The Futures Desk Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full The Futures Desk review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

The Futures Desk

Commodities, Futures, Energies, Metals

2024

CEO: Josh TFD

ProjectX

Credit/Debit Card

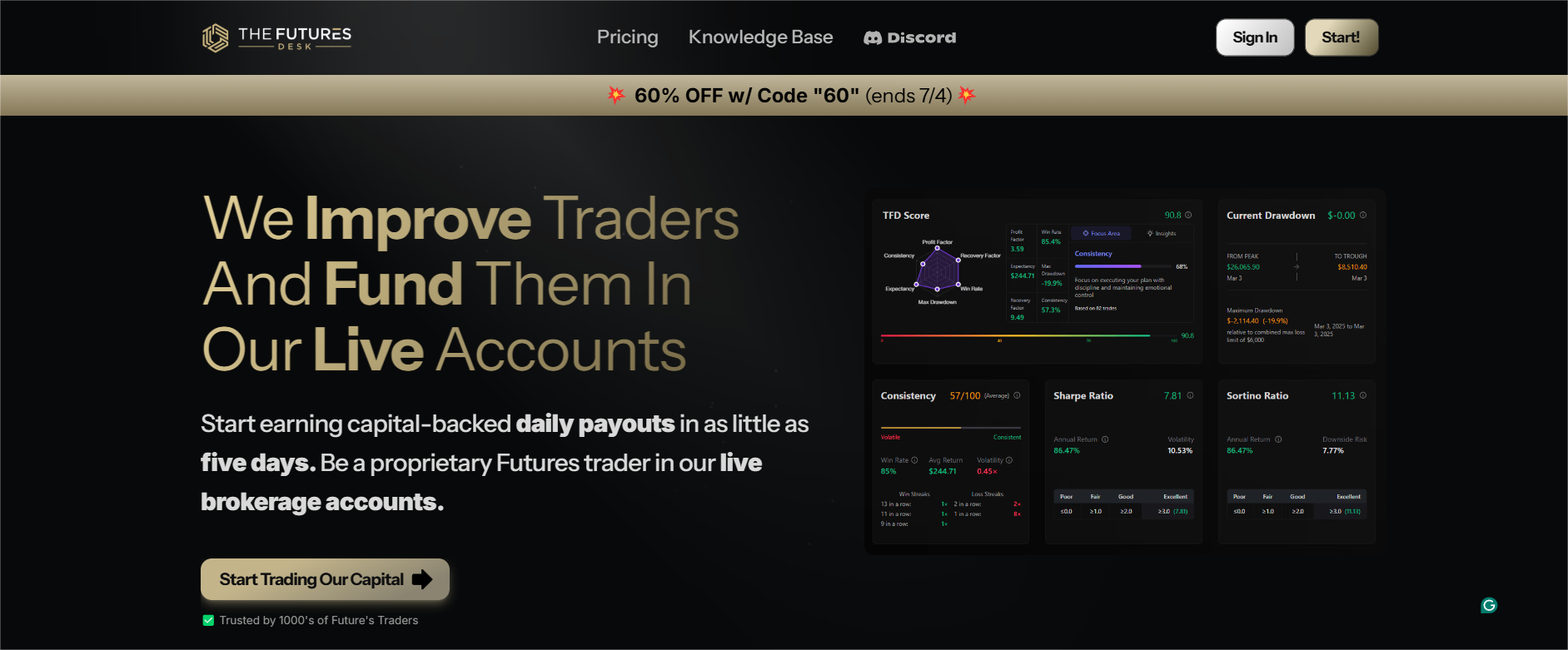

The Futures Desk is not your typical prop firm. They don’t believe in dragging traders through endless rules, tricky restrictions, or surprise fees. Instead, they have built something refreshingly straightforward: one-step evaluations, no activation fees, and uncapped daily payouts all backed by real brokerage accounts.

Whether you are brand new and testing the waters, or an experienced futures trader ready to scale big, you’ll find a challenge that fits your style. And the best part? You don’t need to trade for 30 days straight or follow strange “consistency” rules to qualify for payouts. Hit your goal, stay within your drawdown, and you are live.

Their platform access (TFD-X or Rithmic), fair execution fees, and wide range of tradeable instruments make it even easier to feel like you're trading with freedom, not fighting with fine print.

The Futures Desk Prop Firm Overview

| Feature | Details |

|---|---|

| Company Name | The Futures Desk |

| Broker | The broker associated with The Futures Desk IS not publicly disclosed |

| Company Legal Name | The legal name of The Futures Desk is The Futures Desk LLC |

| Company legal registration number | The Futures Desk legal registration number is not disclosed publicly |

| Headquarters | The Futures Desk is based in Chicago, Illinois |

| Years in Operation | The Futures Desk has been operating since 2024 |

| CEO | The CEO of The Futures Desk is Josh TFD |

| Challenge Types | The Futures Desk offers a One-Step Assessment |

| Challenge Fees | The challenge fee for The Futures Desk starts at $139 |

| Financial Markets | Trading instruments offered by The Futures Desk are, Currencies, Micro Futures, Energy, Commodities, and Metals ( Traders cannot trade Forex) |

| Trading Platforms | The Futures Desk supports TFD-X and Rithmic |

| Payout | Uncapped daily payouts |

| TrustPilot Score | The Futures Desk is rated 4.8/5 on Trustpilot |

Pros & Cons of The Futures Desk

| Pros | Cons |

|---|---|

| Uncapped daily payouts No limits, no holdbacks. | Not available in all countries (see restricted country list). |

| No activation fees ever. Fastest path to funding - you can go live in as few as 5 days. | Limited support for technical issues with bots or copy traders. |

| No consistency or min-day rules Just hit your profit target. | You are responsible for staying within CME/CFTC compliance at all times. |

| Fully customizable challenges you choose drawdown, risk, etc. | Once you exceed $3,000 drawdown, you are limited to one live account. |

| Scalping, algo trading, DCA, and news trading are allowed. | Higher-tier challenges (like Premium) cost more upfront. |

| Access to a wide range of futures instruments from grains to gold. | No hands-on support for setting up bots or automated strategies. |

If you are looking for a firm that lets you trade your edge without playing games, The Futures Desk might just be your best bet in 2025. Real tools, real rules, real payouts finally, a prop firm that gets it.

The Futures Desk Challenge Details - Rules, Profit Split, and Fees

If you are tired of hidden fees, long payout timelines, and rigid trading rules, The Futures Desk might just feel like a breath of fresh air. They have scrapped activation fees altogether and even cover your first pro data fee worth $140/month when you go live a rare move in the prop firm world.

But what really sets them apart is their one-step evaluation model. You only need to pass a single test to start earning, and there are no minimum trading days or consistency rules standing in your way. Once you hit your profit buffer, you are eligible for payouts and live trading within 24 to 48 hours.

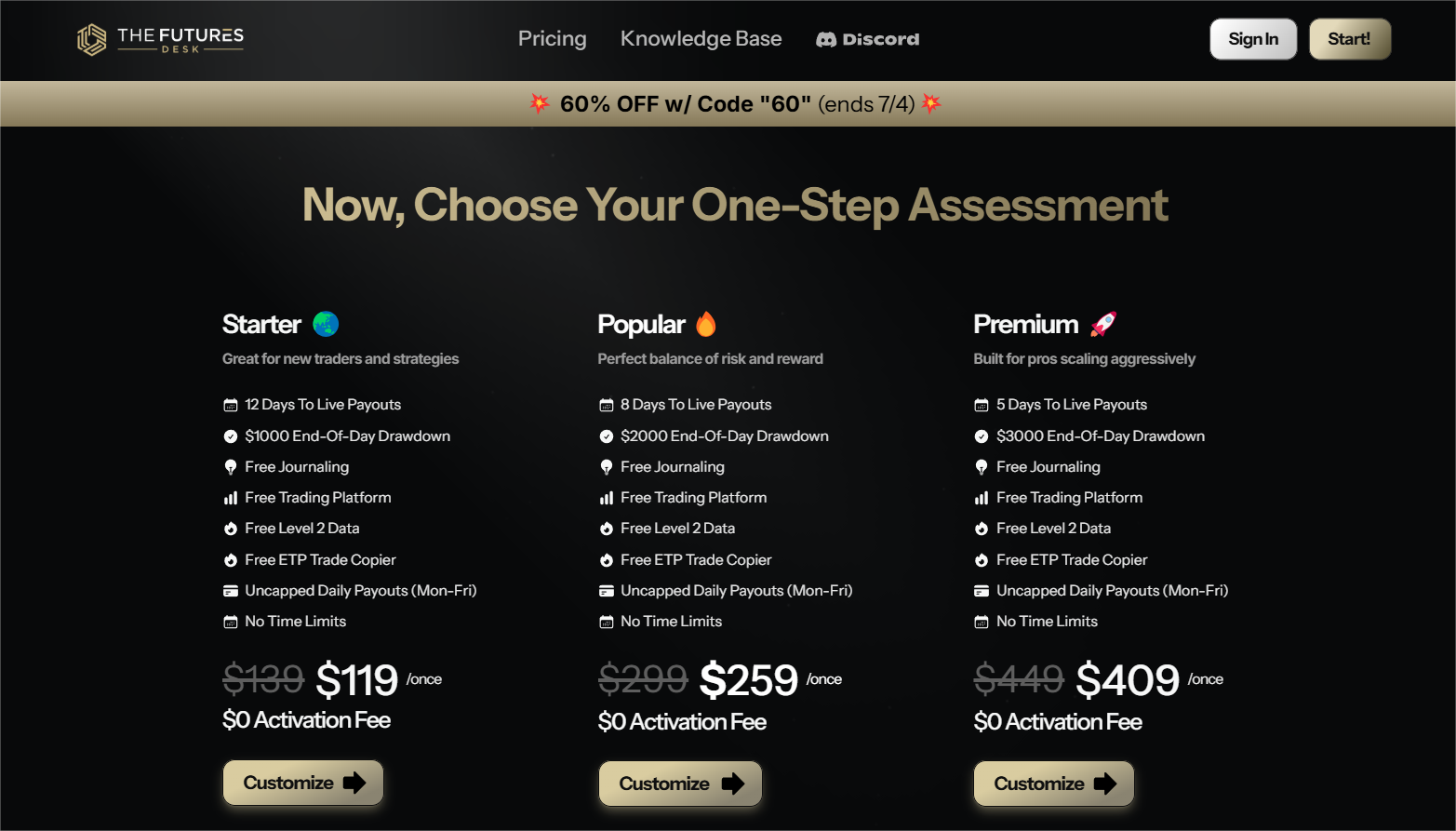

Below is a simple breakdown of their one-step challenge options whether you are a fresh face or a seasoned futures trader scaling big.

The Futures Desk One-Step Challenge Comparison Table

| Plan | Starter | Popular | Premium |

|---|---|---|---|

| Best For | Beginners & strategy testing | Balanced risk vs reward | Advanced traders are scaling fast |

| Price | $139 (One-time) | $299 (One-time) | $449 (One-time) |

| Activation Fee | $0 | $0 | $0 |

| Days to Payout | 12 Days to Live Payouts | 8 Days to Live Payouts | 5 Days to Live Payouts |

| Drawdown Limit | $1,000 End-of-Day | $2,000 End-of-Day | $3,000 End-of-Day |

| Platform Access | TFD-X and Rithmic | TFD-X and Rithmic | TFD-X and Rithmic |

| Data Access | Free Level 2 Data | Free Level 2 Data | Free Level 2 Data |

| Trade Copier | ETP Copier Included | ETP Copier Included | ETP Copier Included |

| Daily Payouts | Uncapped (Mon–Fri) | Uncapped (Mon–Fri) | Uncapped (Mon–Fri) |

| Trading Time Limit | No Expiry | No Expiry | No Expiry |

| Free Tools | Journaling Tool | Journaling Tool | Journaling Tool |

The Futures Desk One-Step Starter Challenge

The Starter Challenge at The Futures Desk is built for anyone who is looking to trade real futures contracts with minimal friction. It is not just for absolute beginners it is also great for traders testing new strategies, scalpers, and anyone who wants to prove they’ve got the skill without the stress of two-step evaluations or confusing rules.

And the best part? You only need to pass one simple challenge to get on the path to payouts, with no annoying time restrictions or profit consistency demands.

Your Assessment

- Connection Type: Choose between TFD-X (The Futures Desk’s in-house sim brokerage) or Rithmic, one of the most trusted futures data feeds in the business.

- Days to Live: You will be eligible to start live trading in 12 days or fewer, depending on your performance.

- Base Price: Starts at just $146 for the Starter.

- Contracts: Begin with 1 Mini or 10 Micro contracts. But here is the best part you can customize it later if you want a larger size (up to 12 minis/120 micros).

Profit & Risk Targets

| Metric | Value |

|---|---|

| Profit Target | $1,750 |

| End-of-Day Drawdown | $1,000 (adjustable) |

| Daily Loss Limit | $400 (adjustable) |

If you want more cushion, you can increase your drawdown and daily loss all the way up to a $6,000 max loss / $2,400 daily limit. Just keep in mind: once you go above a $3,000 drawdown, you can only hold one account at a time.

You also get to choose between end-of-day drawdown and static drawdown, which is rare flexibility in the prop trading space.

The Futures Desk One-Step Starter Challenge Fully Customizable: Make It Yours

This Starter package is not rigid. You can customize it however you want:

- Drawdown Size: $1,000 to $6,000

- Daily Loss: $400 to $2,400

- Contract Size: 1 Mini / 10 Micros to 12 Minis / 120 Micros

- Days to Live: You can tweak your path from 5 to 12 days

Note: Going above $3,000 drawdown? You’ll be limited to one account, so size up only if you're focused on one good account.

Why Traders Choose The Futures Desk One-Step Starter Challenge

The Futures Desk does not try to trap you with fine print. This Starter Challenge is all about freedom, realistic targets, and support tools that actually help. Whether you are scalping micros or testing bond strategies, this gives you a fair shot without breaking the bank.

No fees when you go live. No forced trading days. And yes, you get a real shot at keeping what you earn.

Ready to start? Your path to a funded account might just be 12 days away.

The Futures Desk One-Step Popular Challenge

So you're done testing the waters, and now you want a bit more firepower. Welcome to the Popular Challenge from The Futures Desk arguably the sweet spot for serious traders who still want flexibility without coughing up premium-level fees.

This plan is for those who have gained some traction, trust their edge, and want faster payouts, more contracts, and better risk room, all without jumping through unnecessary hoops.

Your One-Step Assessment

- Connection: Plug into TFD-X (The Futures Desk’s own sim brokerage) or go with the well-known Rithmic. Both get the job done your choice.

- Time to Funded: You can go live in just 8+ days, depending on performance. No forced waiting.

- Base Price: Starts at just $219 for this challenge.

- Contracts: Start off with 2 Minis or 20 Micros. Need more firepower? You can scale up later (details below).

- Profit Target: Hit $1,750 and you’re in business.

- Drawdown Limit: $1,000 End-of-Day (EOD) drawdown by default. You can bump it up as needed.

- Daily Loss Limit: Starts at $400. Again, you can increase this depending on your trading style.

Customizations:

If you want to tailor the account more to your liking, here is what’s flexible:

| You Can Customize | Range |

|---|---|

| Drawdown | $1,000 to $6,000 |

| Daily Loss Limit | $400 to $2,400 |

| Contract Size | 2 Minis/20 Micros → 12 Minis/120 Micros |

| Minimum Days | 5 to 12 Days |

| Drawdown Type | End-of-Day or Static |

Heads-up: If your max drawdown exceeds $3,000, you’re limited to holding just one account at a time.

The Futures Desk One-Step Popular Challenge Is Really For?

If you…

- Want more than just the basics

- Like freedom to trade how you want

- Appreciate tools that support growth, not just pass/fail checkpoints

- Want to go live quickly and start earning

…then this is your zone.

It strikes a clean balance between low risk and higher capital potential, plus gives you room to customize without blowing your wallet.

The Futures Desk Popular Challenge gives you a well-balanced, no-BS path to getting funded. You’re not locked into rules that make no sense, and you don’t have to wait weeks to start live trading. The flexibility to pick your platform, contracts, drawdown style that’s what makes this one stand out.

If you are looking to level up your futures journey and get paid without the red tape, this one-step challenge is worth a serious look.

The Futures Desk One-Step Premium Challenge

If you are a serious futures trader and you have outgrown the baby steps, the Premium Challenge at The Futures Desk is where you level up. It is the highest tier in their one-step lineup, designed for those who want real size, real payouts, and the fewest possible roadblocks.

You are not here to dabble. You are here to go live fast, trade with size, and withdraw profits daily and this challenge gives you the firepower to do exactly that.

Your One-Step Assessment

- Connection Option: Choose between TFD-X (The Futures Desk is a proprietary sim broker) or Rithmic (a pro-favorite for data accuracy and low latency).

- Path to Live: Fast-track it in just 5+ days the quickest of all their options.

- Base Price: $1,050 yeah, it is a bigger entry, but you are getting big tools and even bigger opportunities.

- Starting Contracts: You begin with 2 Minis or 20 Micros, and can expand if needed.

- Profit Target: You will need to hit $5,250. Ambitious? Yes. But it matches the size you are working with.

- End-of-Day Drawdown: $3,000 to start generous breathing room.

- Daily Loss Limit: $1,200, letting you work your edge with flexibility.

Customizable Settings:

| You Can Customize | Range Available |

|---|---|

| Drawdown | $1,000 to $6,000 |

| Daily Loss Limit | $400 to $2,400 |

| Contracts | 2 Minis/20 Micros → 12 Minis/120 Micros |

| Minimum Days to Go Live | 5 to 12 Days |

| Drawdown Type | End-of-Day or Static |

Note: If you raise your drawdown over $3,000, you will be limited to one active account only. So plan accordingly if you are managing multiple accounts or scaling.

Who Should Pick The Futures Desk One-Step Premium Challenge?

Let us keep it real: This isn’t a "test the waters" package. This Premium Challenge is for traders who:

- Already have a solid system

- Want to scale up fast

- Don’t want to mess around with rules that punish sharp traders

- Prefer tools over gimmicks

- Want the fastest route to real payouts

If you are past demo accounts, funded tests, and sandbox setups, this one is for you.

The Premium Challenge at The Futures Desk is for the trader who is ready to go pro. You are not here to tiptoe you are here to trade at size, hit solid targets, and get paid fast. With premium-level tools, zero nonsense rules, and real funding behind it, this is one of the cleanest paths to big futures capital on the market right now.

So if you have been looking for a no-friction, trader-first prop experience… this is it.

Final Thoughts: Why The Futures Desk Challenge Hits Different

Honestly most prop firms out there make you jump through hoops just to get funded. Hidden fees, weird rules, delays in payouts… it gets exhausting. That is exactly why The Futures Desk stands out. They have trimmed the mess and built something that actually respects your time and trading ability.

Whether you are just starting out or you are already crushing micros and looking to scale, there is a one-step challenge here that fits your lane. You get:

- No activation fees

- No minimum days

- No consistency requirements

- And your first pro data fee covered when you go live that is $140 saved right there.

But it is more than just the structure. The freedom to customize your challenge, the access to real tools like journaling and P&L simulators, and the choice of platform (TFD-X or Rithmic) make it feel like you are trading on your terms. Fast payouts, solid support, and real brokerage accounts? That is the stuff funded traders dream of.

If you are done playing with demo accounts and ready to take your trading seriously without getting stuck in red tape The Futures Desk might just be your best move in 2025.

The Futures Desk Scaling Plan

Once you have shown that you can trade consistently and stay profitable, The Futures Desk gives you room to grow. As your results speak for themselves, you can increase your contract limits and even get a higher daily drawdown to match your progress.

It is simple: just reach out to their support team or your assigned risk manager, and ask for a raise. If you have earned it, they will back you.

No fancy forms. No unnecessary hurdles. Just real growth based on real performance.

Understanding Drawdown at The Futures Desk

At The Futures Desk, your drawdown is your safety net and knowing how it works is key to protecting your account. Here is how it all breaks down:

Max Drawdown: What It Really Means

Every trading account comes with a drawdown limit basically, the lowest your balance is allowed to go before your account fails. This limit depends on two things:

- Your drawdown value

- Your drawdown type

Good news? There are no intraday unrealized drawdowns meaning your open trades don’t affect your limit. Even better, the drawdown type you pick will stay the same even when you get funded.

End of Day (EOD) Drawdown

This is a trailing drawdown that moves with your progress.

Every evening, The Futures Desk checks your highest end-of-day balance so far.

Then, it subtracts your drawdown value from that high point to set the minimum allowed balance for the next day.As you grow your account, your minimum balance rises but it never drops after a losing day.

Eventually, your trailing drawdown locks at $0 and stops trailing that is when it becomes static.

Example Walkthrough:

- Day 1: End balance = $0 → Drawdown = –$2000

- Day 2: End balance = $500 → Drawdown = –$1500

- Day 3: End balance = $1000 → Drawdown = –$1000

- Day 4: End balance = $400 → Drawdown stays at –$1000

- Day 5: End balance = $2500 → Drawdown hits $0 and locks there

- Days 6–10: No matter what happens, your drawdown stays at $0

Static Drawdown

This version is fixed from the start. It does not move ever.

Your minimum balance is set on Day 1 and won’t change no matter how much you gain or lose. It is simple: Starting balance - drawdown value = minimum balance

Example Walkthrough:

Day 1 to 10: No matter if your balance is $0, $1000, or $2500 your minimum allowed balance stays at $2000 the entire time.

Daily Loss Limit: Stay Safe, Stay in the Game

When you sign up, you get to choose your Daily Loss Limit. If you hit it, your account is paused for the rest of the day but it does not fail. You just wait for the next trading day to start again.

- The loss limit tracks your total P&L (open + closed) from zero each day.

- If your losses hit the limit, you are locked out until tomorrow.

- During the challenge phase, your Daily Loss Limit is 40% of your Max Drawdown.

- Once you go live, this limit grows with your performance.

Example:

Day 1

- Balance: $50,000

- Loss Limit: $500

- You lose $500 → Locked out at $49,500

Day 2 (No Profits)

- Reset → Loss limit stays $500

Day 2 (With Profits)

- You gain $1,000

- New Loss Limit = $1,000 + $500 = $1,500

- You’d need to give back $1,500 before getting locked out again

Final Thoughts on Drawdown at The Futures Desk

Drawdown can feel confusing at first, but at The Futures Desk, it is designed to be fair and simple. Whether you pick End-of-Day or Static, your limits are clear, your progress is protected, and your open trades never randomly shut you down.Even the Daily Loss Limit works in your favor, giving you a chance to cool off without killing your account. And as your trading improves, your limits grow with you.

You are in control. Understand your drawdown, stick to your plan, and trade with confidence.

The Futures Desk Execution Fees

The Futures Desk holds a CME corporate membership with leased seats, which means traders get access to heavily discounted execution fees a major plus for anyone trading regularly.

To keep things simple and fair, the fees during your assessment and sim-brokerage phase are set up to closely match what you'd pay when live.Here is how the fees break down:

| Product | All-In Per Side (Commissions + Clearing Fees) |

|---|---|

| Minis | $1.20 |

| Micros | $0.40 |

Just note: Commissions and fees are controlled by the Brokerage, the CFTC, and the CME, so they can change from time to time. But for now, this is what you can expect simple, predictable, and trader-friendly.

Trading Rules at The Futures Desk: What is Allowed and What is Not

At The Futures Desk, the rulebook is refreshingly simple and actually built to support your trading style instead of restrict it. Here is what you need to know:

What is Allowed at The Futures Desk

| Strategy / Behavior | Allowed? | Details |

|---|---|---|

| Microscalping | ✅ Yes | No minimum hold times. Scalpers are welcome. |

| Bots / Algorithmic Trading | ✅ Yes | Allowed, but must be fully controlled by you. No support will be provided. |

| Dollar-Cost Averaging (DCA) | ✅ Yes | You are free to build positions using DCA. |

| News Trading | ✅ Yes | Fully allowed during assessment. See below for live account details. |

| Dynamic Contract Sizing | ✅ Yes | Adjust as needed. No restrictions on sizing strategy. |

| Hedging Within Account | ✅ Yes | Allowed only between different products or expiration. |

| Copy Trading | ✅ Yes | Use at your own risk. No technical support is provided. |

A Quick Heads-Up on Automation & Copy Tools at The Futures Desk

Yes, you can use bots and copy trading tools during both Assessment and Live Brokerage phases. But here’s the deal:

- The Futures Desk won’t assist with setup or technical issues.

- If a glitch causes you to lose trades or fail your account you are on your own.

- You are expected to make sure these tools comply with CME rules.

In short: use them wisely. You have got the freedom, but also the full responsibility.

The Futures Desk News Trading Rules: Know Before You Click

Can I trade the news? Yes but it depends on the phase you are in.

During Assessment:

No restrictions. Trade any event, any size, anytime.

During Live Brokerage Account:

Limits Apply.

- One minute before and after a news event, you are limited to 5 micro contracts max.

- You must use reasonable stop-losses during this period.

- Violating this rule can get your position flattened.

Why? Because this is not just a sim firm The Futures Desk is looking to build real, long-term traders who can manage capital with discipline, even in volatile conditions.

Minimum Trading Days & Daily Goals at The Futures Desk

When you set up your challenge, you will also choose your Minimum Trading Days and that is how your Daily P&L Goal is calculated.

How it works:

- Your overall profit target is split across your chosen trading days.

- Hitting your daily goal helps you reach the finish line on time.

- If you make more than your goal on a day, great the extra gets added to your total. It does not delay or hurt your progress.

They don’t call this “consistency,” because it is not the same frustrating rule other firms use. This is just a clear, fair way to guide your pacing.

The Only Way to Fail

There is only one rule that will actually fail your account: Hitting your Max Drawdown.

Things that don’t fail your account:

- Hitting your Daily Loss Limit (you are just locked out for the day)

- Trading more than your daily P&L goal

- Exceeding your minimum trade days

At The Futures Desk, you have got flexibility, clarity, and freedom to trade your way with just one golden rule: protect your drawdown. Everything else is built to help you focus on trading, not chasing rulebooks.

What Can You Trade at The Futures Desk?

One of the best things about The Futures Desk is that you are not stuck trading just one or two markets. They give you a wide menu of futures products to work with, so you can build your own strategy around what you know best, or explore new territory as you grow.

If you are into agriculture, they have got plenty: Mini Corn (XC), Corn (ZC), Soybean Oil (ZL), Soybean Meal (ZM), Oats (ZO), Rough Rice (ZR), Soybeans (ZS), and Wheat (ZW). That’s a solid lineup for anyone who trades grain or soft commodities.

Prefer the currency markets? You can trade both standard and micro futures, including AUD (6A, M6A), GBP (6B, M6B), CAD (6C, MCD), EUR (6E, 6M, M6E), JPY (6J, MBT), NZD (6N), and CHF (6S, MSF). Whether you're going big or testing micros, it's all there.

For energy traders, the platform supports Brent Crude (BZ), Crude Oil (CL), Micro Crude (MCL), Natural Gas (NG), E-mini Natural Gas (QG), Heating Oil (QH), E-mini Crude (QM), and RBOB Gasoline (RB). If you're active in oil and gas, you've got everything you need.

In equities, The Futures Desk lets you trade a full spread of U.S. and international indices from S&P MidCap 400 (EMD), S&P 500 (ES), Micro S&P (MES), Micro Nasdaq (MNQ), Micro Dow (MYM), Micro Russell 2000 (M2K), to the Nikkei Dollar Index (NKD), Nasdaq (NQ), Russell 2000 (RTY), and Dow (YM).

When it comes to interest rates, they’ve got all the essentials: Eurodollar (GE), Micro Treasuries (TWE), T-Notes (TN), Ultra 10-year (UB), 30-year Bonds (ZB), 5-year Notes (ZF), 10-year Notes (ZN), 3-month T-Bills (ZQ), and 2-year Notes (ZT). Great for those who like playing the yield curve or hedging with government debt.

Livestock traders are not left out either with Feeder Cattle (GF), Lean Hogs (HE), and Live Cattle (LE) all on the board.

And of course, for those drawn to metals, there is no shortage of choices. You can trade Gold (GC), Micro Gold (MGC), Micro Metals (MHG), Silver (QC), Platinum (QI), and Palladium (QO).

In short, The Futures Desk gives you real market variety so no matter what style or asset class you prefer, there is room to trade it here.

Our Review of the Instruments Offered by The Futures Desk

No matter your style scalping the micro indices, holding oil, or working the grain markets The Futures Desk gives you a serious list of instruments to trade. If you have got a setup, they have got the product. Just pick your lane and get to work.

Payments & Payouts at The Futures Desk

What Payment Methods Do The Futures Desk Accept?

To sign up for an assessment, you can use any major debit or credit card. It’s a quick and simple checkout no complicated steps, no crypto wallets, just standard card payments.

How Payouts Work at The Futures Desk (And How Fast You Can Get There)

The Futures Desk is built to get serious traders earning as fast as possible but you still need to prove yourself first. Here is how it works, step-by-step:

1. Assessment Phase (Min. 5 Days)

Take the challenge. Trade clean. No tricks or hidden rules just hit your profit target without hitting your max drawdown.

If you pass, your sim-brokerage account activates instantly sometimes even mid-day.

Heads-up: The 5-day path is the fastest available. But trading isn’t easy only sign up if you’re really ready.

2. Sim Brokerage Phase (0-Day Minimum)

Once you pass the assessment, you move to the sim-brokerage where you can start earning immediately.

There are no more minimum days or daily goals. Just grow your account. Once you hit a buffer equal to your drawdown, you unlock payouts. Any profit over the buffer won’t move with you to live but it still gets you there faster.

3. Live Brokerage Phase (0-Day Minimum)

Here is where it gets exciting. You have hit the buffer, gone live, and now…

- Daily payouts (Monday to Friday)

- No minimum days

- No consistency rules

- $100 minimum no max

- ACH and Rise payouts available

Most live accounts are set up in under 48 hours, and once you are in payouts are uncapped and processed quickly.

Fun fact: If you request before 11 AM (Mon to Fri), you will usually get paid the same day.

Grow As You Go

Once you are live, the support does not stop. You can increase your limits and improve your trading with 1-on-1 coaching calls. And the better you perform, the more room you get.In short? The Futures Desk pays you like a pro no games, no schemes. Just real trading, real payouts, real fast.

Restricted Countries at The Futures Desk

At The Futures Desk, they truly aim to support traders from all over the world. But sometimes, it is not entirely in the hands.

The broker and payout partners like Rithmic and ProjectX have their own country restrictions that we must follow. Because of that, there are certain countries we cannot currently support, even though we’d love to.

Countries The Futures Desk Cannot Service (via Rithmic or ProjectX Live):

| Country | Rithmic (Dorman) | ProjectX (Plus 500) |

|---|---|---|

| Afghanistan | ❌ | ❌ |

| Albania | ❌ | ❌ |

| Algeria | ❌ | ❌ |

| Angola | ❌ | ❌ |

| Balkans | ❌ | ❌ |

| Belarus | ❌ | ❌ |

| Bosnia And Herzegovina | ❌ | ❌ |

| Botswana | ❌ | ✅ |

| Bulgaria | ❌ | ❌ |

| Burkina Faso | ❌ | ❌ |

| Burma | ❌ | ❌ |

| Burundi | ❌ | ❌ |

| Cameroon | ❌ | ✅ |

| Central African Republic | ❌ | ❌ |

| China | ✅ | ✅ |

| Congo-Brazzaville | ❌ | ❌ |

| Cote d'Ivoire (Ivory Coast) | ❌ | ❌ |

| Crimea Region of Ukraine | ❌ | ❌ |

| Croatia | ❌ | ❌ |

| Cuba | ❌ | ❌ |

| Democratic Republic of the Congo | ❌ | ❌ |

| Ecuador | ❌ | ✅ |

| Ethiopia | ❌ | ❌ |

| Ghana | ✅ | ❌ |

| Guam | ❌ | ❌ |

| Guyana | ❌ | ✅ |

| Haiti | ❌ | ❌ |

| Hong Kong | ✅ | ❌ |

| Iceland | ✅ | ❌ |

| Indonesia | ❌ | ✅ |

| Iran | ❌ | ❌ |

| Iraq | ❌ | ❌ |

| Jamaica | ❌ | |

| Kenya | ❌ | ❌ |

| Kosovo | ❌ | ❌ |

| Lao People's Democratic Republic | ❌ | ✅ |

| Lebanon | ❌ | ❌ |

| Liberia | ✅ | ❌ |

| Libya | ❌ | ❌ |

| Macedonia | ❌ | ❌ |

| Magnitsky | ✅ | ❌ |

| Malaysia | ✅ | ✅ |

| Mali | ❌ | ❌ |

| Malta | ❌ | ✅ |

| Mauritius | ❌ | ✅ |

| Monaco | ❌ | ❌ |

| Mongolia | ✅ | ❌ |

| Montenegro | ❌ | ❌ |

| Morocco | ✅ | ❌ |

| Mozambique | ❌ | ❌ |

| Myanmar | ❌ | ❌ |

| Namibia | ❌ | ❌ |

| Nicaragua | ❌ | ❌ |

| Nigeria | ❌ | ❌ |

| North Korea | ❌ | ❌ |

| Panama | ✅ | ❌ |

| Papua New Guinea | ❌ | ✅ |

| Philippines | ✅ | ✅ |

| Romania | ❌ | ✅ |

| Senegal | ❌ | ✅ |

| Slovenia | ❌ | ❌ |

| Somalia | ❌ | ❌ |

| South Africa | ❌ | ❌ |

| South Sudan | ❌ | ❌ |

| Sri Lanka | ❌ | ✅ |

| Sudan and Darfur | ❌ | ❌ |

| Syria | ❌ | ❌ |

| Tanzania | ❌ | ✅ |

| Trinidad and Tobago | ❌ | ❌ |

| Tunisia | ❌ | ✅ |

| Ukraine* | ✅ | ❌ |

| US Virgin Islands | ❌ | ❌ |

| Venezuela | ❌ | ❌ |

| Vietnam | ❌ | ❌ |

| Yemen | ❌ | ❌ |

| Yugoslavia | ❌ | ❌ |

| Zimbabwe | ❌ | ❌ |

Need Clarification?

If your country has is not listed at all, don’t hesitate to reach out The Futures Desk via support chat. The Futures Desk team is always happy to help clear things up.

We’d love to work with everyone but some restrictions are just outside our control.

Final Thought on The Futures Desk Prop Firm

The Futures Desk is not your average prop firm. It is built for serious futures traders who want real chances, real payouts, and no schemes. There is no confusion around trading rules, no surprise consistency traps, and no mess in the challenges. What you see is what you get: clear drawdown structures, fair daily loss limits, and a fast track from assessment to payouts sometimes in under a week.

If you are someone who values freedom in your trading style whether that is scalping, news trading, or running your own algo, this firm gives you the space to do that, while still playing by industry rules. You don’t have to deal with minimum hold times or weird platform restrictions. Just follow proper risk, respect the trading rules, and you are good to go. If you are ready to treat prop trading like a profession not a shortcut The Futures Desk gives you the trading tools and flexibility to make it work.