BullTador Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full BullTador review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

0.0

0.0

BullTador

Commodities, Stocks, Crypto, Forex

2025

CEO: Sven Christian Hofmann

MatchTrader

Trading View

Crypto

Wire Transfer/ Bank Transfer

Crypto

Wire transfer/ Bank Transfer

Mastercard

Visa

MatchTrader

BullTador Detailed Review 2026

BullTador is a UAE-based prop firm, which provides traders with an opportunity to trade Forex, Cryptocurrencies and Stocks using different evaluation methodologies. The prop firm might suit traders with discipline who are after a high BullTador profit split of 90% and a modern platform featuring TradingView integration. While BullTador requires focused individual performance on instant accounts, traders benefit from a structured drawdown rules designed to limit risk exposure, to protect their capital during market volatility, ensuring a professional environment that rewards long-term consistency and genuine skill.

In this BullTador review 2026, we analyze the latest prop firm trading rules and how to successfully manage a funded account within their ecosystem.

BullTador Prop Firm Overview

The following information is compiled from the official website of BullTador, public disclosures and available trader feedback as of 2026.

| Category | Details |

| Company Name | The prop firm name is BullTador. |

| Legal Name | The BullTador prop firm's legal name is Bulltador LLC FZ. |

| Registration Number | BullTador's registration number is 0000004075708. |

| CEO | The CEO of BullTador is Sven Christian Hofmann. |

| Headquarters | The headquarters is located at Ras Al Khaimah, UAE. |

| Broker | BullTador is associated with a Trading Technology Provider known as Match-Trade Technologies. |

| Operating Since | BullTador has been operating since November 2025. |

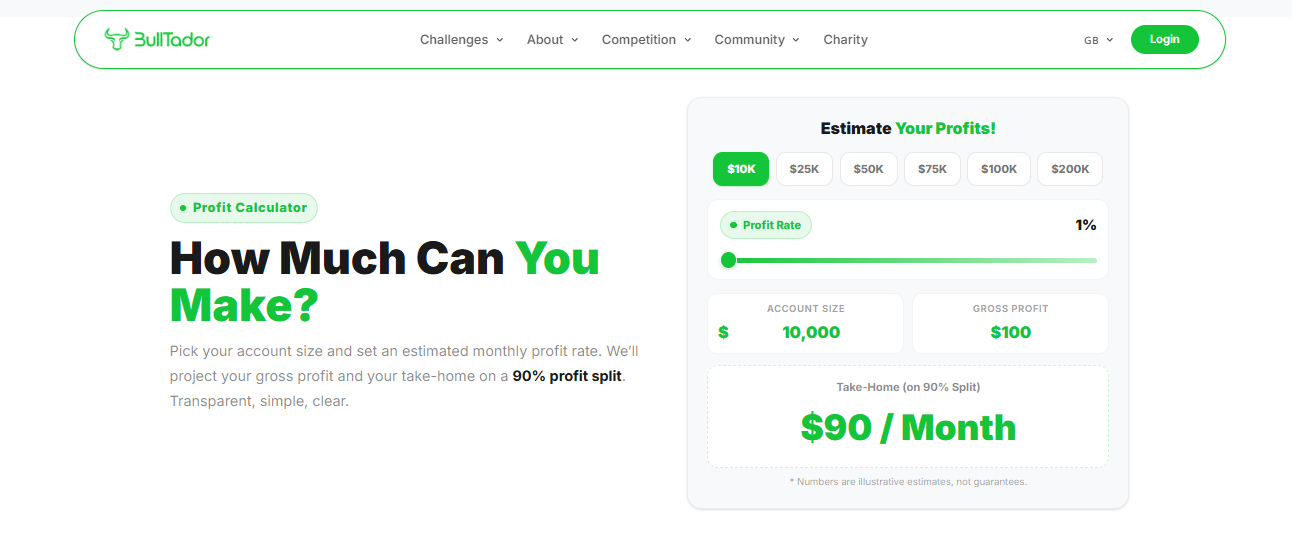

| Account Sizes | BullTador provides account sizes ranging from $10,000 to $200,000. |

| Profit Split | BullTador offers up to 90% profit split. |

| Challenge Types | BullTador offers 2-Phase, 1-Phase, Instant Funded and Day Trader challenges. |

| Payout Cycle | BullTador offers payouts on a daily basis (after the initial 14-day eligibility). |

| Payout Method | The withdrawal methods supported by BullTador are Visa, Mastercard, Crypto and Bank Transfer. |

| Trading Platforms | BullTador supports trading on MatchTrader with full integration of TradingView. |

| Financial Markets | BullTador supports trading in 41 Forex pairs, 26 Cryptos, 17 Commodities, and 155 Stocks. |

| Max Allocation | BullTador offers a maximum allocation of $4,000,000. |

| Max Scaling | BullTador provides scaling opportunities up to $4,000,000. |

| Support Mail | [email protected] |

| Trustpilot Score | BullTador has a 4/5 rating based on 7 trader reviews (as of 2026). |

Pros and Cons of Trading with BullTador

BullTador is a prop firm catering to the needs of competitive traders by offering a competitive trading conditions supported by modern technology infrastructure. Understanding the BullTador trading rules, including drawdown limits and profit split structure, is critical before purchasing any evaluation account. That said, a thorough comprehension of the requirements both during and after the challenge stages is a must for anyone willing to buy into the BullTador prop firm accounts 2026.

| Pros | Cons |

|---|---|

| BullTador profit split of 90% allows traders to retain a significant portion of gains. | Copy trading is prohibited after getting funded, which may impact signal-based traders. |

| BullTador payout frequency is on a daily basis providing fast capital access after the first 14 days. | Strict IP monitoring rules may result in account suspension if multiple locations access the account simultaneously. |

| TradingView integration offers professional-grade charting and analysis. | 30-day inactivity period requires traders to stay active to avoid account expiration. |

| 26 Cryptocurrencies and 155 Stock assets provides excellent diversification. | Relative newness of the firm (Nov 2025) means a shorter track record. |

Most of the traders’ primary challenge comes from sticking to the drawdown limit of 5% set by BullTador. Although the rules are geared towards competition, the prop firm’s strictness to IP address mismatches and funded-stage copy trading without negotiation. These enforcement policies indicate that BullTador emphasizes individual trading performance and rule compliance. Traders unfamiliar with structured prop firm environments may need time to adjust.

BullTador Account Types, Fees & Profit Split Explained (2026)

BullTador offers multiple funded account models including 1-Step, 2-Step, Instant Funding and Day Trader account types. Each model differs in fees, drawdown structure, leverage and payout eligibility.

Understanding the BullTador account structure is critical, as fees, drawdown type and profit targets directly impact a traders’ long-term profitability.

BullTador Account Types Comparison Table

| Account Types | 1-Step Challenge | 2-Step Challenge | Instant Funding | Day Trader Challenge |

|---|---|---|---|---|

| Account Sizes | $10k - $200k | $10k - $200k | $1k - $50k | $10k - $200k |

| Account Fees | Standard | Standard | Premium | Standard |

| Profit Target | 10% | 8% (P1) / 5% (P2) | N/A | 10% |

| Daily Drawdown | 5% | 5% | 7% | 5% |

| Max Drawdown | 10% | 10% | No Max Drawdown | 10% |

| Drawdown Type | Balance-based | Balance-based | Static | Balance-based |

| Min. Trading Days | 24 Hours | 24 Hours | 24 Hours | 24 Hours |

| Max. Trading Days | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | 1:50 | 1:50 | 1:50 | 1:50 |

| Consistency Rule | No | No | No | No |

| Profit Split | Up to 90% | Up to 90% | 80% | Up to 90% |

| Payout Frequency | Daily | Daily | Daily | Daily |

BullTador frequently offers discounts on challenge and funded accounts, which can significantly reduce initial evaluation cost of entry. The comparison table above helps traders assess drawdown type, leverage and profit targets side-by-side to determine which funding model aligns with their trading strategy and risk tolerance.

BullTador 1-Step Challenge

The BullTador 1-Step Challenge provides traders who want a simple route to getting funded by achieving just one 10% profit target. One of the main perks is the balance-based drawdown model that gives a clearer and less volatile risk indicator than trailing equity models do, as it only resets at the beginning of each day-based on the account balance.

Traders still have to be careful about the risk coming from the tight 5% daily drawdown limit because a day of high volatility might break the rule even if the trader managed to stash some profit in previous days. Below is a detailed breakdown of BullTador 1-Step Challenge account sizes, entry fees, profit target and drawdown rules requires to pass the evaluation:

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

|---|---|---|---|---|

| $10,000 | $69.99 | $1,000 | $500 | $1,000 |

| $25,000 | $119.99 | $2,500 | $1,250 | $2,500 |

| $50,000 | $199.99 | $5,000 | $2,500 | $5,000 |

| $75,000 | $299.99 | $7,500 | $3,750 | $7,500 |

| $100,000 | $499.99 | $10,000 | $5,000 | $10,000 |

| $200,000 | $999.99 | $20,000 | $10,000 | $20,000 |

Why Choose the BullTador 1-Step Challenge?

The BullTador 1-Step challenge has become the favorite path for active traders who wish to grab opportunities in the prop trading market without having to go through a multi-step evaluation process.

- Streamlined Funding: Become a funded trader by simply hitting a 10% profit target in just one phase and get 90% profit share in funded account.

- Modern Execution: Perfect for scalpers that take full advantage of the MatchTrader platform's TradingView integration for pinpoint technical entries.

- Rapid Payout Access: Get the daily payout cycle after you have already completed an initial 14 day funded account eligibility period.

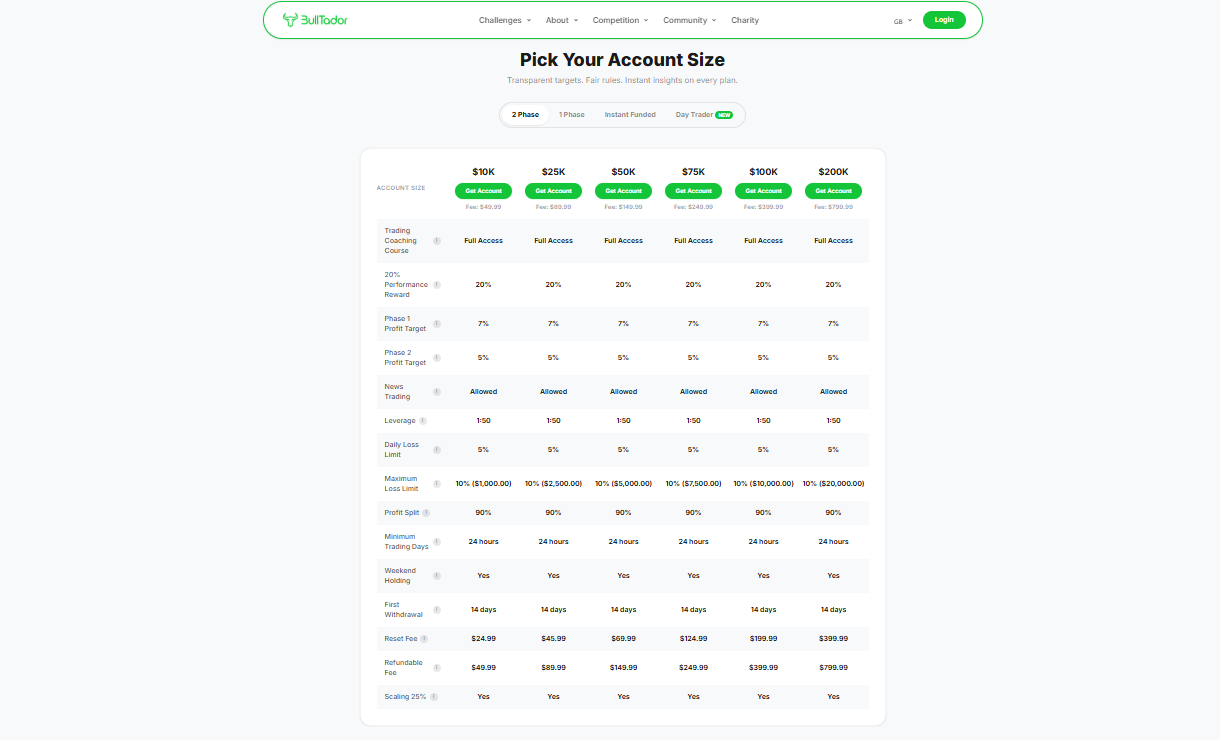

BullTador 2-Step Challenge

The BullTador 2-Step Challenge is a traditional performance evaluation framework that aims to identify traders who can consistently deliver results in two separate phases. This model's main advantage lies in the 10% maximum total drawdown, which gives a significantly larger safety buffer for long-term strategies than the single, phase options of the firm. But, the biggest risk is the very strict same IP security measure - as the firm requires manual trading to confirm real activity, any accidental change in the login location or the use of more than one device can result in the account's suspension according to their anti-theft professional standards. Here is a detailed breakdown of BullTador 2-Step Challenge account sizes, entry fees, profit targets and drawdown rules mentioned below:

| Account Size | Account Fee | Profit Target (P1: 7% / P2: 5%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

|---|---|---|---|---|

| $10,000 | $49.99 | $700 / $500 | $500 | $1,000 |

| $25,000 | $89.99 | $1,750 / $1,250 | $1,250 | $2,500 |

| $50,000 | $149.99 | $3,500 / $2,500 | $2,500 | $5,000 |

| $75,000 | $249.99 | $5,250 / $3,750 | $3,750 | $7,500 |

| $100,000 | $399.99 | $7,000 / $5,000 | $5,000 | $10,000 |

| $200,000 | $799.99 | $14,000 / $10,000 | $10,000 | $20,000 |

Why Choose the BullTador 2-Step Challenge?

The 2-Step evaluation is basically made for those disciplined traders who want more significant loss allowance while dealing with professional grade technical environments.

- What the first phase does (7%) and second (5%) is that the traders have to do really good work step-by-step to get the 90% profit split.

- A system trader with low risk who also needs the 10% total drawdown to have some leeway for their strategy without risking a hard breach will find this 2 step challenge suitable for them.

- Traders who want full MatchTrader integration with TradingView to get advanced multi-asset analysis across Forex, Cryptos and Stocks.

BullTador Instant Funding Model

The BullTador Instant Funding account is considered to be a top-tier account with unfettered access to the profit phase from day one. One of the main features of this account is the static drawdown structure which is set at the original hard floor and does not follow your unrealized gains, giving you a constant and predictable safety net while you make more profits. The main risk-though, is that in some setups there is no maximum total drawdown over the daily limit, so you would have to be very careful and stick strictly to the 7% daily static limit rule if you want to keep your account sustainable while operating at a lower initial leverage of 1:50. Here is the complete breakdown of BullTador Instant Funding model account size, fees and drawdown limits.

| Account Size | Account Fee | Profit Target | Max Daily Drawdown (7%) | Max Total Drawdown |

|---|---|---|---|---|

| $1,000 | $125 | None | $70 | None |

| $2,500 | $225 | None | $175 | None |

| $5,000 | $450 | None | $350 | None |

| $10,000 | $950 | None | $700 | None |

| $25,000 | $1,350 | None | $1,750 | None |

| $50,000 | $2,000 | None | $3,500 | None |

Why Choose the BullTador Instant Funding Model?

This model caters to traders with strong trading skill who want to have immediate access to capital without going through the psychological torture of a "pass/fail" evaluation phase.

- Immediate Profit Participation: You don't have to go through the 30 to 60 day evaluation period and after 14 days of trading actively, you will be able to collect your first payout.

- Capital Protection: This product can be a perfect match for low-risk systematic traders who want to have a fixed risk floor (Static Drawdown) which over time allows them to accumulate a profit cushion.

- Diversified Asset Access: Trading of more than 155 global stocks and 26 cryptocurrencies is available to you at once, along with full TradingView integration for professional grade analysis.

BullTador Day Trader Model

The BullTador Day Trader Challenge is a unique evaluation model designed for rapid traders who need the highest buying power for their day trading strategies. The major benefit of this account is the 1:100 leverage, which offers a substantial increase in purchasing power compared to the standard 1:50 leverage found in other BullTador models that it significantly outperforms in terms of allowing traders to take larger positions on small price movements. Unfortunately, the main danger is the 5% daily balance-based drawdown, which gets tight when trading with such high leverage. A few pips from slippage or a sudden news spike can quickly turn into a hard breach even before a trader realizes that their position needs adjusting. Here is the complete breakdown of BullTador Day Trader Challenge size, fees, profit target and drawdown limits.

| Account Size | Account Fee | Profit Target (10%) | Max Daily Drawdown (5%) | Max Total Drawdown (10%) |

|---|---|---|---|---|

| $10,000 | $69.99 | $1,000 | $500 | $1,000 |

| $25,000 | $124.99 | $2,500 | $1,250 | $2,500 |

| $50,000 | $199.99 | $5,000 | $2,500 | $5,000 |

| $75,000 | $299.99 | $7,500 | $3,750 | $7,500 |

| $100,000 | $499.99 | $10,000 | $5,000 | $10,000 |

| $200,000 | $999.99 | $20,000 | $10,000 | $20,000 |

Why Choose the BullTador Day Trader Model?

BullTador Day Trader might be a suitable choice of funding model for aggressive intraday traders who want to make the most of their capital and get quick execution of their trades.

- Enhanced Leverage (1:100): On high-confidence intraday setups in the Forex, Commodities and Indices markets use double the industry standard leverage to maximize your gains.

- Balance-Based Risk Tracking: With your drawdown being reset each day based on the initial level of your account, you get that clear reset point for each trading session, which lets you plan your trading better.

- Scalping-Based Traders: Such a high leverage account is perfect for scalpers who want to take big positions for small tick movements under strict daily loss limits.

Our Verdict on BullTador Account Types

Based on our research and analysis of BullTador’s challenge models and funded account structures, we find that these account types are designed to suit specific trading styles rather than a one-size-fits-all approach. These accounts may suit consistent day traders and low-risk systematic traders who can operate within a 5% daily drawdown framework. Traders who typically benefit include experienced prop firm participants familiar with balance-based risk models and structured evaluation phases. Another plus point is that all BullTador challenge accounts have 100% refundable fee system. This means once you pass the challenge and request profit withdrawal then your account fees are fully refunded with the first payout.

Although, these accounts may not be suitable for beginners without strong risk management discipline or traders heavily dependent on news-based volatility spikes. Traders unfamiliar with drawdown mechanics may struggle under strict daily loss limits.

For the latest pricing and verified discount offers on BullTador, check the updated listing on The Trusted Prop.

BullTador Drawdown and News Trading Rules

Before starting the BullTador challenge or manage its instant funded account, it is crucial that you understand BullTador's drawdown rules and news trading rules. The prop firm uses structured daily drawdown limits that traders must follow at all times. Not adhering to these risk parameters leads to an account failure instantly, even if the profit potential is not realized.

The BullTador daily drawdown limit of 5% is calculated based on the account's starting balance each day. This gives a clear, static marker for traders to follow each day, instead of an intricate trailing equity model.

Drawdown Details:

The daily loss limit is 5% of the starting balance of the day.

- Example: If your account begins the day at $100,000, your daily drawdown limit is $5,000. If your balance (including floating losses) hits $95,000, the account is considered failed.

- Common Mistake: A lot of traders mistakenly think that the daily limit changes at any time (normally midnight server time) and that previous profits always accumulate to prevent a daily violation.

News Trading Details:

- Allowed, no restriction: BullTador allows news trading during both the challenge and funded stages. Traders are free to take advantage of high-volatility events like NFP or CPI to make significant profit out of it.

Trading Instruments offered by BullTador

BullTador provides access to multiple financial markets through the MatchTrader platform. Instrument variety plays an important role in strategy diversification, especially for traders managing risk across asset classes. The available instruments include forex, crypto, commodities and stocks.

Instrument availability may vary depending on the selected account type and trading platform. Traders should review leverage, contract size and spread conditions before placing trades. A broader instrument selection can support diversified strategies but should always align with individual risk management rules.

- Forex: 41 currency pairs that cover all major, minor and several exotic pairs for 24/5 trading.

- Cryptocurrencies: 26 popular digital assets, allowing you to trade even during the weekends 24/7 on high-volatility coins like Bitcoin and Ethereum.

- Commodities: 17 instruments, including precious metals like Gold (XAUUSD) and Silver and Energy products like Oil.

- Stocks: 155 individual global stocks, giving you a chance to trade equity price movements without having to use a separate brokerage.

Note: Instrument availability may depend on the selected account type and trading platform.

The availability of multiple asset classes allows traders to apply different strategies, including cross-asset exposure and diversification. However, instrument availability may vary depending on the selected account type and platform configuration. Traders should verify specific contract specifications before trading.

BullTador Spreads & Commissions: What You Really Pay

It is vital for traders to comprehend the major cost elements of trading in order to sustain trading profitability over the long-term. With this goal in mind, BullTador has quite cleverly set up its fee structure to be competitive in the prop trading industry, so that the BullTador profit split 90% will not be taken away because of an overrun of execution costs. The prop firm through the MatchTrader platform offers a very clear and transparent environment where you can see in real, time the reductions in your account due to fees.

Spreads and Commissions Details

The prop firm through the MatchTrader platform offers a very clear and transparent environment where you can see in real-time the reductions in your account due to fees. BullTador execution works through the MatchTrader platform whose pricing setup aims at replicating ECN, style liquidity. This is a very good way for the high-frequency traders and scalpers since these types of traders need very tight pricing to be able to keep their advantage.

- Forex Spreads: On the primary pairs such as EUR/USD and GBP/USD, spreads are extremely competitive, often starting at 0.0 and going up to only 0.4 pips during very liquid market hours (London and New York).

- Commissions: In the case of Forex, usually, the prop firm grounds its commission rate on the industry top-tier benchmarks match, facilitating the most efficient cost modeling when reaching the daily profit target figures.

Analyzing the BullTador trading rules 2026, the costs should be looked at alongside the BullTador drawdown limits of 5%. The lower the spreads, the quicker a trade can become net positive helping to save the daily drawdown buffer. Intraday traders, in particular, must consider these effective trading costs as a risk management tool. Overall, prop firm trading fees at BullTador are designed to facilitate active trading styles without creating a very high barrier to entry. By offering both low BullTador spreads and a high profit sharing ratio, the firm creates a cost-effective environment for traders who stick to their plans.

BullTador Rules (2026): What is Allowed and What is Not

Navigating the BullTador trading rules 2026 is vital if you want to keep your funded account for a long-term and regularly receive your payouts. Although the firm gives a lot of room for maneuver during the evaluation stages, once you have a funded account, you are under stricter monitoring as the capital belongs to the firm. Knowing these limits allows you to trade securely and comfortably while complying with the BullTador rules for a funded account.

These rules include strict daily drawdown limits, overall drawdown rules and clearly defined news trading rules that every funded trader must understand before scaling their account.

| Trading Strategies | Allowed or Not | Details |

|---|---|---|

| EA / Robots | Allowed | Algorithmic trading is permitted across all stages provided they do not use high-frequency or arbitrage strategies. |

| Copy Trading | Restricted | Allowed during the challenge phase - Prohibited once the account is funded to ensure manual performance and avoid signal-based account management. |

| News Trading | Allowed | Traders can trade high-impact events like NFP and CPI without restrictions. |

| Weekend Holding | Allowed | Positions can be held through the weekend on all account types, supporting swing trading styles. |

| Scalping | Allowed | Intraday scalping is permitted, provided it complies with standard risk management and lot size rules. |

Prohibited Practices at BullTador

In order to provide a fair trading environment, BullTador is strict about a list of prohibited activities. If you are found to be engaging in these behaviors, also known as Gambling Rules or manipulative behaviors, your account will be terminated without any further warning.

- IP Address Violations: Simultaneous logins from different IP addresses, especially from different geographic regions that may trigger fraud detection systems and result in immediate investigation or account termination.

- Arbitrage Trading: It is totally forbidden to use latency or price feed gaps to obtain an unfair advantage.

- Grid/Martingale Strategies: On the one hand, the use of EAs is allowed but strategies that consist of over-layering or using high-risk martingale recovery may be considered as risk rules.

- Inactivity: Trading accounts must show activities at least once in a 30 day period. When no trade has been made, it will lead to a soft breach (account expiration).

Soft vs Hard Breaches at BullTador

One of the major factors that determine how long a trader will last with BullTador is whether they understand the difference between soft and hard breaches.

- Hard Breach: When a trader commits a hard breach, they have violated the BullTador rules that are not forgivable and doesn’t come with second chances. Hence, this results in getting your funded account closed immediately and you won’t be receiving a chance to reset your account.

Example: If a trader exceeds the 5% daily drawdown limit even once, it constitutes a hard breach. The account is closed immediately and cannot be reset under standard conditions.

- Soft Breach: These are minor rule infractions that may lead to a trade being rescinded or an account being temporarily frozen but the account is still functional.

Example: If your account remains inactive for 30 days, it is regarded as a soft breach. When an account expires, you can normally get in touch with the support team to get it reactivated, but you might be losing the profits you have earned.

Overall, BullTador prop firm rules revolve mainly around strict risk management especially in terms of drawdown rules and protecting capital. Traders with a solid grasp of daily drawdown mechanics and adherence to the news trading regulations will hardly ever run into the scenario of account violations that come as a surprise. Going over these rules thoroughly is very important before trading a funded account.

Our Verdict on BullTador Rules

At The Trusted Prop, through our research, we conclude that BullTador is quite clear with its rules but the trader needs to be very disciplined, especially when it comes to safety. The restriction on copy trading for funded accounts and the strict IP address monitoring indicate that the firm prioritizes individual trading performance over signal-based account activity. Being able to trade around news and holding trades over weekends are great features. Overall, the rules are generally transparent but require discipline. Traders who follow structured risk management practices may find the environment manageable, while aggressive recovery-based or high-leverage trading styles may struggle under these conditions.

BullTador Scaling Plan – Grow Your Account Over Time

The BullTador prop firm scaling plan is structured for traders who prioritize trading consistency and long-term capital management. Instead of giving one more balance increase, the firm leads the funded account growth through a structured path, which allows successful participants to handle substantially larger capital allocations. This orderly approach guarantees that the performance and risk discipline that have been demonstrated are the ones that are reflected in the capital increases.

Scaling Plan Details

BullTador has a performance-based scaling model in place, which means that traders can get a maximum capital allocation of up to $4,000,000. This scaling plan requires the traders to have a steady track record of consistent profit making by following the underlying criteria that are different from other firms aggressive promotional funding models:

- Performance Requirement: In order to be eligible for an account increase, the trader is usually required to achieve a net profit gain (commonly 10% or more) and at the same time, not violate any of the drawdown limits 5% set by BullTador.

- Time-Based Condition: In most cases, a scaling review is done after a 3 months period. This time frame is what allows the firm to make sure that the traders winning was not a single lucky streak but indeed a repeatable strategy.

- Consistency Requirement: A trader is not only expected to be consistent with their trade volume and risk parameters but also be careful not to exhibit gambling behavior. A sudden increase in lot sizes during the scaling period will be taken as a red flag and the account might get disqualified from receiving a balance increase.

- Increment Increases: Account scaling is done in steps, each step being a fraction of 25% to 50% of the original account balance per successful review cycle.

The objective of the BullTador scaling framework is to transition a retail trader into a high-capital manager by implementing disciplined risk management rules that helps them in long-term trading. By requiring a quarterly performance check, the firm ensures that funded account growth is sustainable, protecting both the firm's capital and the trader. Ultimately, this prop firm scaling plan reinforces long-term stability, though continued eligibility remains strictly dependent on ongoing compliance with all trading rules and drawdown limits.

Payment Methods & Payout Process at BullTador

First thing is to know about the payment methods and payout process at BullTador is essential before getting into this prop firm. In this BullTador review 2026, we explain the prop firm’s payout frequency, processing timelines, supported withdrawal methods and key eligibility conditions that traders should be aware of before requesting their first profit split.

Details of Payment Methods Supported at BullTador

BullTador goes out of its way to help traders have diverse ways of funding their accounts. For that reason, they support a wide range of the most popular global payment gateways, including;

- Debit & Credit Cards: Visa and Mastercard transactions are secured.

- Cryptocurrency: Quick and unlimited payments are done using your favorite digital assets.

- Bank Transfer: Direct wire transfers for those who just want to do their banking as usual.

Details of Payout Options Supported at BullTador

On deciding to withdraw profits under BullTador’s 90% profit split model, you are surrounded by a number of trustworthy means through which you can get the funds:

- Visa/Mastercard: In some cases, your card may be directly credited or refunded.

- Crypto (USDT/BTC): Traders that are across borders usually pick this channel because it is the fastest and charges the lowest fees.

- Bank Transfer: A secure way to have your money directly through an international wire transfer into your local bank account.

How the Payout Process Works

Before your first profit withdrawal request is approved there are a few BullTador payout conditions that your account must pass through – which usually includes a series of standard security and compliance audits. Below is the complete BullTador payout process which is applicable on each account type:

- Eligibility Period: Before you can request your first withdrawal, your account must have been funded for at least 14 days.

- Profit Requirement: Your account balance should be higher than the initial balance at the time of the withdrawal request.

- Payout Frequency: Once trader request their first payout after 14 days, from their onwards traders are free to request daily payouts.

- Request Submission: You can only request payouts from your trader dashboard. After the request is submitted, the team will check the account to see if there are any rule violations.

- Verification: The firm conducts a security check which among other things, includes verifying funded account rules like drawdown rules, IP address consistency and trading restrictions compliance that have not been breached prior to payout approval.

- Processing: Once your withdrawal is approved then the firm calculates your 90% profit share and initiates the transfer via your selected payment gateway.

For example, if you make a payout request on Monday, your request will usually be processed within 1 to 2 days, and the money will be there on your account, on Wednesday or thereabout.

Note: Processing speed may vary depending on verification status, payment provider and regional banking timelines.

Our Verdict on BullTador Payout Process & Payment Methods

Based on our review at The Trusted Prop, BullTador’s payout structure appears competitive compared to many traditional evaluation-based prop firm models. For prop traders who rely on trading as a primary income source, the move to a daily payout frequency, right after the first 14 days, is a tremendous benefit. The very first 14-day "lock-up" period is a standard, the speed of the subsequent processing is in fact highly competitive. However, traders should carefully review the 14-day eligibility requirement and rule verification process, as any breach prior to payout approval may delay or void withdrawals.

Countries Not Allowed at BullTador

BullTador currently operates as a globally accessible prop firm, which means they allowing traders from most regions to participate in its evaluation and funded account programs. However, country eligibility is subject to regulatory frameworks and payment provider policies. Traders should always verify prop firm funded account access eligibility before purchasing a challenge.

Restricted Countries

- Currently, no publicly listed restricted countries.

Traders need to note that, as of now there is no restrictions, but restrictions by country may vary as a result of changes in regulations or requirements of payment providers.

Our Final Verdict on BullTador

Based on our research and structured evaluation at The Trusted Prop, BullTador seems to be a good choice for traders who like to trade in a trading environment that is integrated with TradingView and at the same time gives access to multi-asset across the stock and cryptocurrency markets. This prop firm is basically a match for swing traders and disciplined intraday participants who seek a high profit sharing ratio, refundable account fee option and a daily payout structure.

These account types might potentially be unsuitable for traders who use copy-trading software, or group trading systems. The prop firm operates a very rigorous Same IP security protocol is strict and traders must ensure not to violate this rule. Looking from a cost versus value angle, the BullTador profit split of 90% across all account types is quite competitive in the prop firm space, although the 5% daily drawdown limits might be strict risk management for some traders.

The BullTador rules for each account type is mentioned quite clearly on their official website, including the drawdown structure, trading restrictions as well as the security protocols that requires strict adherence by traders. In 2026, traders who can manage the 5% daily drawdown rule while aiming for high profit split and fast payouts they can definitely consider the BullTador challenge types. But, those who are unfamiliar with these structured drawdown limits are need to stay away rather than taking risks.

Currently, you can check up on the latest pricing and verified prop firm offers which The Trusted Prop has reviewed for the most accurate viewpoint.