Seacrest Markets Review 2026 – Prop Firm Features, Rules & Payout Explained

Read our full Seacrest Markets review, including a detailed breakdown of Challenge types, Drawdown rules, Prohibited Strategies, and Payout process.

.jpeg&w=1080&q=75)

4.2

4.2

Seacrest Markets

Forex, Crypto, Indices, Commodities, Energies

CY

2022

CEO: Kevin Warner

This firm is not listed on our Trusted or Affiliate list.

MatchTrader

Metatrader 5

Rise

Crypto

Crypto

Credit/Debit Card

Apple Pay

Seacrest Markets (PTY) Ltd

Seacrest Markets Review 2026

Seacrest Markets is an independent prop trading firm established in the year 2022, offering traders flexible evaluation challenges, profit splits of 80% (up to 92.75% with vip program), and scaling opportunities reaching $1,000,000 (2 Step only) . With multiple challenge types, diverse trading instruments, and a supportive community, Seacrest Markets has positioned itself as a notable player in the prop trading industry.

Seacrest Markets - Prop Firm Overview

| Feature | Details |

|---|---|

| Company Name | The prop firm name is Seacrest Markets |

| Company Legal Name | The Legal name of Seacrest Markets is MyFunded Capital Solutions Ltd |

| Registration Number | Seacrest Markets Registration Number is HE455361 |

| Headquarters | Seacrest Markets is registered and located in Cyprus |

| Years in Operation | Seacrest Markets has been operating since 2022 |

| Broker | The broker associated with Seacrest Markets is Seacrest Markets (PTY) Ltd |

| CEO | The CEO of Seacrest Markets is Kevin Warner |

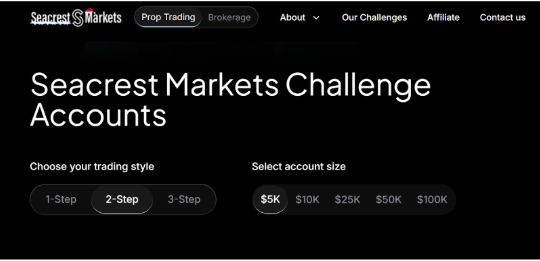

| Challenge Types | 1-Step, 2-Step and 3- Step challenge account types is offered by Seacrest Markets |

| Challenge Fees | The Challenge fees of Seacrest Markets start from $40 |

| Profit Split | Seacrest Markets offers 80% profit split on funded account, Traders can buy an Add-ons to get 90% profit split (Up to 92.75% VIP) |

| Account Sizes | The funded accounts offered by Seacrest Markets range from $5,000, $10,000, $25,000, $50,000, to $100,000 |

| Max Allocation | Up to $400k per plan |

| Payouts | Payouts with Seacrest Markets are available every 14 days from your first trade |

| Financial Markets | Traders at Seacrest Markets can trade Forex, Crypto, Indices, Commodities, Energies |

| Trading Platform | Seacrest Markets supports trading on MetaTrader 5 (MT5) and Match Trader |

| TrustPilot Score | Seacrest Markets is rated 4.3 out of 5 on Trustpilot |

Pros and Cons about a Seacrest Markets Account - Brief Overview

Seacrest Markets, formerly known as MyFundedFX, is a prop firm which offers scalable capital, up to 90% payout profit splits (and up to 92.75% with VIP), and various challenges tailored to suit different trader profiles. From their reviews it is clear that many traders appreciate the flexibility and the range of supported prop trading platforms by the firm. Seacrest Markets is appealing in the prop trading downfall thanks to bi-weekly payouts and trader-friendly rules.

| Pros | Cons |

|---|---|

| Various Challenge Types provided with High Profit Splits - up to 90% (with upgrade) and 92.75% (VIP) | Trailing Drawdown for Some Challenges (e.g., 1-Step) |

| Weekly and Bi-Weekly Payouts | Profit Split Upgrade Fees (20% of challenge cost) |

| High Profit Splits - (Standard: 80%; VIP: up to 92.75% ) | Crypto Leverage capped at 1:2 |

| Top Trading Platforms are supported: MT5, MatchTrader Instruments: Forex, Crypto, Indices, Commodities, Energies provided. | Funded Account News Trading Restrictions (3 minutes before/after) |

Seacrest Markets Challenge Types, Fees, Profit Splits, and More

Seacrest Markets caters to different trading approaches and experiences by offering various challenge types. Traders can manage up to $1,000,000 (2 Step Only) through account milestones with profit splits of 80% standard and up to 92.75% profit via VIP program, flexible trading rules, and a clearly defined scaling plan.

| Details | 1-Step Challenge | 2-Step Challenge | 3-Step Challenge |

| Account Balance | $5,000 - $100,000 | $5,000 - $100,000 | $5,000 - $100,000 |

| Registration Fee | $50 | $50 | Varies by size ($40 - $395) |

| Sim Gain Target | 10% | 8% (Step 1), 5% (Step 2) | 6% (Step 1), 6% (Step 2), 6% (Step 3) |

| Daily Sim Loss | 4% | 5% | 4% |

| Overall Sim Loss | 6% | 8% | 8% |

| Min Profitable Days | 3 Days | 3 Days | 3 Days |

| Trading Period | Unlimited | Unlimited | Unlimited |

| Leverage | 30:1 | 30:1 | 30:1 |

| Profit Split | 80% | 80% | 80% |

| Payout Frequency | 14 Days | 14 Days | 14 Days |

Seacrest Markets 1-Step Challenge Breakdown

| Account Size | Challenge Fee | Profit Target (10%) | Max Daily Drawdown (4%) | Max Total Drawdown (6%) |

| $5,000 | $50 | $500 | $200 | $300 |

| $10,000 | $100 | $1,000 | $400 | $600 |

| $25,000 | $200 | $2,500 | $1,000 | $1,500 |

| $50,000 | $300 | $5,000 | $2,000 | $3,000 |

| $100,000 | $500 | $10,000 | $4,000 | $6,000 |

After passing the challenge and progressing to the Live Simulated Trader tier with Seacrest Markets, the trader retains a standard 80% of profit which can be increased up to 92.75% with VIP program. Risk limits should be maintained within a daily drawdown of 4% and a total drawdown of 6%. At this stage a trader can devise any number of income strategies, with no profit target in place. For disciplined traders, automated withdrawals can be arranged for a fortnightly basis.

Seacrest Markets 2-Step Challenge Breakdown

| Account Size | Challenge Fee | Profit Target (Step 1 / Step 2) | Max Daily Drawdown (5%) | Max Total Drawdown (8%) |

| $5,000 | $50 | $400 / $250 | $250 | $400 |

| $10,000 | $100 | $800 / $500 | $500 | $800 |

| $25,000 | $200 | $2,000 / $1,250 | $1,250 | $2,000 |

| $50,000 | $300 | $4,000 / $2,500 | $2,500 | $4,000 |

| $100,000 | $500 | $8,000 / $5,000 | $5,000 | $8,000 |

Seacrest Markets 3-Step Challenge Breakdown

| Account Size | Registration Fee (One-Time) | Profit Target (Per Step - 6%) | Max Daily Drawdown (4%) | Max Total Drawdown (8%) |

| $5,000 | $40 | $300 (Each Step) | $200 | $400 |

| $10,000 | $69 | $600 (Each Step) | $400 | $800 |

| $25,000 | $155 | $1,500 (Each Step) | $1,000 | $2,000 |

| $50,000 | $245 | $3,000 (Each Step) | $2,000 | $4,000 |

| $100,000 | $395 | $6,000 (Each Step) | $4,000 | $8,000 |

The 3-Step Challenge is a three-phase evaluation with identical rules and targets for each phase. Upon passing all three steps, the trader progresses to the Live Simulated Trader phase.

Once Funded (Live Simulated Trader Phase)

After completion of both challenge phases, traders begin the Live Simulated Trader phase. There is no performance target during this period, only risk management must be observed. Profit sharing is set at 80% standard which can be increased up to 92.75% through VIP program, a daily account cap of 5% loss and an overall traction cap of 8% loss. A bi-weekly profit share is provided by Seacrest, with no cap on the number of trading days.

Which Seacrest Markets Challenge Should You Choose?

| Challenge Type | Best For |

|---|---|

| 1-Step Challenge | If you want a simple, single-phase evaluation with no time constraints. |

| 2-Step Challenge | If you prefer structured evaluations that test consistency in stages. |

| 3 -Step Challenge | For traders who prefer a more progressive, multi-stage evaluation (as included in the initial data). |

Trading Strategies allowed during challenge phase at Seacrest Markets

Allows Copy Trading: Yes, via TradersConnect only

Allows News Trading: Yes, with standard news windows observed

Allows Weekend Holding: Yes

Allows EAs: Yes

Our Review of Seacrest Markets Challenges

Our experience with Seacrest Markets - Our experience as traders of the Seacrest Markets has mainly been positive and somewhat similar to other traders we surveyed who use the firm. In 2026, Seacrest Markets has positioned itself as one of the more reputable prop firms, especially for individuals trading forex or crypto that want flexible challenge models. The firm offers three models, a one step, two-step, or three-step evaluation model with no time restriction and have fast payout rounds every two weeks or after only 5 days. This is certainly helpful to both day traders and swing traders.

The traders that we spoke to complimented Seacrest Markets on having a solid array of multiple tradeable assets in their Forex, Indices, Commodities,Energies and Cryptos regardless of their somewhat realistic trading conditions with reasonable drawdown limits and most offer a profit sharing agreement with some traders above 90% (up to 92.75%). In addition, prop traders enjoy trading on Metatrader 5 (MT5) and Match-Trader.

For serious traders looking forward to flexible capital (up to $400k initial max allocation) and different trading conditions, Seacrest Markets has some of the best incentives with solid policies and reasonable rates and favorable conditions to trade relative to other process firms and also a well-shaped active Discord community with over 125,000 traders!

Seacrest Markets Scaling Plan - Up to $1 Million

The Seacrest Markets Scaling Plan is designed for traders who demonstrate consistent profitability and disciplined risk management. It offers a structured and realistic path to scale your funded account - rewarding both steady performance and responsible trading.

How the Scaling Plan Works

To qualify for scaling at Seacrest Markets - traders must show steady performance and a pattern of responsible trading behavior over a set period. Here is what it takes:

Qualifying Criteria:

Achieve 12% net profit within a 90-day period on your funded account.

Payout Condition:

Make at least 4 withdrawals during the same 90-day timeframe to qualify for scaling.

Scaling Boost:

Every 90 days, your account balance increases by 25% of the original starting balance, depending on your

withdrawal activity.

Maximum Funded Capital:

- The maximum initial allocation is up to $400K per plan.

This plan gives serious traders a clear growth pathway — the more consistent and disciplined you are, the faster you scale.

Scaling Plan Overview

| Scaling Criteria | Details |

|---|---|

| Scaling Interval | Every 90 days (3 months) |

| Profit Target | 12% net profit over the 3-month period |

| Payout Requirement | Minimum 4 withdrawals within the same period |

| Capital Growth Rate | 25% increase per scaling cycle |

| Profit Split | Starts at 80%, upgradeable to 90% with add-on (Up to 92.75% VIP) |

| Maximum Funded Capital | Up to $1,000,000 |

| Trading Rules | Same conditions apply as account grows |

Why the Seacrest Scaling Plan Stands Out

- Transparent Growth Path: You know exactly what to achieve for every scale-up.

- Performance-Driven Rewards: The more consistent and profitable you are, the faster your account grows.

- High Capital Ceiling: Scale up to $1M without changing your trading style or rules.

- Stable Trading Conditions: No surprises — the same trading parameters remain as you grow.

Our Review on Seacrest Markets Scaling Plan

The Seacrest Markets Scaling Plan is perfect for disciplined traders who aim to grow their funded accounts systematically. There are no tricks, just a simple way to get additional funding. There is no need to over-trade, take excessive risks or achieve insane drawdown targets. If you’re consistent, patient and maintain steady withdrawals then scaling to $1 million is not just possible - it is built into the program.

The continuity when scaling is a major advantage for traders - your spreads stay tight, drawdowns remain reasonable and the rules don’t get stricter as your account grows. Combine this with bi-weekly payouts, copy-trading options, up to 92.75% profit share (and 92.75% VIP) and flexible scaling and you have got one of the most scalable prop firm programs of 2026.

Spreads & Commissions at Seacrest Markets

Seacrest Markets enables its traders to access tight institutional-grade spreads through one of its core brokerage infrastructures, Purple Trading Match-Trader. Traders further enjoy enhanced execution speed along with minimal slippage due to the trade raw spreads starting from as low as 0.0 pips on major currency pairs. The competitive trading environment is supportive of short-term and long-term strategies and is ideal for scalpers, day traders, and even swing traders.

Spreads:

MT5 Spread Account:

Username: 123494

Password: w5R_ftBa4

Server: SeacrestMarkets-MT5

Commission Fees

Seacrest Markets continues to offer a flexible and competitive commission structure.

Forex & Gold Trades:

A commission of $6 per standard lot is charged on a Forex & Gold trade. This commission is slightly lower than the industry standard which benefits high-volume traders.

Commodities, Indices, and Cryptocurrencies

No commission is charged on these instruments which makes these appealing to prop traders who wish to diversify their strategies without incurring extra costs.

This commission is structured flexibly to maximize different asset classes while accommodating any trading strategy from high-frequency to swing trading.

Daily Drawdown Calculation at Seacrest Markets

Seacrest Markets uses a Trailing Drawdown model for most of its challenges - such as the 1-Step Challenge which provides dynamic risk management based on your account’s highest equity achieved.

Key Features of Seacrest’s Drawdown Model:

1.Trailing Upwards:

- The drawdown limit moves up as your account equity grows.

- It never decreases, so your protected equity level only improves over time.

2.Static Drawdown at Funded Stage:

- Once you enter the funded account stage and take profit splits, the drawdown becomes static, locking in your risk radius based on the funds already withdrawn.

3.Real-Time Calculation:

- Unlike many firms that calculate drawdown at end-of-day, Seacrest calculates it in real-time, allowing for precise risk management throughout the trading day.

Why This Matters:

- Encourages frequent profit-taking while protecting your capital.

- Provides better capital preservation, so traders can scale confidently.

- Makes the program more trader-friendly, rewarding consistent performance without unnecessary restrictions.

Seacrest Markets Prohibited Trading Rules

Prohibited Trading Practices at Seacrest Markets Explained:

| Prohibited Trading Practice | Allowed? | Details |

| Copy Trading | Yes | Copy trading via EAs or signals across accounts is allowed. Copy trading is only allowed via the TradersConnect platform. |

| Reverse Trading / Group Hedging | No | Opposite trades on multiple accounts or coordinated group hedging to exploit rules are forbidden. |

| Account Management Services | No | Buying or selling account management or passing services is prohibited. Sharing account access is also banned. |

| High-Frequency Trading (HFT) | No | HFT methods including order layering and excessive scalping are banned. Violations may result in profit removal or account termination. |

| Max Leverage & Gambling-style Trading | No | Using max leverage or gambling trades is not allowed. Max risk should not exceed 2%. Repeated violations lead to profit removal. |

| Tick Scalping / Spamming / Order Layering | No | Spamming trades to reduce commissions or bypass rules, including multiple small-lot trades, will result in penalties or termination. |

| Multiple Accounts Under Same CID (MT5) | No | Running multiple accounts under the same Client ID (CID) on MT5 is strictly banned and will lead to account closure and disqualification. |

| Arbitrage (All Forms) | No | All forms of arbitrage including latency, one-leg, and two-leg arbitrage are strictly prohibited and lead to immediate removal. |

| Excessive Scalping | No | Average holding time per trade must exceed 2 minutes. Tick scalping and price manipulation will void profits and reset accounts. |

| EAs Trading | Yes | Using Expert Advisors (EAs) on MT5 or other platforms is allowed. |

IP Rules & Inactivity Policy

IP Rules:

Seacrest Markets does not enforce strict IP restrictions, but traders are expected to maintain professional decorum and ensure their accounts are used responsibly. Any suspicious activity or account sharing may lead to investigation or action.

Inactivity Period:

Challenge Accounts: 30 days of inactivity will result in account expiration.

Funded Accounts: 180 days of inactivity may lead to account suspension or closure.

Seacrest Markets News Trading Policy What You Really Need to Know

So, can you trade during the news? Well… yes and no. Seacrest Markets has a balanced approach when it comes to news trading but you have got to follow their rules carefully or risk losing out on profits. Here is the real-talk version of how it works:

Is News Trading Allowed?

During the Challenge Phase: Yes, you can trade around news events. No restrictions here.

During the Live (Funded) Phase: Yes. News trading is allowed on standard funded accounts but with limitation.

Note: If you're on the special “2-Step News Plan,” this rule doesn’t apply. That plan has its own conditions.

The News Violation Window: What’s Off-Limits?

Here is the main thing to keep in mind:

If you open or close a trade 3 minutes before or after a high-impact (Red Label) news release, any profits from those trades will be removed. That’s right, profits gone. But don’t panic, your account won’t be terminated. This is considered a soft breach. You’ll still be allowed to trade. Let’s break it down with simple rules:

How to Avoid Getting Profits Removed:

| Trade Timing | What Happens? |

|---|---|

| Opened 3 hours before the news and closed during the 6-minute window | Profits are safe |

| Opened less than 3 hours before the news and closed during the 6-minute window | Profits removed |

| Opened AND closed within the 3-minute window around the news | Profits removed |

| Holding trades through the news is okay IF they were placed well in advance | No penalty |

This 6-minute window = 3 minutes before and 3 minutes after the Red Label news drop.

How Do You Know Which News Events Count?

To make it easy, Seacrest Markets uses the Red Label/High-Risk news events as seen on ForexFactory. Just filter by red folder news, and you’ll know exactly which announcements are restricted.

Also, the rule only applies to currencies affected by the event.

Example: If there is a major USD news release, you should avoid trades in USD pairs like EUR/USD, GBP/USD, XAU/USD, SPX, NAS, DOW, and so on.

Final Thoughts on Seacrest Markets News Trading

News trading at Seacrest Markets is not off the table but it is carefully managed. As long as you plan ahead and don’t open or close trades during those tight news windows, you’ll be fine.

Golden Rule? If you are not sure, check ForexFactory, give yourself a few hours of breathing room before the event, and let the storm pass before hitting close.

“It’s not about avoiding risk, it is about trading smartly.”

What Can You Trade with Seacrest Markets (Formerly MFFX)?

If you are wondering what markets you can explore as a trader with Seacrest Markets, here is the good news: they give you access to a pretty solid mix of asset classes.

Trading Instruments Offered:

At Seacrest Markets, you are allowed to trade:

- Forex Pairs: Major, minor, and exotic currencies

- Cryptocurrencies: Including popular ones like Bitcoin, Ethereum, and more

- Indices: Like SPX500, NASDAQ, Dow Jones, etc.

- Commodities: Including gold, silver, and agricultural instruments

- Energies: Like crude oil and natural gas

This wide range lets you build a well-balanced trading portfolio. Whether you are a forex-only scalper or someone who likes to hold crypto over weekends (rules permitting), there is something here for most styles.

Want to swing trade gold or scalp the NASDAQ? You can. Prefer trading BTC during Asia session hours? That’s covered too.

Just remember to stay within their trading rules and drawdown limits Seacrest Markets is flexible with instruments but strict with risk.

Trading Commissions of Seacrest Markets:

Commissions can vary based on the trading platform which the traders has chosen on Seacrest Markets.

For Match-Trader :-

- For Forex, Metals, Oils and Energies - $3 per lot

- For Indices and Crypto - $0 per lot

For Platform 5 :-

- For Forex, Metals, Oils and Energies - $5 per lot

- For Indices and Crypto - $0 per lot

Payment & Payout Methods at Seacrest Markets

When you are ready to pay for your trading challenge or finally cash in on your payout after passing, it's important to know exactly how things work at Seacrest Markets. Here is everything explained.

How Can You Pay for a Challenge?

Seacrest Markets makes it pretty easy for traders to buy their Challenge Accounts. You can use:

- Cards: Apple Pay, Debit/Credit Card, Crypto.

Important: If you are paying with crypto, double-check that you are using the correct blockchain network. Sending funds to the wrong one means your payment might vanish, and you won’t get your login details. So take your time and confirm before clicking "Send."

How Do Payouts Work After You Pass?

Once you have passed the challenge and are on a funded (simulated) account, your profits can be paid out through:

- Crypto

- Riseworks (also known as Rise)

Getting Paid via Rise – Step-by-Step:

- Log in to your Seacrest Markets Dashboard and head to the Profit Share section.

- Click Request Payout and choose Riseworks/ Rise Crypto as the payment option.

- Enter how much you want to withdraw and your email.

- Generate a passcode (you will be guided through it).

- Wait for the team to review and approve your request.

- After approval, check your email for an invitation from Riseworks.

- Click the link to create your Rise account and verify your ID.

- Go to Action Items in the Rise dashboard.

- Accept the invitation and sign the Professional Service Agreement.

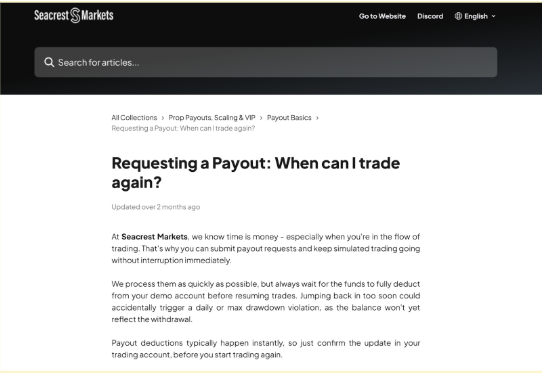

- Payout eligible on every 14 days (bi-weekly)

Once all that’s done and your Rise account is fully verified, the payout will be processed. Seacrest’s payout team checks verifications every 24 hours, so be patient, no verification, no payment.

A Few Key Things to Know

- Minimum payout amount is $65.

- Don’t submit invoices directly on Riseworks. That’s a big no-no and could get your trading account revoked.

- You will only get paid if your Rise account is properly verified.

- If you try to skip steps or rush the process, your payout could be delayed or denied altogether.

Whether you are depositing or withdrawing, just follow the steps and you’re good to go. Stay patient, stay verified, and Seacrest will make sure your money gets to you.

Countries Restricted at Seacrest Markets?

Even though we are offering a simulated prop trading environment (not live financial services), there are still international laws and compliance guidelines we must follow.

Because of that, some countries are restricted from joining. It is not personal it’s just about staying safe, legal, and secure for everyone.

Restricted Countries at Seacrest Markets List

If you are from any of the countries listed below, unfortunately, you won’t be able to sign up or trade with Seacrest Markets due to regulatory restrictions:

- Algeria

- Belarus

- Cuba

- Central African Republic

- Congo

- Democratic Republic of Congo

- Ethiopia

- Hong Kong

- Iran

- Iraq

- Kenya

- Lebanon

- Libya

- Morocco

- Myanmar

- Nicaragua

- North Korea

- Pakistan

- Philippines

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- United Arab Emirates

- United States of America

- Venezuela

- Vietnam

- Yemen

- Malaysia

If your country is on this list, we hope to expand access in the future but for now, these restrictions help us stay compliant with global legal standards.

What If You are From an Approved Country?

If you are not from a restricted country then that’s great! You can now join ATFunded, but you will still need to meet a few basic requirements:

- You must be of legal age to trade in your country.

- You need to complete KYC verification. That means submitting:

- A government-issued ID

- Proof of address

We take compliance seriously to ensure fair play, security, and a smooth experience for everyone on our platform.

Final Thoughts: Is Seacrest Markets Worth It?

If you have made it this far into the review, first off, well done. That’s a lot of info to digest. But here’s the bottom line:

Seacrest Markets offers a variety of evaluation models, including a 1-step, 2-step, and 3-step, with a focus on clear rules and high potential profit splits up to 92.75%.

And in a prop trading world filled with gimmicks, hidden rules, and one-size-fits-all structures, that alone makes it stand out. Whether you're a scalper, a swing trader, or someone still figuring it all out, Seacrest gives you a variety of paths. No ticking clock. No pressure. Just rules you can understand and a platform that wants you to grow if you’re willing to put in the work.

The payout timelines are trader-friendly. The risk rules are clear. The profit splits? Pretty generous, especially when you factor in scaling to $1M from an initial allocation of up to $400k . And yeah, there are a few things we’d love to see improve like a bit more educational content or trial resets but let’s be real: no firm is perfect.

So, is it for you?

- If you are the type who likes structured challenge with not too strict rules

- If you want flexibility without the fear of losing everything over one bad trade

- If you are a trader looking for a platform that rewards good risk management and consistency

Then Seacrest Markets is 100% worth considering.

And if you are still unsure? Test the waters with their lower-tier challenge, learn the ropes, and grow from there. After all, prop trading is not a sprint, it is a series of smart decisions stacked over time.