OneFunded Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full OneFunded review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

OneFunded

Forex, Crypto, Indices, Metals, Stocks

GB

2024

CEO: Anastasiia Kaplunenko

Trade Locker

Crypto

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

Liquidity Providers

TradeLocker

OneFunded Prop Firm Review 2025

Prop firms have become a common entry point for traders who want to access larger capital without putting too much of their own money on the line. Every new firm tries to differentiate itself with fees, profit splits, or trading rules. OneFunded, which officially launched in late August 2024, is one of the latest entrants to the space. Operated by Brynex Tech Limited and headquartered in London, the company is attempting to capture attention with low-cost challenges, quick payouts and flexible rules.

Whether that mix is enough to stand out in 2025 is the real question. Below, we will walk through the structure, rules and funding models OneFunded currently offers.

OneFunded Prop Firm Overview

| Category | Details |

|---|---|

| Company Name | The Prop Firm name is OneFunded |

| Legal Name | The Prop Firm’s legal name is Brynex Tech Limited |

| Registration Number | The Prop Firm’s registration number is 15918986 |

| CEO | The CEO of OneFunded Is Anastasiia Kaplunenko |

| Headquarters | OneFunded’s headquarters located in, 71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ |

| Broker | The broker associated withOneFunded is Liquidity Provider – TradeLocker |

| Operating Since | One Funded is operating since 27 August 2024 |

| Account Sizes | OneFunded provides account sizes ranging from $2,000 to $100,000 |

| Profit Split | OneFunded offers 80:20 Standard profit split, up to 90:10 (from next month) |

| Challenge Types | OneFunded offers 1-Step, 2-Step, 1F Limited |

| Payout Cycle | OneFunded offers Every 14 days (standard), every 7 days with add-ons |

| Payout Method | The withdrawal method supported by OneFunded are Crypto, Bank Transfer |

| Trading Platforms | OneFunded supports trading on TradeLocker |

| Financial Markets | OneFunded supports Forex, Crypto, Indices, Metals, Stocks |

| Max Allocation | OneFunded offers $100,000 max allocation |

| Trustpilot Score | OneFunded has a 4.3 rating Trustpilot (based on 104 reviews) |

Pros and Cons of Trading with OneFunded

Getting started with OneFunded has its advantages and drawbacks. Below is a balanced view:

| Pros | Cons |

|---|---|

| Affordable challenge fees compared to many competitors | Maximum allocation limited to $100,000 |

| Profit splits up to 90% | No scaling plan currently |

| Wide range of tradable instruments (Forex, crypto, indices, stocks, metals) | Relatively new firm, limited track record |

| Flexible rules like EAs, news trading and copy trading allowed | Only one platform available: TradeLocker |

OneFunded Challenge Types, Fees & Profit Split

OneFunded offers three types of challenges: 1-Step, 2-Step and 1F Limited (2-Step). Each comes with unique drawdown rules, profit targets and pricing. Importantly, it is designed to accommodate both beginners and experienced traders.

Challenge Features Overview

| Feature | 1-Step | 2-Step | 1F Limited (2-Step) |

|---|---|---|---|

| Account Sizes | $2k to $100k | $2k to $100k | $2k to $25k |

| Challenge Fees | Starts from $29 | Starts from $23 | Starts from $25 |

| Profit Target | 10% | Phase 1: 8%, Phase 2: 5% | Phase 1: 7%, Phase 2: 4% |

| Daily Drawdown | 4% | 5% | 5% |

| Max Drawdown | 6% | 10% | 11% |

| Drawdown Type | Equity-Based | Equity-Based | Equity-Based |

| Min. Trading Days | 5 | 3 | 2 |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| Leverage | FX 1:100, Indices/Commodities 1:30, Crypto/Stocks 1:2 | Same | Same |

| Stop Loss Rule | Not mandatory | Not mandatory | Not mandatory |

| Consistency Rule | No | No | No |

| News Trading Allowed | Yes | Yes | Yes |

| Profit Split | 80% | 80% | 80% |

| Payout Frequency | 14 days - 7 days with add-ons | 14 days - 7 days with add-ons | 14 days - 7 days with add-ons |

The 1-Step Challenge

The simplest route is one evaluation phase, a 10% profit target and strict risk limits. Daily drawdown is capped at 4% and the overall drawdown at 6%.

| Account Size | Fee | Profit Target (10%) | Daily Drawdown (4%) | Max Drawdown (6%) |

|---|---|---|---|---|

| $2k | $29 | $200 | $80 | $120 |

| $5k | $56 | $500 | $200 | $300 |

| $10k | $107 | $1,000 | $400 | $600 |

| $25k | $204 | $2,500 | $1,000 | $1,500 |

| $50k | $307 | $5,000 | $2,000 | $3,000 |

| $100k | $564 | $10,000 | $4,000 | $6,000 |

Why it appeals:

- Faster funded access with no second phase

- Lower minimum trading days (5)

- Clear-cut rules, easy to understand

The 2-Step Challenge

A more traditional structure, which are two phases, each with lower profit targets (8% and then 5%), but more room on risk (10% max drawdown).

| Account Size | Fee | Profit Target (8% + 5%) | Daily Drawdown (5%) | Max Drawdown (10%) |

|---|---|---|---|---|

| $2k | $23 | $260 total | $100 | $200 |

| $5k | $45 | $650 total | $250 | $500 |

| $10k | $89 | $1,300 total | $500 | $1,000 |

| $25k | $179 | $3,250 total | $1,250 | $2,500 |

| $50k | $279 | $6,500 total | $2,500 | $5,000 |

| $100k | $516 | $13,000 total | $5,000 | $10,000 |

Why it appeals:

- Easier profit targets per phase

- More breathing space with a 10% max drawdown

- Good fit for swing traders who prefer longer setups

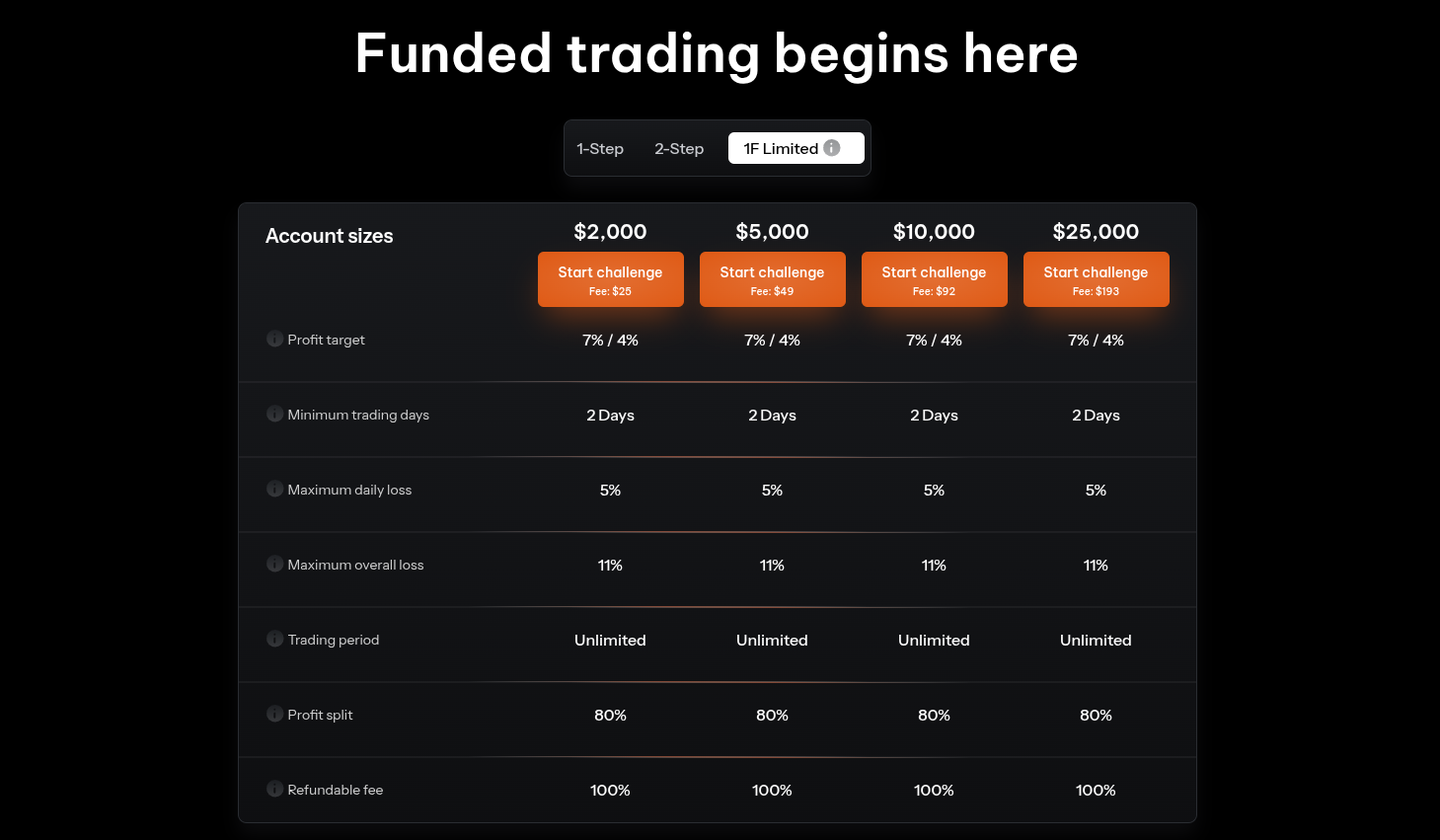

The 1F Limited Challenge

This is also a two-phase model but with even softer targets. 7% in phase one, 4% in phase two. The max drawdown is set at 11%, which is higher than the other options.

| Account Size | Fee | Profit Target (7% + 4%) | Daily Drawdown (5%) | Max Drawdown (11%) |

|---|---|---|---|---|

| $2k | $25 | $220 total | $100 | $220 |

| $5k | $49 | $550 total | $250 | $550 |

| $10k | $92 | $1,100 total | $500 | $1,100 |

| $25k | $193 | $2,750 total | $1,250 | $2,750 |

Why it appeals:

- Lowest targets among the three

- Higher overall drawdown gives flexibility

- Works well for traders who don’t want tight limits

Verdict on OneFunded Challenges

OneFunded has set its fees at an accessible level, which will be attractive to beginners. The 1F Limited Challenge in particular looks designed for traders who value room or flexibility. The trade-off is that the firm’s top allocation of $100,000 might feel too small for advanced or high-frequency traders.

OneFunded Drawdown & News Rules

OneFunded doesn’t play around with risk. They use equity-based drawdowns, which, if you have traded a prop account before, you know can be a bit unforgiving.

- Daily loss: It is around 4–5%, depending on which challenge you are running.

- Max drawdown: It sits between 6% and 11%. Not the loosest rules out there, but fair if you have got discipline.

- News trading: Yes, they let you trade the events. You can open or close during NFP, CPI, Fed meetings, all that.

But, and this is important, if it looks like you are only chasing those crazy five-minute spikes, compliance will

notice. They don’t want “gaming the system” stuff. A warning if you do it once, but if you make a habit of it, you might lose the account.

Spreads & Commissions by OneFunded

The costs are actually pretty competitive. Commission is $0.07 per 0.01 lot. For most traders, that’s solid, definitely affordable than some bigger names.

Spreads aren’t fixed, they move with market conditions. The easiest way to check them is just log into the TradeLocker demo they provide. That way you see live pricing before committing.

And here is a nice touch, no cap on lot sizes. If you want to scale positions, you are free to do it (as long as you don’t blow your limits). A lot of firms put restrictions there, OneFunded doesn’t.

Trading Instruments Offered by OneFunded

Trading Instruments Offered OneFunded gives traders a decent mix of markets to work with. You’re not just stuck on forex pairs.

- Forex : majors, minors, even some exotics.

- Cryptos : good coverage for those who like digital assets.

- Indices : popular global stock indexes.

- Metals : gold, silver, and a few others.

- Stocks : select equities available.

For a prop firm that only started last year, that’s a pretty wide range. Many low-cost firms usually stick to

Hedging between accounts forex-only, so this is a step up.

OneFunded Trading Rules - What’s Allowed and What’s Not

The trading rules by OneFunded are trader-friendly, but with a few sensible limits.

| Allowed | Restricted |

|---|---|

| Expert Advisors (EAs) | Hedging between accounts |

| Copy trading setups | Arbitrage-style bots |

| Weekend positions | Gambling-style trades |

| Trading around news events | Abusing news spikes over and over |

OneFunded also checks IPs and devices. Trading from different locations is fine, but if they notice overlap with another user’s account, they’ll probably review it.

Scaling Plan by OneFunded

Right now, there’s no scaling option. The top allocation sits at $100,000, and that’s it. Bigger firms do let traders grow into seven-figure accounts, so this is an area where OneFunded is behind the curve.

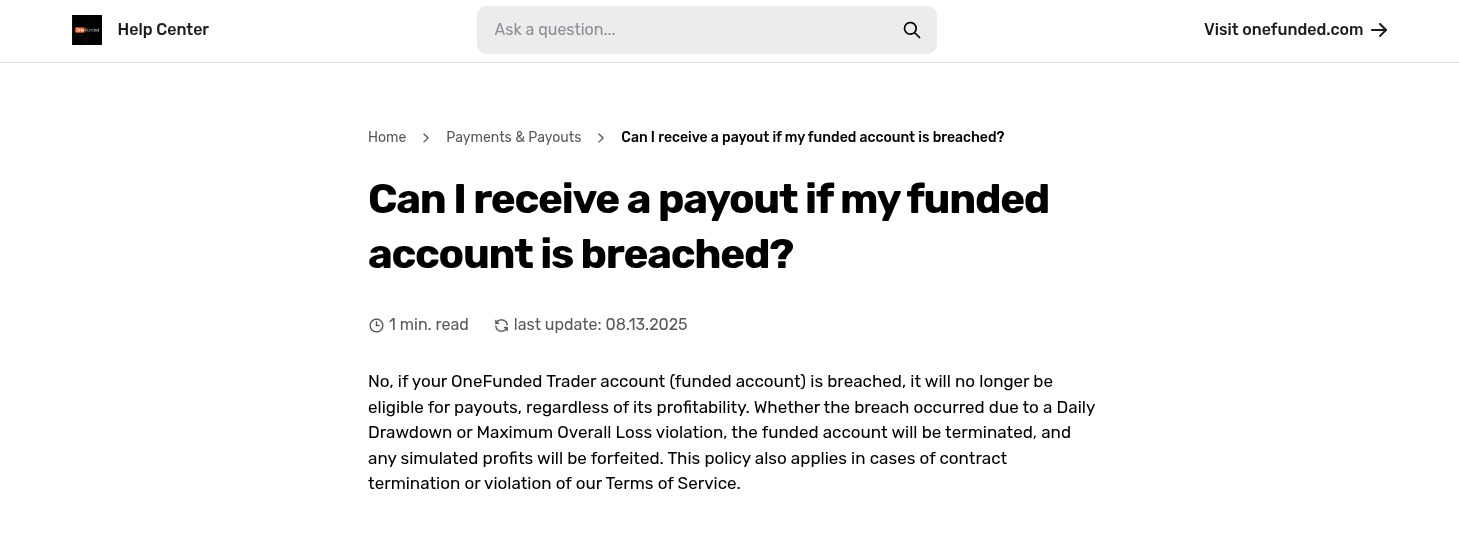

OneFunded Payments and Payouts Explained

Paying for a challenge is straightforward - Traders have the option to buy OneFunded Challenge via PayPal, cards, or crypto.

For payouts after getting a funded account are available via bank transfer or crypto, with a $100 minimum withdrawal.

- By default, payouts are every 14 days, but you can switch to weekly if you grab the add-on.

- Challenge fees get refunded once you pass and go funded.

Restricted Countries by OneFunded

Traders from certain regions cannot purchase the OneFunded challenges. These include,

- Afghanistan

- Al-Qaida

- Belarus

- Central African Republic

- Crimea and Occupied Parts of Ukraine

- Cuba

- Democratic Republic of the Congo

- Eritrea

- Guinea-Bissau

- Iran

- Iraq

- ISIL (Da’esh)

- Lebanon

- Libya

- Mali

- North Korea (DPRK)

- Russia

- South Sudan

- Sudan

- Somalia

- Syria

- Taliban

- Yemen

- Zimbabwe

Our Final Verdict of OneFunded

OneFunded is a new player - but looking at the setup, it’s got appeal: low entry fees, fair rules, and the possibility of hitting 90% profit splits down the line. On the downside, the cap at $100k, no scaling, and the lack of a long track record might make pros hesitate. For beginners and mid-level traders, though, OneFunded could be an affordable way to test strategies with real funded capital in 2025. If you are a pro aiming for huge allocations, it’s probably best to wait and see how this firm develops.