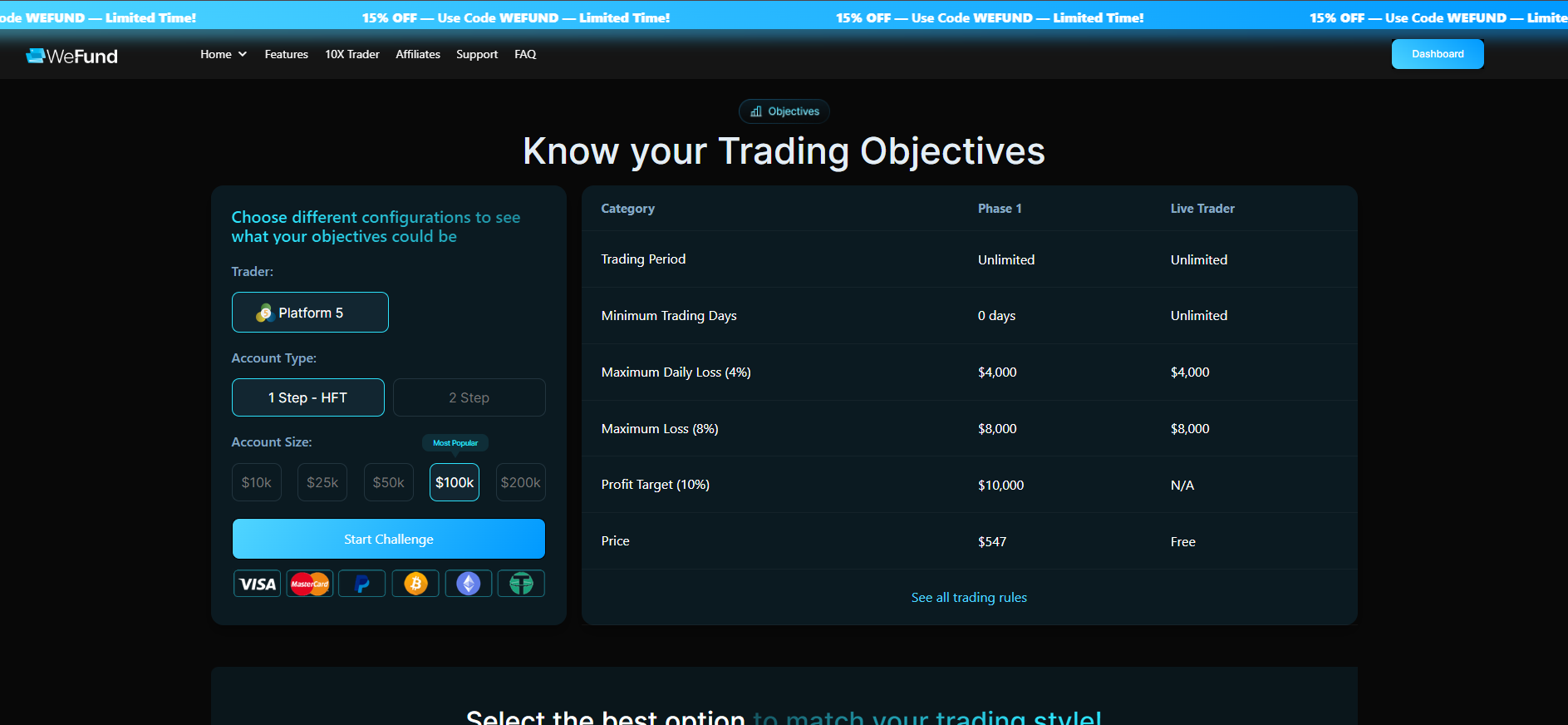

1-Step HFT Challenge (Speed Meets Simplicity)

The 1-Step HFT model is for traders who want to get funded quickly and don’t want to be limited by old school trading restrictions. High-frequency trading, news trading, EAs… it’s all allowed here. Just meet the profit target without breaching drawdown limits and you are on your way to a funded account.

| Detail | $10k | $25k | $50k | $100k | $200k |

|---|---|---|---|---|---|

| Fee (USD) | $147 | $297 | $387 | $547 | $997 |

| Profit Target | 10% | 10% | 10% | 10% | 10% |

| Max Drawdown (Static) | 8% | 8% | 8% | 8% | 8% |

| Daily Drawdown (Trailing) | 4% | 4% | 4% | 4% | 4% |

| Min Trading Days | None | None | None | None | None |

| HFT Allowed? | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Profit Split (Live) | 50-80% | 50-80% | 50-80% | 50-80% | 50-80% |

Why Choose the 1-Step Challenge?

Get Funded Fast - There’s only one phase to pass and no time limits to meet your profit target.

HFT, News Trading, and EAs are Welcome - If your strategy includes speed or automation then this is your playground.

Built for Scalpers & High-Frequency Traders - Perfect if you take multiple trades a day or rely on market speed.

2-Step Traditional Challenge (For the Disciplined Trader)

The 2-Step Evaluation is designed for traders who thrive on structure. This model rewards patience, planning and consistency. With two phases to complete and stricter drawdown limits - it’s closer to a real institutional trading experience.

| Detail | $5k | $10k | $25k | $50k | $100k | $200k |

|---|---|---|---|---|---|---|

| Fee (USD) | $47 | $77 | $187 | $247 | $447 | $897 |

| Step 1 Profit Target | 8% | 8% | 8% | 8% | 8% | 8% |

| Step 2 Profit Target | 5% | 5% | 5% | 5% | 5% | 5% |

| Max Drawdown (Static) | 10% | 10% | 10% | 10% | 10% | 10% |

| Daily Drawdown (Trailing) | 5% | 5% | 5% | 5% | 5% | 5% |

| Min Trading Days / Phase | 4 | 4 | 4 | 4 | 4 | 4 |

| HFT Allowed? | ❌ No | ❌ No | ❌ No | ❌ No | ❌ No | ❌ No |

| Profit Split (Live) | 80–90% | 80–90% | 80–90% | 80–90% | 80–90% | 80–90% |

Why Choose the 2-Step Challenge?

- A More Balanced Evaluation - With profit targets spread over two steps, you’re judged on consistency.

- Institutional-Like Discipline - Strict drawdowns and phase requirements reward long term thinking.

- Higher Max Profit Cap - You can earn up to 12% profit per cycle in the live phase, ideal for steady performers.

The 10X Trader Program – WeFund’s Instant A-Book Scaling Plan

Now, this is where things get really interesting. The 10X Trader Program is WeFund’s flagship A-Book scaling model. It’s not a challenge. It’s a reward and only available by invitation or performance qualification. This program is reserved for traders who’ve proven they can deliver consistent returns, manage risk, and handle serious capital.

It comes with everything you’d expect from a top-tier institutional environment:

- Real market execution (A-Book) through their broker partner.

- Guaranteed daily payouts, not bi-weekly or monthly.

- Profit splits up to 95% - yes, you read that right.

- Instant funding, with no challenge phases.

- Scale to $2,000,000 in allocation if you meet performance benchmarks.

| Feature | Details |

|---|---|

| Access | By invite or performance-based milestone |

| Drawdown Limit | 10% static |

| Payout Frequency | Daily (through Rise) |

| Max Account Allocation | $2,000,000 |

| Execution Model | A-Book with STP (Straight Through Processing) broker |

| Profit Split | Up to 95% |

| Scaling Opportunity | Top-up accounts get multiplied 10X |

| Trading Rules | No HFT, no market manipulation, no excessive risk strategies |

| EA Usage | Allowed if compliant with fair trading guidelines |

| Refund Policy | Account fee refundable (minus payment fees) if no breach and no open trades |

Why Traders Love the 10X Program

- No Phases. No Games. Just Trading. - Start with a funded account, skip evaluations and scale based on results.

- A-Book = Real Execution - No gimmicky fills or backend manipulation. Your trades hit the live market.

- Daily Payouts & Flexible Top-Ups - You’re rewarded as you go and you can boost your account with ease.

Note: You can’t just buy your way into The 10X Trader Program. You have to earn your spot. The path? Get funded, stay consistent for at least 2 months, complete 3 payouts and hit a 7.5% total gain. Or, show a verifiable track record and get fast tracked.

Final Takeaway on WeFund Challenges and Scaling Plan

If you are a trader looking for flexibility, fast payouts and a real shot at growing serious capital, WeFund checks a lot of boxes.

The 1-Step HFT Challenge is perfect for scalpers and fast-paced traders who want fewer rules and quicker results. On the other hand, the 2-Step Traditional Challenge is better suited for steady, methodical traders who prefer a structured evaluation process. Both give you the freedom to trade your way without time pressure and reward you fairly for success.

But the real standout is the 10X Trader Program.

This isn’t just another funding model it’s an invite-only opportunity for proven traders to scale up massively. With daily payouts, up to 95% profit splits and the power to multiply your profits 10X at every 2% gain, it’s one of the most aggressive scaling plans we have seen. And it runs on real market execution (A-Book), so you are not just trading demos behind the curtain then you are building real trading discipline.

Whether you are just starting your prop journey or ready to level up, WeFund offers a serious path to funded trading success with fewer restrictions and more rewards.

- Want quick access, flexible rules, and daily payouts? Start with the 1-Step.

- Prefer a balanced challenge that mirrors real trading habits? Go for the 2-Step.

- Ready to scale big and prove you’re elite? Aim for that 10X Trader invite.

The choice is yours but whichever route you take, WeFund gives you the tools to turn skill into income.

WeFund Prohibited Trading Practices & What Strategies are Allowed

Before you jump into trading with WeFund, it’s important to know what’s okay and what’s not. Unlike some prop firms that keep things vague, WeFund is clear about their expectations. Their goal is to keep the platform fair for everyone while allowing traders enough room to use real world strategies.

That said, not all strategies are welcome. Some high risk, manipulative, or exploit style trading techniques can get your account flagged or even terminated - especially in the live phase. But don’t worry - many solid trading strategies like news trading, swing trading and using approved EAs are allowed.

Let’s break it down simply 👇

✅ Allowed vs ❌ Prohibited Strategies at WeFund

| Strategy Type | Allowed? | Notes |

|---|---|---|

| High-Frequency Trading (HFT) | ✅ Only in 1-Step Eval | Allowed in the 1-step evaluation phase only |

| News Trading | ✅ Yes | Allowed in both challenges (limited in live 2-Step) |

| Expert Advisors (EAs) | ✅ If approved | Only clean, compliant bots allowed |

| Martingale | ❌ No | Considered high-risk and banned |

| Grid Trading | ❌ No | Can create excessive exposure, not allowed |

| Hedging | ❌ No in Live Phase | Not allowed to avoid artificial equity protection |

| Tick Scalping | ❌ No | Tiny pip trading is flagged and banned |

| Reverse Arbitrage | ❌ No | Trading opposite positions to game payouts is banned |

| Overleveraging | ❌ No | Constant max lot usage or margin abuse = violation |

Details on Prohibited Strategies at WeFund

Let’s talk briefly about some of the banned trading methods and why they are restricted:

- Martingale: This strategy doubles your trade size after every loss to try and recover. It looks smart until it wipes your account out. WeFund bans it due to the extreme risk.

- Grid Trading: Placing layered buy/sell orders to catch volatility might work short term, but it builds up big exposure fast. That’s why it’s on the no-go list.

- Hedging: Opening buy and sell trades on the same pair to pause drawdown may look clever, but it’s considered manipulation.

- Tick Scalping: Think of it as trading just for 1-2 pip moves. It puts strain on systems and doesn’t reflect real-world execution - so WeFund bans it.

- Arbitrage Tricks: Whether it’s latency, cross-broker, or reverse - any method trying to “outsmart” the system instead of trading the market is a hard pass.

- All-In or Over-Leveraging: Using your full margin or oversized lots without good reason is reckless and breaks their risk policies.

What’s Allowed (If Done Right)

- Swing Trading: Totally fine.

- News Trading: Go for it, but if you are on a live 2-step account, avoid entering trades 5 minutes before

- or after major announcements.

- EAs/Robots: You can use them, but they must follow WeFund’s rules. No shady bots, copy trades or strategy switchers.

- Holding Overnight: Yes for most pairs. No for weekends (except crypto).

- Scaling Lots: Okay if it’s gradual and logical - not sudden jumps without consistency.

Our Take on WeFund’s Trading Rules

Honestly, WeFund does a solid job of balancing freedom and structure. They are not overly strict like some legacy prop firms, but they also won’t let traders abuse the system. Most common sense, professional trading strategies are allowed here.

If you trade responsibly, avoid shortcuts and follow simple rules then you’ll have zero issues. But if you are the kind of trader who chases loopholes, tries to hack payouts or runs high risk bots, WeFund isn’t going to be the right fit.

At the end of the day, these rules aren’t just about control - they’re about protecting the ecosystem, keeping things transparent and rewarding legit traders.

Pro Tip: Read the rules before placing your first trade. It could save your account and your payout.

Trading Instruments, Leverage & Spreads at WeFund

WeFund gives you access to all the major markets you’d expect from a top tier prop firm. Whether you are into currencies, indices, metals or crypto - there’s something for every kind of trader.

What Can You Trade on WeFund?

Here’s a look at the trading instruments available:

- Forex Pairs - All major and minor currency pairs

- Indices - Like US30, NAS100, and GER40

- Metals - Including Gold (XAU/USD) and Silver (XAG/USD)

- Commodities - Oil and more

- Cryptocurrencies - Bitcoin, Ethereum and other popular coins

You get the flexibility to build your strategy across multiple asset classes and yes, crypto trading is available even on weekends.

Leverage Details by Trading Instrument

WeFund offers different leverage depending on what you are trading. Here's how it breaks down:

| Asset Class | 1-Step Account | 2-Step Account |

|---|---|---|

| Forex | 1:30 | 1:30 |

| Metals & Commodities | 1:20 | 1:20 |

| Indices | 1:15 | 1:15 |

| Crypto | 1:2 | 1:2 |

The leverage is designed to be realistic, helping traders manage risk properly. You are not encouraged to over leverage your account which is a good thing if you are aiming for long-term success.

How About Spreads and Commissions?

WeFund keeps it pretty fair and transparent:

- Forex & Metals - A flat $3 per lot commission applies

- Indices, Commodities & Crypto - No commission per lot

Spreads vary depending on the market and time of day, just like a normal broker. But overall, the trading conditions are competitive - especially considering that all accounts are connected to WeFund’s trusted institutional broker partner.

Summary

- Trade forex, indices, metals, commodities, and crypto

- Real market execution through A-Book setup

- Competitive leverage that helps manage your risk

- Simple, low-cost commission structure

If you are looking for a prop firm that supports multi asset strategies with fair spreads and smart leverage then WeFund delivers a solid, trader friendly experience.

Payment Methods & Payout Process at WeFund

Getting paid at WeFund is refreshingly simple and fast.

Once you are trading on a live account and meet the payout requirements, you can request a withdrawal directly from your dashboard. Whether you’re in the 1-Step, 2-Step or even the 10X Trader Program then you are in control of when and how you get paid.

How Do Payouts Work?

- 1-Step Accounts: You can request your first payout after 21 days from your first trade, and once you've made at least 5 trades on 5 different days.

- 2-Step Accounts: You’re allowed to request a payout right after your first profitable trade in the live phase. No waiting around.

- 10X Trader Accounts: You can withdraw profits daily - yes, every day - as long as your payout meets the basic criteria.

Profit Splits Breakdown

- 1st payout: 50%

- 2nd payout: 70%

- 3rd and beyond: 80%

- 2-Step Accounts: 80% standard, or up to 90% with an add-on

- 10X Program: Flat 90% profit split, paid daily

Top performers in the scaling program can even reach 95% split.

How Do You Get Paid?

All payments go through Rise, WeFund’s secure payout partner. It supports multiple withdrawal options:

- Bank Transfers (local & international)

- Cryptocurrency Payments

- Popular E-wallets

Most traders receive funds in their Rise account within 24 hours of approval - often even faster. From Rise, you can move the money to your preferred method.

Is There a Minimum Withdrawal Amount?

There’s no minimum for 10X payouts. For 1-Step and 2-Step accounts, it depends on your payout method but all the details are clearly listed in your dashboard.

A Few Things to Keep in Mind:

- Once you submit a payout request, you can’t change the method - so double check before confirming.

- Any fees from your bank, crypto network or e-wallet provider are your responsibility.

- If there’s a delay, it’s usually due to bank processing times, blockchain congestion or pending verification.

- And yes - WeFund even gives you digital payout certificates for each successful withdrawal, so you can keep track of your milestones.

In short, WeFund’s payout system is built to move with you and not against you. Whether you want to cash out regularly or reinvest through scaling - the process is smooth, transparent and fast.

Restricted Countries at WeFund

While WeFund is open to traders from many parts of the world, there are some countries where access is currently not allowed due to legal, regulatory, or compliance reasons.

Countries Restricted from Using WeFund

As of now, residents from the following countries cannot join or trade with WeFund:

United States (USA)

Afghanistan

Algeria

Cuba

Iran

Libya

Myanmar

North Korea

Syria

WeFund also blocks access during the checkout process if you are located in one of these restricted regions.

Note: WeFund has announced that it may open access to U.S. traders in the near future, potentially around March. So if you're from the U.S., keep an eye out for updates.

Our Final Verdict on WeFund Prop Firm

WeFund stands out as a modern, trader focused prop firm that offers real flexibility, fast rewards and a solid path for serious growth. Whether you are a fast paced HFT trader or someone who prefers slow and steady consistency, there’s a challenge type built to match your trading style. The rules are clear, the evaluations are fair and there’s no pressure to rush your trades.

What really makes WeFund different is its 10X Trader A-Book program, which gives top performers a chance to grow their accounts all the way up to $2 million with real market execution, daily payouts and up to 95% profit split. Plus, the ability to scale your profits on demand makes it one of the most trader-friendly systems out there.

If you are looking for a prop firm that truly rewards skill and consistency without overcomplicating the process then WeFund is absolutely worth considering.