Apex Trader Funding Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Apex Trader Funding review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

4.0

4.0

Apex Trader Funding

Crypto, Indices, Commodities, Metals, Futures

US

2021

CEO: Not publicly available

Coupon Code:

R Trader Pro

Tradovate

Wise

Wire Transfer/ Bank Transfer

WISE

Mastercard

Apex Trader Funding is a futures-based prop firm that offers retail traders high-leverage capital behind a simulated evaluation process. The prop firm is kind of the perfect fit for disciplined futures traders who love having the freedom of high contract limits and being able to juggle multiple accounts at the same time. Although, one might say that traders should really watch out for the intraday trailing drawdown which basically tracks in real, time "unrealized" profit and can be quite a handful especially during high volatility.

Based on our research, This Apex Trader Funding review 2026 aims to provide an unbiased look at whether this firm aligns with your trading objectives and risk management style.

As part of our commitment at The Trusted Prop, we analyze firms based on transparency, reliability and rule clarity as the three descriptors of firms that good partners for your trading career.

Apex Trader Funding Prop Firm Overview

The data below has been gathered from the official website of Apex Trader Funding public disclosures and trader feedback available as of early 2026.

| Category | Details |

|---|---|

| Company Name | The prop firm name is Apex Trader Funding. |

| Legal Name | Apex Trader Funding legal name is Apex Trader Funding Inc. |

| CEO | The CEO of Apex Trader Funding is Darrell Martin. |

| Headquarters | The headquarters is located at Austin, Texas, USA. |

| Broker | The broker associated with Apex Trader Funding is various (via Rithmic/Tradovate data feeds). |

| Operating Since | Apex Trader Funding has been operating since 2021. |

| Account Sizes | Apex Trader Funding provides account sizes ranging from 25k to 300k. |

| Profit Split | Apex Trader Funding offers a 90/10 profit split (after initial 100% threshold). |

| Challenge Types | Apex Trader Funding offers Rithmic, Tradovate and WealthCharts evaluations. |

| Payout Cycle | Apex Trader Funding offers payouts twice per month (1st-7th and 15th-21st). |

| Payout Method | The withdrawal methods supported by Apex Trader Funding are Plane (ACH/Wire) and Cryptocurrency. |

| Trading Platforms | Apex Trader Funding supports trading on NinjaTrader, Tradovate, Rithmic and WealthCharts. |

| Financial Markets | Apex Trader Funding supports trading in CME, CBOT, NYMEX and COMEX Futures. |

| Max Allocation | Apex Trader Funding offers a maximum allocation of up to 20 accounts. |

| Max Scaling | Apex Trader Funding provides scaling opportunities based on contract limits per account size. |

| Trustpilot Score | Apex Trader Funding has a 4.4/5 (as of Feb 2026) rating based on 17,039 reviews. |

Pros and Cons of Trading with Apex Trader Funding

Apex Trader Funding still dominates the futures prop firm space in terms of volume and offers different account sizes ranging from 25k to 300k. In our Apex Trader Funding review, we examine the practical benefits and the tough mechanical constraints that characterize the prop firm’s trading journey.

| Pros | Cons |

|---|---|

| Diverse platform options including Rithmic, Tradovate and WealthCharts. | The Live Trailing Threshold (drawdown) updates in real-time during open trades. |

| High contract limits on larger accounts (up to 35 contracts on the 300k plan). | Strict consistency and flipping rules apply during the payout phase. |

| Frequent promotional pricing makes evaluation entry costs very low. | Daily loss limits are not automated - traders must manage their own risk. |

| Simple one-step evaluation process with no daily drawdown on most plans. | Support response times can lag during high-traffic promotional periods. |

| Multiple account types, including Static accounts with no trailing drawdown. | Payout cycles are restricted to specific windows twice per month. |

The Trader Funding review trend has been towards greater transparency in the rules and Apex has changed accordingly by making clear its position on "flipping" and "bracket trading". The prop firm provides large leverage - the drawdown limits and the intraday trailing rules of the prop firm mean that unrealized profits can push your liquidation point higher, requiring disciplined trade management.

When deciding between Apex Trader Funding Rithmic vs Tradovate, traders are advised to assess their technical requirements. Rithmic is usually a favorite among NinjaTrader users due to its highly stable data, while Tradovate has a more contemporary, web-based interface. However, the first step to getting funded is through a clear understanding of the Apex Trader Funding evaluation rules, no matter what platform you use.

Apex Trader Funding Account Types, Fees & Profit Split Explained (2026)

Understanding account structure is critical, as fees, the type of drawdown and profit targets all affect the profitability over time. This comparison makes clear the technical differences between the high-leverage evaluation models and the specialized static risk model.

| Feature | Standard (Rithmic) | Standard (Tradovate) | Standard (WealthCharts) | Static Account (100k) |

|---|---|---|---|---|

| Account Sizes | 25k to 300k | 25k to 300k | 25k to 300k | 100k Only |

| Account Fees | Lowest (Platform Base) | Mid-Tier (Includes Fees) | Premium Interface Fee | Single Fixed Fee |

| Profit Target | $1,500 - $9,000 | $1,500 - $9,000 | $1,500 - $9,000 | $6,000 |

| Daily Drawdown | None | None | None | None |

| Max Drawdown | Trailing Threshold | Trailing Threshold | Trailing Threshold | $625 (Fixed) |

| Drawdown Type | Intraday Trailing | Intraday Trailing | Intraday Trailing | Static (Non-Trailing) |

| Min. Trading Days | 7 Days | 7 Days | 7 Days | 7 Days |

| Max. Trading Days | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage | Up to 35 Contracts | Up to 35 Contracts | Up to 35 Contracts | 10 Contracts |

| Consistency Rule | 30% Rule | 30% Rule | 30% Rule | 30% Rule |

| Profit Split | 90/10 (1st $25k 100%) | 90/10 (1st $25k 100%) | 90/10 (1st $25k 100%) | 90/10 (1st $25k 100%) |

| Payout Frequency | Twice Monthly | Twice Monthly | Twice Monthly | Twice Monthly |

The chart above shows the flexibility of the Apex Trader Funding prop firm ecosystem. While the Rithmic and Tradovate routes both offer different Apex Trader Funding account sizes, the Static account is more of a specialized tool for those who want to prioritize a fixed loss limit over a high number of contracts.

Capital-efficient traders should keep an eye on the firm's official channels because the firm often offers big promotional discounts on evaluation and funded accounts to help users save on account fees.

The above summary facilitates the traders in finding the technical environment aligns with their trading style, software preferences and risk management. Not every type of account is suitable for all trading styles. A thorough description of each model is given below.

But, while paying the account fee in Apex Trader Funding accounts, get 15% Off via The Trusted Prop using coupon code ‘CKRUQQJB’.

Apex Trader Funding Account Breakdown

In our Apex Trader Funding review 2026, we look at one of the longest running prop firms in the futures market. Apex Trader Funding has earned a name through high contract limits and a fast payout cycle. But, their unique intraday trailing drawdown remains a significant technical hurdle for the unprepared. In our analaysis, Apex Trader Funding offers a fair and detailed analysis of their present setup to see if their model is in line with your trading style.

Apex Trader Funding Rithmic Account

Recognizing traders' perspective, This prop firm provides a broad selection of Apex Trader Funding Rithmic accounts. These platforms have been generally considered the best choice by futures traders, especially attributing to the fact that through Rithmic, they enjoy an ultra, low, latency connection and support of numerous third, party platforms. Significantly, these accounts come with a simple one, step evaluation process that can be immediately funded, allowing for zero daily loss and thus greatly opening intraday space for the traders. The biggest downside, however, lies in the trailing drawdown, that is locked at the peak of your open equity and thus implemented point by point in real, time. To this end, the traders must secure their profits meticulously since the unrealized gains if they are not set aside, will still elevate your drawdown level.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $25,000 Rithmic | $187 | $1,500 | None | $1,500 (6%) (Trailing) |

| $50,000 Rithmic | $197 | $3,000 | None | $2,500 (5%) (Trailing) |

| $100,000 Rithmic | $297 | $6,000 | None | $3,000 (3%) (Trailing) |

| $150,000 Rithmic | $397 | $9,000 | None | $5,000 (3.33%) (Trailing) |

| $250,000 Rithmic | $397 | $15,000 | None | $6,500 (2.60) (Trailing) |

| $300,000 Rithmic | $397 | $20,000 | None | $7,500 (2.50) (Trailing) |

Why Choose Apex Trader Funding Rithmic Account?

Apex Trader Funding Rithmic accounts are considered the premier option for those traders who need a comprehensive technical environment for their futures trade execution.

- Execution with Low Latency: Your Apex Trader Funding Rithmic account can act as a bridge to professional trading software such as NinjaTrader, Sierra Chart or Bookmap, enabling highly accurate trade entries.

- Flexible Payout Structure: If you barely pass, the successful traders can harvest the industry leading Apex Trader Funding payout policies that allow you to keep 100% of the first $25,000 earned.

- Scalping Friendly: These accounts are ideal for scalpers who execute a high volume of trades very quickly and hence are willing to forgo the overhead of complex intraday loss rules.

Apex Trader Funding Tradovate Account Breakdown

The prop firm has given a specific segment of Apex Trader Funding Tradovate accounts that are extremely popular with the traders who like a modern, web-based interface and great cross, device compatibility. An important benefit of these accounts is that they rest on a smooth one-step evaluation process without daily loss limits, granting a big freedom intraday. Though, the major drawback is the trailing drawdown that keeps changing in real-time and is based on your highest open equity point. Hence, traders need to handle unrealized profits carefully, as if a winning trade is not closed before a decline, the drawdown limit will still go up, your margin for error will be narrowed.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $25,000 Tradovate | $187 | $1,500 | None | $1,500 (6%) (Trailing) |

| $50,000 Tradovate | $197 | $3,000 | None | $2,500 (5%) (Trailing) |

| $100,000 Tradovate | $297 | $6,000 | None | $3,000 (3%) (Trailing) |

| $150,000 Tradovate | $397 | $9,000 | None | $5,000 (3.33%) (Trailing) |

| $250,000 Tradovate | $397 | $15,000 | None | $6,500 (2.60) (Trailing) |

| $300,000 Tradovate | $397 | $20,000 | None | $7,500 (2.50) (Trailing) |

Why Choose Apex Trader Funding Tradovate Account?

The Tradovate route is definitely the best option for the traders who desire highly accessible and cleaner, user-friendly experience.

- Multi-Device Flexibility: With Apex Trader Funding Tradovate you can trade from any web browser, Mac or mobile device without complicated local installations.

- Integrated Charting and Tools: Take full advantage of Tradovates built-in modern charting tools, that allow you to observe the Apex Trader Funding evaluation criteria right from the platform.

- Consistent Day Traders: This account suits the ones who are daily traders that not only consistently make profits but also like a visual-first interface for tracking their progress towards the profit target in the 30% consistency guidelines.

Apex Trader Funding WealthCharts Account Breakdown

The Apex Trader Funding WealthCharts accounts are a high-end offering designed for traders who require sophisticated algorithmic insights and institutional grade visualization. One of the main benefits of this setup is the combination of top, tier analytical tools within a single step evaluation that imposes no daily loss limits for ultimate intraday freedom. But, the biggest risk is the trailing drawdown, which is constantly updated in real time based on your account's highest unrealized equity. So, if a trade hits a large profit but you don't close it before the market pulls back, the drawdown limit will still stay at that higher level, your margin for risk will be greatly reduced.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $25,000 WealthCharts | $187 | $1,500 | None | $1,500 (6%) (Trailing) |

| $50,000 WealthCharts | $197 | $3,000 | None | $2,500 (5%) (Trailing) |

| $100,000 WealthCharts | $297 | $6,000 | None | $3,000 (3%) (Trailing) |

| $150,000 WealthCharts | $397 | $9,000 | None | $5,000 (3.33%) (Trailing) |

| $250,000 WealthCharts | $397 | $15,000 | None | $6,500 (2.60) (Trailing) |

| $300,000 WealthCharts | $397 | $20,000 | None | $7,500 (2.50) (Trailing) |

Why Choose Apex Trader Funding WealthCharts Account?

The WealthCharts route is mainly designed for technically, driven traders who base their decisions on advanced algorithmic indicators.

- Advanced Technical Integration: Leverage the Apex Trader Funding WealthCharts to get the most of secret algorithmic indicators and automated discovery tools that you won't find on regular platforms.

- Streamlined Performance Tracking: If you want to quickly check how well you are doing against the Apex Trader Funding evaluation rules, just use the detailed native performance reporting of the platform.

- Low-Risk Systematic Traders: This account is perfectly suited for low-risk systematic traders who depend on high, probability technical setups and require a platform to visualize complex data sets in real-time.

Apex Trader Funding Static Account (100k) Breakdown

The Apex Trader Funding static account (100k) is a specialized evaluation instrument for traders who focus on a fixed risk floor rather than the traditional trailing mechanisms usually seen in other futures accounts. This is applicable for all Rithmic, Tradovateand WealthCharts accounts. One of the greatest features of this account is that your drawdown limit is set in stone and thus it doesn't follow your profits, so you are able to build a large cushioning as your balance goes up. The biggest risk, however, is the extremely tight Max Total Drawdown of $625 which hardly gives room for mistakes. Therefore, traders have to be right almost all the time and strictly control their position sizes to avoid a hard breach from even the smallest market pullbacks.

| Account Size | Account Fee (Original Price) | Profit Target (6%) | Max Daily Drawdown | Max Total Drawdown |

|---|---|---|---|---|

| $100,000 Static | $297 | $2,000 | None | $625 (0.625%) (Fixed) |

Why Choose Apex Trader Funding Static Account?

Traders who feel that a live trailing drawdown is psychologically draining or simply don't agree with it as a risk component usually pick the 100k static model.

- Fixed Capital Protection: Out of all the Apex Trader Funding account sizes, the static drawdown level remains unchanged at $99,375 no matter how high your profit gets.

- Attainable Profit Target: With a target of only $2,000 (2%), this account has one of the lowest performance thresholds relative to its size in the prop firm industry.

- Scalping-Based Traders: This model is perfect for scalpers who by trading small high, probability ticks aim for a predictable hard floor rather than a moving target.

Our Verdict on Apex Trader Funding Account Types

Based on our research, Apex Trader Funding accounts are designed for different trading styles rather than providing a generic account for everyone. The profiles of successful users usually feature consistent day traders, low risk systematic traders who apply the 100k Static model and traders coming from prop firm trading background. Such models might not work for traders just starting who don't have risk management, scalpers who use too much leverage or traders who are not aware of how intraday trailing drawdowns and unrealized gains can quickly move liquidation points, particularly when the market is very volatile.

Apex Trader Funding Drawdown and News Trading Rules

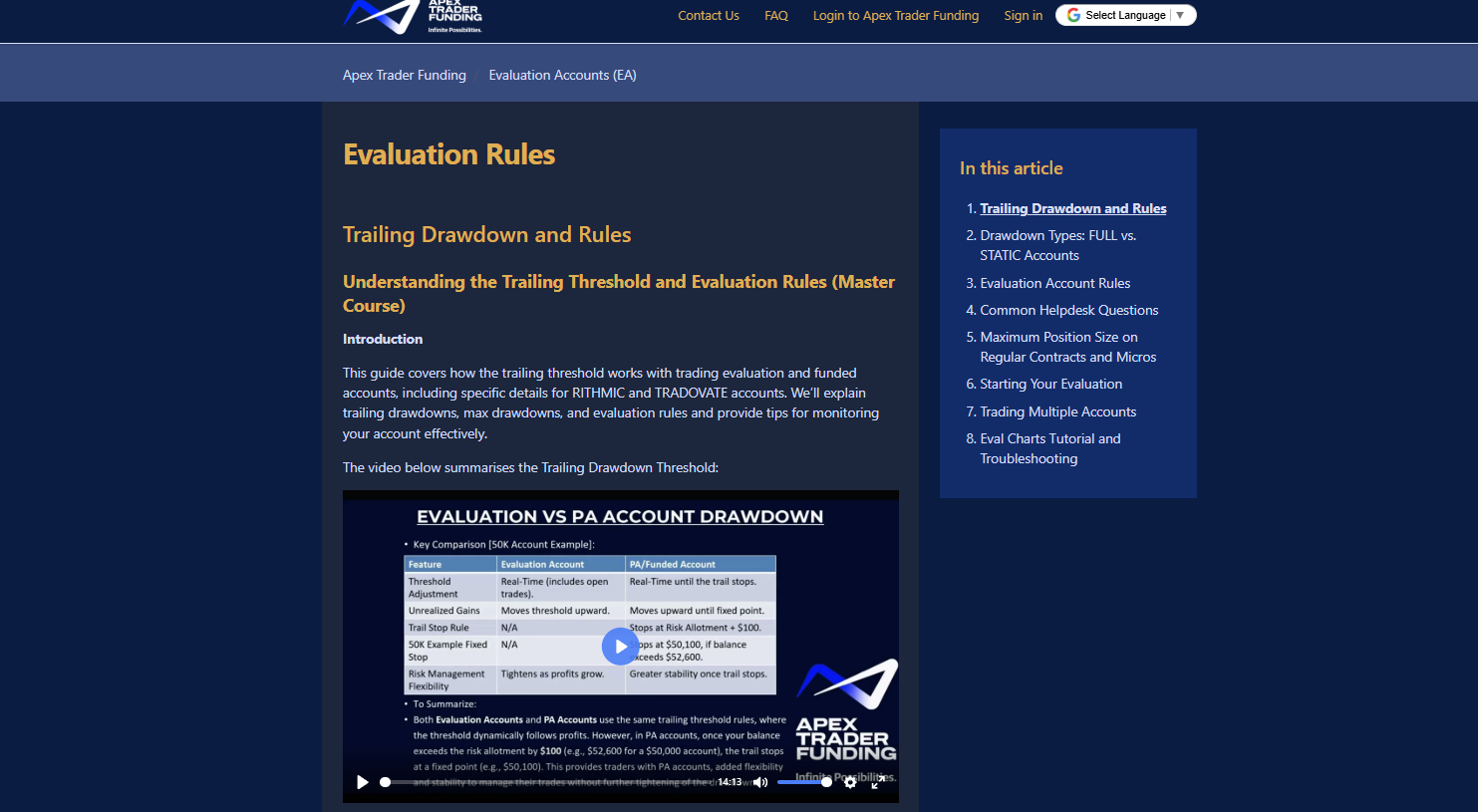

Figuring out the different Apex Trader Funding drawdown rules is probably the biggest hurdle for any trader who decides to become a part of this platform. Opposite to those firms deciding to use the "End-of-Day" (EOD) method, Apex is an Intraday Trailing Drawdown user for its standard evaluation and Performance Account (PA). That is to say, your risk floor keeps going up in real-time as your trade makes a profit, even if that profit is never actually taken.

Drawdown Details:

The drawdown is a Live Trailing Threshold. It keeps the record of the highest point your account balance reaches during an active trade. Suppose you have a winning position which then pulls back heavily before you close it, in that case, your drawdown limit has already been moved up, basically it has reduced your "breathing room" for this trade and future ones.

Numerical Example:

Let's say you have a $50k account and the maximum loss you are ready to accept is $2,500. Your initial fail point (threshold) is $47,500.

- You make a trade and it first goes up to +$1,000 in unrealized profit (account hits $51,000).

- Your drawdown threshold instantly moves up with the price to $48,500 ($51,000, $2,500).

- If you don't close the trade and the price falls back and you finally close the trade making only +$100 profit, your account balance will be $50,100, but your threshold will still be $48,500.

- You only have $1,600 of risk room left now, even if you technically made money.

Most Common Trader Mistake: Holding a losing position because they turned a winner into a loser. The traders who aim at huge targets by not taking partial profits end up being liquidated when the trailing threshold "got them" during a typical market pull-back.

News Trading Details:

The strategy of dealing with news at Apex is totally for the purpose of preventing speculative gambling rather than banning traders from participating.

- Allowed with restriction: You may trade around highimpact news events (CPI, FOMC, etc. ) but you are not allowed to hedge.

- One Direction Rule: You must have a definite market bias. Opening long and short positions at the same time (straddles/strangles) to catch a breakout in either direction is not permitted.

- Consistency Alignment: News trading is allowed but any windfall profits made during a news spike are subject to the 30% consistency rule when payout requests are made. If one news trade makes up 80% of your profit, you will need to keep trading to dilute that fraction before you can withdraw.

The drawdown rules and news trading rules at Apex have been tailored to be aligned with a professional institutional environment where "gambling" is discouraged and systematic execution promoted. While the Apex Trader Funding drawdown rules are often cited as the most difficult hurdle in any review, they serve as an effective filter for risk management.

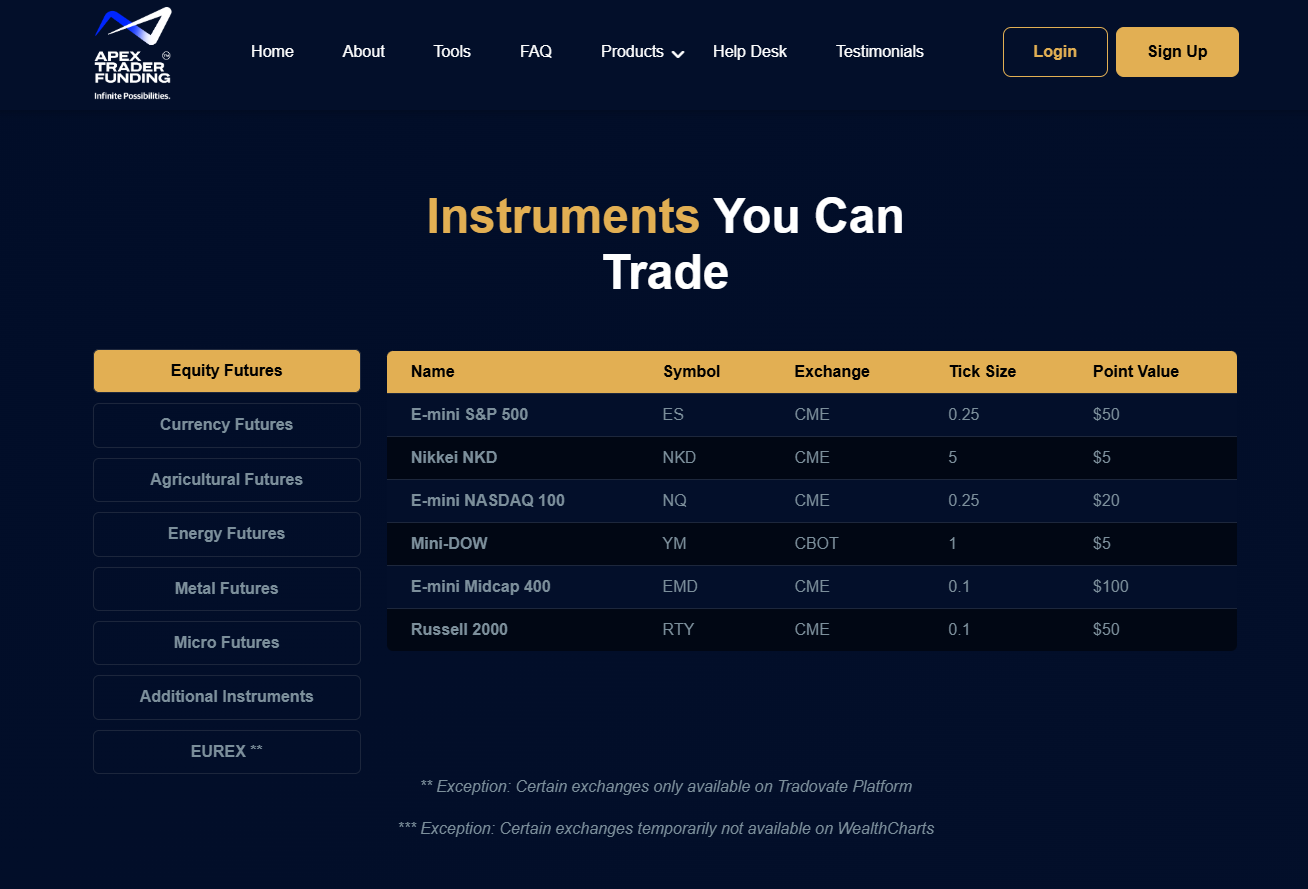

Trading Instruments offered by Apex Trader Funding

Apex Trader Funding allows its clients to trade extensively in futures contracts across different asset classes. This not only enables a high level of diversification within a single Apex Trader Funding prop firm account but also provides flexibility. For example, if you want to trade equity indices or the highly volatile energy markets, the prop firm sells both standard (Mini) and Micro contracts. It offers to diversified Apex Trader Funding account sizes and traders' risk aversions. Knowing these symbols is the key to understanding and hence, effectively following the Apex Trader Funding evaluation rules.

Tradable Asset Classes of Apex Trader Funding

- Equity Index Futures: Covers the "Big Four" (ES, NQ, YM, RTY) available in the standard as well as the micro sizes (MES, MNQ, MYM, M2K). This facilitates accurate position sizing when going through the Apex Trader Funding 50k account or Apex Trader Funding 100k account challenges.

- Foreign Exchange (FX) Futures: Several major currency pairs are available for trading such as the Euro FX (6E), British Pound (6B) and Australian Dollar (6A).

- Agricultural Futures: Market participants can take a position in softs like Corn (ZC), Soybeans (ZS) and Wheat (ZW).\

- Energy and Metal Futures: Among others, high-volatility products such as Crude Oil (CL), Natural Gas (NG), Gold (GC) and Silver (SI) are open to traders who select Apex Trader Funding aggressive pricing plans.

- Interest Rate and Crypto Futures: Treasury Notes/Bonds and Micro Bitcoin/Ethereum contracts are available for trading systematic strategies which are extremely specialized.

Note: Availability of instruments depends on both the trading account selected and the trading platform used (Rithmic, Tradovate or WealthCharts).

Apex Trader Funding Spreads & Commissions: What You Really Pay

After our analysis, in this Trader Funding review, we look at the operational costs that to a large extent determine a traders net profitability. Besides the initial evaluation fee, the effective trading costs commissions and the bid-ask-spread are the most recurring expenses you will face. Knowing how the Apex Trader Funding rithmic and tradovate paths differ in their fee execution is crucial for any Apex Trader Funding prop firm participant who wants to keep their margins intact.

Spreads and Commissions Details

While Apex Trader Funding provides institutional-grade data feeds, traders at Apex Trader Funding are responsible for the commissions related to every contract traded. Such realistic fee impacts are instantly and automatically, deducted from your account balance determining how far you are from the Apex Trader Funding drawdown rules at any given time.

The spreads you get are the reflection of the underlying futures market (CME, CBOT, NYMEX, COMEX) and their changes during the time of your trade. Since you are trading the real futures market, the spread is the difference between the current Buy and Sell price (the "bid" and "ask"). The most liquid instruments such as the E-mini S&P 500 (ES) usually have the tightest pricing, whereas the energy or agricultural futures may have wider spreads depending on the volatility of the market.

Here is an updated schedule of 2026 commissions for the most popular platforms. It should be understood that Apex Trader Funding tradovate and wealthcharts usually have a similar fee structure, whereas Rithmic keeps its legacy pricing.

| Instrument Type | Platform | Per Side Commission | Round Turn (Total) |

|---|---|---|---|

| Equity Minis (ES, NQ, YM) | Rithmic | $1.99 | $3.98 |

| Equity Minis (ES, NQ, YM) | Tradovate / WC | $1.55 | $3.10 |

| Equity Micros (MES, MNQ) | Rithmic | $0.51 | $1.02 |

| Equity Micros (MES, MNQ) | Tradovate / WC | $0.52 | $1.04 |

| Crude Oil (CL) | Rithmic | $1.98 | $3.96 |

| Crude Oil (CL) | Tradovate / WC | $1.67 | $3.34 |

| Micro Crude Oil (MCL) | Rithmic | $0.51 | $1.02 |

| Micro Crude Oil (MCL) | Tradovate / WC | $0.67 | $1.34 |

| Gold (GC) | Tradovate / WC | $1.77 | $3.54 |

We have to state that Apex Trader Funding tradovate looks like a round-turn commission for minis that is a little bit lower, but the Apex Trader Funding rithmic way is mostly preferred by high-volume scalpers using NinjaTrader for its raw execution speed. In fact, the same evaluation rules at Apex Trader Funding mean that no matter what platform you use, you have to include these costs because your profit target is "net" of all commissions that is you must make the target plus the cost of your trades in order to pass.

Apex Trader Funding Rules (2026): What is Allowed and What is Not

Figuring out the rules for the Apex Trader Funding evaluation is like carefully understanding what a trading day compliant with the rules looks like. This Trader Funding review 2026 shows us how the actual contractual obligations, rather than marketing, reveal what the real deal is. Apex Trader Funding may be one of the prop firm which heavily leverages its customers, but at the same time, its setting is one that is looking to a professional-grade consistency rather than lucky windfalls. Knowing these rules is what differentiates a profitable payout from a forfeited account.

| Trading Category | Allowed or Not | Details |

|---|---|---|

| News Trading | Allowed | No restrictions on trading during high-impact economic releases or holidays. |

| Copy Trading | Allowed | Permitted across up to 20 of your own accounts - third-party copying is prohibited. |

| Overnight Holding | Allowed | Positions can be held overnight but must be closed before the weekend. |

| Weekend Holding | Not Allowed | All positions must be closed by Friday, 4:59 PM ET to avoid a breach. |

| HFT / Arbitrage | Not Allowed | Exploitative strategies like latency arbitrage or high-frequency automated flooding. |

| Stop Losses | Recommended | Not technically "hard-coded" as mandatory, but required for risk management. |

| Hedging | Not Allowed | Opening opposite positions on the same asset across accounts is prohibited. |

Prohibited Practices at Apex Trader Funding

Apex Trader Funding is a proprietary trading firm that aims to keep the good faith of its traders high. Therefore, the behaviors that are inconsistent with the agreements are strictly controlled via the Apex Trader Funding dashboard. Once you engage in any of these behaviors, your account will be immediately terminated or your payout will be denied.

- Account & IP Sharing: There is a strict ban on sharing login credentials. Apex keeps track of how consistent your IP address region is - if there are major changes without you notifying the support, you may get an audit.

- Gambling / Windfall Trading: These are strategies that try to "pass in one trade" by risking the entire drawdown limit on a single volatile move.

- Trailing Threshold Exploitation: The practice of fully utilizing an account's threshold as a de facto stop-loss method instead of actively managing risk is referred to as threshold exploitation.

- Account Stockpiling: If you buy a bunch of accounts just so that you can "blow them up" and thereby help one lucky pass, it will be considered a professional standards violation.

Soft Breach vs Hard Breach

In the Apex Trader Funding review, the evaluation rules and consequences of your actions are thoroughly explained:

- Soft Breach Example: Going beyond your maximum contract limit or breaking the 30% Negative P&L rule for an open trade. Usually, the position will be closed or your account will be temporarily "flattened" but you may continue using the account.

- Hard Breach Example: Your account balance (or unrealized profit) falling to the trailing threshold level. Your trading account gets immediately frozen and you will have to do an Apex Trader Funding evaluation reset or repurchase a new account.

IP Address Policy

Apex keeps track of IP addresses to ensure the same trader and also to avoid the use of unauthorized third, party "passing" services. It is possible to work from different places, but a very high number of random IPs changes (very different IP addresses in a short time period, e.g., London to New York in two hours) will raise an alarm for a security audit. You can inform the support beforehand that you are going to traveling via the Apex Trader Funding dashboard.

Our Verdict on Apex Trader Funding Rules

After thoroughly analyzing and comparing the Apex Trader Funding reviews 2026, we see that the Apex Trader Funding evaluation rules, are quite easier and they demand a very high level of technical discipline. These types of accounts are generally a good fit for professional day traders as well as for high-frequency scalpers who have systematical exit strategies that they can use to deal with the intraday trailing limit. Such accounts can be risky for novices or for those who do not understand the drawdown rules, as the trailing limit goes up with the unrealized profit and never has been, the case that most traders who hold through a deep pullback or reversal get penalized.

Apex Trader Funding Scaling Plan: Grow Your Account Gradually

In our Apex Trader Funding review 2026, we focus on the tools that allow for the accumulation of capital over a long period. Apex Trader Funding prop firm does not have a traditional "tier-based" system of account promotion where the firm increases your account balance manually. Instead, the scaling is done by the combination of the contract limit expansion and the permission to manage up to 20 multiple funded accounts simultaneously. In this way, the capacity for account growth through the fund is a matter of the trader's skills in risk profiling consistency.

Details of the Scaling Plan

The scaling method at Apex Trader Funding depends to a large extent on the Contract Scaling Rule which defines the number of contracts you are allowed to trade based on your current account "buffer". In most Apex Trader Funding account sizes, the management only allows you to trade half of your maximum allowed contracts until you have passed the first trailing limit (the "Safety Net").

| Condition | Performance Requirement | Scaling Impact |

|---|---|---|

| Initial Phase | Account balance is below the Safety Net. | Restricted to 50% of Max Contracts. |

| Threshold Met | Balance > Initial Capital + Drawdown + $100. | 100% of Max Contracts unlocked. |

| Multi-Account Scaling | Successful payout history on primary account. | Ability to trade up to 20 accounts (max $6M capital). |

| Live Account Transition | Post 6th payout or firm discretion. | Potential move to Live Prop Trading Account. |

This prop firm scaling plan is meant to support a traders consistency in trading by stopping them from using high-risk "all-in" strategies at the beginning of the account cycle. As soon as the safety net is hit, the trailing drawdown freezes, the trader is given a kind of "extra space" to gradually increase their position sizing.

Payment Methods & Payout Process at Apex Trader Funding

In this Trader Funding 2026 review, we explore how easily one can turn virtual profits into real money. For a lot of traders, the Apex Trader Funding payout method and the speed of processing are the main indicators of the firm's trustworthiness. Though the firm hands out a generous profit split, the whole thing is really wrapped up with strict "safety net" and consistency windows that need to be done at the right time if you want to avoid the hassle of going through the paper works.For example, if you any time will a payout during the first window (1st 5th of the month), that payout will most likely reviewed within 2 business days and be processed shortly after, with funds usually being available to the trader within 37 business days.

Payment & Payout Details of Apex Trader Funding

The Apex Trader Funding prop firm relies on well, known third-party payment providers to facilitate disbursements both locally and internationally. Depending on where you live, you will be interacting with different systems that are part of the Apex Trader Funding dashboard.

Payment Methods Supported by Apex Trader Funding

Traders using Apex Trader Funding can pay for their first Pricing Plans by:

- Credit/Debit Cards: Visa, Mastercard and American Express.

- Cryptocurrency: Through several payment gateways available in specific regions.

Payout Options Supported by Apex Trader Funding

When you have become a Performance Account (PA), payouts will be made through:

- ACH Direct Deposit: Only for US residents (needs an ACH routing number).

- Plane (formerly Pilot): The main payout channel for non, US users, which is compatible with local bank transfers in more than 100 countries.

How the Payout Process Works at Apex Trader Funding?

Knowing the working of Apex Trader Funding payout process in detail step by step is of prime importance to prevent your request from being turned down just because of a technicality.

- Eligibility Check: It is required that at least 8 trading days have passed after your last request (10 days for the very first payout) in order to proceed. Moreover, at least five of those days should show a net profit of $100 or more.

- Safety Net Verification: Just like before, you will be required to keep a "Safety Net" balance for the initial three payments (Min Balance = Starting Balance + Drawdown + $100).

- Consistency Rule Audit: 30% consistency rule by Apex Trader Funding is a must the best trading day of yours can make up for not more than 30% of your total profit at the moment of the request.

- Submission Windows: In order for requests to be valid, they must be made via the Apex Trader Funding dashboard only during two specific periods: the 1st till the 5th or the 15th till the 20th of the month.

- Review & Approval: The verification team goes over the request within 2 working days.

- Disbursement: Following the approval, the funds are being wired through ACH or Plane. Normally, US clients will have their money within 13 days, but foreign applicants might have to wait for 37 days.

Our Verdict on Apex Trader Funding Payout Process & Payment Methods

When it comes to payout systems in this Trader Funding review, we consider it to be of institutional level and highly regulated. Although some traders may find the restrictive nature of the two payout windows per month compared to "on-demand" firms, the system is established for high-volume stability.

The process is reliable but "rule-heavy." If you adhere to the Apex Trader Funding payout rules and maintain the required safety net, the firm has a consistent track record of payment in 2026. However, traders who "gamble" for a single large windfall day will almost certainly see their requests denied under the 30% rule.

Countries Restricted at Apex Trader Funding

Apex Trader Funding currently serves traders in over 150 countries. But, several nations are restricted due to international sanctions, anti-money laundering (AML) laws or service limitations from third-party vendors.

List of Restricted Countries

Traders residing in the following locations are currently unable to participate in any Apex Trader Funding evaluation rules or hold a Performance Account (PA):

- Sanctioned Regions: North Korea, Iran, Syria, Cuba and regions of Ukraine (Crimea, Donetsk, Luhansk).

- High-Risk Jurisdictions: Afghanistan, Iraq, Yemen, Libya, Somalia and South Sudan.

- Compliance-Based Restrictions: Russia, Belarus, Venezuela, Palestine and Myanmar.

- Vendor-Specific Limits: Pakistan, Vietnam and several African nations (e.g., Nigeria, Kenya) may experience limited access to Apex Trader Funding tradovate due to external data provider restrictions.

Traders please note that, this country restrictions may change due to regulatory or payment provider requirements.

Our Final Verdict on Apex Trader Funding

Our research in this Trader Funding review 2026 highlights that Apex Trader Funding continues to be at the core of the futures market offering high contract limits and scalable multi account management. The way the Apex Trader Funding prop firm model works is that it perfectly fits the needs of experienced scalpers who use Apex Trader Funding rithmic or tradovate and are familiar with the live trailing drawdown feature.

New traders or swing traders might find the Apex Trader Funding drawdown rules a bit confusing as the limit is based on unrealized gains and is adjusted continuously. The Apex Trader Funding pricing plans are very much in line with the services offered and are a great deal, especially when there are sales, but one has to be very disciplined in following the 30% consistency rule to succeed. We believe that Apex is a well disciplined prop firm for professionals who want to operate at institutional leverage levels.

See latest pricing and verified prop firm deals, reviewed by The Trusted Prop.