Evercrest Funding Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Evercrest Funding review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

Evercrest Funding

Forex, Crypto

AE

2025

CEO: Michael Thomas

Metatrader 5

Wire Transfer/ Bank Transfer

Crypto

Crypto

Wire transfer/ Bank Transfer

Evercrest Funding is a prop firm from the UAE that provides direct funding and evaluation-based accounts for Forex and Crypto traders. This prop firm is particularly well-suited for seasoned traders who like to carry their trades over the weekend and prefer a high level of flexibility when it comes to news trading. Evercrest Funding offers its own MT5 license and allows a wide range of trading strategies. Traders need to be aware of the specific drawdown rules of Evercrest Funding, especially the trailing drawdown on Instant and Standard accounts and the daily consistency percentages that may affect the eligibility for payouts.

In this review of Evercrest Funding 2026, we examine whether the prop firm’s exclusive infrastructure and its potential for scaling make it a trustworthy partner for your funded trading journey.

Evercrest Funding Prop Firm Overview

The following information is taken from the official website of Evercrest Funding, public disclosures and available trader feedback as of first quarter 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Evercrest Funding. |

| Legal Name | Evercrest Funding legal name is Evercrest Funding. |

| Registration Number | Evercrest Funding registration number is 100442089700003. |

| CEO | The CEO of Evercrest Funding is Michael Thomas. |

| Headquarters | The headquarters is located in UAE. |

| Broker | The Evercrest Funding has own MT5 licence. |

| Operating Since | Evercrest Funding has been operating since December 2025. |

| Account Sizes | Evercrest Funding provides account sizes ranging from 10k to 200k. |

| Challenge Types | Evercrest Funding offers Instant Funding, One-Step (Standard, Plus) Challenge and Two-Step Challenge. |

| Payout Cycle | Evercrest Funding offers payouts Bi-weekly. |

| Payout Method | The withdrawal methods supported by Evercrest Funding are Crypto and Bank Transfer. |

| Trading Platforms | Evercrest Funding supports trading on MT5 platform. |

| Financial Markets | Evercrest Funding supports trading in Forex and Crypto. |

| Max Allocation | Evercrest Funding offers a maximum allocation of 300k capital. |

| Max Scaling | Evercrest Funding provides scaling opportunities up to 560k. |

| Trustpilot Score | Evercrest Funding has a 4.5/5 (as of 2026) rating based on 16 user reviews. |

Pros and Cons of Trading with Evercrest Funding

As an analyst-driven prop firm review platform, The Trusted Prop mainly evaluates firms based on how transparent they are with their operations and how structurally sound their trading rules are. Evercrest Funding prop firm which was set up at the end of 2025, has a quite different proposal for the market by using their own MT5 license instead of a third-party broker, which generally means more control over spreads and execution. But, just like any new prop trading firm in the industry, their tough challenge rules, especially those concerning consistency, should be handled with caution by the traders.

| Pros | Cons |

|---|---|

| Operates with its own license, potentially offering better execution and RAW spreads. | The 20% to 45% daily profit cap on funded accounts can significantly delay payouts for volatile traders. |

| Offers a standard 80% split that is scalable up to 100% among the highest in the 2026 market. | The Instant and One-Step Standard models utilize trailing drawdown limits which are more restrictive than static types. |

| Fully supports both Forex and Crypto trading, provides modern multi-asset strategies. | Strict prohibition of high-frequency EAs and tick-based strategies limits the utility for certain automated traders. |

| Global crypto and bank transfer payout support available. | Accounts are terminated after 30 days of inactivity, a relatively short window for swing traders. |

By offering both trailing and static drawdown models, Evercrest Funding effectively gives the trader a choice to select an account that matches his or her risk appetite. With high profit split option - a trader's continued success in an Evercrest Funding account mostly depends on his or her ability to keep a smooth equity curve while not breaking any phase-wise consistency percentages.

Evercrest Funding Account Types, Fees & Profit Split Explained (2026)

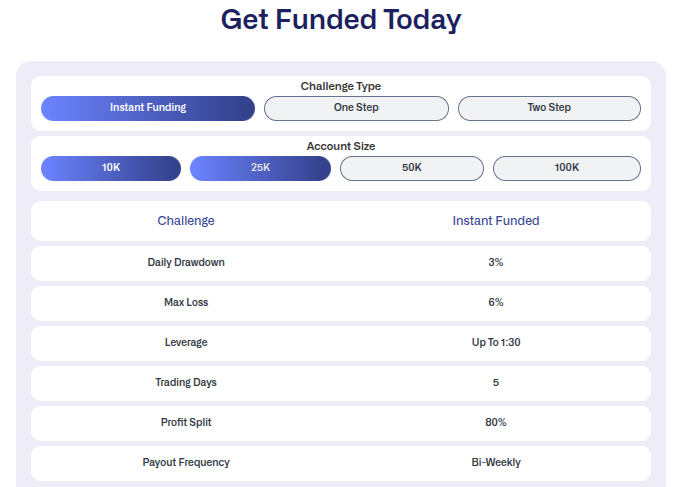

Choosing the perfect challenge needs a good comprehension of how risk parameters and expenses fit your trading strategy. The table below gives a comparison of the different Evercrest Funding evaluation models for you to decide which funding model aligns with your trading style and risk tolerance.

| Account Types | Instant Funding | 1-Step Standard | 1-Step Plus | 2-Step |

|---|---|---|---|---|

| Account Sizes | 10k to 100k | 10k to 200k | 10k to 100k | 10k to 200k |

| Account Fees | $139 to $729 | $97 to $997 | $119 to $579 | $89 to $1,099 |

| Profit Target | N/A (Direct) | 10% | 10% | 8% (Ph1) / 4% (Ph2) |

| Daily Drawdown | 3% | 4% | 4% | 4% (Constant) |

| Max Drawdown | 6% | 6% | 6% | 10% |

| Drawdown Type | Trailing | Trailing | Static | Static |

| Min. Trading Days | 5 Days | 3 Days | 3 Days | 3 Days per phase |

| Max. Trading Days | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | Up to 1:30 | 1:100 (1:50 Funded) | 1:100 (1:50 Funded) | 1:100 (1:50 Funded) |

| Consistency Rule | 20% Rule | 45% Rule (Funded) | 35% Rule (Funded) | None |

| Profit Split | 80% to 100% | 80% to 100% | 80% to 100% | 80% to 100% |

| Payout Frequency | Bi-Weekly | Bi-Weekly | Bi-Weekly | Bi-Weekly |

To assist traders in starting the evaluation by Evercrest Funding at more affordable price, the firm has been known to offer various challenge fee discounts, and promotional offers that allow traders to minimize their initial overhead when opening a new prop firm evaluation or funded account.

However, not every type of account would be suitable for a certain trading style. To help you find out how the Evercrest Funding drawdown rules and profit targets of different accounts fit your way of trading, a thorough description of each funding model is given below.

Evercrest Funding Account Breakdown

Evercrest Funding has a strong range of funded trading models specially made to meet different risk profiles and professional traders' needs. Whether you want instant market access or more structured evaluations with higher drawdown limits then the Evercrest Funding offers four separate routes to get funded.

Evercrest Funding Instant Funding Model

Evercrest Funding instant funding model is perfect for those traders who want to trade instant and start making profits immediately without going through the evaluation process. One of the great advantages is that there are no profit targets at all, which can make your trading experience much more comfortable. But, the 6% trailing drawdown still remains a very important factor to watch out for as it tracks your account's highest balance and therefore, traders need to be very careful and smart in taking profits so as not to hit the drawdown limit.

| Account Size | Account Fee | Profit Target | Max Daily Drawdown (3%) | Max Total Drawdown (6%) (Trailing) |

| $10,000 | $139 | None | $300 | $600 |

| $25,000 | $279 | None | $750 | $1,500 |

| $50,000 | $419 | None | $1,500 | $3,000 |

| $100,000 | $729 | None | $3,000 | $6,000 |

Why Choose Evercrest Funding Instant Funding Model?

- Direct Market Access: Forget / Skip the evaluation stress and get the profit sharing phase straight on day one.

- Flexible Strategy Support: Perfect for swing traders who wish to hold their positions through news and weekends without target pressure.

- Zero Profit Target: Concentrate fully on capital preservation and steady growth instead of reaching arbitrary percentage milestones.

Evercrest Funding One Step Standard Challenge

The Evercrest Funding one step standard challenge is for those traders who are willing to compromise speed and simplicity at some extension of the evaluation phase till getting a funded account. The main benefit of this account type is that the entry price is much less than for specialized "Plus" accounts while at the same time the complicated multi-phase barriers are taken out. But, the main focus for traders is on the 6% trailing drawdown that keeps track of your account's peak balance continuously in real-time.

This feature implies that if your trades are still open and you dont sell, your liquidation level will sound to always go up and thus you will have to be very careful with your trading and selling if you want to have a margin for error at all. This is because if you do not liquidate in time while the market is reversing, your little margin for error will disappear even if you do not actually lose money.

| Account Size | Account Fee (Original Price) | Profit Target (10%) | Max Daily Drawdown (4%) | Max Total Drawdown (6%) (Trailing) |

| $10,000 | $97 | $1,000 | $400 | $600 |

| $25,000 | $179 | $2,500 | $1,000 | $1,500 |

| $50,000 | $279 | $5,000 | $2,000 | $3,000 |

| $100,000 | $479 | $10,000 | $4,000 | $6,000 |

| $200,000 | $997 | $20,000 | $8,000 | $12,000 |

Why Choose Evercrest Funding One Step Standard Challenge?

- Quick Funding Road: Obtain your, funded MT5 account by reaching a single 10% profit target in just about 3 trading days.

- Scalping Potential on the Edge: The scalper, who is very accurate and quick enough to grab even the smallest moves to hit the target before the trailing drawdown will have a minimum bench of the time to work, gets here the perfect suit.

- Small Initial Capital: The price of your single, phase evaluation in the MT5 prop space is one of the most competitive.

Evercrest Funding One Step Plus Challenge

The Evercrest Funding one step Plus challenge is a high-quality evaluation program that aims at traders who want to keep risk at a minimum and are very protective of their capital. One of the main benefits of the Plus account by Evercrest Funding is its drawdown limitation concept, which is a static drawdown level that does not move up with unrealized profits, giving a much more stable and reliable kind of safety net than the Standard account. The main risk, is the 4% daily loss limit as well as the slightly higher upfront account fee that essentially a trader has to weigh the increased cost of entry against the technical advantage of a non, moving drawdown.

| Account Size | Account Fee (Original Price) | Profit Target (10%) | Max Daily Drawdown (4%) | Max Total Drawdown (6%) (Static) |

|---|---|---|---|---|

| $10,000 | $119 | $1,000 | $400 | $600 |

| $25,000 | $239 | $2,500 | $1,000 | $1,500 |

| $50,000 | $329 | $5,000 | $2,000 | $3,000 |

| $100,000 | $579 | $10,000 | $4,000 | $6,000 |

Why Choose Evercrest Funding One Step Plus Challenge?

- Non-Trailing Drawdown: Stay calm and focused with a non-moving drawdown level so that you can smoothly and effectively set aside an extra profit cushion.

- Simple and Direct Single-Phase Route: After achieving the 10% profit target, a secondary phase evaluation isn't necessary anymore and you will directly get a funded MT5 account.

- Low-Risk Systematic Traders: This account is ideal for low, risk systematic traders who use fixed risk parameters and simply want to get rid of the hassles of real-time trailing equity rules.

Evercrest Funding Two Step Challenge

The Evercrest Funding two step challenge is a pretty typical funded trading path with an 8% in Phase One and 4% in Phase Two profit targets. The main feature of the Two Step Challenge is its high 10% static drawdown, which is a lot more lenient than the firm's other funding models. The risk, is the two-phase reset which essentially means that a trader cannot start profit sharing until they have demonstrated consistent performance during the next two phases.

| Account Size | Account Fee | Profit Target (8% / 4%) | Max Daily Drawdown (4%) | Max Total Drawdown (10%) (Static) |

|---|---|---|---|---|

| $10,000 | $89 | $800 / $400 | $400 | $1,000 |

| $25,000 | $219 | $2,000 / $1,000 | $1,000 | $2,500 |

| $50,000 | $319 | $4,000 / $2,000 | $2,000 | $5,000 |

| $100,000 | $559 | $8,000 / $4,000 | $4,000 | $10,000 |

| $200,000 | $1,099 | $16,000 / $8,000 | $8,000 | $20,00 |

Why Choose Evercrest Funding Two Step Challenge?

- Higher Loss Allowance: Take advantage of a solid 10% static max drawdown which gives you more room to fluctuate with the markets.

- No Consistency Pressures: This is the only model at Evercrest that there are no daily specific profit percentage consistency rules at all.

- Institutional Standard: This is the most suitable option for low-risk systematic traders who prefer a traditional, lower-leverage approach to long-term funding, want to maintain the least risk possible.

Our Verdict on Evercrest Funding Account Types

Our research together with the analysis of Evercrest Fundings challenge models and funded account structures have revealed that these account types are basically designed to fit certain trading styles and are not a single-style-fits-all solution. The traders that are usually most advantageous to these types of accounts are the consistent day traders who could easily handle the 20% to 45% consistency rules, swing traders who are all about holding for a couple of days including weekends and during high-impact news or pro traders who don’t need to use tactics such as HFT or arbitrage which are prohibited at Evercrest fuynding.

These funded accounts might not be a good fit for beginners who don't know how to manage risk. The trailing drawdown rule is very strict and can be hard to handle. They are also not ideal for over-leveraged scalpers, because the 3% to 4% daily loss limits are quite small. Finally, any trader who doesn't understand how trailing drawdown works might be surprised by how quickly their account can be closed.

Now, you learned the account types and fees structure of Evercrest funding, so we are moving forward to examine about the firm’s drawdoena dn news trading rules.

Evercrest Funding Drawdown and News Trading Rules

Evercrest Funding accommodates a variety of evaluation and direct funding models that are each characterized by specific risk parameters intended to give traders some limits while maintaining the prop firm’s stability. Knowing Evercrest Funding's drawdown rules shows is vital if you want your account longevity because the ways of calculating differ greatly between Instant, One Step and Two Step challenge formats.

Drawdown Details

Evercrest Funding determines your drawdown amount solely based on the account model you decide on. Knowing the difference between Trailing and Static drawdown types is very important to prevent accidental breaches.

- Trailing Drawdown (Instant & One Step Standard): It follows your peak balance (High Water Mark). As your balance increases, the drawdown limit changes accordingly. However, even after losing successive trades, the limit does not return downward.

- Static Drawdown (One Step Plus & Two Step): This is a non-moving drawdown with a reference point at your starting balance. It provides a broader margin for traders who prefer to take it slow and steady rather than aggressively scaling.

Numerical Example ($100, 000 One-Step Standard Account):

- Starting Point: You are given a 6% trailing drawdown ($6,000). Your breaking point is $94, 000.

- Account Growth: You increase the account to $105,000. Since the drawdown is trailing, your new breaking point is $98,700 ($105,000, $6,000).

- The Mistake: Your account equity falls to $98,600 and you have breached the rule although you are actually still above your original $100,000 starting balance.

Major Trader Mistake: The majority of traders here often misunderstand how the trailing drawdown is calculated on equity or how it resets daily. At Evercrest Funding, on trailing accounts, the "safety net" follows your peak balance, so that technically you can get "blown up" even if your account shows a positive balance, simply if you allow a very big percentage of your peak profit to disappear.

News Trading Rules

Evercrest Funding takes a very diversified approach to market volatility, which makes it a good choice for fundamental traders.

- Allowed without restriction: Traders are allowed to open and close positions during high, impact news events for any type of account. There are no "no, trade zones" and profits made during news events with the red sign are not deducted.

Important Note: Although there are no restrictions on trading with news, the traders should be mindful of Evercrest Funding drawdown rules during these times. Since news events are usually accompanied with great slippages and spread widenings on the MT5 platform, the prop firm using raw spreads, a sudden spike might lead to the daily drawdown limit violation (4% for most accounts) even if your stop loss is correctly placed.

By laying out clear criteria for both the evaluation and the funded stages, Evercrest Funding opens up the space to a number of strategies, such as intraday scalping or news-based trading.

We suggest that traders go for the Evercrest Funding two step challenge if they need the security of a static drawdown or the Evercrest Funding instant funding model if they are sure of their ability in handling trailing risk for capital access immediately.

Trading Instruments offered by Evercrest Funding

Evercrest Funding stands as an excellent multi-asset trading prop firm with its main emphasis on the most liquid parts of the financial markets. At Evercrest Funding, traders can trade on the most popular MT5 trading platform that gives an institutional-grade experience, which is a part of their trading tool in both traditional and digital assets.

Such a focused approach makes sure that Evercrest Funding liquidity is always maintained at a high level, which is very important for a trader who is familiar with the prop firm’s drawdown rules.

Trading Instrument Details

At this time, Evercrest Funding offers support for two main types of trading instruments for traders to trade in:

- Forex: An extensive lineup of the major, minor and exotic currency pairs with RAW spreads making it possible for high-frequency and day trading style strategies to be used.

- Cryptocurrencies: A direct access to multiple cryptocurrency market where traders can make the most of the price fluctuations of the top crypto assets without having to worry about external wallets.

Access to the trading instruments can be limited based on the account type chosen and the trading platform.

Those asking themselves if Evercrest Funding is good for forex and crypto trading in MT5 will find that the firms’ RAW spreads along with a $5 per lot commission is indicative of a professional level pricing structure. Bringing these instruments together under a single MT5 license, the firm makes it easier for traders to diversify their trading style over multi-financial markets.

Evercrest Funding Spreads & Commissions: What You Really Pay

For a serious trader, the prop firm evaluation fee is only the start of the capital equation. Besides that, to understand what makes a firm viable for trading in the long run, you have to check what daily operational costs are eating away your equity. In this part of our Evercrest Funding review 2026, we take a look at the execution environment available through their proprietary MT5 setup.

Evercrest Funding utilizes an in-house MT5 license to create a professional-grade trading environment instead of going through a third-party brokerage. This vertical integration is a big advantage as it enables closer control of liquidity feeds, traders should be able to benefit from a Raw Spread environment, which is a big plus for those implementing high-frequency strategies or scalping according to the rules.

The real costs of trading are deducted from your trading profits like this:

- Forex Spreads: Typically start from 0.0 pips on the majors such as EUR/USD in the periods when market liquidity is at its highest.

- Commissions: A round figure charge of $5 per lot will be the cost of trades.

- Asset Classes: The pricing is the same for all of the prop firm’s instruments. That is to say their offer includes Forex and Crypto and a multi-asset trader will always have one cost base.

When deciding if Evercrest Funding is good for forex and crypto traders who prefer trading on MT5, the $5 commission rate makes a lot of sense compared to the 2026 prop firm market where many firms charge between $7 and $10 per lot. Keeping the commissions down and adding raw spreads is a good way for a firm to lower the overall drag on a trader's profit and thereby give the trader the ability to achieve their profit targets without being too affected by the cost of execution.

Evercrest Funding Rules (2026): What is Allowed and What is Not

Evercrest Funding features an improved trading environment with a fresh MT5 license and different types of prop firm challenges and instant account. In fact, knowing the details of the Evercrest Funding challenge rules, funded account restrictions and how the trading is regulated will help you stay in line with the requirements of the funded account and receive your bi-weekly payouts without any account or rule violations.

| Trading Strategies | Allowed or Not | Details |

|---|---|---|

| Copy Trading | Allowed | Permitted across all account types. (Both - challenge and funded phase) |

| News Trading | Allowed | For both challenge and funded phase, there is no restrictions on trading high-impact news events. |

| Weekend Holding | Allowed | Positions can be held through the weekend. (Both - challenge and funded phase) |

| Expert Advisors (EAs) | Partial | Standard EAs allowed - HFT, Arbitrage and Tick Scalping are strictly prohibited in both challenge phase and funded account. |

| Forex & Crypto | Allowed | Both asset classes are available on the MT5 platform. |

| Hedging | Allowed | Permitted within a single account. |

Prohibited Practices at Evercrest Funding

To keep its capital allocation in good order, Evercrest Funding applies a series of very clear rules against predatory or non-market-standard behaviors. If you execute any of the following actions, your account will be terminated:

- High-Frequency Trading (HFT): Using execution algorithms that are ultra-fast.

- Arbitrage Trading: Taking advantage of price differences between different feeds or platforms.

- Tick Scalping: Opening and closing trades within seconds to make small profits from fluctuations in prices.

- Consistency Breaches: Not following the specific daily profit caps (Instant 20%, One Step Standard 45%, and One Step Plus 35%).

Breach Types: Soft vs Hard

Knowing the difference between breach types is very important if you wish to survive in the funded trader program for a long time:

- Hard Breach: Violating the Max Daily Drawdown or Maximum Overall Drawdown rules. So if your 100k account equity on a One Step account falls below $94,000 (6% Max Drawdown) then the account will be closed permanently.

- Soft Breach: Evercrest runs a hard breach policy for drawdown breaches. However, minor administrative errors (like exceeding a lot size limit if applicable) may close the trade but not the account. But, most technical rule breaks here point to hard breaches.

- IP Address Policy:

Traders should stay away from using VPN or VPS that changes IP addresses frequently. Opening multiple accounts and trading in different geographical IPs at the same time can lead to an account sharing security review, a standard prohibited practice in the prop industry. Account sharing is banned to make sure the registered trader is the one executing the strategy.

Our Verdict on Evercrest Funding Rules

The challenge rules and account restrictions at Evercrest Funding are basically transparent but one has to be very disciplined, especially in regard to the different types of drawdowns. Since the One Step Standard and Instant Funding models use a trailing drawdown, they are much more restrictive than the One Step Plus and Two Step Challenge which have a static drawdown. If you are a trader looking to trade news and want to have the option of trading during weekends then the rules will work for you. The consistency rules during the evaluation phases mean that this brokerage is more suitable for "steady-handed" traders rather than those who want to pass through a high-volatility trade only.

Evercrest Funding Scaling Plan – Grow Your Account Over Time

Evercrest Funding has set a clear funded account growth path for those traders who are disciplined and show a consistent profitability track record in the long run. The Evercrest Funding scaling plan is aimed at encouraging low-risk trading behavior by gradually expanding the limit of the capital allocation which will be based on the historical account data. Hence, trading accounts are allowed to switch from standard account sizes to larger capital tiers. Traders then get the opportunity to work with bigger positions while still respecting the firm's main risk framework.

Scaling Plan Details

Evercrest Funding has adopted a performance-based scaling approach that recognizes the efforts of traders who not only keep their accounts healthy but also manage to grow them to a certain level. The main conditions are as follows:

- Time-Based Condition: Account review for possible scaling is done on a quarterly (3-month) basis. This is a measure to ensure that the growth is due to a long-term record of good performance and not just a temporary market condition.

- Performance Requirement: For a scaling-up to occur, a trader will need to have a net profit of at least 10% over the given period.

- Consistency Requirement: Traders have to prove that the trading style they use is consistent, the profit cannot be from a single exceptional trade but instead the profit should be the aggregate of a series of profitable trades.

- Account Status: Review of the account will only occur if the account has a positive balance and all previous payouts have been correctly processed.

- Growth Incentive: Those who scale up are able to increase their accounts by a quarter of the original account size with the maximum scaling amount being equivalent to a $560k account.

Understanding the Growth Path

Scaling plays a crucial role, especially for those contemplating the offer of Evercrest Funding for MT5 forex and crypto traders. It provides the mechanism for a 100k account to continue expanding until it eventually reaches the firm's maximum capital funding limit of 300k and even beyond by scaling milestones. The firm, by linking capital increments to both profit and consistency, makes sure that only those who have a professional attitude towards risk management are granted the highest levels of funding.

At The Trusted Prop, we believe scaling strategies to be an essential element in determining a prop firm’s potential for survival over time. The Evercrest Funding provides a scaling system which is more suitable for the trader’s who are patient and consider the duration of their trading career as a factor rather than the use of aggressive high-risk tactics. We advise traders to get acquainted with the specific Evercrest Funding drawdown and consistency regulations for their selected account type as adherence to these limits is the main condition for any subsequent capital increase.

Payment Methods & Payout Process at Evercrest Funding

Figuring out the financial operations of a prop firm is a must for a trader who has a focus on profitability over the long-term. As a newcomer firm in 2026, Evercrest Funding has done a great job of globally accessible features. This section is about an Evercrest Funding payout review and talks about the whole process from paying for your first challenge account to to receiving high profit split via payouts.

For example, if a payout request is sent on Monday, it is usually done within one to three days. After the internal review team approves the payout, the money is sent out right away, but the time when it will show up in your bank account will mainly depend on the withdrawal method you chose.

Payment Methods Supported at Evercrest Funding

Evercrest Funding has offered an extensive range of payment gateways that support the MT5 prop firm accounts to ensure a smooth on boarding process. So traders are able to fund their account instantly and get started on their evaluation without waiting for paperwork.

- Cryptocurrency: Major tokens are supported for fast and direct worldwide payments.

- Credit/Debit Cards: Basic Visa and Mastercard options for those who prefer traditional banking.

- Mobile Wallets: Also Apple Pay is among the supported ones for traders using their phones.

Payout Options & Withdrawals at Evercrest Funding

Evercrest Funding offers multiple ways for traders to request profit withdrawal. The firm’s key focus is on providing speed and decentralization when its comes to challenge fee payments and profit withdrawals. At the moment, the prop firm has two main methods, with a third major integration on the way in 2026.

- Cryptocurrency (USDT): This is the most favored way of payment for a majority of traders being that it entails lower fees and transfers being accomplished very fast regardless of borders.

- Bank Transfer: Traders who are lovers of traditional wire transfer direct to their local bank accounts can take advantage of this.

- Rise (Coming Soon): Evercrest Funding is partnering with Rise, it will allow a more formalized contract-based payout system for professional traders.

How the Payout Process Works at Evercrest Funding?

Knowing at what frequency Evercrest Funding is paying traders, helps you plan your personal cash flow. After the evaluation phases, the firm follows a payout process of bi-weekly cycle.

- Eligibility: Traders must be at the funded stage and also trade for a minimum of 14 days (bi-weekly frequency).

- Request Submission: Payouts can be requested via the trader's dashboard. A request can only be made when the trader has no open positions.

- Consistency Check: The prop firm will check the account to verify that the trader has complied with the Evercrest Funding drawdown and consistency rules (for example, the 20%, 35% or 45% daily profit cap rules depending on your account type).

- Processing & Approval: Profit sharing (from 80% to 100%) is determined and the amount is sent through the trader's selected means once the account has been audited and approved.

After thoroughly examining the Evercrest Funding's payout process, we found that the firm’s account fee payment and payout methods are said to the fast and flexible as per multiple traders’ review. Starting with bi-weekly payouts, they offer a competitive edge over those prop firms which require traders to withdraw their very first profit after a waiting period of 30 days.

Moreover, the availability of Evercrest Funding instant funding permits traders to initiate the payout cycle without delay, if they adhere to the very tight 20% consistency rule. Although the prop firm is still new in the industry (Dec 2025), their "own MT5 license" instead of a white label broker indicates a long-term operational stability. For traders who put crypto-friendly profit withdrawals and frequent prop firm payout access as their top priorities - Evercrest Funding can be an attractive choice for traders in 2026.

Countries Restricted at Evercrest Funding

Here at The Trusted Prop, we are committed to providing clear and actionable data, as part of this commitment we have delved into the jurisdictional limitations of this firm. Knowing whether a region is served by a prop firm account is a crucial first step for any trader planning to open an Evercrest Funding account to be sure of local regulations compliance and successful processing of a payout.

According to our Evercrest Funding review 2026, the following countries have been banned from the purchase of either evaluation or funded accounts at present:

• Bangladesh

• Bulgaria

• Chile

• Cuba

• Hong Kong

• Iran

• Japan

• Jordan

• Lebanon

• Libya

• Malaysia

• Myanmar

• North Korea

• Russia

• Senegal

• Somalia

• South Korea

• Sri Lanka

• Sudan

• Syria

• Togo

• Thailand

• Vietnam

Disclaimer: Country restricted status can be changed due to regulatory or payment provider requirements.

Traders living in these areas can follow the official updates or get in direct contact with the support team, as prop firm change their compliance lists quite often in response to international financial laws that keeps evolving. It is especially important to Evercrest Funding payout review cases when going through the KYC verification procedures, as the place of residence is the major factor in the identity verification, which is the successful part of the process.

Our Final Verdict on Evercrest Funding

Evercrest Funding is a new prop firm launches on december 2025 in trading market with its own MT5 license. Even though they are fresh to the industry, they are able to respond to a wide range of trading skills by delivering various models such as Evercrest Funding instant funding and multi-step evaluations.

The prop firm is incredibly flexible as it allows news trading and weekend holding which is a plus for swing traders and traders used to automated strategies. The difference between the trailing and static Evercrest Funding drawdown rules as well as the specific consistency requirements makes picking an account a bit tricky.

While Evercrest Funding two step challenge accounts are high in value with static limits and no consistency rules, the instant account calls for a more disciplined profit distribution with fast access to funded capital. In the end, Evercrest Funding can be an excellent option for forex and crypto traders who are looking for a straightforward trading environment with flexible trading rules.

Want to know about the other newly launch prop firms in early 2026, visit our The Trusted Prop site to get detailed reviews and latest prop firm offers.