Maven Trading Rules to Keep in Mind While Trading

Maven Trading Rules to Keep in Mind While Trading

8/11/2024

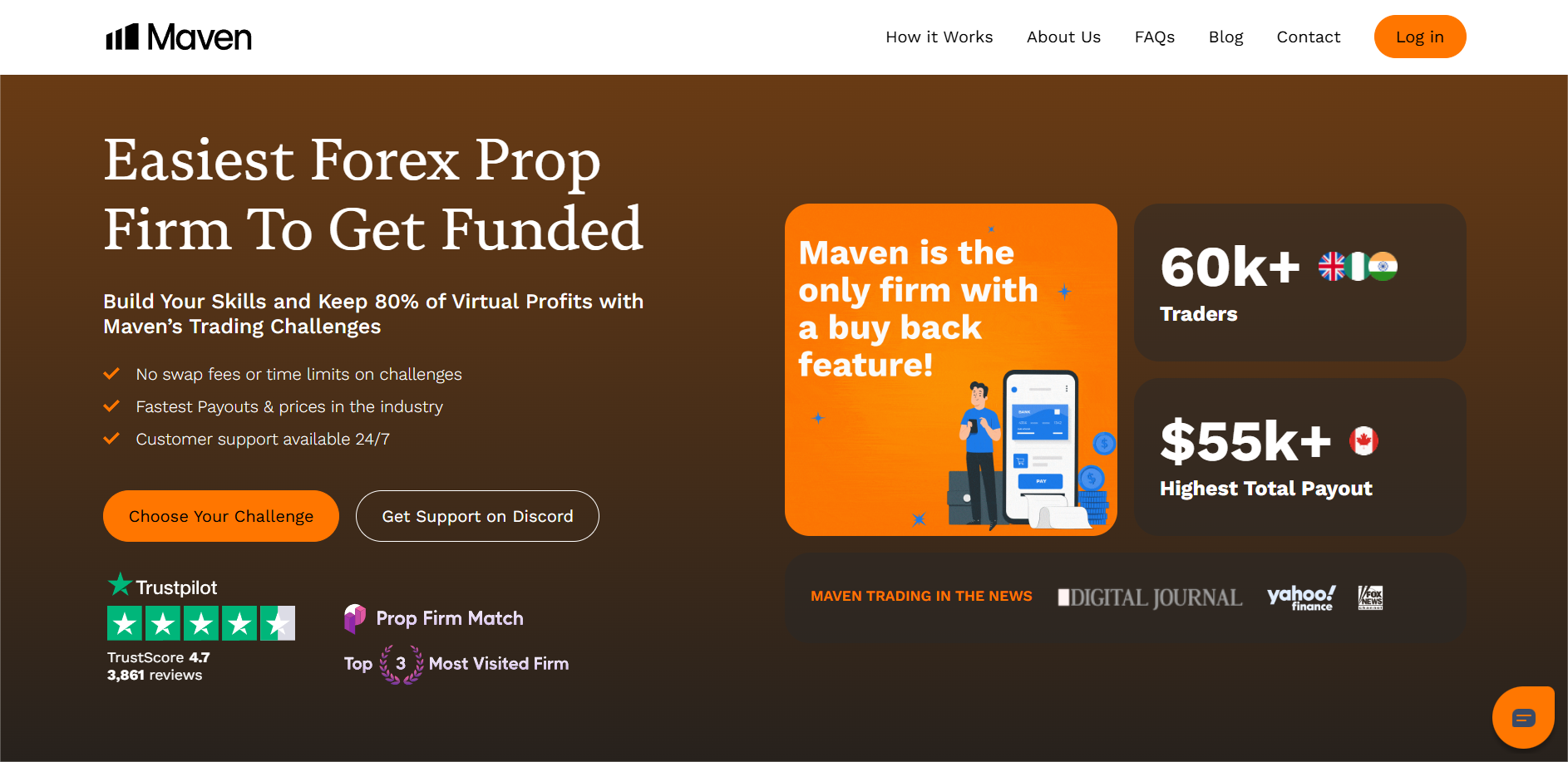

Trading with Maven Trading offers a great opportunity to make money by trading in the markets. However, there are specific rules you need to follow. Understanding and sticking to these rules can help you avoid losing your account and increase your chances of success. In this article, we'll go over the key rules and tips for trading with Maven Trading.

Understanding Maven Trading's Rules

Maven Trading is a prop trading firm that gives traders the money they need to trade different markets. To keep everything fair and secure, they have set some rules. These rules are there to protect the firm’s money and ensure everyone has a fair chance.

The IP Address Rule

Why Your IP Address Matters

At Maven Trading, you need to use the same device and IP address during all phases of trading, including when you have a funded account. This is to ensure that you are trading from the same location and not getting outside help. Keeping your IP address the same helps prevent fraud and proves that you are the one making the trades.

What Happens If You Change Your IP Address

If you change your IP address, your account will be paused. Maven Trading will ask you for a reason and proof for the change. If your reason is valid, they might allow you to continue trading. If not, you could lose your account. So, it’s important to keep using the same IP address throughout your trading journey with Maven Trading.

Trading Activities That Are Not Allowed

Maven Trading does not allow certain trading activities because they can be seen as cheating. If you engage in any of these activities, your account could be terminated.

Reverse/Group Hedging

Reverse or group hedging means placing trades in opposite directions in different accounts to guarantee a win. This is strictly forbidden. If you’re caught doing this, your account will be closed.

Hedging

Hedging, which means protecting yourself against losses by making opposite trades, is not allowed during Maven Trading’s challenge or funded accounts. Some traders might use hedging to take advantage of the demo trading environment, which doesn’t reflect the real market. If Maven Trading thinks you’re hedging, they may ask you to prove that your trades are legitimate, and they might close your account.

High-Frequency Trading (HFT)

High-frequency trading (HFT) involves making trades in a very short time, often in microseconds. This is not allowed because it can be used to quickly pass challenge accounts unfairly. Maven Trading watches for HFT activity and will close accounts that engage in this practice.

Using Expert Advisors (EAs)

Maven Trading does allow Expert Advisors (EAs), but they must follow the firm’s rules. If your EA is found to be breaking the rules, like engaging in HFT or hedging, your account will be closed. You might be asked to prove that your EA is not doing anything wrong, so make sure you use EAs that follow the guidelines.

Buy the most affordable Maven Trading Challenge starting from 13$ with our exclusive coupon code "TRUSTED" at The Trusted Prop. Get additional benefits like Cashbacks or 1-Month FREE Trade-Sync access when you buy through us!

Trading Styles and Strategies That Are Prohibited

There are also certain trading styles and strategies that Maven Trading does not allow because they can be harmful or unfair.

Toxic Trading

Toxic trading refers to activities that disrupt the market or harm other traders. This includes practices that create an unfair advantage. Such activities are strictly banned and will result in account closure.

Long/Short Arbitrage

Long/short arbitrage involves taking advantage of price differences between markets or instruments. While arbitrage can be a legitimate strategy, it’s not allowed at Maven Trading if it exploits the firm’s environment. Engaging in this can get your account suspended or terminated.

Reverse Arbitrage

Reverse arbitrage is another strategy that is not allowed. This involves taking opposite positions in different markets to guarantee profits. Like other types of arbitrage, it can exploit the trading platform, and it’s prohibited.

Tick Scalping

Tick scalping involves making many quick trades to profit from small price movements. This strategy is not allowed because it can manipulate the market and give the trader an unfair advantage.

Server Execution

Server execution means exploiting delays or issues in the server’s response to gain an unfair advantage. This is unethical and will lead to immediate account closure at Maven Trading.

Trading Around News Events

Timing Rules for News Events

At Maven Trading, you cannot open or close trades within two minutes before or after a major news event (marked with a red folder). These events often cause big market movements. Trading during this time can give an unfair advantage or distort the true performance of your strategy.

How News Events Affect Your Account

If you pass a challenge or make a profit during the restricted time around a news event, those results won’t count. The same applies to funded accounts—any profits made during these times won’t be credited to you. It’s important to be aware of news events and avoid trading during those periods.

Getting Your Funded Account

Account Review Process

After you pass a challenge, Maven Trading’s team will review your account to make sure you followed all the rules. This review process can take up to three days. Once your account is approved, you’ll receive an email, and you’ll need to verify your identity to get your funded account.

Identity Verification

Before you can get your funded account, you need to verify your identity by providing valid ID documents. This step ensures that the account is given to the right person and helps prevent fraud.

Withdrawal and Payment Options

Payment Methods

Maven Trading offers two ways to deposit and withdraw money: cryptocurrency and bank transfer. These options give you flexibility in managing your funds. Choose the method that works best for you and be aware of any fees or processing times.

Profit Split

When you withdraw money from Maven Trading, you’ll keep 80% of the profits, and Maven Trading will take 20%. This profit split allows you to benefit from your successful trades while also giving the firm an incentive to maintain a good trading environment.

Scaling Plan for Funded Traders

How Scaling Works

Maven Trading offers a scaling plan for traders who do well consistently. To qualify, you need to make a 2.5% profit regularly and withdraw at least once a month. If you meet these criteria, your trading capital will increase by 25%, giving you more opportunities in the market.

Maximum Capital Limit

The most capital you can have through Maven Trading’s scaling plan is $1 million. This limit ensures that successful traders can grow their accounts while keeping risk manageable.

Maven Trading's Leverage Options

Leverage for Forex

Maven Trading offers leverage of 75:1 for forex trading. This allows you to control larger positions with a smaller amount of money, increasing your profit potential (and risk).

Leverage for Commodities

For commodities, the leverage is 20:1. This level is suitable for trading things like precious metals and oil with moderate risk.

Leverage for Digital ETFs

Digital ETFs have a leverage of 2:1 at Maven Trading. This lower leverage is good for those who want to invest in ETFs with minimal risk.

Leverage for Indices

Indices trading comes with a leverage of 20:1. This allows you to trade stock market indices with a balanced approach to risk.

Conclusion

Trading with Maven Trading requires you to follow certain rules and guidelines to keep the trading environment fair and safe. By understanding and following these rules, you can increase your chances of success and avoid losing your account. Whether it’s keeping your IP address the same, avoiding banned strategies, or following news event restrictions, each rule is important for making your trading experience with Maven Trading both rewarding and secure.

Want to know more about Maven?

Read our detailed Maven Trading Review on The Trusted Prop and don't forget to save on your challenge fee with our "TRUSTED" coupon code!

You may also like

Goat Funded Futures Instant Account Explained 2026: Rules & Payouts

My Funded Futures Drawdown Rules Explained (2026 Guide)

.jpg&w=1920&q=75)

FTMO 1-Step Challenge Explained (2026): Rules & Payouts

The5ers Trading Rules & Risk Limits Explained (2026 Update)

.jpg&w=1920&q=75)

The5ers Payout Rules, Profits & Withdrawals (2026 Guide)

Goat Funded Trader Instant Goat Account Explained (2026)

.jpg&w=1920&q=75)

DNA Funded Detailed Review 2026: Our Honest Verdict

.jpg&w=1920&q=75)

No FAQs are available for this topic yet.