Moneta Funded Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Moneta Funded review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

.jpeg&w=1080&q=75)

0.0

0.0

Moneta Funded

Forex, Crypto, Indices, Commodities

LC

2025

CEO: David Bily

MatchTrader

Metatrader 5

Crypto

Wise

Rise

Credit/Debit Card

Moneta Funded Review 2026

Moneta Funded is a broker-backed prop firm operated by Moneta Markets, a regulated global brokerage best-known for its institutional grade liquidity and execution infrastructure. Unlike many standalone prop firms, Moneta Funded allows traders to access funding through a broker-powered environment - offering direct exposure to financial markets like Forex, Cryptocurrencies, Indices, and Commodities on professional trading platforms.

In 2026, Moneta Funded continues to attract disciplined, rule-compliant traders by combining a straightforward evaluation structure, up to 88% profit split and stable trade execution backed by real brokerage systems. However, this is not a firm built for high-frequency or rule bending trading strategies. Traders must strictly follow Moneta Funded’s trading conditions - including the mandatory 2-minute minimum trade duration on most account types and news trading restrictions during evaluation phases.

In this Moneta Funded review for 2026, we break down how the firm’s broker-backed funding model works, analyze its evaluation and account rules, profit targets, drawdown limits and payout structure - and explain who Moneta Funded is best suited for - and who should avoid it. Our goal is simple: to help traders decide whether Moneta Funded aligns with their trading style, risk management approach and long-term funding goals.

Moneta Funded Prop Firm Overview

The following information is taken from the official website of Moneta Funded, public disclosures and available trader feedback as of 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Moneta Funded. |

| Legal Name | The prop firm legal name is Moneta Funded LTD. |

| Registration Number | The registration number of Moneta Funded is 5192153. |

| CEO | The CEO of Moneta Funded is David Bily. |

| Headquarters | The headquarters of Moneta Funded is located at Saint Lucia. |

| Broker | The broker associated with Moneta Funded is Moneta Markets. |

| Prop Firm Type | Moneta Funded is a broker-backed prop firm. |

| Operating Since | Moneta Funded has been operating since December 2025. |

| Account Sizes | Moneta Funded provides account sizes ranging from $2.5K to $100K. |

| Profit Split | Moneta Funded offers an 88% Moneta Funded profit split. |

| Challenge Types | Moneta Funded offers Moneta Funded one step challenge, Moneta Funded two step challenge, Instant Funding and Moneta Funded Phoenix challenge. |

| Payout Cycle | The Moneta Funded payout rules state that payouts are available on a 14-day cycle. |

| Payout Method | The profit withdrawal methods supported by Moneta Funded are Crypto (USDT-ERC20/TRC20), Rise or Wise. |

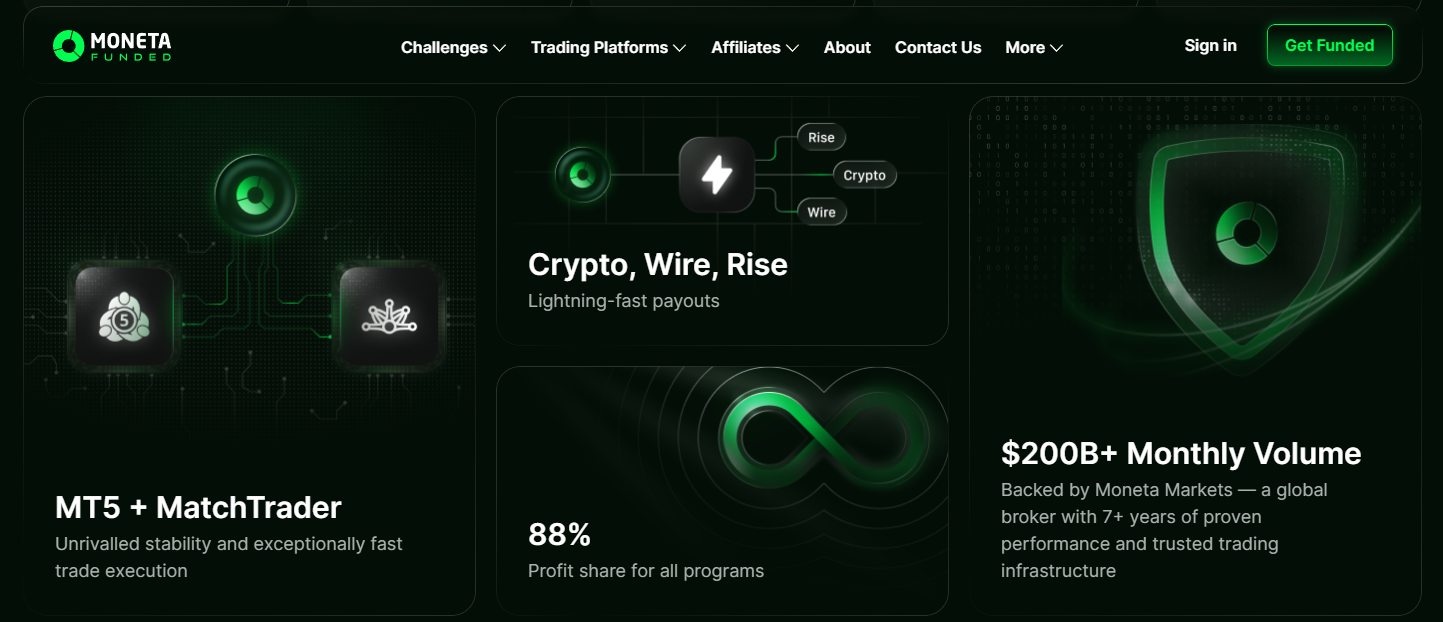

| Trading Platforms | Moneta Funded supports trading on MT5 and Match Trader platforms. |

| Financial Markets | Moneta Funded supports trading in Forex, Cryptocurrency, Indices and Commodities financial markets. |

| Max Allocation | Moneta Funded offers a maximum allocation of $2.3M. |

| Max Scaling | Moneta Funded provides scaling opportunities up to $2.3M. |

| Trustpilot | As of Jan 2026, Moneta Funded has a 4.6/5 rating on Trustpilot based on 33 user reviews. |

Pros and Cons of Trading with Moneta Funded

When traders ask “Is Moneta Funded a legitimate prop firm?” - the short answer is yes. Moneta Funded is a broker-backed prop firm powered by Moneta Markets - which gives it a clear execution and liquidity advantage over many white abel prop firms operating in 2026.

However, legitimacy alone does not automatically mean trader friendly. Whether Moneta Funded is the right prop firm for you depends heavily on your trading style, risk tolerance and ability to operate under static and trailing drawdown frameworks. Below is a balanced breakdown of the real advantages and limitations of trading with Moneta Funded in 2026.

| Pros | Cons |

|---|---|

| Moneta Funded backed by Moneta Markets that provides high-quality liquidity and execution. | Moneta Funded rules prohibit news trading execution (±5 mins) on 1-Step and 2-Step accounts. |

| Competitive Moneta Funded profit split fixed at 88% across all account models. | Evaluation fees are strictly non-refundable - unlike many competitors in 2026. |

| Diverse Moneta Funded account types that includes Moneta Funded instant funding for immediate access. | A 20% consistency rule applies to most challenges that limits "one-shot" profit strategies. |

| Moneta Funded general rules allow for weekend holding and the use of Expert Advisors (EAs). | Moneta Funded instant funding utilizes a trailing drawdown which can be more difficult to manage than static limits. |

| Wide range of instruments including Forex, Crypto, Indices and Commodities. | Average trade duration must be at least 2 minutes to avoid exploitation violations. |

Final Verdict: Is Moneta Funded Worth It in 2026?

Moneta Funded is a legitimate, broker-backed prop firm that focuses on execution quality and risk discipline over aggressive growth tactics. The firm’s account and trading rules structure - including drawdown limits, consistency controls and news trading restrictions - clearly favors traders who are systematic and perform on risk managed strategies rather than high risk or event driven trading strategies.

With a fixed 88% profit split and a 14-day payout cycle, Moneta Funded can be a strong fit for the traders who value stability and professional grade trading conditions. But the real deciding factor is whether the Moneta Funded challenge rules and drawdown models align with how you already trade - which we break down in detail below.

Moneta Funded Account Types, Fees & Profit Split Explained (2026)

Moneta Funded provides a vast range of funding paths instead of forcing traders into a single evaluation model. From the classic 1-step and 2-step challenges to recovery-style accounts like the Phoenix Challenge and Instant Funding, the firm provides account for different risk profiles, experience levels and trading styles.

Choosing the right Moneta Funded account is not just about the entry fee. Profit targets, drawdown structure (static vs trailing), leverage and consistency rules all play a major role in long term profitability when it comes to trading with prop firm funded account. Understanding how these Moneta Funded rules interact with your trading strategy is essential before committing capital.

Below is a side by side comparison of all Moneta Funded account types - updated for 2026.

Moneta Funded Account Comparison Table

| Account Types | One Step Challenge | Two Step Challenge | Phoenix Challenge | Instant Funding |

|---|---|---|---|---|

| Account Sizes | $5K - $100K | $5K - $100K | $5K - $100K | $5K - $100K |

| Account Fees (lowest to highest) | $95 - $670 | $49 - $650 | $195 - $1150 | $105 - $735 |

| Profit Target | 12% (Phase 1) | 5% (P1) / 10% (P2) | 10% | N/A (Direct Funded) |

| Daily Drawdown | 3% (Static) | 4% (Static) | 3% (Trailing) | 3% (Trailing) |

| Max Drawdown | 6% (Static) | 10% (Static) | 6% (Trailing) | 6% (Trailing) |

| Drawdown Type | Static | Static | Trailing | Trailing |

| Minimum Trading Days | 3 Days | 3 Days | 3 Days | N/A |

| Maximum Trading Days | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | 1:30 | 1:30 | 1:30 | 1:30 |

| Consistency Score Rule | 20% Rule | 20% Rule | N/A | 20% Rule |

| Profit Split | 88% | 88% | 88% | 88% |

| Payout Frequency | 14 Days | 14 Days | 14 Days | 14 Days |

There are many occasions when traders come across promotional codes that discount Moneta Funded fees, making the doors to professional capital even wider. The information above is an unbiased guide to assist you in deciding which risk limits and drawdown mechanisms are in harmony with your trading strategy. Different account types have different impacts on trading styles. Below is a detailed breakdown of each model.

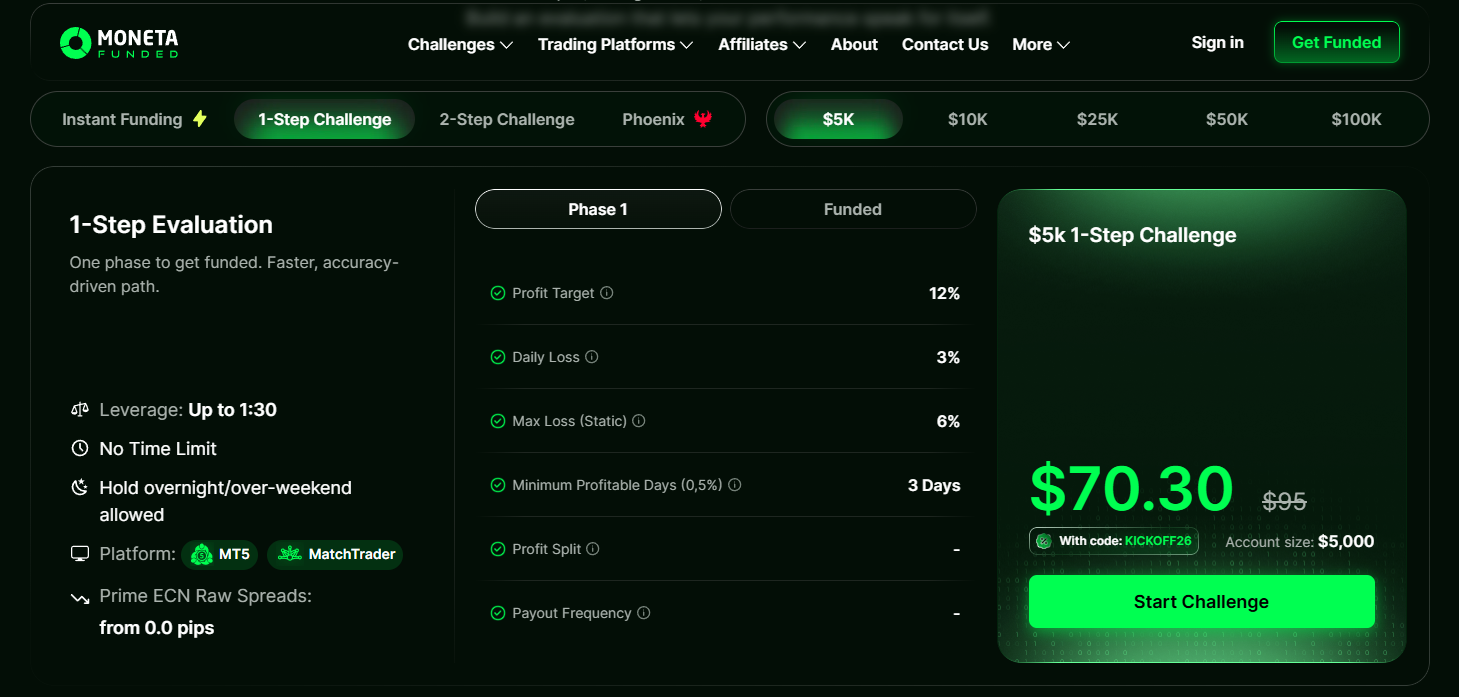

Moneta Funded 1-Step Challenge

The Moneta Funded 1-step challenge offers the traders those who want to be quickly funded in a single stage evaluation. It is a great advantage that the challenge is very simple, only one profit target should be met but the fixed 6% maximum drawdown being quite tight will increase the risk of an account being breached if there is a spike in volatility.

| Account Size | Account Fee | Profit Target (12%) | Max Daily Drawdown (3%) | Max Total Drawdown (6%) |

|---|---|---|---|---|

| $5,000 | $95 | $600 | $150 | $300 |

| $10,000 | $170 | $1,200 | $300 | $600 |

| $25,000 | $265 | $3,000 | $750 | $1,500 |

| $50,000 | $420 | $6,000 | $1,500 | $3,000 |

| $100,000 | $670 | $12,000 | $3,000 | $6,000 |

Why Choose Moneta Funded 1-Step Challenge?

Traders often choose this model because it offers a very direct path to a funded account.

• Experienced traders can benefit from an efficient single, phase evaluation that saves them time.

• The strategy based method suits swing traders whose main preference is static drawdown over trailing equity rules.

• Mid tier account sizes with Moneta Funded fee competition and pricing breakdowns.

Moneta Funded 2-Step Challenge

The Moneta Funded 2-step challenge offers a more conventional route to the evaluation with the benefit of increased leverage and bigger drawdown buffers. Traders are granted a 10% maximum drawdown, more flexibility for strategy errors but the two stage requirement means it takes longer to reach the Moneta Funded profit split than in other models.

| Account Size | Account Fee | Profit Target (Phase 1: 5%) / (Phase 2: 10%) | Max Daily Drawdown (4%) | Max Total Drawdown (10%) |

|---|---|---|---|---|

| $5,000 | $49 | $250 / $500 | $200 | $500 |

| $10,000 | $85 | $500 / $1,000 | $400 | $1,000 |

| $25,000 | $190 | $1,250 / $2,500 | $1,000 | $2,500 |

| $50,000 | $365 | $2,500 / $5,000 | $2,000 | $5,000 |

| $100,000 | $650 | $5,000 / $10,000 | $4,000 | $10,000 |

Why Choose Moneta Funded 2-Step Challenge?

This is the most popular choice among people who want maximum drawdown flexibility and higher leverage.

• Provides the highest leverage up to 1:100 and a 10% max drawdown buffer.

• Moneta Funded rules allow for a much less strict trading pace with unlimited trading days.

• Traders who can get the most out of this are those with prior prop firm experience and who are comfortable with multi phase audits.

Moneta Funded Instant Funding

Having an understanding of Moneta Funded instant funding requires to grasp the idea of immediate capital access without going through the evaluation stage. The main benefit is the possibility to start trading with an instant funded account from the very first day. The closing of the trailing drawdown and the increased Moneta Funded fees make it a quite, risky selection for those who don't have a strict stop loss discipline.

| Account Size | Account Fee | Profit Target | Max Daily Drawdown (3%) | Max Total Drawdown (6%) Trailing |

|---|---|---|---|---|

| $5,000 | $105 | N/A | $150 | $300 |

| $10,000 | $190 | N/A | $300 | $600 |

| $25,000 | $290 | N/A | $750 | $1,500 |

| $50,000 | $465 | N/A | $1,500 | $3,000 |

| $100,000 | $735 | N/A | $3,000 | $6,000 |

Why Choose Moneta Funded Instant Funding?

Designed to cater to traders who prefer bypassing evaluation and getting profit split right away.

• There are no profit targets to be met in order to keep the account.

• Trading the news without any restrictions is included in the Moneta Funded trading rules.

• Great for consistent day traders who can handle the risk of a trailing drawdown.

Moneta Funded Phoenix Challenge

The Moneta Funded Phoenix challenge is a top level model that permits trading the news freely and holding positions over the weekend. Its main advantage is the finely tuned rules that offers traders the use of advanced strategies, the significantly higher costs for entry per account size pose a major financial risk for traders who are not already generating profits on a regular basis.

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (3%) | Max Total Drawdown (6%) Trailing |

|---|---|---|---|---|

| $2,500 | $195 | $250 | $75 | $150 |

| $5,000 | $350 | $500 | $150 | $300 |

| $10,000 | $600 | $1,000 | $300 | $600 |

| $20,000 | $1,150 | $2,000 | $600 | $1,200 |

Why Choose Moneta Funded Phoenix Challenge?

An exclusive boutique option for seasoned professionals who require specific liberties in trading.

• Complete authorization for news trading and weekend position holding.

• Ideal for those who are news events dependent and fundamental traders.

• Professional level account supported by the standard of Moneta Funded and the backing of Moneta Markets.

Our Verdict On Moneta Funded Account Types

Moneta Funded accounts are designed to target certain trading styles instead of beginners looking for flexibility. Judging from our review, the accounts are quite appropriate for disciplined day traders as well as organized, low risk traders who are familiar with consistency rules and drawdown limits. Traders who deploy MT5 or Match Trader might highly appreciate Moneta Funded's broker-backed setup via Moneta Markets.

These accounts might be unsuitable for beginners, news based strategies or high leverage scalpers, especially because of the strict drawdown limits and trailing drawdown regulations on instant funding accounts.

Moneta Funded Drawdown and News Trading Rules

It is quite necessary to follow the Moneta Funded rules fully if you want to keep your account for a long time. The prop firm is using a blend of static and trailing drawdown models depending on whether the trader is going for a standard challenge or an instant funding path. Following these Moneta Funded general rules will help traders find their way through Moneta Funded profit split as a professional successfully.

Drawdown Details:

The way Moneta Funded calculates daily drawdown is by using an equity balance model. Simply the system takes your balance and equity at 10PM UTC and whichever is higher between these two values is used to determine the next day's breach level. For Moneta Funded challenges such as 2-step challenge, the daily limit is set to 4% and the maximum static drawdown is fixed at 10%.

Numerical Example: Assuming a $100,000 account, at 10PM UTC, if your balance is still $100,000 but the value of your open trades shows your equity at $102,000, the system considers $102,000 as the starting point. When there is a daily loss limit of 4%, your breach level is $97,920 ($102,000, $4,080).

The most frequent mistake made by traders is not considering their floating profits at the time of reset, this in effect "locks in" a higher equity peak and subsequently the loss for the next day gets more tightly limited.

News Trading Rules Details:

The news trading rules at Moneta Funded depend quite a lot on the path you choose:

• Allowed with restriction: On the Moneta Funded one step challenge and Moneta Funded two step challenge, you are allowed to hold positions during news but you are not allowed to open new orders (including Stop Loss / Take Profit modifications) 5 minutes before or after major news events.

• Allowed, no restriction: It is a different thing how Moneta Funded instant funding works - both Moneta Funded instant funding and the Moneta Funded Phoenix challenge allow news trading without any restrictions.

Traders need to be wary during red folder news events so as not to have any automated orders triggered on restricted account types. The Moneta Funded trading rules mentioned here are meant to encourage professional risk management rather than gambling with high stakes volatility.

Trading Instruments available at Moneta Funded

Moneta Funded offers a wide range of account types that allow traders to tap into various globally liquid markets. As the prop fim is supported by Moneta Markets the data streams are very well tuned for institutional style execution across different asset classes.

Trading Instruments Details:

Listing diversification of traders is possible with a large number of different types of instruments:

- Forex: Major, minor and exotic currency pairs.

- Crypto Currency: Most traded digital assets like Bitcoin and Ethereum.

- Indices: World's stock market indices for gaining diversified equity exposure.

- Commodities: Hard and soft commodities, for example, Gold and Oil.

Instrument availability may differ depending on the chosen account type and trading platform.

Regardless of whether you are using Match Trader or MT5, the spread and commission structure is still very competitive, with commissions being currently set at $8 per round trip lot. This variety of instruments along with a clear Moneta Funded fees and pricing breakdown, makes the prop firm a serious challenger for those who want a multi asset Moneta Funded prop firm partnership. By following the Moneta Funded payout policy, disciplined traders can reliably withdraw their profits every 14 days through Crypto, Rise or Wise.

Moneta Funded Spreads & Commissions: What You Really Pay

One of the critical factors to consider for long term success when trading with a new entity like the Moneta Funded prop firm is understanding the trading costs. Since the firm is Moneta Funded supported by Moneta Markets, it uses Moneta Markets good liquidity to offer a competitive trading environment to its traders. This Moneta Funded review is mainly about how commissions and spreads influence your net earnings across different Moneta Funded account types.

Spreads and Commissions Details:

The overall trading costs at Moneta Funded are designed to very closely replicate trading under current market conditions. Charges for the Moneta Funded one step challenge and Moneta Funded two step challenge traders include a commission of $8 per round trip lot. This is a typical industry rate that helps keep the simulation environment a realistic testing ground for professional trading methods.

Moneta Funded takes steps to provide transparency on the spreads by allowing potential traders to verify current data directly. Through a simple login into their MetaTrader 5 (MT5) or Match Trader platforms using the provided guest credentials, you can check out real, time spreads for Forex, Crypto, Indices and Commodities.

Besides, the Moneta Funded trading rules stipulate that trades need to be held for a minimum of 2 minutes on average to avoid demo server exploitation, which emphasizes the firm's commitment to genuine market execution instead of high frequency arbitrage.

Our Verdict on Moneta Funded Spreads & Commissions

If you are working through the Moneta Funded Phoenix challenge or taking advantage of the Moneta Funded instant funding model then the expenses are taken from your trading account balance immediately. This is one of the most critical reasons that the Moneta Funded is considered a legit prop firm in 2026, as it shows the prop firm’s dedication to sustainable trading.

It is extremely important to figure in operating expenses when determining your net earnings after the Moneta Funded profit split of 88% has been taken into account. The firm is basically allowing the traders to conduct a thorough inspection before finishing the Moneta Funded checkout process by giving them direct access to their MT5 and Match Trader servers for spread verification. This level of transparency is exactly what we look for at The Trusted Prop to ensure our readers have the most accurate data possible.

Moneta Funded Rules (2026) What is Allowed and What is Not

Understanding the general rules of a Moneta Funded account is a key factor for account longevity and the success of withdrawal processes. The prop firm uses a combination of static and trailing drawdown methods depending on the account type along with some restrictions on high impact news events for evaluation types.

| Trading Strategies | Allowed or Not | Details |

|---|---|---|

| Scalping | Allowed | Trades should be held for an average of 2 minutes to avoid exploitation flags. |

| Swing Trading | Allowed | Weekend holding is permitted across all account types. |

| News Trading | Partial | Restricted on 1-Step/2-Step accounts - allowed on Instant Funding and Phoenix. |

| Expert Advisors (EAs) | Allowed | Permitted as long as they do not use HFT, Martingale or Arbitrage strategies. |

| Copy Trading | Allowed | Permitted only if you are copying your own trades from your own accounts. |

| Grid/Martingale | Not Allowed | These high-risk strategies are strictly prohibited and will lead to account termination. |

Prohibited Practices at Moneta Funded

To keep the atmosphere professional, Moneta Funded has implemented strict rules that are against gambling like behavior and the use of technical exploits. The below actions are strictly forbidden:

- Arbing & HFT: Using high frequency trading or latency arbitrage to exploit demo server feeds.

- Account Sharing: It is not permitted to trade for other people or doing the reverse trading between different accounts.

- Gambling Strategies: "All-in" style or bad risk management that lacks a consistent approach.

- IP Address Policy: Unlike most of the competitors, currently there are no IP restrictions. So traders can enjoy more freedom in choosing the places where they do their trading.

Soft Breach vs Hard Breach Example:

- Soft Breach: Opening a position (also closing positions using Stop Loss/Take Profit) during a restricted news window on a Moneta Funded two step challenge. This is a situation that trade might get voided or you might receive a warning, it does not always mean immediate account loss unless it is a repeated violation.

- Hard Breach: Exceeding the specified Max Drawdown according to the Moneta Funded fees and pricing breakdown (e.g, 6% on a One Step account). This is a non negotiable violation that will cause your account to be closed immediately.

Our Verdict on Moneta Funded Rules

According to our review at The Trusted Prop, Moneta Funded rules are mostly clear but one has to be highly disciplined especially in the case of news trading and trade duration. While the firm is a Moneta Funded legit prop firm in 2026 backed by a strong broker foundation, the 2 minute average hold time rule implies that these accounts might not be the best for super fast scalpers or traders who entirely depend on the news spikes.

However, traders who take the Moneta Funded Phoenix challenge or Moneta Funded instant funding will experience a lot less strict rules where news trading is completely allowed. Generally, the rules are meant to select systematic traders and not those who want to gamble quickly.

Moneta Funded Scaling Plan – Grow Your Account Over Time

The Moneta Funded infrastructure prioritizes rewarding long-term stability over short-term gains. The firm, through providing a clear pathway for the growth of funded accounts which makes it possible for disciplined traders to reach higher capital tiers without the necessity of buying multiple new challenges. This prop firm scaling plan is geared towards those who show trading consistency and a professional attitude to risk management.

Scaling Plan Details:

Even though Moneta Funded allows a maximum capital allocation and scaling frontier of up to $2.3 million then the whole scaling process is based strictly on performance. Generally, to be eligible for a balance increase, traders must satisfy the following conditions:

• Performance requirement: The trader must make a profit of a certain percentage (usually 10% or more) without violating the drawdown and consistency rules of Moneta Funded.

• Time based requirement: Scaling is typically evaluated quarterly, so that the trader shows a track record over a longer period of time, not just succeeding a single month.

• Consistency score: In nearly all account categories, a 20% consistency rule is in place which means that no single trading day is allowed to make an excessive contribution to the profit target.

The Trusted Props neutral, trust-first positioning is strengthened by this structured approach which basically works as a merit based system for earning capital increases. At the same time it serves as a filter for serious professionals and discourages the very high risk gambling approach that is explicitly prohibited under the Moneta Funded rules.

Traders who want to fully leverage their experience will discover that Moneta Funded offers the execution stability needed to reach these long-term goals. Knowing the differences between Moneta Funded instant funding and the various evaluation models is crucial as different accounts may have different scaling paces. Just before you try to scale, always check with the Moneta Funded support center for the most up-to-date performance criteria.

Payment Methods & Payout Process at Moneta Funded

Managing your capital and profits is easier if you have a good grasp of the financial pipeline of the firm. Moneta Funded keeps both the Moneta Funded checkout and profit distribution at bare minimum complexity by using a 14 day cycle that is in line with the industry standards. Traders who are deciding whether Moneta Funded a legit prop firm in 2026, will probably find that the transparency of their payment operations is the most significant support of their assertion.

Real Time Example: Moneta Funded has a 14 day payment cycle. For example, if a trader requests for a withdrawal on a Monday after completing the 14 day trading cycle, Moneta Funded usually processes and approves the payout within the standard 24 to 48 hour window, as long as the trader follow all the Moneta Funded rules and consistency checks.

Details of Payment Methods Supported:

The Moneta Funded fees and challenge costs are disposed of through highly secure electronic payment gateways. The main Moneta Funded support on purchasing challenges presently consists of:

• Credit/Debit Cards: The firm supports normal card transactions to enable quick and secure Moneta Funded checkout process.

Details of Payout Options Supported:

After achieving a Moneta Funded profit split of 88%, a trader has a modern choice of several payout options to fund their accounts. Among the withdrawal methods supported are:

• Crypto: Traders have the option of either USDT, ERC20 or USDT, TRC20 for quick, blockchain based transfers.

• Rise: A widely used worldwide payout platform that makes international transfers efficient.

• Wise: Previously TransferWise, this is for those who want their money directly in their bank account with very good exchange rates.

Details of How the Payout Process Works:

The payout route at this Moneta Funded prop firm is controlled by a set of very specific Moneta Funded rules for security and compliance reasons:

• Eligibility Cycle: Payouts start after two weeks and traders are eligible for the first and all other subsequent payouts every 14 days.

• Profit Split: Standard profit, sharing of Moneta Funded is a highly competitive 88% for all trading account models including the Moneta Funded 1-step challenge and Moneta Funded instant funding.

• Verification: A payout may be granted only after the Moneta Funded support center and the risk team have inspected the trading account to make sure none of the Moneta Funded general rules such as the 20% consistency rule or news trading are infringed upon.

• Request Submission: Traders send their request through the dashboard, choosing their method of payment from Crypto, Rise or Wise.

Our Verdict On Moneta Funded Payout Process & Payment Methods

Moneta Funded seems to offer a professional and stable financial environment based on our review at The Trusted Prop. It's normal for payouts to occur every 14 days but the 88% profit split is really exceptional and way above the average of many competitors. The non refundable challenge fee is definitely a negative side, yet the support of a broker like Moneta Markets which has an existing reputation brings a level of institutional trust which a few operating firms do not have. Traders who use modern withdrawal methods such as USDT and Rise as their priority will find the system efficient and well structured for the 2026 market.

Country Restricted At Moneta Funded

The Moneta Funded prop firm has certain geographical restrictions in place to follow international financial regulations and the policies of its associated broker, Moneta Markets. Although the firm has a vast global reach, individuals living in the below, mentioned jurisdictions are presently not allowed to participate in Moneta Funded challenges.

• Afghanistan

• Thailand

• Cuba

• Lebanon

• Myanmar

• North Korea

• Pakistan

• United Arab Emirates (UAE)

• Venezuela

• Vietnam

• Yemen

Traders please note, due to regulatory or payment provider changes, country restrictions might be lifted or added.

If you are a trader in a permitted area, it is very important to confirm your residency status at the first registration to guarantee a hassle-free Moneta Funded payout. In case you are not sure of your exact location, it is advisable that you get in touch with the Moneta Funded support centre for the latest regulatory news.

Our Final Verdict on Moneta Funded

Moneta Funded is a top level choice for traders who want a Moneta Funded with the added security and Moneta Markets brokerage backing. It has a variety of account types from a classic Moneta Funded two step challenge to instant funding models. Moneta Funded rules about high impact news and the 20% consistency requirement are very demanding of very disciplined traders but at the same time these rules are very sustainable. The firm offers a professional trading environment MT5 and Match, Trader with a competitive 88% Moneta Funded profit split. Basically, if traders are more concerned about broker-backed security than easy rules then Moneta Funded can be their reliable option in the 2026 prop trading market.

View the latest pricing and verified prop firm offers, reviewed by The Trusted Prop.