MyFundedCapital (MFC) Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full MyFundedCapital (MFC) review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

MyFundedCapital (MFC)

Forex, Crypto, Commodities, Indices

AE

2024

CEO: Bogdan Rubtsov

MatchTrader

DXTrade

cTrader

Wire Transfer/ Bank Transfer

Crypto

Crypto

Wire transfer/ Bank Transfer

Founded in 2024 and based in Dubai, MyFundedCapital (MFC) is making waves a leading prop firm in the trading industry. This firm wants to back the best forex, crypto and commodity traders with up to $100,000 per account. With an 80% profit split that can climb to 100% thanks to add-ons, MFC has the offering flexibility needed with its 1-Step, 2-Step and Instant Funding challenge types. If you are looking for a prop firm that offers relaxed challenge rules and a good profit split then you must check out this detailed MyFundingCapital review 2025.

MyFundedCapital (MFC) Prop Firm Overview

| Category | Details |

| Company Name | The prop firm name is MyFundedCapital (MFC). |

| Legal Name | MyFundedCapital (MFC) legal name is MFC Technologies L.L.C-FZ. |

| Registration Number | MyFundedCapital (MFC)'s registration number is 104226440600001. |

| CEO | The CEO of MyFundedCapital (MFC) is Bogdan Rubtsov. |

| Headquarters | The headquarters is located at Business Center 1, M Floor, The Meydan Hotel, Nad Al Sheba, Dubai, UAE. |

| Broker | The broker associated with MyFundedCapital (MFC) is FPFX Markets (Purple Trading Technology). |

| Operating Since | MyFundedCapital (MFC) has been operating since 2024. |

| Account Sizes | MyFundedCapital (MFC) provides account sizes ranging from $2,000 - $100,000. |

| Profit Split | MyFundedCapital (MFC) offers an 80% standard profit split that goes up to 100% with an add-on. |

| Challenge Types | MyFundedCapital (MFC) offers 1-Step Challenge, 2-Step Challenge, Instant Funding. |

| Payout Cycle | MyFundedCapital (MFC) offers payouts Weekly (1-Step), Every 14 days (2-Step), Weekly after first 14 days (Instant). |

| Payout Method | The withdrawal methods supported by MyFundedCapital (MFC) are Cryptocurrency (BTC, USDT), Bank Wire, Wise. |

| Trading Platforms | MyFundedCapital (MFC) supports trading on Match-Trader, DXTrade, cTrader. |

| Financial Markets | MyFundedCapital (MFC) supports trading in Forex pairs, Cryptocurrencies, Commodities (Gold, Silver, Oil), Indices. |

| Max Allocation | MyFundedCapital (MFC) offers a maximum allocation of $300,000 combined across all active evaluation accounts. |

| Max Scaling | MyFundedCapital (MFC) provides scaling opportunities up to $100,000 per funded account (as the maximum account size). |

| Trustpilot Score | MyFundedCapital (MFC) has a 3.9/5 (as of 2025) rating based on 93 reviews. |

Pros and Cons of Trading with MyFundedCapital (MFC)

MyFundedCapital provides some alternative funded account types for different kinds of traders. But before you start, you have to consider the pros (e.g., high potential RTP) with the cons such as no ‘news trading’ and no weekend holding unless you pay for an add-on. This section will give you a balanced view of the pros and cons of trading with MyFundedCapital (MFC) in 2025.

| Pros | Cons |

| High Profit Share: Standard 80% - Plus up to 100% available as an add-on. | News Trading is limited: You are not allowed to open a position 3 min before/after major news unless add-on purchased. |

| Variety of challenges: Has 1-Step, 2-Step and Instant Funding option. | Weekend Holding Limited: Remaining positions must be liquidated before the weekend, if the weekend holding add-on is not purchased. |

| Refundable Deposit: The challenge fee is refunded after the first payout. | Banned Trading Styles: Strong restrictions on Scalping (70%+ trades under 10 minutes), Martingale, Grid, Arbitrage and HFT. |

| Unlimited Trading Days: No time limit to achieve the challenge targets. | Inactivity Rule: Account is closed if there is no trading for 30 days. |

| Choose How You Want To Get Paid: Crypto / Bank Wire with Wise for withdrawal. | Payout Cap: Max $5,000 per payout cycle is applied. |

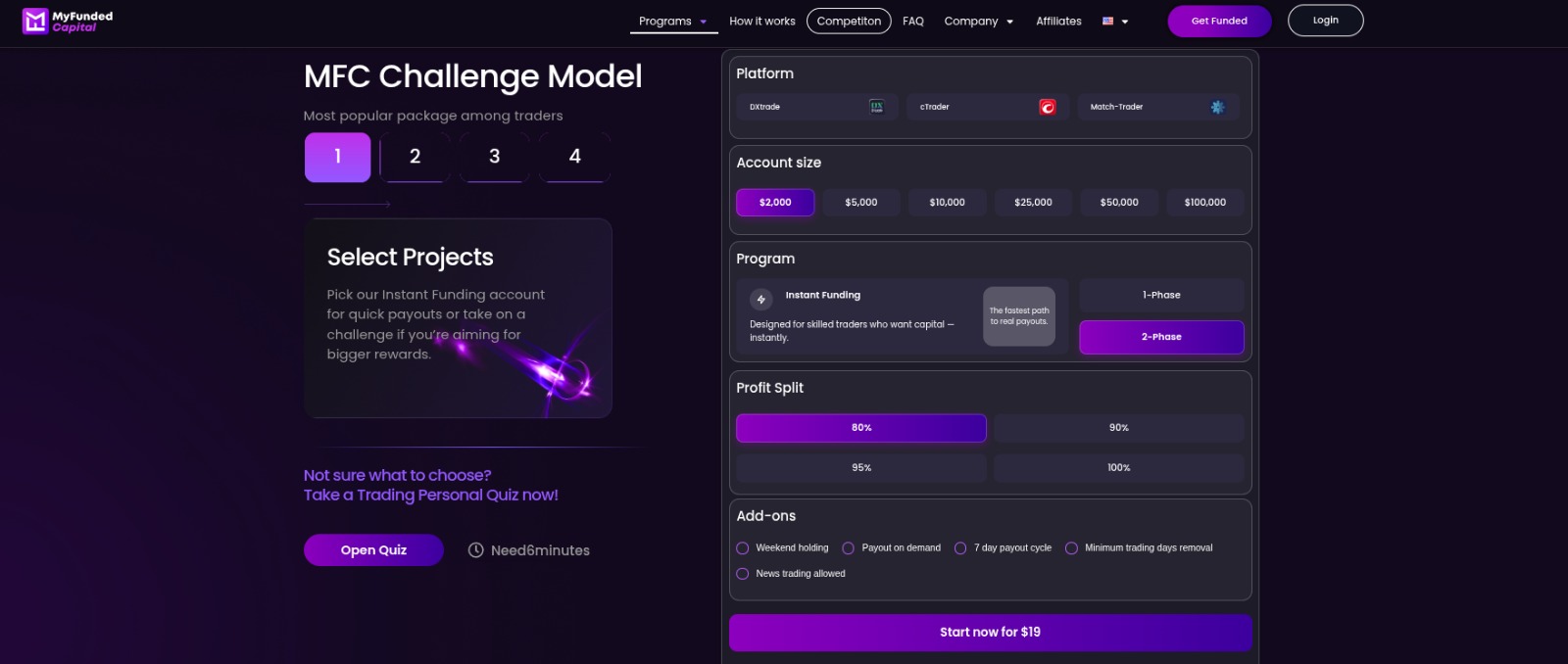

MyFundedCapital (MFC) Account Types, Fees & Profit Split

MyFundedCapital offers traders three different options to get funded: the 1-Step Challenge, the traditional 2-Step Challenge and a no evaluation - Instant Funding path. All models have a set of unique rules for trade drawdown, leverage and fees so traders can select the model that best suits their trading style and comfort level.

| Feature | 1-Step Challenge | 2-Step Challenge | Instant Funding |

| Account Sizes | $5k - $100k | $2k - $100k | $5k - $80k |

| Account Fees (Start From) | $59 (for $5k account) | $19 (for $2k account) | $289 (for $5k account) |

| Profit Target | 10% | Phase 1: 8%, Phase 2: 5% | None (No evaluation) |

| Daily Drawdown | 5% (equity-based) | 5% (equity-based) | 5% |

| Max Drawdown | 10% (trailing, locks on initial balance after 10% profit) | 10% (static, equity-based) | 6% 1st turn, 5% after making a profit of 5% |

| Drawdown Type | Trailing (stops at 10% profit) | Static | Dynamic (tightens with profit) |

| Min. Trading Days | 3 days | 3 days per phase | No minimum |

| Max Trading Days | Unlimited | Unlimited | Unlimited |

| Leverage | 1:50 | 1:100 | Forex 1:30 |

| Stop Loss Rule | Not explicitly required | Not explicitly required | Not explicitly required |

| Consistency Score Rule | No consistency rule | No consistency rule | No consistency rule |

| News Trading Allowed | No (unless add-on purchased) | No (unless add-on purchased) | No (unless add-on purchased) |

| Profit Split | 80% (up to 100%) | 80% (up to 100%) | Starts at 70%, up to 100% |

| Payout Frequency | First payment after 7 days then on weekly basis | 14 days first payout, bi-weekly afterwards (possibility to add on 7 day payouts and payout on demand) | Initial payment after 14 days, then weekly |

1-Step Challenge Details

The 1-Step Challenge offers an alternative to traders who wish to fast track their target and have it all condensed into one phase. The point is the trailing MDD gets set once you make a 10% profit, acting as an insurance to safeguard your account.

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

| $5,000 | $59 | $500 | $250 | $500 |

| $10,000 | $105 | $1,000 | $1,000 | $500 |

| $25,000 | $199 | $2,500 | $1,250 | $2,500 |

| $50,000 | $299 | $5,000 | $2,500 | $5,000 |

| $100,000 | $599 | $10,000 | $5,000 | $10,000 |

Why Choose 1-Step Challenge by MyFundedCapital

- It then only needs a single target to become funded.

- The drawdown-locking-from-behind locks on the original balance when you are at a 10% gain.

- The first payment can be immediately, just after 7d. of trade.

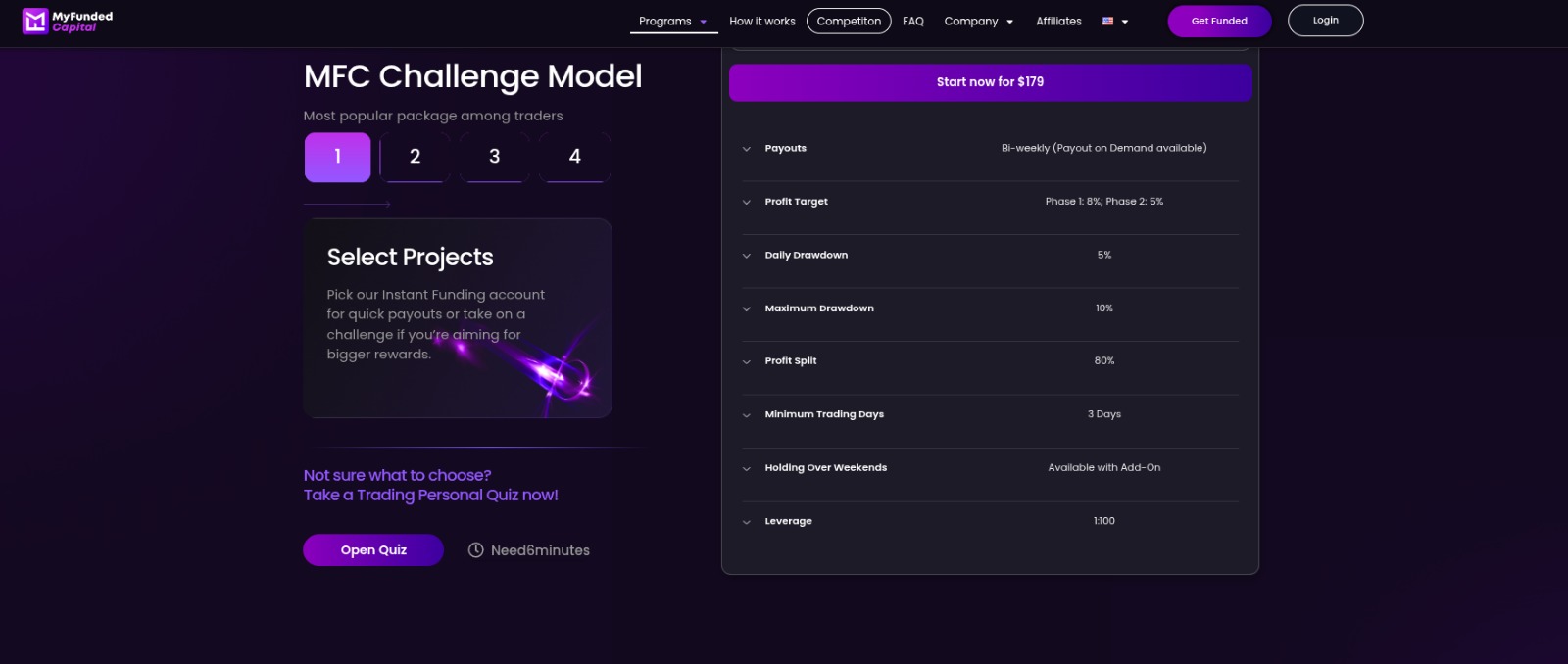

2-Step Challenge Details

This is the more traditional and often least expensive route. It also has a static max drawdown - meaning it is locked to the start account balance and will not adjust down as you make profit. This is more the camp for traders who desire to have a tighter leash on their max loss.

| Account Size | Account Fee | Phase 1 Profit Target (8%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

| $2,000 | $19 | $160 | $100 | $200 |

| $5,000 | $32 | $400 | $250 | $500 |

| $10,000 | $69 | $800 | $500 | $1,000 |

| $25,000 | $179 | $2,000 | $1,250 | $2,500 |

| $50,000 | $299 | $4,000 | $2,500 | $5,000 |

| $100,000 | $429 | $8,000 | $5,000 | $10,000 |

Why Choose 2-Step Challenge by MyFundedCapital

- It is the least expensive in terms of challenge fees relative to the other two alternatives.

- The drawdown is fixed so it provides a more predictable level of loss limit.

- Has 1:100 maximum leverage available for all of the members.

Instant Funding Details

The Instant Funding model does away with evaluation altogether, and provides you instant access to a funded account. You will pay a higher fee, but you can start making profits immediately. The profit share and maximum drawdown dynamically increases as your account grows.

| Account Size | Account Fee | Profit Target | Max Daily Drawdown (5%) | Initial Max Drawdown (6%) |

| $5,000 | $289 | None | $250 | $300 |

| $10,000 | $450 | None | $500 | $600 |

| $20,000 | $890 | None | $1,000 | $1,200 |

| $40,000 | $1,735 | None | $2,000 | $2,400 |

| $80,000 | $3,470 | None | $4,000 | $4,800 |

Why Choose Instant Funding by MyFundedCapital

- It doesn’t have an evaluation phase, so you get funded right away.

- The profit split begins at 70% and grows to 90% and then to 100% as you met up profit targets.

- The rule of maximum drawdown changes into tight after 5 % profit.

Our Final Verdict of MyFundedCapital Account Types

MyFundedCapital has really done a solid job when it comes to putting forward a challenge for every type of trader. The 2-Step Challenge is a fantastic choice for beginners, as it has an incredibly low price and static drawdown. The 1-Step Challenge is tailored for aggressive traders trying to make a fast pass. Instant Funding enables you to have your capital sooner; however it is worth bearing in mind the lower dynamic drawdown rule and leverage. All tasks being timed is the biggest, bestest thing.

MyFundedCapital (MFC) Drawdown and News Trading

MyFundedCapital is concerned about the risk management and visits it while enforcing daily and maximum drawdown rules. Also, the firm has explicit rules around high-impact market events such as news releases, a frequent source of both high and volatile price action.

Drawdown Details

- Daily Drawdown: For all accounts it is 5%. It is equity-based, which means it’s computed based on previous day balance and reset at 5 PM EST.

- Max Drawdown (2-Step): A 10% flat drawdown on the deposit.

- Max Drawdown (1-Step Method): Follow the 10% trailing drawdown but, if a gain of 10% is reached, stop trailing and lock in at starting balance.

- Max Drawdown (Instant): A Dynamic DrawDown that goes from 6% to 5% after account is at +5%.

News Trading Details

- Rule: It is not allowed to open or close a position 3 minutes before or after a big news release.

- Exception: This rule can be overridden by buying the News Trading Add-On, priced at an extra +15% of the challenge fee.

MyFundedCapital (MFC) Spreads & Commissions

Knowing the costs of trading is critical for a trader's success. MyFundedCapital operates on a raw spread model, so the spread (the difference in price between buying and selling) is very low, however commissions are charged on some instruments to cover costs.

Spreads and Commissions Details

- Spreads: The broker offers RAW spreads from its counterparty, FPFX Markets. That usually means spreads are very tight.

- Trade Commissions: Commissions are charged on Forex pairs and CFDs.

- Other Instruments: The Price for CFDs on Commodities and Indices are Commission.

Trading Instruments Offered by MyFundedCapital (MFC)

MyFundedCapital offers traders access to various global financial markets. This range makes it possible for traders to engage in broad-based trading, rather than confining themselves to a conservative strategy and only one or two asset classes.

Trading instruments details

- Forex: A range of major, minor and exotic Forex pairs.

- Cryptocurrencies: Popular digital currencies.

- Commodities: Hard and soft commodities such as Gold, Silver and Oil.

- Indices: Stock market indexes from several global markets.

.jpeg)

MyFundedCapital (MFC) Trading Rules

MyFundedCapital has tight guidelines as it won’t allow what it considers being “gambling” or abusive trading habits and certain that traders are adopting professional strategies. Most traditional trading models are permitted, though automatic and high risk methods may be more strictly observed and seldom accepted.

| Trading Strategies | Allowed or Not | Details |

| Expert Advisors (EAs) | Yes (with restrictions) | Permitted, but not the HFT robots or Martingales and Arbitrages EAs. |

| Copy Trading | No | There is no such thing as trading from trader A to trader B. |

| News Trading | No | Off limits for 3 minutes before/after news of supreme importance; unless add-on has been bought. |

| Weekend Holding | No | Positions must be liquidated before the weekend market closing unless an add-on is purchased. |

| Hedging Between Accounts | No | Hedging order among two or more MFC Accounts is forbidden. |

| Scalping (short duration) | Restricted | More than 70% of offer/trade profits for stocks/ETFs executed will occur within 10 minutes (Based thereon) is classified as Excessive Short Duration Trading and is deemed unacceptable. |

Prohibited Practices:

- All-in Trades: Entering trades that go near or beyond, maximum leverage (and also where the margin usage is running close to maximum)

- Event-Betting: Bet on news events with high volatility without the add-on.

- Martingale Strategy: A strategy in which the trade size is added to a losing trade.

- Grid Trading: A technique that creates a grid of speculative buy and sell orders at predetermined intervals around current trading prices.

- Arbitrage: Taking advantage of disparities in price between carriers.

- High Frequency Trading: The use of ultra-fast, high-volume, computerised systems.

- Switching Strategies: Consistent moves from a go-to trading strategy across accounts.

- IP Rules: Multiple IPs or VPNs are not allowed as IP and device fingerprints are tracked.

- Inactivity: An account will experience a Hard Breach when no trade has been executed for the past 30 days.

.jpeg)

Scaling Plan at MyFundedCapital (MFC)

The scaling of MyFundedCapital is not an automation process for every trader to add more capital on one account, it rewards consistent traders with large capital to trade and manage.

Scaling plan details

- Max Scaling: Traders can scale as high as $100,000 for any one funded Trading Account.

- Max Allocation: The aggregate notional value across all live evaluation accounts for an individual is limited to a maximum of $300,000.

- Scale path: The way for a trader to grow their account is by passing challenges for higher account sizes up to $100k with the goal of reaching our $300K maximum active evaluation cap.

Payment Methods & Payout Process at MyFundedCapital (MFC)

Convenient MyFundedCapital has multiple convenient methods available for traders to pay their challenge fees and withdraw their profits. The firm offers below mentioned range of flexible transaction types for fee deposits and profit withdrawals.

Payment Method Supported by MyFundedCapital

- Credit/Debit cards.

- Cryptocurrency.

Payout Methods Supported by MyFundedCapital

- Cryptocurrency (BTC, USDT).

- Bank Wire.

- Wise.

How the Payout Process Works at MyFundedCapital

- Payout Cap: No more than $5,000 per payout cycle may be paid from all accounts.

- 1-Step Payout: First payout is possible 7 days after registration starting from 1st trade on the client’s real account; follow-up payment - every 7 days. The add-on Payout on Demand is there.

- 2-Step Payout: The first payout is available after 14 trading days of the initial trade that was traded on a funded account. After that, payouts are every two weeks. 7-Day Payouts and Payout on Demand are offered as add-ons.

- Instant Funding Payout: First payout is after 14 days. Weekly payouts follow (if at least one trade is made).

- Refundable Fee: The full challenge fee of 100% is refunded back to the trader on the first successful payout.

Countries Restricted at MyFundedCapital (MFC)

As with all financial service companies - there are international compliance and sanction requirements (laws) that MyFundedCapital must abide by. This then creates a list of countries where residents are not allowed to buy any accounts with MyFundedCapital.

List of countries restricted at MyFundedCapital

- Pakistan

- Vietnam

- All OFAC Restricted Countries (as listed on the official OFAC website)

Our Take on MyFundedCapital (MFC)

MyFundedCapital (MFC) is indeed one of the leading and most flexible prop firms around. Three different types of challenges (1-Step, 2-Step, Instant Funding) with no maximum trading days is a very positive thing. The firm appeals to a broad spectrum of traders. The opportunity to get a 100% profit split through an add-on is also very enticing, but beware of the strict trading guidelines against news trading and weekend holding - traders must pay for an add-on to use these trading strategies.

All in all, MyFundedCapital (MFC) offers competitive funded accounts and fair trading rules but traders need to consider their tightly anti-gambling rules as well as the $5k cap on payouts before they purchase a challenge.